CRH Boston Consulting Group Matrix

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

CRH Bundle

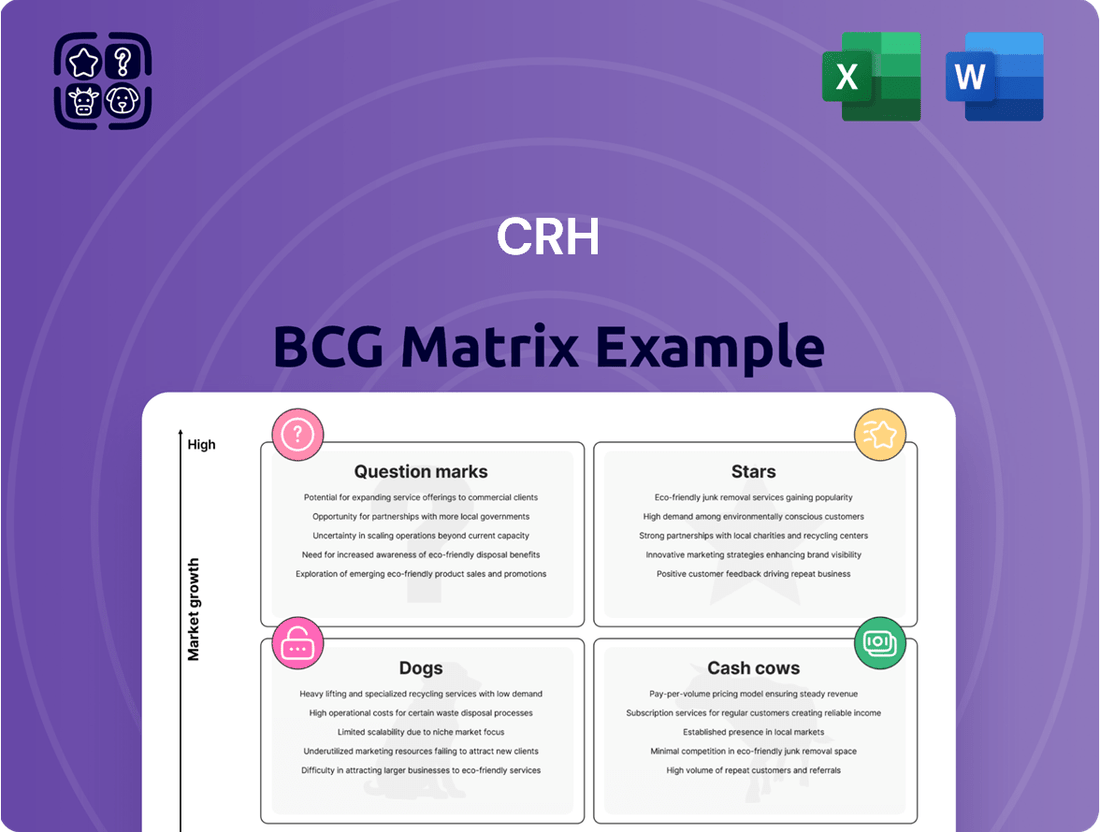

Uncover the strategic positioning of this company's product portfolio with our insightful BCG Matrix preview. See how its offerings stack up as Stars, Cash Cows, Dogs, or Question Marks, and get a glimpse into potential growth areas and resource allocation.

Ready to transform this high-level overview into actionable strategy? Purchase the full BCG Matrix to gain a comprehensive breakdown of each product's quadrant, data-driven recommendations for optimizing your portfolio, and a clear roadmap for future investment decisions.

Stars

North American Infrastructure Materials, a star in CRH's portfolio, benefits from strong demand for asphalt and aggregates. This sector is propelled by substantial government spending on infrastructure, with the U.S. Bipartisan Infrastructure Law injecting significant capital into road and bridge construction. In 2023, CRH reported a substantial portion of its sales from the Americas, underscoring the importance of this segment.

CRH's acquisition of Eco Material Technologies for $2.1 billion in 2024 signifies a major strategic push into the burgeoning low-carbon cement sector. This move positions CRH to leverage supplementary cementitious materials (SCMs) like fly ash and synthetic gypsum, crucial for reducing reliance on traditional Portland cement and its associated carbon footprint.

