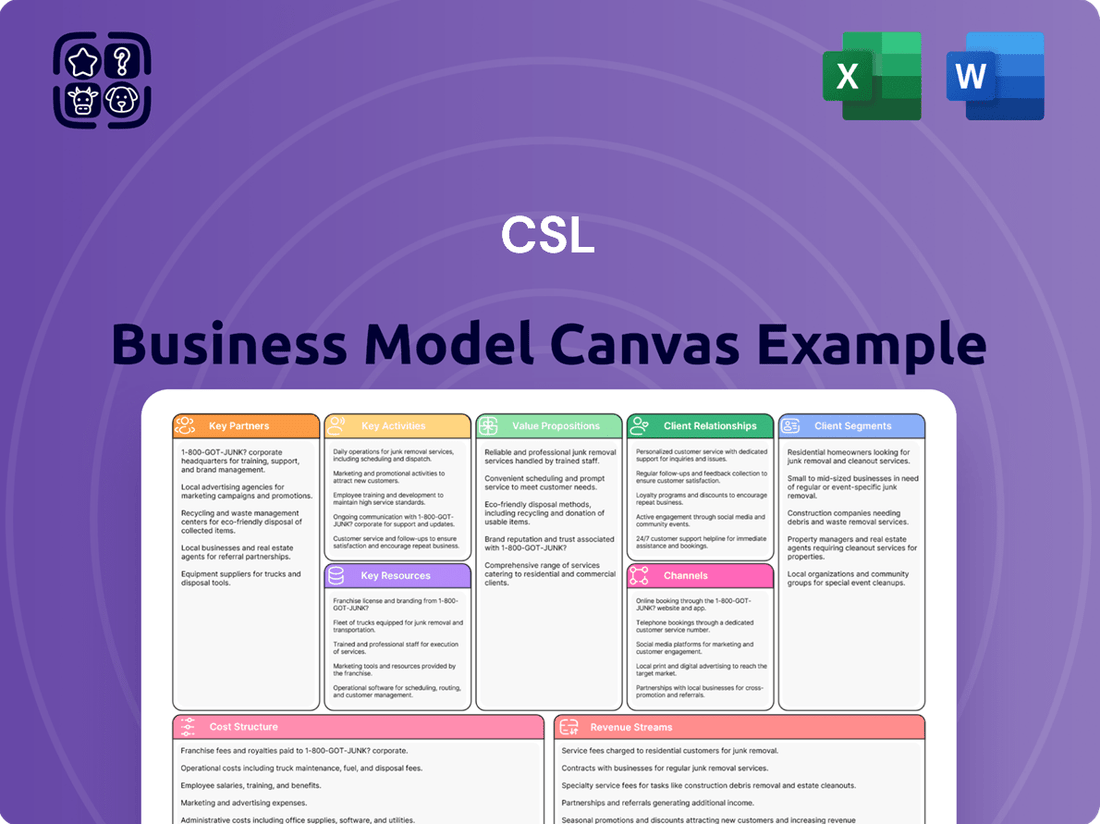

CSL Business Model Canvas

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

CSL Bundle

Curious how CSL achieves its market dominance? Our Business Model Canvas breaks down their core customer segments, value propositions, and revenue streams, offering a clear strategic overview. Understand the key resources and activities that power their success and drive innovation. This detailed analysis is perfect for anyone looking to dissect a winning business strategy. Unlock the full blueprint and see exactly how CSL operates.

Partnerships

CSL actively cultivates strategic partnerships to bolster its research and development capabilities and expedite the commercialization of novel therapies. These collaborations are vital for tapping into cutting-edge technologies and accessing new market territories, exemplified by its alliance with Arcturus Therapeutics for mRNA vaccine development.

Another key partnership is with ARS Pharmaceuticals, focusing on critical care treatments, which highlights CSL's strategy to leverage external expertise for accelerated product advancement. These alliances are instrumental in diversifying CSL's innovation pipeline and enhancing its competitive edge in the biopharmaceutical sector.

CSL's plasma collection hinges on its extensive network of CSL Plasma centers worldwide, but strategic partnerships are crucial for donor recruitment. These collaborations with local communities and organizations help ensure a consistent and reliable supply of plasma, the vital raw material for CSL's life-saving therapies. For example, CSL's expansion into Puerto Rico and Marburg, Germany, signifies ongoing efforts to broaden this network and secure a stable source of donations.

CSL, through its influenza vaccine division Seqirus, actively collaborates with governments globally to bolster pandemic preparedness. These vital partnerships ensure the availability of critical vaccines, safeguarding public health during health crises.

Recent agreements highlight this commitment. For instance, CSL Seqirus secured a contract with the European Commission for pre-pandemic influenza vaccines, reinforcing the bloc's readiness. Additionally, a significant agreement with the UK government focuses on supplying H5 influenza vaccines, crucial for avian flu preparedness.

These collaborations are instrumental in building and maintaining national vaccine stockpiles. They enable governments to respond swiftly and effectively to emerging infectious disease threats, a testament to CSL's role in global health security.

Academic and Biotech Venture Collaborations

CSL actively cultivates innovation through strategic alliances with academic institutions and emerging biotech ventures. This approach is clearly demonstrated by CSL's participation in critical investment vehicles such as Brandon Capital's BioCatalyst Fund 6, which plays a vital role in advancing Australian medical research and development. These collaborations are designed to offer CSL preferential access to groundbreaking scientific discoveries and promising new therapeutic candidates.

By engaging with entities like the Jumar Bioincubator, CSL gains early insights into novel technologies and research pipelines. This proactive strategy ensures a continuous flow of potential future therapies, thereby strengthening CSL's overall innovation pipeline and its ability to bring life-saving treatments to market. Such partnerships are foundational to maintaining a competitive edge in the rapidly evolving biopharmaceutical landscape.

- Early Access to Innovation: Partnerships provide CSL with a first look at novel scientific advancements and potential breakthrough therapies.

- Pipeline Diversification: Collaborations with academic and biotech firms help build a broad and resilient portfolio of future product candidates.

- Strategic Investment: CSL's involvement in funds like BioCatalyst Fund 6 signifies a commitment to nurturing the early-stage biotech ecosystem.

- Access to Talent and Expertise: These relationships foster a synergistic environment, leveraging external scientific talent and specialized knowledge.

