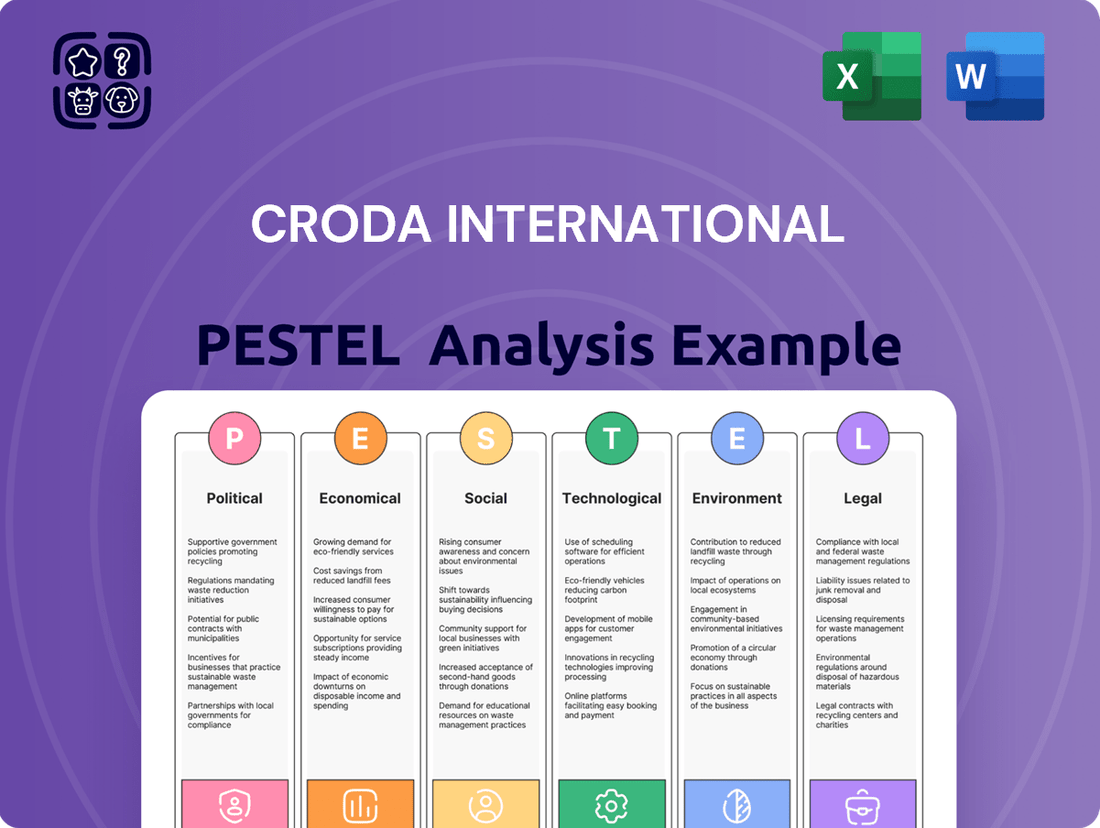

Croda International PESTLE Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Croda International Bundle

Unlock the strategic advantages of Croda International by understanding the intricate web of political, economic, social, technological, legal, and environmental factors influencing its operations. Our comprehensive PESTLE analysis delves deep into these external forces, providing you with the critical intelligence needed to anticipate market shifts and capitalize on emerging opportunities. Download the full version now to gain actionable insights that will empower your strategic decision-making.

Political factors

Changes in global trade policies, including shifts in international agreements and the imposition or removal of tariffs, directly influence Croda International's operational costs and market reach. For instance, the United States' imposition of tariffs on certain Chinese goods in 2018-2019, and subsequent retaliatory tariffs, created cost pressures and supply chain adjustments for many chemical companies, including those sourcing or selling into these markets. Croda, with its global footprint, must navigate these complex trade landscapes to ensure competitive pricing and consistent access to essential raw materials and key markets.

Global chemical safety regulations, like REACH in Europe and TSCA in the US, are increasingly stringent, impacting how companies like Croda International operate. These rules dictate everything from chemical production to their ultimate disposal, demanding constant vigilance and adaptation.

Croda must therefore allocate significant resources to research and development, ensuring its products and manufacturing methods meet these complex and ever-changing environmental, health, and safety standards. For instance, in 2024, companies faced increased scrutiny on PFAS chemicals, requiring substantial R&D investment for alternatives.

Failure to comply with these regulations carries substantial risks, including hefty fines, operational shutdowns, and severe damage to a company's reputation. In 2023, a major chemical manufacturer faced a $50 million fine for non-compliance with waste disposal regulations, highlighting the financial consequences.

Political stability in regions where Croda operates, such as Europe and North America, is crucial. For instance, the ongoing economic recovery in the UK, a key market for Croda, is influenced by the government's trade policies and international agreements post-Brexit. Geopolitical tensions, like those in Eastern Europe, can disrupt supply chains for specialty chemicals, impacting Croda's raw material sourcing and potentially increasing operational costs.

