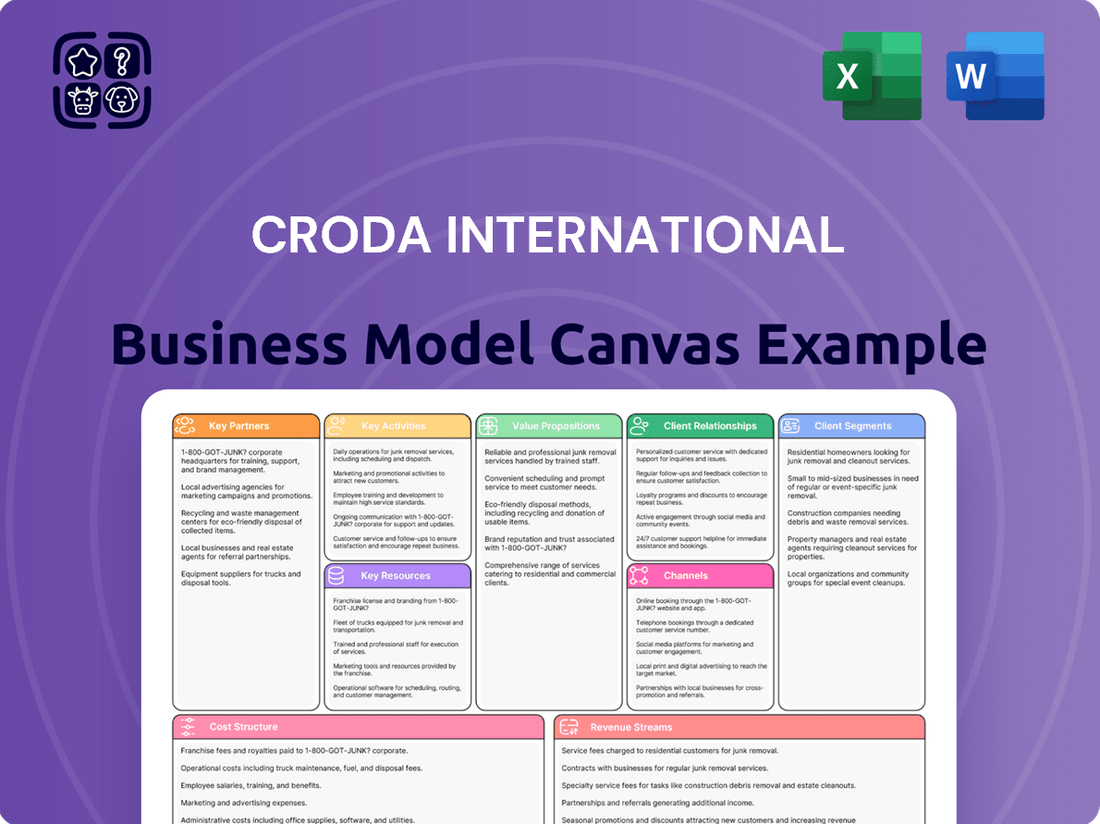

Croda International Business Model Canvas

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Croda International Bundle

Unlock the full strategic blueprint behind Croda International's business model. This in-depth Business Model Canvas reveals how the company drives value, captures market share, and stays ahead in a competitive landscape. Ideal for entrepreneurs, consultants, and investors looking for actionable insights.

Partnerships

Croda actively partners with esteemed universities and research bodies to fuel its innovation engine in specialized chemistry. These collaborations are vital for pushing the boundaries of scientific discovery, creating advanced ingredients, and maintaining leadership in emerging fields such as biotechnology and the development of sustainable raw materials. For instance, in 2024, Croda continued its engagement with several top-tier universities, focusing on projects aimed at enhancing the biodegradability of its product portfolio and exploring novel bio-based feedstocks, reflecting a commitment to sustainable chemistry.

Croda International’s commitment to sustainability hinges on robust partnerships with suppliers of bio-based raw materials. These collaborations are crucial for securing renewable feedstocks that form the backbone of their innovative product lines, aligning with their Climate, Land, and People Positive strategy.

In 2024, Croda continued to deepen these relationships, recognizing that a reliable and ethically sourced supply chain is fundamental to their business model. These partnerships directly support their ambitious sustainability targets, ensuring the consistent availability of ingredients that meet stringent environmental and social criteria.

Croda actively pursues co-development and licensing partnerships to accelerate innovation and market entry for new technologies and ingredients. These collaborations are crucial for expanding their product portfolio and accessing new markets.

For instance, Croda has entered into agreements for the co-development of sustainable vaccine adjuvants, a critical component in enhancing vaccine efficacy. They also engage in licensing for novel neurocosmetic actives, tapping into the growing demand for advanced skincare ingredients.

Industry Associations & Sustainability Initiatives

Croda actively engages with industry associations and sustainability initiatives to influence best practices and champion responsible chemistry. This involvement allows them to shape industry standards and showcase their commitment to sustainability. For instance, their participation in initiatives focused on developing greener supply chains and establishing science-based targets underscores their dedication to environmental stewardship.

These collaborations are crucial for Croda's strategic positioning. By partnering with organizations like the Responsible Care initiative, Croda can contribute to setting benchmarks for safety and environmental performance across the chemical sector. This proactive engagement not only enhances their reputation but also provides valuable insights into emerging sustainability trends and regulatory landscapes.

- Industry Leadership: Croda's participation in associations like the Chemical Industries Association (CIA) in the UK allows them to contribute to policy discussions and shape industry standards, promoting sustainable development.

