CRH Porter's Five Forces Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

CRH Bundle

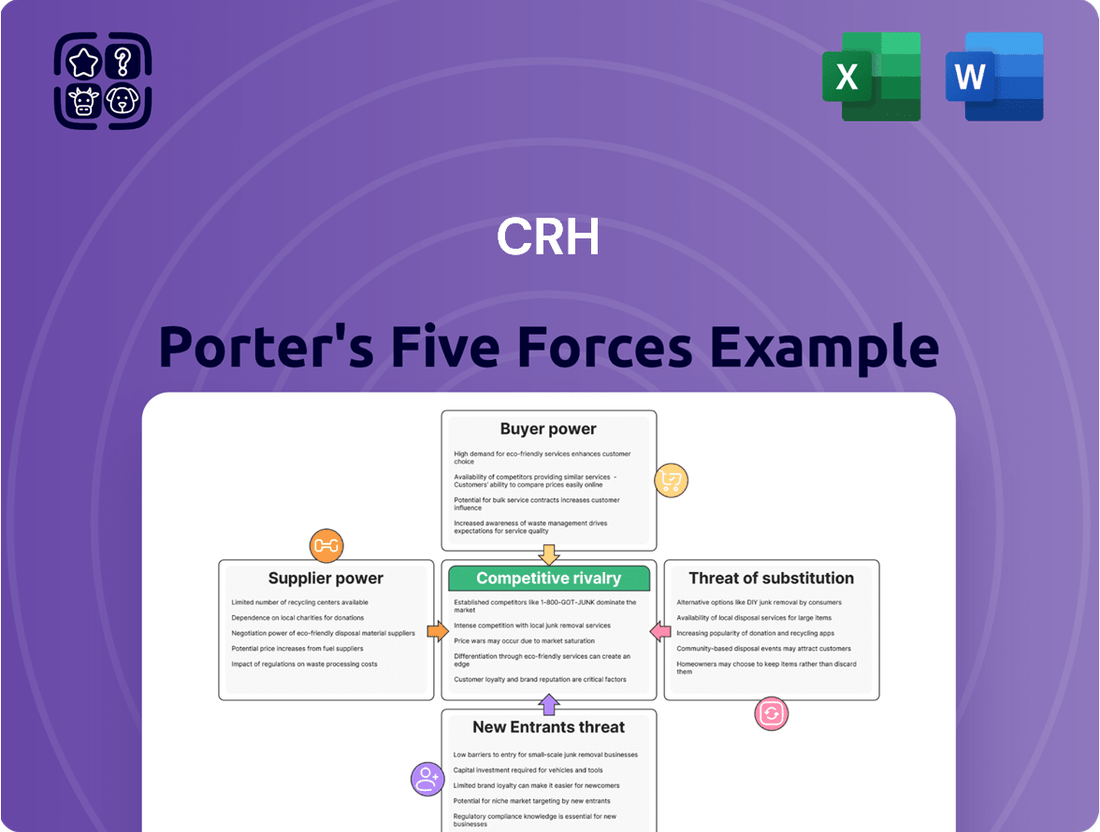

CRH's competitive landscape is shaped by powerful forces, from intense rivalry to the constant threat of substitutes. Understanding these dynamics is crucial for strategic success.

The complete report reveals the real forces shaping CRH’s industry—from supplier influence to threat of new entrants. Gain actionable insights to drive smarter decision-making.

Suppliers Bargaining Power

CRH's reliance on essential raw materials like limestone, aggregates, and energy directly impacts supplier bargaining power. The availability and concentration of suppliers for these critical inputs are key determinants. For instance, in 2024, the global aggregates market, a core component for CRH, saw significant regional variations in supplier concentration, with some areas exhibiting a more fragmented landscape while others were dominated by a few large players.

If CRH faces a limited number of suppliers for a particular material, or if those suppliers offer highly differentiated products with few substitutes, their bargaining power increases. This leverage allows suppliers to potentially dictate terms, including pricing and delivery schedules, which can affect CRH's cost structure and operational efficiency. The construction materials sector, as a whole, often deals with localized supply chains, meaning that in specific geographic markets, supplier concentration for aggregates or cement can indeed be high.

CRH faces significant switching costs for essential inputs like cement, aggregates, and asphalt. Transitioning to a new supplier often necessitates substantial investment in retooling manufacturing equipment to accommodate different material specifications or processing requirements. For instance, altering the chemical composition of asphalt mixes might require recalibrating paving machines, a process that can incur hundreds of thousands of dollars in engineering and testing.

