Croda International Porter's Five Forces Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Croda International Bundle

Croda International navigates a landscape shaped by intense rivalry and the constant threat of substitutes, while also managing significant buyer power in its specialty chemical markets. Understanding these dynamics is crucial for any stakeholder.

The complete report reveals the real forces shaping Croda International’s industry—from supplier influence to threat of new entrants. Gain actionable insights to drive smarter decision-making.

Suppliers Bargaining Power

Croda International operates within the specialty chemicals sector, a market frequently dependent on unique and often proprietary raw materials. When the supply of these critical inputs is concentrated among a limited number of providers, those suppliers gain significant leverage. This situation is especially pronounced for highly differentiated or patented ingredients that are fundamental to Croda's advanced product formulations.

For instance, in 2024, the specialty chemicals market saw continued demand for advanced materials, meaning suppliers of novel or patented chemical intermediates held substantial pricing power. If a key ingredient for one of Croda's high-margin product lines is sourced from a single or very few specialized manufacturers, these suppliers can dictate terms, potentially impacting Croda's cost of goods sold and profit margins.

The bargaining power of suppliers for Croda International is significantly influenced by switching costs. For highly specialized or custom-formulated ingredients, the expense and effort Croda incurs to change suppliers can be substantial. This involves costs for re-formulating products, conducting rigorous re-testing to ensure quality and performance, and navigating complex regulatory approval processes, all of which can take considerable time and resources.

These switching costs, coupled with the potential for production disruptions during a transition, give suppliers a stronger negotiating position. For instance, if a key ingredient requires unique manufacturing processes or has stringent quality specifications, finding an alternative supplier that can meet these demands without compromising product integrity or incurring significant delays is challenging. This reliance on established suppliers for critical components bolsters their leverage in pricing and contract negotiations.

Croda's emphasis on innovative and high-performance ingredients means that suppliers offering unique, proprietary, or highly specialized chemicals wield considerable bargaining power. When these specialized inputs are difficult for Croda to replicate, suppliers can command higher prices or more favorable terms. This is particularly impactful for Croda's New and Protected Products (NPP) segment, which represented a substantial 35% of its sales in 2024, underscoring the critical nature of these specialized inputs.

Threat of Forward Integration by Suppliers

The threat of suppliers integrating forward into Croda's specialty chemical business could significantly increase their bargaining power. If key suppliers were to develop their own manufacturing capabilities for the same specialized products Croda offers, they could directly compete, potentially leading to price pressures and reduced market share for Croda.

However, this threat might be somewhat mitigated by the high degree of specialization and the established market access required within Croda's diverse end-user industries, such as personal care, life sciences, and performance technologies. Building the necessary expertise, regulatory compliance, and distribution networks to effectively compete in these varied sectors represents a substantial barrier to entry for most suppliers.

For instance, Croda's focus on high-value, niche applications means that simply producing a chemical is not enough; understanding customer needs, formulation expertise, and global regulatory landscapes are critical. The capital investment and time required for a supplier to achieve this level of integration across multiple specialized product lines are considerable.

- Supplier Forward Integration Threat: If suppliers can credibly threaten to manufacture Croda's specialty chemicals themselves, their bargaining power increases.

- Barriers to Integration: This threat is limited by the specialized nature of Croda's products and the significant market access and technical expertise required in its diverse end markets.

- Industry Specifics: Croda's success relies on deep customer understanding and formulation knowledge, making direct competition challenging for raw material suppliers.

Importance of Croda to Supplier

The bargaining power of suppliers to Croda International is influenced by Croda's significance to their business. If Croda constitutes a substantial portion of a supplier's revenue, that supplier might be more inclined to maintain the relationship, potentially limiting their leverage. For example, in 2023, Croda International reported total revenue of £1.6 billion, indicating a significant customer base for its suppliers.

However, the situation becomes more nuanced with highly specialized ingredients. If a supplier provides unique or proprietary chemicals that are essential for multiple specialty chemical companies, Croda's individual importance to that supplier is diluted. This scenario can bolster the supplier's bargaining power, as they have alternative avenues for sales and are not solely reliant on Croda.

- Croda's 2023 revenue reached £1.6 billion, highlighting its market presence.

- Supplier reliance on Croda can reduce supplier bargaining power.

- Suppliers of specialized ingredients may serve multiple clients, diminishing Croda's individual impact.

- The uniqueness of an ingredient is a key factor in determining supplier leverage.