Healthcare Provider and Distributor Networks

CSL’s business model heavily relies on its robust healthcare provider and distributor networks. These partnerships are critical for delivering its specialized biotherapies, which often require precise cold-chain logistics and specialized administration. For instance, CSL Behring’s immunoglobulin therapies and plasma-derived protein therapies are distributed through a global network of hospitals, clinics, and specialty pharmacies.

These relationships are not just about logistics; they are fundamental for market access and ensuring patients receive timely treatment. CSL actively collaborates with these partners to develop patient support programs and provide necessary training for healthcare professionals. As of 2024, CSL’s global supply chain network encompasses over 100 countries, with a significant portion dedicated to ensuring these complex therapies reach their intended recipients efficiently.

- Global Reach: Partnerships with over 100 countries ensure broad market access for CSL's therapies.

- Specialized Distribution: Networks are designed to handle biotherapies requiring specific cold-chain and administration protocols.

- Patient Support: Collaborations facilitate crucial patient support and educational programs.

- Market Access Enabler: These networks are vital for overcoming regulatory and logistical hurdles in diverse healthcare systems.

CSL’s engagement with academic institutions and early-stage biotech firms, such as its participation in Brandon Capital’s BioCatalyst Fund 6, grants it preferential access to groundbreaking scientific discoveries. This strategy ensures a continuous flow of promising therapeutic candidates, strengthening its innovation pipeline.

These collaborations are vital for tapping into cutting-edge technologies and accessing new markets, exemplified by its alliance with Arcturus Therapeutics for mRNA vaccine development. Furthermore, partnerships with healthcare providers and distributors in over 100 countries are critical for delivering specialized biotherapies, ensuring efficient market access and patient support.

CSL Seqirus collaborates with governments for pandemic preparedness, securing contracts for pre-pandemic influenza vaccines with entities like the European Commission and the UK government, reinforcing vaccine stockpiles and national readiness against emerging infectious diseases.

| Partner Type | Purpose | Example | 2024 Data/Impact |

|---|---|---|---|

| Academic/Biotech Ventures | Early access to innovation, pipeline diversification | Brandon Capital's BioCatalyst Fund 6 | Access to early-stage Australian medical research |

| mRNA Technology Partners | Accelerated R&D, novel therapies | Arcturus Therapeutics | Development of mRNA vaccines |

| Healthcare Providers/Distributors | Market access, specialized delivery | Global networks in over 100 countries | Efficient delivery of cold-chain biotherapies |

| Governments | Pandemic preparedness, vaccine supply | European Commission, UK Government | Secured contracts for influenza vaccines |

What is included in the product

A strategic blueprint detailing CSL's approach to creating, delivering, and capturing value, organized across key business components.

The CSL Business Model Canvas provides a structured framework to identify and address critical business challenges by visualizing all key elements in one place.

It helps alleviate the pain of fragmented strategic thinking by offering a comprehensive, yet easily digestible, overview of how a business creates, delivers, and captures value.

Activities

CSL's core activities revolve around robust Research and Development, a crucial driver for its innovative biopharmaceutical offerings. The company channels significant resources into plasma protein technology, recombinant protein technology, cell and gene therapy, and vaccine technology, aiming to tackle significant unmet medical needs.

This focus translates into advancing its pipeline across key therapeutic areas such as immunoglobulins, hematology, and nephrology. CSL also dedicates efforts to continuously enhance its existing product portfolio and optimize manufacturing processes for greater efficiency and quality.

For the fiscal year 2025, CSL anticipates maintaining its commitment to R&D, with spending projected to remain at approximately 10% of its total revenue, underscoring the strategic importance of innovation to its business model.

CSL's primary activity revolves around running a worldwide network of CSL Plasma centers. These facilities are crucial for collecting human plasma, the raw material for CSL's life-saving therapies.

The collected plasma undergoes a complex process called fractionation. This process separates the plasma into its various protein components, which are then developed into critical medications.

CSL is actively investing in expanding its plasma collection capacity. This expansion is key to meeting the growing demand for its therapies and ensuring a stable supply chain.

The company is also adopting advanced technologies, such as the RIKA plasmapheresis devices. These innovations are designed to boost efficiency and maximize the amount of plasma yielded from each donation, thereby enhancing operational effectiveness.

CSL's core activities revolve around the large-scale manufacturing of critical biotherapies. This includes the intricate production of plasma-derived medicines, recombinant proteins, and essential influenza vaccines. These processes demand substantial capital investment and the operation of advanced, highly regulated facilities.

The company's commitment to expanding production capacity is evident in its strategic investments. For instance, the new Broadmeadows plasma processing facility significantly boosted CSL's capabilities, increasing its output capacity ninefold. This expansion is vital for meeting global demand for its life-saving therapies.

Commercialization and Global Distribution

CSL's commercialization and global distribution efforts are critical to its mission of delivering life-saving therapies. This involves a robust strategy for marketing, sales, and getting its diverse product portfolio to over 100 countries.

Navigating the intricate regulatory landscapes in each of these markets is a significant undertaking, requiring meticulous attention to detail and compliance. The company focuses on strong commercial execution to ensure its innovative treatments are accessible to patients and healthcare systems across the globe.

- Global Reach: CSL's products are available in more than 100 countries, highlighting its extensive international presence.

- Regulatory Expertise: The company demonstrates a deep understanding of complex regulatory requirements essential for market access.

- Commercial Execution: CSL emphasizes efficient sales and marketing strategies to effectively reach target markets and patients.

- Product Portfolio: This activity supports the distribution of a wide range of CSL's therapeutic offerings, from plasma-derived therapies to influenza vaccines.

Patient Support and Access Programs

CSL is dedicated to patient-centric care, which involves offering flexible administration options for treatments like Hizentra®. This commitment extends to developing robust patient support programs designed to enhance the quality of life for individuals managing chronic conditions. These initiatives underscore CSL's core purpose of prioritizing patient well-being and ensuring consistent access to vital therapies.

These programs are crucial for ensuring patients can manage their conditions effectively, often at home. For instance, CSL Behring's focus on immunoglobulin therapies involves significant resources allocated to patient education and adherence support. By facilitating easier administration and providing ongoing assistance, CSL aims to minimize the burden of treatment and improve therapeutic outcomes.

- Flexible Administration: Offering options like subcutaneous infusion for therapies such as Hizentra®, allowing patients greater control and convenience.