Beyond physical retooling, CRH must also account for the complex and time-consuming process of re-certifying materials. Regulatory bodies and industry standards often mandate rigorous testing and approval for construction materials, which can take several months and significant expenditure. This adds another layer of expense and delay, making a swift switch impractical and costly.

Furthermore, renegotiating contracts with new suppliers, especially for large-volume, long-term agreements crucial for CRH's operations, involves considerable legal and administrative effort. The potential disruption to supply chains and the need to establish new logistical networks also contribute to these high switching costs. In 2023, CRH's cost of goods sold was approximately $23.7 billion, highlighting the sheer scale of inputs and the potential financial impact of supplier disruptions.

CRH's core operations in cement and concrete rely heavily on specific raw materials like aggregates, cementitious materials, and admixtures. The quality and consistency of these inputs directly impact the performance and durability of CRH's final products, making supplier reliability crucial. For instance, the availability of high-quality limestone and gypsum is fundamental to cement production.

The bargaining power of CRH's suppliers is amplified when these essential inputs are difficult to substitute or source from multiple providers. If a particular aggregate source is unique in its properties or if there are limited suppliers of specialized cement additives, those suppliers can exert greater influence over pricing and terms. This is particularly relevant in regional markets where transportation costs for bulk materials are significant.

In 2024, CRH's significant global footprint means it engages with a diverse supplier base, but the strategic importance of key inputs remains. For example, disruptions in the supply of essential raw materials can directly affect production schedules and cost structures across CRH's extensive network of manufacturing facilities.

Threat of Forward Integration by Suppliers

The threat of forward integration by suppliers poses a moderate risk to CRH. Suppliers in the building materials sector, particularly those providing raw materials like aggregates or cement, could potentially move into manufacturing finished products, directly competing with CRH. This would significantly increase their bargaining power by allowing them to capture more of the value chain.

While this threat exists, it is generally considered lower in capital-intensive industries like cement and concrete production, where significant investment is required to establish manufacturing capabilities. For example, setting up a new cement plant involves billions of dollars in capital expenditure. However, specialized suppliers with strong technological expertise or unique raw material access might find it more feasible to integrate forward.

- Forward Integration Risk: Suppliers may enter CRH's market, increasing competition.

- Capital Intensity Barrier: High upfront costs in cement and concrete manufacturing limit this threat.

- Strategic Incentive: Suppliers with unique advantages may seek greater value capture.

CRH's Ability to Backward Integrate

CRH demonstrates a significant capacity for backward integration, a key factor in mitigating supplier power. The company actively quarries its own aggregates and materials, reducing reliance on external suppliers for these essential inputs. This vertical integration strategy allows CRH to control costs and ensure a steady supply chain.

By owning and operating quarries, CRH directly addresses the bargaining power of aggregate suppliers. For instance, in 2023, CRH's Americas Materials segment generated approximately $17.9 billion in sales, with a substantial portion derived from its own material production. This internal sourcing capability acts as a credible threat to external suppliers, limiting their ability to dictate terms and prices.

- Internal Aggregate Production: CRH operates numerous quarries globally, directly supplying its downstream operations.

- Energy Generation: While less prevalent than aggregate quarrying, CRH explores localized energy solutions to reduce reliance on external energy providers.

- Cost Control: Backward integration allows CRH to better manage input costs, directly impacting its profitability.

- Supply Chain Security: Owning key inputs ensures greater stability and predictability in CRH's supply chain.

CRH's suppliers for essential raw materials like aggregates and cement possess moderate bargaining power. This is due to the localized nature of many material sources and the significant switching costs CRH faces, including equipment recalibration and material re-certification, which can run into hundreds of thousands of dollars. In 2023, CRH's cost of goods sold was around $23.7 billion, underscoring the substantial volume of inputs involved and the potential financial impact of supplier leverage.

CRH actively mitigates supplier power through backward integration, notably by operating its own quarries. This strategy ensures a stable supply of key materials and allows for better cost control. For instance, CRH's Americas Materials segment generated approximately $17.9 billion in sales in 2023, with a significant portion stemming from internally sourced materials.

