China Communications Services Porter's Five Forces Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

China Communications Services Bundle

China Communications Services operates in a dynamic landscape shaped by intense rivalry and the significant bargaining power of its large customer base. Understanding these forces is crucial for navigating its market. The full Porter's Five Forces Analysis delves into the specific pressures influencing China Communications Services, revealing the true competitive intensity and strategic levers available.

Ready to move beyond the basics? Get a full strategic breakdown of China Communications Services’s market position, competitive intensity, and external threats—all in one powerful analysis.

Suppliers Bargaining Power

China Communications Services' reliance on a small pool of specialized equipment providers, especially for advanced network components like fiber optics, significantly bolsters supplier bargaining power. Major global suppliers, including Huawei and ZTE, hold substantial market share in telecommunications equipment, giving them considerable leverage in negotiations. This concentration limits China Communications Services' ability to source critical technologies from multiple vendors, potentially driving up costs.

The Chinese government exerts considerable influence over supplier relationships in the telecommunications industry, frequently prioritizing domestic manufacturers such as Huawei and ZTE. This governmental backing can foster stability in supply chains and potentially curb extreme price fluctuations, though it also means that supplier selection is often aligned with national strategic objectives.

This oversight can simultaneously diminish and redirect the bargaining power of suppliers. For instance, in 2024, state-owned enterprises in China's telecom sector continued to receive directives prioritizing local content, impacting procurement decisions for critical infrastructure components.

China Communications Services, like many telecom infrastructure firms, relies heavily on specialized technology providers for essential installation equipment. This includes advanced tools like micro-trenching machinery and fiber optic splicing equipment, crucial for deploying and maintaining networks.

The global market for these specialized telecom installation tools was projected to reach approximately $7.5 billion in 2023, with steady growth anticipated. This dependency grants significant leverage to the technology providers, allowing them to influence pricing and terms, thus increasing their bargaining power over companies like China Communications Services.

Potential for Supplier Consolidation

The telecom infrastructure sector is seeing a rise in supplier consolidation, with larger firms buying out smaller ones to boost their market presence. This trend can put pressure on companies like China Communications Services by reducing the number of available suppliers, which often translates to less competitive pricing and potentially higher costs for essential components.

This consolidation means China Communications Services might face a situation with fewer bargaining options. For instance, in 2023, the global market for telecom equipment saw significant M&A activity, with reports indicating that the top five suppliers controlled over 70% of the market share, a figure that has been steadily increasing.

- Increased Market Share by Top Suppliers: Leading telecom equipment manufacturers are actively acquiring smaller competitors to expand their reach and product portfolios.

- Reduced Supplier Competition: As consolidation progresses, the number of independent suppliers diminishes, lessening the competitive pressure on pricing and terms.

- Potential for Higher Input Costs: Fewer suppliers can lead to a situation where China Communications Services has less leverage, potentially resulting in increased costs for materials and services.

- Impact on Supply Chain Flexibility: A more concentrated supplier base can reduce flexibility and increase reliance on a smaller number of key partners.

Quality Control and Technological Advancements Drive Supplier Choice

China Communications Services (CCS) prioritizes suppliers capable of stringent quality control and possessing advanced technological capabilities. This is particularly true for critical infrastructure components, such as those needed for 5G deployment and AI development, where reliability and performance are paramount. Suppliers demonstrating consistent quality and innovation in these cutting-edge fields naturally command greater influence in negotiations. For instance, in 2024, the demand for specialized optical fiber and advanced base station equipment, where technological leadership is key, saw suppliers with patented solutions able to negotiate more favorable terms.

The dynamic nature of the telecommunications sector necessitates that CCS partners with suppliers who are not just providers but also collaborators in innovation. Companies that can offer forward-looking solutions and adapt quickly to evolving technological landscapes, such as those developing next-generation network hardware or specialized software for network management, hold stronger positions. This reliance on supplier innovation means that CCS may face higher costs or less favorable contract terms if few suppliers meet these demanding criteria. For example, the scarcity of suppliers with proven expertise in quantum-resistant cryptography for network security in 2024 highlighted this dynamic, giving those few providers significant leverage.

