China Communications Services Boston Consulting Group Matrix

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

China Communications Services Bundle

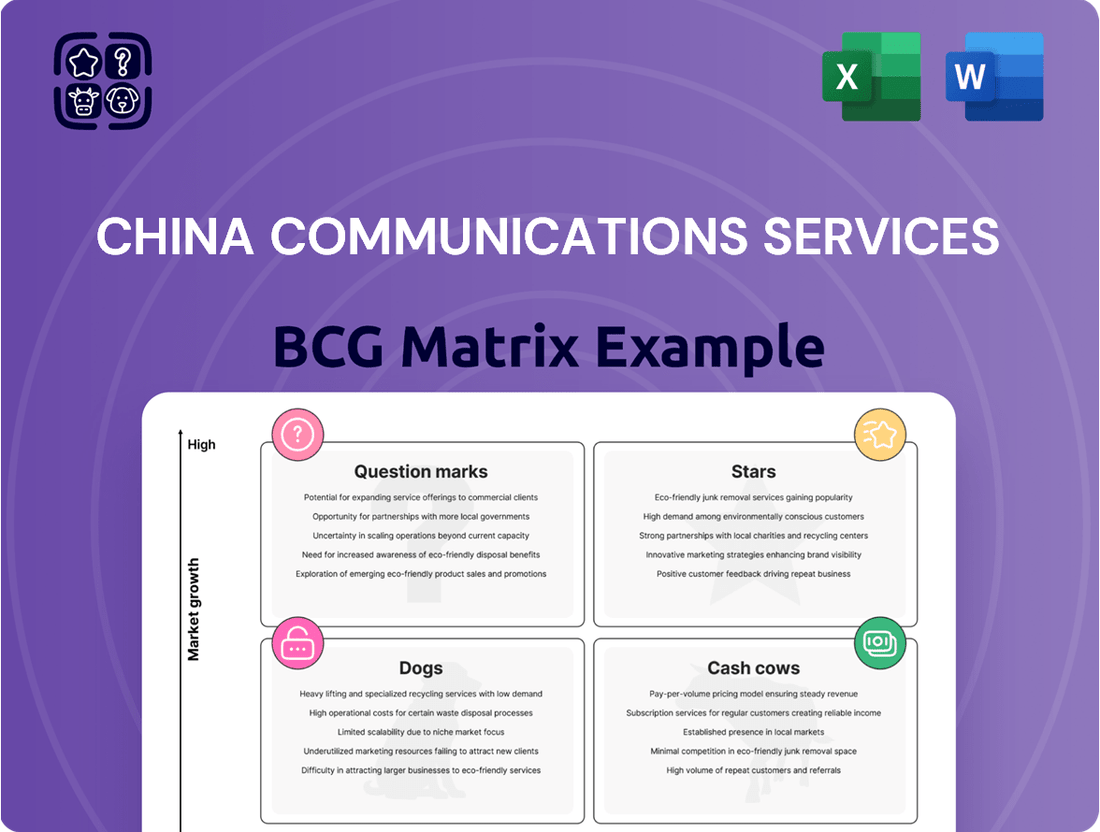

Uncover the strategic positioning of China Communications Services' diverse portfolio with our comprehensive BCG Matrix analysis. This preview offers a glimpse into how their offerings stack up as Stars, Cash Cows, Dogs, or Question Marks, providing a foundational understanding of their market performance.

To truly unlock the potential of this analysis, purchase the full BCG Matrix report. Gain access to detailed quadrant placements, data-driven recommendations, and a clear roadmap for smart investment and product development decisions that will drive your business forward.

Stars

5G Infrastructure Deployment Services is a significant growth engine for China Communications Services (CCS). China's aggressive 5G rollout, with over 4 million 5G base stations by late 2024, fuels demand for these services. CCS, benefiting from its strong market position and government backing, is a key beneficiary of this expansion.

The Applications, Content, and Other (ACO) services segment has been a significant growth engine for China Communications Services. For the third year running, ACO services have fueled revenue expansion, with a notable 8.4% increase in 2024. This segment now accounts for more than 20% of the company's total revenues, highlighting its increasing importance.

Digital Infrastructure Solutions, including computing power, is a key focus for China Communications Services (CCS) as it aligns with China's strategic push for digitalization and intelligentization. This sector is experiencing robust growth, with the digital economy's added value in China reaching approximately 45.5% of its GDP in 2023, indicating substantial market potential. CCS aims to leverage this trend as a leading integrated smart service provider.