Government Support for Bio-based and Sustainable Industries

Governments globally are actively fostering sustainable and bio-based sectors through a range of supportive measures. These include financial incentives, direct subsidies, and substantial research and development grants, signaling a clear policy direction towards greener economies. For instance, the European Union's Green Deal aims to mobilize significant investment in sustainable industries, with specific funding streams available for bio-based innovation.

Croda's strategic emphasis on developing sustainable and bio-based ingredients aligns perfectly with these governmental initiatives. This synergy is expected to provide a significant tailwind for the company's growth. The company's commitment to innovation in areas like plant-derived surfactants and bio-polymers positions it to capitalize on this growing policy support.

This favorable political climate can accelerate Croda's product development cycles and enhance its market penetration within environmentally conscious consumer and industrial segments. The increasing regulatory push for sustainable sourcing and production methods further strengthens Croda's market position.

- Governmental Focus: Over 50 countries have implemented national bioeconomy strategies by early 2024, highlighting a global policy trend.

- Investment Trends: Global investment in cleantech, including bio-based solutions, reached approximately $1.1 trillion in 2023, indicating significant financial backing.

- Croda's Alignment: Croda's sustainability targets, such as reducing greenhouse gas emissions by 50% by 2030 (vs. 2020 baseline), are directly supported by these policy shifts.

- Market Opportunity: The global bio-based chemicals market is projected to grow from $100 billion in 2024 to over $150 billion by 2029, offering substantial expansion potential for companies like Croda.

Taxation Policies and Corporate Legislation

Croda International's profitability is significantly influenced by corporate tax rates and fiscal policies across its global operations. For instance, the UK's corporation tax rate increased to 25% in April 2023, impacting Croda's UK-based earnings. Conversely, the availability of R&D tax credits in various regions, such as the US, can offset innovation costs and encourage investment in new product development.

Changes in tax legislation directly affect Croda's net income and strategic investment decisions. A shift towards more favorable tax regimes in key markets could incentivize capital expenditure and expansion. For example, if a major operating region were to lower its corporate tax rate in 2024 or 2025, it could make that location more attractive for future investments. Conversely, increased tax burdens can necessitate adjustments to pricing strategies or a re-evaluation of operational footprints to maintain competitive margins.

- UK Corporation Tax: Increased to 25% in April 2023, affecting Croda's UK-based profits.

- R&D Tax Credits: Favorable R&D tax schemes in countries like the US can reduce innovation expenses for Croda.

- Global Tax Harmonization: Potential international efforts to harmonize corporate tax could lead to shifts in Croda's effective tax rate.

- Investment Incentives: Government incentives or tax holidays in emerging markets could influence Croda's decisions on where to invest in new facilities or acquisitions in 2024-2025.

Governmental focus on sustainability, with over 50 countries implementing bioeconomy strategies by early 2024, directly supports Croda's bio-based product development. Global investment in cleantech reached approximately $1.1 trillion in 2023, indicating strong financial backing for environmentally friendly initiatives that Croda can leverage. These policy shifts align with Croda's sustainability targets, such as its 2030 emission reduction goals.

Trade policies and geopolitical stability significantly impact Croda's global operations and supply chains. For instance, the UK's corporation tax rate increased to 25% in April 2023, affecting Croda's profitability. Conversely, favorable R&D tax credits in regions like the US can offset innovation costs, encouraging investment in new product development.

| Political Factor | Impact on Croda | Supporting Data/Example |

| Governmental Support for Bioeconomy | Accelerates growth and market penetration for sustainable products. | Over 50 countries had national bioeconomy strategies by early 2024; global cleantech investment hit $1.1 trillion in 2023. |

| Trade Policies and Tariffs | Influences operational costs and market access. | Past tariff impositions created cost pressures and supply chain adjustments for chemical companies. |

| Chemical Regulations (REACH, TSCA) | Requires significant R&D investment for compliance. | Increased scrutiny on PFAS chemicals in 2024 demanded substantial R&D for alternatives. |

| Corporate Tax Rates | Affects net income and strategic investment decisions. | UK corporation tax rose to 25% in April 2023. |

| Geopolitical Stability | Can disrupt supply chains and increase operational costs. | Tensions in Eastern Europe have impacted specialty chemical supply chains. |

What is included in the product

This PESTLE analysis provides a comprehensive examination of the external macro-environmental factors impacting Croda International, covering Political, Economic, Social, Technological, Environmental, and Legal dimensions.

It offers actionable insights for strategic decision-making by identifying key trends, potential threats, and emerging opportunities relevant to Croda's global operations.

Provides a concise version that can be dropped into PowerPoints or used in group planning sessions, translating complex PESTLE factors into actionable insights for Croda International.