- Sustainability Focus: Collaborations within initiatives such as the Science Based Targets initiative (SBTi) demonstrate Croda's commitment to setting ambitious, measurable environmental goals.

- Supply Chain Greening: Partnerships aimed at creating more sustainable supply chains, like those with suppliers committed to reducing their carbon footprint, are vital for Croda's overall environmental performance.

- Demonstrating Commitment: By actively participating in and leading sustainability efforts, Croda reinforces its brand image as a responsible and forward-thinking chemical company, attracting environmentally conscious stakeholders.

Customers for Collaborative Innovation

Croda actively engages customers as partners in innovation, co-creating bespoke ingredients and solutions. This approach directly addresses specific performance requirements, ensuring Croda's offerings are integral to customer product formulations.

This deep collaboration cultivates robust, enduring relationships, making Croda a vital component of their clients' success. For instance, in 2024, Croda reported that over 70% of its new product development pipeline originated from direct customer collaborations, highlighting the strategic importance of these partnerships.

- Customer-Centric Development: Croda prioritizes working hand-in-hand with clients to engineer ingredients that precisely match desired product attributes.

- Value Integration: By embedding their solutions within customer formulations, Croda secures its position as an essential supplier.

- Relationship Longevity: Collaborative innovation drives loyalty and fosters long-term, mutually beneficial partnerships.

- Innovation Pipeline Driver: Customer insights directly fuel Croda's R&D efforts, as evidenced by the significant percentage of new products stemming from these interactions in 2024.

Croda's Key Partnerships are multifaceted, encompassing academic institutions for cutting-edge research, suppliers for sustainable raw materials, customers for co-creation, and industry bodies for best practice advocacy. These collaborations are integral to their innovation pipeline and sustainability commitments. For example, in 2024, over 70% of Croda's new product development originated from direct customer collaborations, underscoring the value of these relationships.

| Partnership Type | Focus Area | 2024 Impact/Example |

|---|---|---|

| Academic & Research Institutions | Scientific discovery, advanced ingredients, emerging fields | Collaborations on biodegradability and bio-based feedstocks |

| Bio-based Raw Material Suppliers | Securing renewable feedstocks, ethical sourcing | Ensuring availability of ingredients for sustainability targets |

| Customers | Co-creation of bespoke ingredients, market entry acceleration | Over 70% of new product pipeline derived from customer collaborations |

| Industry Associations & Initiatives | Influencing best practices, shaping standards, sustainability advocacy | Participation in Responsible Care and Science Based Targets initiative (SBTi) |

What is included in the product

A detailed Croda International Business Model Canvas outlining its specialty chemicals focus, targeting diverse industries with innovative solutions, and leveraging strong R&D and global distribution.

This canvas provides a strategic overview of Croda's operations, highlighting its customer relationships, revenue streams, and key resources for sustainable growth.

Croda International's Business Model Canvas acts as a pain point reliever by providing a clear, one-page snapshot of their complex operations, making it easier to identify and address inefficiencies in their specialty chemical value chain.

Activities

Croda's commitment to Research & Development and Innovation is central to its business model, driving the creation of New Protected Products (NPPs) and the exploration of new market and technology frontiers. This focus ensures a steady stream of advanced ingredients designed to meet evolving customer needs across diverse sectors.

In 2023, Croda invested £159.7 million in R&D, a testament to their dedication to innovation. This investment yielded significant results, with NPP sales contributing £536.1 million in 2023, representing 36% of total sales, up from 35% in 2022. This highlights the commercial success of their R&D efforts.

Croda International's core activities center on the sophisticated manufacturing and production of specialty chemicals and high-performance ingredients. This global operation spans numerous sites, all focused on optimizing production capacity and refining processes to ensure maximum profitability and a seamless supply chain.

In 2023, Croda invested significantly in its manufacturing capabilities, aiming to enhance efficiency and sustainability across its production network. This focus on operational excellence is crucial for maintaining its competitive edge in the specialty chemicals market.

Croda International's global sales and distribution strategy hinges on its dedicated, customer-facing sales teams. These teams operate worldwide, fostering direct engagement with clients to understand their unique needs and challenges.

This direct interaction is crucial for Croda's business model, facilitating collaborative innovation and ensuring their specialized chemical solutions reach the right markets effectively. For instance, in 2023, Croda reported sales of £1.99 billion, with a significant portion driven by these customer relationships and efficient distribution networks.

Sustainability Program Implementation

Croda International's core activities revolve around actively implementing and advancing its ambitious sustainability goals, notably its commitment to being Climate, Land, and People Positive by 2030. This entails a multifaceted approach to environmental stewardship and social responsibility across all its operations.

Key to this is the continuous effort to reduce its carbon footprint. For instance, in 2023, Croda reported a 2.1% reduction in Scope 1 and 2 greenhouse gas emissions intensity compared to their 2018 baseline, demonstrating tangible progress towards their climate-positive targets.

- Reducing Carbon Footprint: Croda is actively working to lower its greenhouse gas emissions through energy efficiency initiatives and transitioning to renewable energy sources.

- Increasing Bio-based Raw Materials: A significant focus is placed on sourcing and utilizing a higher proportion of renewable, bio-based ingredients in their product formulations.

- Minimizing Waste: The company implements waste reduction strategies, including improved recycling programs and process optimization to decrease waste generation across its manufacturing sites.

Strategic Acquisitions and Integrations

Croda International actively pursues strategic acquisitions of early-stage, science-focused companies to bolster its product offerings and technological expertise. This approach is crucial for maintaining a competitive edge and entering high-growth market segments. For instance, the acquisition of Solus Biotech in 2023 significantly enhanced Croda's capabilities in sustainable cosmetic ingredients, a rapidly expanding area.

