China Communications Services Business Model Canvas

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

China Communications Services Bundle

Unlock the strategic blueprint behind China Communications Services's business model. This comprehensive Business Model Canvas reveals how they leverage key partnerships and customer relationships to deliver essential communication infrastructure and services. Discover their unique value propositions and revenue streams.

Dive deeper into China Communications Services's operational excellence with our full Business Model Canvas. This downloadable resource provides a clear, professionally written snapshot of their core activities, cost structure, and key resources, offering invaluable insights for strategic planning.

Want to understand how China Communications Services dominates its market? Our complete Business Model Canvas offers a detailed, section-by-section breakdown of their customer segments, channels, and competitive advantages. Download it now to accelerate your own business thinking.

Partnerships

China Communications Services (CCS) cultivates deep ties with China's three primary telecommunications operators, who act as both crucial customers and significant shareholders. These collaborations are fundamental to CCS's ability to deliver essential telecommunications infrastructure services and to broaden its market presence across China.

The continuation of connected transactions with key players like China Telecom, as reported, underscores the enduring strength and strategic importance of these partnerships. This ongoing collaboration ensures long-term stability and fuels future growth opportunities for CCS within the dynamic Chinese telecommunications landscape.

China Communications Services (CCS) actively collaborates with a multitude of government bodies and state-owned enterprises (SOEs) across China. These partnerships are crucial for securing and executing large-scale infrastructure projects, particularly those focused on digital transformation. For instance, in 2024, CCS continued its involvement in national initiatives like the Digital China strategy, contributing to smart city development and the modernization of public services.

These collaborations extend to areas such as digital government platforms and advanced emergency management systems. By aligning with national strategies for digitalization and industrial upgrades, CCS leverages these relationships to drive innovation and secure significant project opportunities. The company’s deep integration with public sector development underscores the strategic importance of these government and SOE partnerships.

China Communications Services actively collaborates with technology and software providers to boost its offerings in applications, content, and various services. These partnerships are crucial for integrating advanced technologies like AI, big data, cloud computing, and IoT, enabling the development of comprehensive smart solutions and fostering innovation.

For instance, in 2024, the company continued its focus on leveraging these partnerships to enhance its digital service delivery. Collaborations with leading AI developers helped refine its intelligent network management systems, while alliances with big data analytics firms bolstered its capacity for personalized customer experiences and service optimization.

Overseas Partners and Local Contractors

China Communications Services actively cultivates relationships with overseas telecom operators and international enterprises to drive its global expansion. These alliances are crucial for navigating new markets and securing significant international projects, especially within the Belt and Road Initiative framework. For instance, in 2023, the company reported a substantial increase in its overseas project pipeline, underscoring the importance of these international collaborations.

To effectively execute projects abroad, China Communications Services relies on partnerships with local construction companies. These collaborations ensure compliance with local regulations and facilitate efficient project delivery. By leveraging local expertise, the company can better manage the complexities of diverse international markets, thereby strengthening its global footprint.

- Overseas Telecom Operators: Facilitate market entry and understanding of local telecom landscapes.

- Local Construction Companies: Ensure efficient project execution and regulatory compliance.

- International Enterprises: Broaden scope of projects and access to global supply chains.

Equipment Manufacturers and Suppliers

China Communications Services (CCS) cultivates strategic alliances with major communication equipment manufacturers and supply chain providers. These partnerships are crucial for securing essential hardware, components, and logistics, directly impacting project execution and network upkeep. For instance, in 2024, CCS continued to leverage its strong relationships with leading vendors like Huawei and ZTE, ensuring a steady flow of advanced telecommunications equipment needed for 5G network build-outs across China.

These collaborations are foundational to CCS's ability to deliver services efficiently and maintain high standards in network maintenance and product distribution. The reliability of these supply chain partners directly translates into operational efficiency and the consistent quality of services offered to clients, from individual consumers to large enterprises.

- Access to Advanced Technology: Partnerships ensure CCS has access to the latest communication and IT equipment, vital for staying competitive in a rapidly evolving market.

- Supply Chain Resilience: Strong relationships with suppliers mitigate risks associated with component shortages or delivery delays, particularly important given global supply chain volatility observed in recent years.

- Cost Optimization: Strategic sourcing and bulk purchasing through key manufacturers can lead to significant cost savings, enhancing CCS's pricing competitiveness.

- Logistics and Distribution Network: Collaborations with logistics providers are key to the efficient distribution of communication and IT products, ensuring timely delivery and installation for customers.

China Communications Services (CCS) maintains vital partnerships with China's three major telecom operators, who are also significant shareholders. These collaborations are essential for delivering infrastructure services and expanding market reach throughout China. The company also works closely with government bodies and state-owned enterprises, securing large-scale digital transformation projects, such as those related to the Digital China strategy in 2024.

Further strengthening its capabilities, CCS collaborates with technology and software providers to integrate advanced solutions like AI and big data, enhancing its smart service offerings. Internationally, CCS partners with overseas telecom operators and local construction firms to facilitate global expansion and ensure efficient project execution within frameworks like the Belt and Road Initiative.

Strategic alliances with communication equipment manufacturers and supply chain providers are critical for CCS to secure hardware and logistics, ensuring efficient project delivery and network maintenance. For example, in 2024, CCS continued to rely on strong vendor relationships for 5G network build-outs.

| Key Partner Type | Strategic Importance | 2024 Impact/Focus |

|---|---|---|

| Major Telecom Operators | Customer base, shareholder relations, market access | Continued connected transactions, network expansion support |

| Government Bodies & SOEs | Project acquisition, national strategy alignment | Digital China initiatives, smart city development |

| Tech & Software Providers | Innovation, service enhancement | AI integration for network management, big data analytics |

| Overseas Telecom Operators | Global market entry, project pipeline | Belt and Road Initiative projects |

| Equipment Manufacturers | Supply chain, technology access | Securing 5G equipment, maintaining network quality |

What is included in the product

A comprehensive business model canvas detailing China Communications Services' strategy, covering customer segments, channels, and value propositions with insights into competitive advantages and SWOT analysis.

This canvas reflects real-world operations and plans, organized into 9 classic BMC blocks, ideal for presentations and informed decision-making by entrepreneurs and analysts.