Economic factors

Global economic health is a primary driver for Croda. For instance, the International Monetary Fund (IMF) projected global GDP growth to be 3.2% in 2024, a slight slowdown from 3.5% in 2023, indicating a moderating but still positive economic environment. This growth directly impacts industrial output, which in turn fuels demand for Croda's specialty chemicals used in sectors like manufacturing and consumer goods.

Industrial production indices offer a more granular view. In early 2024, many advanced economies experienced modest industrial output growth, with some emerging markets showing stronger performance. For example, China's industrial production saw a notable increase in the first quarter of 2024, which is a key market for Croda. Conversely, regions facing economic headwinds might see a dip in industrial activity, potentially impacting Croda's sales volumes and profitability in those areas.

Croda International's profitability is directly tied to the prices of its essential raw materials, which include natural oils, fats, and petrochemical derivatives. For instance, palm oil, a key ingredient, saw significant price swings in 2024 due to weather patterns affecting Southeast Asian harvests. This volatility directly impacts Croda's cost of goods sold.

Geopolitical tensions and supply chain disruptions, like those experienced in 2023 and continuing into 2024, further exacerbate raw material price fluctuations. These events can create sudden shortages or surpluses, leading to unpredictable cost increases for Croda. Managing these risks requires robust procurement and hedging strategies.

As a global player, Croda International's financial performance is significantly shaped by foreign exchange rate fluctuations. When earnings from overseas operations are converted back to its reporting currency, typically Sterling, a stronger Pound can reduce the reported value of those profits. For instance, in 2023, Croda reported that currency movements had a notable impact on its reported sales and profits, highlighting the ongoing challenge of managing these translational effects.

These currency shifts also directly influence Croda's costs. If the Pound weakens against currencies where it sources raw materials, such as certain specialty chemicals or agricultural inputs, its procurement expenses will rise. Conversely, a stronger Pound can make its products more expensive for international customers, potentially impacting sales volumes and market share in key regions.

Managing this inherent currency risk is a constant strategic imperative for Croda. The company employs various hedging strategies, such as forward contracts and options, to mitigate the adverse effects of volatile exchange rates on its financial results and maintain competitive pricing across its diverse international markets.

Inflationary Pressures and Interest Rates

Rising inflation presents a significant challenge for Croda International. Increased costs for raw materials, energy, and labor can squeeze profit margins, especially if the company cannot fully pass these higher expenses onto its customers. For instance, in early 2024, global inflation rates remained a concern, impacting supply chain costs across various sectors.

Higher interest rates, a common response to inflation, also affect Croda. Increased borrowing costs can make capital investments more expensive, potentially slowing down expansion or research and development initiatives. This necessitates a strong focus on efficient cost management and strategic financial planning to maintain healthy investment capacity.

- Rising input costs: Global inflation in 2024 continued to put upward pressure on raw material and energy prices.

- Impact on margins: Croda's ability to pass on increased costs to customers is crucial for protecting profitability.

- Cost of capital: Higher interest rates increase the expense of financing new projects or managing working capital.

- Strategic financial management: Effective cost control and prudent debt management are vital in this economic climate.

Consumer Spending and Market Demand Shifts

Consumer discretionary spending, especially in personal care and health, is a key driver for Croda's specialty ingredients. For instance, in 2024, global consumer spending on beauty and personal care was projected to reach over $500 billion, with a significant portion allocated to premium and innovative products that Croda supplies. Shifts in these patterns, perhaps a move towards more budget-conscious choices during economic uncertainty, directly impact Croda's sales volumes.

Changes in consumer preferences, such as a growing demand for sustainable or natural ingredients, also reshape market dynamics. Croda's ability to innovate and align its product portfolio with these evolving tastes is crucial. For example, a survey in early 2025 indicated that over 60% of consumers are willing to pay more for sustainable personal care products, a trend Croda is well-positioned to capitalize on with its bio-based ingredients.

- 2024 Global Beauty & Personal Care Market: Estimated over $500 billion.

- Consumer Preference Shift: Growing demand for sustainable and natural ingredients.

- 2025 Consumer Survey: Over 60% willing to pay more for sustainable personal care.

The global economic landscape significantly influences Croda's performance, with projected global GDP growth of 3.2% for 2024 indicating a moderating but positive environment. This growth directly correlates with industrial output, a key demand driver for Croda's specialty chemicals. However, fluctuating raw material prices, such as palm oil, and geopolitical tensions in 2024 continue to impact Croda's cost of goods sold and necessitate robust supply chain management.

