CSL Boston Consulting Group Matrix

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

CSL Bundle

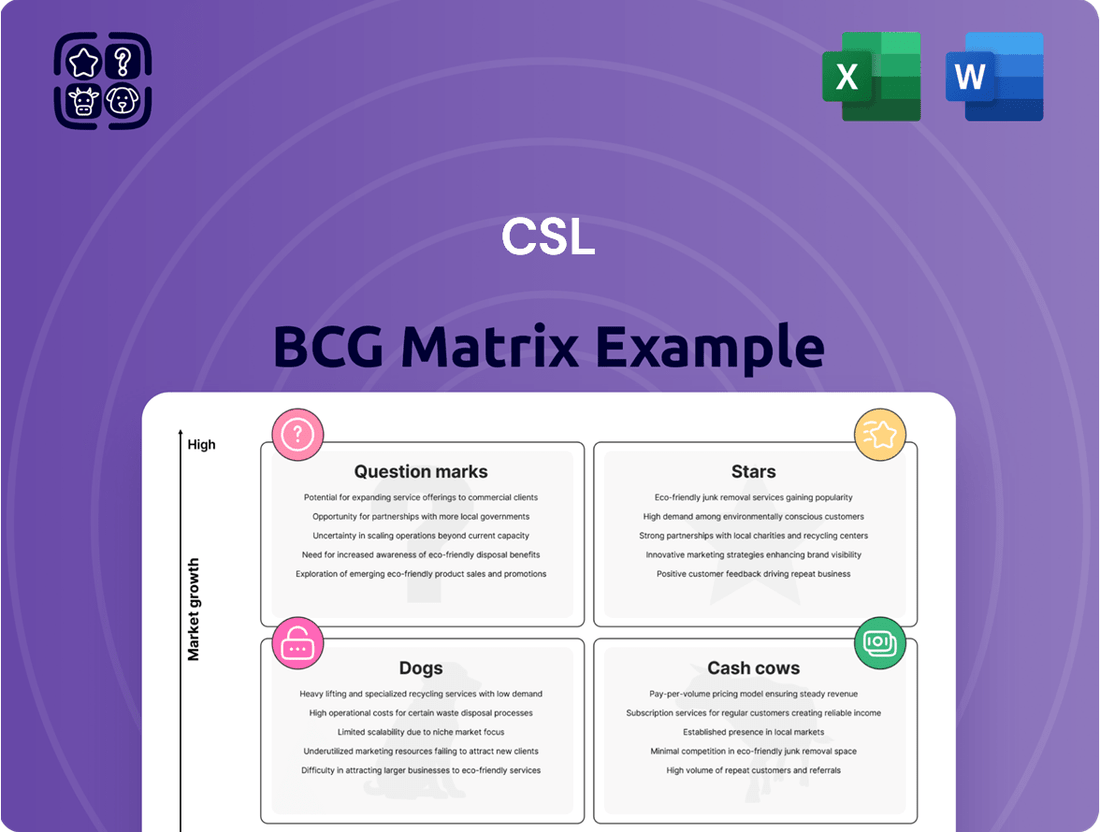

Curious about how this company's product portfolio stacks up in the market? The BCG Matrix categorizes products into Stars, Cash Cows, Dogs, and Question Marks, offering a powerful visual for strategic analysis. Understanding these placements is crucial for optimizing resource allocation and driving future growth.

This preview offers a glimpse into the strategic potential of each product category. To truly leverage this framework for your business, dive deeper with the full BCG Matrix. It provides the detailed insights and actionable recommendations you need to make informed decisions about investment and product development.

Don't miss out on unlocking the full strategic advantage. Purchase the complete BCG Matrix today and gain a clear, data-driven roadmap to navigate your market with confidence and achieve sustainable success.

Stars

CSL's immunoglobulin (Ig) portfolio is a significant growth driver, showcasing impressive performance with sales up 20% in FY24 and 23% in H1 FY24 at constant currency. This surge is fueled by strong patient demand and a notable rebound in plasma collection volumes. CSL's strategic investments in its plasma supply chain are key to maintaining its leading market share and robust growth trajectory in this expanding therapeutic area.

