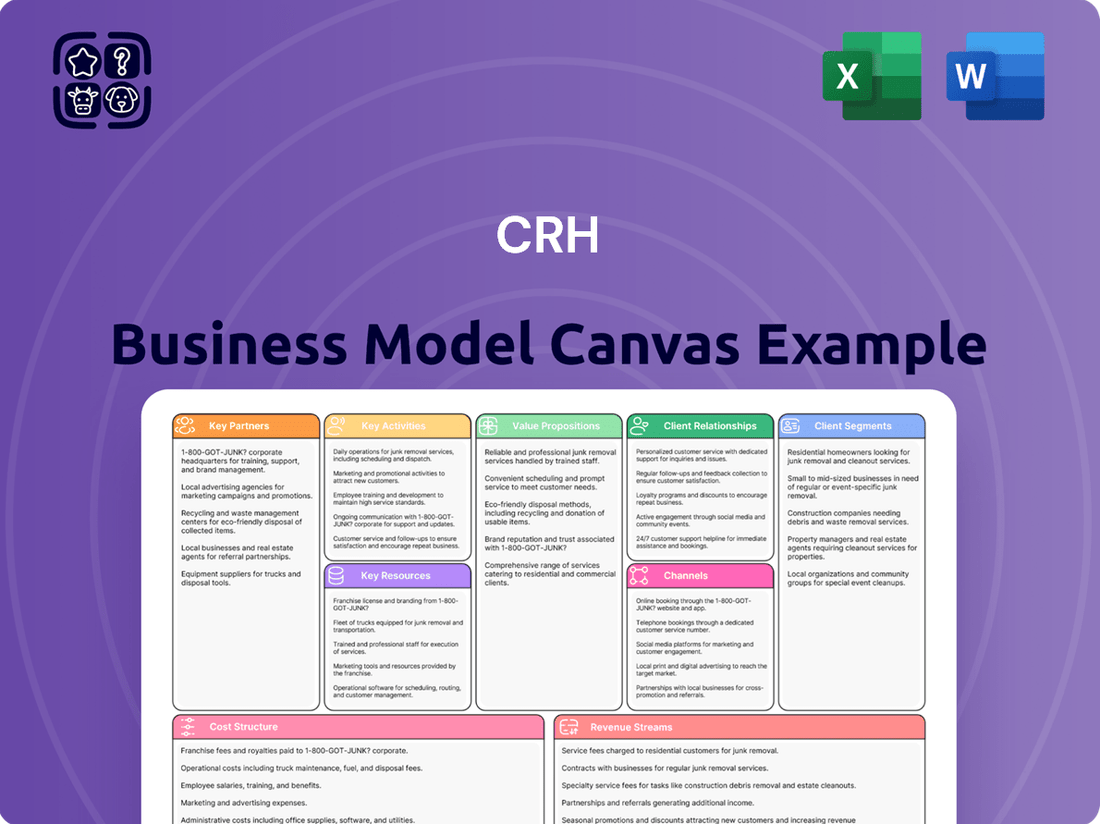

CRH Business Model Canvas

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

CRH Bundle

Unlock the complete strategic blueprint behind CRH's impressive market position. This comprehensive Business Model Canvas dives deep into their customer segments, value propositions, and revenue streams, offering a clear roadmap to their success. Ideal for anyone looking to understand and replicate industry-leading strategies.

Partnerships

CRH actively pursues strategic acquisitions to bolster its market position and product offerings. A prime example is the agreement to acquire Eco Material Technologies for $2.1 billion, which aims to expand its sustainable materials segment, specifically supplementary cementitious materials (SCMs).

In 2024 alone, CRH completed 40 acquisitions totaling $5 billion. These strategic moves are designed to secure leading positions in high-growth markets and ensure a stable, long-term supply of essential materials.

Beyond acquisitions, CRH also engages in joint ventures to drive technological innovation. The collaboration with FBR Limited for a U.S. Demonstration Programme focused on robotic block-laying exemplifies this approach to developing and implementing new solutions.

CRH actively cultivates key partnerships with leading technology firms and academic institutions to foster innovation in construction materials. These collaborations are vital for advancing sustainable solutions and enhancing product performance across the industry.

Strategic investments through CRH Ventures exemplify this approach. For instance, their investment in Sublime Systems aims to revolutionize cement production with more sustainable methods, while the partnership with FIDO AI focuses on developing advanced leak detection software, crucial for infrastructure maintenance and water conservation efforts.

These technology and innovation collaborations are instrumental in CRH's mission to tackle significant global challenges. By focusing on areas like decarbonization, circular economy principles, and efficient resource management, CRH leverages these partnerships to drive meaningful progress within the construction sector.

CRH depends on a wide array of suppliers for crucial raw materials, equipment, and services necessary for its operations. The company actively cultivates a robust and dependable supply chain to guarantee consistent access to needed inputs.

For instance, CRH's strategic acquisition of Eco Material Technologies in 2023 highlights its commitment to securing key materials like fly ash and pozzolans. These are fundamental for developing and producing CRH's lower-carbon cement solutions, aligning with sustainability goals.

Research and Development Institutions

CRH actively partners with universities and specialized research centers to drive innovation in construction materials. These collaborations are vital for exploring advanced technologies and enhancing product performance, ensuring CRH remains a leader in material science. For instance, in 2023, CRH reported significant investment in R&D, fueling projects focused on sustainable concrete formulations and advanced insulation materials, aligning with global green building initiatives.

These research partnerships are crucial for developing next-generation building solutions that address critical industry challenges and sustainability targets. By working with R&D institutions, CRH gains access to cutting-edge scientific knowledge and testing capabilities. This strategic approach allows CRH to bring novel products to market more efficiently, such as low-carbon cement alternatives and recycled aggregate technologies, which are increasingly in demand.