The threat of forward integration by suppliers is generally low due to the immense capital required for cement and concrete manufacturing, often in the billions of dollars for a new plant. However, specialized suppliers with unique advantages might still pose a strategic risk to CRH.

What is included in the product

This analysis dissects the competitive forces impacting CRH, examining the bargaining power of suppliers and buyers, the threat of new entrants and substitutes, and the intensity of rivalry within the building materials industry.

Visualize competitive intensity across all five forces with an intuitive, interactive dashboard, instantly highlighting areas of strategic concern.

Customers Bargaining Power

CRH's customer base is diverse, encompassing large infrastructure projects, commercial developers, and residential builders. The concentration of these customers significantly influences their bargaining power. If a few key clients, such as major government infrastructure tenders or large construction firms, represent a substantial portion of CRH's revenue, they can leverage this volume to negotiate more favorable pricing and terms.

The bargaining power of CRH's customers is significantly influenced by switching costs. For many building materials, especially standardized ones like cement or basic aggregates, switching to a competitor is relatively straightforward and inexpensive, meaning customers have considerable leverage to push for lower prices.

Factors such as the complexity of integrating new suppliers' materials into existing construction projects and the established trust built through long-term relationships can increase these switching costs. However, for specialized or custom-designed building products, the effort and expense involved in a switch are higher, thereby reducing customer power.

In 2024, CRH's diverse product portfolio means that switching costs vary greatly across its customer base. While a small contractor might easily shift suppliers for common materials, a large infrastructure project relying on specific, high-performance concrete admixtures would face greater hurdles in changing providers.

CRH's customers, particularly those involved in large-scale construction projects, exhibit significant price sensitivity for essential materials such as cement, aggregates, and asphalt. Even minor fluctuations in material costs can translate into substantial budget impacts for these projects. For instance, a mere 1% increase in the cost of cement for a major infrastructure project could add millions to the overall expenditure.

This heightened price sensitivity directly translates into increased bargaining power for CRH's customers. They are more inclined to negotiate aggressively for lower prices, seek alternative suppliers, or even delay projects if material costs become prohibitive. In 2023, the global construction market experienced price volatility for key materials, with some regions seeing aggregate prices rise by as much as 8-10% year-on-year, a factor that would have amplified customer pressure on suppliers like CRH.

Customer's Threat of Backward Integration

The threat of backward integration by CRH's customers, such as large construction firms, can significantly impact its pricing power. For instance, a major developer might consider establishing its own concrete batching plants or aggregate quarries. While this requires substantial capital investment, it's a viable option for highly integrated customers seeking greater control over their supply chain.

This potential for customers to produce their own materials directly challenges CRH's market position. If key clients can bypass CRH by manufacturing their own inputs, it reduces CRH's ability to dictate prices and margins. For example, if a large contractor in a specific region decides to vertically integrate, it could directly impact CRH's sales volume and profitability in that area.

- Backward Integration Threat: Customers may establish their own production facilities for key materials.

- Capital Intensity: Setting up production for building materials is capital-intensive, potentially limiting the number of customers who can integrate.

- Impact on Pricing Power: If customers can produce their own materials, CRH's ability to command higher prices diminishes.

- Strategic Consideration: CRH must monitor its major customers for signs of vertical integration to anticipate competitive shifts.

Availability of Substitute Products for Customers

The availability of substitute products significantly influences the bargaining power of customers in the construction materials sector. If customers can easily switch to alternative materials or construction methods, their leverage over suppliers like CRH increases. For instance, the rise of engineered wood products or advanced composite materials can offer viable alternatives to traditional concrete and aggregates, especially in certain building applications. This competitive landscape compels CRH to focus on cost-effectiveness and product differentiation to retain its customer base.

In 2024, the construction industry continued to see innovation in alternative materials. For example, the market for mass timber construction, which uses engineered wood products, has been growing steadily, offering a more sustainable alternative to concrete and steel in some structural applications. This trend, coupled with ongoing advancements in recycled materials and 3D printing in construction, provides customers with more choices. CRH's ability to offer competitive pricing and develop innovative, high-performance products is crucial in mitigating the impact of these substitutes.

- Market Share of Substitute Materials: While CRH is a major player in aggregates, cement, and asphalt, the market for alternative building materials, such as mass timber and recycled plastics for construction, is expanding. For example, the global mass timber market was projected to reach over $10 billion by 2025, indicating a growing customer preference for sustainable alternatives.

