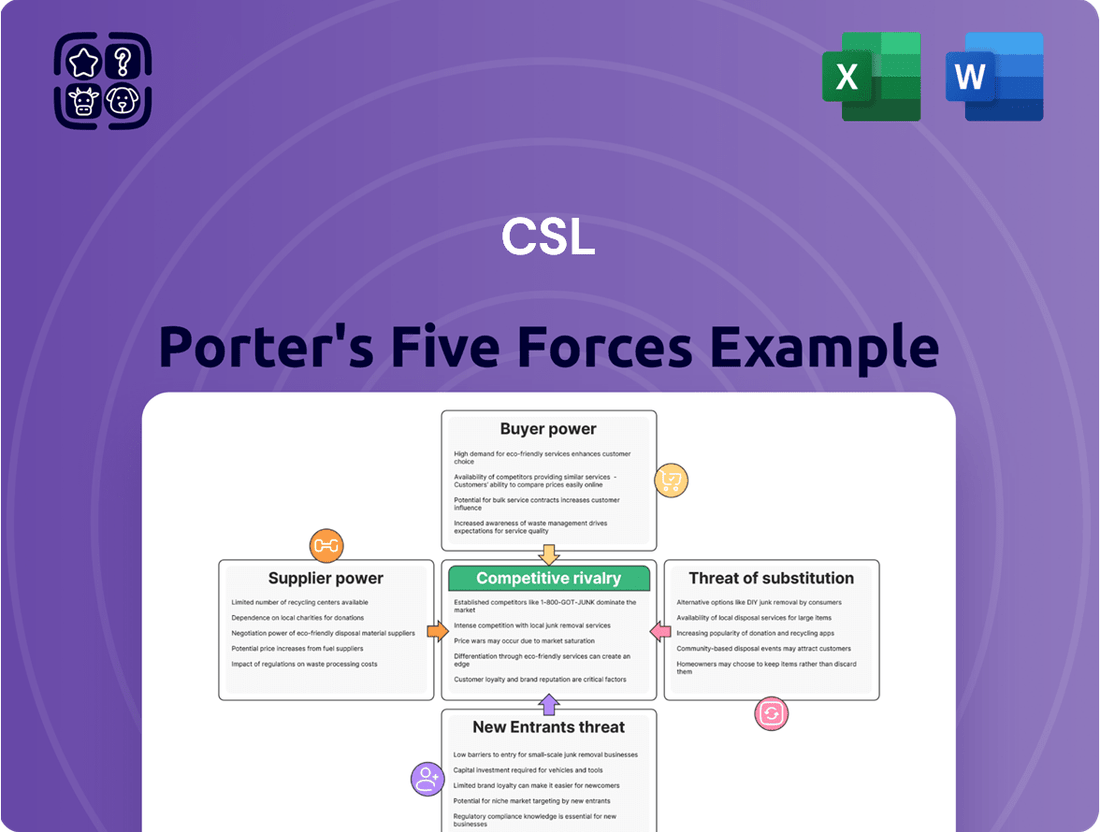

CSL Porter's Five Forces Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

CSL Bundle

CSL’s competitive landscape is shaped by five key forces: the bargaining power of buyers, the bargaining power of suppliers, the threat of new entrants, the threat of substitute products or services, and the intensity of rivalry among existing competitors.

Understanding these forces is crucial for assessing CSL’s market attractiveness and its ability to generate profits.

This brief snapshot only scratches the surface. Unlock the full Porter's Five Forces Analysis to explore CSL’s competitive dynamics, market pressures, and strategic advantages in detail.

Suppliers Bargaining Power

CSL's core business, particularly its plasma-derived therapies, hinges entirely on the consistent supply of human plasma. This makes plasma donors a significant factor in CSL's operational landscape.

The bargaining power of plasma donors is shaped by several factors. Availability of plasma, driven by donor willingness and collection infrastructure, directly impacts supply. Ethical considerations and the growing number of plasma collection centers create competition for donors, potentially increasing their leverage.

In 2023, CSL collected approximately 20.2 million liters of plasma, a testament to the scale of its donor network. The increasing global demand for plasma-derived therapies, projected to grow, further highlights the strategic importance of maintaining a robust and engaged donor base.

The company's ability to secure and retain donors, through effective outreach, compensation, and ethical practices, is crucial. Any disruption or significant increase in the cost of acquiring plasma could directly affect CSL's profitability and production capacity.