- Collaborations with leading universities and research institutes.

- Focus on material science and sustainable construction technologies.

- Development of innovative products like low-carbon cement and recycled materials.

- Driving advancements to meet evolving industry standards and environmental goals.

Local Community and Government Agencies

CRH's decentralized approach necessitates strong ties with local communities and government bodies to navigate permitting processes and regulatory landscapes effectively. In 2024, CRH continued to engage with these stakeholders to ensure compliance and foster goodwill, which is crucial for their on-the-ground operations. This collaboration is fundamental for securing approvals for new projects and maintaining operational licenses across their diverse markets.

These partnerships are also vital for CRH's contribution to local infrastructure development. By working with government agencies, CRH can align its projects with public sector needs and potentially leverage public funding opportunities. For instance, in 2024, CRH was involved in numerous road and infrastructure projects that received government backing, highlighting the symbiotic relationship between the company and public initiatives.

- Permitting and Regulatory Compliance: CRH relies on local government agencies for obtaining permits and adhering to zoning laws, which are essential for project execution.

- Infrastructure Project Collaboration: Partnerships facilitate CRH's participation in public infrastructure projects, often co-funded or supported by government bodies.

- Community Engagement: Building positive relationships with local communities ensures social license to operate and can lead to collaborative development opportunities.

- Access to Public Funding: Engaging with government agencies allows CRH to tap into public sector funding for infrastructure programs, enhancing project viability.

CRH's key partnerships are diverse, encompassing strategic acquisitions and collaborations aimed at innovation and market expansion. The company actively partners with universities and research institutions to drive advancements in material science and sustainable construction technologies.

In 2024, CRH completed 40 acquisitions totaling $5 billion, demonstrating a strong focus on inorganic growth and securing market leadership. These partnerships are crucial for developing innovative products like low-carbon cement and recycled materials, aligning with evolving industry standards and environmental goals.

CRH also engages with government bodies and local communities to navigate regulatory landscapes and collaborate on infrastructure projects, ensuring operational continuity and fostering positive stakeholder relationships.

| Partnership Type | Focus Area | Examples/Impact | 2024 Data/Context |

|---|---|---|---|

| Strategic Acquisitions | Market Expansion, Product Enhancement | Eco Material Technologies acquisition ($2.1B) for SCMs | 40 acquisitions totaling $5B |

| Research & Development Collaborations | Material Science, Sustainability | Universities, research centers for low-carbon cement, recycled aggregates | Significant R&D investment in sustainable formulations |

| Technology Partnerships | Innovation, Efficiency | FBR Limited (robotic block-laying), FIDO AI (leak detection) | Investment in Sublime Systems for cement production |

| Government & Community Engagement | Regulatory Compliance, Infrastructure Projects | Permitting, public infrastructure development, community relations | Continued engagement for compliance and project approvals |

What is included in the product

A structured framework detailing CRH's approach to creating, delivering, and capturing value across its diverse building materials operations.

It outlines CRH's key partners, activities, and resources, while also defining customer relationships, channels, and value propositions for its global markets.

The CRH Business Model Canvas streamlines complex strategies by visually mapping all essential business elements, relieving the pain of scattered information and disjointed planning.

It acts as a single, coherent document that alleviates the frustration of piecing together various business aspects, making strategic alignment effortless.

Activities

CRH's primary focus is the extensive manufacturing and distribution of fundamental construction supplies. This encompasses items like cement, aggregates, asphalt, and various concrete products, forming the backbone of infrastructure projects.

The company's manufacturing operations are designed for vertical integration, meaning CRH controls many stages of production. This approach allows for greater oversight of product quality and a more secure supply chain, which is crucial for consistent delivery.

In 2023, CRH reported significant revenue, with its Americas Materials segment alone generating approximately $20.4 billion. This highlights the sheer scale of their manufacturing and production activities across diverse product lines and geographies.

CRH's core activities revolve around efficiently managing its vast global supply chain. This involves everything from sourcing essential raw materials like aggregates and cement to ensuring the timely delivery of finished construction products to diverse project sites.

A key focus is optimizing logistics across various transportation modes, including rail, sea, and inland waterways. This multimodal approach helps CRH minimize its environmental footprint and maintain reliable, cost-effective delivery schedules, which is crucial for project timelines.

For instance, in 2023, CRH reported significant investments in logistics infrastructure and fleet modernization to further enhance efficiency and sustainability across its operations. This commitment underpins their ability to serve a global customer base effectively.

CRH is deeply invested in research and development, focusing on creating building materials that are not only innovative but also sustainable. This includes a strong push towards lower-carbon products and embracing circular economy principles. For instance, in 2023, CRH reported a significant increase in its sustainability-linked investments, with a substantial portion allocated to R&D initiatives aimed at reducing the environmental footprint of construction.

The company actively explores and invests in new technologies, often through pilot projects. These initiatives frequently center on practical applications like reusing waste materials, developing alternative, more eco-friendly materials, and designing infrastructure that can withstand the impacts of climate change. This forward-thinking approach ensures CRH remains at the forefront of developing solutions for a more resilient built environment.

Acquisitions and Portfolio Optimization

CRH's core activities revolve around strategic acquisitions and divestitures to continuously refine its business portfolio. This involves actively seeking out value-accretive deals that not only expand its market reach but also bolster its presence in higher-growth sectors, particularly those focused on sustainable building materials and innovative solutions.

In 2024, CRH continued this disciplined approach. For instance, the company completed several bolt-on acquisitions in North America and Europe, enhancing its product offerings in areas like precast concrete and asphalt. These moves are designed to strengthen its competitive position and capitalize on evolving market demands for greener construction practices.