- Patient Education: Providing comprehensive resources and training to help patients and caregivers manage their treatments safely and effectively.

- Adherence Support: Implementing programs designed to encourage consistent therapy use, which is critical for managing chronic immune deficiencies.

- Access Programs: Working to overcome financial and logistical barriers, ensuring eligible patients can obtain and continue their prescribed CSL medications.

CSL's key activities include extensive research and development to create innovative biotherapies, focusing on plasma protein, recombinant protein, and cell/gene therapies. The company also operates a global network of plasma collection centers, essential for gathering the raw materials for its life-saving treatments. Furthermore, CSL engages in the large-scale manufacturing of its complex biopharmaceutical products and manages global commercialization and distribution, ensuring its therapies reach patients worldwide. A significant ongoing activity is patient support, providing education and access programs to enhance treatment adherence and quality of life.

| Activity | Description | Fiscal Year 2024 Data/Focus |

|---|---|---|

| Research & Development | Innovating biotherapies for unmet medical needs. | Continued investment in pipeline advancement across immunoglobulins, hematology, and nephrology. |

| Plasma Collection | Operating a worldwide network of plasma centers. | Expansion of collection capacity to meet growing demand; adoption of advanced RIKA devices. |

| Manufacturing | Large-scale production of biotherapeutics and vaccines. | Strategic investments in expanding production capabilities, such as the Broadmeadows facility. |

| Commercialization & Distribution | Marketing, sales, and delivery of products to over 100 countries. | Navigating complex regulatory landscapes and ensuring strong commercial execution. |

| Patient Support | Enhancing patient quality of life through support programs. | Focus on flexible administration options and adherence support for therapies like Hizentra®. |

Full Version Awaits

Business Model Canvas

The CSL Business Model Canvas preview you see is the actual document you will receive upon purchase. It's not a simplified sample, but a direct representation of the complete, ready-to-use file. This ensures you know exactly what you're getting – a professionally structured and comprehensively detailed Business Model Canvas, prepared for immediate application and customization.

Resources

CSL's intellectual property portfolio is a cornerstone of its business model, featuring numerous patents covering its groundbreaking biotherapies and advanced manufacturing processes. This includes protected technologies in plasma protein therapies, recombinant protein production, and cutting-edge cell and gene therapies.

This proprietary knowledge acts as a significant competitive moat, directly fueling CSL's robust pipeline and future product innovation. For example, CSL Behring's development of novel immunoglobulin therapies is heavily reliant on its patented technologies in plasma fractionation and purification.

In 2024, CSL continued to invest heavily in R&D, with a reported spend of approximately $1.2 billion, underscoring its commitment to expanding its intellectual property and maintaining its leadership in biotherapeutics.

CSL Plasma's global network of over 300 plasma collection centers is a cornerstone of its operations. This vast infrastructure is crucial for securing a consistent and expanding supply of plasma, the fundamental ingredient for CSL Behring's life-saving therapies.

The logistical capabilities supporting this network, including the specialized transportation and processing of plasma, represent another vital resource. This ensures the integrity and quality of the collected plasma from collection to its use in manufacturing.

In 2024, CSL Plasma continued to invest in expanding and modernizing its collection centers, enhancing efficiency and donor experience. This ongoing commitment supports the growing demand for plasma-derived medicines.

The company's focus on regulatory compliance and quality control throughout its collection and processing infrastructure is paramount. This meticulous attention to detail safeguards the safety and efficacy of the final therapeutic products.

CSL's advanced manufacturing and fractionation facilities are foundational to its business model, ensuring the consistent supply of vital plasma-derived therapies. These state-of-the-art sites, including key operations in Broadmeadows, Australia, Marburg, Germany, and Liverpool, UK, are equipped with sophisticated automation and digital technologies. This technological integration is critical for the efficient, high-volume production required to meet global demand for CSL's extensive product range.

Highly Skilled Workforce and Scientific Expertise

CSL's highly skilled workforce, numbering over 32,000 individuals, is a cornerstone of its business model. This talent pool includes specialized scientists, dedicated researchers, and experienced manufacturing professionals who are crucial for CSL's success in the complex biotechnology sector.

The scientific and technical expertise within CSL is directly applied to its core operations, from pioneering research and development to the intricate manufacturing of life-saving therapies. This deep knowledge base allows CSL to navigate and excel in areas like complex biotechnological processes, rigorous R&D, and the demanding landscape of regulatory affairs.

- Human Capital: Over 32,000 employees globally, with a significant proportion in scientific and technical roles.

- Expertise Areas: Biotechnology, pharmaceuticals, R&D, clinical trials, manufacturing, quality assurance, and regulatory compliance.

- Innovation Engine: Scientists and researchers are key drivers of new product development and therapeutic advancements.

- Operational Excellence: Manufacturing specialists ensure the safe and efficient production of complex biologics.

Strong Financial Capital and Investment Capacity

CSL's strong financial capital is a cornerstone of its business model, fueling its innovation and market expansion. In fiscal year 2023, CSL reported a strong performance with revenues of approximately $13.3 billion and a net profit attributable to shareholders of about $2.1 billion. This financial muscle directly translates into substantial reinvestment capacity.

This robust financial health empowers CSL to make significant investments in research and development, which is critical for maintaining its leadership in the complex biotechnology sector. For example, their commitment to innovation is evident in their ongoing development pipeline, targeting unmet medical needs.

Furthermore, CSL's financial strength was instrumental in its strategic acquisition of Vifor Pharma in August 2022 for approximately $11.7 billion. This major acquisition significantly broadened CSL's portfolio, particularly in iron deficiency, nephrology, and cardio-renal therapies, demonstrating their capacity for large-scale strategic growth.

The company’s financial capacity also supports its operational expansion initiatives, allowing them to scale production and enhance their global supply chain to meet growing demand for their life-saving therapies. This financial stability ensures sustained growth and a resilient position in the market.

- Revenue Growth: CSL's revenue increased by 10% to $13.3 billion in FY23, showcasing strong top-line performance.

- Profitability: Net profit attributable to shareholders reached approximately $2.1 billion in FY23, indicating healthy margins.

- R&D Investment: Significant capital is allocated to R&D, underpinning future product innovation and pipeline development.

- Strategic Acquisitions: The $11.7 billion Vifor Pharma acquisition highlights CSL's financial capacity for impactful strategic moves.