- Price Sensitivity of Customers: Customers, particularly in large-scale infrastructure projects, are highly sensitive to material costs. If substitute products offer a significant cost advantage without compromising essential performance metrics, CRH may face pressure to lower its prices.

- Performance and Innovation of Substitutes: The performance characteristics of alternative materials are constantly improving. For instance, some advanced polymers and composites offer lighter weight and greater durability than traditional materials, presenting a direct challenge to CRH's core offerings in specific market segments.

CRH's customers, especially large developers and infrastructure project managers, wield considerable bargaining power due to their significant purchase volumes. This concentration allows them to negotiate aggressively on price and terms, particularly for high-volume, standardized materials like aggregates and cement. For example, a major infrastructure project could account for a substantial percentage of a regional CRH subsidiary's annual sales, giving that client significant leverage.

Switching costs for customers are generally low for CRH's basic materials, empowering them to easily shift suppliers if pricing or terms are not competitive. However, for specialized products or integrated solutions, switching becomes more complex and costly, thereby reducing customer power. In 2024, the ease of sourcing common construction inputs meant that price remained a primary driver for many of CRH's customers.

The threat of backward integration, where large customers might develop their own material production capabilities, also influences CRH's pricing power. While capital-intensive, this option exists for significant players, potentially reducing their reliance on external suppliers like CRH. The availability of substitute materials, such as mass timber or recycled composites, further enhances customer choice and bargaining leverage, especially as these alternatives gain traction for their sustainability and performance benefits.

| Factor | Impact on CRH Customer Bargaining Power | 2024 Context/Example |

|---|---|---|

| Customer Concentration | High for large clients, enabling price negotiation. | A major government infrastructure bid could represent 15-20% of regional sales. |

| Switching Costs | Low for standard materials, high for specialized products. | Easy to switch cement suppliers; difficult to switch custom concrete admixtures. |

| Backward Integration Threat | Potential for large customers to produce own materials. | Large developers may consider establishing captive aggregate quarries or concrete plants. |

| Availability of Substitutes | Increases customer leverage; e.g., mass timber vs. concrete. | Growing market for sustainable building materials provides alternatives. |

Same Document Delivered

CRH Porter's Five Forces Analysis

This preview showcases the complete CRH Porter's Five Forces analysis you'll receive upon purchase, offering a detailed examination of competitive forces within the industry. You are viewing the exact, professionally formatted document, ready for immediate download and application to your strategic planning. This comprehensive analysis will equip you with the insights needed to understand CRH's competitive landscape and inform your business decisions.

Rivalry Among Competitors

CRH operates in markets characterized by a significant number of competitors, ranging from large multinational corporations to smaller, specialized regional and local firms. This diverse competitive landscape means CRH must contend with a variety of strategies, operational scales, and market objectives. For instance, in the aggregates sector, the presence of numerous local quarry operators alongside global giants like Holcim and Cemex creates intense price competition and demands constant innovation.

The diversity in competitor size and strategic focus further amplifies competitive rivalry. While global players might leverage economies of scale and broad product portfolios, smaller, agile regional competitors can often respond more quickly to local market demands and pricing pressures. This fragmentation means CRH faces a complex web of competitive dynamics, where success hinges on understanding and outmaneuvering a wide array of market participants with differing strengths and approaches.

The building materials industry, particularly in CRH's key operating regions like North America and Europe, has experienced varied growth. In 2024, North America's construction market showed resilience, with infrastructure spending and residential construction providing a steady, albeit moderate, growth impetus. Europe, on the other hand, faced a more subdued environment, with certain markets experiencing slower growth due to economic headwinds and fluctuating construction activity.

In mature markets where growth is slower, such as parts of Western Europe, competition among building material suppliers like CRH can become quite intense. Companies often vie more aggressively for existing market share, leading to price pressures and a greater emphasis on operational efficiency and product differentiation. This dynamic can impact profit margins as players compete for a limited pool of new projects.

Conversely, regions exhibiting more rapid growth, often driven by significant infrastructure investment or housing demand booms, tend to see less intense rivalry. When demand outstrips supply, companies can more easily expand their operations and gain market share without directly poaching from competitors. For instance, CRH's performance in markets with strong public infrastructure programs in 2024 benefited from this dynamic, allowing for more straightforward sales growth.

