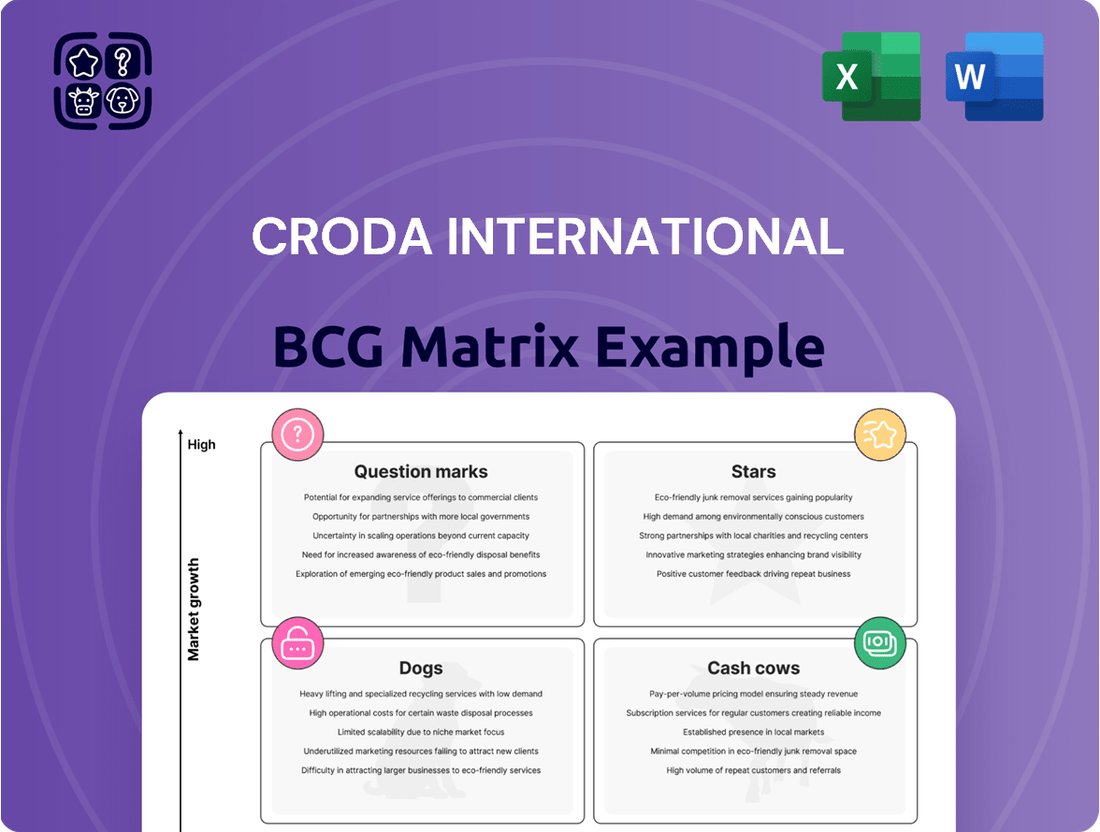

Croda International Boston Consulting Group Matrix

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Croda International Bundle

Explore the strategic positioning of Croda International's diverse product portfolio through a comprehensive BCG Matrix analysis. Understand which innovations are poised for growth as Stars, which reliable offerings are fueling cash flow as Cash Cows, and where potential challenges or opportunities lie within their product landscape. Purchase the full report to unlock detailed quadrant placements and data-driven recommendations for optimizing Croda's market strategy.

Stars

The Consumer Care - Fragrances & Flavours segment of Croda International is a star performer, demonstrating robust growth driven by a strong base of local and regional customers. This segment experienced a significant uplift, particularly fueled by its success in the burgeoning Asian markets.

Croda is strategically investing in this high-potential area to further solidify its market position. This includes the establishment of a new R&D center in Dubai, a move designed to tap into regional innovation, and the expansion of its fine fragrances capabilities in Grasse, France, a globally recognized hub for perfumery.

Beauty Actives, a key segment within Croda International's Consumer Care division, demonstrated robust growth of 6% in constant currency during 2024. This expansion was notably driven by strong performance in Asia, with China emerging as a particular bright spot. This success is attributed to Croda's cultivated relationships with local and regional clients who are actively increasing their market share.