- Operational Expansion: Financial resources support the expansion of manufacturing capabilities and global reach.

CSL's key resources encompass a robust intellectual property portfolio, a vast global network of plasma collection centers, advanced manufacturing facilities, and a highly skilled workforce. These elements are critical for its operations and innovation. The company also leverages significant financial capital to drive growth and strategic acquisitions.

The company’s intellectual property, particularly patents covering biotherapies and manufacturing, provides a significant competitive advantage. CSL's investment in R&D, around $1.2 billion in 2024, directly supports the expansion of this IP. This focus on innovation fuels its product pipeline, exemplified by advancements in immunoglobulin therapies.

CSL's extensive network of over 300 plasma collection centers is vital for securing raw materials. Supported by specialized logistics and stringent quality control, this infrastructure ensures the integrity of plasma for life-saving therapies. In 2024, continued investment in these centers enhances efficiency and supports growing demand.

The company's advanced manufacturing sites and its workforce of over 32,000 skilled employees, many in scientific roles, are foundational. This human capital drives expertise in R&D, manufacturing, and regulatory compliance, enabling CSL to excel in the biotechnology sector.

| Resource Category | Key Components | 2023/2024 Data/Impact |

|---|---|---|

| Intellectual Property | Patents for biotherapies, recombinant protein production, cell & gene therapies | ~ $1.2 billion R&D spend in 2024 |

| Physical Resources | Over 300 global plasma collection centers | Ongoing investment in center expansion and modernization |

| Manufacturing Facilities | State-of-the-art fractionation and processing sites | Critical for high-volume production of plasma-derived therapies |

| Human Capital | Over 32,000 employees (significant scientific/technical roles) | Expertise in biotech, R&D, manufacturing, quality assurance |

| Financial Capital | Strong revenue and profit generation | FY23 Revenue: ~$13.3 billion; Net Profit: ~$2.1 billion; Vifor acquisition: ~$11.7 billion |

Value Propositions

CSL's core value proposition lies in delivering life-saving therapies for rare and serious conditions, directly impacting patient well-being. They focus on developing innovative biotherapies that address critical unmet medical needs in areas such as immune deficiencies and bleeding disorders like hemophilia.

These advanced treatments significantly enhance the quality of life for patients who often have limited or no other therapeutic options. For instance, CSL Behring's therapies for hemophilia have revolutionized management, allowing many patients to lead more active lives.

In fiscal year 2024, CSL reported strong performance in its Plasma-Derived Therapies segment, driven by demand for its immunoglobulin and albumin products, which are vital for managing various immune and critical care conditions. This segment continues to be a cornerstone of CSL's commitment to providing essential treatments.

CSL Seqirus stands out by offering a comprehensive range of advanced influenza vaccines, featuring both adjuvanted and cell-based technologies. This innovation allows for improved protection and addresses diverse patient needs.

The company's commitment extends to bolstering global public health through robust seasonal flu prevention programs. In 2024, Seqirus continued its significant role in supplying influenza vaccines to numerous countries, aiming to reduce the burden of the flu.

Furthermore, CSL Seqirus is a key player in pandemic preparedness, developing and stockpiling vaccines to ensure rapid response to emerging influenza threats. Their advanced manufacturing capabilities are critical for scaling up production during public health emergencies.

CSL Vifor provides innovative therapies for iron deficiency and kidney diseases, including IgA Nephropathy, addressing significant unmet patient needs.

This strategic focus allows CSL to broaden its healthcare impact, extending beyond its established plasma-derived therapies and vaccines into specialized medical areas.

In 2024, CSL Vifor's pipeline includes promising treatments that aim to improve the quality of life for patients suffering from chronic kidney disease and related complications.

The business unit's expansion into nephrology represents a key growth driver, leveraging scientific advancements to offer novel solutions in a critical and expanding therapeutic field.

Commitment to Innovation and Scientific Advancement

CSL's unwavering dedication to research and development fuels its progress. In fiscal year 2023, the company invested approximately $1.2 billion in R&D, a testament to its focus on scientific breakthroughs. This investment is crucial for developing novel therapies and enhancing existing ones, ensuring CSL remains a leader in biopharmaceutical innovation.

This focus on world-class science and technology directly translates into a strong pipeline of future products. CSL's commitment to innovation means it consistently explores new avenues to address unmet medical needs. For instance, their work in gene therapy and novel biologics highlights this forward-thinking approach, aiming to bring life-saving treatments to patients.

The company's strategic investments in R&D are designed to create a sustainable advantage. By prioritizing cutting-edge research, CSL not only develops new therapies but also strengthens its existing portfolio. This dual approach ensures both near-term revenue generation and long-term growth potential, reinforcing its position as an innovator.

- $1.2 billion invested in R&D in FY23.

- Focus on novel therapies and improved treatments.

- Robust pipeline driven by scientific advancement.

- Leadership in biopharmaceutical innovation through continuous investment.

Reliable Supply and Global Accessibility

CSL's extensive plasma collection network, comprising over 300 plasma collection centers globally as of early 2024, underpins its reliable supply chain. This robust infrastructure ensures a consistent inflow of plasma, the essential raw material for its life-saving therapies.

Advanced manufacturing capabilities, including state-of-the-art fractionation plants, allow CSL to process plasma efficiently and produce a diverse portfolio of critical medicines. This operational mastery is crucial for meeting global demand.

CSL's commitment to global accessibility is evident in its distribution to over 100 countries, reaching patients who depend on its therapies. For instance, CSL Behring's immunoglobulin products are vital for individuals with primary immune deficiencies, and their widespread availability is paramount.

- Global Reach: Serves patients in over 100 countries.

- Plasma Collection: Operates a vast network of collection centers.

- Manufacturing Excellence: Utilizes advanced processing for critical medicines.

- Patient Trust: Ensures consistent availability of life-saving therapies.