The company's commitment to portfolio optimization is evident in its ongoing review of underperforming assets and strategic divestitures. This ensures capital is allocated to the most promising opportunities, driving long-term shareholder value and aligning with its strategic goals of becoming a leading provider of sustainable building solutions.

- Value-Accretive Acquisitions: CRH actively pursues acquisitions that enhance its market position and profitability.

- Portfolio Optimization: The company regularly reviews and divests non-core or underperforming assets.

- Focus on Sustainability: Strategic investments are directed towards businesses offering sustainable building materials and solutions.

- Market Expansion: Acquisitions are targeted to enter attractive, higher-growth geographic markets and product segments.

Customer-Connected Solutions and Service Delivery

CRH's key activities revolve around delivering customer-connected solutions and services. This means they don't just supply materials; they integrate their products and services to offer comprehensive answers to customer problems. For instance, CRH aims to provide end-to-end solutions that tackle specific challenges faced by their clients.

These tailored solutions consider critical factors such as evolving building regulations, persistent labor shortages, tight project timelines, paramount safety requirements, and the growing demand for sustainable building practices. This integrated approach ensures CRH is a valuable partner in overcoming complex construction hurdles.

- Integrated Solutions: CRH combines materials, products, and services to offer complete project solutions.

- Customer-Centricity: The focus is on understanding and addressing specific customer needs and challenges.

- Adaptability: Solutions are customized to meet diverse project requirements, including regulatory compliance and sustainability goals.

- Value Addition: CRH goes beyond basic supply to provide expertise and support that enhances project outcomes.

CRH's key activities center on strategic acquisitions and divestitures to continually shape its business portfolio. This involves actively seeking value-adding deals that expand market reach and strengthen its position in high-growth sectors, particularly sustainable building materials. In 2024, CRH continued its disciplined approach by completing several bolt-on acquisitions in North America and Europe, enhancing its offerings in areas like precast concrete and asphalt to align with market demands for greener construction.

Full Document Unlocks After Purchase

Business Model Canvas

The CRH Business Model Canvas preview you are viewing is the exact document you will receive upon purchase. This means you are seeing the final, complete file, not a sample or mockup. Once your order is processed, you will gain full access to this professionally structured and ready-to-use Business Model Canvas.

Resources

CRH's extensive network of over 3,800 operating locations across 28 countries, with a strong foothold in North America and Europe, is a cornerstone of its business model. This vast global footprint ensures proximity to customers and efficient local production and distribution of its comprehensive building materials portfolio.

These numerous production facilities and operating sites are critical for delivering essential construction products like cement, aggregates, and asphalt directly to local markets. In 2024, CRH continued to leverage this infrastructure to serve a wide range of construction projects, from residential developments to major infrastructure upgrades, underscoring the strategic importance of its physical presence.

CRH's diverse portfolio is its bedrock, encompassing essential building materials like cement, aggregates, and asphalt. This comprehensive range also includes ready-mixed concrete and precast concrete products, catering to a wide array of construction demands.

This extensive product offering enables CRH to be a one-stop shop for many projects, serving sectors from infrastructure to residential building. For instance, in 2023, CRH reported revenue of $32.7 billion, a testament to the demand for its broad material solutions.

CRH's operational success hinges on its vast workforce, numbering around 80,000 employees globally. This substantial human capital is instrumental in delivering the company's industry-leading financial performance and effectively serving its diverse customer base.

The company actively cultivates an environment that empowers its employees and encourages an entrepreneurial spirit. This approach is key to attracting a broad spectrum of specialized skills essential for CRH's complex operations and strategic growth initiatives.

Strategic Aggregate Reserves and Raw Material Access

CRH's strategic aggregate reserves and raw material access are cornerstones of its business model, guaranteeing a steady flow of essential inputs for its vast production network. This vertical integration is crucial for maintaining cost competitiveness and operational reliability.

Acquisitions play a vital role in bolstering CRH's raw material base. For instance, in 2024, CRH continued its strategic expansion, notably acquiring significant aggregate reserves in Colorado, thereby strengthening its regional supply chain and market position.

- Strategic Asset Ownership: Direct control over aggregate quarries and other raw material sources minimizes reliance on external suppliers and price volatility.

- Acquisition-Driven Growth: Expansion of the raw material portfolio through targeted acquisitions, such as the Colorado reserves in 2024, is a key growth strategy.

- Supply Chain Security: Ensures consistent availability of materials for the company's extensive cement, aggregates, and building products manufacturing operations.

Advanced Technology and Innovation Capabilities

CRH's commitment to advanced technology and innovation is a cornerstone of its business model, driving efficiency and sustainability. Through CRH Ventures, the company actively invests in cutting-edge solutions like artificial intelligence and robotics. These investments are designed to streamline operations, reduce waste, and create more environmentally friendly building materials and techniques. For instance, in 2023, CRH Ventures supported startups focused on digital construction and advanced materials, signaling a strategic push towards technological integration.

This focus on innovation provides CRH with a significant competitive edge. By adopting and developing new technologies, CRH can offer superior products and services, optimize its supply chain, and respond more effectively to evolving market demands. The company's pursuit of digital transformation and automation in its manufacturing and logistics processes directly contributes to its ability to deliver value and maintain market leadership.

Key aspects of CRH's Advanced Technology and Innovation Capabilities include:

- Investment in AI and Robotics: CRH Ventures actively seeks out and invests in companies developing AI and robotic solutions to enhance operational efficiency and safety across its sites.

- Development of Sustainable Products: Innovation efforts are directed towards creating greener building materials and construction methods, aligning with global sustainability goals and increasing market demand.