- Supplier Quality: Consistent delivery of high-grade components is non-negotiable for CCS.

- Technological Edge: Suppliers leading in 5G, AI, and future network technologies have increased bargaining power.

- Innovation Partnerships: CCS seeks suppliers who can co-develop and adapt to rapid technological shifts.

- Market Dynamics: Scarcity of specialized expertise, like quantum-resistant cryptography, amplifies supplier leverage.

China Communications Services faces significant supplier bargaining power due to the concentrated nature of the telecom equipment market. Major players like Huawei and ZTE, bolstered by government support in 2024, control a substantial portion of critical infrastructure components, limiting CCS's options and potentially increasing costs.

Dependency on specialized installation tools further empowers suppliers, as the global market for these items, projected to grow steadily, sees providers with patented solutions dictating terms. This reliance, coupled with industry consolidation, reduces competition, allowing fewer suppliers to command higher prices and less flexible contract conditions for CCS.

CCS's demand for high-quality, technologically advanced components, particularly for 5G and AI, grants considerable leverage to suppliers demonstrating innovation and stringent quality control. The scarcity of expertise in emerging areas, like quantum-resistant cryptography in 2024, further amplifies the bargaining power of those few providers.

| Factor | Impact on CCS | Supporting Data/Trend |

|---|---|---|

| Market Concentration | Increased supplier leverage, potential cost hikes | Top 5 telecom equipment suppliers controlled >70% market share in 2023. |

| Specialized Equipment Dependency | Higher prices for critical tools | Global telecom installation tools market ~ $7.5 billion in 2023. |

| Technological Requirements | Advantage to innovative suppliers | Demand for 5G/AI components favors patented solutions. |

| Government Support (China) | Prioritization of domestic suppliers | 2024 directives favored local content in telecom infrastructure. |

What is included in the product

This analysis delves into the competitive forces shaping China Communications Services' market, examining supplier and buyer power, the threat of new entrants and substitutes, and the intensity of rivalry within the telecommunications infrastructure and services sector.

Easily identify and mitigate competitive threats within China's telecom infrastructure sector, making strategic planning for China Communications Services more efficient.

Customers Bargaining Power

China Communications Services benefits from a wide array of customers, encompassing domestic telecom operators, government agencies, corporate clients, and international businesses. This extensive customer portfolio, especially the vast number of mobile subscribers served by its operator clients, significantly dilutes the bargaining power of any single customer.

While China Communications Services provides a broad spectrum of offerings, certain fundamental telecom services are becoming increasingly commoditized. This trend heightens customer price sensitivity, as individuals and businesses can readily compare and switch between providers based on cost. For instance, basic broadband internet packages, once a premium service, now face intense competition, forcing providers to offer more aggressive pricing to retain subscribers.

This heightened price sensitivity directly pressures profit margins for services like basic voice and data plans. Customers are more likely to shop around for the cheapest option, especially for services where perceived differentiation is low. In 2024, the average monthly cost for a residential broadband plan in major Chinese cities saw a slight decline year-over-year, reflecting this competitive pricing environment driven by customer demand for affordability.

China Communications Services (CCS) frequently secures long-term contracts with key players such as China Mobile, China Telecom, and China Unicom. These agreements, often spanning multiple years, lock in service provision and reduce the immediate ability of these major operators to switch providers or demand significant concessions.

The strategic partnerships extend to government entities, further solidifying CCS's position and limiting customer bargaining power. For instance, in 2023, CCS reported that its revenue from telecommunications operators accounted for a substantial portion of its total income, highlighting the importance of these long-standing relationships.