The China Communications Services Business Model Canvas offers a clear, structured approach to understanding and improving complex service delivery, effectively relieving the pain point of operational opacity.

Activities

China Communications Services' key activity in telecommunications infrastructure services encompasses the full lifecycle of network development, from initial planning and detailed design to construction and ongoing supervision. This covers a broad range of essential technologies including fixed-line, mobile, and broadband networks, as well as critical data centers and their supporting systems.

Leveraging extensive experience, the company constructs robust communication networks that are vital for modern connectivity. In 2023, China Communications Services' revenue from telecommunications infrastructure services reached approximately RMB 173.6 billion, highlighting its significant role in building and maintaining these essential networks.

This segment also extends to the construction of ancillary communication networks and the provision of integrated solutions for broader informatization projects, demonstrating a commitment to comprehensive digital infrastructure development.

China Communications Services (CCS) offers extensive Business Process Outsourcing (BPO) services, crucial for maintaining and enhancing client telecommunications infrastructure. This includes specialized network maintenance and optimization across fiber optic networks, mobile base stations, and diverse network equipment, ensuring peak performance and reliability.

Beyond network operations, CCS provides comprehensive property management for critical data centers and other facilities, alongside integrated supply chain solutions encompassing logistics, warehousing, and procurement. These integrated BPO offerings are designed to streamline operations and reduce costs for their clients.

In 2023, CCS reported revenue of approximately RMB 220.8 billion, with its integrated services segment, which includes BPO, demonstrating robust growth. The company's ability to manage complex infrastructure and supply chains efficiently is a key driver of its market position.

Applications, Content, and Other Services (ACO) is a significant revenue generator for China Communications Services, focusing on high-value informatization solutions. This segment provides crucial system integration, software development, and ongoing system support, underpinning the company's digital transformation efforts.

In 2023, the ACO segment demonstrated robust growth, contributing significantly to the company's overall performance. For example, China Communications Services reported that its informatization and other services revenue saw a substantial increase, highlighting the market's demand for their smart solutions and digital offerings.

Research and Development (R&D) and Innovation

China Communications Services (CCSC) channels significant resources into Research and Development, focusing on cutting-edge technologies. Their investment priorities include artificial intelligence, big data analytics, cloud infrastructure, and the Internet of Things (IoT). This commitment fuels the creation of unique products and services, driving technological advancement within the company.

CCSC’s R&D efforts are strategically aligned with China's national objectives for digital transformation and smart city initiatives. By developing proprietary solutions, they aim to solidify their position as a leader in the evolving digital landscape. This proactive approach to innovation is essential for staying ahead in a rapidly changing market.

- AI and Big Data: CCSC is developing AI-powered solutions for network optimization and customer service, leveraging big data analytics to improve operational efficiency.

- Cloud Computing: The company is expanding its cloud service offerings, focusing on private and hybrid cloud solutions tailored for enterprise clients.

- IoT Development: CCSC is actively involved in building IoT platforms and applications, particularly for smart city projects and industrial internet solutions.

- National Strategy Alignment: Their R&D roadmap directly supports China's digital infrastructure development and smart city blueprints, ensuring relevance and market impact.

Overseas Market Expansion and Project Execution

A core activity for China Communications Services involves aggressively seeking and successfully completing projects in overseas markets, particularly those aligned with the Belt and Road Initiative. This strategic push is crucial for expanding their global footprint and driving revenue.

This includes a strong emphasis on securing new contracts, refining how they operate in foreign countries, and fostering better partnerships with Chinese businesses expanding internationally. For instance, in 2024, the company continued to leverage its expertise in ICT infrastructure and services to support these cross-border ventures.

- Securing International Contracts: Actively bidding for and winning new projects in regions targeted by the Belt and Road Initiative.

- Optimizing Overseas Operations: Streamlining operational models to enhance efficiency and profitability in diverse international markets.

- Enhancing Cross-Border Collaboration: Building stronger partnerships with Chinese enterprises operating abroad to offer integrated solutions.

- Driving Global Revenue Growth: Contributing a significant portion of the company's overall revenue through successful international project execution.

China Communications Services' key activities revolve around delivering comprehensive telecommunications infrastructure services, from design to construction and maintenance. They also provide extensive Business Process Outsourcing (BPO) for network operations and facility management, alongside developing and integrating advanced informatization solutions. A significant focus is also placed on research and development for new technologies and expanding their presence in overseas markets, particularly those aligned with the Belt and Road Initiative.

| Key Activity Area | Description | 2023 Revenue Contribution (Approx.) |

|---|---|---|

| Telecommunications Infrastructure Services | Design, construction, and maintenance of fixed-line, mobile, and broadband networks, data centers. | RMB 173.6 billion |

| Business Process Outsourcing (BPO) | Network maintenance, property management for data centers, supply chain solutions. | Included in Integrated Services Segment |

| Applications, Content, and Other Services (ACO) | System integration, software development, and system support for informatization projects. | Significant growth driver |

| Research and Development (R&D) | Focus on AI, big data, cloud computing, and IoT for innovative solutions. | Investment in future growth |

| International Market Expansion | Securing contracts and optimizing operations in overseas markets, especially Belt and Road Initiative countries. | Driving global revenue |