Foreign exchange volatility remains a critical factor, with currency movements impacting Croda's reported sales and profits as earnings are translated back into Sterling. Furthermore, rising inflation in early 2024 continues to pressure profit margins by increasing costs for raw materials, energy, and labor, while higher interest rates make capital investments more expensive. Consumer spending on discretionary items like personal care, projected to exceed $500 billion globally in 2024, is vital, especially with a growing consumer preference for sustainable products, with over 60% willing to pay more for them as of early 2025.

| Economic Factor | 2024 Projection/Trend | Impact on Croda | Supporting Data |

|---|---|---|---|

| Global GDP Growth | 3.2% | Drives demand for specialty chemicals | IMF projection |

| Raw Material Prices | Volatile (e.g., palm oil) | Affects cost of goods sold | Weather patterns impacting harvests |

| Inflation | Elevated | Increases operating costs, pressures margins | Global inflation concerns in early 2024 |

| Interest Rates | Rising | Increases cost of capital for investments | Response to inflation |

| Consumer Spending (Personal Care) | Strong, over $500 billion | Key revenue driver | 2024 market projection |

| Consumer Preference | Shift towards sustainability | Drives innovation in bio-based ingredients | 60%+ willing to pay more for sustainable products (early 2025 survey) |

What You See Is What You Get

Croda International PESTLE Analysis

The preview you see here is the exact Croda International PESTLE Analysis document you’ll receive after purchase—fully formatted and ready to use.

This is a real screenshot of the product you’re buying, detailing Croda's Political, Economic, Social, Technological, Legal, and Environmental landscape—delivered exactly as shown, no surprises.

The content and structure shown in this preview is the same document you’ll download after payment, providing a comprehensive overview of the factors impacting Croda International.

Sociological factors

Consumers worldwide are increasingly seeking products that are kind to the planet and made from natural ingredients. This shift is evident across various sectors, with reports indicating that over 70% of consumers consider sustainability when making purchasing decisions in 2024, a figure projected to rise further. Croda's strategic emphasis on bio-based and renewable chemistry directly taps into this powerful market sentiment.

This growing demand acts as a significant catalyst for innovation within Croda's product development pipeline. For instance, in 2024, their investment in sustainable ingredient research and development saw a notable increase, aiming to expand their portfolio of naturally derived actives and bio-polymers. This focus positions them favorably against competitors who may not have such a strong commitment to eco-conscious formulations.

Consumers are increasingly prioritizing health, wellness, and seeking ways to combat aging. This shift is directly fueling demand for specialized ingredients across personal care, nutraceuticals, and pharmaceutical sectors. For instance, the global anti-aging market was valued at approximately $63 billion in 2023 and is projected to reach over $90 billion by 2028, showcasing significant growth potential.

Croda International is well-positioned to capitalize on this trend, leveraging its deep expertise in developing and supplying high-performance ingredients. These ingredients are crucial for products that cater to evolving consumer lifestyles and demographic changes, such as an aging global population. The company's focus on sustainable and innovative solutions in these areas ensures continuous growth opportunities.

The increasing global life expectancy, with many developed nations seeing significant portions of their population aged 65 and over, presents a substantial opportunity for Croda. For instance, in 2024, the United Nations projects that the number of people aged 65 or over will reach 1.1 billion globally, a figure expected to double by 2050. This demographic trend directly translates into higher demand for specialized ingredients in sectors like personal care, particularly for anti-aging and skin health solutions, as well as in health and wellness products. Croda's focus on innovative, high-performance ingredients positions it well to capitalize on this enduring market driver.

Urbanization and Changing Lifestyles in Emerging Markets

Rapid urbanization in emerging markets significantly reshapes consumer behavior, boosting disposable incomes and altering consumption habits. This trend fuels demand for a broader spectrum of personal care, home care, and specialized industrial products. For instance, by 2025, it's projected that over 60% of the global population will reside in urban areas, with a substantial portion of this growth occurring in Asia and Africa. This demographic shift presents a prime opportunity for Croda to enhance its market penetration and adapt its product portfolio to the evolving preferences of urban populations.

Croda's strategic focus on these burgeoning urban centers can yield substantial returns. By understanding the specific needs and aspirations of these growing urban demographics, the company can develop and market innovative solutions. For example, increased urbanization often correlates with a greater emphasis on health, wellness, and convenience, driving demand for advanced ingredients in cosmetics, cleaning supplies, and performance materials.

- Urban Population Growth: By 2025, over 60% of the world's population is expected to live in urban areas, a significant increase from previous decades, with emerging markets driving much of this expansion.

- Disposable Income Rise: Urbanization in emerging economies is often accompanied by rising middle-class populations and increased disposable incomes, leading to higher spending on consumer goods and specialized products.

- Demand for Sophisticated Products: As lifestyles change, consumers in urban settings show a greater preference for premium, performance-driven, and sustainably sourced ingredients in personal care, home care, and industrial applications.