This investment directly addresses the increasing demand for sustainable building materials, driven by global environmental concerns and supportive regulatory frameworks. CRH is actively cultivating a leadership position in this high-growth market, aligning its portfolio with essential sustainability trends.

The Americas Materials Solutions segment of CRH is a clear star in its BCG Matrix. This segment has shown impressive growth, with adjusted EBITDA soaring by 293% in Q1 2025.

This remarkable financial performance is a direct result of CRH's strategic approach, including successful acquisitions and disciplined pricing strategies within a robust market environment. It highlights the company's adeptness at leveraging opportunities and solidifying its position in the materials sector across the Americas.

Road Solutions in North America

Road Solutions in North America stands out as a star within CRH's portfolio, largely due to its dominant position as the continent's largest road builder. This segment is a primary beneficiary of the significant public infrastructure spending currently underway across North America. The sector is experiencing robust demand, evidenced by increased paving activity and substantial growth in both asphalt and ready-mixed concrete volumes.

CRH's commanding market share in this arena, coupled with sustained, high-level investment in the region's road networks, solidifies its star status. For instance, in 2023, CRH reported significant growth in its Americas Materials segment, with sales increasing by 10% to $24.1 billion, driven by strong demand for heavy materials like asphalt and aggregates.

- Dominant Market Position: CRH is the leading road builder in North America.

- Infrastructure Spending Tailwinds: Benefiting from a boom in public infrastructure investment.

- Volume Growth: Increased paving activity and higher sales of asphalt and ready-mixed concrete.

- Financial Performance: Americas Materials segment sales reached $24.1 billion in 2023, up 10% year-over-year.

Strategic Acquisitions for Growth

CRH's strategic acquisition approach, exemplified by its substantial investment of $5 billion in 40 value-accretive acquisitions throughout 2024, highlights a deliberate push into high-growth markets, especially within the Americas.

These targeted acquisitions are instrumental in bolstering CRH's market presence in lucrative and expanding sectors. This expansion not only reinforces its dominant position but also lays a strong foundation for sustained revenue and profit expansion in the years ahead.

- Aggressive Expansion: CRH deployed $5 billion in 2024 across 40 acquisitions.

- Geographic Focus: Significant investment was directed towards the Americas.

- Market Share Growth: Acquisitions aimed at increasing presence in attractive, growing segments.

- Future Profitability: Strategy designed to drive future revenue and profit growth.

Stars in CRH's portfolio represent high-growth, high-market-share businesses. These segments are crucial for the company's overall growth trajectory, demanding continued investment to maintain their leading positions and capitalize on market opportunities.

The Americas Materials Solutions segment, a key star, demonstrated exceptional performance with adjusted EBITDA increasing by 293% in Q1 2025. This surge is attributed to strategic acquisitions and effective pricing within a strong market.

Road Solutions in North America, another star, benefits from its status as the largest road builder and significant public infrastructure spending. This has led to increased paving activity and robust sales of asphalt and concrete.

CRH's strategic acquisitions, totaling $5 billion in 2024 across 40 deals, particularly in the Americas, reinforce the star status of its key segments by expanding market presence in high-growth areas.

| Segment | Market Share | Growth Driver | 2023 Americas Materials Sales | 2024 Acquisition Spend |

|---|---|---|---|---|

| North American Infrastructure Materials | Leading | Infrastructure spending, Asphalt & Aggregates demand | $24.1 billion (10% YoY growth) | Significant portion of $5 billion |

| Road Solutions (North America) | Largest | Public infrastructure investment, Paving activity | Included in Americas Materials | Significant portion of $5 billion |

| Low-Carbon Cement Sector | Emerging | Sustainability demand, Regulatory support | N/A (Acquisition in 2024) | $2.1 billion (Eco Material Technologies) |

What is included in the product

Strategic guidance on investing in Stars, holding Cash Cows, developing Question Marks, and divesting Dogs.

CRH BCG Matrix offers a clear, visual pain point reliever by placing each business unit in a quadrant.