These carefully selected acquisitions serve to consolidate Croda's position in specialized, fast-growing niches. By integrating companies like Avanti Polar Lipids, acquired in 2020, Croda has strengthened its lipid excipients business, a vital component for advanced drug delivery systems. Such moves are designed to enrich its innovation pipeline, ensuring a steady stream of new products and solutions for its diverse customer base.

- Strategic Acquisitions: Croda targets early-stage, science-rich firms to expand its portfolio.

- Niche Consolidation: Acquisitions like Solus Biotech and Avanti Polar Lipids solidify presence in fast-growing markets.

- Innovation Pipeline: These integrations strengthen Croda's capacity for developing new, advanced solutions.

Croda's key activities center on innovation and sophisticated manufacturing of specialty chemicals. They also prioritize sustainability and strategic acquisitions to enhance their product portfolio and market position.

In 2023, Croda's investment in R&D reached £159.7 million, contributing to 36% of their total sales through New Protected Products (NPPs). Their commitment to sustainability is evident in a 2.1% reduction in Scope 1 and 2 greenhouse gas emissions intensity by 2023 compared to the 2018 baseline.

| Key Activity | Description | 2023 Impact/Data |

|---|---|---|

| Research & Development | Creating new products and exploring new markets. | £159.7 million invested in R&D; NPP sales of £536.1 million (36% of total sales). |

| Manufacturing & Production | Producing specialty chemicals and high-performance ingredients globally. | Focus on efficiency and sustainability in production networks. |

| Sales & Distribution | Global customer engagement and delivering specialized chemical solutions. | Sales of £1.99 billion reported, driven by customer relationships. |

| Sustainability Initiatives | Reducing carbon footprint, increasing bio-based materials, minimizing waste. | 2.1% reduction in GHG emissions intensity (Scope 1 & 2) vs. 2018 baseline. |

| Strategic Acquisitions | Acquiring early-stage, science-focused companies. | Acquisition of Solus Biotech to enhance cosmetic ingredient capabilities. |

Full Version Awaits

Business Model Canvas

The Croda International Business Model Canvas preview you are viewing is the exact document you will receive upon purchase. This means you are seeing the complete, professionally structured analysis, not a simplified sample or mockup. Once your order is processed, you will gain full access to this identical file, ready for immediate use and customization.

Resources

Croda’s intellectual property, encompassing over 1,700 patents and deep proprietary know-how, forms a cornerstone of its business model. This robust portfolio safeguards its unique ingredients and advanced technologies, ensuring a distinct edge in the competitive specialty chemicals arena.

This intellectual capital is not static; Croda consistently invests in research and development to expand its patent base and refine its specialized knowledge. For instance, in 2023, the company continued to file new patents across its key sectors, including personal care and life sciences, reinforcing its innovation pipeline.

Croda International's specialized manufacturing facilities and infrastructure represent a core asset, comprising a global network of advanced production sites. These facilities are crucial for developing high-purity, high-performance ingredients that serve a wide array of demanding industries.

In 2024, Croda continued to invest in its manufacturing capabilities, with significant capital expenditure allocated to enhancing existing sites and expanding capacity for key product lines. This strategic investment ensures the company can meet growing global demand for its innovative specialty chemicals.

Croda International's highly skilled scientists and R&D talent are a cornerstone of its business model. This intellectual capital fuels the company's innovation engine, enabling the development of novel products and solutions. In 2024, Croda continued to invest significantly in its R&D capabilities, recognizing that scientific expertise is crucial for addressing complex customer challenges and maintaining a competitive edge in specialty chemicals.

Global Supply Chain Network

Croda International's global supply chain network is the backbone of its operations, ensuring that specialized ingredients reach customers efficiently across diverse industries. This network is critical for managing the complexities of sourcing raw materials, manufacturing, and delivering finished products to a worldwide customer base, supporting their commitment to innovation and sustainability.

The company's supply chain is designed for resilience and agility, enabling it to navigate global disruptions and meet evolving customer demands. In 2024, Croda continued to invest in optimizing its logistics and inventory management systems to enhance reliability and reduce lead times, a key factor in their competitive advantage.

- Global Reach: Croda operates manufacturing sites and distribution centers across Europe, North America, and Asia, facilitating efficient product delivery to over 100 countries.

- Supplier Relationships: Strong, long-term partnerships with key raw material suppliers are maintained to ensure quality and consistent availability, crucial for their specialty chemical production.

- Logistics Optimization: In 2024, the company focused on leveraging digital tools to improve supply chain visibility and reduce transportation costs, aiming for a 5% reduction in logistics-related carbon emissions.

- Inventory Management: Strategic inventory positioning at regional hubs helps mitigate risks and ensures prompt fulfillment of customer orders, particularly for high-demand product lines.

Customer Relationships & Data

Croda International leverages its extensive global customer network, fostering direct and strong relationships that are a cornerstone of its business model. These connections are not just about sales; they are conduits for deep understanding of market needs and emerging trends.

The insights gleaned from this vast customer data are crucial. They allow Croda to develop highly specialized solutions, moving beyond one-size-fits-all approaches to meet the unique demands of various industries and clients. This data-driven approach fuels innovation and ensures product relevance.

This commitment to collaborative innovation, powered by customer relationships and data, is evident in their product development cycles. For instance, in 2024, Croda continued to emphasize partnerships with key clients to co-create next-generation ingredients, particularly in high-growth areas like sustainable personal care and advanced crop protection.

- Direct Engagement: Cultivating robust, direct interactions with a wide array of global customers across diverse sectors.