CSL relies on suppliers of highly specialized equipment for critical processes like plasma fractionation, purification, and vaccine production. These suppliers often wield significant bargaining power due to the unique and complex nature of their technology, which can include proprietary intellectual property. The substantial costs and time involved in retooling or switching these sophisticated manufacturing systems further bolster their leverage.

CSL relies on a diverse range of suppliers for essential raw materials, chemicals, and consumables crucial for both its plasma-derived products and recombinant therapies. The bargaining power held by these suppliers is a significant factor influencing CSL's operational costs and profitability.

The concentration of these suppliers plays a key role; if only a few companies provide a critical component, their leverage increases. For instance, specialized reagents or unique manufacturing equipment components might be sourced from a limited number of highly specialized providers, giving them considerable pricing power.

Furthermore, the uniqueness of a supplier's offering directly impacts their bargaining strength. If CSL cannot easily substitute a particular chemical or consumable without compromising product quality or efficacy, the supplier's position is strengthened. This is particularly relevant for highly regulated pharmaceutical production where validation of new suppliers can be a lengthy and costly process.

The criticality of these materials to CSL's production processes also dictates supplier power. If a raw material is indispensable for manufacturing a high-demand product, such as a key component for CSL Behring's albumin or immunoglobulin therapies, suppliers of that material can command higher prices. In 2024, the global pharmaceutical supply chain continued to grapple with disruptions, further amplifying the bargaining power of suppliers providing essential, difficult-to-substitute inputs.

Labor and Specialized Talent

The biotechnology sector, including companies like CSL, relies heavily on highly specialized labor. This includes scientists, researchers, manufacturing experts, and regulatory affairs professionals who possess unique skills. The demand for these individuals often outstrips the available supply, especially in cutting-edge fields.

This scarcity of specialized talent translates directly into increased bargaining power for these labor pools. For CSL, this means that skilled employees can command higher salaries and more attractive benefits packages, directly impacting operational costs. For example, a report from 2024 indicated a 15% year-over-year increase in average salaries for biopharmaceutical researchers due to high demand and limited supply.

The bargaining power of suppliers in this context is amplified when the specialized skills are niche. Consider areas like advanced plasma fractionation or novel vaccine development – having a limited pool of experts in these specific domains allows them to negotiate more favorable terms. CSL’s ability to attract and retain such talent is therefore a critical factor in managing its cost structure and maintaining a competitive edge.

- Specialized Skill Scarcity: The biotechnology industry requires highly specialized scientific and technical expertise, leading to a limited supply of qualified professionals.

- High Demand for Talent: Companies like CSL face intense competition for these skilled individuals, driving up labor costs.

- Impact on Operational Costs: The bargaining power of specialized labor directly influences CSL's expenses related to research, development, and manufacturing.

- Niche Expertise Advantage: Talent in highly specific areas, such as advanced plasma processing, holds even greater leverage due to the extreme scarcity of qualified personnel.

Regulatory and Compliance Service Providers

CSL's reliance on regulatory and compliance service providers significantly influences its bargaining power with these entities. The highly regulated nature of CSL's operations, encompassing areas like medical devices and pharmaceuticals, means that specialized expertise is not just beneficial but essential for market entry and continued operation.

These suppliers, including regulatory consultants, testing laboratories, and compliance software developers, often possess unique accreditations and deep knowledge of complex legal frameworks. This specialization can elevate their bargaining power, particularly when their services are critical gatekeepers for CSL's product launches and market access. For instance, in the pharmaceutical sector, adherence to FDA or EMA regulations, verified by specialized labs and consultants, is non-negotiable, thereby strengthening supplier leverage.

The cost of non-compliance, which can include hefty fines, product recalls, and reputational damage, further underscores the importance of these services and, consequently, the suppliers' influence. In 2024, the global regulatory affairs outsourcing market was valued at over $7 billion, indicating the substantial investment companies like CSL make in these critical services, highlighting the providers' considerable bargaining strength.

- High Switching Costs: CSL faces substantial costs and risks in switching its regulatory and compliance service providers due to the need for re-validation, re-accreditation, and potential disruption to ongoing compliance efforts.

- Supplier Concentration: In specific niche areas of regulatory compliance, the number of accredited and experienced service providers may be limited, concentrating bargaining power among a few key players.

- Criticality of Service: The services provided are fundamental to CSL's ability to operate legally and access markets; any failure in these areas can have severe financial and operational consequences, increasing supplier leverage.