CSL provides life-saving therapies for rare and serious diseases, significantly improving patient quality of life, particularly for those with hemophilia and immune deficiencies. The company also offers advanced influenza vaccines through CSL Seqirus, contributing to public health and pandemic preparedness. Furthermore, CSL Vifor addresses unmet needs in iron deficiency and kidney diseases, broadening CSL's impact across critical therapeutic areas.

| Value Proposition | Description | Key Segments Involved | 2024 Relevance |

| Life-Saving Therapies for Rare Diseases | Innovative treatments for immune deficiencies and bleeding disorders. | CSL Behring | Strong demand for immunoglobulin and albumin products. |

| Advanced Influenza Vaccines | Comprehensive range of seasonal and pandemic influenza vaccines. | CSL Seqirus | Continued supply for global public health programs. |

| Specialized Treatments for Nephrology and Iron Deficiency | Therapies addressing iron deficiency and kidney diseases like IgA Nephropathy. | CSL Vifor | Pipeline growth in chronic kidney disease treatments. |

Customer Relationships

CSL prioritizes a patient-centric approach, evident in its comprehensive support programs designed to improve the quality of life for those undergoing therapy. These programs often include flexible administration options, making treatments more manageable. For instance, CSL Behring's Uniqure gene therapy for hemophilia B, etranacogene dezaparvovec (Hemgenix), launched in 2022, is administered via a one-time infusion, simplifying the patient journey compared to frequent traditional treatments.

Direct engagement with patient advocacy groups and communities is a cornerstone of CSL's strategy. This collaboration ensures that their therapies and support systems are tailored to address genuine, real-world patient needs and overcome existing challenges in accessing and managing treatment. This feedback loop is critical for continuous improvement and patient satisfaction.

CSL cultivates deep, lasting connections with healthcare institutions like hospitals and clinics, as well as individual doctors and nurses who are key to their therapy delivery. This is crucial for consistent product adoption and patient support.

A core part of this strategy involves offering comprehensive educational materials and direct clinical support to healthcare providers. CSL aims to empower them with the knowledge and resources needed for the effective use of their specialized therapies.

Ensuring seamless product availability is paramount. CSL's commitment to reliable supply chains directly impacts their partners' ability to provide uninterrupted patient care, solidifying trust and long-term collaboration.

In 2024, CSL reported significant investments in its medical affairs and patient support programs, underscoring the importance of these provider relationships. This focus aims to enhance understanding and utilization of their growing portfolio of life-saving treatments.

CSL's collaborative engagements with governments and public health bodies are foundational to its business model, particularly concerning vaccine supply and pandemic preparedness. These relationships are often long-term and strategic, built on a bedrock of trust and CSL's consistent track record in delivering vital public health solutions. For instance, in 2024, CSL continued its work with various national health agencies on ensuring the availability of influenza vaccines, a critical component of seasonal public health strategies. These partnerships are essential for navigating complex regulatory pathways and securing agreements that guarantee supply during public health emergencies.

Investor Relations and Transparency

CSL prioritizes clear and consistent communication with its varied investor base, encompassing both individual and institutional shareholders. This commitment to transparency is demonstrated through regular financial reports, investor briefings, and participation in annual general meetings, ensuring comprehensive financial data and strategic direction are readily accessible.

In 2024, CSL continued its practice of providing detailed quarterly earnings reports, alongside investor presentations that highlight key performance indicators and future growth strategies. For instance, their H1 2024 results showed a revenue increase of 7% year-on-year, with management attributing this growth, in part, to successful product launches and expanded market reach, which were thoroughly discussed during investor calls.

- Regular Financial Reporting: CSL consistently publishes quarterly and annual financial statements, adhering to strict disclosure requirements.

- Investor Presentations: These sessions offer in-depth analysis of financial performance, strategic initiatives, and market outlook.

- Annual General Meetings (AGMs): AGMs provide a forum for direct engagement between management and shareholders, facilitating discussion and voting on critical company matters.

- Shareholder Communications: CSL utilizes various channels, including its investor relations website and email newsletters, to disseminate timely information and respond to inquiries.

Engagement with Donors at Plasma Collection Centers

CSL Plasma focuses on building strong connections with its plasma donors, acknowledging them as essential to its operations. The company prioritizes a safe, welcoming environment for donations, offers competitive compensation, and educates donors on how their contributions directly help patients requiring plasma-derived therapies.

- Donor Experience: CSL Plasma invests in creating a positive and comfortable donation environment, which is crucial for donor retention.

- Compensation and Incentives: Donors are compensated for their time and contribution, with programs designed to encourage repeat donations. In 2023, CSL Plasma reported strong revenue growth, partly driven by donor loyalty and an increasing number of donations.

- Education and Impact: The company actively communicates the life-saving impact of plasma donations, reinforcing the value of each donation to the donor and the wider community.

- Community Building: CSL Plasma centers often foster a sense of community among donors, further strengthening their commitment and engagement.

CSL's customer relationships are built on a foundation of patient-centricity, direct engagement with patient advocacy groups, and strong partnerships with healthcare providers. This multifaceted approach ensures therapies are accessible and well-supported.

Channels

CSL deploys highly trained, specialized sales forces to directly connect with hospitals, clinics, and various healthcare institutions worldwide. This direct engagement is crucial for disseminating knowledge about intricate biotherapies.

These teams are instrumental in educating healthcare providers on the proper administration and therapeutic benefits of CSL's products, thereby driving product adoption and ensuring optimal patient outcomes.

In 2024, CSL's global sales force, numbering over 5,000 individuals, focused on key therapeutic areas like hematology and immunology, directly impacting hundreds of thousands of healthcare professionals. Their efforts are vital for navigating the complex regulatory and clinical environments of the healthcare sector.

CSL relies heavily on pharmaceutical distributors and wholesalers to get its life-saving therapies to patients. These partners are crucial for reaching a wide range of healthcare providers, from large hospital systems to smaller clinics. In 2024, CSL continued to leverage these established networks, which is a cornerstone of its go-to-market strategy.

The efficiency of these distribution channels is vital for CSL's operations. They ensure that products, especially those requiring specific storage conditions like many biologics, arrive promptly and in optimal condition. This logistical prowess is a key element of CSL's business model, enabling consistent supply chain management.

Globally, the pharmaceutical wholesale market is substantial. For instance, by the end of 2023, the global pharmaceutical wholesale and distribution market was valued at over $1.5 trillion, demonstrating the scale and importance of these partners for companies like CSL to maintain broad market access.

CSL's relationships with these distributors allow for economies of scale in logistics and reduce the complexity of managing a direct supply chain to thousands of individual healthcare facilities. This strategic outsourcing allows CSL to focus on its core competencies of research, development, and manufacturing.