Garadacimab, CSL's innovative therapy for Hereditary Angioedema (HAE), is strategically positioned for a strong market debut. With ongoing regulatory reviews by the FDA and EMA, and a recent approval in Switzerland in February 2025, its market entry is imminent. The HAE market itself is experiencing robust growth, with projections indicating continued expansion.

Garadacimab's unique profile as a long-acting prophylactic treatment offers significant advantages, potentially capturing a leading market share. This next-generation therapy is anticipated to launch in Fiscal Year 2025, marking it as a crucial growth engine for CSL. The company expects garadacimab to be a key contributor to its future revenue streams, solidifying its position in the rare disease therapeutic area.

FLUAD®, CSL Seqirus's adjuvanted influenza vaccine, demonstrated robust performance with a 14% sales increase in fiscal year 2024. This growth outpaced the overall influenza vaccine market, highlighting its competitive edge.

The strong sales of FLUAD® are attributed to CSL Seqirus's advanced vaccine technology, which offers a differentiated product in a growing market. Increased immunization campaigns globally further bolster demand for such advanced vaccines.

This success positions FLUAD® as a key revenue driver for CSL Seqirus within the influenza vaccine sector. Its performance underscores the strategic importance of innovative vaccine formulations in capturing market share.

CSL Vifor's New Nephrology Therapies

CSL Vifor is making significant strides in the nephrology sector, a market poised for substantial growth. Their innovative therapy, FILSPARI®, for IgA Nephropathy, secured standard European Union approval in April 2025, marking a key milestone. This expansion highlights CSL's commitment to precision healthcare and strategic alliances within the kidney disease space.

The nephrology market is increasingly attractive due to rising global incidences of chronic kidney disease. CSL Vifor's investment in novel treatments like FILSPARI® positions them to capture a significant share of this expanding market. These developments are crucial for their continued growth and market leadership.

- FILSPARI® EU Approval: Standard EU approval in April 2025 for IgA Nephropathy.

- Nephrology Market Focus: Strategic expansion into a growing healthcare segment.

- Precision Healthcare: Emphasis on targeted therapies for kidney diseases.

- Market Position: Strengthening CSL Vifor's presence in evolving therapeutic areas.

Hizentra (Subcutaneous Immunoglobulin)

Hizentra represents a significant asset for CSL, positioned as a strong contender within the immunoglobulin market. Its impressive 60% market share in the subcutaneous immunoglobulin segment highlights its dominance and customer preference.

This market leadership, coupled with its convenient administration and proven effectiveness, fuels consistent demand and contributes substantially to the immunoglobulin portfolio's robust growth trajectory. The product's exclusivity in the United States until fiscal year 2025 further solidifies its competitive advantage and market position.

- Market Share: Hizentra holds a commanding 60% share in its specific subcutaneous immunoglobulin market segment.

- Portfolio Contribution: It is a major driver of growth for CSL's overall immunoglobulin business.

- Competitive Advantage: Convenient administration and established efficacy ensure sustained demand.

- Exclusivity: US market exclusivity extends through fiscal 2025, reinforcing its strong position.

CSL's portfolio features several products that can be categorized as Stars in the BCG Matrix, indicating high market share in high-growth markets. These products are driving significant revenue and are expected to continue doing so. Their strong performance is a testament to CSL's innovation and strategic market positioning.

| Product | Market Segment | Growth Rate | Market Share | Fiscal Year 2024 Sales (Constant Currency) |

|---|---|---|---|---|

| Immunoglobulin (Ig) Portfolio | Immunoglobulin Therapy | High | High | +20% |

| Garadacimab | Hereditary Angioedema (HAE) | High (Projected) | High (Targeted) | N/A (Pre-launch) |

| Hizentra | Subcutaneous Immunoglobulin | High | 60% | Significant Contributor |

| FILSPARI® | IgA Nephropathy Treatment | High (Nephrology Market) | Growing | N/A (Recent EU Approval) |

What is included in the product

Detailed breakdown of a company's portfolio, categorizing products into Stars, Cash Cows, Question Marks, and Dogs to guide strategic decisions.