Cash Cows

CRH's traditional cement and aggregates business represents its core strength, holding a significant market share in established construction markets. This segment benefits from consistent, foundational demand as these materials are essential for nearly all building projects.

These operations are reliable cash generators, requiring less capital for expansion or promotion compared to newer ventures. For instance, in 2023, CRH reported strong performance in its Americas Materials segment, a key area for aggregates, contributing significantly to overall profitability.

CRH's established ready-mixed concrete operations are solid cash cows, mirroring the strength of their cement and aggregates businesses. These operations typically command strong market positions in developed, mature markets where construction demand is consistent, albeit not explosive.

Benefiting from significant economies of scale, these concrete businesses generate substantial and reliable cash flow for CRH. For instance, in 2023, CRH reported that its Americas Materials segment, which includes ready-mixed concrete, delivered robust profitability and cash generation, enabling continued investment and shareholder distributions.

CRH's European Materials Operations are a cornerstone of the company's portfolio, often acting as cash cows within the BCG matrix. The company holds significant regional leadership in Europe, particularly in key areas like cement, concrete, and asphalt. This strong market position allows for consistent revenue generation, even in markets with more moderate growth.

Despite potentially lower growth rates compared to North America, CRH's substantial market share in Europe translates to reliable profitability and robust cash flow. For instance, in 2023, CRH reported that its European businesses contributed significantly to its overall performance, demonstrating the enduring strength of these established operations. This consistent cash generation is vital for funding other growth initiatives within the company.

Stable Precast Concrete Products

CRH's stable precast concrete products, a cornerstone of their business, are firmly positioned as Cash Cows within the BCG Matrix. These offerings, encompassing everything from commercial building components to residential concrete solutions, benefit from a well-established market and consistent, predictable demand.

Leveraging CRH's vast manufacturing capabilities and expansive distribution channels, these products enjoy significant market penetration. For instance, CRH's Americas Materials segment, which includes a substantial precast concrete component, reported strong performance in 2023, contributing significantly to the company's overall financial health.

- Mature Market Position: Precast concrete products serve a broad array of sectors, including infrastructure, commercial, and residential construction, indicating a stable and mature market.

- Consistent Demand and Profitability: These products generate reliable revenue streams due to their essential role in construction and typically boast healthy profit margins.

- Extensive Network Utilization: CRH's established manufacturing and distribution infrastructure allows for efficient production and widespread availability, reinforcing their market dominance.

- Cash Flow Generation: The stability and profitability of precast concrete products make them a vital contributor to CRH's overall cash flow, funding other strategic initiatives.

Overall Operational Efficiency and Scale

CRH's exceptional scale and unique strategy are key drivers of its overall operational efficiency. This, combined with rigorous cost control and a commitment to operational excellence, consistently translates into robust financial performance.

The company demonstrated its ability to generate substantial profits from its mature businesses by achieving its 11th consecutive year of margin expansion in 2024. This sustained improvement highlights the effectiveness of CRH's operational model.

- Unmatched Scale: CRH operates on a global level, allowing for significant economies of scale in procurement and distribution.

- Differentiated Strategy: The company focuses on integrated solutions and value-added services, setting it apart from competitors.

- Disciplined Cost Management: Continuous efforts in cost reduction and efficiency improvements are embedded in CRH's culture.

- Operational Excellence: A focus on optimizing processes and leveraging technology enhances productivity across all business units.

CRH's established cement and aggregates businesses in mature markets, particularly in the Americas and Europe, are prime examples of its Cash Cows. These segments benefit from consistent demand and significant market share, translating into reliable profitability and substantial cash flow generation for the company.

The company's focus on operational excellence and disciplined cost management further bolsters the cash cow status of these segments. For instance, CRH reported its 11th consecutive year of margin expansion in 2024, underscoring the efficiency and profitability of its core operations.