The bargaining power of suppliers for Croda International is a significant factor, particularly for specialized raw materials crucial to its advanced formulations. In 2024, the demand for novel chemical intermediates meant suppliers of these unique inputs held considerable pricing leverage, directly impacting Croda's cost of goods sold. High switching costs associated with re-formulation and regulatory approvals further strengthen supplier positions.

Croda's reliance on proprietary ingredients for its New and Protected Products (NPP) segment, which accounted for 35% of sales in 2024, amplifies supplier influence. While the threat of supplier forward integration exists, it's tempered by the substantial expertise and market access required in Croda's diverse end markets. Croda's 2023 revenue of £1.6 billion signifies its market presence, yet the impact on supplier leverage is diluted when suppliers cater to multiple specialty chemical clients with unique ingredients.

| Factor | Impact on Croda | 2024 Data/Context |

| Supplier Concentration | High for specialized inputs, increasing leverage | Demand for novel chemical intermediates |

| Switching Costs | Substantial for unique ingredients (re-formulation, regulatory) | Time and resource intensive |

| Product Differentiation | Suppliers of proprietary materials command higher prices | Crucial for NPP segment (35% of 2024 sales) |

| Forward Integration Threat | Limited by Croda's market access and technical expertise | High barriers for suppliers to enter diverse end markets |

| Croda's Customer Importance | Diluted for suppliers of non-exclusive specialized ingredients | Croda's 2023 revenue £1.6 billion |

What is included in the product

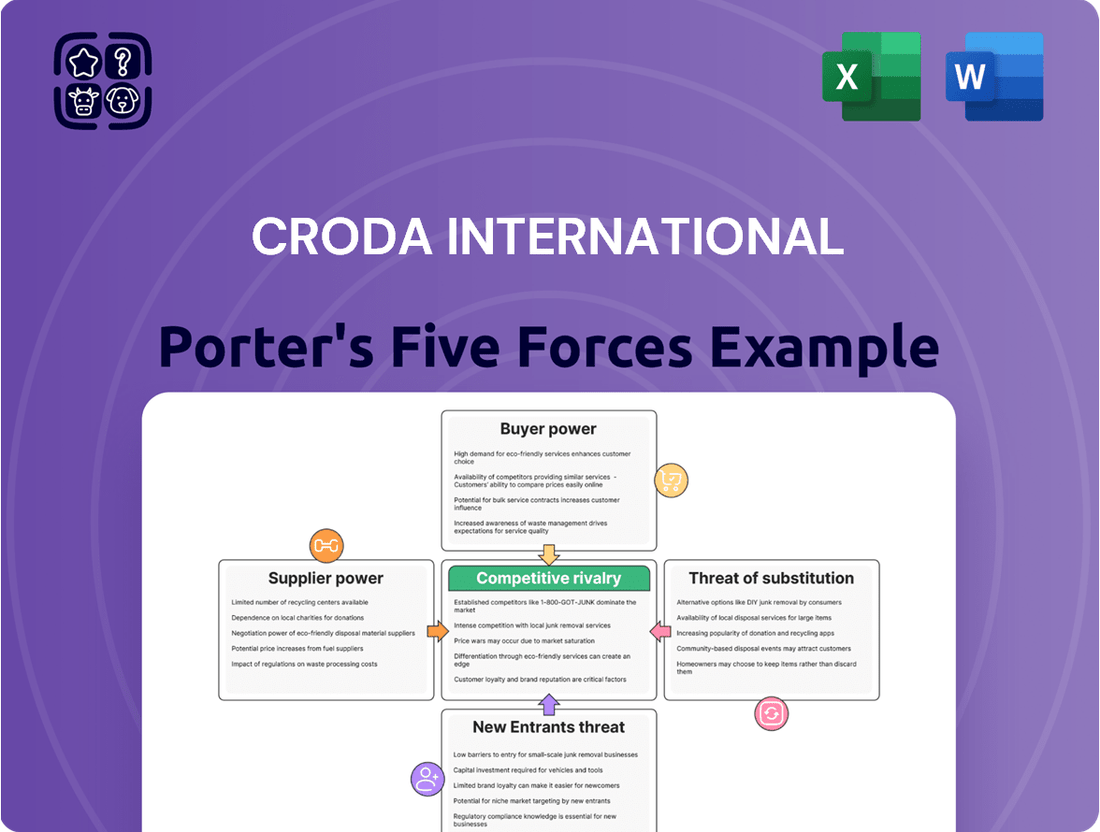

Analyzes the competitive intensity within the specialty chemicals sector, focusing on Croda International's unique market position and strategic responses to industry pressures.