CRH's core products like cement, aggregates, and asphalt are largely seen as commodities, making direct product differentiation challenging. However, CRH actively pursues differentiation through superior product quality, reliable supply chains, and value-added services such as technical support and customized solutions. For instance, in 2023, CRH reported a significant portion of its revenue derived from solutions and products that offer enhanced performance or sustainability features, signaling a move beyond basic material supply.

The construction materials industry generally exhibits low switching costs for customers. Once a supplier is chosen for a project, the effort to switch mid-project is often prohibitive due to logistics and established relationships. Despite this, CRH aims to mitigate intense rivalry by fostering long-term customer loyalty through consistent performance and service excellence, which can indirectly raise the perceived switching cost for clients valuing reliability.

Exit Barriers in the Industry

Exit barriers in the building materials sector are substantial, often trapping companies in the market even when profitability wanes. A primary driver is the high asset specificity; think of specialized cement kilns or concrete batching plants that have little to no alternative use outside the industry. These specialized assets represent significant sunk costs, making liquidation or repurposing incredibly difficult and financially damaging.

Furthermore, long-term contracts with construction firms or infrastructure projects create further exit impediments. Unwinding these commitments can incur penalties and reputational damage, compelling companies to continue operations. The significant capital investment required for production facilities, coupled with the specialized nature of the equipment, means that exiting the market is not a simple matter of closing shop; it often involves substantial write-downs and a complex divestment process.

These high exit barriers can unfortunately lead to prolonged periods of industry overcapacity. When companies struggle to leave, they may continue to produce even at low margins, exacerbating price competition. For instance, in 2023, the global cement industry faced challenges with overcapacity in several regions, partly due to these entrenched exit barriers, leading to intense price pressures that impacted profitability across many players.

- High Asset Specificity: Specialized plants and equipment like cement kilns and concrete batching plants have limited alternative uses, representing significant sunk costs.

- Long-Term Contracts: Commitments to construction and infrastructure projects create contractual obligations that are costly and reputationally damaging to break.

- Capital Intensity: The substantial upfront investment in manufacturing facilities makes exiting the market a financially arduous undertaking, often involving significant asset write-downs.

- Prolonged Overcapacity: Entrenched exit barriers contribute to a situation where companies remain in the market despite low profitability, fueling intense price competition.

Strategic Stakes and Intensity of Competition

CRH operates in a highly competitive arena where market share and profitability are paramount. Rivals, including global giants like Saint-Gobain and Heidelberg Materials, constantly vie for dominance, often through strategic pricing and product innovation. The pursuit of growth, particularly in emerging markets, intensifies this rivalry, as companies invest heavily in capacity and distribution networks.

The intensity of competition is further fueled by companies with substantial fixed costs, such as those involved in large-scale cement or aggregate production. These firms are often compelled to operate at high utilization rates to spread their costs, leading to aggressive sales tactics and price competition to maintain market presence. This dynamic is evident in the European construction materials sector, where overcapacity can trigger intense price wars.

Mergers and acquisitions play a significant role in reshaping the competitive landscape for CRH. For instance, CRH's own strategic acquisitions, such as its significant expansion in the Americas through deals like the acquisition of Ashland's global vinyl business, demonstrate how companies actively consolidate to gain scale, diversify offerings, and enhance their competitive positioning. These transactions can alter market concentration and the strategic calculus of remaining players.

- Strategic Importance: Market share and profitability are key drivers for CRH and its competitors, influencing investment decisions and long-term viability.

- Fixed Costs and Growth: Companies with high fixed costs or aggressive growth objectives often engage in more intense rivalry to secure sales volume and market penetration.

- M&A Impact: Mergers and acquisitions are critical in reshaping the competitive environment, leading to consolidation and altered strategic dynamics among industry players.

- Example of Rivalry: The European construction materials market often sees price competition due to high fixed costs and the need for high capacity utilization.

Competitive rivalry within CRH's operating sectors is notably high, driven by a fragmented market with numerous global and regional players. This intensity is amplified in mature markets where growth is slower, leading to aggressive competition for existing market share and putting pressure on profit margins. For instance, in 2024, CRH navigated a competitive landscape in North America where infrastructure spending provided a steady, albeit moderate, growth impetus, while Europe presented a more subdued environment with heightened price competition.

