China Communications Services PESTLE Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

China Communications Services Bundle

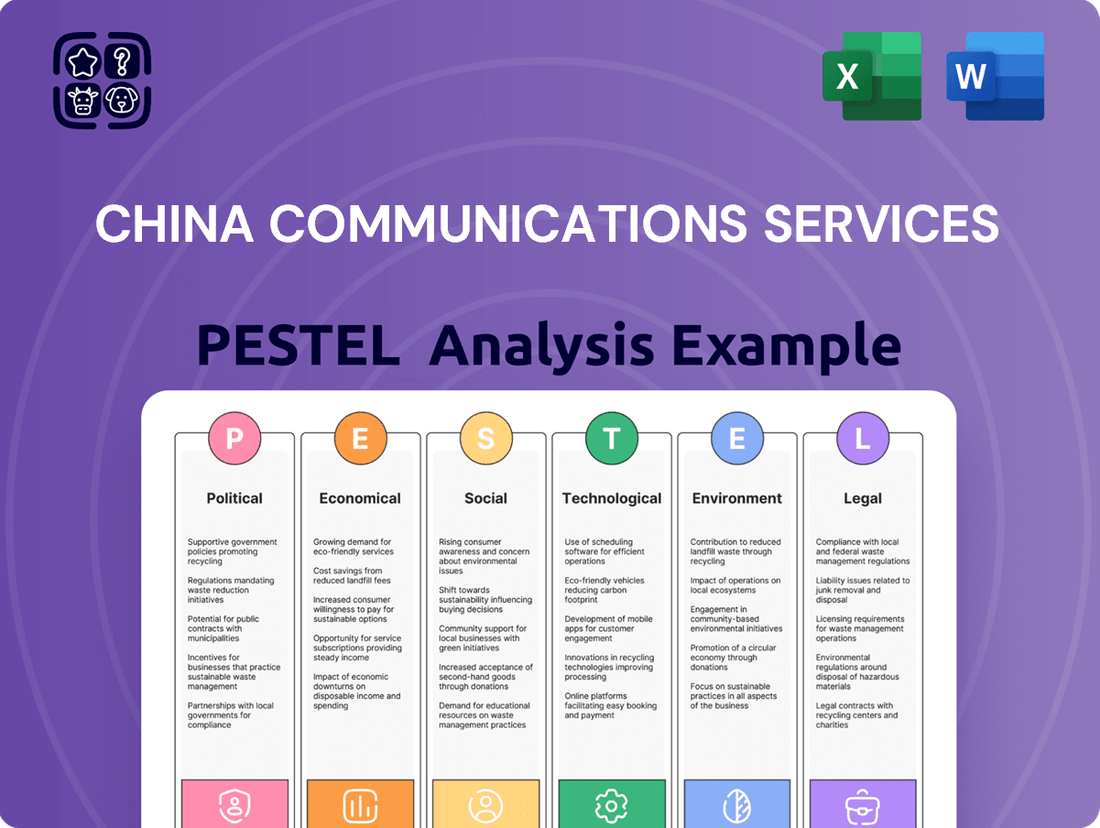

China Communications Services operates within a dynamic environment shaped by evolving political landscapes, robust economic growth, and rapid technological advancements. Understanding these external forces is crucial for strategic planning and identifying future opportunities. Our comprehensive PESTLE analysis delves into these critical factors, offering actionable insights specifically for China Communications Services. Download the full version now and gain a significant competitive advantage.

Political factors

The Chinese government's ongoing commitment to digital infrastructure development, including significant investments in 5G and the nascent 6G networks, creates a robust market for companies like China Communications Services. This political backing translates into sustained demand for the company's core services in building and maintaining telecommunications networks.

In 2024, China's Ministry of Industry and Information Technology reported that the country had deployed over 3.3 million 5G base stations, a testament to the government's aggressive push. This expansion directly fuels the need for the infrastructure services that China Communications Services provides, ensuring a steady stream of projects.

China Communications Services (CCS) operates as a listed state-owned enterprise (SOE), deeply intertwined with China's telecommunications sector. Its major shareholders and primary customers are the country's leading telecom operators: China Mobile, China Telecom, and China Unicom. This structure ensures a remarkably stable customer base and aligns CCS's strategic goals with national telecom development plans.

The government's significant influence over SOEs directly shapes CCS's operational landscape and future growth. For instance, national directives on 5G infrastructure deployment or rural broadband expansion directly translate into business opportunities and strategic priorities for CCS. In 2023, China's investment in fixed-asset infrastructure, including telecom networks, reached over 10 trillion yuan, underscoring the scale of government-driven projects that benefit companies like CCS.