Instantly identify and address competitive pressures with a visual representation of Croda International's Porter's Five Forces, enabling targeted strategic adjustments.

Customers Bargaining Power

Croda's customer base is broad, spanning personal care, health, and crop care sectors, including both global giants and smaller regional businesses. If a handful of major clients represent a substantial percentage of Croda's revenue, their leverage to negotiate price reductions or more favorable contract conditions grows significantly.

However, Croda's strategic focus on expanding its reach within local and regional consumer care markets could lead to a more diversified customer portfolio. This diversification has the potential to dilute the bargaining power of any single large customer, thereby strengthening Croda's position.

Switching away from Croda's specialized ingredients often incurs significant costs for customers. These can include the expense and time involved in reformulating their own products, conducting extensive re-testing to ensure performance and safety, and navigating new regulatory approval processes, particularly in sectors like pharmaceuticals and personal care where compliance is paramount.

Croda's position is further strengthened by its supply of 'mission-critical' ingredients. These are components that are absolutely vital to the functionality and performance of their customers' end products, making the decision to switch providers a complex and potentially risky one for the buyer.

Customer price sensitivity for Croda International hinges on how crucial its ingredients are to the final product's cost and how unique those ingredients are. For instance, in 2024, many consumer goods companies faced inflationary pressures, leading them to scrutinize all input costs.

Even though Croda's specialty ingredients often represent a small percentage of a customer's overall production expenses, customers operating in intensely competitive sectors, such as the personal care market where margins can be tight, may still push for lower prices. This was evident in some contract negotiations during early 2024 where volume commitments were leveraged in exchange for modest price adjustments.

Threat of Backward Integration by Customers

The threat of backward integration by Croda's customers is relatively low, particularly for its highly specialized and complex chemical offerings. While large customers might explore producing specialty ingredients in-house if it becomes economically attractive and strategically beneficial, the significant R&D investment and advanced manufacturing expertise required for Croda's products create a substantial barrier. This is especially true in sectors demanding intricate chemistry and specialized production processes.

For instance, a customer needing a highly specific surfactant for a niche personal care application would face considerable hurdles in replicating Croda's proprietary formulations and manufacturing capabilities. The substantial capital expenditure and the need for deep chemical engineering knowledge make in-house production a less feasible option compared to sourcing from a specialist like Croda.

- Customer Integration Risk: Generally low due to the complexity and R&D intensity of Croda's specialty chemicals.

- Barriers to Entry for Customers: High capital investment and specialized technical expertise are required for backward integration.

- Croda's Competitive Advantage: Proprietary formulations and advanced manufacturing processes deter customer self-sufficiency.

- Market Dynamics: The specialized nature of Croda's products means customers often rely on their expertise rather than attempting in-house production.

Customer's Information and Knowledge

Customers in the specialty chemicals sector, including those interacting with Croda International, are often highly knowledgeable. They possess a deep understanding of available ingredient alternatives and current market pricing, which significantly enhances their negotiating leverage. This informed customer base compels companies like Croda to consistently prove the distinct value and superior performance of their specialized chemical solutions.

This heightened customer awareness directly impacts Croda's pricing strategies and product development focus. For instance, in 2023, Croda reported that its Performance Technologies sector, which serves industries with sophisticated customer bases, saw strong demand for innovative solutions that offer clear performance advantages, helping to offset price sensitivity.

- Informed Buyers: Customers in specialty chemicals are typically well-versed in product specifications, performance benchmarks, and competitive offerings.

- Price Transparency: The availability of information on alternative ingredients and their costs empowers customers to negotiate more effectively.

- Value Demonstration: Croda must continuously highlight the unique benefits, R&D investment, and technical support associated with its products to justify premium pricing and maintain customer loyalty.

- Market Dynamics: A 2024 industry report indicated that over 60% of B2B buyers in advanced materials expect suppliers to provide detailed technical data and case studies to validate product claims, directly influencing their purchasing decisions.