Demand for Integrated and Smart Solutions

Customers are increasingly seeking integrated and smart solutions that blend telecommunications, IT, and media services. This trend empowers them to demand more value and tailored offerings from providers.

China Communications Services' strength in delivering comprehensive smart solutions, such as digital infrastructure and smart city applications, directly addresses this customer demand. By offering these advanced, integrated services, the company can differentiate itself from competitors focused solely on basic infrastructure.

This ability to provide a higher value proposition through smart solutions can effectively reduce the bargaining power of customers. When customers find unique and comprehensive benefits in a service, their ability to negotiate for lower prices or more favorable terms on basic services diminishes.

- Demand for Integrated Services: In 2024, the global market for smart city solutions, a key area for integrated offerings, was projected to reach over $2.5 trillion, indicating strong customer interest.

- Value Proposition Enhancement: By bundling telecommunications, IT, and smart applications, China Communications Services can create a stickier customer relationship, making switching less attractive.

- Reduced Price Sensitivity: Customers prioritizing convenience and advanced functionality are often less sensitive to price for basic services when a comprehensive solution is available.

Government as a Key Customer and Regulator

The Chinese government is a colossal customer for China Communications Services (CCS), particularly in its massive push for nationwide infrastructure development and digital transformation initiatives. For instance, in 2023, government-led projects accounted for a substantial portion of CCS's revenue, reflecting the critical role the company plays in national connectivity goals.

However, this significant customer also wears the hat of a powerful regulator, directly influencing market access, service standards, and pricing mechanisms for CCS. This dual capacity means the government can exert considerable control, potentially limiting the bargaining leverage of other customer groups by shaping the competitive landscape and dictating terms for essential services.

- Government as Dominant Customer: The state's direct investment in digital infrastructure and telecommunications projects makes it a primary revenue driver for CCS.

- Regulatory Influence on Pricing: Government regulations on service pricing and market entry can cap the bargaining power of other customer segments.

- Shaping Demand: The government's strategic directives, such as promoting 5G adoption or rural broadband expansion, directly shape the overall demand for CCS's services.

While China Communications Services (CCS) serves a vast customer base, including major telecom operators and government entities, the bargaining power of individual customers is generally low due to long-term contracts and the integrated nature of its offerings. However, the commoditization of basic services like broadband does increase price sensitivity among residential and smaller business clients.

The demand for integrated solutions, such as smart city applications, allows CCS to differentiate its services, thereby reducing the leverage of customers seeking only basic connectivity. This focus on value-added services helps mitigate the impact of price-sensitive buyers. For example, the projected growth in the smart city market in 2024 underscores this trend.

The Chinese government, a significant customer, also acts as a powerful regulator, influencing market conditions and pricing. This dual role can indirectly limit the bargaining power of other customer segments by shaping the overall competitive environment and setting standards for essential services.

| Customer Segment | Bargaining Power Factors | Impact on CCS |

| Major Telecom Operators (e.g., China Mobile) | Long-term contracts, significant volume | Low to moderate; contracts provide stability but require ongoing relationship management |

| Government Agencies | Large-scale infrastructure projects, regulatory influence | Low; government is a key partner and regulator, shaping market terms |

| Corporate Clients | Demand for integrated solutions, switching costs | Low to moderate; value proposition of integrated services reduces price sensitivity |

| Residential Customers | Price sensitivity for basic services, ease of switching | Moderate; commoditization of basic services creates some price pressure |