Delivered as Displayed

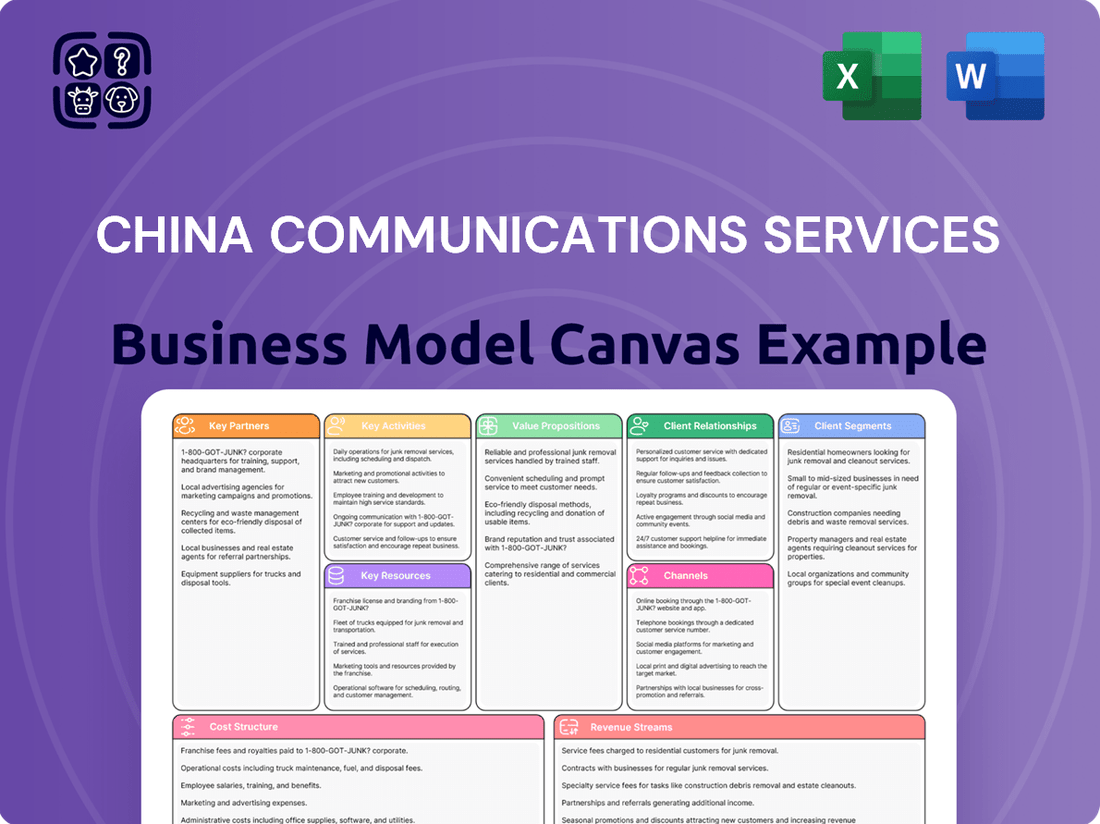

Business Model Canvas

The Business Model Canvas for China Communications Services that you are previewing is the exact document you will receive upon purchase. This is not a sample or a mockup; it's a direct representation of the comprehensive analysis you'll gain access to, ensuring full transparency and immediate usability.

Resources

China Communications Services relies heavily on its substantial pool of experienced engineers, technicians, and IT professionals. This human capital is a cornerstone, providing the deep expertise needed in telecommunications, IT, and digital solutions to tackle complex projects and deliver innovative services.

In 2023, the company reported a significant number of employees, with a strong emphasis on technical and engineering roles, underscoring the importance of this skilled workforce. Continuous investment in training and development programs is crucial to ensure these capabilities remain cutting-edge and aligned with evolving industry demands.

China Communications Services leverages its extensive network infrastructure, a cornerstone of its business model. This includes proprietary and managed telecommunications assets like vast fiber optic networks and numerous data centers, crucial for delivering services and digital solutions.

These physical assets are not just infrastructure; they are significant competitive advantages. For instance, in 2024, the company continued to expand its fiber optic coverage, reaching over 1 billion households, a testament to its scale and reach.

The company's investment in specialized equipment further solidifies its position. This robust infrastructure underpins its ability to offer a wide array of telecommunications and digital services, supporting everything from basic connectivity to advanced cloud solutions.

China Communications Services (CCS) heavily invests in research and development, boasting a significant portfolio of advanced technologies, software copyrights, and patents. This focus is particularly strong in emerging fields like artificial intelligence, big data analytics, and comprehensive smart city solutions. For instance, in 2023, the company reported substantial R&D expenditures, fueling the creation of these critical technological assets.

These proprietary technological assets are the engine behind CCS's innovation, allowing them to deliver state-of-the-art applications and services that meet evolving market demands. The company's commitment to developing these capabilities is evident in its continuous efforts to integrate AI and big data into its service offerings, enhancing efficiency and customer experience.

Intellectual property plays a vital role in differentiating CCS's market position. By securing patents and copyrights for its unique technologies and software, the company establishes a competitive edge, protecting its innovations and ensuring its ability to offer specialized, high-value solutions that are difficult for competitors to replicate.

Strong Relationships with Key Customers and Stakeholders

China Communications Services (CCS) leverages its deep-rooted connections with major domestic telecom operators, government agencies, and large enterprise clients. These enduring relationships are a cornerstone of its business, ensuring a consistent and reliable customer base that generates predictable revenue. This stability is a direct result of years of trust and consistent, high-quality service delivery.

The company's status as a state-owned enterprise, with major telecom operators like China Telecom, China Mobile, and China Unicom as significant shareholders, further cements these crucial partnerships. This ownership structure inherently aligns CCS's interests with those of its primary clients, fostering a mutually beneficial environment.

- Customer Loyalty: Long-standing relationships translate into high customer retention rates, minimizing churn and providing a predictable revenue stream.

- Strategic Alignment: Shareholding by major operators ensures strategic alignment, facilitating easier access to new projects and service expansions.

- Market Access: These relationships grant CCS preferential access to tender processes and new infrastructure development projects within the Chinese telecommunications sector.

- Revenue Stability: In 2023, China Communications Services reported a revenue of approximately RMB 221.6 billion, with a significant portion attributable to these key customer segments, underscoring the importance of these strong relationships.

Financial Capital and Robust Funding Channels

China Communications Services (CCS) leverages its unique position as a state-owned enterprise and its public listing to access substantial financial capital. This financial backing is crucial for funding its extensive infrastructure projects and continuous technological advancements. For instance, in 2023, CCS reported total assets of RMB 247.6 billion, demonstrating its significant financial capacity.

A strong financial foundation and consistent cash flow are paramount for CCS to support its daily operations, execute strategic growth plans, and pursue potential acquisitions. This financial stability is a direct result of its robust operational performance and effective financial management. The company's ability to generate healthy operating cash flow allows it to reinvest in its business and maintain a competitive edge.