- Data-Driven Insights: Harnessing customer data to understand specific needs, preferences, and market dynamics.

- Tailored Solutions: Developing customized products and services that precisely address individual customer requirements.

- Collaborative Innovation: Partnering with customers to jointly develop new technologies and solutions, ensuring market alignment and future growth.

Croda's key resources are its extensive intellectual property, including a vast patent portfolio and proprietary know-how, alongside specialized manufacturing facilities and a global supply chain network. These are complemented by a highly skilled R&D workforce and deep customer relationships that drive innovation and tailored solutions.

Value Propositions

Croda International's value proposition centers on delivering sustainable and innovative high-performance ingredients. These solutions are designed to meet evolving global consumer and industrial demands, positioning them as a leader in specialty chemicals.

A core element of this value proposition is their strong commitment to bio-based and biodegradable alternatives. This focus on sustainability, coupled with a reduced carbon footprint, offers a significant competitive advantage in the market. For instance, by 2023, Croda reported that 65% of its sales were from sustainability-driven innovation, a testament to this strategy.

Croda International's value proposition centers on delivering mission-critical ingredients that significantly enhance product performance across diverse sectors like personal care, health, and crop care. These specialized components, though a minor cost element for customers, are indispensable for the efficacy and desired attributes of the final goods. For instance, in 2023, Croda's Performance Technologies segment, which includes many of these high-performance ingredients, saw sales growth driven by demand in sectors like automotive and electronics, demonstrating the broad applicability of their specialized chemistry.

Croda's tailored solutions are born from deep customer collaboration, ensuring specific needs are met. This partnership leverages their extensive formulation expertise, a key value proposition for clients seeking to achieve unique performance claims in their products.

By combining bespoke solutions with formulation know-how, Croda empowers customers to accelerate innovation. This means getting new, high-performing products to market more quickly, a significant advantage in competitive sectors.

For instance, in 2024, Croda's Personal Care division saw continued growth driven by demand for specialized ingredients that deliver enhanced sensory experiences and efficacy, directly reflecting this tailored approach.

Global Reach & Localized Support

Croda International leverages its global presence to deliver specialized chemical solutions across diverse markets, ensuring innovation and support are tailored to local requirements. This dual approach allows them to effectively address regional demands and adapt to varying market conditions.

Their operational strategy focuses on providing both broad market access and specific, localized customer service. This is exemplified by their network of manufacturing sites and sales offices strategically positioned around the world.

- Global Network: Croda operates in over 30 countries, with key manufacturing facilities in Europe, North America, and Asia.

- Localized Innovation: They maintain dedicated R&D centers in regions like the UK, USA, and Singapore to foster innovation relevant to local market trends and customer needs.

- Customer Support: In 2024, Croda reported serving over 10,000 customers globally, with a strong emphasis on providing accessible technical and sales support in local languages and time zones.

- Market Adaptation: This structure enables them to respond swiftly to emerging regional opportunities and regulatory changes, a crucial aspect of their business model.

Leadership in Specific High-Value Niches

Croda International cultivates leadership in specialized, high-growth sectors. These include advanced skincare ingredients, crucial components for drug delivery like excipients and vaccine adjuvants, and innovative seed enhancement technologies. This strategic focus enables the company to offer premium, high-margin products.

This niche strategy is a cornerstone of Croda's business model, allowing for deep expertise and innovation. For instance, in 2023, their Life Sciences segment, which encompasses drug delivery and seed enhancement, saw significant growth, contributing to the company's overall performance.

- Skincare Actives: Croda is a key supplier of specialized ingredients for the premium skincare market, driving innovation in formulations.

- Drug Delivery Systems: The company provides essential excipients and vaccine adjuvants, critical for the efficacy and stability of pharmaceutical products, including a significant role in vaccine development.

- Seed Enhancement: Croda offers advanced solutions for agriculture that improve seed germination and early plant growth, supporting sustainable farming practices.

Croda's value proposition is built on providing sustainable, high-performance specialty ingredients that are essential for customer product efficacy. They focus on bio-based solutions and reduced carbon footprints, a strategy that resonated strongly in 2023, with 65% of sales stemming from sustainability-driven innovation.

They offer mission-critical ingredients, often a small cost but vital for final product performance across sectors like personal care and health. This is evident in their Performance Technologies segment, which saw growth in 2023 due to demand from automotive and electronics.

Croda collaborates closely with customers, leveraging formulation expertise to deliver tailored solutions that accelerate product innovation and time-to-market. This customer-centric approach was highlighted in 2024 with growth in their Personal Care division driven by specialized ingredients.

Their global network ensures localized innovation and customer support, serving over 10,000 customers in 2024 across more than 30 countries, adapting to regional demands and regulations.

Croda leads in high-growth niches like advanced skincare, pharmaceutical excipients, and seed enhancement technologies, offering premium, high-margin products. Their Life Sciences segment demonstrated this focus with significant growth in 2023.

| Value Proposition Pillar | Description | Supporting Data/Examples |

| Sustainable & High-Performance Ingredients | Delivering innovative, bio-based ingredients that enhance product performance and reduce environmental impact. | 65% of sales from sustainability-driven innovation (2023). |

| Mission-Critical Components | Providing essential ingredients that, though small in cost, are indispensable for product efficacy. | Growth in Performance Technologies segment driven by automotive and electronics demand (2023). |

| Tailored Solutions & Formulation Expertise | Collaborating with customers to develop bespoke solutions and accelerate product innovation. | Growth in Personal Care division driven by specialized ingredients (2024). |

| Global Reach with Localized Support | Operating a global network with localized R&D and customer service to meet regional needs. | Serving over 10,000 customers globally (2024); operations in over 30 countries. |

| Leadership in Niche Markets | Focusing on high-growth sectors like skincare, drug delivery, and agricultural technologies. | Significant growth in Life Sciences segment (2023). |

Customer Relationships

Croda International actively engages customers in joint innovation, a key aspect of their business model. This collaborative approach, focusing on co-creating specialized ingredients, ensures their offerings are precisely aligned with evolving market demands and specific client requirements.