Ongoing geopolitical tensions, particularly with the United States, are fueling China's drive for technological independence, especially in crucial sectors like semiconductors and telecommunications equipment. This strategic shift presents significant opportunities for Chinese domestic firms to step in and reduce dependence on foreign-made technology. For instance, China's investment in its domestic semiconductor industry has surged, with government funding and private sector initiatives aiming to achieve breakthroughs in advanced chip manufacturing by 2025.

While this pursuit of self-sufficiency fosters growth for local players, it also introduces complexities. Challenges arise concerning the ability to collaborate internationally and potential limitations on expanding globally or accessing certain advanced technologies due to trade restrictions and export controls. For example, Huawei, a major player in telecom equipment, has faced significant hurdles in accessing critical components, impacting its market share in certain regions.

Data Security and Cybersecurity Governance

China's commitment to bolstering data security and cybersecurity governance is evident in its evolving regulatory landscape. New measures, such as the Network Data Security Management Regulations, are being implemented, placing greater compliance burdens on businesses that manage substantial data volumes. These regulations mandate stringent security protocols and adherence to guidelines for transferring data across borders.

The increasing emphasis on data protection translates to significant operational considerations for companies like China Communications Services. For instance, the Cybersecurity Review Measures, updated in 2023, require critical information infrastructure operators to undergo security reviews before listing overseas. This highlights the government's proactive stance in safeguarding national data assets.

- Increased Compliance Costs: Companies must invest in advanced cybersecurity infrastructure and personnel to meet new regulatory standards.

- Cross-Border Data Transfer Restrictions: Navigating the rules for moving data outside China requires careful planning and potentially data localization strategies.

- Enhanced Government Oversight: The regulatory focus implies a higher level of scrutiny on how companies collect, store, and process user data.

Market Liberalization and Foreign Investment Policies

China's telecom market, while largely state-controlled, is cautiously opening specific value-added services to foreign investment via pilot programs in designated zones. This strategic move, aimed at injecting market dynamism and improving service standards, presents potential avenues for China Communications Services to engage in new competitive landscapes or forge strategic alliances.

These policy shifts reflect Beijing's intent to leverage foreign expertise and capital to upgrade its telecommunications sector. For instance, by mid-2024, several pilot zones were reportedly exploring relaxed ownership rules for certain cloud computing and data center services, areas closely related to telecommunications infrastructure.

- Gradual Opening: Selective liberalization of value-added telecom services to foreign investors.

- Pilot Programs: Implementation through localized trials in specific geographic regions.

- Stimulating Competition: Government objective to enhance market vitality and service quality.

- Partnership Potential: Opportunities for China Communications Services to collaborate or compete with new entrants.

The Chinese government's strong support for digital infrastructure, including massive 5G and future 6G investments, directly benefits China Communications Services (CCS) by creating consistent demand for its network construction and maintenance services. This political backing is crucial, as evidenced by China deploying over 3.3 million 5G base stations by the end of 2024, a figure that directly translates into business for CCS.

As a state-owned enterprise, CCS's strategy is closely aligned with national telecom development plans, ensuring a stable client base among major operators like China Mobile. Government directives on infrastructure expansion, such as the over 10 trillion yuan invested in fixed-asset infrastructure in 2023, directly shape CCS's growth opportunities.

Geopolitical shifts are driving China's push for technological self-sufficiency, particularly in critical areas like semiconductors, which creates opportunities for domestic firms like CCS while also presenting challenges related to international collaboration and access to advanced technologies due to export controls.

New regulations, such as updated Cybersecurity Review Measures in 2023, emphasize data security and impose stricter compliance burdens, requiring companies like CCS to invest in advanced security measures and carefully manage cross-border data transfers, reflecting enhanced government oversight.

What is included in the product

This PESTLE analysis examines the external macro-environmental factors influencing China Communications Services, covering political, economic, social, technological, environmental, and legal dimensions.

It provides actionable insights into how these factors create opportunities and threats, enabling strategic decision-making for stakeholders.

A PESTLE analysis for China Communications Services offers a structured approach to identifying and mitigating external risks, thereby relieving the pain of navigating complex market dynamics.

Economic factors

China's digital economy is on a strong upward trajectory, with the government setting ambitious targets. By 2025, the aim is for core digital economy industries to represent 10% of the nation's Gross Domestic Product. This significant push fuels demand for the very services China Communications Services offers, such as telecommunications infrastructure and IT support.