- Access to Capital: CCS benefits from its state-owned enterprise status and public listing, providing access to significant financial resources for large-scale investments.

- Operational Funding: A robust financial position and sound cash flow are vital for funding ongoing operations, strategic initiatives, and potential acquisitions.

- Project Viability: This financial strength directly enables CCS to undertake and successfully complete major infrastructure and technology upgrade projects.

- Financial Health: As of the end of 2023, CCS maintained a healthy balance sheet with total assets of RMB 247.6 billion, underscoring its financial capacity.

China Communications Services (CCS) has cultivated strong relationships with key domestic telecom operators, government entities, and large enterprises. These partnerships are fundamental to its business, ensuring a steady customer base and predictable revenue streams. This stability is a direct outcome of years of trust and consistent, high-quality service delivery.

As a state-owned enterprise, CCS benefits from its close ties and significant shareholding by major telecom operators like China Telecom, China Mobile, and China Unicom. This ownership structure fosters a synergistic environment, aligning CCS's objectives with those of its primary clients and facilitating access to new projects and service expansions within the Chinese telecommunications sector. In 2023, CCS reported revenue of approximately RMB 221.6 billion, with a substantial portion derived from these core customer segments, highlighting the critical importance of these relationships.

| Key Resource | Description | 2023 Data/Impact |

|---|---|---|

| Human Capital | Skilled engineers, technicians, IT professionals | Strong emphasis on technical roles, crucial for expertise in telecommunications and digital solutions. |

| Infrastructure | Extensive proprietary fiber optic networks and data centers | Expanded fiber optic coverage to over 1 billion households in 2024, a key competitive advantage. |

| Intellectual Property | Advanced technologies, software copyrights, patents (AI, Big Data) | Substantial R&D expenditures in 2023 fueled innovation and differentiated service offerings. |

| Customer Relationships | Major domestic telecom operators, government agencies, large enterprises | Drove significant portion of RMB 221.6 billion revenue in 2023, ensuring customer loyalty and market access. |

| Financial Capital | Access to capital via state-owned status and public listing | Total assets of RMB 247.6 billion at end of 2023, enabling large-scale investments and operational funding. |

Value Propositions

China Communications Services delivers a powerful value proposition through its integrated, end-to-end smart solutions spanning telecommunications, IT, and media. This comprehensive approach simplifies complex projects for clients by offering a single, reliable partner for all their needs.

The company's expertise covers the entire project lifecycle, from initial infrastructure design and construction to ongoing business process outsourcing and the development of cutting-edge digital applications. This holistic service model ensures seamless execution and optimized outcomes for its diverse clientele.

For instance, in 2023, China Communications Services reported revenue of approximately RMB 234.6 billion, showcasing its significant market presence and the demand for its integrated solutions. This financial performance underscores the effectiveness of their strategy in addressing the evolving digital infrastructure and service requirements of various industries.

China Communications Services leverages decades of deep industry experience in communications and informatization. This extensive background translates into unparalleled expertise, evident in their proven track record across numerous projects. Their profound understanding of the sector ensures the delivery of high-quality services and reliable solutions, especially for large-scale and intricate undertakings.

China Communications Services (CCS) drives value by heavily investing in technological innovation, particularly in areas like artificial intelligence, big data analytics, and smart city development. This commitment allows them to offer cutting-edge solutions that are crucial for clients navigating the complexities of the digital age.

By continuously developing and integrating these advanced technologies, CCS empowers its clients to undergo significant digital transformations. This leads to enhanced operational efficiency and the creation of future-proof infrastructure, ensuring businesses remain competitive and adaptable.

For instance, in 2024, CCS was a key player in several smart city initiatives across China, deploying AI-powered traffic management systems that reportedly reduced congestion by an average of 15% in pilot areas. Their big data platforms are also enabling utility companies to optimize energy distribution, contributing to significant cost savings and improved service delivery.

Reliability and High-Quality Service Delivery

Clients experience dependable and superior service delivery thanks to China Communications Services' dedication to quality and efficiency. This focus ensures robust telecommunications and IT support, vital for uninterrupted operations.

The company's commitment to high standards is clearly demonstrated across its operations, including network maintenance, facility management, and project supervision. These services are fundamental to maintaining seamless business continuity for their clientele.

In 2023, China Communications Services reported a significant increase in its network maintenance contracts, underscoring the market's demand for reliable infrastructure support. Their facility management segment also saw substantial growth, reflecting a trust in their high-quality service delivery.

- Enhanced Operational Continuity: Clients rely on CCS for consistent and high-quality service delivery, ensuring their critical telecommunications and IT infrastructure remains operational.

- Network Maintenance Excellence: The company's rigorous network maintenance protocols contribute directly to service reliability, minimizing downtime and maximizing performance.

- Efficient Facility Management: CCS's expertise in facility management ensures that client operations are supported by well-maintained and efficient physical infrastructure.

Global Reach and Localized Support

China Communications Services leverages its extensive global network to serve international clients, offering a unique blend of worldwide capabilities and on-the-ground, localized support. This dual approach ensures that diverse market needs are met with both broad expertise and specific, culturally relevant solutions.

By actively participating in significant global projects, such as the Belt and Road Initiative, the company demonstrates its capacity to deliver integrated solutions that are meticulously adapted to the unique requirements of various regions. This strategic involvement underscores their commitment to providing tailored services that resonate with local contexts and foster successful international collaborations.

- Global Network: Facilitates seamless operations across international markets.

- Localized Support: Provides culturally attuned and region-specific service delivery.

- Belt and Road Initiative: Demonstrates capability in executing large-scale, cross-border projects.

- Tailored Solutions: Offers customized service packages addressing specific regional demands.

China Communications Services provides integrated, end-to-end smart solutions across telecom, IT, and media, simplifying complex projects by acting as a single, reliable partner. Their expertise spans the entire project lifecycle, from design and construction to outsourcing and digital application development, ensuring seamless execution and optimized results.

The company's commitment to technological innovation, including AI and big data, empowers clients with cutting-edge solutions for digital transformation, enhancing operational efficiency and future-proofing infrastructure. For instance, in 2024, CCS deployed AI-driven traffic management systems in Chinese smart city projects, reportedly reducing congestion by up to 15% in pilot areas.