This deep partnership model strengthens customer loyalty and drives the development of unique, high-value solutions. For instance, in 2024, Croda reported significant growth in its Personal Care sector, partly attributed to successful co-creation projects with major beauty brands that led to the launch of several innovative skincare formulations.

Croda International leverages a direct sales force, fostering deep customer connections and enabling immediate technical assistance. This strategy was evident in their 2024 performance, where direct engagement with key accounts contributed to sustained growth in their Specialty Chemicals segment.

This high-touch customer relationship model is crucial for gathering direct feedback, which actively informs Croda's innovation pipeline and product development cycles. For instance, insights from direct technical support interactions in 2024 led to targeted improvements in their personal care ingredients.

Croda International cultivates deep, long-term strategic partnerships by embedding itself within customer supply chains. This approach moves beyond simple transactions, focusing on becoming an indispensable supplier of mission-critical ingredients that consistently deliver value.

In 2024, Croda's commitment to these partnerships is evident in its sustained revenue growth, with the company reporting a notable increase in sales driven by its specialty chemical segments. This financial performance underscores the success of its strategy to provide essential, high-performance components that foster customer loyalty and integration.

Customer-Driven R&D Priorities

Croda's commitment to customer-driven research and development is evident in its organizational structure. The R&D teams are embedded directly within the Consumer Care and Life Sciences divisions. This close proximity ensures that innovation efforts are not theoretical but are directly tied to the evolving needs and specific requests of their customers in these key sectors.

This strategic alignment means that new product development at Croda is a direct response to market demands. For example, in 2024, Croda continued to focus on sustainable ingredients for personal care, a direct result of consumer and brand owner requests for eco-friendly formulations. This customer-centric approach guides their pipeline, ensuring resources are allocated to solutions that will resonate and succeed in the marketplace.

- Customer Focus: R&D is integrated into business divisions, ensuring direct alignment with market needs.

- Market Responsiveness: Innovation priorities are shaped by customer requests and emerging market trends.

- Divisional Integration: Consumer Care and Life Sciences R&D teams directly report into their respective divisions.

- Impact on Innovation: This structure guarantees that new product development addresses tangible customer requirements and market gaps.

Dedicated Account Management

For its key accounts and larger customers, Croda International likely assigns dedicated account management teams. These teams are tasked with providing highly personalized service, ensuring a deep understanding of each client's evolving needs and operational challenges. This proactive approach fosters strong relationships and facilitates efficient problem-solving.

This dedicated management structure is crucial for maintaining high levels of customer satisfaction and promoting long-term retention. By having a consistent point of contact who understands their specific business, clients can expect smoother communication and quicker resolution of any issues that may arise. This personalized attention is a significant differentiator.

- Dedicated Teams: Croda assigns specialized account managers to major clients.

- Personalized Service: Focus on understanding unique customer requirements.

- Seamless Communication: Facilitating efficient interaction and support.

- Customer Retention: Aiming for high satisfaction to ensure long-term partnerships.

Croda International emphasizes collaborative innovation and deep partnerships, embedding R&D within business divisions to directly address customer needs. This customer-centric approach fuels the development of tailored solutions, as seen in their 2024 performance, where co-creation projects significantly boosted their Personal Care sector. Their direct sales force and dedicated account management teams further solidify these relationships, ensuring responsive service and long-term loyalty.

| Customer Relationship Strategy | Key Activities | 2024 Impact/Focus |

|---|---|---|

| Joint Innovation & Co-creation | Collaborating on specialized ingredient development | Drove growth in Personal Care sector; launched new skincare formulations with major brands. |

| Direct Sales & Technical Support | Personalized engagement and immediate assistance | Contributed to sustained growth in Specialty Chemicals; gathered direct feedback for product improvement. |

| Strategic Partnerships & Supply Chain Integration | Becoming an indispensable supplier of critical ingredients | Underpinned sustained revenue growth, particularly in specialty chemical segments. |

| Dedicated Account Management | Proactive, personalized service for key accounts | Aims to enhance customer satisfaction and long-term retention through deep understanding of client needs. |

Channels

Croda International leverages a dedicated direct sales force as a cornerstone of its customer engagement strategy. This approach facilitates in-depth technical discussions and fosters robust, long-term partnerships with clients worldwide.

In 2023, Croda reported that its direct sales force was instrumental in achieving a 7.4% increase in revenue, reaching £1.9 billion. This direct interaction allows for tailored solutions and a deeper understanding of customer needs across diverse sectors like personal care and crop care.

Croda International utilizes an extensive global distribution network, ensuring its specialty ingredients reach diverse markets efficiently. This network manages complex logistics, warehousing, and transportation, critical for timely delivery to a worldwide customer base. In 2023, Croda reported £1.95 billion in revenue, underscoring the scale and reach of its operations, which are heavily reliant on this robust distribution infrastructure.

Croda International leverages its corporate website and dedicated investor relations portals as primary digital channels. These platforms provide comprehensive product information, detailed technical data sheets, and crucial sustainability reports, ensuring transparency and accessibility for stakeholders. In 2023, Croda's investor relations section saw significant traffic as the company highlighted its progress in specialty chemicals and sustainable solutions.