Provides a clear visual of business unit performance, easing the pain of strategic ambiguity.

Cash Cows

CSL Behring's established Intravenous Immunoglobulins (IVIg) products, like PRIVIGEN and INTRAGRAM, are true cash cows. These are mature therapies in a steady market, and CSL holds a strong leading position with them.

These foundational IVIg products consistently deliver significant cash flow. CSL can effectively leverage these gains with minimal promotional investment required, reflecting their stable market presence and established demand.

With a high market share in treating immune deficiencies, these IVIg therapies act as reliable revenue generators for CSL Behring. Their consistent performance underpins the company's financial stability and ability to fund other growth initiatives.

Albumin products represent a vital cash cow for CSL Behring, a critical plasma-derived therapy with consistent demand in a mature market. CSL's robust market position in albumin ensures reliable cash generation, underpinning its financial stability.

This essential medical treatment for various conditions, including shock and hypoalbuminemia, provides a predictable and stable income stream for the company. In the fiscal year 2023, CSL Behring's revenue from its plasma-derived therapies, which includes albumin, demonstrated strong performance, contributing significantly to the company's overall profitability and reinforcing its cash cow status.

CSL Seqirus’s established egg-based influenza vaccines are undisputed cash cows, generating a consistent and substantial revenue stream for the company. These vaccines are essential for public health, administered annually to millions worldwide, ensuring a reliable demand. In the 2023 influenza season, Seqirus reported strong sales from its egg-based influenza vaccine portfolio, contributing significantly to its overall revenue, underscoring their dependable cash-generating capabilities.

Core Iron Deficiency Treatments

CSL Vifor's core iron deficiency treatments, while in a mature phase, are recognized as cash cows within the BCG matrix. These established products consistently provide stable volume growth, with a notable presence in the European market. This steady cash generation is crucial for funding CSL Vifor's investments in other areas of its business.

- Established Market Position: CSL Vifor holds a strong, long-standing position in the iron deficiency treatment market.

- Stable Volume Growth: The company continues to see consistent demand and volume increases for these core products, particularly in Europe.

- Steady Cash Flow Generation: These mature products are reliable sources of cash, supporting overall business operations and strategic initiatives.

- Competitive Viability: CSL Vifor is well-equipped to maintain its competitive edge in this segment despite market evolution.

Recombinant Factor VIII Products

Recombinant Factor VIII products, exemplified by Afstyla, represent established therapies within CSL's hematology segment, fitting squarely into the Cash Cows category of the BCG Matrix. These therapies are cornerstones of CSL's revenue generation, benefiting from the company's deep-rooted expertise in recombinant protein technology.

Despite a more competitive landscape in the hemophilia market, these products continue to hold a substantial market share, consistently providing robust revenue and predictable cash flow for CSL. This stability is a hallmark of Cash Cows, allowing for investment in other areas of the business.

- Established Market Position: Recombinant Factor VIII products like Afstyla are mature offerings with a strong, recognized presence.

- Consistent Revenue Generation: These products reliably contribute significant and stable cash flow to CSL.

- Leveraged Expertise: CSL's long-standing proficiency in recombinant protein manufacturing underpins the success and efficiency of these offerings.

- Market Resilience: Despite evolving market dynamics and increased competition, these therapies maintain their market relevance and financial contribution.

CSL Behring's established Immunoglobulin (Ig) portfolio, including key products like Privigen and Intragam, are definitive cash cows. These therapies operate in a mature, stable market where CSL holds a dominant position, ensuring consistent and substantial cash flow with minimal incremental investment.

The company's albumin products also function as significant cash cows. These plasma-derived therapies are critical for treating various medical conditions, including shock and hypoalbuminemia, and benefit from consistent, predictable demand in their established market. CSL Behring's strong market share in albumin reinforces its role as a reliable revenue generator, bolstering overall financial stability and funding strategic growth initiatives.

CSL Seqirus's egg-based influenza vaccines are another prime example of cash cows. These vaccines are essential public health tools with a steady, high-volume demand, administered annually to millions globally. In the 2023 influenza season, Seqirus saw robust sales from this portfolio, highlighting its dependable cash-generating capabilities.