CSL Plasma collection centers are the lifeblood of CSL Behring's operations, acting as the primary source for the human plasma needed to create life-saving therapies. These centers are crucial for securing the raw material that fuels their entire value chain.

The strategic expansion of this channel, exemplified by recent growth in locations like Puerto Rico, directly enhances CSL's ability to meet demand. In 2023, CSL opened over 60 new plasma collection centers globally, bringing their total to more than 300, significantly boosting their sourcing capacity.

Government Procurement and Tenders

CSL Seqirus actively participates in government procurement and tenders, particularly for critical public health needs like vaccines. This channel is vital for securing substantial supply agreements with national governments and international health bodies, ensuring broad access to essential immunizations. For instance, in 2024, CSL Seqirus secured a significant contract with the U.S. Department of Health and Human Services for influenza vaccines, highlighting the importance of this channel for pandemic preparedness and seasonal health programs.

These government contracts are often awarded through competitive bidding processes and tenders, where CSL Seqirus demonstrates its capacity to deliver high-quality, large-volume vaccine supplies. The company’s ability to meet stringent regulatory requirements and ensure reliable distribution networks is key to winning these tenders.

The financial implications of these procurement channels are substantial, often representing a significant portion of CSL Seqirus's revenue. Winning these bids directly impacts the company's ability to fund research and development for future health innovations.

- Secures large-scale supply contracts for pandemic preparedness.

- Engages directly with national governments and international health organizations.

- Essential for seasonal immunization programs and public health initiatives.

- Competitive tendering processes are crucial for contract acquisition.

Digital Platforms and Investor Portals

CSL leverages its corporate website and dedicated investor relations portals as key digital platforms to communicate critical company information. These channels are vital for disseminating financial results, annual reports, and timely updates, ensuring a broad and accessible flow of data to investors and the general public.

Through online presentations and webcasts, CSL enhances transparency and engagement, allowing stakeholders to gain deeper insights into the company's performance and strategic direction. For instance, in fiscal year 2024, CSL reported a significant increase in website traffic to its investor relations section following the release of its interim financial results, highlighting the effectiveness of these digital touchpoints.

- Corporate Website & Investor Relations Portals: Central hubs for financial reports, news, and governance documents.

- Online Presentations & Webcasts: Live and archived sessions detailing company performance and outlook.

- Information Accessibility: Ensures broad reach for financial results and strategic updates.

- Transparency & Engagement: Fosters trust by providing open access to corporate information.

CSL utilizes a multi-channel approach to reach its diverse customer base. Direct sales forces engage healthcare professionals to educate them on complex biotherapies, while established distributor networks ensure broad market access for its products. Furthermore, CSL Plasma collection centers are critical for securing the raw material for its therapies, and strategic government procurement channels are vital for vaccine distribution.

Digital platforms, including the corporate website and investor relations portals, serve as key channels for transparent communication with investors and the public, providing essential financial and strategic information.

In 2024, CSL’s global sales force, exceeding 5,000 individuals, focused on hematology and immunology, impacting hundreds of thousands of healthcare professionals. The company also continued to leverage its extensive distributor networks, a strategy supported by the global pharmaceutical wholesale market's valuation exceeding $1.5 trillion by the end of 2023. CSL Plasma expanded significantly, opening over 60 new centers in 2023, bringing its global total to over 300.

| Channel | Description | Key Activities | 2024 Relevance/Data |

| Direct Sales Force | Specialized teams engaging healthcare institutions globally. | Educating providers on biotherapies, administration, and benefits. | Over 5,000 personnel focused on hematology and immunology. |

| Distributors & Wholesalers | Established networks for product delivery to healthcare providers. | Ensuring broad market access and efficient logistics. | Leveraging networks within a $1.5T+ global market (2023). |

| CSL Plasma Collection Centers | Primary source for human plasma for CSL Behring. | Securing raw material for therapy production. | Over 300 centers globally; 60+ opened in 2023. |

| Government Procurement & Tenders | Securing large supply agreements for vaccines and public health needs. | Engaging with national governments and health bodies. | Secured significant HHS contract for influenza vaccines in 2024. |

| Corporate Website & Investor Relations | Digital platforms for company information dissemination. | Sharing financial results, annual reports, and strategic updates. | Increased website traffic to investor relations post-FY24 interim results. |

Customer Segments

Patients with rare and serious diseases represent a core customer segment for CSL, encompassing individuals with conditions such as primary immune deficiencies, hereditary bleeding disorders like hemophilia A and B, hereditary angioedema, and alpha-1 antitrypsin deficiency.

These patients depend on CSL's highly specialized, often life-sustaining plasma-derived and recombinant therapies, which are critical for managing their chronic and complex health needs.

In fiscal year 2024, CSL Behring, a key division, reported strong performance driven by its immunoglobulin and albumin portfolios, serving many of these rare disease patients.

The company continues to invest in research and development to expand its offerings for these underserved populations, aiming to improve treatment outcomes and quality of life.

Individuals seeking protection against seasonal and pandemic influenza represent a significant customer segment for influenza vaccines. This includes the general public, with a particular focus on vulnerable groups such as the elderly, who are often prioritized for vaccination due to increased health risks. In 2024, the global influenza vaccine market was valued at approximately $6.5 billion, demonstrating the substantial demand.

CSL Seqirus directly addresses this broad need through its comprehensive vaccine portfolio, including products like FLUAD®, specifically formulated for older adults. The Centers for Disease Control and Prevention (CDC) in the US recommended the use of cell-based or high-dose influenza vaccines for individuals aged 65 and older in the 2023-2024 season, further underscoring the importance of targeted solutions for this demographic.

CSL Vifor specifically targets patients grappling with iron deficiency, a condition that can arise from various underlying causes. This segment is critical as iron deficiency can significantly impact a patient's energy levels and overall well-being.

A key focus area for CSL Vifor is serving individuals with chronic kidney disease, often referred to as nephrology patients. These individuals require specialized care to manage the complex symptoms associated with kidney dysfunction.

Within the chronic kidney disease population, CSL Vifor also addresses the needs of patients suffering from IgA Nephropathy. This specific condition necessitates tailored therapeutic approaches to mitigate its progression and impact on kidney function.

The treatments provided to these patient segments are designed to manage symptoms effectively and ultimately enhance health outcomes, addressing the unique challenges posed by iron deficiency and kidney-related conditions.