This digital transformation translates directly into opportunities for China Communications Services. As businesses and consumers increasingly rely on digital platforms and services, the need for robust network infrastructure, data centers, and cloud solutions will only grow. The company's expertise in these areas positions it to capitalize on this expanding market.

China's commitment to its 14th Five-Year Plan (2021-2025) is driving a substantial infrastructure investment surge, with projections indicating continued robust spending through 2025. This national focus includes major outlays in high-speed rail networks, advanced nuclear power facilities, and critical scientific research infrastructure, signaling a strong economic push.

This heightened infrastructure development directly benefits China Communications Services by increasing the demand for its specialized telecommunications infrastructure services. The company's expertise in the design, construction, and supervision of complex communication networks positions it to capitalize on these large-scale government projects, particularly in areas requiring advanced connectivity.

For instance, the planned expansion of 5G networks and the development of smart city initiatives, both key components of the five-year plan, necessitate significant investment in fiber optics and base station construction, areas where China Communications Services holds a strong market position. This trend is expected to continue, with infrastructure spending in China projected to grow, providing a fertile ground for the company's growth.

China Communications Services has shown a consistent ability to grow its revenue and profits, even when the broader economic conditions have been tough. For instance, in 2023, the company reported a revenue of RMB 217.9 billion, a 5.4% increase year-on-year, with net profit reaching RMB 8.3 billion, up 10.2%.

Looking ahead, financial analysts are projecting further earnings and revenue expansion for China Communications Services. This positive outlook suggests a stable financial future for the company, which is a key factor for investors assessing its reliability and potential.

This sustained growth and the positive forecasts underscore the ongoing demand for the essential services China Communications Services provides, contributing to its dependable financial performance and attractiveness to stakeholders.

Rising Demand for IT and Digital Services

The demand for IT and digital services in China is surging, extending beyond basic telecom infrastructure. This growth is fueled by the ongoing industrial digitalization and the ambitious development of smart cities across the nation.

China Communications Services is well-positioned to benefit from this trend. Their expertise in offering integrated, comprehensive smart solutions, coupled with robust software development capabilities, allows them to meet the evolving needs of this expanding digital market.

By 2024, China's digital economy was projected to reach significant milestones, with IT services forming a crucial component. For instance, the market for cloud computing services, a key enabler of digital transformation, saw substantial growth, with revenue expected to increase by over 20% in 2024 compared to the previous year.

- Industrial Digitalization: Businesses are increasingly adopting digital technologies to enhance efficiency and innovation.

- Smart City Initiatives: Government investment in smart city projects drives demand for integrated IT solutions and digital platforms.

- Software Development: China Communications Services' strong software capabilities are a key asset in capturing market share for digital services.

- Cloud Computing Growth: The expansion of cloud services underpins the broader digital transformation, creating opportunities for service providers.

Impact of Global Economic Headwinds

While China's domestic demand for communications services remains robust, global economic headwinds and ongoing trade tensions present indirect challenges for China Communications Services. These external pressures can impact its overseas ventures and complicate supply chain logistics, potentially affecting cost structures and international expansion plans. For instance, a slowdown in global tech spending, a key export market for many Chinese technology firms, could indirectly influence demand for certain components or services that China Communications Services might utilize or provide.

The company's strategy to mitigate these risks involves a dual approach: fortifying its strong domestic market position while strategically investing in and capitalizing on the growth of emerging industries within China. This focus allows it to leverage internal strengths to offset external vulnerabilities. For example, China Communications Services' significant role in the domestic rollout of 5G infrastructure and its involvement in the burgeoning digital economy provide a stable revenue base.

- Global GDP Growth Slowdown: Projections for global GDP growth in 2024 and 2025 suggest a moderation compared to previous years, potentially impacting international demand for technology and infrastructure services. The IMF, in its April 2024 World Economic Outlook, forecast global growth at 3.2% for 2024, a slight decrease from 2023.

- Trade Tensions and Tariffs: Persistent trade disputes, particularly between major economic blocs, can lead to increased costs for imported components and affect the competitiveness of Chinese technology exports, indirectly influencing supply chain stability for companies like China Communications Services.

- Emerging Industry Focus: China's emphasis on developing advanced manufacturing, artificial intelligence, and green technologies presents significant growth opportunities. China Communications Services' alignment with these sectors, such as providing infrastructure for data centers supporting AI, can buffer against broader economic downturns.