Croda's customers possess moderate to high bargaining power, largely due to their technical knowledge and the availability of alternatives, though switching costs and the critical nature of Croda's ingredients mitigate this. In 2024, many customers, especially in consumer-driven markets, actively sought cost optimizations, leading to price pressure on certain product lines. However, Croda's focus on specialty ingredients with unique performance attributes, backed by extensive R&D, often limits customers' ability to find direct substitutes without compromising product quality or facing reformulation expenses.

| Factor | Croda's Position | Customer Impact |

|---|---|---|

| Customer Knowledge & Transparency | Customers are well-informed on alternatives and pricing. | Increases negotiation leverage. |

| Switching Costs | High due to reformulation and testing needs. | Reduces customer incentive to switch. |

| Ingredient Criticality | Many ingredients are vital for end-product performance. | Limits customer ability to demand significant price cuts. |

| Backward Integration Threat | Generally low due to technical complexity. | Protects Croda's market share. |

Preview the Actual Deliverable

Croda International Porter's Five Forces Analysis

This preview showcases the complete Croda International Porter's Five Forces Analysis, offering a detailed examination of the competitive landscape within the specialty chemicals sector. You'll receive this exact, professionally formatted document immediately upon purchase, providing actionable insights into industry rivalry, buyer and supplier power, threat of new entrants, and the bargaining power of substitutes. Rest assured, what you see is precisely what you get—a ready-to-use analysis for your strategic decision-making.

Rivalry Among Competitors

The global specialty chemicals market is poised for growth, with forecasts suggesting a compound annual growth rate (CAGR) between 3.23% and 6.7% for the coming years. This expansion, however, doesn't guarantee smooth sailing for all players.

A slowdown in key end-markets or a general climate of subdued demand, as experienced by Croda in 2024, can significantly ramp up competitive rivalry. When demand falters, companies often fight harder for a smaller piece of the pie, leading to increased price pressures and promotional activities.

The specialty chemicals sector where Croda International operates is intensely competitive, featuring a broad array of global giants like BASF, Evonik Industries AG, Solvay, and DuPont. These large corporations possess significant resources for research and development, as well as extensive distribution networks.

Beyond these major players, the market is also populated by a multitude of smaller, specialized companies, each focusing on specific product categories or technological niches. This diversity means that Croda faces competition not only from broad-spectrum chemical manufacturers but also from highly focused innovators who can quickly adapt to emerging market needs.

For instance, in 2024, the global specialty chemicals market was valued at over $700 billion, underscoring the sheer scale and the number of entities vying for market share. Croda's position, while strong in its chosen segments, is within this dynamic and crowded field, demanding constant vigilance and strategic differentiation to maintain its competitive edge.

Croda International thrives on product differentiation, focusing on high-performance, sustainable ingredients. Their New and Protected Products (NPP) strategy is central to this, ensuring a pipeline of innovative offerings. This approach allows them to avoid direct price competition by providing unique value.

In 2023, Croda reported that 40% of their sales came from NPP, demonstrating the success of their differentiation strategy. This focus on specialized, often bio-based, solutions enables them to charge premium prices, thereby reducing the intensity of rivalry based solely on cost.

Exit Barriers

Croda International operates within the specialty chemicals sector, where exit barriers are notably high. These barriers, stemming from substantial investments in fixed assets like manufacturing plants and specialized equipment, make it difficult and costly for companies to leave the market. For instance, the chemical industry often requires significant capital expenditure that is not easily redeployed.

These high exit barriers can trap less profitable competitors within the industry, contributing to sustained price competition and potential overcapacity. This situation can pressure margins for all players, including Croda, as these struggling firms may continue to operate even at low profitability to recoup some of their sunk costs.

The presence of long-term customer relationships further solidifies these exit barriers. Once a supplier like Croda establishes strong ties with clients, switching costs for the customer can be substantial, making it challenging for new entrants or exiting firms to disrupt established market dynamics. In 2023, Croda reported revenue of £1.6 billion, indicating its established position within this competitive landscape.

- High Fixed Asset Investment: Specialty chemical manufacturing requires significant, often industry-specific, plant and equipment, making divestment or repurposing costly.

- Specialized Equipment: The need for highly specialized machinery for particular chemical processes creates a barrier to exit as this equipment has limited alternative uses.

- Long-Term Customer Contracts: Established relationships and contracts with customers create switching costs, discouraging both customers from leaving and competitors from easily exiting without impacting supply chains.

- Brand Reputation and R&D Investment: Significant investment in brand building and ongoing research and development creates intangible assets that are difficult to liquidate upon exit.

