CRH SWOT Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

CRH Bundle

While CRH shows strong market positioning and operational efficiency, understanding the full scope of its competitive landscape and potential regulatory hurdles is crucial for strategic planning. Our comprehensive SWOT analysis delves into these factors, providing actionable insights to leverage strengths and mitigate weaknesses.

Want the full story behind CRH’s growth drivers and potential threats? Purchase the complete SWOT analysis to gain access to a professionally written, fully editable report designed to support your strategic planning and investment decisions.

Strengths

CRH's global market leadership is a significant strength, with operations spanning 31 countries and four continents, encompassing over 3,800 locations. This vast network translates into substantial operational efficiencies and robust purchasing power, allowing CRH to secure favorable terms and drive down costs. The company's diversified revenue streams across these regions also bolster its resilience against localized economic downturns, ensuring stability and consistent performance.

CRH has showcased impressive financial strength, with 2024 seeing double-digit growth in net income and Adjusted EBITDA. This marks the eleventh year in a row for margin expansion, a testament to their commercial acumen and operational efficiency.

CRH's strategic acquisition-led growth has been a powerhouse, fueling roughly 60% of its profit expansion over the past ten years. This approach isn't just about getting bigger; it's about smart expansion.

The company consistently targets value-adding bolt-on acquisitions. A prime example is the recent Eco Material Technologies acquisition, which broadens CRH's market reach, diversifies its product portfolio, and integrates cutting-edge sustainable technologies, demonstrating a clear commitment to innovation through M&A.

This disciplined approach to mergers and acquisitions not only strengthens CRH's competitive standing but also continually enhances its operational capabilities and market presence, ensuring sustained growth and market leadership.

Diversified Product Portfolio and End Markets

CRH's strength lies in its extensive product range, encompassing vital building materials like cement, aggregates, asphalt, and concrete. This diverse offering caters to a broad spectrum of industries, from large-scale infrastructure developments to commercial and residential construction.

This wide market exposure, especially to robust sectors such as public infrastructure and the reshoring of manufacturing, provides a significant buffer against economic slowdowns in any particular segment. For instance, in 2023, CRH reported strong performance in its Americas Materials segment, partly driven by infrastructure spending, which helped offset softer demand in certain European markets.

- Diverse Product Offering: Cement, aggregates, asphalt, concrete, and more.

- Broad End-Market Exposure: Infrastructure, commercial, residential, and industrial projects.

- Resilience through Diversification: Mitigation of risks associated with single-market downturns.

- Strategic Market Focus: Benefiting from growth in public infrastructure and re-industrialization trends.

Commitment to Sustainability and Innovation

CRH's dedication to sustainability is a significant strength, underscored by ambitious carbon reduction goals and substantial investments in recycling. The company is actively repurposing millions of tonnes of waste annually into valuable circular economy solutions, demonstrating a tangible commitment to environmental stewardship.

Innovation is central to CRH's strategy, particularly in developing low-carbon cement and other sustainable building materials. Through its CRH Ventures program, the company is fostering advancements that position it as a leader in the global shift towards a greener built environment.

- ESG Leadership: CRH has set aggressive targets for carbon reduction, aiming for significant emissions cuts across its operations.

- Circular Economy Focus: The company actively diverts millions of tonnes of waste from landfills each year, transforming it into sustainable building materials.

- Sustainable Product Development: CRH Ventures is a key driver for innovation, supporting the creation of next-generation low-carbon cement and advanced building solutions.

CRH's extensive global footprint, with operations in 31 countries, provides significant market leverage and operational efficiencies. This vast network, encompassing over 3,800 locations, translates into strong purchasing power and resilience against regional economic fluctuations.

The company's financial performance in 2024 highlights its strength, with double-digit growth in net income and Adjusted EBITDA, marking the eleventh consecutive year of margin expansion. This consistent financial health is a direct result of their commercial expertise and efficient operations.