Healthcare Professionals and Institutions

Healthcare professionals and institutions, including physicians, specialists, hospitals, and clinics, represent a core customer segment for CSL. These entities are the primary prescribers, administrators, and managers of patient care involving CSL's vital biotherapies. Their decisions directly impact product adoption and patient access. In 2024, the global biopharmaceutical market continued its robust growth, driven by advancements in biologics and a rising prevalence of chronic diseases, underscoring the importance of this segment. For instance, CSL's revenue from its plasma-derived therapies segment has consistently shown strong performance, reflecting the ongoing demand from these healthcare providers.

This segment is critical as they act as direct consumers and gatekeepers for CSL's innovative treatments. Their trust and adoption are paramount for CSL's success. The increasing complexity of patient care pathways and the need for specialized treatments further solidify the influence of healthcare professionals and institutions in the biopharmaceutical landscape. CSL's engagement with this group focuses on providing reliable, high-quality therapies and supporting evidence-based clinical practice.

- Key Decision-Makers: Physicians and hospital administrators are central to the procurement and utilization of CSL's biotherapies.

- Direct Consumers: Hospitals and clinics directly administer CSL's products to patients, making them crucial touchpoints.

- Market Influence: The prescribing habits and treatment protocols established by healthcare professionals significantly shape market demand.

- Focus on Innovation: This segment demands cutting-edge therapies, driving CSL's research and development efforts.

Governments and Public Health Organizations

Governments and public health organizations are critical customer segments, acting as major purchasers of vaccines and essential biotherapies. These entities, ranging from national health ministries to international bodies like the World Health Organization (WHO), fund and implement national health programs and maintain strategic stockpiles for disease prevention and pandemic preparedness. For instance, in 2024, many governments continued to invest heavily in vaccine procurement and public health infrastructure to combat ongoing infectious disease threats.

Their procurement decisions are often driven by public health mandates, disease surveillance data, and national security concerns. These organizations require reliable, high-quality biopharmaceutical products to meet population health needs and respond to health emergencies. The scale of their purchases can significantly impact market demand and supply chain strategies for biopharmaceutical companies.

- Key Role: Purchasers of vaccines and biotherapies for national health programs and stockpiles.

- Driving Factors: Public health mandates, disease surveillance, and pandemic preparedness.

- Procurement Needs: High-quality, reliable biopharmaceutical products for population health.

- Market Impact: Significant influence on demand and supply chains due to large-scale purchases.

CSL serves diverse patient populations with critical unmet medical needs, including those with rare genetic disorders and chronic conditions like kidney disease. The company's focus on specialized therapies, particularly plasma-derived and recombinant products, highlights its commitment to these often vulnerable groups. In fiscal year 2024, CSL Behring's performance was notably strong, driven by its immunoglobulin and albumin offerings, directly benefiting these patient segments.

Cost Structure

Research and Development (R&D) is a cornerstone of CSL's cost structure, with a substantial portion of its expenditure dedicated to innovation. These costs encompass the entire lifecycle of product development, from initial drug discovery and preclinical research to the rigorous and lengthy process of clinical trials. CSL's commitment to advancing its product pipeline means that billions are consistently invested annually in these crucial activities, underscoring its strategy for long-term growth and market leadership in the biopharmaceutical sector.

Operating CSL's global plasma collection network is a significant expense. This includes compensating donors, maintaining a vast network of donation centers, and the intricate processes involved in plasma fractionation and purification. In fiscal year 2023, CSL’s cost of goods sold, heavily influenced by these collection and manufacturing activities, was approximately $4.2 billion.

Continuous efforts are made to enhance the efficiency of plasma collection. This focus aims to reduce the per-unit cost of plasma, a key input for CSL's life-saving therapies. Innovations in donor recruitment and retention, alongside advancements in collection technology, are central to these efficiency drives.

CSL's sales, marketing, and distribution expenses are significant investments crucial for global product commercialization and market penetration. These costs encompass everything from maintaining a dedicated sales force and executing broad marketing campaigns to navigating complex regulatory environments and managing intricate logistics networks across diverse geographies. For instance, in fiscal year 2023, CSL reported selling, general and administrative expenses of approximately $3.7 billion, a substantial portion of which is allocated to these commercialization efforts.

Acquisition and Integration Costs

CSL's cost structure includes substantial acquisition and integration expenses, exemplified by its significant investment in the Vifor Pharma acquisition. This strategic move, aimed at expanding CSL's global footprint and therapeutic portfolio, required considerable capital outlay and ongoing resources for successful integration. These costs are fundamental to CSL's long-term growth strategy, enabling market penetration and the broadening of its product pipeline.

The Vifor Pharma acquisition, for instance, represented a substantial financial commitment for CSL, underscoring the high costs associated with pursuing strategic inorganic growth. These integration efforts are critical for unlocking the anticipated synergies and achieving the envisioned market expansion. Such investments are directly tied to CSL's ambition to enhance its competitive position and diversify its revenue streams.

- Acquisition Costs: Significant capital deployed for strategic purchases like Vifor Pharma.

- Integration Expenses: Ongoing investment in merging operations, systems, and cultures post-acquisition.

- Synergy Realization Costs: Resources allocated to achieve the anticipated benefits and efficiencies from acquired businesses.

- Long-Term Growth Investment: These costs are viewed as essential investments for future market share and product portfolio expansion.

General and Administrative (G&A) Expenses

General and Administrative (G&A) expenses represent the essential overhead costs required to run CSL as a business. These are not directly tied to the production of goods or services but are crucial for overall operations. This category encompasses a range of expenditures, from the salaries of executive leadership and the support staff in administrative functions to the costs of maintaining IT infrastructure and covering legal services. For fiscal year 2024, CSL has reported G&A expenses amounting to approximately $2.1 billion, reflecting investments in corporate functions necessary for global business management.

CSL's strategy involves a continuous drive for operational efficiencies to manage these vital G&A costs effectively. This focus on streamlining processes and optimizing resource allocation is key to maintaining profitability and competitiveness in the biopharmaceutical industry. For instance, in 2023, CSL achieved cost savings of over $150 million through various G&A optimization initiatives, demonstrating their commitment to this area.

- Executive Salaries and Benefits: Compensation for senior management responsible for strategic direction.

- Administrative Support: Costs associated with HR, finance, and general office management.

- IT Infrastructure: Investments in technology systems, software, and cybersecurity for corporate functions.