Smart City Solutions

Smart City Solutions are a key strategic focus for China Communications Services (CCS), reflecting China's aggressive push towards urbanization and digital infrastructure development. This segment is categorized as a question mark or potentially a rising star within the BCG matrix due to its high market growth potential, driven by government investment and the increasing demand for intelligent urban management systems.

The market for smart city solutions is expanding rapidly. For instance, global smart city spending was projected to reach $180 billion in 2024, a significant increase from previous years, with a substantial portion of this investment coming from China. CCS is well-positioned to capitalize on this trend, leveraging its extensive network and technological capabilities to gain market share.

- High Market Growth: The smart city sector is experiencing robust expansion, fueled by government initiatives and technological advancements.

- Strategic Importance: CCS views smart city solutions as a critical area for future growth and market leadership.

- Leveraging Expertise: CCS aims to utilize its existing infrastructure and service capabilities to excel in this emerging market.

- Market Share Expansion: The company is focused on capturing a significant portion of the growing smart city market.

AI Strategic Deployment and Services

China Communications Services (CCS) is aggressively advancing its AI strategy, recognizing its potential to create significant competitive edges in the dynamic artificial intelligence landscape. The company is focusing on building robust AI capabilities and services to capture emerging opportunities.

Supported by substantial government initiatives and a robust increase in demand for AI and intelligent computing solutions across various sectors, this area is a key growth engine for CCS. The company is channeling significant investments into this segment to solidify its future market position. In 2023, China's AI market was valued at approximately $170 billion, with projections indicating continued strong growth.

- AI Strategic Deployment: CCS is prioritizing the integration of AI across its operations and service offerings.

- New Competitive Advantages: The company aims to leverage AI to differentiate itself and gain market share.

- Market Growth Drivers: Government policy support and rising industry demand for AI are fueling this segment's expansion.

- Investment Focus: CCS is making substantial investments to secure a leading position in the AI services market.

The AI and Intelligent Computing segment is a clear Star for China Communications Services (CCS). This is driven by substantial government support and a surge in demand for AI solutions across industries, with China's AI market valued at approximately $170 billion in 2023 and expected to grow significantly. CCS's strategic investments here are designed to capture emerging opportunities and build a strong competitive advantage.

What is included in the product

This BCG Matrix analysis identifies China Communications Services' Stars, Cash Cows, Question Marks, and Dogs.

The China Communications Services BCG Matrix offers a clear, one-page overview of business units, alleviating the pain of complex strategic analysis.

Cash Cows

China Communications Services' core telecommunications infrastructure services, encompassing network consultation, planning, design, engineering, construction, and supervision, represent its established cash cows. These offerings are fundamental to the ongoing maintenance and enhancement of China's extensive telecom networks, ensuring a steady and substantial demand.

In 2023, China Communications Services reported a revenue of approximately RMB 234.2 billion, with its infrastructure services segment contributing significantly to this total. The company’s dominant market share in this mature sector guarantees consistent cash flow, even as growth moderates.

Domestic Network Maintenance and Management is a cornerstone of China Communications Services' Business Process Outsourcing offerings. This service provides essential, ongoing support for the vast networks of telecom operators, ensuring their smooth and efficient operation.

This segment represents a mature market with consistent, predictable demand, allowing China Communications Services to generate stable and reliable revenue streams. The company holds a significant market share in this critical support function, underscoring its established presence and expertise.

In 2023, China Communications Services reported that its network maintenance and operation segment generated approximately RMB 50.5 billion in revenue, highlighting its substantial contribution to the company's overall financial performance. This robust figure demonstrates the enduring strength and profitability of this Cash Cow.

Within China Communications Services' (CCS) Business Process Outsourcing (BPO) segment, general facilities management, encompassing property management, stands as a mature and stable service. This area is characterized by its recurring revenue streams and CCS's robust operational infrastructure, positioning it as a high-market-share, low-growth component, often referred to as a cash cow.

In 2023, CCS reported revenue of RMB 220.7 billion, with its BPO services contributing significantly to this total. While specific segment breakdowns for facilities management aren't always granularly detailed, its nature as a foundational service suggests a steady and predictable cash flow generation, vital for funding other ventures within the company's portfolio.