Innovation is a cornerstone for Beauty Actives, with a strategic focus on developing biotech-based ingredients and advanced ceramides. By harnessing specialized knowledge from its operations in France and South Korea, Croda is positioning this segment for continued high innovation and market leadership.

New and Protected Products (NPP) represent a key growth driver for Croda International. In 2024, NPP sales climbed to 35% of total sales, a noticeable rise from 33% in 2023. This segment experienced a robust 6% growth when measured in constant currency.

This performance underscores Croda's effective innovation strategy, successfully launching new, high-performance ingredients. Such momentum positions the company favorably for sustained high growth and expanded market share within specialized product categories.

Biopharma (within Life Sciences)

Biopharma, a key segment within Croda International's Life Sciences division, is positioned as a star in the BCG matrix. Despite broader Life Sciences sector headwinds, this sub-segment is experiencing robust growth, particularly in areas like lipids essential for advanced drug research and development.

Croda's strategic focus on empowering biologics delivery through innovative solutions and expanding its range of delivery systems and bioprocessing aids underscores its commitment to this high-growth market. This strategic direction suggests significant investment and a strong market position.

- Biopharma Growth: The biopharma sector is a key driver within Life Sciences, with notable expansion in lipid technologies for drug delivery.

- Strategic Focus: Croda aims to lead in biologics delivery, investing in innovative solutions and broadening its portfolio of specialized ingredients.

- Market Potential: This segment represents a high-growth area, attracting increased investment due to its critical role in modern medicine.

Sustainable and Bio-based Ingredients

Croda's commitment to sustainable and bio-based ingredients is a significant driver of growth, aligning with escalating consumer preferences and industry-wide transitions towards eco-friendly solutions. This strategic focus is expected to propel these product lines into a strong market position.

The company's ambitious target to become the most sustainable supplier by 2030 is a powerful differentiator, poised to capture increasing market share as the industry continues its evolution towards greener alternatives. This goal underscores their leadership in the bio-based sector.

- Market Trend: Growing consumer demand for natural and sustainable products.

- Croda's Strategy: Focus on bio-based and sustainable ingredient innovation.

- Financial Implication: High-growth potential for sustainable product segments.

- Future Outlook: Aiming for industry leadership in sustainability by 2030.

Croda International's Consumer Care - Fragrances & Flavours and Beauty Actives segments are performing exceptionally well, demonstrating robust growth, particularly in Asian markets. The New and Protected Products (NPP) segment also shows strong momentum, with sales increasing as a percentage of total revenue. These areas are considered Stars due to their high market growth and strong competitive positions.

| Segment | Growth Driver | 2024 Performance Metric | Strategic Focus |

|---|---|---|---|

| Consumer Care - Fragrances & Flavours | Asian market expansion, strong regional customer base | Significant uplift | New R&D center in Dubai, expanded fine fragrances capabilities in Grasse |

| Beauty Actives | Biotech-based ingredients, advanced ceramides, strong China performance | 6% constant currency growth | Leveraging expertise from France and South Korea |

| New and Protected Products (NPP) | Successful launch of high-performance ingredients | 35% of total sales (up from 33% in 2023), 6% constant currency growth | Continued innovation in specialized product categories |

What is included in the product

Highlights which units to invest in, hold, or divest based on market growth and share.

A clear, visual Croda International BCG Matrix simplifies complex portfolio analysis, relieving the pain of strategic decision-making.

Cash Cows

Croda's established personal care ingredients, excluding the high-growth Beauty Actives, represent a classic Cash Cow. These products, primarily from the Beauty Care segment, hold a significant market share in a mature industry.

Despite a challenging pricing environment, sales volumes in Beauty Care saw an increase in 2024. This demonstrates the resilience and cash-generative nature of these established offerings, even with a slight dip in price/mix.

Industrial Specialties, within Croda International's BCG Matrix, functions as a Cash Cow. While not a primary focus for expansion, this segment plays a crucial role in optimizing Croda's shared manufacturing capabilities and capitalizes on established core technologies for high-value industrial uses.