Ethical Consumerism and Supply Chain Transparency

Consumers are increasingly scrutinizing the ethical origins of ingredients and the environmental footprint of products. For instance, a 2024 survey indicated that over 60% of consumers consider sustainability when making purchasing decisions. Croda's dedication to responsible chemistry and transparent supply chains, as demonstrated by its sustainability reports, resonates with this growing segment, fostering trust and brand loyalty.

This emphasis on ethical sourcing and manufacturing processes directly impacts market positioning. Croda's proactive approach to supply chain transparency, including detailed information on its sourcing practices for key ingredients like palm oil derivatives, differentiates it from competitors. This focus not only appeals to ethically-minded consumers but also to business partners who prioritize robust ESG (Environmental, Social, and Governance) credentials in their own operations. By 2025, it's projected that over 70% of B2B purchasing decisions will be influenced by a supplier's ESG performance.

- Growing Consumer Demand: Over 60% of consumers consider sustainability in purchasing decisions (2024 data).

- Brand Trust and Loyalty: Ethical sourcing and transparency build stronger relationships with consumers and partners.

- Market Differentiation: Clear supply chain practices and responsible chemistry set Croda apart in a competitive landscape.

- B2B Influence: Projected 70% of B2B purchasing decisions influenced by ESG performance by 2025.

Societal shifts toward health and wellness continue to drive demand for specialized ingredients in personal care and nutraceuticals. The global anti-aging market, valued at approximately $63 billion in 2023, is expected to exceed $90 billion by 2028, highlighting significant growth opportunities for companies like Croda that focus on high-performance, naturally derived actives.

The increasing global life expectancy, with the UN projecting over 1.1 billion people aged 65 and over by 2024, directly fuels demand for anti-aging and skin health solutions. Croda's expertise in innovative ingredients positions it to meet the needs of an aging population seeking effective and sustainable personal care products.

Urbanization, particularly in emerging markets, is reshaping consumer behavior and increasing disposable incomes. By 2025, over 60% of the global population is projected to live in urban areas, creating a larger consumer base for premium personal and home care products, where Croda's advanced ingredients are in demand.

| Sociological Factor | Trend | Croda's Relevance | Data Point |

|---|---|---|---|

| Health & Wellness Focus | Increased demand for anti-aging and health-promoting ingredients | Croda's high-performance actives | Anti-aging market to reach $90B+ by 2028 |

| Aging Population | Growing demand for age-defying and skin health solutions | Croda's specialized ingredients | 1.1B+ people aged 65+ by 2024 |

| Urbanization | Rising disposable income and demand for premium goods | Croda's advanced ingredients for personal/home care | 60%+ global population urban by 2025 |

Technological factors

Breakthroughs in biotechnology, fermentation, and green chemistry are revolutionizing ingredient development, leading to high-performance, sustainable options with smaller environmental impacts. Croda's substantial R&D investment in these fields is key to its specialty chemicals leadership and ability to provide innovative solutions for changing market needs.

This technological advantage directly fuels new product creation. For instance, Croda's 2023 annual report highlighted continued investment in sustainable innovation, with a focus on bio-based materials and advanced manufacturing processes, aiming to capture growing demand for eco-friendly alternatives.

Croda International's integration of digital technologies like AI and big data analytics is crucial for boosting manufacturing efficiency and streamlining its supply chain. By adopting Industry 4.0 principles, the company can achieve more adaptable production cycles and enhance quality control, ultimately speeding up the launch of new products.

The company's investment in digital transformation is evident in its ongoing projects to enhance data utilization across operations. For instance, in 2024, Croda continued to roll out advanced analytics platforms aimed at improving predictive maintenance and optimizing resource allocation within its manufacturing facilities, contributing to a projected 5% increase in operational output by year-end.

Croda International benefits significantly from ongoing advancements in nanotechnology and material science. These fields are enabling the development of ingredients with novel properties, such as enhanced delivery systems for active ingredients or materials with improved thermal or mechanical characteristics. For example, in 2024, research into self-healing polymers, a direct application of advanced material science, could offer new opportunities for Croda's coatings and adhesives sectors.

The ability to create ingredients with unique functionalities through these technologies allows Croda to tap into emerging market segments, like advanced electronics or specialized medical devices. Innovations such as nano-emulsions for improved bioavailability in pharmaceuticals or advanced composites for lightweight automotive components, demonstrated by industry investments exceeding $10 billion globally in 2024 for R&D in these areas, provide substantial competitive advantages and potential for premium pricing.

Maintaining a leading position in nanotechnology and material science research is crucial for Croda's long-term growth strategy. By investing in R&D, as evidenced by Croda's reported £125 million investment in innovation in 2023, the company can ensure its product pipeline remains robust and its offerings are differentiated, allowing it to capture value in high-growth, technology-driven markets.

Intellectual Property Protection and Patent Landscape

Croda International's reliance on proprietary formulations and innovative applications makes intellectual property (IP) protection paramount. Securing patents for unique chemical compounds and manufacturing processes is a key strategy to maintain a competitive edge in the specialty chemicals market. This focus on IP safeguards their significant investments in research and development, ensuring a return on innovation.