- Legal and Compliance: Expenses related to regulatory adherence, intellectual property, and corporate governance.

- Other Corporate Functions: Includes costs for facilities management, insurance, and professional services.

CSL's cost structure is heavily influenced by its extensive research and development efforts, with billions invested annually in innovation and product pipeline advancement. Operational costs for its global plasma collection network, including donor compensation and fractionation processes, also represent a significant expenditure, with cost of goods sold around $4.2 billion in fiscal year 2023. Sales, marketing, and distribution expenses, totaling approximately $3.7 billion in SG&A for fiscal year 2023, are crucial for global commercialization.

Strategic acquisitions, such as Vifor Pharma, contribute substantial one-time and ongoing integration costs to CSL's overall expense base. General and administrative expenses, amounting to roughly $2.1 billion in fiscal year 2024, cover essential corporate functions, with ongoing initiatives targeting over $150 million in G&A cost savings as seen in 2023.

| Cost Category | Fiscal Year 2023 (Approx.) | Fiscal Year 2024 (Approx.) | Key Drivers |

|---|---|---|---|

| Research & Development | Billions | Billions | New drug discovery, clinical trials, innovation |

| Cost of Goods Sold (Plasma Ops) | $4.2 billion | N/A | Donor compensation, collection centers, fractionation |

| Selling, General & Administrative (SG&A) | $3.7 billion | N/A | Sales force, marketing, distribution, corporate overhead |

| General & Administrative (G&A) | N/A | $2.1 billion | Executive management, IT, legal, HR |

| Acquisition & Integration | Significant (Vifor Pharma) | Ongoing | Mergers, synergy realization, market expansion |

Revenue Streams

The sale of plasma-derived therapies stands as CSL's primary revenue engine. This segment is largely driven by immunoglobulins (Ig), essential for treating various immune deficiencies, and albumin, a vital protein. In fiscal year 2024, CSL Behring's immunoglobulin portfolio demonstrated robust expansion, becoming a cornerstone of the company's financial performance and contributing a substantial portion to its total earnings.

CSL Seqirus generates revenue primarily through the worldwide sales of seasonal and pre-pandemic influenza vaccines. This revenue stream is influenced by various market dynamics, including fluctuating demand and national immunization program uptake. For instance, CSL Seqirus reported revenue of approximately AUD 2.4 billion for influenza vaccines in the fiscal year 2023, demonstrating the significance of this segment.

The company's investment in a differentiated product portfolio, featuring offerings like FLUAD®, a cell-based influenza vaccine, plays a crucial role in its revenue generation. These advanced formulations often command a premium and contribute significantly to Seqirus's market share and overall financial performance. The introduction of new vaccine technologies and expanded indications continues to bolster this important revenue stream.

CSL Vifor's sales of therapies for iron deficiency and kidney disease represent a significant and expanding revenue source. For instance, FILSPARI® is a key product in this segment, contributing to CSL's financial strength.

The company also generates substantial revenue from iron volumes, particularly in the European market. This diversification across different therapeutic areas and geographies bolsters CSL's overall revenue streams.

Recombinant Product Sales

Revenue from recombinant products, such as therapies for hemophilia like IDELVION®, is a significant contributor to CSL's financial performance. These specialized treatments address critical medical needs and command premium pricing within the biopharmaceutical sector.

The gene therapy HEMGENIX® also bolsters this revenue stream, representing a high-value innovation in the treatment of hemophilia B. The success of these advanced therapies highlights CSL's capability in developing and commercializing complex biological products.

- Hemophilia Therapies: IDELVION® and HEMGENIX® drive substantial revenue.

- High-Value Segments: These products operate in lucrative biopharmaceutical markets.

- Innovation Impact: Gene therapy represents a significant growth driver.

Licensing and Collaboration Agreements

CSL generates revenue through licensing its innovative technologies to other companies. This allows partners to utilize CSL's advancements, providing CSL with upfront fees and ongoing royalties. For instance, in 2024, CSL continued to explore such opportunities, building on its history of successful collaborations.

Collaborative research and development (R&D) agreements also contribute to CSL's revenue streams. These partnerships often involve milestone payments tied to the successful development of new products or therapies. Such ventures underscore CSL's commitment to leveraging its substantial R&D investments for broader market impact.

- Technology Licensing: CSL generates income by licensing its proprietary technologies to third parties, securing upfront fees and royalties.

- Collaborative R&D: Milestone payments from joint research projects contribute to revenue, recognizing progress in developing new therapies.

- Leveraging R&D: These revenue streams effectively monetize CSL's extensive investments in research and development.

- Focus on Proprietary Sales: While significant, these licensing and collaboration revenues complement, rather than replace, CSL's core revenue from proprietary product sales.

CSL's revenue streams are diverse, with plasma-derived therapies being the primary driver, particularly immunoglobulins and albumin, which saw robust growth in fiscal year 2024. Influenza vaccines, primarily from CSL Seqirus, represent another significant contributor, with the company reporting approximately AUD 2.4 billion in influenza vaccine revenue for fiscal year 2023. CSL Vifor's sales in iron deficiency and kidney disease therapies, including FILSPARI®, are also expanding. Furthermore, revenue from recombinant products like hemophilia therapies (IDELVION®) and the gene therapy HEMGENIX® are crucial high-value segments.

| Revenue Stream | Key Products/Segments | Fiscal Year 2023 Data (if available) | Fiscal Year 2024 Notes |

| Plasma-Derived Therapies | Immunoglobulins (Ig), Albumin | N/A (Primary driver) | Robust expansion in Ig portfolio |

| Influenza Vaccines | Seasonal and pre-pandemic vaccines (e.g., FLUAD®) | AUD 2.4 billion (Influenza vaccines) | Continued market influence |

| Iron Deficiency & Kidney Disease Therapies | FILSPARI® | N/A | Significant and expanding source |

| Recombinant Therapies | Hemophilia treatments (IDELVION®), Gene Therapy (HEMGENIX®) | N/A | High-value, innovation-driven growth |

| Licensing & Collaborations | Technology licensing, R&D agreements | N/A | Ongoing opportunities explored |

Business Model Canvas Data Sources

The CSL Business Model Canvas is built upon a robust foundation of internal financial data, comprehensive market research, and detailed competitive analysis. These sources ensure each component of the canvas is grounded in factual evidence and strategic understanding.