China's digital economy is a significant growth driver, with government targets aiming for core digital industries to reach 10% of GDP by 2025. This strong digital push directly benefits China Communications Services by increasing demand for its telecommunications and IT infrastructure services.

The nation's 14th Five-Year Plan (2021-2025) emphasizes substantial infrastructure investment, projected to continue robustly through 2025. This includes major projects in high-speed rail and advanced technology, creating opportunities for the company's specialized network construction and supervision services.

Demand for IT and digital services is escalating, driven by industrial digitalization and smart city development. China Communications Services, with its integrated smart solutions and software capabilities, is well-positioned to capture this expanding market, especially in areas like cloud computing, which saw over 20% revenue growth in 2024.

Financial performance reflects this positive trend, with China Communications Services reporting RMB 217.9 billion in revenue and RMB 8.3 billion in net profit for 2023, marking year-on-year increases of 5.4% and 10.2% respectively. Analysts project continued earnings and revenue expansion.

| Metric | 2023 Value (RMB) | Year-on-Year Growth | Outlook for 2024/2025 |

|---|---|---|---|

| Revenue | 217.9 billion | +5.4% | Projected expansion |

| Net Profit | 8.3 billion | +10.2% | Projected expansion |

| Digital Economy Contribution to GDP | Target 10% by 2025 | N/A | Strong government focus driving growth |

| Cloud Computing Services Market Growth | N/A | N/A | Expected >20% growth in 2024 |

Full Version Awaits

China Communications Services PESTLE Analysis

The preview shown here is the exact document you’ll receive after purchase—fully formatted and ready to use for your China Communications Services PESTLE analysis.

This is a real screenshot of the product you’re buying—delivered exactly as shown, no surprises, providing a comprehensive PESTLE breakdown of China Communications Services.

The content and structure shown in the preview is the same document you’ll download after payment, offering a detailed examination of the Political, Economic, Social, Technological, Legal, and Environmental factors impacting China Communications Services.

Sociological factors

China's rapid embrace of digital technologies, particularly 5G, is a significant sociological driver for China Communications Services. Projections indicate the nation will surpass 1 billion 5G connections by 2025, highlighting a deep societal integration with advanced digital infrastructure.

This escalating reliance on seamless connectivity directly fuels the demand for the very services China Communications Services provides, from network build-out to maintenance and upgrades. The expanding base of internet users amplifies this need, creating a robust market for the company's core competencies.

China's rapid urbanization continues to be a major driver for smart city initiatives. By the end of 2023, over 65% of China's population resided in urban areas, a figure projected to climb further. This trend necessitates sophisticated digital infrastructure and interconnected smart solutions to manage growing urban populations efficiently.

China Communications Services is strategically positioned to benefit from this urban transformation. The company's expertise in designing, constructing, and deploying integrated smart city solutions, including 5G networks and IoT platforms, makes it a crucial partner for these ambitious projects. For instance, the company was instrumental in building the communication infrastructure for several pilot smart cities in 2024, enhancing services like traffic management and public safety.

China's digital transformation is accelerating, fueling a surge in demand for advanced digital services. By the end of 2024, the country had over 1.1 billion mobile internet users, a figure expected to grow as more individuals and businesses embrace digital solutions. This trend highlights the increasing need for robust communication infrastructure and sophisticated digital services, areas where China Communications Services is strategically positioned.

Enterprises are particularly driving this evolution, seeking cloud computing, AI, and big data analytics to enhance efficiency and competitiveness. In 2024, China's cloud computing market was projected to reach over $30 billion, indicating a strong enterprise appetite for these technologies. China Communications Services' broad portfolio, encompassing network construction, cloud services, and IT solutions, directly addresses these growing enterprise demands.

Emphasis on Digital Inclusion and Accessibility

China's government is strongly committed to digital inclusion, a societal priority that directly impacts the telecommunications sector. Initiatives like the "Broadband China" strategy, which has seen significant investment in rural broadband expansion, aim to connect underserved populations. This focus on bridging the digital divide fuels demand for network infrastructure and services, presenting a clear opportunity for companies like China Communications Services.

By 2024, China's rural internet penetration rate was reported to be over 60%, a substantial increase from previous years, demonstrating the success of these government-driven inclusion efforts. This expansion into less developed regions creates ongoing demand for network deployment and maintenance, areas where China Communications Services holds a strong position.

- Digital Inclusion Drive: Government policies actively promote wider access to telecom services, particularly in rural and remote areas.