Same Document Delivered

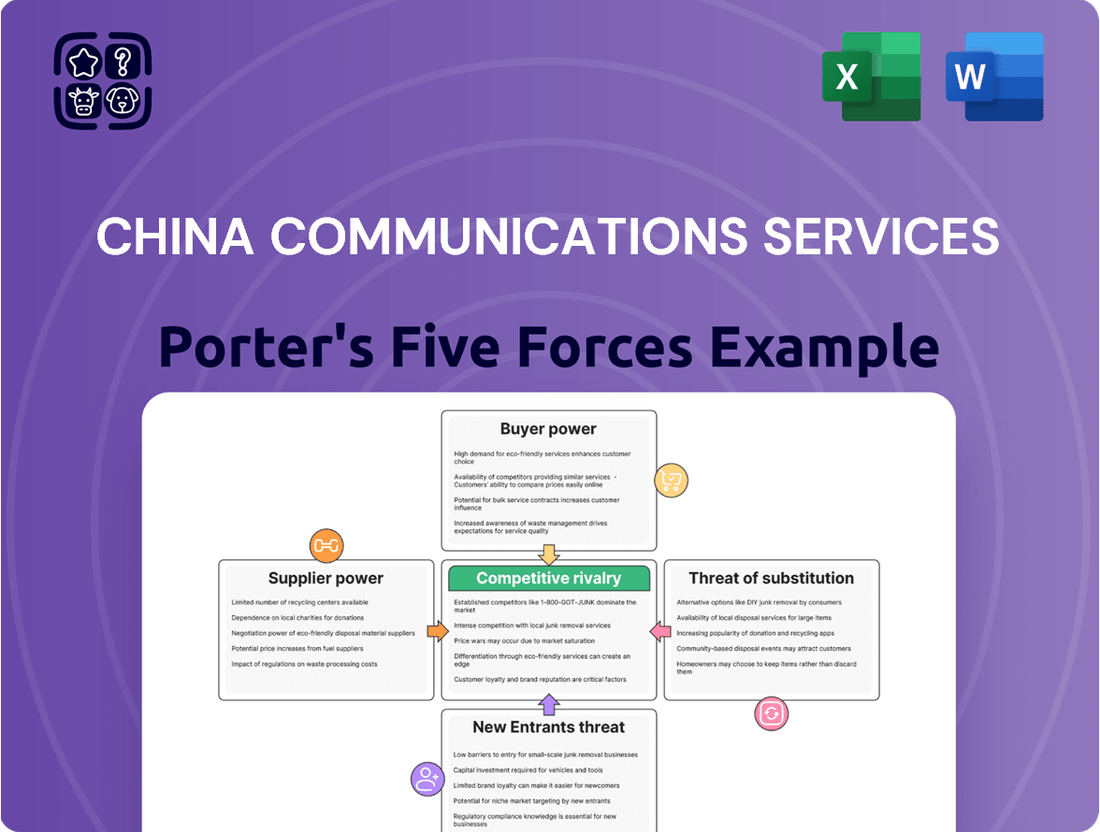

China Communications Services Porter's Five Forces Analysis

This preview showcases the comprehensive Porter's Five Forces Analysis for China Communications Services, detailing the industry's competitive landscape. You're looking at the actual document; once you complete your purchase, you’ll get instant access to this exact file, providing a thorough examination of competitive rivalry, buyer and supplier power, threat of new entrants, and the threat of substitute products.

Rivalry Among Competitors

The Chinese telecommunications sector is largely controlled by three major state-owned enterprises: China Mobile, China Telecom, and China Unicom. These giants are not only competitors among themselves but also significant customers for companies like China Communications Services. This dominance by state-owned entities shapes the competitive landscape, focusing rivalry on areas beyond basic infrastructure.

While direct competition for core network infrastructure services may be somewhat contained due to state ownership, the real battleground is shifting towards value-added services and new business ventures. For instance, China Mobile reported over 990 million mobile subscribers by the end of 2023, highlighting the sheer scale of these operators and the intense competition for customer loyalty and market share in these newer service areas.

While China Communications Services benefits from a relatively stable core telecom infrastructure market, its competitive landscape is sharpening significantly in newer growth areas. The push towards industrial digitalization, smart cities, and green technologies is attracting a wider array of players, including specialized tech firms and international competitors.