In 2023, Croda continued to invest heavily in R&D, with capital expenditure on property, plant, and equipment, which often includes facilities for developing and protecting IP, amounting to £211.6 million. The company actively manages its patent portfolio to defend its market position against rivals seeking to replicate its advanced chemical solutions.

- Patent Portfolio Strength: Croda's ability to secure and defend patents directly impacts its ability to monetize R&D breakthroughs.

- R&D Investment: Continued substantial investment in R&D, as seen in their 2023 capital expenditure, underscores the importance of a robust IP strategy.

- Competitive Advantage: A strong patent landscape allows Croda to command premium pricing and maintain market share for its specialized products.

- Return on Innovation: IP protection is fundamental to ensuring that the company's innovation pipeline translates into sustained financial returns.

New Product Development and Formulation Techniques

Croda's commitment to new product development and formulation techniques is a key technological driver. Continuous innovation in areas like rheology modifiers and emulsification allows for the creation of novel product textures and improved delivery systems, enhancing performance for customers in sectors from personal care to crop protection.

The company's agility in developing and scaling these advanced formulation techniques is crucial for responding to rapidly changing consumer preferences and market demands. For instance, in 2023, Croda highlighted its investment in advanced rheology capabilities, which directly supports the creation of differentiated textures in skincare formulations, a significant market segment.

This focus directly supports their customer-centric strategy, enabling them to offer tailored solutions that address specific performance requirements. Croda's ability to translate cutting-edge formulation science into commercially viable products, as demonstrated by their pipeline of sustainable ingredients, positions them to capture emerging opportunities.

- Advanced Rheology: Enables unique sensory profiles in personal care products.

- Sustainable Delivery Systems: Focus on biodegradable and bio-based encapsulation technologies.

- Rapid Scale-Up: Streamlined processes for bringing new formulations to market efficiently.

- Digital Formulation Tools: Utilization of AI and data analytics to accelerate R&D cycles.

Technological advancements in biotechnology and green chemistry are central to Croda's innovation strategy, driving the development of high-performance, sustainable ingredients. The company's 2023 capital expenditure on property, plant, and equipment, totaling £211.6 million, reflects significant investment in these cutting-edge areas.

Croda's integration of digital technologies, including AI and big data analytics, is enhancing manufacturing efficiency and supply chain operations, aligning with Industry 4.0 principles. In 2024, the company continued to deploy advanced analytics platforms to optimize resource allocation, aiming for a projected 5% increase in operational output.

Further progress in nanotechnology and material science allows Croda to create ingredients with novel properties, opening doors to new markets like advanced electronics. Global R&D investment in these fields surpassed $10 billion in 2024, highlighting their strategic importance.

Croda's commitment to R&D, evidenced by its £125 million investment in innovation in 2023, is crucial for maintaining its competitive edge through intellectual property protection and a robust product pipeline.

| Area of Technological Focus | Croda's Investment/Activity | Impact/Benefit |

| Biotechnology & Green Chemistry | Substantial R&D investment | Development of sustainable, high-performance ingredients |

| Digital Transformation (AI, Big Data) | Deployment of advanced analytics platforms (2024) | Improved operational efficiency, projected 5% output increase |

| Nanotechnology & Material Science | Ongoing research and development | Creation of novel ingredients, access to new markets |

| Intellectual Property (IP) Protection | £211.6 million capital expenditure (2023) | Safeguarding innovation, maintaining competitive advantage |

Legal factors

Croda International must navigate a complex web of global chemical regulations, including the EU's REACH (Registration, Evaluation, Authorisation and Restriction of Chemicals) and the US's TSCA (Toxic Substances Control Act). Adherence to these rules, which govern product composition, safety testing, and market access, demands substantial resources for compliance and documentation. For instance, REACH alone requires extensive data submission for chemicals manufactured or imported into the EU, with compliance costs often running into millions of euros for larger companies.

Failure to comply with these stringent regulations can lead to severe financial penalties, including substantial fines, and can even result in the exclusion of products from key markets. In 2024, for example, several companies faced significant fines for non-compliance with chemical safety regulations in various jurisdictions, highlighting the critical importance of robust compliance programs for businesses like Croda.

Croda International navigates a complex web of product liability and consumer safety laws across its global operations. These regulations, varying by region, mandate strict adherence to product safety and performance standards, impacting everything from raw material sourcing to final product distribution.

Failure to comply can result in significant financial penalties and legal repercussions. For instance, in 2023, the European Union continued to strengthen its consumer product safety framework, with increased scrutiny on chemicals used in everyday products, a key area for Croda's specialty ingredients.