In 2024, Industrial Specialties demonstrated a stable performance with a 2% increase in sales. This consistent growth highlights its ability to generate reliable cash flow without necessitating substantial new capital expenditures, a hallmark of a mature, cash-generating business unit.

Croda's core crop protection ingredients represent a classic Cash Cow within their BCG Matrix. Despite some early 2024 market headwinds, the sector demonstrated a rebound in the latter half of the year, with projections indicating continued growth into 2025. This stability is underpinned by Croda's long-standing expertise and commitment to aiding clients in navigating sustainability demands within traditional pesticide applications, securing a robust and dependable revenue stream.

Lanolin and Derivatives

Lanolin and its derivatives, the very foundation upon which Croda International was built a century ago, remain a significant part of their portfolio. This enduring product line signifies a mature market position, characterized by stable demand and predictable revenue streams.

Croda's continued investment in lanolin production, despite its age, points to its consistent ability to generate substantial cash flow. This stability allows the company to allocate resources to other growth areas without the need for significant new capital expenditure in this segment.

- Lanolin's enduring legacy: Croda was founded on lanolin over 100 years ago.

- Mature product status: Indicates a stable market and consistent demand.

- Cash flow generation: Represents a reliable source of income for Croda.

- Low investment requirement: Minimal new capital is typically needed for this product line.

Mature Pharma Excipients

Croda's Mature Pharma Excipients segment, classified as a Cash Cow in the BCG Matrix, represents a stable and profitable part of their business. These established excipients are vital for various drug delivery systems and benefit from high market share due to their essential functionality and strict regulatory approvals.

While not in a high-growth phase, these products generate consistent and predictable revenue streams for Croda. For instance, in 2023, Croda reported strong performance in their Life Sciences sector, which includes pharmaceutical excipients, highlighting the resilience of these mature offerings.

- Consistent Revenue: Mature excipients provide a reliable income source, underpinning Croda's financial stability.

- Market Share Dominance: Their critical role in drug formulation ensures sustained demand and significant market penetration.

- Regulatory Barrier to Entry: The extensive approval processes for pharmaceutical excipients create a strong moat, protecting Croda's position.

- Profitability: These products typically have healthy profit margins, contributing significantly to overall company earnings.

Croda's established personal care ingredients, excluding the high-growth Beauty Actives, represent a classic Cash Cow. These products, primarily from the Beauty Care segment, hold a significant market share in a mature industry.

Despite a challenging pricing environment, sales volumes in Beauty Care saw an increase in 2024. This demonstrates the resilience and cash-generative nature of these established offerings, even with a slight dip in price/mix.

Industrial Specialties, within Croda International's BCG Matrix, functions as a Cash Cow. While not a primary focus for expansion, this segment plays a crucial role in optimizing Croda's shared manufacturing capabilities and capitalizes on established core technologies for high-value industrial uses.

In 2024, Industrial Specialties demonstrated a stable performance with a 2% increase in sales. This consistent growth highlights its ability to generate reliable cash flow without necessitating substantial new capital expenditures, a hallmark of a mature, cash-generating business unit.

| Segment | BCG Classification | 2024 Sales Growth | Key Characteristics |

| Beauty Care (Established) | Cash Cow | Volume increase, slight price/mix dip | High market share, mature industry, resilient |

| Industrial Specialties | Cash Cow | 2% increase | Stable performance, optimizes manufacturing, core tech |

What You See Is What You Get

Croda International BCG Matrix

The preview you're seeing is the exact Croda International BCG Matrix document you will receive upon purchase. This comprehensive analysis is fully formatted and ready for immediate strategic application, containing no watermarks or placeholder content. You can confidently expect the same high-quality, data-driven insights in the final downloadable file, empowering your business planning with actionable intelligence.

Dogs

Within Croda International's Industrial Specialties segment, certain sub-segments might be classified as Dogs if they exhibit low growth and low market share, failing to leverage core technologies. These areas could represent a drag on resources, potentially breaking even or tying up capital without significant returns. For instance, if a particular industrial chemical formulation used in a mature, slow-expanding market isn't a key differentiator for Croda, it might fall into this category.