This intensified rivalry necessitates a stronger focus on technological innovation and service excellence. For instance, in the smart city sector, companies are competing on the sophistication of data analytics, AI integration, and the seamlessness of connected systems. China Communications Services needs to continuously upgrade its offerings to stay ahead.

Emerging digital infrastructure projects, often government-backed, also see robust competition. Companies are vying for contracts by demonstrating superior capabilities in areas like 5G deployment for industrial use cases and the development of sustainable digital solutions. This dynamic environment demands agility and a commitment to high operational standards.

The telecommunications industry, including China Communications Services, is defined by significant upfront investments in network infrastructure, such as fiber optic cables and base stations. These high fixed costs mean that companies must operate at high volumes to spread the expense, leading to intense competition to capture market share.

For instance, China's 5G network buildout alone was projected to cost hundreds of billions of dollars, creating a substantial barrier to entry and forcing existing players to fight aggressively for customers to justify these massive capital expenditures.

This environment compels companies to relentlessly pursue operational efficiency and maximize the return on their substantial infrastructure investments, directly fueling a fierce competitive rivalry as each player strives to gain an edge in this capital-intensive sector.

Focus on Technological Innovation and Service Quality

Competitive rivalry in China's telecommunications and IT services sector is intense, pushing companies like China Communications Services to prioritize technological innovation and service quality. To secure and grow market share, significant investments are being made in cutting-edge technologies such as 5G, artificial intelligence (AI), and cloud computing. For instance, China's 5G network deployment continued its rapid expansion throughout 2024, with the number of base stations exceeding 3.3 million by the end of the year, creating a strong demand for related services.

China Communications Services is actively differentiating itself by bolstering its software development prowess and enhancing its digital service standards. This focus on software and digital experiences is crucial in a market where customers increasingly expect seamless and advanced solutions. The company aims to leverage these capabilities to offer more value-added services beyond basic connectivity, a strategy vital for maintaining a competitive edge.

- Technological Investment: Companies are pouring resources into 5G, AI, and cloud computing to stay ahead.

- Service Differentiation: Emphasis on software development and digital service quality is key to market positioning.

- Market Dynamics: The rapid rollout of 5G infrastructure in China, with over 3.3 million base stations by end-2024, fuels competition in service provision.

Geographic and Segment-Specific Competition

While China's major state-owned telecom operators, like China Mobile, China Unicom, and China Telecom, hold significant sway nationally, the competitive intensity can sharpen considerably in specific geographic areas or for particular service niches. This is particularly true as China gradually relaxes foreign investment limitations in certain value-added telecommunication services, potentially introducing new players or intensifying existing rivalries.

China Communications Services, with its broad and diversified service offerings, is well-positioned to manage these varied competitive pressures. Its ability to operate across different segments, from infrastructure build-out to customer service and IT solutions, allows it to adapt to localized competitive dynamics. For instance, while competition for basic mobile services might be concentrated among the big three, the market for enterprise cloud solutions or specialized network maintenance could see different competitive forces at play.

In 2024, the telecommunications infrastructure sector, a core area for China Communications Services, continued to see robust investment, driven by the ongoing 5G rollout and the expansion of data centers. This expansion, while creating opportunities, also intensifies competition among service providers and equipment manufacturers. The company's diversified revenue streams, including network operations and maintenance, IT solutions, and supply chain services, provide a buffer against intense competition in any single segment.

- National Dominance, Local Intensity: Major state-owned operators like China Mobile, China Unicom, and China Telecom dominate the national market, but competition can be fiercer in specific regions or for niche services.

- Easing Foreign Investment: Recent policy shifts easing foreign investment restrictions in certain value-added telecom services are likely to introduce new competitive dynamics.

- Diversified Strategy: China Communications Services leverages its broad service portfolio, spanning infrastructure, IT, and supply chain, to navigate these varied competitive landscapes effectively.

- 5G and Data Center Growth: Continued investment in 5G infrastructure and data centers in 2024 fuels competition among service providers and equipment vendors in these key growth areas.