CSL Vifor's core iron deficiency treatments, despite being in a mature phase, operate as cash cows. These products consistently deliver stable volume growth, particularly in the European market, providing crucial cash flow to support other business ventures. Their established market position and consistent demand underscore their role as reliable revenue streams.

Recombinant Factor VIII products, such as Afstyla, are established cash cows within CSL's hematology segment. Benefiting from CSL's deep expertise in recombinant protein technology, these therapies maintain a significant market share, generating robust and predictable cash flow despite a competitive landscape. Their market resilience and consistent financial contribution are hallmarks of their cash cow status.

| Product Category | Key Products | Market Status | BCG Matrix Role | Financial Contribution |

| Immunoglobulins (IVIg) | Privigen, Intragam | Mature, Stable Market | Cash Cow | Significant, consistent cash flow |

| Plasma-Derived Therapies | Albumin | Mature Market, Consistent Demand | Cash Cow | Reliable revenue, supports financial stability |

| Influenza Vaccines | Egg-based Vaccines | Essential Public Health Tool, High Volume | Cash Cow | Substantial and dependable revenue |

| Iron Deficiency Treatments | Core Iron Products | Mature Phase, Stable Volume Growth | Cash Cow | Steady cash flow for business investment |

| Hematology | Recombinant Factor VIII (e.g., Afstyla) | Established, Competitive Market | Cash Cow | Robust and predictable cash flow |

What You See Is What You Get

CSL BCG Matrix

The CSL BCG Matrix preview you're examining is the identical, final document you will receive upon purchase. This means you're seeing the complete, professionally formatted analysis, ready for immediate strategic application without any alterations or watermarks.

Dogs

Hemgenix, a groundbreaking gene therapy for Hemophilia B, currently occupies the 'Dog' quadrant in the CSL BCG Matrix. Despite its FDA approval in late 2022, patient adoption has been notably subdued, with only 12 patients receiving the infusion by June 2024.

This limited market penetration, especially within the specialized and high-cost hemophilia market, signifies that Hemgenix is a significant resource consumer with minimal current revenue generation. The strategy for this product necessitates careful review, potentially involving a pivot in marketing, pricing, or patient access programs to stimulate demand.

CSL has made a strategic decision to deprioritize some of its ex vivo lentiviral-based gene therapy research programs. This move suggests that these particular avenues are no longer seen as prime opportunities for significant future growth, leading to a reduction in allocated resources.

These deprioritized programs would typically be placed in the 'Dogs' category of the CSL BCG Matrix. This classification signifies that they are likely experiencing low market share and low market growth, making them less attractive for continued substantial investment.

While specific financial data for these deprioritized programs isn't publicly disclosed, the decision to reduce investment aligns with a broader industry trend of companies re-evaluating early-stage or less promising R&D projects to focus resources on more impactful areas. For example, in 2023, many biopharmaceutical companies announced shifts in R&D spending, cutting back on projects with uncertain outcomes to bolster those with clearer paths to market and higher potential returns.

Within CSL Vifor's portfolio, some established iron deficiency products are encountering significant competition from generic manufacturers. These older, less innovative offerings are finding it harder to maintain their market position in increasingly commoditized segments. This pressure can lead to declining market share and limited future growth potential for these specific legacy brands.

For instance, while CSL Vifor reported strong overall revenue growth, certain legacy iron products might be experiencing a slowdown. In 2024, the global market for iron deficiency treatments is substantial, but the rise of biosimil and generic versions of older injectables, like those for intravenous iron administration, presents a clear challenge. Companies often see revenue from these products plateau or decline as pricing power diminishes due to generic entry.

Older, Non-Core Assets from Acquisitions

CSL's portfolio might contain legacy assets from acquisitions, such as those from the Vifor Pharma deal, that may not fit its current high-growth strategy. These products, if they have low market share and limited growth prospects, would typically be classified as Dogs in the BCG Matrix.

These "Dogs" are often characterized by declining demand or intense competition, leading to minimal revenue generation and profitability. Their presence can tie up valuable resources that could be better allocated to more promising business units.