- Digital Transformation: CRH is implementing digital tools and platforms to improve data analytics, supply chain management, and customer engagement, fostering a more agile and responsive business.

- Partnerships and Ventures: Strategic collaborations and investments through CRH Ventures allow the company to access and integrate emerging technologies, ensuring it remains at the forefront of industry advancements.

CRH's key resources are its extensive global operating network, a diverse product portfolio, a skilled workforce, strategic raw material access, and a commitment to advanced technology and innovation. These elements collectively enable CRH to efficiently produce and distribute essential building materials, serve a broad customer base, and maintain a competitive edge in the market.

The company's vast network of over 3,800 locations across 28 countries, particularly strong in North America and Europe, facilitates local production and distribution. CRH's comprehensive product range includes cement, aggregates, asphalt, and ready-mixed concrete, making it a one-stop solution for various construction needs. In 2023, CRH achieved revenues of $32.7 billion, highlighting the strong demand for its offerings.

With approximately 80,000 employees globally, CRH leverages its human capital for operational excellence and customer service. The company's strategic ownership of aggregate reserves and raw material access, bolstered by acquisitions like Colorado aggregate reserves in 2024, ensures supply chain security and cost competitiveness. Furthermore, CRH Ventures invests in AI, robotics, and digital transformation to drive efficiency and sustainability.

| Key Resource | Description | 2023/2024 Impact |

| Global Operating Network | Over 3,800 locations in 28 countries. | Facilitates efficient local production and distribution. |

| Diverse Product Portfolio | Cement, aggregates, asphalt, ready-mixed concrete, etc. | Catters to broad construction demands; $32.7 billion revenue in 2023. |

| Human Capital | Approximately 80,000 employees worldwide. | Drives operational success and customer service. |

| Raw Material Access | Strategic aggregate reserves and acquisitions. | Ensures supply chain security; e.g., Colorado reserves in 2024. |

| Technology & Innovation | Investments in AI, robotics, digital transformation via CRH Ventures. | Enhances efficiency, sustainability, and competitive advantage. |

Value Propositions

CRH provides a broad spectrum of building materials and services, acting as a one-stop shop that streamlines complicated construction projects for clients. This comprehensive offering helps customers navigate challenges such as evolving building codes, a scarcity of skilled labor, and tight project deadlines.

In 2024, CRH's commitment to integrated solutions was evident in its robust performance, with reported sales reaching approximately $32.4 billion for the first half of the year. This demonstrates their ability to deliver value across the entire construction lifecycle.

CRH champions sustainable building materials, offering products that significantly lower environmental impact. This commitment is evident in their portfolio, which increasingly features items crafted from recycled content and manufactured using renewable energy sources.

By prioritizing these eco-friendly options, CRH empowers its customers to achieve their own sustainability targets and reduce their overall carbon footprint. In 2023, CRH reported that 70% of its product portfolio contributed to sustainable solutions, a testament to this leadership.

CRH's unrivaled scale and market leadership in building materials, particularly in North America and Europe, translate into significant advantages for its customers. This extensive reach ensures a reliable supply chain and competitive pricing, crucial for the success of large-scale infrastructure and commercial projects. For instance, CRH's operations in 2023 generated €32.7 billion in sales, underscoring its dominant market presence and ability to serve diverse project needs across vast geographies.

Customer-Connected Approach and Local Market Responsiveness

CRH's decentralized structure fosters a deep connection with customers, enabling them to swiftly adapt to local market demands. This responsiveness is key to their strategy, allowing them to customize offerings and build lasting relationships through effective problem-solving for specific project needs.

This customer-centricity translates into tangible business benefits. For instance, CRH's focus on local market responsiveness was evident in their 2023 performance, where they achieved €32.8 billion in sales, driven by strong demand in key sectors like infrastructure and construction, directly linked to their ability to meet localized project specifications.

- Decentralized Operations: CRH empowers local management teams to make decisions, ensuring agile responses to regional market dynamics.

- Tailored Solutions: The company develops specific product and service packages that directly address the unique requirements of individual projects and customer needs.

- Repeat Business: By consistently meeting and exceeding local customer expectations, CRH cultivates loyalty and secures ongoing project opportunities.

- Market Penetration: This approach allows CRH to effectively penetrate diverse local markets by understanding and catering to their distinct challenges and opportunities.

Enhanced Productivity, Efficiency, and Safety on Job Sites

CRH's commitment to enhancing job site operations is evident in its focus on boosting productivity, efficiency, and safety through advanced solutions. For instance, their development of robotic block-laying technology directly tackles labor shortages and aims for superior, more consistent construction outcomes.

This technological push is crucial given industry trends. In 2024, the construction sector continued to grapple with skilled labor deficits, with reports indicating that over 70% of construction firms experienced difficulties in finding qualified workers. CRH's innovations offer a tangible response to this persistent challenge.

- Increased Output: Robotic systems can operate continuously, potentially increasing block-laying output by 30-50% compared to manual methods.

- Reduced Rework: Enhanced precision in automated processes leads to fewer errors and less need for costly rework, improving overall project efficiency.

- Improved Safety: Automating repetitive and physically demanding tasks like block laying significantly reduces the risk of worker injuries on site.

CRH's value proposition centers on providing integrated building solutions that simplify complex projects, championing sustainable materials to meet environmental goals, and leveraging its extensive market presence for supply chain reliability and competitive pricing.

The company’s customer-centric, decentralized approach ensures tailored solutions and fosters repeat business by effectively addressing local market needs and project specifications.