Competitive rivalry within China's telecommunications sector is fierce, primarily driven by the dominance of three state-owned giants: China Mobile, China Telecom, and China Unicom. These entities compete intensely not only with each other but also indirectly with service providers like China Communications Services by demanding superior performance and innovation.

The battle for market share extends beyond basic infrastructure into value-added services, with companies like China Mobile boasting nearly a billion mobile subscribers by the close of 2023, underscoring the pressure to retain and attract customers through advanced offerings.

China Communications Services navigates this landscape by focusing on technological advancement and service differentiation, particularly in emerging areas like smart cities and industrial digitalization, where competition from specialized tech firms and international players is escalating.

The substantial capital expenditure required for infrastructure development, exemplified by China's 5G network buildout potentially costing hundreds of billions of dollars, intensifies rivalry as companies strive for operational efficiency and maximum return on investment.

| Key Competitors | Market Share (Approx. End 2023) | Key Competitive Focus Areas |

| China Mobile | ~60% (Mobile Subscribers) | 5G, IoT, Digital Services |

| China Telecom | ~20% (Mobile Subscribers) | Broadband, Enterprise Solutions, Cloud |

| China Unicom | ~20% (Mobile Subscribers) | 5G Innovation, Consumer Services, AI Integration |

SSubstitutes Threaten

The proliferation of Over-the-Top (OTT) services presents a substantial threat of substitution for traditional voice and messaging. Platforms like WeChat, QQ, and WhatsApp have become deeply ingrained in daily communication for Chinese consumers, offering features that often surpass basic calling and texting.

While China Communications Services (CCS) focuses on infrastructure and support, a significant shift away from traditional telecom services by its operator clients directly impacts CCS. For instance, if mobile operators see a substantial portion of their revenue eroded by OTT alternatives, their investment in and need for CCS’s network maintenance and expansion services could diminish.

In 2023, China's mobile data traffic continued its upward trajectory, reaching approximately 292 billion gigabytes, indicating a strong preference for data-driven communication, which OTT services leverage heavily. This trend underscores the ongoing challenge for traditional telecom services and, by extension, their support providers like CCS, as users increasingly opt for data-based communication channels.

The increasing availability and sophistication of cloud-based solutions and Software as a Service (SaaS) present a significant threat of substitution for traditional IT infrastructure and on-premise services. These offerings often provide greater flexibility, scalability, and cost-efficiency, directly impacting the demand for China Communications Services' legacy offerings. For instance, the global cloud computing market was projected to reach over $1.3 trillion by 2024, highlighting the substantial shift towards these alternative models.

Emerging technologies like direct-to-satellite communication and advanced wireless solutions present a growing threat of substitutes for traditional terrestrial network infrastructure. These innovations, particularly promising for remote or underserved regions, offer alternative connectivity pathways.

While still in early stages, the long-term potential for these technologies to replace or supplement existing networks is significant. For instance, satellite internet providers are actively expanding their reach, aiming to connect millions globally. SpaceX's Starlink, a prominent example, reported over 3 million subscribers by the end of 2024, illustrating the increasing adoption of satellite-based connectivity.

Internal Capabilities of Large Enterprise and Government Clients

Large enterprise and government clients possess the potential to develop or enhance their internal IT and network management capabilities. This strategic move can significantly decrease their dependence on external providers like China Communications Services for business process outsourcing and IT support. Such insourcing decisions are often motivated by a desire for greater cost control, enhanced operational oversight, or stricter security protocols.

For instance, in 2024, many large corporations are investing heavily in building out their in-house cybersecurity teams, aiming to manage sensitive data more effectively. This trend is partly driven by concerns over data breaches and the desire for direct control over their digital infrastructure.

- Cost Savings: Insourcing can lead to reduced long-term operational costs compared to ongoing service fees from external vendors.