- Infrastructure Investment: Significant capital is allocated to expanding broadband and mobile networks, creating opportunities for network builders.

- Bridging the Divide: Efforts to connect the unconnected directly translate into increased demand for services and infrastructure upgrades.

Workforce Demographics and Skill Development

The telecommunications and IT sectors in China are heavily reliant on a skilled workforce to navigate swift technological shifts. China Communications Services must prioritize ongoing investment in talent development and retention. This ensures they possess the critical expertise in emerging fields such as 5G, artificial intelligence, and cybersecurity to effectively address evolving market needs and maintain a competitive edge.

By 2024, China's digital economy was projected to reach $7.7 trillion, underscoring the demand for specialized IT and telecom talent. The nation's focus on innovation, particularly in areas like AI, means a continuous need for advanced skill sets. For China Communications Services, this translates to a strategic imperative to cultivate a workforce adept at managing and deploying these cutting-edge technologies.

- Talent Gap: A persistent shortage of highly skilled professionals in AI and cybersecurity remains a challenge across China's tech sectors.

- Upskilling Initiatives: Government and industry partnerships are increasingly focused on reskilling and upskilling programs to meet future demands.

- Retention Strategies: Companies like China Communications Services are implementing competitive compensation and career development paths to retain top talent.

- Digital Literacy: A growing emphasis on digital literacy across the broader population supports the foundational talent pool for the tech industry.

China's increasing adoption of digital services, evidenced by over 1.1 billion mobile internet users by the end of 2024, directly boosts demand for China Communications Services' network infrastructure and maintenance. This societal shift towards digital engagement is further amplified by the nation's rapid urbanization, with over 65% of the population living in urban areas by late 2023, fueling the need for smart city solutions and integrated digital platforms.

The government's commitment to digital inclusion, exemplified by the expansion of rural broadband reaching over 60% penetration by 2024, creates sustained demand for network deployment and upgrades. Simultaneously, the burgeoning digital economy, projected at $7.7 trillion in 2024, necessitates a skilled workforce, pushing companies like China Communications Services to invest in talent development to meet the growing need for expertise in areas like 5G and AI.

Technological factors

China is aggressively pursuing the widespread adoption of 5G-Advanced (5G-A), with commercialization efforts well underway. Simultaneously, the nation is heavily investing in the foundational research and development for 6G, aiming to lead in the next era of wireless communication. This strategic push creates substantial avenues for China Communications Services, particularly in building out the necessary infrastructure and enhancing network capabilities.

By 2024, China had already achieved significant milestones in 5G network coverage, with over 3.3 million 5G base stations deployed nationwide, a figure expected to grow substantially with the rollout of 5G-A. This expansion directly fuels demand for China Communications Services' expertise in network deployment and maintenance. The company is poised to capitalize on the increasing need for sophisticated network solutions as these advanced technologies mature, driving revenue through infrastructure projects and managed services.

China Communications Services is actively integrating AI, IoT, and cloud computing to revolutionize its services. This synergy allows for the development of sophisticated smart solutions and significantly boosts operational efficiency. For instance, the company is employing AI to optimize energy consumption within its network infrastructure, a crucial step towards sustainable operations.

China's commitment to enhancing its digital infrastructure and computing power is a significant technological driver. The nation is actively optimizing computing power centers and constructing robust digital frameworks, essential for fueling its rapidly expanding digital economy and supporting cutting-edge technologies like AI and big data. This strategic focus directly benefits China Communications Services, as the company is instrumental in building and maintaining the very digital assets that underpin these advancements.

Emphasis on Domestic Technology Innovation and Self-Sufficiency

China's strategic focus on domestic technology innovation and self-sufficiency, particularly in critical sectors like semiconductors and telecommunications, is a significant technological factor. This national imperative is directly influencing companies like China Communications Services to bolster their research and development efforts and decrease dependence on foreign suppliers. For instance, China's investment in its domestic semiconductor industry reached an estimated $27 billion in 2023, aiming to reduce reliance on international chipmakers.

This drive for technological independence translates into opportunities and challenges for China Communications Services. The company is incentivized to invest heavily in its own R&D to develop proprietary solutions and secure its supply chain. This national policy supports companies in areas such as 5G infrastructure, AI development, and advanced manufacturing technologies, fostering a more resilient domestic tech ecosystem.

- Increased R&D Investment: Companies are expected to allocate more resources to internal innovation to meet national self-sufficiency goals.

- Focus on Core Technologies: Emphasis is placed on developing indigenous capabilities in areas like advanced chip manufacturing and next-generation communication equipment.