Strategic acquisitions are a core growth driver for CRH, accounting for approximately 60% of its profit expansion over the last decade. Recent acquisitions, like Eco Material Technologies, enhance its product portfolio and integrate sustainable technologies, reinforcing its market leadership through smart expansion.

| Metric | 2023 Data | 2024 Projection |

|---|---|---|

| Revenue Growth | Reported strong performance in Americas Materials | Expected continued growth |

| Profit Expansion (Acquisition-led) | ~60% over the past 10 years | Continued focus on value-adding acquisitions |

| Margin Expansion | 11 consecutive years | Ongoing trend |

What is included in the product

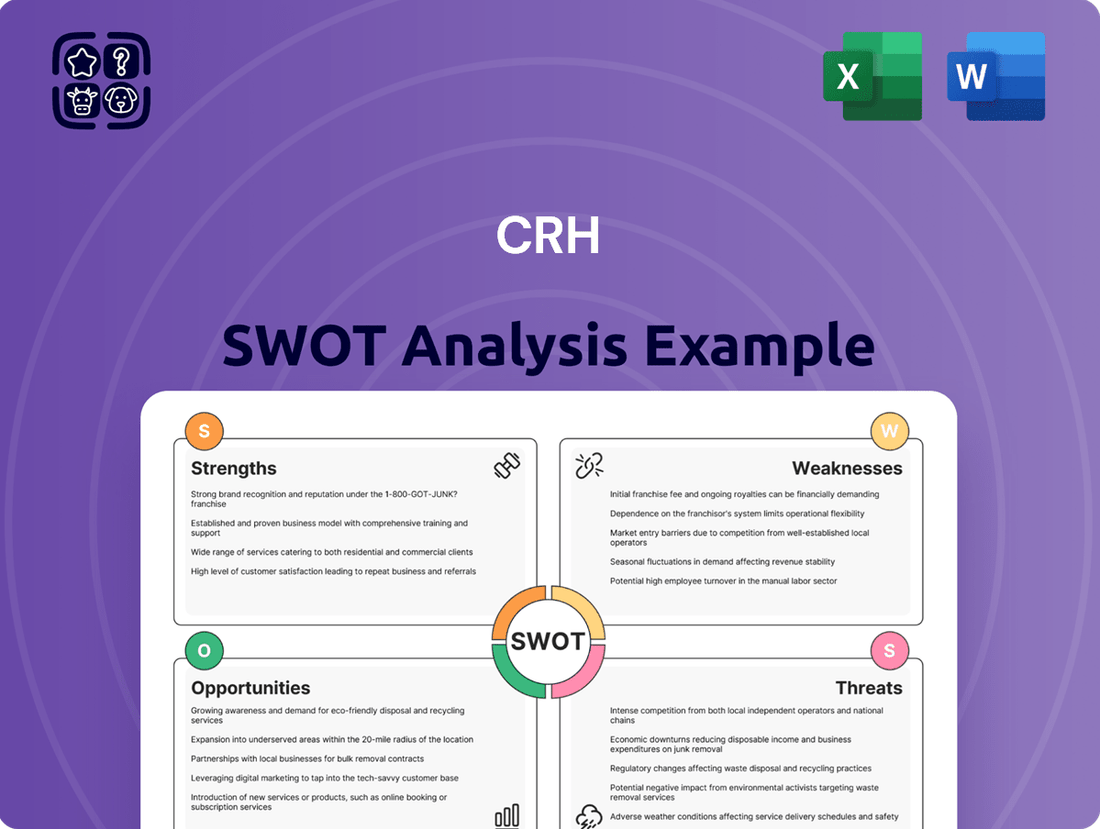

Analyzes CRH’s competitive position through key internal and external factors, detailing its strengths, weaknesses, opportunities, and threats.

Offers a clear, actionable framework for identifying and addressing strategic challenges.

Weaknesses

CRH's operations are significantly impacted by economic cycles. A slowdown in construction spending, often triggered by recessions or rising interest rates, directly reduces demand for CRH's materials and products. For instance, during periods of economic contraction, new housing starts and infrastructure projects typically decrease, leading to lower sales volumes for the company.

Seasonal weather patterns also pose a considerable weakness. Adverse conditions, such as heavy snow, rain, or extreme cold, can halt or slow down construction activities, particularly in regions with distinct seasons. This was evident in Q1 2025, when challenging weather in key markets like North America and Europe led to a noticeable dip in operational activity and, consequently, CRH's financial performance for that quarter.

While CRH consistently delivers strong Adjusted EBITDA, its reported net income can be quite volatile. For instance, in the first quarter of 2025, the company reported a net loss. This was largely due to the absence of gains from divestitures that had boosted prior-year results, highlighting how non-recurring items can skew net profit figures.

CRH's net debt has been on the rise, reaching $12.7 billion by March 31, 2025, a notable jump from $10.5 billion at the close of 2024. This increase is largely a consequence of the company's robust acquisition activities and ongoing share repurchase initiatives.