- Enhanced Control: Direct management of IT and network functions provides greater control over service quality, security, and customization.

- Security Imperatives: For government entities and sensitive industries, insourcing can be a critical strategy to ensure data sovereignty and compliance with stringent security regulations.

Alternative Infrastructure Development Models

New approaches to building infrastructure, like private networks for businesses or specialized regional networks, could offer alternatives to relying on major national telecom providers. This means China Communications Services needs to be flexible in providing customized solutions and exploring various collaborations.

For instance, the rise of private 5G networks for industrial campuses or smart cities presents a direct substitute for public infrastructure in specific use cases. Companies are increasingly looking at these bespoke solutions to meet unique connectivity demands, potentially bypassing traditional carrier services. In 2024, investments in private network deployments saw significant growth, with global spending projected to reach tens of billions of dollars, highlighting a clear shift in infrastructure development.

- Emergence of Private Networks: Enterprises are investing in dedicated, private network infrastructure for enhanced security, control, and performance, offering an alternative to shared public networks.

- Regional Specialization: Smaller, specialized providers focusing on specific geographic areas or industries can offer tailored solutions that compete with the broad-stroke approach of national carriers.

- Partnership Models: China Communications Services must adapt by forming strategic partnerships with technology providers and end-users to co-create and deploy these alternative infrastructure models.

The threat of substitutes for China Communications Services (CCS) is significant, driven by the rise of Over-the-Top (OTT) communication services and evolving technological landscapes. These substitutes directly impact the demand for traditional telecom services that CCS supports.

OTT platforms like WeChat and QQ have captured a substantial share of consumer communication, leading to reduced reliance on traditional voice and messaging services. This shift is evident in China's mobile data usage, which grew to approximately 292 billion gigabytes in 2023, underscoring the preference for data-intensive applications often facilitated by OTT providers.

Furthermore, the growing adoption of cloud computing and Software as a Service (SaaS) offers alternatives to traditional IT infrastructure, a core area for CCS. The global cloud market's projected growth to over $1.3 trillion by 2024 highlights this trend. Emerging technologies like satellite internet, with over 3 million Starlink subscribers by the end of 2024, also present a substitute for terrestrial networks, especially in remote areas.

Entrants Threaten

The threat of new entrants in China's telecommunications infrastructure and IT services sector is significantly dampened by the immense capital required for network development and the adoption of cutting-edge technologies. For instance, the ongoing 5G network expansion necessitates billions of dollars in investment, making it a formidable hurdle for newcomers.

Furthermore, stringent government regulations and licensing processes create substantial barriers, particularly for foreign companies seeking to enter the market. While some areas, like value-added services, have seen a relaxation of these rules, the core infrastructure remains heavily protected, limiting the ease with which new competitors can emerge.

The threat of new entrants in China's telecommunications market is significantly dampened by the entrenched dominance of established state-owned enterprises (SOEs). These giants, such as China Mobile, China Telecom, and China Unicom, control the vast majority of the market, making it exceptionally difficult for newcomers to gain a foothold.

These incumbents benefit from substantial existing infrastructure, including extensive fiber optic networks and cellular towers, which represent billions in capital investment. For instance, China's total investment in telecommunications infrastructure surpassed 600 billion yuan in 2023, a figure that is challenging for any new entrant to replicate.

Furthermore, these SOEs possess massive, loyal customer bases built over decades, providing them with significant economies of scale and pricing power. Their strong government backing also translates into preferential regulatory treatment and access to capital, further solidifying their market position and deterring potential new competitors.

New entrants would face a significant hurdle in matching the deep technological expertise required for China Communications Services' operations, particularly in cutting-edge fields like 5G deployment, artificial intelligence integration, and robust cybersecurity solutions. Acquiring and retaining the specialized talent needed for these complex domains presents another substantial barrier, as competition for skilled engineers and IT professionals remains fierce globally.