For example, if a recently acquired product line from Vifor Pharma is experiencing a market share of less than 5% and operating in a mature market with less than 10% annual growth, it would likely fall into the Dog category. CSL's financial reports would show the revenue contribution of such assets, which would be disproportionately low compared to the capital invested.

- Legacy Products: Assets from past acquisitions that have low market share and minimal growth potential.

- Resource Drain: These products can consume management attention and financial resources without significant returns.

- Strategic Re-evaluation: CSL would likely consider divesting or phasing out these non-core assets to focus on high-growth areas.

- 2024 Financial Impact: In 2024, such assets would contribute minimally to CSL's overall revenue and profit margins, potentially dragging down performance metrics.

Products in Stagnant/Declining Niche Markets

Products in stagnant or declining niche markets within CSL's portfolio, while not explicitly labeled as such, would represent those with limited growth prospects due to market saturation or evolving consumer preferences. These items might be in legacy therapeutic areas with dwindling patient populations or facing intense competition from newer, more effective treatments. For instance, a product treating a rare, age-related condition with few new diagnoses could fit this description.

These "Dogs" in the BCG matrix are characterized by low market share in a low-growth industry. While they might still generate some revenue, their contribution to overall profitability is minimal, and they often require ongoing investment just to maintain their current position. CSL's focus remains on innovation and expanding into high-growth areas, making these niche products less of a strategic priority.

Consider a hypothetical scenario where a CSL product for a specific, non-progressive neurological disorder, which saw peak usage in the early 2000s, now faces a shrinking patient base due to improved diagnostic methods or the natural decline of the affected demographic. Such a product would likely be in a stagnant market, with limited opportunities for significant revenue growth or market share expansion.

- Low Market Share: Products in these niche, declining segments likely possess a small share of their respective small markets.

- Stagnant/Declining Growth: The overall market for these products experiences little to no expansion, or even contraction, year-over-year.

- Limited Innovation: Innovation within these niches is often minimal, making it difficult to differentiate offerings or create new demand.

- Break-Even Potential: While not generating substantial profits, these products might cover their costs, thus avoiding outright losses but offering little strategic upside.

Dogs within CSL's BCG Matrix represent products with low market share in low-growth markets. These assets, often legacy products or those in niche, declining segments, contribute minimally to overall revenue and profit. CSL's strategy typically involves either divesting these units or reducing investment to reallocate resources to more promising growth areas.

For instance, while specific product-level financials for "Dogs" aren't always public, CSL's 2023 annual report indicated a strategic focus on its core biopharmaceutical and influenza vaccine businesses, suggesting a de-emphasis on lower-performing legacy assets. These products may struggle to compete as newer, more innovative treatments emerge, leading to a plateau or decline in their market presence.

The challenge with "Dogs" lies in their potential to consume resources without delivering significant returns, necessitating careful portfolio management. CSL's approach would involve assessing whether these products can be revitalized or if divestment is the more prudent financial decision to optimize capital allocation.

In 2024, the continued pressure from generic competition in certain established therapeutic areas further solidifies the "Dog" classification for some of CSL Vifor's older iron deficiency products. These face a shrinking revenue stream as pricing power erodes, making them less attractive for substantial future investment.

Question Marks

CSL Seqirus is actively engaged in preclinical testing for mRNA influenza vaccines, a significant move into a burgeoning area of vaccine technology. This initiative represents CSL's investment in a high-growth potential market, aiming to leverage next-generation platforms for influenza prevention.

Currently, the mRNA influenza vaccine program is in its nascent stages, with no established market share. This places it firmly in the 'Question Mark' category of the BCG matrix, demanding considerable R&D investment and a clear path through clinical trials to demonstrate efficacy and safety.

Success in these preclinical and subsequent clinical phases is crucial for this program to potentially transition into a 'Star' performer. The global influenza vaccine market, valued at approximately $8.5 billion in 2023, is expected to grow, offering substantial opportunity for innovative technologies like mRNA vaccines.

CSL112, a promising drug candidate for preventing recurrent cardiovascular events after a heart attack, is currently undergoing Phase III clinical trials. This addresses a substantial market with significant growth potential.