CRH actively differentiates itself through product quality and service, moving beyond commodity-based competition. However, the largely commoditized nature of core products like cement and aggregates means that price remains a significant factor. This is particularly true in markets experiencing overcapacity, a situation exacerbated by high exit barriers in the industry. For example, the global cement industry in 2023 faced challenges with overcapacity, leading to intense price pressures across many players.

Mergers and acquisitions are key strategic tools used by CRH and its competitors to gain scale and market position, thereby influencing the intensity of rivalry. Companies with substantial fixed costs, such as those in large-scale production, often engage in more aggressive sales tactics to maintain high utilization rates and spread costs. This dynamic is evident in regions like Europe, where overcapacity can trigger price wars.

| Competitor | 2023 Revenue (Approx. USD Billions) | Key Markets |

|---|---|---|

| CRH | $32.8 | North America, Europe |

| Holcim | $22.5 | Global |

| Cemex | $15.7 | Americas, Europe, Asia |

| Saint-Gobain | $52.6 | Global |

| Heidelberg Materials | $23.2 | Global |

SSubstitutes Threaten

The threat of substitutes for CRH's products, particularly in construction materials, is a significant consideration. For instance, while concrete remains a dominant material, alternatives like engineered timber (cross-laminated timber, or CLT) are gaining traction, offering comparable structural performance with a lower carbon footprint. In 2024, the global engineered wood market was projected to reach over $10 billion, indicating a growing acceptance of these alternatives.

The price-performance trade-off is crucial here. While traditional concrete might offer a lower upfront cost in some regions, the increasing focus on sustainability and life-cycle costs can make alternatives like recycled aggregates or advanced composite materials more attractive. For example, the use of recycled concrete aggregates can reduce landfill waste and lower raw material costs, presenting a compelling value proposition for environmentally conscious projects.

The performance characteristics of substitutes also play a vital role. Innovations in steel framing and advanced polymers offer lightweight, high-strength solutions that can compete with concrete in specific applications, such as high-rise construction or modular building. This constant evolution of alternative materials means CRH must continually innovate to maintain its competitive edge.

CRH's customers, primarily in the construction and infrastructure sectors, generally exhibit a moderate propensity to substitute. This is influenced by the established nature of traditional building materials like cement, aggregates, and asphalt, where familiarity and proven performance are highly valued. For instance, while there's growing interest in sustainable alternatives, the widespread adoption of new materials often faces hurdles related to regulatory approval and the perceived risks of unproven performance in large-scale projects. Industry standards and the sheer inertia of long-established supply chains also contribute to this moderate willingness to switch.

The threat of substitutes for CRH's products, particularly cement and aggregates, is a significant factor. Modular construction techniques are gaining traction, potentially reducing the demand for traditional concrete in certain building projects. For instance, advancements in pre-fabricated components and off-site manufacturing can streamline construction timelines, offering an alternative to on-site pouring of ready-mix concrete.

Emerging technologies in binders and materials also present a substitute threat. Innovations in geopolymer concrete or other cementitious alternatives, which utilize industrial byproducts and have a lower carbon footprint, are becoming more viable for specific applications. The increasing availability and acceptance of these alternatives directly challenge CRH's core material offerings.

Cost of Switching to Substitutes for Customers

Customers switching from CRH's traditional building materials like concrete and asphalt to substitutes such as engineered wood or advanced composites face significant costs. These can include redesigning structures to accommodate different material properties, investing in new installation equipment, and retraining construction crews. For instance, a switch to mass timber might necessitate specialized joinery tools and training for carpenters.

These switching costs act as a considerable barrier, effectively dampening the threat of substitutes for CRH. The financial outlay and operational adjustments required to adopt alternative materials mean customers are less likely to make a change unless the benefits are substantial and long-term.

- Design Modifications: Architects and engineers may need to re-engineer building plans to integrate alternative materials, incurring additional design fees.

- New Equipment Investment: Construction firms might need to purchase specialized tools for handling, cutting, or fastening new materials, representing capital expenditure.

- Labor Retraining: Workers may require training on new installation techniques and safety protocols for unfamiliar materials, impacting labor costs and project timelines.

Innovation and Technological Advancements

Innovation and technological advancements present a growing threat of substitution for CRH. The construction industry is seeing rapid development in alternative materials and methods. For instance, advancements in engineered wood products, recycled materials, and 3D printing technologies are offering viable alternatives to traditional concrete and aggregates, CRH's core products.