Established Domestic Business Process Outsourcing

Established Domestic Business Process Outsourcing (BPO) within China Communications Services (CCS) operates as a cash cow. This segment benefits from a mature domestic market where CCS holds a dominant position.

These established BPO services, distinct from newer digital ventures, generate consistent revenue and impressive profit margins. They are crucial for the ongoing operations of telecom operators and various enterprises across China.

- Stable Revenue Streams: The demand for core BPO services remains robust, driven by the continuous operational needs of China's large telecom sector.

- High Profitability: Mature service offerings, coupled with CCS's scale and efficiency, contribute to significant profit margins.

- Market Dominance: CCS's established infrastructure and long-standing relationships in the domestic market solidify its leadership in BPO.

- Consistent Demand: The ongoing requirement for essential business processes ensures a predictable and reliable revenue base for this segment.

Supply Chain and Products Distribution Services

China Communications Services' supply chain and product distribution operations are a foundational element of its business, serving the telecommunications and IT industries. These services are mature, generating consistent revenue and holding a significant market share within their segment.

As a Cash Cow, these operations are characterized by their stability and strong cash flow generation. They represent a vital part of the company's infrastructure, ensuring the smooth delivery of products and services to a broad customer base.

- Stable Revenue Stream: The supply chain and distribution services consistently contribute to China Communications Services' top line, reflecting their essential role in the market.

- High Market Share: The company commands a substantial portion of the market for these services, indicating a strong competitive position.

- Mature Industry Segment: Operating in a well-established sector, these services benefit from predictable demand and operational efficiency.

- Operational Backbone: They are crucial for supporting the company's broader offerings and ensuring customer satisfaction through reliable product delivery.

China Communications Services' established domestic telecom infrastructure services, including network engineering and construction, are its primary cash cows. These services benefit from a mature market with consistent demand, ensuring stable cash flow for the company. In 2023, the company's overall revenue reached approximately RMB 234.2 billion, with these foundational services forming a significant and reliable revenue base.

The company's domestic network maintenance and management segment also operates as a cash cow. Providing essential ongoing support for China's vast telecom networks, this segment generated around RMB 50.5 billion in revenue in 2023. Its mature market position and consistent demand contribute to predictable and robust cash generation.

Furthermore, China Communications Services' general facilities management within its BPO segment is a stable cash cow. This service, characterized by recurring revenue, leverages CCS's strong operational infrastructure. While specific figures for facilities management are not always detailed, its foundational nature within the BPO sector, which contributed significantly to the company's RMB 220.7 billion revenue in 2023, points to its reliable cash flow.

Finally, the company’s supply chain and product distribution operations for the telecom and IT industries are mature cash cows. These services have a high market share and provide a stable revenue stream, acting as a crucial operational backbone. They ensure the efficient delivery of products, supporting the company's broader offerings and contributing to its consistent cash flow generation.

| Service Segment | BCG Category | 2023 Revenue Contribution (Approx.) | Market Characteristics |

|---|---|---|---|

| Infrastructure Services | Cash Cow | Significant portion of RMB 234.2 billion | Mature, stable demand, high market share |

| Network Maintenance & Management | Cash Cow | RMB 50.5 billion | Mature, consistent demand, essential support |

| General Facilities Management (BPO) | Cash Cow | Contributes to BPO segment (part of RMB 220.7 billion total) | Mature, recurring revenue, stable operations |

| Supply Chain & Distribution | Cash Cow | Stable revenue stream | Mature industry, high market share, operational backbone |

Full Transparency, Always

China Communications Services BCG Matrix

The China Communications Services BCG Matrix preview you're seeing is the complete, unwatermarked document you will receive immediately after purchase. This means you're getting the exact, professionally formatted analysis ready for your strategic planning needs. No additional content or edits will be applied; what you preview is precisely what you'll download and utilize for your business insights.

Dogs

China Communications Services' low-margin product distribution business is categorized as a Dog in the BCG Matrix. This is underscored by a substantial 18.9% revenue decline in this segment during 2024, signaling a shrinking market and reduced demand.

The company's strategic focus on controlling and optimizing this business segment further reinforces its Dog status. This indicates a low-growth area where market share and profitability are diminishing, requiring careful management to mitigate losses.