While CRH currently holds an investment-grade credit rating, this growing debt burden introduces a potential for increased financial risk, particularly if the broader economic landscape experiences a downturn.

Substantial Capital Expenditure Requirements

The building materials sector inherently demands significant and continuous capital investment. This is essential for both keeping current facilities running smoothly and for financing new growth initiatives. For CRH, these large outlays, while vital for future competitiveness and operational effectiveness, can strain financial resources and affect the company's ability to generate free cash flow.

For instance, in 2023, CRH reported capital expenditure of $3.9 billion. This substantial figure underscores the ongoing need to invest in its global operations, including plant upgrades, new acquisitions, and sustainability initiatives, which are critical for maintaining market position but also represent a significant draw on capital.

- High Capital Intensity: The business model requires substantial ongoing investment in plant, property, and equipment.

- Impact on Free Cash Flow: Large capital expenditures can reduce the cash available for other purposes like dividends or debt reduction.

- Need for Continuous Investment: Maintaining and expanding operations in a competitive global market necessitates consistent capital allocation.

Challenges in Specific Market Segments

CRH has faced ongoing challenges in specific market segments, particularly within residential construction. Adverse market conditions have also created headwinds for certain product areas, impacting overall performance.

While CRH benefits from broad diversification, localized market contractions can still affect segmental profitability. For instance, in 2023, while the company reported strong overall results, certain regions or product lines experienced slower growth due to factors like rising interest rates impacting new home starts.

- Segmental Weakness: Persistent softness in residential construction markets has been a notable challenge.

- Product Headwinds: Specific product categories have encountered difficulties due to unfavorable market dynamics.

- Impact of Localized Contractions: Despite overall resilience, localized downturns can still affect CRH's segmental performance.

CRH's substantial debt levels, increasing to $12.7 billion by March 31, 2025, from $10.5 billion at the end of 2024, elevate financial risk, especially during economic downturns. This growing debt is a direct result of aggressive acquisition strategies and ongoing share repurchases, which, while potentially beneficial for growth, place a greater burden on the company's financial stability.

The company's high capital intensity, evidenced by $3.9 billion in capital expenditures in 2023, necessitates significant ongoing investment. This continuous need for capital to maintain and expand operations can strain financial resources, potentially limiting free cash flow available for other corporate objectives such as debt reduction or shareholder returns.

Despite overall diversification, CRH faces localized weaknesses, particularly in the residential construction sector, which has experienced persistent softness. Additionally, certain product lines have encountered headwinds due to unfavorable market dynamics, impacting segmental profitability even when broader company performance remains resilient.

Full Version Awaits

CRH SWOT Analysis

This preview reflects the real document you'll receive—professional, structured, and ready to use. You're seeing the actual CRH SWOT analysis, ensuring transparency and quality. Once purchased, you'll gain access to the complete, detailed report.

Opportunities

Significant public investment in critical infrastructure projects across CRH's core markets, particularly in North America and Europe, presents a major growth opportunity. For instance, the U.S. Infrastructure Investment and Jobs Act, enacted in late 2021, allocates over $1 trillion to transportation, broadband, and utility upgrades, with a substantial portion flowing into 2024 and 2025.

CRH, with its strong market positions in essential materials like asphalt and aggregates, is well-positioned to benefit substantially from these long-term government-backed initiatives. In 2023, CRH reported that its Americas Materials segment saw significant demand driven by infrastructure projects, contributing to a strong performance that is expected to continue into 2024 and 2025 as these projects ramp up.

The increasing global push for sustainable construction and decarbonization presents a significant growth opportunity. CRH's strategic focus on low-carbon products, circular economy practices, and acquisitions such as Eco Material Technologies positions them well to capitalize on this expanding market for environmentally friendly building solutions.

CRH's ongoing mergers and acquisitions strategy is a key opportunity for deeper integration. This approach not only strengthens supply chain resilience but also unlocks substantial synergies by combining operations. For instance, in 2023, CRH completed several acquisitions, including the $3.4 billion purchase of the remaining stake in CRH Americas Materials, which significantly expanded its North American footprint.

By strategically acquiring complementary businesses, CRH can consolidate its market position. This allows for improved pricing power and a greater ability to pivot towards higher-margin, value-added solutions. Such moves are crucial for driving consistent, long-term growth in a competitive landscape.