- Information Asymmetry: Specialized knowledge held by regulatory consultants and testing labs can create an information advantage, allowing them to command higher prices and terms.

CSL faces significant bargaining power from suppliers of specialized equipment, particularly those with proprietary technology critical for plasma fractionation and vaccine production. The substantial costs and time associated with switching these sophisticated systems significantly amplify supplier leverage, impacting CSL's operational flexibility and cost structure.

What is included in the product

A CSL-specific Porter's Five Forces analysis dissects the competitive intensity and industry attractiveness, revealing how bargaining power of buyers and suppliers, threat of new entrants and substitutes, and existing rivalry shape CSL's strategic landscape.

Quickly identify and address competitive threats with a visual, actionable breakdown of all five forces.

Customers Bargaining Power

Healthcare systems and government bodies represent significant customer segments for pharmaceutical and biotech companies, particularly for vaccines and essential medicines. Their sheer scale means they often act as major purchasers, wielding considerable influence through their ability to negotiate bulk contracts. For instance, in 2024, many national healthcare systems continued to leverage their purchasing power to secure lower prices for critical drugs, impacting company revenue streams.

These powerful entities can also shape market demand by influencing reimbursement policies and formulary decisions. When a government health agency or a large hospital network prioritizes cost-effectiveness, it directly pressures suppliers to offer more competitive pricing. This dynamic is crucial in understanding how customer bargaining power affects overall industry profitability.

Physicians and other healthcare prescribers hold considerable sway over product choice, even though they aren't the direct buyers. Their medical knowledge, existing treatment guidelines, and views on how well a product works and its safety profile can really shape CSL's sales and market standing. This makes them an indirect but powerful customer influence.

In 2024, physician preference remains a critical driver in pharmaceutical markets. For instance, the adoption rate of new biologic therapies, a key area for companies like CSL, is heavily dependent on prescriber education and clinical trial data. A significant percentage of pharmaceutical marketing spend is directed towards engaging physicians, highlighting their pivotal role in influencing purchasing decisions upstream.

Patient advocacy groups can significantly sway demand for CSL's products by championing specific treatments and lobbying for broader patient access. For instance, in 2024, many such groups actively campaigned for improved coverage for rare disease therapies, directly impacting the market perception of CSL's offerings in these areas. This heightened awareness and demand, coupled with the financial leverage of health insurers and payers who dictate reimbursement rates, places considerable pressure on CSL's pricing strategies and overall market approach.

Global Distribution Networks and Wholesalers

CSL's reliance on a robust global distribution network, including wholesalers and pharmacies, significantly influences customer bargaining power. The concentration of these intermediaries can dictate CSL's pricing flexibility and inventory management. For example, in 2024, the global pharmaceutical distribution market was valued at over $1.5 trillion, with a few major players dominating many regions, giving them considerable leverage.

These powerful distributors can exert pressure on CSL for better payment terms, preferential product allocation, and lower prices, directly impacting CSL's profit margins. If a significant portion of CSL's sales volume is channeled through a limited number of large wholesalers, these entities gain substantial bargaining power.

The ability of these distributors to switch to competing products or to consolidate their purchasing power further amplifies their influence. This concentration means CSL must carefully manage relationships to ensure continued access to key markets and consistent product availability, a challenge in 2024 as supply chain disruptions persisted.

CSL's strategy involves cultivating strong partnerships with these intermediaries to mitigate this bargaining power. However, the sheer scale of global distribution networks means that customer (distributor) concentration remains a key factor in CSL's operational and financial planning.

- Global Pharmaceutical Distribution Market Value (2024): Exceeds $1.5 trillion.

- Impact of Distributor Concentration: Affects CSL's pricing, inventory control, and product availability.

- Potential for Margin Pressure: Arises from strong bargaining power of intermediaries.

- Strategic Importance of Relationships: Crucial for maintaining market access and product flow.

Price Sensitivity and Reimbursement Policies

The significant cost associated with many specialized biotherapies makes customers, particularly healthcare systems and insurers, acutely sensitive to pricing. This price sensitivity directly enhances their bargaining power, as they actively seek ways to manage expenditure. For instance, in 2024, many national health services continue to scrutinize the cost-effectiveness of high-priced pharmaceuticals, leading to tougher negotiations.

Global healthcare systems are increasingly focused on cost containment, which further empowers customers. Evolving reimbursement policies often favor treatments demonstrating clear value or offer alternative payment models. This trend means buyers can demand more affordable options or negotiate pricing based on patient outcomes.