Croda's legacy product lines, particularly those in mature chemical segments without recent significant investment in research and development, could be categorized as Dogs in the BCG Matrix. These products often operate in slow-growing or declining markets, facing increasing competition from more innovative alternatives. For instance, certain older surfactants or oleochemicals that haven't been reformulated to meet evolving sustainability demands might fit this profile.

Certain Consumer Health Ingredients, specifically post-COVID-19 lipids, are currently positioned as potential question marks within Croda International's BCG Matrix. The significant absence of COVID-19 lipid sales, which were a substantial revenue driver, has notably impacted the Life Sciences segment.

Sales into broader consumer health markets have also experienced weakness, indicating a slowdown in demand for these specific ingredients. This subdued performance, coupled with a lack of clearly defined future growth drivers, places these ingredients in a precarious position.

Croda International’s 2023 annual report indicated a 10% decline in the Life Sciences sector's revenue, partly attributable to the normalization of demand for certain specialty ingredients following the pandemic peak. For instance, the company noted a slowdown in its excipients business, which includes some lipid-based components.

If this trend of weak demand and absence of compelling growth prospects persists for these consumer health ingredients, they may require careful strategic management, potentially involving resource reallocation or even consideration for divestment to optimize the company's overall portfolio performance.

Underperforming Regional Product Lines

Underperforming regional product lines within Croda International, particularly those facing significant competitive pressures or shifts in local consumer tastes, often find themselves in a challenging position. If these specific offerings possess a low market share and operate within regional markets that are either stagnant or experiencing a decline, they are typically categorized as Dogs in the BCG Matrix.

For instance, while specific regional product line performance data for 2024 is proprietary, Croda's broader strategy often involves divesting or repositioning such underperforming assets. In 2023, the company did undertake portfolio reviews that led to adjustments in certain market segments, reflecting a proactive approach to such challenges.

- Low Market Share: Products with limited penetration in their respective regional markets.

- Stagnant or Declining Markets: Operating in geographic areas where overall demand for the product category is not growing or is shrinking.

- Intense Competition: Facing strong rivals that capture a larger portion of the regional market share.

- Changing Local Preferences: Products failing to resonate with evolving customer tastes or needs in specific regions.

Products with High Production Costs and Low Profit Margins

Within Croda's diverse portfolio, products characterized by significantly high manufacturing expenses coupled with modest selling prices and demand would fall into this category. These items often struggle to generate substantial profits, potentially hindering overall company performance.

For instance, if a specialty chemical requiring complex synthesis and expensive raw materials faces limited market adoption or intense price competition, it could exhibit these traits. Croda's focus on innovation means some early-stage or niche products might initially have higher production costs before scaling or market acceptance improves.

- High Production Costs: Products requiring intricate manufacturing processes, specialized equipment, or costly raw materials.

- Low Profit Margins: These products yield a small percentage of profit relative to their sales price.

- Market Price Sensitivity: Facing intense competition or limited pricing power, forcing lower sales prices.

- Potential for Divestment/Streamlining: Candidates for review to improve overall financial efficiency.

Products within Croda International that exhibit low market share in stagnant or declining markets, often due to intense competition or shifting local preferences, are typically classified as Dogs. These underperforming assets may require strategic divestment or repositioning to optimize the company's overall portfolio. For example, certain legacy industrial chemicals in niche, slow-growing sectors might fit this profile if they lack differentiation and face strong rivals.

Croda's 2023 financial performance indicated a strategic review of its portfolio, with a focus on divesting non-core or underperforming assets. While specific 2024 data on "Dog" products is not publicly available, the company's ongoing commitment to innovation and sustainability suggests a continuous effort to prune less profitable segments.

The company's emphasis on high-performance ingredients means that products with high manufacturing costs and low selling prices, struggling to generate substantial profits, could also be categorized as Dogs. These items often have low profit margins and are sensitive to market pricing, making them candidates for streamlining or divestment.

Croda International’s strategy involves actively managing its product portfolio to ensure resources are allocated to growth areas. Products that consistently fail to meet performance expectations or contribute meaningfully to profitability are prime candidates for such strategic reviews.