- Reduced Foreign Dependency: A strategic aim is to minimize reliance on foreign hardware, software, and intellectual property in critical infrastructure.

- Government Support and Subsidies: Expect continued government backing through funding, tax incentives, and policy support for domestic tech champions.

Evolution of Data Security and Network Management Solutions

The escalating volume and sensitivity of data in China are fueling a significant demand for sophisticated data security and network management solutions. China Communications Services (CCS) must therefore continually enhance its portfolio, particularly in areas like cybersecurity and regulatory compliance, to effectively counter evolving digital threats and meet stringent governmental mandates. For instance, China's cybersecurity market was projected to reach approximately $250 billion by 2025, highlighting the substantial growth opportunity.

To remain competitive, CCS needs to invest in and adapt its service offerings to address the dynamic landscape of cyber threats and evolving data privacy regulations. This includes developing advanced threat detection, incident response capabilities, and robust compliance frameworks that align with national and international standards.

- Cybersecurity Market Growth: China's cybersecurity market is experiencing rapid expansion, driven by increased digitalization and heightened security concerns.

- Regulatory Compliance Demands: Stricter data protection laws and cybersecurity regulations necessitate advanced compliance solutions from service providers.

- Technological Advancement: Continuous innovation in security technologies, such as AI-powered threat intelligence and secure network architectures, is crucial for CCS to maintain its edge.

- Data Volume Increase: The exponential growth in data generation across various sectors requires scalable and efficient network management and security infrastructure.

China's aggressive push into 5G-Advanced (5G-A) and foundational 6G research presents significant opportunities for China Communications Services in infrastructure development. By 2024, China had deployed over 3.3 million 5G base stations, a number set to grow with 5G-A, directly increasing demand for CCS's deployment and maintenance services.

The nation's focus on optimizing computing power centers and building robust digital frameworks supports the expansion of China Communications Services' role in underpinning the digital economy. This strategic emphasis on digital infrastructure directly benefits CCS, as the company is key in constructing and maintaining these essential digital assets.

China's commitment to domestic technology innovation, particularly in semiconductors, is driving companies like CCS to enhance R&D and reduce foreign supplier reliance. China's investment in its domestic semiconductor industry reached an estimated $27 billion in 2023, signaling a drive for self-sufficiency that CCS must align with.

The escalating volume of data in China fuels demand for sophisticated data security and network management, with the cybersecurity market projected to reach $250 billion by 2025. CCS must enhance its cybersecurity and compliance offerings to address evolving digital threats and stringent governmental mandates.

Legal factors

China's Cybersecurity Law (CSL) and Data Security Law (DSL) are seeing robust enforcement, with recent amendments in 2024 introducing more stringent penalties and compliance requirements for companies. China Communications Services must prioritize full adherence to these evolving regulations, especially regarding network security, data localization, and mandatory incident reporting protocols.

The enforcement actions in 2024 have already seen significant fines levied against non-compliant entities, underscoring the critical need for China Communications Services to maintain rigorous data protection measures. Failure to comply with the DSL, for instance, can result in penalties up to five times the illegal income or a fine of up to one million RMB for certain violations, as per the latest directives.

China's Personal Information Protection Law (PIPL), enacted in November 2021, significantly impacts how China Communications Services manages user data, dictating strict rules for collection, processing, and cross-border transfers. The law’s comprehensive nature means ongoing adaptation is crucial, especially as regulatory enforcement evolves.

As of early 2024, companies are still refining their PIPL compliance strategies, with particular attention on data localization and obtaining explicit consent for data processing. The potential for substantial fines, up to 5% of annual turnover or ¥5 million, underscores the financial imperative for adherence.

New provisions, such as the Provisions on Promoting and Regulating Cross-Border Data Transfer effective September 2023, are introducing a more nuanced approach to data movement. While these regulations aim to facilitate data transfers, they still mandate rigorous compliance measures for companies like China Communications Services operating internationally.

These measures often include security assessments and certifications before sensitive data can leave Mainland China, impacting operational efficiency and potentially increasing compliance costs. For instance, companies may need to undergo specific government reviews for data deemed critical or personal information.

Foreign Investment Regulations in Telecommunications

China's telecommunications sector, while generally opening, maintains substantial government oversight. This means foreign investment faces specific limitations, particularly in core infrastructure. For China Communications Services, this translates to a carefully managed competitive environment.