- Price Sensitivity: Customers, especially insurers and healthcare providers, are highly sensitive to the high costs of biotherapies.

- Reimbursement Policies: Shifting reimbursement landscapes and pressure for cost containment globally increase customer leverage.

- Value-Based Solutions: Buyers are increasingly demanding more affordable or value-based pricing models, impacting manufacturer pricing power.

- Negotiation Leverage: The ability of large payers to negotiate prices, especially for blockbuster drugs, is a significant factor in their bargaining power.

The bargaining power of customers for CSL is significantly influenced by the concentration of buyers and the availability of substitutes. Large healthcare systems and government bodies, representing substantial purchasing volume, can negotiate favorable terms. For example, in 2024, many national health services leveraged their scale to secure lower prices for critical medicines, directly impacting pharmaceutical revenue streams.

Physicians, while not direct purchasers, wield considerable influence through prescribing habits, making them a key indirect customer segment. Patient advocacy groups also shape demand by lobbying for access and raising awareness, particularly for rare disease therapies. This combined influence from direct buyers, prescribers, and advocacy groups amplifies customer power.

The global pharmaceutical distribution network, valued at over $1.5 trillion in 2024, comprises powerful intermediaries like wholesalers and pharmacies. Concentration within this network grants these entities significant leverage over CSL, affecting pricing flexibility and inventory management. For instance, a few dominant wholesalers in key markets can dictate terms, pressuring CSL's profit margins.

| Customer Segment | Influence Factor | 2024 Impact Example |

| Healthcare Systems/Govt. Bodies | Purchasing Volume, Reimbursement Policies | Negotiated lower prices for bulk drug contracts. |

| Physicians | Prescribing Habits, Medical Knowledge | Influenced adoption of new therapies through education and data. |

| Patient Advocacy Groups | Demand Shaping, Lobbying | Increased market perception for rare disease therapies. |

| Distributors (Wholesalers/Pharmacies) | Market Concentration, Payment Terms | Exerted pressure on pricing and product allocation due to market dominance. |

Same Document Delivered

CSL Porter's Five Forces Analysis

This preview displays the complete CSL Porter's Five Forces Analysis, which you will receive in its entirety immediately after purchase. You are viewing the actual, professionally crafted document, ensuring there are no surprises or placeholder content. The detailed breakdown of competitive rivalry, threat of new entrants, bargaining power of buyers, bargaining power of suppliers, and threat of substitute products is exactly what you'll download. This comprehensive analysis is ready for your immediate use, providing valuable strategic insights for CSL.

Rivalry Among Competitors

CSL operates in a highly competitive landscape, facing formidable rivals such as Takeda and Grifols, particularly in the specialized area of plasma fractionation. These global biopharma giants are locked in a constant struggle for market dominance.

The competition is fueled by substantial research and development expenditures, with companies pouring billions into discovering and bringing innovative therapies to market. For instance, CSL’s R&D investment for FY24 was approximately USD 1.5 billion, a figure comparable to its peers. This intense R&D focus leads to frequent product launches and aggressive marketing campaigns.

Battles for market share are fierce across numerous therapeutic areas, from rare diseases to immunology and influenza vaccines. Companies like CSL, alongside major vaccine producers, are constantly vying for patient populations and physician preferences, driving innovation and often leading to price pressures.

The biotechnology sector, and by extension CSL, is characterized by intense rivalry fueled by a relentless innovation race. Companies pour significant resources into research and development, with the global biotech R&D spending projected to reach over $300 billion by 2024. This high expenditure is essential for discovering new drugs and therapies, creating a highly competitive environment where being first-to-market with a groundbreaking treatment can secure substantial market share and profitability.

Competitive rivalry within the biopharmaceutical sector, particularly for companies like CSL, is intensely driven by product differentiation. This often centers on the efficacy of treatments, their safety profiles, innovative delivery methods, and the overall convenience for patients. CSL's strategic emphasis on specialized plasma-derived and recombinant therapies is designed to carve out unique market positions, but this inherently invites intense competition as rivals actively pursue the development of comparable or even superior alternatives.

For instance, in the immunoglobulin market, a key area for CSL, competition is fierce. Companies continuously invest in R&D to enhance product purity, reduce administration times, and improve patient tolerability. CSL Behring's products, such as Privigen, compete against offerings from companies like Takeda (with its immunoglobulin portfolio) and Grifols, all vying for market share through incremental improvements and differentiated patient support programs. The race to develop next-generation therapies, including subcutaneous immunoglobulins for improved convenience, exemplifies this dynamic.