Strategic Stakes

The specialty chemicals sector is experiencing a rapid evolution, fueled by sustainability mandates, digital advancements, and breakthroughs in biotechnology. This dynamic environment means companies like Croda are channeling substantial resources into research and development, alongside strategic acquisitions, to solidify their positions for future expansion. The competitive stakes are therefore exceptionally elevated as industry participants actively compete for dominance in burgeoning market segments.

In 2024, the pursuit of innovation and market share is particularly intense. For instance, major players are reporting significant R&D expenditures, with some allocating over 5% of their revenue to new product development. This focus on innovation is critical for addressing the growing demand for bio-based and sustainable chemical solutions, a trend that is reshaping the competitive landscape.

- Intensified R&D Investment: Companies are increasing R&D budgets to develop sustainable and bio-based alternatives, crucial for market leadership.

- Strategic Acquisitions: Mergers and acquisitions are common as firms seek to gain access to new technologies and expand their market reach in high-growth niches.

- Sustainability as a Differentiator: Meeting environmental, social, and governance (ESG) targets is becoming a key competitive advantage, driving innovation in green chemistry.

- Digital Transformation: Investment in digital tools for R&D, manufacturing, and supply chain management is crucial for operational efficiency and competitive edge.

Competitive rivalry in the specialty chemicals sector is fierce, with global giants and niche players vying for market share. Croda International faces intense competition from companies like BASF and Evonik, who possess substantial R&D and distribution capabilities. Croda's strategy of focusing on high-performance, sustainable products, exemplified by its New and Protected Products (NPP) driving 40% of its 2023 sales, helps mitigate direct price competition.

The market's value, exceeding $700 billion in 2024, attracts numerous competitors, necessitating constant innovation and differentiation. High exit barriers, due to significant fixed asset investments and specialized equipment, can keep less profitable firms in the market, potentially leading to sustained price pressures despite Croda's premium pricing strategy. Croda's 2023 revenue of £1.6 billion reflects its established position within this dynamic landscape.

The pursuit of market dominance in 2024 is marked by intensified R&D, with leading firms investing over 5% of revenue in new product development, particularly in sustainable and bio-based solutions. Strategic acquisitions and digital transformation are also key competitive tactics. This environment demands continuous adaptation and investment to maintain a competitive edge.

SSubstitutes Threaten

Direct substitutes for Croda's highly specialized ingredients are often limited. This is due to their unique chemical properties and the specific performance benefits they offer in niche applications, making it difficult for competitors to replicate their exact functionality. For example, in the personal care sector, while some natural ingredients can be considered, synthetic ingredients designed to mimic natural elements are also emerging as alternatives.

Furthermore, advancements in biotechnology are continuously introducing novel solutions that further differentiate Croda's offerings from readily available substitutes. This technological edge means that for many of Croda's high-performance ingredients, a true, direct substitute that delivers equivalent results is not easily found.

The threat of substitutes for Croda's specialty chemicals hinges on their price-performance balance. While basic or commodity chemicals can be less expensive, they often fall short on the crucial performance and sustainability features that Croda's advanced ingredients deliver.

Customers prioritizing high efficacy and environmental responsibility find the trade-off with cheaper, less capable substitutes to be unfavorable. For instance, in the personal care sector, while a basic surfactant might cost less, it won't offer the same mildness, conditioning, or biodegradability as Croda's specialized emollients and emulsifiers, which are critical for premium product formulations.

Customer propensity to substitute for Croda's products is generally low, especially in high-stakes sectors like pharmaceuticals and personal care. This is because switching costs can be substantial, involving extensive testing, regulatory re-approval, and potential disruption to established product lines. For instance, in the personal care market, a new ingredient might require months of reformulation and consumer testing before market acceptance.

Brand loyalty and the perceived risk associated with unproven alternatives play a significant role. Companies relying on Croda's specialized ingredients often value consistency and reliability, making them hesitant to adopt substitutes that might compromise product performance or safety. In 2023, Croda reported that its Life Sciences sector, which includes pharmaceuticals, saw revenue growth driven by strong demand for its excipients and active ingredients, indicating customer stickiness.

Technological Advancements Enabling Substitutes

Technological advancements are a significant driver of substitute threats for Croda International. Innovations in biotechnology, green chemistry, and synthetic biology are paving the way for novel ingredients that can rival or even surpass existing offerings, particularly in terms of sustainability. For instance, the growing demand for eco-friendly materials sees bio-based polymers making significant inroads in packaging and other industries.