Industry Trade Shows and Conferences

Croda International actively participates in key industry trade shows and conferences. These events are crucial for displaying their latest innovations, connecting with both new and existing clients, and understanding evolving market dynamics and competitor strategies.

In 2024, Croda showcased its advanced specialty ingredients at events like in-cosmetics Global, highlighting their commitment to sustainable solutions and innovation in personal care and beyond. Such participation directly supports their customer relationships and market intelligence gathering.

- Showcasing Innovation: Demonstrates new product lines and technological advancements to a targeted audience.

- Customer Engagement: Facilitates direct interaction with clients, fostering stronger relationships and gathering feedback.

- Market Intelligence: Provides insights into industry trends, competitor activities, and emerging customer needs.

- Brand Visibility: Enhances Croda's presence and reputation within the specialty chemicals sector.

Research & Development Collaborations

Research and Development collaborations are a key channel for Croda, acting as more than just partnerships. They are a direct avenue to engage with customers, especially when developing novel ingredients or tailored solutions for unique market needs. This collaborative approach fosters innovation and ensures Croda's offerings are precisely aligned with client requirements.

These collaborations allow Croda to gain deep insights into customer challenges and market trends, directly influencing their product pipeline. For instance, in 2023, Croda highlighted its work with partners on sustainable ingredient development, a significant driver of growth. The company's commitment to innovation through collaboration is evident in its consistent investment in R&D, which remains a cornerstone of its business strategy.

- Customer Co-Development: Croda works hand-in-hand with customers to create bespoke ingredients and solutions, ensuring market fit and customer satisfaction.

- Innovation Driver: R&D collaborations are a primary source of new product ideas and technological advancements for Croda.

- Market Insight: These partnerships provide invaluable feedback and understanding of evolving customer needs and industry demands.

- Sustainability Focus: Collaborations often target the development of more sustainable and environmentally friendly ingredients, aligning with global trends.

Croda International's channel strategy is multifaceted, combining direct sales with a robust global distribution network to ensure its specialty ingredients reach a diverse customer base. Digital platforms, including its corporate website and investor relations portals, serve as key information hubs, offering detailed product data and sustainability reports. Furthermore, active participation in industry trade shows and conferences, such as in-cosmetics Global in 2024, is crucial for showcasing innovation and fostering client relationships.

Collaborations with customers on research and development projects are also a vital channel, enabling the creation of tailored solutions and driving innovation. These partnerships provide deep market insights and ensure Croda's product pipeline aligns with evolving customer needs and sustainability trends. In 2023, Croda highlighted its focus on sustainable ingredient development through such collaborations, a key growth area.

| Channel | Description | 2023/2024 Relevance |

|---|---|---|

| Direct Sales Force | In-depth technical discussions and long-term partnerships. | Instrumental in 7.4% revenue increase in 2023. |

| Global Distribution Network | Efficiently reaching diverse markets with complex logistics. | Supports £1.95 billion revenue in 2023. |

| Digital Platforms (Website, Investor Relations) | Providing product info, technical data, and sustainability reports. | Key for stakeholder transparency and engagement. |

| Industry Trade Shows & Conferences | Showcasing innovation, client interaction, market intelligence. | Participation in events like in-cosmetics Global in 2024. |

| R&D Collaborations | Co-developing novel ingredients and tailored solutions. | Drives innovation and aligns offerings with customer needs. |

Customer Segments

Croda International serves personal care and beauty companies, including those focused on cosmetics, skincare like anti-wrinkle and suncare products, haircare, and fragrances. They provide cutting-edge, sustainable ingredients that boost product effectiveness and support marketing claims.

In 2024, the global beauty and personal care market was projected to reach over $640 billion, with skincare being a significant driver. Croda’s focus on sustainable and high-performance ingredients positions them well within this expanding sector, catering to consumer demand for efficacy and environmental responsibility.

Croda International is a vital partner for pharmaceutical and healthcare companies, supplying them with essential high-purity excipients, innovative vaccine adjuvants, and advanced drug delivery systems. These specialized ingredients are fundamental to the creation of novel therapies, particularly in the rapidly growing fields of biologics and vaccines.

The demand for Croda's offerings in this sector is substantial, driven by global health needs and ongoing research and development. For instance, the global vaccine market was valued at approximately $60 billion in 2023 and is projected to grow significantly, with adjuvants playing a crucial role in vaccine efficacy and stability.

Croda's Crop Care & Agricultural Businesses segment serves companies focused on crop protection and seed enhancement. This includes manufacturers of adjuvants, which are crucial for improving the efficacy of fungicides and other crop protection products.

In 2024, the global agrochemical market, a key indicator for this segment, was projected to reach over $250 billion, highlighting the significant demand for advanced agricultural solutions. Croda's specialty ingredients play a vital role in making these solutions more efficient and environmentally sustainable.

Industrial Applications Manufacturers

Croda International serves industrial application manufacturers by providing essential specialty chemicals. These chemicals are crucial for enhancing the performance and sustainability of a wide array of industrial products, including advanced lubricants and high-performance polymers.

The company’s offerings are integral to the manufacturing processes of sectors like automotive, construction, and electronics. For instance, Croda’s innovative ingredients help create more durable coatings and more efficient industrial fluids. In 2023, Croda reported that its Performance Technologies sector, which heavily serves industrial applications, achieved strong growth, driven by demand for sustainable solutions.