The landscape for recombinant therapies also showcases this rivalry. CSL's Hemgenix, a gene therapy for hemophilia B, represents a significant innovation. However, it competes with other hemophilia treatments, including Factor VIII and IX therapies from companies like Novo Nordisk and BioMarin Pharmaceutical, as well as emerging gene therapy candidates. The high development costs and regulatory hurdles in these specialized areas do not deter competitors from entering or intensifying their efforts to innovate and capture market share by offering distinct advantages.

Market Share and Pricing Pressure

CSL faces significant competitive rivalry, particularly in established therapeutic areas where market share gains often translate into pricing power. This dynamic intensifies as product lifecycles mature, leading to aggressive marketing campaigns and the negotiation of favorable contract terms with healthcare providers and payers. The pressure is further amplified by the looming threat of biosimilar or generic entrants.

In 2024, the global biopharmaceutical market, a key arena for CSL, continued to see robust competition. For instance, in the immunology segment, where CSL Behring is a major player, companies are actively vying for market share. Reports from early 2024 indicated that several blockbuster therapies were experiencing increased generic or biosimilar competition, a trend expected to accelerate. This directly impacts pricing, forcing established players to innovate and offer value beyond the drug itself.

The pricing pressure is a direct consequence of this rivalry. As more treatment options become available, especially lower-cost alternatives like biosimilars, payers and providers naturally push for reduced prices. CSL’s strategy often involves demonstrating the superior efficacy, safety, or convenience of its products, or securing exclusive contracts.

Key aspects of this competitive rivalry include:

- Market Share Dynamics: Companies actively seek to expand their footprint in lucrative therapeutic areas, impacting CSL's ability to maintain or grow its existing market share.

- Pricing Power Erosion: The entry of biosimilars and generics, coupled with payer negotiations, directly challenges the pricing power of originator products.

- Aggressive Marketing and Sales Strategies: Increased competition necessitates higher spending on marketing and sales to differentiate products and secure customer loyalty.

- Contractual Advantage: Favorable contract terms with distributors, hospitals, and insurance providers become crucial tools for competitive differentiation.

Regulatory Landscape and Market Access

Navigating the intricate and ever-changing global regulatory environment is a critical battleground for companies. Success hinges not just on innovation but on the speed and efficiency with which businesses can obtain necessary approvals, secure market entry, and adhere to varied regional healthcare regulations, thereby establishing a substantial competitive advantage.

This regulatory complexity acts as a significant barrier to entry. For instance, in 2024, the United States Food and Drug Administration (FDA) continued to streamline certain approval pathways for novel therapies, but the overall process remained rigorous and time-consuming, influencing market dynamics.

- Regulatory Hurdles as Competitive Barriers: Companies that master regulatory compliance and market access can outmaneuver rivals who struggle with these processes.

- Global Variations in Healthcare Policies: Differences in drug pricing regulations, reimbursement policies, and data privacy laws across regions like the EU, Japan, and emerging markets present distinct challenges and opportunities.

- Impact on R&D Investment: The lengthy and costly nature of clinical trials and regulatory submissions, often spanning years and costing hundreds of millions of dollars, directly impacts a company's willingness and ability to invest in new product development.

- Market Access Strategies: Companies actively vie for favorable reimbursement decisions and market inclusion on formularies, understanding that this is as crucial as product efficacy for commercial success.

Competitive rivalry is a defining characteristic of CSL’s operating environment, with companies like Takeda and Grifols intensely competing, especially in plasma fractionation. The race for market share is driven by significant R&D investments, with CSL allocating around USD 1.5 billion in FY24, mirroring peer expenditures. This rivalry extends across various therapeutic areas, from rare diseases to immunology and vaccines, where differentiation through innovation, efficacy, and patient convenience is paramount.