The development of gelatin substitutes, for example, highlights how new technologies can directly challenge established product categories. These emerging alternatives often boast improved environmental footprints, making them attractive to increasingly conscious consumers and businesses. This trend is likely to accelerate as R&D in these fields continues to mature, potentially impacting Croda's market share in its core specialty chemical segments.

Consider the following:

- Biotechnology advancements are enabling the creation of novel bio-based ingredients with tailored functionalities.

- Green chemistry principles are fostering the development of sustainable alternatives to traditional petrochemical-based chemicals.

- Synthetic biology offers pathways to engineer microorganisms for producing high-value chemicals, potentially disrupting existing supply chains.

- Market reports in 2024 indicate a substantial increase in investment in bio-based materials, with the global bio-based chemicals market projected to reach over $100 billion by 2025, signaling strong growth in potential substitutes.

Regulatory and Sustainability Pressures

Increasing regulatory scrutiny and a growing consumer demand for sustainable and eco-friendly products are significant drivers for the adoption of substitute materials. For instance, in 2024, the European Union continued to strengthen its chemical regulations, including REACH, pushing industries to find safer and more environmentally sound alternatives. This trend directly impacts companies like Croda, as it can accelerate the shift towards substitutes that better meet these evolving standards.

Croda's strategic focus on developing bio-based and sustainable solutions is a proactive measure to mitigate this threat. By investing in innovation that aligns with environmental concerns, Croda aims to stay ahead of the curve. Their commitment to sustainability, as evidenced by their 2023 sustainability report highlighting a 15% reduction in Scope 1 and 2 greenhouse gas emissions compared to their 2018 baseline, positions them favorably against potential substitutes driven by environmental pressures.

- Regulatory Shifts: Evolving environmental regulations, such as stricter chemical safety standards and carbon pricing mechanisms, encourage the use of alternative materials.

- Consumer Preferences: A marked increase in consumer preference for products with a lower environmental impact, particularly in sectors like personal care and coatings, fuels demand for sustainable substitutes.

- Croda's Mitigation: Croda's investment in green chemistry and bio-derived ingredients directly counters the threat by offering compliant and desirable alternatives.

- Market Response: The market is increasingly rewarding companies that demonstrate strong environmental, social, and governance (ESG) performance, making sustainable substitutes a more attractive proposition.

The threat of substitutes for Croda's specialized ingredients is generally low due to their unique performance characteristics and high switching costs for customers. While basic chemicals may be cheaper, they often lack the efficacy and sustainability features demanded in premium applications. For instance, in 2024, the personal care market continues to show a preference for high-performance, sustainable ingredients, making direct substitution with commodity alternatives less appealing.

Technological advancements, particularly in biotechnology and green chemistry, are creating new potential substitutes. Innovations in bio-based materials, for example, are gaining traction, with the global bio-based chemicals market projected to exceed $100 billion by 2025. This rise in sustainable alternatives, driven by both consumer demand and evolving regulations in 2024, presents a growing, albeit often indirect, competitive pressure.

Croda actively mitigates this threat by investing heavily in its own sustainable and bio-based product development. Their commitment to reducing greenhouse gas emissions, with a 15% reduction in Scope 1 and 2 emissions achieved by 2023 compared to an 2018 baseline, aligns with market trends and customer preferences for environmentally responsible solutions. This proactive approach helps maintain customer loyalty and reduces the attractiveness of substitute offerings.

The table below illustrates the varying levels of threat from substitutes across different sectors where Croda operates, considering factors like performance differentiation and switching costs.

| Sector | Threat of Substitutes (Low/Medium/High) | Key Factors Influencing Threat | Examples of Potential Substitutes |

|---|---|---|---|

| Personal Care | Medium | Performance requirements, sustainability demands, brand loyalty, switching costs (reformulation, testing) | Natural oils, plant-derived actives, advanced synthetic emollients |

| Life Sciences (Pharma) | Low | High regulatory hurdles, stringent quality control, proven efficacy, high switching costs (re-validation) | Generic excipients (limited differentiation), emerging novel delivery systems |

| Performance Technologies | Medium | Cost-sensitivity, specific application needs, emerging material science innovations | Commodity polymers, bio-based alternatives, advanced composites |

Entrants Threaten

Entering the specialty chemicals arena, especially at the scale and technical depth Croda operates, demands immense capital. Significant investments are needed for cutting-edge research and development, state-of-the-art manufacturing plants, and robust global supply chains. For instance, in 2024, the specialty chemicals sector continued to see high R&D spending, with major players investing billions to maintain their competitive edge.