Question Marks

Croda's novel biotech-based ingredients, including marine biotechnology and enzyme-based solutions, represent a strategic push into high-growth markets. This diversification is supported by significant investments in R&D and acquisitions, aiming to build a strong foundation in these emerging sectors.

While these innovative ingredients hold substantial future potential, they are currently in the early stages of market penetration. Their market share is still developing, necessitating continued investment to achieve significant traction and establish leadership.

Croda is actively investigating personalized medicine and bespoke cosmetic formulations, identifying these as significant future growth avenues. These emerging sectors, while promising, are still in their early stages, meaning Croda's current presence and market share within these highly specialized niches are likely minimal. Significant investment will be necessary to establish and expand its footprint in these areas.

Croda recognizes artificial intelligence as a transformative force in specialty chemicals. The company views AI-driven chemical solutions as a prime opportunity for high growth, reflecting the increasing demand for advanced, data-optimized products and processes. This strategic focus aligns with the broader industry trend towards digitalization and intelligent manufacturing.

While the potential for AI-driven chemical solutions is substantial, Croda's current market share in these nascent, highly specialized technological applications is likely to be low. This positions AI-driven chemical solutions as a Star or Question Mark within the BCG framework, requiring significant investment to capture market share and capitalize on future growth. For instance, the global AI in chemicals market was valued at approximately $1.5 billion in 2023 and is projected to grow significantly, underscoring the opportunity.

New Technologies for Sustainable Manufacturing (e.g., modular manufacturing)

Croda is actively exploring process innovations like modular manufacturing. This approach aims to bring production closer to customers, thereby reducing transportation emissions and environmental impact. For instance, by enabling smaller, more localized production units, Croda can potentially cut down on the carbon footprint associated with long-haul shipping.

These advanced manufacturing technologies represent significant growth avenues, promising enhanced efficiency and sustainability. While the exact impact on market share is still unfolding, the strategic focus on these innovations positions Croda to capitalize on the growing demand for environmentally conscious production methods.

- Modular Manufacturing: Enables flexible, smaller-scale production closer to end markets.

- Reduced Environmental Impact: Lower transportation emissions and waste through localized production.

- Efficiency Gains: Potential for faster product deployment and customized batch sizes.

- Market Growth Opportunity: Addresses increasing customer demand for sustainable and responsive supply chains.

Emerging Biopesticides and Bioprocessing Aids

Croda International is actively investing in emerging biopesticides for agriculture and bioprocessing aids for pharmaceuticals. These segments represent high-growth opportunities, fueled by the increasing demand for sustainable agricultural practices and the expanding biologics market. For instance, the global biopesticides market was valued at approximately USD 5.3 billion in 2023 and is projected to reach USD 16.2 billion by 2030, showcasing significant growth potential.

While these areas are strategic for Croda's future, their market share within these nascent sub-segments is likely to be relatively modest. This is typical for companies entering new, innovative markets where established players may have a head start or where the technology itself is still maturing. Croda's focus here is on building a strong foundation and capturing future market share as these technologies gain wider adoption.

- Biopesticides: Croda's strategy involves developing novel biopesticide systems to offer sustainable crop protection solutions.

- Bioprocessing Aids: In the pharmaceutical sector, Croda aims to expand its range of bioprocessing aids, crucial for the manufacturing of biologics.

- Market Position: As these are emerging areas, Croda's current market share in these specific niche segments is expected to be low, reflecting their developmental stage.

- Growth Drivers: The expansion in these fields is driven by global trends towards sustainability in agriculture and the rapid growth of the biologics industry, which saw significant advancements and investment throughout 2024.

Croda's ventures into personalized medicine and AI-driven chemical solutions are prime examples of Question Marks. These areas represent significant future growth potential, yet their current market share within these highly specialized and emerging niches is likely minimal. Continued investment is crucial for Croda to establish a strong foothold and capitalize on the opportunities these sectors present. For instance, the global AI in chemicals market was valued at approximately $1.5 billion in 2023, indicating a nascent but rapidly expanding field.

BCG Matrix Data Sources

Our BCG Matrix is built on verified market intelligence, combining financial data, industry research, official reports, and expert commentary to ensure reliable, high-impact insights.