The global market for cardiovascular drugs was valued at approximately $140 billion in 2023 and is projected to grow, making CSL112’s target market very attractive.

As CSL112 is still in development and has no current market share, it fits the profile of a 'Question Mark' in the BCG matrix. Significant investment is needed for its successful launch, contingent on favorable trial results.

The success of CSL112 in Phase III trials, expected to conclude around late 2024 or early 2025, will be critical in determining its future market position and whether it can transition to a 'Star' or even a 'Cash Cow'.

CSL is actively pursuing innovative cell and gene therapies at the early stages, despite the complexities encountered with Hemgenix. These ventures represent a significant investment in a dynamic, high-growth sector, though their current market penetration remains minimal.

These early-stage programs are inherently high-risk but offer substantial potential rewards, reflecting the cutting-edge nature of the field. CSL's commitment underscores its strategy to cultivate future growth drivers in a rapidly advancing therapeutic landscape.

While specific pipeline details are proprietary, the company’s continued R&D spending in this area, which typically forms a substantial portion of biotech budgets, indicates a strong belief in its long-term prospects. For instance, in fiscal year 2024, CSL’s R&D expenditure was reported to be in the billions, with a significant allocation towards novel modalities like cell and gene therapies.

Novel Therapies in Early Clinical Development for Rare Diseases

CSL's research and development efforts are actively exploring novel therapies for rare diseases, placing them in the "Question Marks" category of the BCG Matrix. A prime example is their anti-IL-11R mAb, currently in early clinical trials for conditions like Idiopathic Pulmonary Fibrosis (IPF) and Thyroid Eye Disease (TED).

These potential treatments address significant unmet medical needs within rapidly expanding rare disease markets. However, as they are in the early stages, these candidates currently hold no market share and necessitate considerable financial investment to progress through clinical development and achieve commercialization.

- Targeting High-Growth Rare Disease Markets

- Anti-IL-11R mAb in Early Clinical Development for IPF and TED

- Significant Unmet Medical Needs Addressed

- Require Substantial Investment for Advancement and Commercialization

New Indications/Geographic Expansions for Existing Therapies

CSL is actively pursuing new uses for its established therapies, a strategy that aligns with the 'Question Marks' quadrant of the BCG matrix. This involves identifying novel therapeutic applications or expanding the reach of current treatments into underserved geographic areas. For instance, CSL's pneumococcal conjugate vaccine, Prevenar 13, approved initially for infants, has seen expanded indications for older adults and is being introduced into emerging markets with high unmet needs.

This approach signifies a deliberate move to leverage existing product strengths into new growth avenues. While these new indications or geographic expansions might start with a smaller market share due to initial penetration, they possess significant growth potential. CSL's investment in clinical trials for new indications and robust market development in emerging economies, such as its focus on expanding access to its influenza vaccines in Southeast Asia, exemplifies this strategy. Such initiatives require dedicated marketing efforts and capital investment to build awareness and market presence.

The financial implications are notable:

- Investment in clinical trials and regulatory approvals for new indications can range from tens to hundreds of millions of dollars per therapy.

- Geographic expansion into emerging markets often involves setting up new distribution networks and adapting marketing strategies, requiring substantial upfront investment.

- CSL's commitment to R&D, which forms the backbone of finding new indications, was approximately $1.1 billion in fiscal year 2023, supporting these growth-oriented activities.

- The potential for increased revenue streams from these expanded uses and markets can significantly boost long-term profitability, even if initial market share is low.

CSL's mRNA influenza vaccine program and CSL112 are prime examples of 'Question Marks' in the BCG matrix. These initiatives are characterized by significant investment in research and development within high-growth potential markets, but currently lack established market share. Their future success hinges on positive clinical trial outcomes and effective market penetration strategies. The global influenza vaccine market was valued at around $8.5 billion in 2023, while the cardiovascular drug market reached approximately $140 billion in the same year, underscoring the substantial opportunity for these nascent CSL projects.

BCG Matrix Data Sources

Our CSL BCG Matrix leverages comprehensive market data, including sales figures, industry growth rates, competitor analysis, and consumer behavior insights, to provide a robust strategic overview.