Growth in Emerging Markets and Re-industrialization

CRH can capitalize on the robust growth anticipated in emerging markets, where infrastructure development remains a key priority. For instance, the Asia-Pacific region, projected to see significant construction activity in the coming years, presents a substantial opportunity for CRH to extend its reach and market share.

The global push for re-industrialization is creating a surge in demand for new manufacturing plants, advanced logistics hubs, and essential data centers. This trend directly benefits CRH by increasing the need for its core products, from cement and aggregates to asphalt and building solutions, supporting a diversified revenue stream.

- Emerging Market Expansion: CRH can target regions with high GDP growth and increasing urbanization, such as Southeast Asia and parts of Africa, to drive sales of its construction materials.

- Re-industrialization Demand: The construction of new factories and data centers, fueled by reshoring initiatives and technological advancements, is expected to boost demand for CRH's products by an estimated 5-10% in key industrial sectors by 2025.

- Infrastructure Investment: Government stimulus packages focused on infrastructure upgrades in both developed and developing nations will create sustained demand for CRH's comprehensive product portfolio.

Advancements in Technology and Digitalization

CRH's commitment to technological advancement and digitalization presents a significant opportunity. Investing in cutting-edge tech can yield innovative, higher-performing, and more sustainable building materials. This also boosts operational efficiency throughout the entire process, from production to delivery.

CRH Ventures, for instance, is actively accelerating the adoption of new technologies. By leveraging data analytics, the company can gain substantial competitive advantages. These efforts are geared towards unlocking new revenue streams and improving existing ones.

- Innovation in Materials: CRH can develop next-generation sustainable and high-performance building products.

- Operational Efficiency Gains: Digitalization promises to streamline processes, reduce waste, and lower costs across the value chain.

- Competitive Edge: Embracing new technologies like AI and IoT can differentiate CRH in a crowded market.

- New Revenue Streams: Ventures into digital solutions and advanced materials can open up previously untapped markets.

CRH is well-positioned to capitalize on substantial government infrastructure spending, particularly in North America and Europe. The U.S. Infrastructure Investment and Jobs Act, with over $1 trillion allocated, is a prime example, with significant disbursements expected through 2024 and 2025. This directly translates to increased demand for CRH's core materials like aggregates and asphalt, as evidenced by strong performance in its Americas Materials segment in 2023, a trend anticipated to continue.

The global shift towards sustainable construction offers a significant avenue for growth. CRH's strategic investments in low-carbon products and circular economy initiatives, alongside acquisitions like Eco Material Technologies, align perfectly with this trend, allowing them to capture market share in environmentally conscious building solutions.

CRH's active mergers and acquisitions strategy, including the significant 2023 acquisition of the remaining stake in CRH Americas Materials for $3.4 billion, strengthens its market presence and unlocks synergies. This consolidation enhances pricing power and facilitates a pivot towards higher-margin, value-added products, crucial for sustained growth.

The company can leverage the robust demand from re-industrialization trends, which are driving the construction of new manufacturing facilities, logistics hubs, and data centers. This surge in industrial development directly fuels the need for CRH's diverse product range, from cement to advanced building solutions, diversifying its revenue streams.

CRH's focus on technological advancement and digitalization presents a key opportunity to innovate and enhance operational efficiency. By embracing new technologies and leveraging data analytics, CRH can develop superior building materials, streamline its value chain, and gain a distinct competitive advantage in the market.

| Opportunity Area | Key Drivers | CRH's Position/Actions | Projected Impact (2024-2025) |

|---|---|---|---|

| Infrastructure Investment | Government stimulus (e.g., US IIJA) | Strong market share in aggregates, asphalt | Sustained demand, revenue growth |

| Sustainable Construction | Decarbonization push, circular economy | Investment in low-carbon products, Eco Material Technologies acquisition | Market share gains in green building solutions |

| Mergers & Acquisitions | Market consolidation, synergy realization | Acquisition of CRH Americas Materials ($3.4B in 2023) | Enhanced pricing power, improved margins |

| Re-industrialization | Reshoring, data center growth | Demand for core products (cement, aggregates) | Diversified revenue, increased industrial sector sales |

| Technology & Digitalization | AI, IoT, data analytics | CRH Ventures, focus on innovation | Operational efficiency, new revenue streams |

Threats

Global macroeconomic uncertainties, particularly persistent inflation and rising interest rates, present a substantial threat to CRH. These conditions can significantly curb overall construction spending, a core market for CRH, and simultaneously escalate the company's operational expenses. For instance, the US Producer Price Index for construction materials saw an increase of 5.2% year-over-year in April 2024, impacting input costs.