CRH also enhances job site operations by focusing on productivity, efficiency, and safety through innovative solutions like robotic block-laying, directly addressing industry challenges such as labor shortages.

| Value Proposition Aspect | Description | Supporting Data/Fact (2023/2024) |

|---|---|---|

| Integrated Solutions | Streamlines complex construction projects with a broad spectrum of materials and services. | First half 2024 sales: ~$32.4 billion. |

| Sustainability Focus | Offers eco-friendly materials that help customers reduce environmental impact. | 70% of product portfolio contributed to sustainable solutions in 2023. |

| Market Leadership & Scale | Ensures supply chain reliability and competitive pricing through extensive reach. | 2023 sales: €32.7 billion. |

| Local Responsiveness | Tailors offerings to unique project requirements via a decentralized structure. | 2023 sales: €32.8 billion, driven by meeting localized specifications. |

| Job Site Enhancement | Boosts productivity, efficiency, and safety with advanced technologies. | Addresses >70% of construction firms facing skilled labor shortages in 2024. |

Customer Relationships

CRH's commitment to customer relationships is underscored by its dedicated sales and technical support teams. These teams offer specialized expertise, guiding clients from initial project conception through to completion, ensuring a seamless experience.

This hands-on approach allows CRH to deeply understand and effectively address specific customer requirements. For instance, in 2024, CRH reported a significant increase in customer satisfaction scores directly attributed to the proactive engagement from these support functions.

CRH actively partners with customers to tackle their specific project hurdles, blending its extensive range of materials, products, and services into customized solutions. This customer-centric strategy is fundamental to creating lasting value and fostering loyalty.

In 2024, CRH's commitment to collaborative development was evident in its work with infrastructure projects, where tailoring solutions to meet stringent performance and environmental requirements proved crucial for securing repeat contracts and expanding market share.

CRH cultivates enduring partnerships for substantial projects, becoming a cornerstone supplier in infrastructure, commercial, and residential sectors. This strategic approach ensures consistent engagement and unwavering support, vital for navigating the complexities of major developments.

In 2024, CRH's commitment to these long-term relationships is evident in its extensive project pipeline. For instance, the company is a key partner in several multi-billion dollar transportation infrastructure upgrades across North America and Europe, demonstrating its capacity to deliver on large-scale, complex undertakings.

Digital Platforms and Online Resources

CRH leverages digital platforms and online resources to offer comprehensive product information, detailed technical specifications, and accessible order management tools. This digital engagement significantly enhances customer convenience and accessibility, complementing traditional sales channels.

These online resources are crucial for providing up-to-date market insights and support materials. For instance, in 2024, many B2B customers increasingly rely on supplier websites for initial product research and comparison, making a robust digital presence a key differentiator.

- Digital Product Catalogs: Providing detailed specifications, datasheets, and application guides for their extensive product range.

- Online Order Portals: Enabling customers to place, track, and manage orders efficiently, reducing administrative overhead.

- Technical Support Hubs: Offering FAQs, troubleshooting guides, and direct contact options for technical assistance.

- Customer Account Management: Allowing clients to view purchase history, manage account details, and access personalized content.

Sustainability Reporting and Engagement

CRH actively engages with its customers on sustainability, offering detailed reports that highlight how its products and solutions contribute to a greener built environment. This proactive approach resonates with major clients like Google, which, in 2023, announced a goal to operate all its data centers on 24/7 carbon-free energy by 2030, underscoring the increasing importance of sustainability in procurement decisions.

This commitment to transparency and demonstrable impact is crucial for fostering strong customer relationships in today's market. For instance, CRH's focus on circular economy principles, such as the use of recycled materials in asphalt, directly addresses customer needs for reduced embodied carbon in their projects.

- Customer Demand for Sustainability: Growing pressure from clients, including large corporations with ambitious environmental targets, drives CRH's sustainability reporting.

- Product Contribution: CRH showcases how its materials and solutions enable customers to achieve their own sustainability goals, such as reducing embodied carbon.

- Transparency and Reporting: Providing clear, data-driven sustainability reports builds trust and strengthens partnerships with environmentally conscious customers.

- Market Differentiation: A strong sustainability narrative helps CRH stand out in a competitive market, attracting and retaining clients who prioritize ESG performance.

CRH's customer relationships are built on a foundation of dedicated support, collaborative problem-solving, and a strong digital presence. The company's sales and technical teams act as partners, guiding clients through projects and tailoring solutions to meet specific needs, which contributed to improved customer satisfaction in 2024.

This customer-centric approach extends to fostering long-term partnerships, particularly in large-scale infrastructure projects where CRH's materials and expertise are vital. The company's digital platforms enhance convenience by providing easy access to product information and order management, a crucial element for B2B clients in 2024.

Furthermore, CRH actively engages customers on sustainability, demonstrating how its products support environmental goals. This focus on transparency and shared values strengthens loyalty and positions CRH as a preferred partner for clients prioritizing ESG performance.

| Customer Relationship Aspect | 2024 Focus/Data | Impact |

|---|---|---|

| Dedicated Support Teams | Increased customer satisfaction scores | Enhanced project success and loyalty |

| Collaborative Solution Development | Tailored offerings for infrastructure projects | Secured repeat contracts and market share |

| Digital Engagement | Robust online product catalogs and order portals | Improved customer convenience and accessibility |

| Sustainability Partnership | Reporting on product contribution to greener built environments | Attracted and retained environmentally conscious clients |

Channels

CRH leverages a robust direct sales force and a vast network of local operating companies to serve its diverse customer base. This decentralized approach ensures deep market penetration and allows for tailored responses to regional demands.

In 2023, CRH reported net sales of €32.8 billion, underscoring the scale of its operations and its ability to reach customers effectively through these direct channels. The company's strategy emphasizes local expertise, enabling it to adapt quickly to market specificities.