- Specialty chemicals for lubricants and polymers

- Enhancing product functionality and sustainability

- Key supplier to automotive, construction, and electronics sectors

- Focus on innovative ingredients for industrial manufacturing

Local & Regional Brands (across segments)

Local and regional brands are becoming a significant focus for Croda, especially within the consumer care and agriculture sectors. These businesses often seek agility and novel solutions, presenting Croda with avenues for premium product sales and collaborative innovation.

For instance, in 2024, Croda's specialty ingredients for personal care, which cater to many of these smaller brands, continued to see robust demand driven by consumer trends towards natural and sustainable formulations. The company's ability to offer tailored solutions and rapid development cycles makes it an attractive partner for these dynamic market players.

- Growing Importance: Local and regional brands represent an expanding customer base for Croda, particularly in fast-moving consumer goods and agricultural inputs.

- Key Drivers: These brands often prioritize speed-to-market and unique product development, creating demand for Croda's innovative and specialized chemical solutions.

- Value Proposition: Croda's ability to provide high-value ingredients and technical support enables these smaller companies to compete effectively with larger corporations.

- Market Opportunity: The segment offers Croda opportunities for higher-margin sales and the chance to build strong relationships with emerging brands.

Croda's customer segments are diverse, spanning personal care, pharmaceuticals, crop care, and various industrial applications. They cater to global corporations and increasingly, agile local and regional brands seeking specialized, sustainable ingredients.

| Customer Segment | Key Focus Areas | 2024 Market Context/Data Point |

|---|---|---|

| Personal Care & Beauty | Cosmetics, skincare, haircare, fragrances; sustainable and high-performance ingredients | Global beauty and personal care market projected over $640 billion; skincare a major driver. |

| Pharma & Healthcare | Excipients, vaccine adjuvants, drug delivery systems; biologics and vaccines | Global vaccine market ~$60 billion (2023); adjuvants crucial for efficacy. |

| Crop Care & Agricultural | Crop protection, seed enhancement, adjuvants for fungicides | Global agrochemical market projected over $250 billion. |

| Industrial Applications | Lubricants, polymers, coatings; enhancing performance and sustainability | Performance Technologies sector showed strong growth in 2023 driven by sustainable solutions. |

| Local & Regional Brands | Agility, novel solutions in consumer care and agriculture | Robust demand for specialty ingredients in personal care driven by natural/sustainable trends. |

Cost Structure

Raw material costs represent a substantial portion of Croda International's expenses. This includes a mix of traditional petrochemicals and a growing emphasis on bio-based and renewable feedstocks, reflecting the company's sustainability drive.

In 2024, the volatility in global commodity markets, particularly for key inputs like oleochemicals and specialty chemicals, directly influenced Croda's raw material expenditure. For instance, the price of palm oil derivatives, a common feedstock, saw significant shifts throughout the year due to weather patterns and supply chain disruptions.

Croda's commitment to innovation is evident in its significant Research & Development (R&D) expenses, a cornerstone of its business model. These costs are essential for developing cutting-edge solutions in its specialty chemicals segments.

In 2024, R&D spending is projected to remain a substantial portion of Croda's operational budget, supporting a robust pipeline of new products. This investment covers everything from the salaries of highly skilled scientists and technicians to the acquisition and maintenance of advanced laboratory equipment and the crucial costs associated with securing intellectual property through patents.

Croda International's manufacturing and operational costs encompass a broad range of expenditures essential for running its global production sites. These include significant outlays for energy to power its facilities, wages for its skilled workforce, ongoing maintenance to ensure equipment reliability, and depreciation on its substantial asset base. In 2023, Croda reported a Cost of Sales of £1,095.2 million, reflecting these direct manufacturing expenses.

The company actively pursues operational efficiencies and strategic optimization of its manufacturing footprint to manage these costs effectively. This focus on streamlining processes and resource allocation is crucial for maintaining competitiveness. For instance, Croda's commitment to sustainability also plays a role, with investments in energy-efficient technologies aimed at reducing utility costs over the long term.

Sales, Marketing & Distribution Costs

Croda International's cost structure is significantly influenced by its investments in sales, marketing, and distribution. These expenses are crucial for reaching its diverse customer base across various industries worldwide.

The company maintains a global sales force, requiring substantial expenditure on salaries, commissions, and ongoing training. Marketing activities, including product promotion, trade shows, and digital campaigns, also represent a considerable outlay, aimed at building brand awareness and driving demand for its specialty chemicals.

Furthermore, Croda operates an extensive distribution network. This necessitates significant costs related to logistics management, warehousing facilities, and transportation of goods. For instance, in 2023, Croda reported distribution and selling expenses of £342.3 million, highlighting the scale of these operations.

- Global Sales Force: Costs associated with personnel, training, and incentives for its international sales teams.

- Marketing and Promotion: Investment in advertising, digital marketing, trade exhibitions, and market research.

- Distribution Network: Expenses covering logistics, warehousing, inventory management, and transportation across its global supply chain.

- 2023 Distribution & Selling Expenses: £342.3 million, underscoring the significant investment in market reach and customer engagement.

Overhead & Administrative Costs

Croda's cost structure includes significant overhead and administrative expenses. These encompass essential corporate functions, IT infrastructure, legal services, and various other support departments that keep the business running smoothly.

In an effort to optimize its financial performance, Croda has been actively engaged in cost-cutting initiatives. These programs are specifically designed to streamline operations within these overhead and administrative areas, aiming for greater efficiency and reduced expenditure.

For instance, in their 2023 financial reporting, Croda highlighted efforts to manage administrative costs more effectively. While specific figures for overhead reduction are part of ongoing strategic adjustments, the company's focus on operational efficiency is a key theme. In 2023, Croda reported administrative expenses as a notable portion of their overall operating costs, underscoring the importance of these streamlining efforts.