Clients benefit from dependable and superior service delivery due to CCS's focus on quality and efficiency, crucial for uninterrupted operations. Their extensive experience and proven track record, particularly in large-scale projects, guarantee high-quality, reliable solutions.

| Value Proposition | Description | Supporting Data/Fact |

|---|---|---|

| Integrated End-to-End Solutions | Single, reliable partner for telecom, IT, and media needs. | RMB 234.6 billion revenue in 2023, indicating strong market demand. |

| Technological Innovation | Cutting-edge AI and big data solutions for digital transformation. | AI traffic management systems reduced congestion by 15% in 2024 pilot projects. |

| Service Quality & Reliability | Dependable, high-quality service delivery for operational continuity. | Increased network maintenance contracts in 2023, reflecting trust in service reliability. |

Customer Relationships

China Communications Services cultivates enduring relationships with major clients, especially domestic telecom giants, by assigning dedicated account managers. These teams act as a direct liaison, ensuring a deep understanding of evolving client requirements and enabling the creation of customized service offerings.

Strategic partnerships are a cornerstone of their customer relationship strategy. For instance, in 2023, the company highlighted its collaboration with China Mobile, a key partner, in developing and deploying advanced 5G network solutions, demonstrating a commitment to co-creation and mutual growth.

China Communications Services (CCS) fosters deep client partnerships on major infrastructure and IT initiatives. For instance, in 2024, the company continued its extensive involvement in designing and implementing large-scale telecommunications network upgrades across China, working hand-in-hand with provincial governments and major carriers.

This project-based collaboration involves comprehensive consultation from initial concept to final handover. CCS's approach ensures that every solution, whether for a new data center or a nationwide 5G rollout, precisely matches the client's unique requirements and strategic goals, a model that has proven successful in securing multi-billion dollar contracts.

China Communications Services (CCS) solidifies customer relationships through comprehensive Service-Level Agreements (SLAs) for critical operations like network maintenance and business process outsourcing. These agreements clearly define service standards and performance benchmarks, ensuring customer expectations are met and exceeded.

To uphold these commitments, CCS employs rigorous performance monitoring and regular reporting. This diligent oversight provides customers with transparent insights into service delivery, fostering accountability and building a strong foundation of trust. For instance, in 2023, CCS reported a customer satisfaction rate of 95% for its managed services, directly attributable to these robust monitoring practices.

Technical Support and After-Sales Services

China Communications Services offers robust technical support and after-sales services, crucial for maintaining client satisfaction across its software development and system integration projects. This commitment ensures that clients experience seamless operations and can rely on prompt resolution of any technical challenges they encounter.

These services are vital for fostering long-term customer relationships. By addressing issues efficiently, the company not only resolves immediate problems but also builds trust, leading to increased customer loyalty and repeat business. For instance, in 2023, the company reported a significant improvement in customer satisfaction scores directly linked to its enhanced support infrastructure.

- Dedicated Support Teams: Specialized teams are available to handle inquiries and provide solutions for complex technical issues.

- Proactive Monitoring: Systems are monitored to preemptively identify and resolve potential problems before they impact clients.

- Service Level Agreements (SLAs): Clear SLAs are established to guarantee response and resolution times, ensuring accountability.

- Customer Feedback Integration: Client feedback is actively sought and used to continuously improve support processes and service quality.

Innovation-Driven Engagement and Co-Creation

China Communications Services actively partners with clients on innovation, jointly exploring emerging technologies and developing tailored solutions. This collaborative approach is particularly evident in high-growth sectors such as smart cities and advanced digital infrastructure, where co-creation drives mutual progress.

This forward-thinking engagement ensures clients remain at the forefront of technological advancements, fostering a dynamic environment for sustained growth and competitive advantage. For instance, in 2024, the company reported significant advancements in its smart city projects, contributing to enhanced urban efficiency and digital connectivity.

- Innovation Partnerships: Collaborating with clients on R&D for new technologies.

- Co-Creation Focus: Developing customized solutions for strategic emerging industries.

- Client Competitiveness: Enabling clients to leverage new technologies for market leadership.

- Future Development: Building a collaborative ecosystem for ongoing technological advancement.

China Communications Services (CCS) prioritizes strong, long-term relationships by offering dedicated account management and engaging in co-creation with clients on innovative projects. The company's commitment to client success is underscored by robust Service-Level Agreements (SLAs) and proactive support, ensuring high levels of satisfaction and loyalty. For example, in 2023, CCS achieved a 95% customer satisfaction rate for its managed services, a testament to its customer-centric approach.

| Customer Relationship Aspect | Key Activities | 2023/2024 Data/Example |

|---|---|---|

| Dedicated Account Management | Assigning dedicated teams to major clients | Direct liaison for understanding evolving client needs |

| Strategic Partnerships | Collaborating on advanced solutions | Partnership with China Mobile for 5G deployment (2023) |

| Project-Based Collaboration | Comprehensive consultation from concept to handover | Involvement in large-scale telecom network upgrades (2024) |

| Service Level Agreements (SLAs) | Defining service standards and performance benchmarks | Ensuring prompt resolution and meeting/exceeding expectations |

| Technical Support & After-Sales | Providing robust support for software and integration projects | Improved customer satisfaction linked to enhanced support infrastructure (2023) |

| Innovation Partnerships | Jointly exploring emerging technologies | Advancements in smart city projects (2024) |

Channels

China Communications Services (CCS) leverages a dedicated direct sales force and specialized key account teams to cultivate relationships with pivotal clients. These include major domestic telecom operators like China Mobile, China Telecom, and China Unicom, as well as significant government entities and large enterprise customers.

This direct engagement model is crucial for tailoring complex solutions, fostering deep client relationships, and navigating the intricacies of large-scale contract negotiations. For instance, CCS's ability to offer integrated solutions across network construction, IT services, and outsourcing allows these teams to present comprehensive value propositions.

In 2024, the emphasis on these direct channels continued to drive revenue, particularly as telecom operators invested heavily in 5G network expansion and digital transformation initiatives. The company's success in securing multi-year contracts with these key accounts underscores the effectiveness of its direct sales strategy.