These mature businesses require relatively lower investment for maintenance and growth compared to newer ventures, allowing CRH to allocate capital towards strategic expansion and shareholder returns. The robust performance of its Americas Materials segment in 2023, a key area for aggregates and concrete, highlights this consistent cash generation.

| Business Segment | BCG Category | Key Characteristics | 2023 Financial Highlight |

|---|---|---|---|

| Americas Materials (Aggregates, Cement, Concrete) | Cash Cow | High market share, mature market, consistent demand, economies of scale | Strong profitability and cash generation |

| European Materials (Cement, Concrete, Asphalt) | Cash Cow | Significant regional leadership, stable revenue, consistent cash flow | Contributed significantly to overall performance |

| Precast Concrete Products | Cash Cow | Established market, predictable demand, extensive distribution network | Substantial contribution to financial health |

Full Transparency, Always

CRH BCG Matrix

The CRH BCG Matrix preview you are currently viewing is the exact, final document you will receive upon purchase. This means no watermarks, no demo content, and no hidden surprises – just a fully formatted, professionally designed strategic tool ready for immediate application in your business planning.

Dogs

CRH's divestiture of its European lime operations in 2024, which brought in $1.4 billion, strongly suggests these were considered 'Dogs' within their portfolio. This move aligns with the BCG matrix principle of divesting low-growth, low-market-share assets.

These divested lime businesses likely consumed capital without offering substantial returns or fitting CRH's long-term strategic vision. Freeing up capital from such underperforming units allows for reinvestment in more promising areas of the business.

Within CRH's decentralized structure, localized legacy assets in mature or shrinking regional markets, where the company has a limited market presence, can be identified as underperformers. These operations often exhibit sluggish growth and meager profitability, potentially draining resources without significant returns.

For instance, a regional concrete plant in a declining industrial area might represent such an asset. In 2024, CRH's focus on optimizing its portfolio means these types of operations are prime candidates for strategic review. If such an asset is contributing less than 1% to CRH's overall revenue and has seen no significant capital investment in the past five years, it aligns with the characteristics of an underperforming localized legacy asset.

The strategic imperative for these assets is clear: either implement targeted operational improvements to boost efficiency and profitability, or consider divestiture. This approach is crucial for enhancing the overall health and strategic alignment of CRH's diverse asset base, ensuring capital is allocated to areas with higher growth and return potential.

Certain niche product lines or smaller operations within CRH, particularly those not aligning with the company's strategic focus on infrastructure and sustainable solutions, could be categorized as dogs. These might reside in markets exhibiting limited growth potential, where CRH's competitive advantage is not pronounced. For instance, a legacy product line in a mature, low-demand construction material segment might fit this description.

These segments are subject to ongoing scrutiny for potential divestment or scaling back. The company's 2024 strategic priorities emphasize investments in areas like advanced materials and digital solutions, diverting resources from underperforming or non-strategic units. This proactive approach aims to optimize capital allocation and enhance overall profitability.

Segments Heavily Exposed to Subdued Residential New-Build

The residential new-build sector has seen a noticeable slowdown starting in 2022, and projections indicate this trend will persist. This subdued environment presents challenges for companies with significant exposure to this market.

For CRH, any product lines or smaller regional operations that primarily cater to this low-growth segment, and possess a low market share within it, would likely be categorized as Dogs in the BCG Matrix. These specific business units would face considerable pressure on both sales volumes and pricing power, diminishing their appeal for substantial capital allocation.

In 2023, the US housing market, for instance, experienced a significant cooling. Housing starts, a key indicator for new-build activity, saw a decline. For example, data from the U.S. Census Bureau indicated a year-over-year decrease in housing starts in many regions throughout 2023, impacting companies reliant on this demand.

- Low Market Share in Subdued Sector: CRH segments focused on residential new-builds with limited market penetration are prime candidates for the Dogs category.

- Volume and Pricing Pressures: Expect reduced demand and competitive pricing in these areas, impacting profitability.

- Limited Investment Appeal: These units are unlikely to attract significant new investment due to their poor growth prospects.

- Strategic Review Needed: CRH may need to consider divesting or restructuring these underperforming segments.