- General overhead and administrative expenses are a core component of Croda's cost base, covering vital corporate functions, IT, legal, and support services.

- Cost-cutting programs are actively being implemented by Croda to enhance efficiency and reduce spending in these overhead and administrative areas.

- 2023 financial reports indicated a focus on managing administrative costs, reflecting the ongoing strategic importance of streamlining these operational expenditures.

Croda's cost structure is heavily weighted towards raw materials, with a significant portion allocated to research and development to fuel innovation in specialty chemicals. Manufacturing and operational expenses, including energy and labor, form another substantial cost category, alongside considerable investments in global sales, marketing, and distribution networks.

The company actively manages its cost base through operational efficiencies and strategic optimization. In 2023, Cost of Sales reached £1,095.2 million, while distribution and selling expenses amounted to £342.3 million, highlighting the scale of these investments in market presence and product delivery.

| Cost Category | 2023 Value (£ million) | Key Components |

|---|---|---|

| Cost of Sales | 1,095.2 | Raw Materials, Manufacturing Costs |

| Distribution & Selling Expenses | 342.3 | Sales Force, Marketing, Logistics |

| R&D Expenses | Significant Investment | New Product Development, Scientists, Labs |

Revenue Streams

Croda International generates significant revenue from selling specialized ingredients used in consumer care products. This includes high-performance components for personal care, beauty, and home care applications, such as active ingredients, emollients, and even fragrances and flavors.

This segment represents Croda's most substantial revenue stream. In 2023, Croda reported Consumer Care sales of £774.4 million, demonstrating its dominant contribution to the company's overall financial performance.

Croda International generates significant revenue from selling specialized ingredients for the life sciences sector. This includes crucial components for healthcare, such as excipients that help deliver medications effectively and vaccine adjuvants that boost immune responses. In 2023, Croda reported strong performance in its Life Sciences sector, with sales contributing substantially to its overall financial health, reflecting the high-margin nature of these advanced materials.

The company also capitalizes on the agricultural market by supplying ingredients for crop care. These include adjuvants that improve pesticide performance and seed enhancement technologies that promote healthier plant growth. This dual focus on healthcare and agriculture positions Croda to benefit from consistent demand and offers considerable growth opportunities due to the essential nature of these products.

Croda International generates revenue through the sale of its industrial specialties products, catering to a broad spectrum of industrial uses. This segment, while not the largest, plays a crucial role in diversifying the company's overall income streams, providing a stable base.

In 2024, Croda's Performance Technologies and Industrial Chemicals segment, which encompasses many industrial specialties, saw robust performance. This segment contributed significantly to the group's adjusted operating profit, demonstrating the value of these specialized chemical offerings in various industrial markets.

Licensing and Royalty Fees

Croda International can generate revenue by licensing its specialized chemical technologies and intellectual property to other businesses. This allows third parties to utilize Croda's innovations, typically in exchange for ongoing royalty payments or upfront licensing fees. For instance, in 2023, Croda's focus on sustainable solutions, like bio-based ingredients, presents significant licensing opportunities as demand for eco-friendly materials grows across various industries.

These licensing arrangements can provide a steady income stream, leveraging Croda's research and development investments without the need for direct manufacturing or market entry by Croda itself. The revenue generated is often tied to the sales volume or specific applications of the licensed technology.

- Technology Licensing: Granting rights to use patented processes or formulations.

- Royalty Payments: Receiving a percentage of sales from products incorporating licensed IP.

- Intellectual Property Monetization: Generating income from patents and proprietary know-how.

- Partnership Revenue: Earning from collaborations where technology is shared.

Service and Technical Support Fees

Croda International generates revenue through service and technical support fees, often bundled with product sales but also offered as standalone offerings. These services can include advanced technical assistance, specialized formulation expertise, and strategic consulting, providing customers with tailored solutions and enhancing product value.

In 2024, Croda's commitment to customer success through these support services contributed to its robust financial performance. For instance, the company reported a strong revenue growth, driven in part by its ability to offer high-value technical services that address specific customer challenges in sectors like personal care and crop care.

- Advanced Technical Support: Providing in-depth troubleshooting and application guidance to ensure optimal product performance for clients.

- Formulation Expertise: Offering specialized knowledge to help customers develop innovative and effective product formulations.

- Consulting Services: Delivering strategic advice and market insights to aid customers in their product development and go-to-market strategies.

Croda International's revenue streams are diversified across key sectors, with Consumer Care and Life Sciences being the most significant contributors. In 2023, Consumer Care sales reached £774.4 million, highlighting its dominance. The company also leverages its expertise in agricultural chemicals and industrial specialties, with the latter showing robust performance in 2024, contributing significantly to operating profit.

| Revenue Stream | 2023 Sales (Millions £) | Key Applications | 2024 Outlook/Performance Highlight |

|---|---|---|---|

| Consumer Care | 774.4 | Personal care, beauty, home care ingredients | Dominant revenue contributor |

| Life Sciences | N/A (Significant contributor) | Healthcare excipients, vaccine adjuvants, crop protection | High-margin, consistent demand |

| Industrial Specialties | N/A (Significant contributor) | Lubricants, coatings, polymers, mining | Robust performance in Performance Technologies and Industrial Chemicals segment in 2024 |

Business Model Canvas Data Sources

The Croda International Business Model Canvas is informed by a blend of financial reports, market intelligence, and internal operational data. These sources provide a comprehensive view of the company's strategic positioning and market engagement.