The pace of innovation is accelerating, with breakthroughs in sustainable materials and advanced composites potentially disrupting established markets. For example, the development of high-strength, lightweight composites could reduce the need for traditional structural materials in certain applications. CRH needs to actively monitor these trends and consider strategic investments to stay ahead.

- Sustainable Materials: Growing demand for eco-friendly building solutions is driving innovation in materials like cross-laminated timber (CLT) and recycled plastics for construction.

- Advanced Composites: Fiber-reinforced polymers (FRPs) offer enhanced durability and reduced weight, presenting a substitute for steel and concrete in specific infrastructure projects.

- Additive Manufacturing (3D Printing): This technology allows for on-site construction with novel material formulations, potentially reducing reliance on pre-fabricated components and traditional supply chains.

- CRH's Response: CRH's 2023 sustainability report highlighted investments in R&D for lower-carbon cement and asphalt alternatives, indicating an awareness of this threat.

The threat of substitutes for CRH's core products like cement and aggregates is evolving, driven by sustainability demands and technological advancements. While traditional materials remain dominant, alternatives such as engineered timber and recycled materials are gaining market share. For instance, the global green building materials market was valued at approximately $250 billion in 2023 and is projected to grow significantly, indicating a strong shift towards sustainable options.

The cost and performance of these substitutes are key factors influencing their adoption. While some alternatives may have higher upfront costs, their long-term benefits, including reduced environmental impact and potential for lower lifecycle costs, are making them increasingly attractive. For example, the increasing carbon pricing mechanisms in various regions could further incentivize the use of lower-emission building materials.

CRH's customers face switching costs, including redesign, new equipment, and labor retraining, which act as a barrier to substitution. However, the growing emphasis on ESG (Environmental, Social, and Governance) factors in construction projects means that the perceived benefits of sustainable alternatives are increasingly outweighing these costs for many clients. CRH's 2023 sustainability report detailed investments in developing lower-carbon alternatives, acknowledging this market trend.

| Substitute Material | Key Advantages | Potential Impact on CRH | Market Growth Indicator (2023/2024 Projections) |

|---|---|---|---|

| Engineered Timber (e.g., CLT) | Lower carbon footprint, lighter weight, faster construction | Reduced demand for concrete in certain structural applications | Global engineered wood market projected to exceed $10 billion in 2024 |

| Recycled Aggregates | Reduced landfill waste, lower raw material costs, environmental benefits | Potential for decreased demand for virgin aggregates | Increasing adoption in infrastructure projects due to circular economy initiatives |

| Advanced Composites (e.g., FRPs) | High strength-to-weight ratio, corrosion resistance, durability | Competition in specialized infrastructure and high-rise construction | Growing use in bridge repairs and reinforcement projects |

| Geopolymer Concrete | Lower CO2 emissions, utilization of industrial byproducts | Direct substitute for traditional Portland cement in specific applications | Increasing research and pilot projects demonstrating viability |

Entrants Threaten

Entering the building materials sector, especially for operations like cement production or aggregate quarrying, demands immense capital. For instance, building a new cement plant can easily cost hundreds of millions of dollars, and acquiring suitable land for aggregate extraction also represents a significant outlay. This financial hurdle effectively deters many potential new competitors from even attempting to enter the market.

CRH, as a global leader, benefits immensely from its established scale, which allows it to absorb these high initial investments more readily than a new entrant. In 2023, CRH reported capital expenditures of approximately €3.4 billion, demonstrating the ongoing investment required to maintain and expand its operations, a level of spending that is prohibitive for most aspiring companies.

Established players like CRH benefit significantly from massive economies of scale, allowing them to achieve lower per-unit production costs. Their decades of operational experience translate into refined processes and superior technical expertise, which are difficult for newcomers to replicate quickly. For instance, in 2023, CRH reported net sales of $32.7 billion, a testament to its vast operational capacity and market penetration.

New entrants face a steep climb to match CRH's cost efficiencies and operational prowess. Competing on price or quality from the outset would be a considerable challenge, as they lack the established supply chains, distribution networks, and brand recognition that CRH commands. CRH's extensive global presence further solidifies this barrier, making it arduous for new companies to gain a foothold.

Newcomers face significant hurdles in accessing established distribution channels for building materials, especially for bulky items that require specialized logistics. CRH benefits from its extensive and efficient supply chain, built over years of operation, making it difficult for new players to replicate this reach and reliability. Securing consistent transportation and market access is a major barrier, as CRH's existing relationships with suppliers and customers provide a distinct advantage.