The combination of reduced demand and increased costs puts direct pressure on CRH's pricing power and profit margins. If these inflationary pressures and interest rate hikes continue, CRH will need to implement robust strategic pricing adjustments and stringent cost control measures to protect its profitability. The Federal Reserve's decision to keep interest rates steady in early 2024, while a pause, still reflects a higher rate environment than in previous years, impacting borrowing costs and investment decisions across the construction sector.

CRH operates in a highly competitive building materials market, facing pressure from a multitude of local, regional, and global competitors. This intense rivalry can trigger price wars, potentially eroding market share and profitability.

To navigate this challenging environment, CRH must consistently focus on innovation, product differentiation, and cultivating robust customer relationships. For instance, in 2023, CRH reported net sales of $32.3 billion, demonstrating its scale amidst this competitive pressure.

As of early 2024, the global construction materials sector faces a tightening regulatory environment, especially concerning environmental impact. For CRH, this translates to increased compliance costs, potentially impacting profitability if not managed proactively. For instance, new EU directives on embodied carbon in construction, expected to be fully implemented by 2025, will require significant investment in lower-emission materials and processes.

The ongoing push for stricter environmental standards, including those for waste management and resource conservation, presents a significant challenge. While CRH has demonstrated a commitment to sustainability, the escalating nature of these regulations means continuous adaptation and substantial capital expenditure will be necessary to maintain compliance and operational efficiency through 2024 and into 2025.

Supply Chain Disruptions and Raw Material Price Volatility

CRH faces significant risks from disruptions in global supply chains and fluctuating prices for essential raw materials like energy, cement clinker, and aggregates. Geopolitical tensions and environmental events can worsen these challenges, affecting production expenses and delivery schedules.

For instance, in 2024, the construction materials sector continued to grapple with elevated energy costs, impacting CRH's operational expenditures. The company's reliance on global logistics networks also makes it vulnerable to shipping delays and increased freight charges, as seen in recent periods where port congestion has been a recurring issue.

- Supply Chain Vulnerability: CRH's global operations are susceptible to disruptions, impacting its ability to source materials and deliver finished products efficiently.

- Raw Material Price Swings: Volatility in energy and key material prices, such as aggregates and cement clinker, directly influences CRH's cost of goods sold and profit margins.

- Geopolitical and Environmental Risks: External events can trigger price spikes and logistical bottlenecks, posing a constant threat to operational stability and financial performance.

Workforce Challenges and Safety Risks

CRH, like many in the construction sector, grapples with persistent labor shortages. This scarcity directly impacts project timelines and inflates labor expenses, a trend anticipated to continue through 2024 and into 2025. For instance, the U.S. Bureau of Labor Statistics reported a significant gap in construction employment needs throughout 2024.

The inherent dangers of construction present ongoing safety risks. While CRH maintains stringent safety measures, the industry unfortunately saw workplace fatalities in 2024. Such incidents can severely damage reputation, disrupt operations, and invite increased regulatory oversight, adding another layer of operational complexity.

- Labor Shortages: Affecting project timelines and increasing labor costs.

- Safety Risks: Despite protocols, fatalities occurred in 2024, posing reputational and operational threats.

- Regulatory Scrutiny: Safety incidents can lead to heightened government oversight.

Persistent inflation and rising interest rates continue to pose a threat by dampening construction demand and increasing CRH's operational costs. For example, construction material prices saw a 5.2% year-over-year increase in April 2024, directly impacting CRH's input expenses and potentially squeezing profit margins.

Intensified competition within the building materials market could lead to price wars, eroding market share and profitability, despite CRH's substantial net sales of $32.3 billion in 2023.

Stricter environmental regulations, particularly concerning embodied carbon and waste management, are expected to increase compliance costs and necessitate significant capital expenditure for CRH through 2025.

CRH remains vulnerable to supply chain disruptions and volatile raw material prices, exacerbated by geopolitical tensions and environmental events, with elevated energy costs being a notable concern in 2024.

SWOT Analysis Data Sources

This CRH SWOT analysis is built upon a robust foundation of data, drawing from official company financial filings, comprehensive market intelligence reports, and expert industry analysis to provide a well-rounded and accurate strategic assessment.