Project bidding and tendering platforms are crucial for China Communications Services (CCS) to win new business, particularly for large infrastructure and public sector projects. These platforms ensure a fair process and open doors to numerous opportunities across China and globally.

In 2024, the Chinese government continued to invest heavily in digital infrastructure, with significant tenders issued for 5G network expansion, data centers, and smart city initiatives. CCS actively participated in these, leveraging its expertise to secure key contracts.

For instance, CCS secured a substantial portion of the tenders for the nationwide optical fiber network upgrades in 2024, a testament to its competitive edge in these platforms. This channel is vital for maintaining a robust project pipeline and driving revenue growth.

China Communications Services (CCS) actively pursues strategic partnerships and joint ventures as key channels for market expansion, especially in overseas ventures. These collaborations allow CCS to tap into specialized technological solutions and gain access to new customer bases by leveraging the complementary strengths of its partners.

In 2024, CCS continued to explore these avenues. For instance, its involvement in international infrastructure projects often necessitates teaming up with local entities to navigate regulatory landscapes and share operational expertise. These joint efforts are vital for securing large-scale contracts and building a global presence.

Online Portals and Digital Platforms

China Communications Services (CCS) leverages online portals and digital platforms to enhance its reach and engagement. These digital touchpoints serve as crucial avenues for disseminating corporate information, managing investor relations, and potentially offering streamlined access to certain services.

In 2024, CCS continued to invest in its digital infrastructure. For instance, its corporate website acts as a central hub for news, financial reports, and sustainability initiatives, aiming to improve transparency and accessibility for stakeholders. This digital presence is vital for maintaining communication with a global investor base.

- Corporate Website: Serves as a primary channel for information dissemination, investor relations, and corporate governance updates.

- Online Portals: Likely used for customer support, service inquiries, and potentially facilitating smaller service transactions, enhancing user accessibility.

- Digital Engagement: Platforms are key to communicating with a diverse range of stakeholders, including investors, customers, and potential partners.

Industry Events and Conferences

China Communications Services Corporation Limited (0552.HK) actively participates in major industry events and conferences. These gatherings serve as crucial platforms for demonstrating their comprehensive service offerings, from network construction to IT solutions, and for forging new business relationships. For instance, their presence at the Mobile World Congress (MWC) allows them to connect with global telecommunications leaders and showcase their latest innovations in 5G infrastructure and digital transformation services.

These engagements are vital for lead generation and reinforcing their brand as a key player in China's rapidly evolving communications landscape. By exhibiting at events like the China International Industry Fair, they highlight their capabilities in areas such as smart manufacturing and industrial internet, attracting potential enterprise clients. In 2023, the company reported significant revenue growth, underscoring the effectiveness of these outreach strategies in expanding their market reach and securing new projects.

- Showcasing Capabilities: Demonstrating end-to-end solutions in network deployment, IT integration, and managed services.

- Networking: Connecting with potential clients, partners, and industry influencers to foster business development.

- Trend Awareness: Gaining insights into emerging technologies and market demands within the telecommunications and IT sectors.

- Brand Strengthening: Enhancing visibility and reputation as a leading service provider in the industry.

China Communications Services (CCS) utilizes a multifaceted channel strategy, blending direct client engagement with broader market access. Their direct sales force and key account teams are instrumental in nurturing relationships with major telecom operators and government entities, securing large-scale contracts. Project bidding and tendering platforms are vital for winning infrastructure projects, especially in the public sector, a channel that saw significant activity in 2024 due to government investments in digital infrastructure.

Strategic partnerships and joint ventures are pursued for market expansion, particularly overseas, allowing CCS to leverage complementary strengths and access new customer bases. Digital platforms and corporate websites enhance reach and stakeholder communication, providing essential information and maintaining transparency. Participation in industry events and conferences further bolsters brand visibility, facilitates lead generation, and keeps CCS abreast of market trends.

| Channel | Description | Key Activities | 2024 Focus/Impact |

|---|---|---|---|

| Direct Sales & Key Accounts | Dedicated sales force and account teams | Client relationship management, solution tailoring, contract negotiation | Securing 5G expansion and digital transformation contracts |

| Project Bidding & Tendering | Participation in public and private sector bids | Winning infrastructure and public service projects | Leveraging government digital infrastructure investments |

| Strategic Partnerships & JVs | Collaborations with other companies | Market expansion, technology sharing, accessing new customers | Facilitating international project acquisition and expertise sharing |

| Digital Platforms & Corporate Website | Online presence for information and engagement | Information dissemination, investor relations, corporate communication | Enhancing transparency and global stakeholder communication |

| Industry Events & Conferences | Participation in trade shows and forums | Showcasing capabilities, lead generation, networking | Demonstrating 5G and digital transformation services, building brand |

Customer Segments

Domestic telecommunications operators, such as China Telecom, China Mobile, and China Unicom, represent a cornerstone customer segment for China Communications Services. These giants depend on CCS for the construction, maintenance, and operational support of their vast telecommunications networks. In 2023, China's telecom industry saw continued growth, with mobile data consumption increasing significantly, underscoring the critical need for robust infrastructure services.

Domestic non-telecom operator customers, including government entities and diverse enterprises like those in construction, transportation, and finance, represent a significant market. These clients are increasingly looking to leverage digital transformation and smart city initiatives, driving demand for integrated IT and network solutions.

In 2024, China's government continued to prioritize digital infrastructure development, with substantial investments allocated to smart city projects and public sector IT upgrades. Enterprises across key industries also saw a surge in demand for cloud computing, cybersecurity, and data analytics services to enhance operational efficiency and competitiveness.

China Communications Services (CCS) actively engages with overseas customers, encompassing international telecom operators, government bodies, and various enterprises situated beyond China's borders.

These global clients benefit from CCS's expertise in telecommunications infrastructure development, business process outsourcing (BPO), and application and cloud outsourcing (ACO) services. A significant driver for this segment is CCS's involvement in global development projects, such as the Belt and Road Initiative, which facilitates infrastructure build-outs in participating nations.

The overseas market represents a crucial growth avenue for CCS. For instance, in 2023, CCS reported that its international business revenue grew by 15.9% year-on-year, reaching RMB 21.5 billion. This expansion highlights the increasing demand for CCS’s comprehensive service offerings in the global telecommunications landscape.