Legacy Network Infrastructure Support, encompassing services for older technologies like 2G and 3G, falls into the Dogs category for China Communications Services. The telecommunications industry's swift transition to 5G and fiber optics means these older infrastructure segments are in a low-growth market. Consequently, China Communications Services likely faces declining demand and diminishing returns in these areas, as customers increasingly abandon older technologies for newer, more advanced solutions.

China Communications Services' international operations face significant headwinds in markets like the United States. Here, stringent national security concerns have led to investigations and potential bans for Chinese telecom firms. This environment severely curtails growth prospects and market share.

These restricted segments can become cash traps, demanding investment without yielding commensurate returns. For instance, while China Communications Services reported overall international revenue growth, specific markets with these geopolitical restrictions likely underperformed significantly in 2024.

Outdated IT System Integration and Support

Outdated IT system integration and support services represent a challenge for China Communications Services, likely falling into the Dogs quadrant of the BCG Matrix. These are services that haven't kept pace with digital transformation, catering to a shrinking market. In 2024, the demand for legacy system support continues to dwindle as businesses prioritize cloud migration and modern infrastructure. For instance, while the global IT services market is projected for robust growth, segments focused on maintaining older, proprietary systems are experiencing stagnation or decline.

China Communications Services' offerings in this area would likely face low market growth and a declining market share. This is particularly true for specialized integration projects that haven't adapted to new digital trends like AI-driven automation or IoT connectivity. Such services struggle to attract new clients and retain existing ones who are seeking more agile and future-proof solutions. The shift towards digital-native platforms means that traditional, hardware-centric IT support is becoming less relevant.

- Declining Market Share: Companies are actively migrating away from outdated systems, reducing the need for integration and support of these legacy platforms.

- Low Market Growth: The overall market for outdated IT systems is not expanding; instead, it's contracting as newer technologies gain traction.

- Reduced Investment: China Communications Services may see reduced investment in these areas due to their low growth potential and profitability.

- Strategic Divestment Potential: These services could be candidates for divestment or restructuring to focus resources on more promising growth areas.

Non-Core, Undifferentiated Small-Scale Projects

Within China Communications Services' extensive business operations, non-core, undifferentiated small-scale projects represent those ventures that lack strategic importance and offer minimal competitive advantage. These are often found in mature, low-growth sectors where differentiation is difficult, leading to commoditized offerings.

These projects might consume valuable resources without generating significant returns or demonstrating potential for substantial expansion. For instance, a small regional IT support service with limited client base and no unique technological offering would fit this description. In 2024, companies across various sectors have been actively divesting such units to streamline operations and focus on higher-potential areas. China Communications Services, with its vast infrastructure and service portfolio, likely has numerous such projects that are candidates for divestiture to improve overall profitability and resource allocation.

- Low Market Share: These projects typically hold a negligible share in their respective markets.

- Limited Growth Potential: Operating in stagnant or declining industries, their revenue growth is minimal.

- Resource Drain: They often require management attention and capital investment that could be better utilized elsewhere.

- Divestiture Target: The strategic recommendation is usually to divest or phase out these operations.

China Communications Services' product distribution, legacy network support, and outdated IT system integration services are firmly in the Dog quadrant. These segments are characterized by low growth and declining market share, exemplified by an 18.9% revenue drop in product distribution during 2024. The company's efforts to control and optimize these areas further solidify their Dog status, indicating a need for careful management to minimize losses.

International operations in restrictive markets like the United States also fall into the Dog category due to national security concerns. These segments act as cash traps, demanding investment without significant returns. Undifferentiated, small-scale projects also represent Dogs, consuming resources with minimal competitive advantage or expansion potential, making them prime candidates for divestiture.

| Business Segment | BCG Category | Key Characteristics | 2024 Data/Outlook |

|---|---|---|---|

| Product Distribution | Dog | Low margins, shrinking market | 18.9% revenue decline |

| Legacy Network Infrastructure Support (2G/3G) | Dog | Low market growth, declining demand | Industry shift to 5G/fiber |

| Outdated IT System Integration | Dog | Low market growth, declining demand | Businesses prioritizing cloud migration |

| International Operations (Restrictive Markets) | Dog | Limited growth, market share constraints | Geopolitical headwinds |

| Non-core, Small-scale Projects | Dog | Lack of strategic importance, minimal advantage | Resource drain, potential divestiture candidates |

Question Marks

China Communications Services is making strategic moves into the green and low-carbon solutions market, a sector poised for significant expansion as China prioritizes environmental sustainability. This aligns perfectly with the nation's ambitious carbon neutrality targets, creating a fertile ground for new service offerings.