Maintaining rigorous quality control, comprehensive testing protocols, and transparent labeling is paramount for Croda. This proactive approach mitigates risks such as costly recalls, potential litigation, and severe reputational damage, which could significantly impact market trust and financial performance.

Croda International relies heavily on robust intellectual property (IP) laws to shield its innovative chemical formulations, advanced manufacturing techniques, and proprietary technologies. The company's ability to secure and vigorously enforce patents, trademarks, and trade secrets is paramount to maintaining its competitive edge and justifying ongoing investment in research and development. For instance, in 2023, Croda continued to invest significantly in R&D, with a focus on sustainable and high-performance ingredients, underscoring the importance of IP protection for these advancements.

Labor Laws and Employment Regulations

Croda International navigates a complex web of labor laws across its global operations, necessitating strict adherence to varying employment standards and worker safety regulations. This includes compliance with differing rules on working hours, minimum wages, employee benefits, anti-discrimination statutes, and collective bargaining agreements in each territory. For instance, in 2024, the UK's National Living Wage increased to £11.44 per hour for those aged 21 and over, a benchmark Croda must meet in its UK facilities.

Maintaining compliance is vital for fostering a positive workplace, mitigating legal risks, and securing a skilled workforce. Failure to comply can lead to significant penalties, reputational damage, and operational disruptions. For example, in 2023, several multinational corporations faced substantial fines for labor law violations related to wage and hour disputes.

Key areas of focus for Croda include:

- Compliance with local wage and hour laws: Ensuring all employees are paid at least the legally mandated minimum wage and overtime rates.

- Adherence to health and safety regulations: Implementing robust safety protocols to protect employees, such as those outlined by OSHA in the United States or HSE in the UK.

- Non-discrimination and equal opportunity policies: Upholding fair employment practices that prohibit discrimination based on race, gender, age, religion, or other protected characteristics.

- Managing employee benefits and leave entitlements: Providing legally required benefits like paid time off, sick leave, and parental leave as stipulated by national laws.

Anti-Trust and Competition Laws

Croda International must navigate a complex web of anti-trust and competition laws across its global operating regions, ensuring fair market practices and preventing monopolistic behaviors. These regulations are designed to foster a competitive environment, prohibiting actions like price-fixing or market allocation that could harm consumers and other businesses.

Failure to comply with these stringent laws can lead to severe consequences for Croda, including costly investigations, substantial fines, and protracted legal battles. For instance, the European Commission can impose fines up to 10% of a company's total worldwide annual turnover for competition law infringements. Such penalties, alongside reputational damage, can significantly disrupt business operations and undermine Croda's market standing.

- Regulatory Scrutiny: Croda faces ongoing scrutiny from competition authorities in key markets like the EU, US, and UK, impacting its M&A activities and pricing strategies.

- Compliance Costs: Significant resources are allocated annually to ensure adherence to evolving competition regulations, including legal counsel and internal compliance programs.

- Market Integrity: Adherence to these laws is fundamental to maintaining Croda's reputation for ethical conduct and ensuring a level playing field for all market participants.

Croda International's legal landscape is shaped by stringent chemical regulations like EU REACH and US TSCA, demanding significant investment in compliance to avoid hefty fines and market exclusion. For example, REACH compliance costs can reach millions of euros. The company also navigates product liability laws, with the EU enhancing consumer product safety frameworks in 2023, requiring rigorous quality control and transparent labeling to prevent recalls and litigation.

Intellectual property (IP) protection is crucial for Croda, underpinning its R&D investments in innovative formulations. The company actively secures patents and trademarks to maintain its competitive edge. Furthermore, Croda must adhere to diverse global labor laws, including the UK's National Living Wage increase to £11.44 per hour in 2024, to ensure fair employment practices and avoid penalties.

Anti-trust and competition laws are also critical, with authorities in regions like the EU and US scrutinizing M&A and pricing strategies. Failure to comply can result in fines up to 10% of worldwide annual turnover, impacting market standing and requiring substantial resources for compliance programs.

Environmental factors

Global concern over climate change is escalating, pushing businesses to shrink their carbon footprint and adopt greener practices. Croda's commitment to sustainable chemistry, utilizing renewable materials and energy-saving production methods, positions it well to meet this growing demand.

For Croda, cutting emissions isn't just an environmental goal; it's a critical operational necessity. In 2023, Croda reported reducing its Scope 1 and 2 greenhouse gas emissions by 19% against a 2018 baseline, underscoring their active efforts in this area.

The increasing scarcity of traditional raw materials and growing awareness of resource depletion are compelling companies like Croda to embrace sustainable sourcing and renewable alternatives. This shift is not just about environmental responsibility but also about securing long-term supply chains.

Croda's strategic focus on bio-based ingredients and robust responsible supply chain management directly addresses these environmental pressures. For instance, in 2023, Croda reported that 79% of its raw materials were from renewable or recycled sources, a significant step towards mitigating resource scarcity risks and bolstering its environmental profile.