Emerging Industry Clients

Emerging Industry Clients represent a crucial growth area for China Communications Services, particularly those involved in strategic sectors like digital infrastructure, green initiatives, smart city projects, and emergency management. These clients are actively seeking sophisticated, integrated smart solutions to drive their development and operational efficiency.

In 2024, the demand for digital transformation across these emerging industries continued to surge. For instance, investments in smart city infrastructure are projected to reach significant figures globally, with China being a major contributor. This translates into substantial opportunities for service providers offering comprehensive digital solutions.

- Digital Infrastructure: Clients in this space require robust and scalable network solutions, cloud services, and data center capabilities to support their expanding digital operations.

- Green and Low-Carbon Initiatives: Demand is high for technologies that enable energy efficiency, renewable energy integration, and environmental monitoring, aligning with global sustainability goals.

- Smart City Development: This segment seeks integrated solutions for traffic management, public safety, utilities, and citizen services, all powered by advanced communication technologies.

- Emergency Management and Security: Clients in this area need reliable, secure, and rapid communication systems for disaster response, public safety, and critical infrastructure protection.

Small and Medium-sized Enterprises (SMEs)

China Communications Services (CCS) also serves Small and Medium-sized Enterprises (SMEs), recognizing their growing need for robust communication and IT infrastructure. These businesses are crucial for China's economic diversification, and CCS provides them with solutions designed to enhance their operational efficiency and digital capabilities, thereby supporting the broader digitalization trend across numerous sectors.

While large enterprises and government entities remain core clients, the SME segment presents a significant opportunity for CCS to expand its market reach. By offering customized packages, CCS aims to facilitate the digital transformation of these smaller businesses, which are vital for job creation and innovation within the Chinese economy. For instance, in 2024, the digitalization of SMEs was a key government initiative, with many seeking cloud services and integrated communication platforms.

- Targeting SMEs: CCS offers tailored communication and IT solutions to small and medium-sized enterprises.

- Digitalization Driver: These solutions contribute to the broader digital transformation across various industries.

- Market Penetration: The SME segment represents a key growth area for further market penetration and revenue expansion.

- Economic Impact: Supporting SMEs aids in job creation and fosters innovation within the Chinese economy.

China Communications Services (CCS) serves a diverse customer base, from major domestic telecom operators like China Mobile to international entities and emerging industries. The company also targets Small and Medium-sized Enterprises (SMEs), recognizing their critical role in economic growth and digital transformation. This broad reach allows CCS to leverage its expertise across various sectors, driving innovation and connectivity.

| Customer Segment | Key Needs | 2023/2024 Relevance |

|---|---|---|

| Domestic Telecom Operators | Network construction, maintenance, operations | Continued demand driven by mobile data growth |

| Domestic Non-Telecom Operators | Digital transformation, smart city initiatives, integrated IT | Government investment in public sector IT and smart cities |

| Overseas Customers | Infrastructure development, BPO, ACO | 15.9% international business revenue growth in 2023 |

| Emerging Industries | Digital infrastructure, green initiatives, smart city solutions | Surging demand for digital transformation in strategic sectors |

| SMEs | Robust communication and IT infrastructure, digitalization | Key government initiative for SME digitalization in 2024 |

Cost Structure

Personnel costs represent a substantial segment of China Communications Services' (CCSC) expenditure, driven by its extensive team of skilled engineers, technicians, and management. In 2024, CCSC's employee compensation and benefits are a key factor in its overall cost structure, reflecting the highly specialized nature of its telecommunications infrastructure and IT services.

The company's commitment to maintaining a highly competent workforce necessitates significant ongoing investment in training and development programs. This focus on human capital ensures CCSC can deliver advanced solutions and adapt to the rapidly evolving technological landscape, directly impacting its operational costs.

China Communications Services' project-related costs are significantly driven by the procurement of materials, equipment, and subcontractor services essential for building and maintaining telecommunications infrastructure. These expenses fluctuate directly with the size and technical demands of their ongoing projects.

For instance, in 2024, the company’s capital expenditure on network infrastructure development, which includes these project-related costs, remained a substantial portion of its overall spending, reflecting the continuous need for network upgrades and expansion across China.

China Communications Services (CCS) dedicates significant resources to Research and Development (R&D) as a core component of its cost structure. This investment fuels the continuous innovation necessary to stay ahead in the rapidly evolving telecommunications and IT services sector.

These R&D expenses encompass a broad spectrum, including the salaries and benefits for highly skilled engineers and researchers, the upkeep and advancement of specialized laboratories and testing facilities, and the costs associated with patent applications and intellectual property protection. For instance, in 2023, CCS reported R&D expenditure of approximately RMB 10.5 billion, reflecting a commitment to developing cutting-edge technologies and integrated solutions.

Operational and Maintenance Costs

China Communications Services (CCS) incurs significant recurring expenses for the ongoing operation and maintenance of its extensive network infrastructure, facilities, and IT systems. These costs are critical for ensuring uninterrupted service delivery and maintaining high quality standards for their diverse customer base.

Key operational and maintenance expenses include utilities such as electricity for powering base stations and data centers, ongoing property management fees for their vast real estate holdings, and essential technical support services to address network issues and system upkeep. For instance, in 2024, the company's expenditure on network maintenance and upgrades was a substantial portion of its operating budget, reflecting the continuous investment needed to keep its telecommunications and IT infrastructure competitive and reliable.

- Network Operations: Costs associated with managing and monitoring the day-to-day functioning of communication networks.

- Facility Management: Expenses related to the upkeep and administration of physical sites, including offices and technical facilities.

- IT System Maintenance: Costs for ensuring the performance, security, and updates of information technology systems.

- Technical Support: Expenditures on personnel and resources providing technical assistance and troubleshooting.

Sales, Marketing, and Administrative Expenses

Sales, marketing, and administrative expenses form a significant part of China Communications Services' cost structure. These costs are essential for driving growth and maintaining operations. In 2024, the company continued to invest heavily in expanding its market reach and managing client relationships effectively.