The biopharmaceutical sector's intense competition is further amplified by the emergence of biosimilars and generics, which erode pricing power and necessitate aggressive marketing and contractual strategies. For instance, in 2024, the immunology segment saw increased competition from these lower-cost alternatives, impacting originator product pricing. Companies like CSL must leverage product differentiation and market access strategies to navigate these pressures, with regulatory hurdles acting as both barriers and competitive advantages.

| Competitor | Key Therapeutic Areas | Estimated R&D Spend (USD Billion) | Key Product Examples |

| Takeda | Plasma-derived therapies, rare diseases, oncology, neuroscience | ~5.0 (2023) | Hyqvia, Takhzyro |

| Grifols | Plasma-derived therapies, diagnostics | ~1.0 (2023) | Gamunex-C, Alphanate |

| Novo Nordisk | Diabetes, obesity, rare blood and endocrine disorders | ~6.0 (2023) | NovoSeven, Esperoct |

| BioMarin Pharmaceutical | Rare genetic diseases | ~0.7 (2023) | Roctavian, Naglazyme |

SSubstitutes Threaten

Recombinant therapies directly challenge plasma-derived products for conditions like hemophilia. These engineered proteins can offer enhanced purity and more predictable supply, a significant draw for patients and healthcare providers. For instance, by 2024, the global recombinant factor VIII market alone is projected to reach billions, demonstrating a substantial shift away from traditional plasma sources.

The growing presence of biosimilars further amplifies the threat of substitutes. These are highly similar versions of existing biologic drugs, offering comparable efficacy and safety at a lower price point. In 2023, several key biosimilars for high-value biologic therapies saw expanded market access, with some estimates suggesting biosimilars could capture over 20% of the biologic drug market by 2027, directly impacting established players.

Advancements in pharmaceutical science are creating potent substitutes for CSL's biologic therapies. Small molecule drugs, often more cost-effective and easier to administer, are increasingly viable alternatives for certain chronic conditions. For instance, while CSL Behring's treatments for hemophilia are well-established, research into novel small molecule inhibitors offers a different approach to managing bleeding disorders.

The rise of gene therapies represents a significant long-term threat. These novel treatments aim to address the root cause of genetic disorders, potentially offering a one-time cure rather than ongoing management. Companies are heavily investing in this space; in 2024, global spending on gene therapy research and development is projected to exceed $15 billion, indicating a strong pipeline of curative alternatives to CSL's existing product portfolio.

The threat of substitutes for CSL's products, particularly in chronic disease management and influenza, is influenced by non-pharmaceutical interventions. For instance, advancements in public health initiatives and widespread adoption of healthier lifestyles can directly impact the demand for certain CSL therapies. In 2024, global healthcare spending on preventive medicine and wellness programs continued to grow, with estimates suggesting a significant portion allocated to lifestyle-related interventions. This trend suggests that while CSL's innovative treatments remain crucial, a focus on proactive health management by individuals and governments could moderate the market for some of its offerings.

Alternative Vaccine Technologies

While CSL Seqirus is a significant player in influenza vaccines, the threat of substitutes is evolving rapidly. Emerging technologies like mRNA and viral vector platforms are gaining traction, presenting potential alternatives to CSL's established egg-based and cell-based methods. These new approaches could offer advantages in terms of speed of development, efficacy, or manufacturing efficiency.

The broader vaccine market is witnessing substantial investment in these novel platforms. For instance, by late 2023 and into 2024, significant progress has been made in the development and regulatory pathways for mRNA vaccines beyond COVID-19, indicating their growing viability. This innovation could eventually translate into direct competition for influenza vaccine market share.

- mRNA Vaccines: Offer rapid development cycles and potential for multi-valent formulations.

- Viral Vector Vaccines: Provide robust immune responses and can be developed against a range of pathogens.

- Novel Adjuvants: Enhancements to existing vaccine platforms can boost immunogenicity, acting as a form of substitution for less effective traditional vaccines.

- DNA Vaccines: Another emerging technology with potential for simplified manufacturing and improved stability.

Off-Label Use and Repurposed Drugs

Existing medications approved for different medical conditions can be utilized off-label, or older, more affordable drugs might be repurposed for ailments CSL addresses. This poses a subtle yet significant substitution threat, as medical professionals increasingly look for more accessible or economical treatment alternatives.

For instance, in 2024, the FDA reported a notable increase in off-label prescribing across various therapeutic areas, driven by a need for adaptable treatment strategies. This trend highlights how the availability of alternative therapies, even if not officially sanctioned for a specific condition, can impact market share.

Consider the case of oncology, where drugs initially developed for other cancers or diseases are frequently explored for new applications. This repurposing effort can present a competitive challenge by offering similar efficacy at potentially lower development and patient costs.

- Off-label prescribing continues to be a significant factor in healthcare, particularly in specialized fields.

- Drug repurposing offers a pathway to new treatments with potentially lower R&D investment.