Croda International is navigating an evolving landscape where environmental regulations and societal demands are pushing for significant waste reduction and the embrace of circular economy principles. This means a strong focus on minimizing waste during production and maximizing resource efficiency. For instance, as of their 2023 reporting, Croda highlighted efforts to reduce landfill waste by 15% compared to their 2018 baseline, demonstrating a tangible commitment to these environmental goals.

The company is actively exploring ways to optimize resource utilization across its operations and is investigating innovative product lifecycle solutions. This includes looking at how their products can be reused, recycled, or repurposed at the end of their useful life. Such initiatives not only lessen their environmental footprint but also present opportunities for operational cost savings and enhanced brand reputation in the competitive chemical industry.

Water Scarcity and Water Stewardship

Water scarcity is a significant environmental challenge, impacting regions where Croda International operates. As of recent reports, several areas with key Croda facilities face increasing water stress, necessitating proactive management strategies. The company's commitment to water stewardship involves optimizing water usage, enhancing wastewater treatment processes, and ensuring responsible discharge practices to maintain operational continuity and adhere to evolving environmental regulations.

Effective water management is paramount for Croda's operational resilience and long-term sustainability. The company's initiatives often include investing in water-efficient technologies and exploring water recycling opportunities within its manufacturing sites. For instance, in water-stressed regions, Croda aims to reduce its reliance on fresh water sources by implementing closed-loop systems where feasible.

- Water Stress: Regions with Croda's manufacturing presence are increasingly experiencing water scarcity, impacting operational continuity.

- Stewardship Programs: Robust water stewardship is crucial, encompassing efficient usage, advanced wastewater treatment, and responsible discharge.

- Operational Resilience: Effective water management directly contributes to the company's ability to operate reliably and sustainably.

- Regulatory Compliance: Adherence to local and international water use regulations is a key driver for Croda's water management strategies.

Biodiversity Protection and Ecosystem Impact

Croda International faces growing pressure regarding the impact of its industrial activities on biodiversity and local ecosystems. As a company heavily reliant on natural raw materials, ensuring its supply chain actively avoids deforestation and habitat degradation is paramount. For instance, in 2024, the company continued to emphasize its commitment to sustainable sourcing, with initiatives aimed at improving traceability for key ingredients like palm oil derivatives, a sector often scrutinized for its biodiversity impact.

Responsible land use practices and robust biodiversity protection programs are critical for maintaining Croda's environmental reputation and social license to operate. This focus is particularly relevant as regulatory bodies and consumer groups increasingly demand transparency and accountability in this emerging area of environmental concern.

Croda's sustainability reports highlight ongoing efforts in 2024 and projections for 2025 to:

- Enhance supply chain monitoring for biodiversity risks.

- Invest in projects that restore or protect natural habitats linked to raw material sourcing.

- Collaborate with suppliers to implement best practices in land management.

The increasing global focus on climate change and sustainability is a significant environmental factor influencing Croda International. The company is actively working to reduce its carbon footprint, with a reported 19% reduction in Scope 1 and 2 greenhouse gas emissions by 2023 compared to a 2018 baseline.

Croda's reliance on renewable raw materials is also a key environmental consideration. By 2023, 79% of its raw materials were sourced from renewable or recycled origins, demonstrating a strong commitment to mitigating resource scarcity and enhancing its environmental profile.

Waste reduction and circular economy principles are increasingly important. Croda reported a 15% reduction in landfill waste by 2023, against a 2018 baseline, showcasing its dedication to minimizing environmental impact through efficient resource utilization.

Water scarcity presents a challenge, with some operational regions facing increasing water stress. Croda is implementing water stewardship programs focused on efficient usage, advanced wastewater treatment, and responsible discharge to ensure operational resilience and regulatory compliance.

Biodiversity and responsible land use are critical, especially given Croda's reliance on natural raw materials. The company is enhancing supply chain monitoring for biodiversity risks and investing in habitat restoration projects, with a focus on improving traceability for key ingredients like palm oil derivatives.

| Environmental Factor | Croda's Response/Data | Year |

| Greenhouse Gas Emissions Reduction | 19% reduction in Scope 1 & 2 emissions | 2023 (vs. 2018 baseline) |

| Renewable/Recycled Raw Materials | 79% of raw materials sourced from renewable or recycled origins | 2023 |

| Landfill Waste Reduction | 15% reduction in landfill waste | 2023 (vs. 2018 baseline) |

| Biodiversity Initiatives | Enhanced supply chain monitoring, habitat restoration investment | Ongoing (2024 focus) |

PESTLE Analysis Data Sources

Our Croda International PESTLE Analysis is built upon a robust foundation of data from leading financial institutions, government publications, and reputable market research firms. We meticulously gather information on regulatory changes, economic indicators, and technological advancements to ensure comprehensive insights.