The demand for sustainable infrastructure and operational practices is a major tailwind for this segment. For instance, the global green building market is projected to reach $10.4 trillion by 2025, indicating a substantial opportunity for companies like CCS to offer specialized services in areas such as carbon reduction consulting and green energy infrastructure design.

While the market potential is immense, CCS's position within these newer, specialized green solutions is likely still maturing. This means considerable investment will be necessary to build market share and establish a strong competitive presence, characteristic of a business unit in the early stages of growth within a BCG matrix framework.

Emergency management and security solutions represent a strategic growth area for China Communications Services (CCS), capitalizing on advancements in next-generation information technologies. This sector is experiencing significant expansion, driven by escalating needs for robust resilience and enhanced cybersecurity measures across various industries.

While the market for these specialized offerings is growing, CCS's current market penetration may be relatively modest. Consequently, substantial investment will be necessary to build a strong competitive presence and capture a significant share in this burgeoning field.

China Communications Services is exploring advanced AI applications in specialized sectors, such as AI-powered industrial automation and smart city infrastructure management. These initiatives target emerging, high-potential markets that are still in their early stages of development.

While these ventures represent significant future growth opportunities, their current market share is minimal, reflecting the substantial research and development investment needed to establish a strong foothold. For example, in 2024, the global AI market for industrial automation was projected to reach over $20 billion, but China Communications Services' specific segment within this is likely a small fraction, positioning it as a potential 'Question Mark' in the BCG matrix.

New International Market Entries

China Communications Services' ventures into new international markets, characterized by high growth prospects but a nascent presence and fierce competition, are classified as Question Marks. These initiatives demand significant upfront capital to navigate entry hurdles and establish market share, with success not assured. For instance, in 2024, the company might be exploring opportunities in emerging markets in Southeast Asia or Africa, where digital infrastructure development is accelerating, but local players and global giants already hold substantial ground.

These new market entries are strategic bets, akin to investing in early-stage companies. The company needs to carefully assess the competitive landscape, regulatory environment, and potential return on investment. For example, a potential expansion into a market like Vietnam, which saw its digital economy grow by an estimated 20% in 2023, would require substantial investment in network build-out and marketing to compete with established telecommunications providers.

- High Growth Potential: Targeting markets with rapidly expanding digital economies and increasing demand for communication services.

- Intense Competition: Facing established local and international competitors who already have a strong foothold.

- Substantial Investment Required: Allocating significant capital for market entry, infrastructure development, and brand building.

- Uncertain Success: The outcome of these ventures is not guaranteed, necessitating careful monitoring and potential adjustments to strategy.

Cutting-edge Research and Development Initiatives

China Communications Services is actively investing in research and development for future communication technologies, including exploring advancements beyond 5G, such as the nascent field of 6G and quantum communication. These forward-looking projects represent significant investments in a high-growth technological frontier, though they currently lack established commercial market share.

The company's commitment to R&D in these areas is crucial for maintaining a competitive edge in the rapidly evolving telecommunications landscape. For instance, in 2024, China's Ministry of Science and Technology announced increased funding for 6G research, aiming to establish early leadership in the technology.

- Focus on 6G: Developing core technologies and standards for the next generation of wireless communication.

- Quantum Communication: Investigating secure and advanced communication methods leveraging quantum mechanics.

- High R&D Expenditure: Significant capital allocation towards these experimental and future-oriented initiatives.

- Market Potential: Aiming to capture future market share in emerging communication sectors.

China Communications Services' ventures into emerging technologies like AI-powered industrial automation and advanced green solutions fall into the Question Mark category. These areas offer substantial future growth potential, aligning with national strategies, but currently represent small market shares for CCS. Significant investment is required to build competitive positioning and capture market demand in these nascent fields.

| Business Area | Market Growth Potential | CCS Market Share | Investment Needs | BCG Classification |

|---|---|---|---|---|

| Green & Low-Carbon Solutions | High | Low | High | Question Mark |

| AI in Specialized Sectors | Very High | Very Low | Very High | Question Mark |

| Future Communication Tech (e.g., 6G) | High | Negligible | High | Question Mark |

BCG Matrix Data Sources

Our China Communications Services BCG Matrix leverages official financial disclosures, extensive market research, and industry expert analysis to provide a comprehensive view of business units.