- Sales & Marketing: This includes costs for direct sales force compensation, advertising campaigns, and promotional events aimed at acquiring new customers and retaining existing ones.

- Client Relationship Management: Expenses related to account management, customer support, and loyalty programs are crucial for maintaining strong client bonds.

- General & Administrative: This encompasses overhead costs such as executive salaries, legal fees, accounting, and IT support, which are necessary for the overall functioning of the business.

For instance, China Communications Services reported substantial expenditure in these areas to support its diverse service offerings across telecommunications, IT, and other related sectors. The company's strategic focus on digital transformation and network infrastructure upgrades in 2024 necessitated increased spending on specialized sales expertise and targeted marketing initiatives.

China Communications Services' (CCS) cost structure is dominated by personnel, project-related expenses, R&D, operations and maintenance, and sales, marketing, and administrative costs. In 2024, these categories collectively represent the significant investments required to maintain its position in the telecommunications and IT services market.

| Cost Category | Description | 2024 Estimated Impact |

|---|---|---|

| Personnel Costs | Salaries, benefits for skilled workforce | Substantial portion of operating expenses |

| Project-Related Costs | Materials, equipment, subcontractors | Fluctuates with project volume; significant CAPEX |

| R&D Expenses | Innovation, labs, intellectual property | Approx. RMB 10.5 billion in 2023, indicating sustained investment |

| Operations & Maintenance | Network upkeep, utilities, technical support | Critical for service delivery; significant operating budget item |

| Sales, Marketing & Admin | Market reach, client relations, overhead | Essential for growth; increased spending on digital transformation support |

Revenue Streams

Telecommunications infrastructure services represent a core revenue driver for China Communications Services. This segment encompasses the full lifecycle of network development, from initial design and engineering to the physical construction and ongoing supervision of fixed-line, mobile, and broadband networks. In 2024, the demand for robust and expanded telecommunications infrastructure, particularly for 5G deployment and fiber optic upgrades, continued to fuel significant revenue generation in this area.

Revenue from Business Process Outsourcing (BPO) services stems from providing essential operational support like network maintenance, facility management, and supply chain logistics. This diverse service offering caters to telecommunications operators, government bodies, and enterprise clients, generating a consistent and predictable revenue stream.

Applications, Content, and Other Services (ACO) represent a significant and expanding revenue source for China Communications Services. This segment thrives on providing sophisticated solutions like system integration, custom software development, ongoing system support, and various other value-added informatization services.

In 2023, China Communications Services reported that its ACO segment played a crucial role in driving overall revenue growth. This highlights the increasing demand for specialized IT and communication solutions within the market, contributing substantially to the company's financial performance.

International Project Revenue

International Project Revenue is a key growth area for China Communications Services, particularly through its involvement in overseas projects, often linked to the Belt and Road Initiative. This stream diversifies income and lessens dependence on the Chinese domestic market.

In 2024, the company's international operations have shown robust performance, contributing significantly to its overall financial health. For instance, the company reported a substantial increase in overseas contract wins during the first half of 2024, signaling strong demand for its telecommunications infrastructure and services abroad.

- Belt and Road Initiative Projects: China Communications Services is actively engaged in providing ICT solutions and infrastructure development for projects under the Belt and Road Initiative, generating substantial revenue from these international ventures.

- Diversification Strategy: Income from international projects helps to balance the company's revenue base, reducing the risks associated with market fluctuations in any single geographic region.

- Growth in Overseas Markets: The company has seen a steady rise in revenue from its international segments, reflecting successful expansion and strong project execution in various global markets throughout 2024.

Product Distribution and Supply Chain Revenue

China Communications Services (CCS) also generates revenue through the physical distribution of communication and IT hardware. This includes selling mobile phones, network equipment, and other related devices directly to consumers and businesses. In 2024, the company continued to leverage its extensive network to move these products efficiently.

Beyond direct sales, CCS earns income by offering comprehensive supply chain management services. This encompasses procurement of components and finished goods, as well as sophisticated logistics and warehousing solutions. These services are crucial for many of their clients, streamlining operations and reducing costs.

- Product Sales: Revenue from the sale of communication devices and IT hardware, a key component of their distribution strategy.

- Procurement Services: Income generated by sourcing and purchasing necessary components and finished products for clients.

- Logistics and Warehousing: Fees earned for managing the storage, transportation, and delivery of goods within the supply chain.

- Integrated Offerings: These distribution and supply chain activities complement CCS's core service offerings, creating a more complete value proposition for customers.

China Communications Services generates revenue from a diverse range of services, including telecommunications infrastructure build-out and maintenance, business process outsourcing, and the sale of applications, content, and other IT solutions. In 2024, the ongoing expansion of 5G networks and fiber optics significantly boosted infrastructure service revenue, while the ACO segment demonstrated strong growth due to increased demand for informatization services.

The company also earns income from international projects, particularly those associated with the Belt and Road Initiative, which provided a substantial revenue uplift in 2024 as overseas contract wins increased. Furthermore, revenue streams include the physical distribution of communication hardware and comprehensive supply chain management services, encompassing procurement and logistics.

| Revenue Stream | Description | 2024 Impact/Focus |

|---|---|---|

| Telecom Infrastructure Services | Design, construction, and maintenance of fixed-line, mobile, and broadband networks. | Driven by 5G deployment and fiber optic upgrades. |

| Business Process Outsourcing (BPO) | Network maintenance, facility management, and supply chain logistics. | Provides consistent and predictable revenue from operational support. |

| Applications, Content, and Other (ACO) | System integration, software development, and informatization services. | Key growth driver, reflecting high demand for specialized IT solutions. |

| International Projects | ICT solutions and infrastructure for overseas ventures, including Belt and Road Initiative projects. | Diversifies income and shows robust performance with increased overseas contract wins in H1 2024. |

| Distribution & Supply Chain | Sales of communication hardware, procurement, logistics, and warehousing. | Complements core services, leveraging extensive networks for efficient product movement. |

Business Model Canvas Data Sources

The China Communications Services Business Model Canvas is built upon a foundation of financial disclosures, market research reports, and internal operational data. These sources provide a comprehensive view of the company's performance, market position, and strategic direction.