Recent developments show a cautious liberalization. Pilot programs are exploring relaxed foreign equity caps in specific value-added telecom services. For instance, in 2024, discussions continued around potential adjustments to foreign ownership rules for cloud computing and data center services, areas where China Communications Services has a strong presence.

These regulatory shifts, though incremental, could reshape market dynamics. They might foster new joint ventures or strategic alliances, potentially offering new avenues for growth or increased competition for China Communications Services.

- Government Control: The Chinese government retains significant influence over the telecommunications industry, impacting foreign investment levels.

- Pilot Programs: Initiatives are underway to ease foreign equity restrictions in select value-added telecom services, signaling potential market changes.

- Competitive Landscape: Regulatory adjustments could alter the competitive environment, creating both opportunities and challenges for established players like China Communications Services.

Antitrust and Anti-Monopoly Measures

China's government has been actively implementing antitrust and anti-monopoly measures, particularly targeting the internet sector. In 2024, regulators continued to scrutinize large tech firms for practices deemed unfair or monopolistic, aiming to foster a more competitive environment. This includes stricter enforcement of rules against exclusionary tactics and data misuse.

While China Communications Services is a state-owned enterprise, it operates in a market with increasingly robust antitrust oversight. Compliance with these regulations is crucial for ensuring fair competition and preventing any actions that could stifle innovation or disadvantage smaller players. The company must navigate these evolving legal frameworks to maintain its operational integrity.

- Increased Scrutiny: Regulators have intensified their focus on monopolistic behavior by major internet platforms, impacting various digital services.

- Fair Competition Focus: New guidelines and enforcement actions in 2024 aimed to level the playing field, preventing unfair advantages.

- Compliance Imperative: China Communications Services, despite its SOE status, must adhere to these antitrust rules to operate legally and ethically.

China's evolving legal landscape, particularly concerning data and cybersecurity, necessitates strict adherence from China Communications Services. The robust enforcement of the Cybersecurity Law (CSL) and Data Security Law (DSL), with significant penalties for non-compliance, demands meticulous data protection and incident reporting protocols. The Personal Information Protection Law (PIPL) further dictates stringent data handling practices, including consent and cross-border transfer regulations, with potential fines up to 5% of annual turnover.

Environmental factors

China's commitment to peaking carbon emissions before 2030 and achieving carbon neutrality by 2060 presents a significant environmental factor for China Communications Services. This national strategy directly impacts the telecommunications sector, pushing for more sustainable practices across infrastructure deployment and operational energy consumption.

As a major telecommunications infrastructure and services provider, China Communications Services is poised to play a crucial role in supporting these ambitious climate goals. The company will likely face increased pressure and opportunities to invest in energy-efficient technologies, renewable energy sources for its data centers and network operations, and to develop services that facilitate carbon reduction for its clients.

The push for greener operations means China Communications Services will need to actively reduce its carbon footprint. This could involve optimizing network energy usage, exploring low-carbon materials for infrastructure, and potentially developing green ICT solutions. For instance, by 2023, China's renewable energy capacity reached 1.5 billion kilowatts, highlighting the broader national shift towards cleaner power sources that the company can leverage.

The expansion of China's digital infrastructure, particularly 5G base stations and data centers, is driving a significant increase in energy demand. By the end of 2023, China's 5G base stations exceeded 3.377 million, each requiring substantial power. This escalating consumption presents a considerable environmental hurdle.

China Communications Services is proactively addressing this by integrating AI-powered energy efficiency solutions across its network operations. The company is also committed to green building standards for its facilities. These initiatives aim to directly reduce energy usage and, consequently, lower greenhouse gas emissions associated with its extensive infrastructure.

China Communications Services (CCS) is actively integrating a green development philosophy, prioritizing technological innovation to drive the sustainable transformation of its cloud and network infrastructure. This strategic focus includes the development of advanced smart energy-saving technologies, aiming to significantly reduce the environmental footprint of its operations.

The company is also making a concerted effort to promote the adoption and utilization of green electricity sources across its facilities. For instance, in 2023, CCS reported a substantial increase in its investment in renewable energy projects, with a specific target to power over 60% of its data centers with green electricity by 2025.

Resource Recycling and Circular Economy Initiatives

China Communications Services is actively enhancing its resource recycling efforts and pushing forward with the recovery, disposal, and reuse of waste materials. This focus is central to their strategy for fostering a circular economy within the telecommunications industry. By prioritizing resource efficiency, the company aims to significantly reduce its environmental footprint and contribute to China's overarching sustainability objectives.