Established players like Croda International leverage significant economies of scale across production, procurement, and research and development. This allows them to achieve lower per-unit costs, a formidable barrier for newcomers. For instance, in 2023, Croda reported revenues of £1.6 billion, underscoring its substantial operational capacity.

Croda's extensive global manufacturing network and a highly integrated supply chain further solidify these cost advantages. These operational efficiencies make it exceptionally challenging for new entrants to match Croda's pricing power and compete effectively on cost, thereby mitigating the threat of new entrants.

Croda International's significant investment in research and development, exemplified by its 2023 R&D expenditure of £155 million, fuels the creation of highly specialized and sustainable ingredients. This focus on innovation, coupled with a strong emphasis on direct customer collaboration and established, trust-based relationships, cultivates formidable product differentiation and deep customer loyalty. New market entrants would find it exceptionally challenging to replicate this level of brand equity and customer commitment, effectively raising the barrier to entry.

Access to Distribution Channels

Building extensive and reliable distribution channels, particularly on a global scale, is a significant hurdle for newcomers in the specialty chemicals industry. This process is inherently complex and demands considerable time and investment.

Croda International benefits immensely from its well-established sales teams and robust distribution networks, which act as a formidable barrier to entry for potential competitors. These existing relationships and infrastructure make it challenging for new players to gain market access efficiently.

For instance, in 2023, Croda reported its specialty chemicals segment, which heavily relies on these distribution channels, as a key driver of its performance. The company's ability to reach diverse customer bases across various geographies through these established networks underscores the threat posed by this factor.

- Established Global Reach: Croda's existing distribution infrastructure provides immediate access to markets worldwide, a feat that new entrants would struggle to replicate quickly or cost-effectively.

- Customer Relationships: Long-standing ties with key distributors and end-users, cultivated over years, create loyalty and preferential treatment that new entrants find difficult to disrupt.

- Logistical Expertise: Managing the complex logistics of specialty chemicals, including specialized handling and storage, requires significant expertise and capital investment, which Croda already possesses.

Regulatory Hurdles and Intellectual Property

The specialty chemicals sector, especially areas like health, personal care, and crop protection, faces significant regulatory scrutiny. New companies entering this market must invest heavily in understanding and complying with these complex approval processes, which can be lengthy and costly, effectively raising the barrier to entry.

Croda's strategic focus on its New and Protected Products (NPP) segment, which relies on robust intellectual property (IP) protection, further deters potential competitors. Patents and proprietary technologies create a strong competitive advantage, making it difficult for new entrants to replicate Croda's offerings without infringing on existing IP rights.

- Regulatory Complexity: Navigating stringent health, safety, and environmental regulations in specialty chemicals requires substantial upfront investment and expertise.

- Intellectual Property: Croda's strong patent portfolio for its NPP segment acts as a significant deterrent to new entrants seeking to compete in its key markets.

- R&D Investment: The high cost of research and development necessary to innovate and meet regulatory standards creates a substantial financial barrier for new players.

The threat of new entrants for Croda International is generally low due to substantial capital requirements for R&D, manufacturing, and global supply chains. For example, in 2024, the specialty chemicals sector continued to see significant R&D investments from established players. Croda's established economies of scale and integrated global supply chain, contributing to its £1.6 billion revenue in 2023, further increase the cost disadvantage for newcomers.

| Factor | Barrier Strength | Impact on Croda |

| Capital Requirements | High | Deters new entrants due to substantial investment needs. |

| Economies of Scale | High | Allows Croda to achieve lower per-unit costs, challenging new players. |

| Product Differentiation & Brand Loyalty | High | Croda's £155 million R&D spend in 2023 fosters innovation and customer loyalty. |

| Distribution Channels | High | Croda's established networks provide market access that is difficult for new entrants to replicate. |

| Regulatory Hurdles & IP Protection | High | Complex regulations and Croda's patent portfolio create significant entry barriers. |

Porter's Five Forces Analysis Data Sources

Our Croda International Porter's Five Forces analysis is built upon a foundation of robust data, drawing from Croda's annual reports, investor presentations, and regulatory filings. We supplement this with industry-specific market research reports and data from reputable financial databases to provide a comprehensive view of the competitive landscape.