- Cost-effectiveness is a major driver for healthcare providers when considering treatment options.

- The evolving regulatory landscape for off-label use influences its adoption.

The threat of substitutes for CSL's offerings is substantial and multifaceted, stemming from advancements in biotechnology and evolving healthcare practices. Recombinant therapies, biosimilars, and repurposed drugs all present viable alternatives that can erode market share by offering comparable efficacy, improved delivery, or lower costs. Furthermore, emerging technologies like gene and mRNA therapies promise curative solutions, posing a long-term challenge to CSL's established treatment paradigms.

The global market for biologics, where CSL is a major player, is increasingly competitive due to these substitutes. For instance, the biosimilar market is projected to grow significantly, with some estimates suggesting it could reach over $100 billion globally by 2028, directly impacting the pricing power and market penetration of originator biologic drugs. Similarly, the increasing investment in gene therapy research, projected to exceed $15 billion in global R&D spending for 2024, signals a strong pipeline of potentially curative treatments that could redefine patient care and reduce the demand for CSL's ongoing therapies.

| Substitute Category | Example | Impact on CSL | Market Trend (2024 Data/Projections) |

|---|---|---|---|

| Recombinant Therapies | Recombinant Factor VIII | Direct competition for plasma-derived products, offering higher purity and consistent supply. | Global recombinant Factor VIII market projected to reach billions in 2024. |

| Biosimilars | Biosimilars for biologic drugs | Offer comparable efficacy at lower price points, increasing patient and payer options. | Expected to capture over 20% of the biologic drug market by 2027. |

| Small Molecule Drugs | Novel small molecule inhibitors for hemophilia | Potentially more cost-effective and easier to administer alternatives for chronic conditions. | Continued development and approval of new small molecule drugs across various therapeutic areas. |

| Gene Therapies | Curative treatments for genetic disorders | Address root causes, potentially offering one-time cures instead of ongoing management. | Global R&D spending projected to exceed $15 billion in 2024. |

| Off-Label Drug Use/Repurposing | Older, affordable drugs used for new indications | Provides accessible or economical treatment alternatives, especially in oncology. | Notable increase in off-label prescribing reported by regulatory bodies in 2024. |

Entrants Threaten

The biotechnology sector, particularly in areas like plasma fractionation and large-scale vaccine production, presents a formidable hurdle for newcomers due to exceptionally high capital requirements. Establishing state-of-the-art research facilities, advanced manufacturing plants, and extensive plasma collection networks demands billions of dollars in investment. For instance, constructing a new plasma fractionation facility can easily cost upwards of $500 million, with ongoing investments in specialized equipment and compliance adding to the financial burden.

The biopharmaceutical industry, where CSL operates, presents formidable barriers to new entrants due to the sheer scale of investment required for research and development. Companies like CSL often spend billions of dollars over many years to bring a single therapy to market. For instance, the average cost to develop a new drug was estimated to be around $2.6 billion in 2023, a figure that underscores the immense capital needed.

Furthermore, navigating the complex and lengthy regulatory approval pathways, such as those mandated by the FDA in the United States or the EMA in Europe, acts as a significant deterrent. These processes can take a decade or more and involve rigorous clinical trials, demanding substantial financial commitment and scientific expertise before any product can be commercialized.

This combination of extensive R&D requirements and stringent regulatory hurdles means that potential new entrants must possess substantial financial backing and a long-term strategic vision. The high upfront costs and protracted timelines create a significant risk, effectively limiting the number of companies capable of entering and competing effectively in this specialized sector.

For companies looking to enter the plasma-derived products market, securing a consistent and high-quality supply of human plasma presents a significant hurdle. This raw material is the lifeblood of the industry. New entrants face the formidable task of establishing and managing global plasma collection networks, a process that is both complex and capital-intensive.

Building these intricate supply chains for biologics, which includes plasma, requires substantial investment and expertise. In 2024, the global plasma derivatives market was valued at approximately USD 30 billion, highlighting the scale of operations and the established infrastructure of existing players. This makes it exceptionally challenging for newcomers to compete on cost and reliability.

Intellectual Property and Patents

The threat of new entrants for companies like CSL is significantly mitigated by substantial intellectual property (IP) and patent portfolios. Existing players hold extensive patents covering critical manufacturing processes, unique product formulations, and specific therapeutic applications. This IP creates a formidable barrier, making it difficult for newcomers to launch competitive products without risking patent infringement lawsuits.