This strategic direction is supported by national policies encouraging resource conservation and waste reduction. For instance, China's Ministry of Industry and Information Technology (MIIT) has been promoting the development of a circular economy in the electronics sector, which directly impacts telecom equipment. In 2023, the MIIT reported that the recycling volume of key renewable resources in the industrial sector reached 1.1 billion tons, a testament to the growing emphasis on circularity.

- Resource Recycling: China Communications Services is implementing advanced methods for the recycling of electronic waste, particularly from telecommunications infrastructure and devices.

- Circular Economy Integration: The company is developing business models that prioritize the reuse and remanufacturing of components to extend product lifecycles.

- Waste Management: Initiatives include improved collection systems and responsible disposal practices for obsolete equipment, minimizing landfill impact.

- Sustainability Alignment: These actions directly support China's national goals for environmental protection and a low-carbon economy, as highlighted by the country's commitment to peak carbon emissions before 2030 and achieve carbon neutrality before 2060.

Environmental Regulations and Compliance

China Communications Services (CCS) must navigate increasingly stringent environmental regulations. This includes mandatory requirements for integrating renewable energy sources into its operations and actively participating in regional carbon trading markets. For instance, by the end of 2023, China's national carbon market had seen over 220 million tonnes of carbon allowances traded, with prices fluctuating around ¥60 per tonne, impacting companies with significant carbon footprints.

Compliance with these evolving environmental standards is not just about avoiding penalties; it's fundamental for CCS's long-term operational sustainability. Failure to meet these mandates could lead to increased operating costs through carbon taxes or fines, and potentially damage the company's reputation. In 2024, China further emphasized its commitment to green development, with policies encouraging energy efficiency and emissions reduction across all major industries.

- Renewable Energy Mandates: CCS is subject to government directives pushing for greater adoption of solar, wind, and other clean energy sources in its infrastructure and data centers.

- Carbon Market Participation: The company must comply with regulations governing carbon emissions, including the purchase of allowances in China's burgeoning carbon trading schemes.

- Operational Sustainability: Adherence to environmental standards directly impacts CCS's ability to operate efficiently and avoid financial repercussions from non-compliance.

- Cost Implications: Non-compliance can result in significant financial penalties and increased operational expenditures related to carbon pricing and energy sourcing.

China's national drive towards carbon neutrality by 2060 significantly influences China Communications Services' operational strategy. The company is increasingly focused on adopting renewable energy sources for its vast network infrastructure, including 5G base stations and data centers, to reduce its carbon footprint. By the end of 2023, China's renewable energy capacity reached 1.5 billion kilowatts, providing a substantial base for CCS to leverage cleaner power options.

The company is investing in energy-efficient technologies and green building standards to manage the escalating energy demand from digital infrastructure expansion, such as the over 3.377 million 5G base stations operational by late 2023. CCS is also enhancing resource recycling and waste management, aligning with national policies that promote a circular economy in the electronics sector, with industrial sector recycling volumes reaching 1.1 billion tons in 2023.

Navigating stricter environmental regulations, including participation in carbon trading markets where prices averaged around ¥60 per tonne in 2023, is crucial for CCS's long-term sustainability and cost management. Compliance with mandates for renewable energy integration and emissions reduction is paramount, as non-compliance can lead to financial penalties and reputational damage, especially with China's continued emphasis on green development in 2024.

| Environmental Factor | Impact on China Communications Services | Key Data/Initiatives (as of late 2023/early 2024) |

| Carbon Neutrality Goals | Drives investment in renewable energy and energy efficiency for infrastructure. | China aims for carbon neutrality by 2060; renewable energy capacity reached 1.5 billion kW by end of 2023. |

| Digital Infrastructure Energy Demand | Requires focus on reducing energy consumption of 5G networks and data centers. | Over 3.377 million 5G base stations by end of 2023, increasing power needs. |

| Circular Economy Promotion | Encourages resource recycling, waste management, and component reuse. | Industrial sector recycling volume reached 1.1 billion tons in 2023; focus on e-waste recycling. |

| Environmental Regulations & Carbon Markets | Necessitates compliance with emission standards and participation in carbon trading. | Carbon allowance prices around ¥60/tonne in 2023; ongoing policy emphasis on energy efficiency. |

PESTLE Analysis Data Sources

Our PESTLE Analysis for China Communications Services is built on a robust foundation of official government reports, economic data from international organizations like the IMF and World Bank, and reputable industry analysis firms. This ensures comprehensive coverage of political stability, economic growth, technological advancements, and regulatory changes impacting the sector.