CRH leverages its extensive company-owned distribution network, encompassing numerous quarries, asphalt plants, and ready-mix concrete facilities. This robust infrastructure allows for direct control over product delivery to construction sites, enhancing logistical efficiency and reliability.

This vertical integration, a core component of CRH's business model, enables stringent quality control throughout the production and delivery process. For instance, in 2023, CRH’s Americas Materials segment reported net sales of $24.5 billion, underscoring the scale and importance of its operational footprint.

CRH's corporate website acts as a vital digital cornerstone, offering a wealth of information for investors and customers alike. It's the primary source for financial results, detailed sustainability reports, and overarching company news, ensuring transparency and accessibility.

While not a direct sales platform, this online portal significantly enhances customer engagement by providing easy access to product information and company updates. It plays a crucial role in disseminating CRH's narrative and value proposition to a global audience.

In 2023, CRH reported a significant increase in website traffic, reflecting its growing importance as a communication channel. The site's content strategy focuses on delivering clear, concise information, supporting CRH's commitment to stakeholder communication and brand building.

Strategic Acquisitions and New Business Integration

Strategic acquisitions are a core driver for CRH's market expansion, allowing the company to enter new geographies and tap into diverse customer bases. Throughout 2024, CRH actively pursued and integrated numerous acquisitions, significantly bolstering its presence in key markets.

These integrations are crucial for broadening CRH's operational footprint and enhancing its product and service portfolios. For instance, acquisitions in North America and Europe during 2024 have provided access to new technologies and complementary businesses.

- Market Expansion: CRH's acquisition strategy in 2024 focused on entering high-growth regions and strengthening its position in existing markets.

- New Customer Segments: By acquiring businesses with established customer relationships, CRH effectively reached previously untapped market segments.

- Product Diversification: The integration of acquired companies has expanded CRH's range of building materials and solutions offered to customers.

- Geographic Reach: Acquisitions in 2024 notably increased CRH's operational presence across Europe and North America, enhancing its global capabilities.

Industry Associations and Trade Shows

CRH actively participates in key industry associations and trade shows, providing a vital channel for showcasing its extensive product portfolio and innovative solutions. These events are crucial for direct engagement with a broad spectrum of potential customers, from large-scale developers to specialized contractors. In 2024, CRH was a prominent exhibitor at events like World of Concrete and bauma, which attract hundreds of thousands of industry professionals globally, offering a tangible platform to demonstrate new materials and construction techniques.

These gatherings are instrumental in staying ahead of evolving market demands and technological advancements within the construction materials sector. By interacting with peers and clients, CRH gains invaluable insights into emerging trends, regulatory changes, and customer needs. For instance, discussions at these shows in 2024 highlighted a growing demand for sustainable building materials, a key focus area for CRH’s innovation pipeline.

- Market Visibility: Trade shows offer CRH significant brand exposure, connecting with over 150,000 attendees at major 2024 events.

- Customer Engagement: Direct interaction at these forums allows for immediate feedback and relationship building with key clients and prospects.

- Trend Identification: Participation in industry associations provides early access to research and discussions on future market needs and technological shifts.

- Networking Opportunities: CRH leverages these events to foster partnerships and collaborations within the wider construction ecosystem.

CRH's channels are a multi-faceted approach combining direct sales, extensive distribution networks, and strategic digital presence. The company's direct sales force and local operating companies ensure deep market penetration, allowing for tailored solutions to diverse customer needs.

The company's owned distribution network, including quarries and plants, provides direct control over product delivery, enhancing efficiency. CRH's corporate website serves as a key information hub, supporting transparency and brand building, with notable traffic increases in 2023.

Strategic acquisitions in 2024 significantly expanded CRH's reach and customer base, integrating new technologies and complementary businesses. Participation in industry events like World of Concrete in 2024 also provided crucial market visibility and customer engagement opportunities.

| Channel Type | Description | Key 2023/2024 Data/Impact |

|---|---|---|

| Direct Sales Force & Local Companies | Personalized customer engagement and market-specific solutions. | Underpins €32.8 billion net sales in 2023 through deep market penetration. |

| Company-Owned Distribution Network | Logistical control from production to delivery. | Facilitates efficient delivery from numerous quarries and plants. |

| Corporate Website | Information hub for investors and customers. | Significant traffic growth in 2023, enhancing transparency and brand narrative. |

| Strategic Acquisitions | Market expansion and customer base diversification. | Numerous integrations in 2024 expanded geographic presence and product portfolios. |

| Industry Associations & Trade Shows | Product showcasing and direct customer interaction. | Prominent presence at 2024 events like bauma, engaging with industry professionals. |

Customer Segments

CRH is a key supplier for vital infrastructure projects, offering aggregates, asphalt, and concrete for roads, bridges, and communication networks. This sector is a significant growth area, driven by substantial government spending. For instance, in 2024, the US alone is projected to invest over $150 billion in infrastructure improvements, a substantial portion of which directly benefits CRH's core offerings.

Commercial construction clients, from developers of high-rise offices to those building sports arenas, rely on CRH for a comprehensive suite of building materials. These projects often involve intricate designs and demanding specifications for both internal fit-outs and external facades.

CRH's offerings cater to the unique needs of complex non-residential construction, supplying essential components for structural integrity and aesthetic finishes. For instance, in 2024, the global commercial construction market was projected to reach trillions, with significant investment in infrastructure and large-scale developments.

CRH directly serves the residential construction market, providing essential materials for everything from foundational elements in new homes to the finishing touches on neighborhood streets. This includes a significant focus on the growing demand for enhanced outdoor living spaces, offering a wide array of pavers, landscaping supplies, and related products that cater to both aesthetic appeal and functional durability.