Non-Core Operations with Low Contribution

Non-core operations with low contribution, often termed as 'Dogs' in the BCG matrix framework, represent business units within CRH that generate minimal profits and have little potential for future growth. These segments, while part of the overall company, consume resources without offering substantial strategic advantages or market share expansion. For instance, a small, niche building materials division with declining demand might fall into this category.

These 'Dogs' may at best break even, but they effectively tie up valuable capital and management attention that could be better allocated to more promising ventures within CRH's portfolio. The company's commitment to active portfolio management means these underperforming units are continually assessed for their long-term viability and strategic fit. In 2023, CRH divested several non-core assets, streamlining its operations and focusing resources on higher-growth areas.

- Low Profitability: These operations typically exhibit low profit margins, often struggling to cover their operational costs.

- Minimal Market Share: They usually hold a small and stagnant market share, with little prospect of significant increase.

- Resource Drain: Despite low returns, they require capital investment and management oversight, diverting resources from more strategic initiatives.

- Potential for Divestment: CRH's strategy involves evaluating these units for potential divestment or rationalization to improve overall portfolio performance.

CRH's divestiture of its European lime operations in 2024 for $1.4 billion signals these were likely 'Dogs'. This aligns with divesting low-growth, low-market-share assets that consume capital without significant returns.

These underperforming units, such as regional concrete plants in declining areas, often have limited market presence and meager profitability. For example, an asset contributing less than 1% to CRH's revenue with no capital investment in five years fits this profile.

CRH's strategy involves either improving efficiency or divesting these 'Dogs'. This focus on portfolio optimization ensures capital is directed towards higher-growth, higher-return areas, as seen in their 2024 strategic priorities.

Segments focused on the residential new-build sector, which experienced a slowdown in 2022 and continued into 2023 with declining housing starts in many regions, can also house 'Dogs'. These units face volume and pricing pressures, limiting their investment appeal.

| BCG Category | Characteristics | CRH Example (Hypothetical) | 2024 Strategic Implication |

|---|---|---|---|

| Dogs | Low market share, low growth, low profitability | Niche building material division in a mature, declining market | Divestment or rationalization to free up capital |

| Dogs | Low market share in a subdued sector | Residential new-build focused product lines with limited penetration | Strategic review for potential restructuring or sale |

| Dogs | Non-core operations with minimal profit and growth potential | Small, legacy product lines not aligning with sustainable solutions focus | Resource reallocation to higher-growth strategic areas |

Question Marks

CRH Ventures' accelerator programs, including the one focused on Sustainable Building Materials launched in late 2024, are strategically designed to identify and nurture early-stage companies within the ConTech and ClimateTech sectors. These startups operate in rapidly expanding markets, concentrating on critical areas like decarbonization, circular economy principles, and the development of novel building materials.

While these emerging technologies represent significant future growth potential, CRH's current direct market penetration in these nascent areas remains limited. The ventures within this accelerator are characterized by their high growth prospects but also by their current low market share.

These promising startups necessitate substantial investment and dedicated support to achieve scalability and potentially transition into 'Stars' within CRH's portfolio. For instance, the global green building materials market was valued at approximately $265 billion in 2023 and is projected to reach $574 billion by 2030, indicating the substantial growth trajectory these ventures are targeting.

CRH is actively investing in pioneering sustainable solutions, such as advanced smart water management systems and precision-engineered construction materials. These innovations are designed to tackle pressing global environmental issues and tap into burgeoning markets fueled by increasing demand for eco-friendly practices.

While these segments offer significant growth potential, their current market penetration and CRH's specific market share within them are likely still in early stages. This positions them as question marks within the BCG matrix, requiring substantial capital infusion to foster wider adoption and establish a stronger market presence.

For instance, the global smart water management market was projected to reach over $30 billion by 2025, with a compound annual growth rate of approximately 15%. CRH's investments in this area, though promising, represent a commitment to nurturing these nascent technologies into future stars.

CRH is actively investing in emerging digital construction technologies, recognizing their potential in a fast-growing market. These innovations, including AI for design and robotics for execution, are transforming how projects are managed and built.

While CRH's commitment to these advanced digital tools is strong, its current market share in these pioneering areas is likely nascent. This reflects the early stage of adoption for many of these transformative technologies within the broader construction industry.