Pilot Programs for Foreign Investment in Value-Added Services

Recent pilot programs in China are easing foreign investment caps in specific value-added telecom services, like Internet Data Centers (IDC) and Content Delivery Networks (CDN), particularly in designated free trade zones. This strategic move, observed throughout 2024, aims to foster competition and technological advancement within these segments. For instance, Shanghai's Pudong New Area has been a focal point for such reforms, allowing greater foreign participation.

While these initiatives create opportunities for new foreign entrants in niche areas, the fundamental infrastructure of China's telecommunications market, including 5G network build-out and core network services, remains largely protected. This dual approach means that while some segments might see increased competition, the dominant players in essential communication services are likely to retain significant market power. The impact of these pilot programs on the overall threat of new entrants for China Communications Services will be most pronounced in the value-added services sector, rather than the core network infrastructure.

- Pilot Program Focus: Value-added services like IDC and CDN in specific regions.

- Government Objective: Foster competition and technological advancement.

- Geographic Emphasis: Areas like Shanghai's Pudong New Area are key.

- Market Segmentation: Core infrastructure remains restricted, while value-added services see openings.

Brand Reputation and Existing Client Relationships

China Communications Services (CCSC) benefits immensely from its established brand reputation and deeply entrenched client relationships. These aren't built overnight; they represent years of reliable service delivery and trust, particularly with major telecom operators and government entities. For instance, in 2023, CCSC continued its role as a critical infrastructure partner, underscoring the stability of these relationships.

The significant investment and time required to cultivate such a strong market presence and a comprehensive service portfolio act as a substantial barrier for any potential new competitor. New entrants would struggle to replicate the level of trust and the integrated service offerings that CCSC currently provides, making market entry a considerable challenge.

- Brand Loyalty: CCSC's long-standing ties with key clients create a high degree of loyalty, making it difficult for newcomers to win significant market share.

- Service Integration: The company's ability to offer a wide range of integrated services, from network construction to maintenance, is a complex offering that new entrants would find challenging to match.

- Capital Investment: Establishing a comparable service network and client base requires substantial upfront capital, deterring many potential new players.

The threat of new entrants for China Communications Services (CCSC) remains low, primarily due to the massive capital investment required for infrastructure development and the need for advanced technological expertise. For example, the ongoing 5G network build-out demands billions in investment, a substantial barrier for any newcomer. Stringent government regulations and licensing further solidify this, particularly for core network services, although some value-added segments are seeing eased restrictions in 2024.

Established state-owned enterprises (SOEs) like China Mobile, China Telecom, and China Unicom dominate the market, controlling extensive existing infrastructure and possessing large, loyal customer bases. Their strong government backing and economies of scale make it incredibly difficult for new players to compete. CCSC itself benefits from deep client relationships and a strong brand reputation, built over years of reliable service, which new entrants would struggle to replicate.

While pilot programs in 2024 are opening up certain value-added services, such as Internet Data Centers (IDC) and Content Delivery Networks (CDN), to greater foreign investment, especially in free trade zones like Shanghai's Pudong New Area, the core infrastructure remains largely protected. This selective liberalization means the overall threat to established players in essential communication services is limited.

| Barrier Type | Description | Impact on New Entrants |

| Capital Requirements | Massive investment needed for network development (e.g., 5G expansion). | Very High |

| Government Regulation & Licensing | Strict rules for core infrastructure, limiting market access. | High |

| Economies of Scale | Dominance of SOEs with established infrastructure and customer bases. | High |

| Brand Reputation & Client Relationships | CCSC's long-standing trust and integrated service offerings. | High |

| Technological Expertise | Need for specialized skills in areas like 5G, AI, and cybersecurity. | High |

Porter's Five Forces Analysis Data Sources

Our Porter's Five Forces analysis for China Communications Services leverages data from annual reports, industry research firms like IDC and Gartner, and government regulatory filings to provide a comprehensive view of the competitive landscape.