The company's reach within this segment encompasses both new residential developments and the substantial renovation market. In 2023, CRH reported significant activity in its Americas Materials segment, which heavily includes residential projects, demonstrating robust demand for its diverse product portfolio. For instance, the demand for residential construction, particularly in the single-family home segment, remained a key driver, supported by factors such as demographic shifts and evolving housing preferences.

Specialized Industrial and Manufacturing Projects

CRH caters to specialized industrial and manufacturing projects, a segment gaining traction due to the reshoring of supply chains and increased domestic manufacturing. These projects often demand highly specific material formulations and precise delivery timelines to maintain production continuity.

This focus on specialized needs means CRH must be agile in its production and logistics. For instance, a surge in onshoring initiatives in the US, projected to add trillions to the manufacturing sector by 2030, directly impacts demand for tailored construction materials for new or expanded facilities.

- Custom Material Solutions: Providing concrete mixes with specific aggregate types, strengths, or chemical additives to meet unique industrial process requirements.

- Just-In-Time Delivery: Coordinating complex logistics to ensure materials arrive precisely when needed on-site, minimizing project delays and inventory costs for manufacturers.

- Project-Specific Sourcing: Securing raw materials that meet stringent quality and origin certifications for sensitive manufacturing environments.

- Technical Support: Offering expertise on material performance and application to optimize construction and operational efficiency for industrial clients.

Public Sector and Government Agencies

Government agencies, from federal departments to local municipalities, represent a foundational customer segment for CRH, particularly in the realm of infrastructure development and maintenance. These entities rely on CRH's extensive product portfolio and logistical capabilities to execute vital public works projects, such as road construction, bridge repairs, and utility infrastructure upgrades.

CRH's capacity to consistently meet rigorous quality standards and deliver substantial volumes of materials is paramount for securing contracts with these public sector clients. For instance, in 2024, CRH's Americas Materials division reported significant contributions from government-funded projects, underscoring the segment's importance to overall revenue. The company's ability to navigate complex procurement processes and adhere to strict regulatory requirements makes it a preferred supplier for government tenders.

- Key Government Needs: Public sector clients require reliable, high-volume supply chains for essential construction materials, meeting stringent safety and environmental specifications.

- CRH's Value Proposition: CRH offers a broad range of products, extensive geographic reach, and proven expertise in managing large-scale infrastructure projects, aligning with government procurement demands.

- Market Impact: Government spending on infrastructure, a significant driver for CRH, saw continued investment in 2024, particularly in areas like transportation and renewable energy projects.

- Regulatory Compliance: CRH's adherence to diverse governmental regulations and quality certifications is critical for securing and maintaining contracts with public agencies.

CRH serves a diverse customer base, including government agencies, commercial developers, and residential builders. These segments require a broad range of materials for infrastructure, non-residential, and housing projects. The company also caters to specialized industrial clients needing custom solutions and timely delivery.

Cost Structure

CRH's cost structure is heavily influenced by the procurement of essential raw materials like stone, sand, gravel, and cement. The energy required for processing these materials also represents a substantial expense. For instance, in 2023, CRH reported that the cost of sales, which includes raw materials and energy, was a significant driver of their overall expenditure, reflecting the capital-intensive nature of the building materials industry.

Logistics and transportation expenses are a significant cost for CRH, driven by its vast distribution network and the heavy nature of its building materials. These costs encompass fuel, fleet upkeep, and driver compensation, directly impacting operational expenditures.

In 2023, CRH reported total distribution, selling, and administrative expenses of €3.8 billion. While not solely logistics, this figure underscores the substantial investment in moving products efficiently across its global operations.

CRH's significant global workforce necessitates substantial investment in labor and personnel. In 2023, employee-related expenses, encompassing wages, comprehensive benefits packages, ongoing training initiatives, and robust safety programs, represented a core component of the company's overall cost structure.

The company's commitment to fostering an entrepreneurial mindset among its employees is reflected in its human capital development strategies. This investment in people is designed to drive innovation and operational efficiency across its diverse business units.

Capital Expenditures and Asset Maintenance

CRH's cost structure is significantly impacted by capital expenditures (CapEx) and asset maintenance. This involves substantial ongoing investment in upgrading and maintaining its extensive network of production facilities, quarries, and transportation fleets. For instance, in 2023, CRH reported capital expenditure of $3.3 billion, reflecting its commitment to operational efficiency and expansion.

These investments are crucial for ensuring the longevity and productivity of its assets, as well as for integrating new acquisitions. The company regularly allocates resources for property, plant, and equipment, a core component of its operational backbone. This continuous investment supports CRH's ability to meet market demand and maintain its competitive edge.

- Ongoing Investment: CRH consistently invests in its physical assets, including production sites, quarries, and its vehicle fleet, to ensure operational readiness and capacity.

- Strategic Acquisitions: A portion of CapEx is dedicated to acquiring new businesses and assets, furthering the company's growth strategy and market reach.

- 2023 CapEx: The company's capital expenditure reached $3.3 billion in 2023, highlighting the scale of investment in its infrastructure and future development.

Research, Development, and Technology Investment

CRH's commitment to innovation and future growth is reflected in its significant investment in Research, Development, and Technology. This area captures the costs essential for staying competitive, including the exploration and implementation of new materials, processes, and digital solutions across its operations. These expenditures are crucial for developing more sustainable building solutions and enhancing operational efficiency through automation.

A substantial portion of these costs is allocated to funding venture programs and strategic partnerships aimed at identifying and nurturing emerging technologies. For instance, CRH has been actively investing in areas like advanced materials and digital construction platforms. In 2023, CRH reported that its investment in innovation and technology continued to be a key focus, with significant capital allocated to R&D initiatives aimed at driving long-term value creation and sustainability across its global business.