These digital solutions represent high-growth potential, but also demand significant upfront investment to capture substantial market share. CRH's strategic focus on these areas positions it to potentially lead in the future digital construction landscape.

Pilot Projects from Innovation Initiatives

CRH's innovation pipeline features over 400 projects, with a significant number dedicated to circular economy principles and the development of new materials. Many of these initiatives are structured as pilot programs, testing advanced technologies in real-world settings. These pilots are strategically positioned in sectors with substantial growth prospects, such as CO2 mineralized materials and innovative binders.

While these pilot projects represent high-potential growth areas, they are inherently in the nascent stages of market adoption. Their current market share is consequently low, reflecting their experimental nature. Successful outcomes from these early-stage ventures could propel them into the 'Star' category within the BCG matrix, signifying strong market growth and a leading competitive position.

- Over 400 innovation projects at CRH.

- Focus on circularity and new materials.

- Pilot programs for cutting-edge technologies.

- High-growth potential areas: CO2 mineralized materials, novel binders.

- Early stages of commercialization with low current market share.

- Potential to become Stars if successful.

Geographic Expansion into Untapped High-Growth Regions

Geographic expansion into untapped high-growth regions represents a strategic imperative for CRH, even as a global leader. These markets, often characterized by developing infrastructure and increasing urbanization, present substantial long-term potential but demand significant upfront capital and dedicated market-entry strategies.

For instance, CRH's presence in certain parts of Southeast Asia or Sub-Saharan Africa, while growing, is still nascent compared to its established European or North American operations. These regions are projected to see robust economic growth, driving demand for construction materials. For example, the Asian Development Bank projected a 4.5% GDP growth for developing Asia in 2024, a key indicator for construction sector expansion. Establishing a foothold here requires navigating local regulations, building robust supply chains, and adapting product offerings to specific market needs.

- Untapped Markets: Focus on regions with high infrastructure development needs and growing populations, such as parts of Africa and Asia.

- Investment Required: Significant capital expenditure will be necessary for new facilities, logistics, and market development.

- Strategic Effort: Building market share necessitates tailored strategies, understanding local competition, and adapting to regulatory environments.

- Growth Potential: These regions offer the opportunity to capture substantial market share in a rapidly expanding economic landscape.

Question Marks in the CRH BCG Matrix represent business units or product lines with low market share in high-growth industries. These ventures, like CRH's investments in sustainable building materials and digital construction technologies, require significant capital to develop and capture market share. The global green building materials market, valued at $265 billion in 2023, exemplifies the high-growth potential these Question Marks aim to tap into.

CRH's accelerator programs and pilot projects, such as those focused on CO2 mineralized materials, are designed to nurture these early-stage companies. While their current market penetration is limited, their potential to become market leaders, or Stars, is substantial if they can achieve scalability and wider adoption. The company's innovation pipeline, featuring over 400 projects, underscores a strategic commitment to fostering these high-potential, low-market-share areas.

Geographic expansion into emerging markets also fits the Question Mark profile. Regions like Southeast Asia and parts of Africa offer high growth potential due to increasing urbanization and infrastructure needs, with developing Asia projected to grow at 4.5% GDP in 2024. However, CRH's market share in these areas is still nascent, necessitating considerable investment to build supply chains and navigate local markets.

| CRH Venture Area | Market Growth Potential | Current Market Share | Capital Investment Need | Strategic Outlook |

|---|---|---|---|---|

| Sustainable Building Materials | High (e.g., $265B in 2023, projected $574B by 2030) | Low | High | Nurture into Stars |

| Digital Construction Technologies (AI, Robotics) | High | Low | High | Establish Leadership |

| Circular Economy Initiatives (Pilot Programs) | High (e.g., CO2 mineralized materials) | Low | High | Transition to Stars |

| Geographic Expansion (Emerging Markets) | High (e.g., Developing Asia GDP growth 4.5% in 2024) | Low | High | Build Market Presence |

BCG Matrix Data Sources

Our BCG Matrix leverages comprehensive data, including financial statements, market research, and competitor analysis, to provide a clear strategic overview.