For instance, in the biopharmaceutical sector, where CSL operates, patent protection can last for two decades, providing a long runway for market exclusivity. CSL's own robust R&D investments, exemplified by its consistent pipeline of new therapies, are directly translated into a deep well of intellectual property. This IP acts as a defensive moat, deterring potential competitors who would need to invest heavily in developing non-infringing alternatives or navigate complex licensing agreements.

The high cost and time associated with developing novel biopharmaceuticals, coupled with stringent regulatory approval processes, further amplify the protective power of patents. A new entrant would not only need to circumvent existing IP but also replicate years of research, clinical trials, and regulatory submissions, a financially daunting and time-consuming endeavor.

- Strong patent protection on CSL's core technologies and products.

- High R&D investment by existing players creates a knowledge and IP moat.

- Significant barriers to entry due to patent infringement risks for new firms.

- The lengthy and costly process of developing and gaining regulatory approval for biopharmaceuticals.

Brand Reputation and Established Relationships

CSL's robust global brand reputation for quality and innovation presents a significant barrier to new entrants. Healthcare providers have established trust with CSL based on years of reliable product performance and cutting-edge solutions. It would be exceedingly difficult for newcomers to replicate this level of credibility and foster the deep-seated relationships CSL enjoys.

New entrants face the daunting task of establishing trust within the healthcare community, a process that takes considerable time and investment. Furthermore, CSL possesses extensive and entrenched distribution networks, built over decades. Gaining access to these critical channels and cultivating similar relationships would be a formidable hurdle for any new competitor seeking to enter the market.

- Brand Loyalty: CSL's established reputation fosters significant brand loyalty among healthcare professionals and patients, making it harder for new entrants to capture market share.

- Trust Factor: The company's history of reliability and innovation builds a high level of trust, which is crucial in the healthcare sector and difficult for new players to quickly achieve.

- Distribution Access: New entrants would need to invest heavily in developing their own distribution networks or negotiate access to existing ones, a process that is time-consuming and costly compared to CSL's established infrastructure.

- Relationship Building: CSL's long-standing relationships with key stakeholders, including hospitals, clinics, and regulatory bodies, provide a competitive advantage that new entrants would struggle to overcome in the short to medium term.

The threat of new entrants for CSL is significantly low due to the immense capital required for research, development, and manufacturing in the biopharmaceutical sector. For instance, the average cost to develop a new drug was estimated to be around $2.6 billion in 2023. Stringent regulatory pathways, like those from the FDA and EMA, add further complexity and cost, often taking a decade or more to navigate. This creates a substantial financial and time barrier, limiting the number of capable competitors.

Securing a consistent supply of raw materials, such as human plasma, is another major hurdle. Establishing global collection networks is complex and capital-intensive, with the global plasma derivatives market valued at approximately USD 30 billion in 2024. This scale makes it difficult for newcomers to compete on cost and reliability against established players like CSL.

CSL's strong intellectual property and patent portfolios, often protected for two decades, create a significant barrier to entry. New entrants risk infringement lawsuits and must invest heavily to develop non-infringing alternatives. The established brand reputation and trust CSL holds within the healthcare community, coupled with its entrenched distribution networks, further deter new players.

| Barrier Type | Description | Impact on New Entrants | Example/Data Point |

|---|---|---|---|

| Capital Requirements | High investment needed for R&D and manufacturing facilities. | Significantly deters new entrants. | Average new drug development cost: ~$2.6 billion (2023). |

| Regulatory Hurdles | Lengthy and complex approval processes for biopharmaceuticals. | Extends time-to-market and increases costs. | Approval pathways can take a decade or more. |

| Supply Chain Access | Difficulty in establishing reliable raw material sourcing (e.g., plasma). | Challenges cost-competitiveness and reliability. | Global plasma derivatives market: ~$30 billion (2024). |

| Intellectual Property | Extensive patent protection on existing technologies and products. | Risks of infringement and need for costly alternatives. | Patent protection can last up to 20 years. |

| Brand Reputation & Distribution | Established trust and entrenched distribution networks. | Difficult to replicate credibility and market access. | Decades of relationship building with healthcare stakeholders. |

Porter's Five Forces Analysis Data Sources

Our Porter's Five Forces analysis is built upon a foundation of diverse and credible data, including publicly available financial statements, industry-specific market research reports, and proprietary competitive intelligence databases. This comprehensive data collection ensures a robust understanding of market dynamics and competitive pressures.