- Innovation Investment: Funding for developing new products, services, and processes.

- Technology Adoption: Costs associated with implementing cutting-edge technologies, including automation and digital tools.

- Sustainability Focus: Strategic investments in R&D for eco-friendly materials and solutions.

- Venture Programs: Capital allocated to explore and support promising new technologies and startups.

CRH's cost structure is dominated by the procurement of raw materials, energy for processing, and significant logistics expenses. These operational costs are inherently high due to the weight and volume of building materials. In 2023, CRH's cost of sales, which includes these key inputs, represented a substantial portion of its total expenditure, underscoring the capital-intensive nature of its operations.

Labor and personnel costs are also a major component, reflecting CRH's global workforce and its commitment to employee development and safety. Furthermore, substantial capital expenditures are continuously allocated to maintain and upgrade its extensive asset base, including production facilities and transportation fleets, ensuring operational efficiency and future growth.

| Cost Category | 2023 Impact (Illustrative) | Key Drivers |

|---|---|---|

| Raw Materials & Energy | Significant portion of Cost of Sales | Stone, sand, gravel, cement, fuel |

| Logistics & Distribution | €3.8 billion (Distribution, Selling, Admin) | Fuel, fleet maintenance, driver costs |

| Capital Expenditures (CapEx) | $3.3 billion | Asset upgrades, acquisitions, expansion |

| Research & Development | Ongoing investment | New materials, processes, digital solutions |

Revenue Streams

CRH's core revenue generation stems from the production and sale of essential construction materials. This includes cement, the binder for concrete, aggregates like crushed stone, sand, and gravel that form the bulk of concrete and asphalt, and asphalt itself, used for paving roads and surfaces.

In 2023, CRH reported significant sales from these core products. For instance, their Americas Materials segment, a major contributor, saw substantial revenue from aggregates and asphalt, reflecting ongoing infrastructure development and commercial construction activity across the United States.

CRH generates significant revenue from selling ready-mixed concrete, which is delivered directly to construction sites, and a diverse range of precast concrete products. These precast items are essential components in various building projects, from infrastructure to residential developments.

In 2023, CRH's Americas Materials segment, a key contributor to concrete sales, saw its revenue grow. For instance, its Cement business in the U.S. reported a strong performance, indicating robust demand for concrete materials. This highlights the substantial income derived from these core product sales.

CRH generates revenue from value-added solutions, extending beyond basic material supply. This includes offering specialized product formulations tailored to specific project needs, such as advanced concrete admixtures or high-performance insulation. For instance, in 2024, CRH continued to invest in innovative solutions for water management and circularity, aiming to capture growing market demand for sustainable construction practices.

Contributions from Acquisitions

Contributions from acquisitions represent a vital revenue stream for CRH, fueling its expansion and market penetration. These strategic moves allow CRH to enter new territories and enhance its product portfolio, directly impacting top-line growth.

In 2024 alone, CRH demonstrated a strong commitment to inorganic growth by completing 40 acquisitions with a total investment of $5 billion. This significant capital deployment underscores the importance of acquisitions in CRH's ongoing strategy to build scale and diversify its business.

- Acquisition-driven revenue growth: CRH's revenue is substantially boosted by integrating newly acquired businesses.

- Geographic and product expansion: Acquisitions are key to CRH's strategy for expanding its global footprint and broadening its product and service offerings.

- 2024 investment highlights: The company invested $5 billion in 40 acquisitions during 2024, showcasing a robust M&A pipeline.

- Strategic integration: Successful integration of acquired entities is crucial for realizing projected revenue synergies and operational efficiencies.

Sales of Sustainable and Low-Carbon Building Materials

CRH is increasingly generating revenue from the sale of sustainable and low-carbon building materials. This segment taps into the growing market demand for environmentally friendly construction solutions.

The company's strategic focus on sustainability is evident in its ambitious target: CRH aims for sustainable products to represent at least half of its total revenue by 2025. This highlights the significant growth potential and financial importance of this revenue stream.

- Low-Carbon Cement Alternatives: CRH is developing and selling innovative cementitious materials that significantly reduce the carbon footprint compared to traditional Portland cement.

- Recycled Materials: Revenue is also derived from the sale of products incorporating recycled content, such as aggregates from construction and demolition waste, and asphalt made with recycled materials.

- Sustainable Product Portfolio Expansion: The company is actively investing in research and development to broaden its range of sustainable offerings, anticipating continued market shifts towards greener building practices.

CRH's revenue streams are diversified, encompassing core construction materials, value-added solutions, and strategic acquisitions. In 2024, the company significantly expanded its inorganic growth strategy, investing $5 billion in 40 acquisitions to bolster its market presence and product offerings.

The company is also capitalizing on the growing demand for sustainable building materials, with a strategic aim for these products to constitute at least half of its total revenue by 2025. This includes low-carbon cement alternatives and products incorporating recycled content.

| Revenue Stream | Key Products/Activities | 2024 Significance |

|---|---|---|

| Core Construction Materials | Cement, aggregates, asphalt, ready-mixed concrete | Foundation of sales, strong demand in Americas |

| Value-Added Solutions | Specialized formulations, insulation, water management solutions | Focus on innovation and sustainability for market differentiation |

| Acquisitions | Integration of acquired businesses | $5 billion invested in 40 acquisitions, driving scale and diversification |

| Sustainable Products | Low-carbon cement, recycled materials | Target of 50% of revenue by 2025, meeting environmental demand |

Business Model Canvas Data Sources

The CRH Business Model Canvas is informed by a blend of internal financial data, extensive market research, and strategic analysis of industry trends. This multi-faceted approach ensures each component of the canvas is grounded in actionable insights and validated information.