Regulatory and Environmental Hurdles

The building materials sector, including CRH's operations, faces significant regulatory and environmental hurdles that act as a substantial threat of new entrants. Navigating the complex web of permits, environmental compliance standards, and land-use regulations for quarrying and manufacturing is a formidable challenge.

For instance, in 2024, the European Union continued to strengthen its environmental regulations, impacting material sourcing and production processes. New companies must invest heavily in understanding and adhering to these evolving rules, a cost that often deters smaller, less capitalized entrants. This regulatory landscape, coupled with the potential for local opposition to new industrial sites, creates a high barrier to entry.

- Permitting Complexity: Obtaining necessary permits for quarrying and manufacturing can take years and significant legal and consulting fees, a burden new entrants often cannot bear.

- Environmental Standards: Strict adherence to emissions, waste management, and biodiversity protection regulations requires substantial upfront investment in technology and ongoing operational costs.

- Local Opposition: Community resistance to new quarrying or manufacturing facilities, often driven by environmental concerns, can delay or even halt projects, adding considerable risk and cost for newcomers.

- Incumbent Advantage: Established players like CRH have existing infrastructure, established relationships with regulators, and the financial capacity to manage these ongoing compliance costs, giving them a distinct advantage over potential new competitors.

Brand Loyalty and Product Differentiation

Brand loyalty plays a significant role in the building materials sector, particularly for established players like CRH. While many basic materials are commoditized, CRH's strong brand recognition and consistent delivery of quality and reliable service can deter new companies. Customers often prioritize trust and proven performance, making it challenging for newcomers to build the necessary reputation quickly. For example, in 2024, CRH reported significant revenue, underscoring its market presence and customer base.

New entrants face considerable hurdles in replicating CRH's established relationships and perceived value. Building trust and proving reliability in a market where project timelines and material quality are critical is a slow and costly process. This can manifest in customers sticking with known suppliers even if slightly higher prices are involved, thereby limiting the immediate market share potential for new competitors.

- Brand Recognition: CRH benefits from decades of market presence, fostering customer familiarity and trust.

- Customer Loyalty: Repeat business is driven by consistent product quality and dependable local service, creating a sticky customer base.

- Differentiation: Beyond basic materials, CRH emphasizes reliability and service, which are harder for new entrants to replicate.

- Market Acceptance: New entrants must overcome the ingrained preference for established, trusted suppliers in the building materials industry.

The threat of new entrants in the building materials sector, particularly for companies like CRH, is generally low due to substantial barriers. These include the massive capital required for operations, extensive economies of scale enjoyed by incumbents, and the difficulty in accessing established distribution networks. Furthermore, stringent regulatory and environmental compliance, along with the need to build brand loyalty and trust, create formidable challenges for any newcomer attempting to gain a foothold.

| Barrier | Description | Impact on New Entrants | CRH's Advantage |

|---|---|---|---|

| Capital Requirements | High cost of establishing production facilities (e.g., cement plants) and acquiring land. | Deters many potential entrants due to prohibitive initial investment. | Ability to absorb large capital expenditures. |

| Economies of Scale | Lower per-unit production costs due to large-scale operations and optimized processes. | New entrants struggle to match cost efficiencies, impacting price competitiveness. | Achieves significant cost advantages from vast operational capacity. |

| Distribution Networks | Access to established logistics, transportation, and customer relationships. | Difficult for new players to replicate extensive supply chains and market reach. | Benefits from a robust, efficient, and reliable global supply chain. |

| Regulatory & Environmental | Complex permitting, emissions standards, and land-use regulations. | Requires substantial investment in compliance and navigating lengthy approval processes. | Existing infrastructure and expertise to manage ongoing compliance costs. |

| Brand Loyalty & Trust | Customer preference for established, reliable suppliers with proven track records. | Challenging for new entrants to build reputation and gain customer trust quickly. | Strong brand recognition and a history of consistent quality and service. |

Porter's Five Forces Analysis Data Sources

Our CRH Porter's Five Forces analysis leverages comprehensive data from CRH's annual reports, investor presentations, and SEC filings, alongside industry-specific market research reports and economic indicators.

We integrate insights from CRH's financial statements, competitor analysis, and relevant trade publications to provide a robust assessment of the competitive landscape.