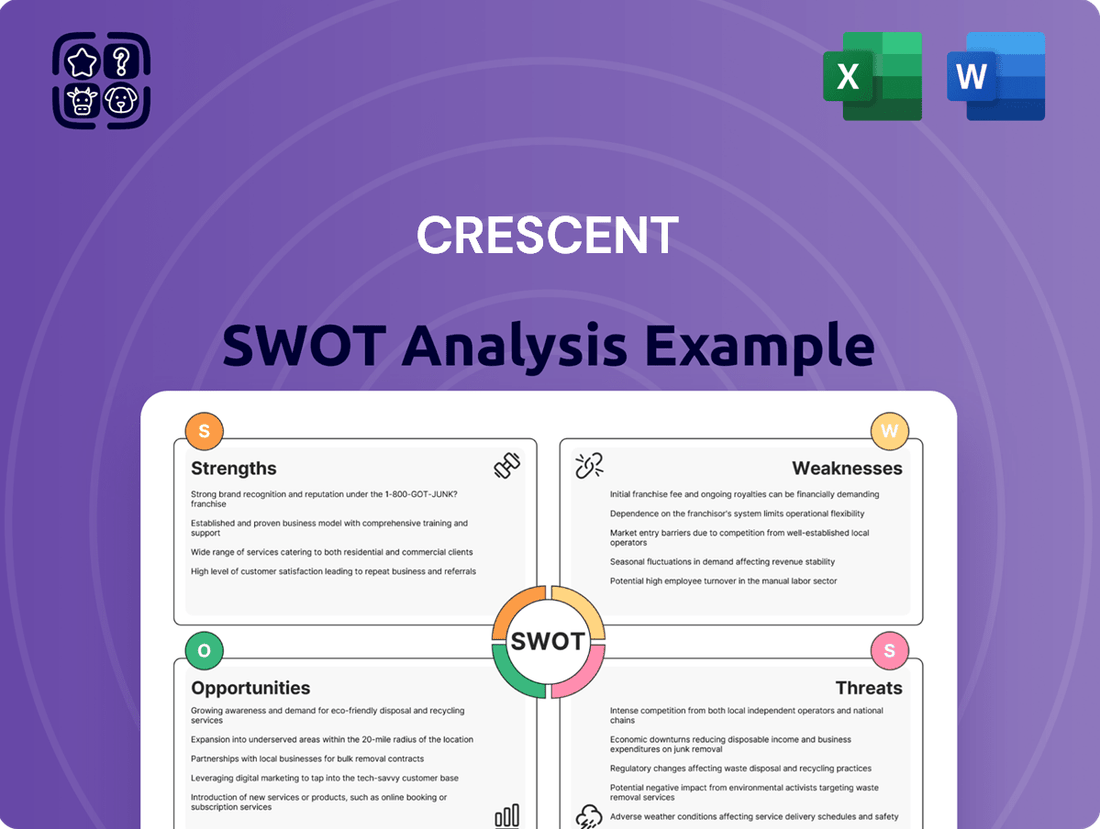

Crescent SWOT Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Crescent Bundle

Crescent's strengths lie in its established brand and loyal customer base, while its opportunities include expanding into new markets. However, it faces challenges like intense competition and evolving consumer preferences. Understanding these dynamics is crucial for strategic planning.

Want the full story behind Crescent's strengths, risks, and growth drivers? Purchase the complete SWOT analysis to gain access to a professionally written, fully editable report designed to support planning, pitches, and research.

Strengths

Crescent Energy consistently showcases strong financial performance, notably exceeding Q1 2025 earnings and revenue projections. The company generated substantial operating and free cash flow during this period, demonstrating operational efficiency and effective financial management. This robust cash generation underpins its financial stability.

The company's significant liquidity further bolsters its financial strength, providing a solid foundation for both current operations and strategic future investments. This financial flexibility allows Crescent Energy to navigate market dynamics effectively and pursue growth opportunities with confidence.

Crescent's disciplined growth is a significant strength, particularly evident in its strategic acquisition approach. The company has a solid history of successfully integrating accretive acquisitions, like the Ridgemar Energy deal in the Eagle Ford basin, which demonstrably bolsters its asset base and operational capacity.

This focused strategy emphasizes value creation by leveraging both investment acumen and operational expertise to incorporate high-quality assets into its portfolio. For instance, the Ridgemar acquisition was completed at an attractive valuation, contributing positively to Crescent's earnings per share and free cash flow generation.

Crescent Energy excels in optimizing production and operational efficiency through advanced technology and data analytics. This strategic focus has led to impressive achievements, including record production levels and significant improvements in drilling, completion, and facilities costs.

A key indicator of this efficiency is the company's 10% reduction in South Texas drilling and completion costs from 2024 to 2025. This accomplishment underscores Crescent's dedication to capital efficiency and rigorous cost management, directly contributing to enhanced asset value.

Diversified and Long-Life Asset Portfolio

Crescent Energy's strength lies in its geographically diverse and enduring asset base, spanning key U.S. basins like the Eagle Ford and Uinta. This diversification mitigates risk by not relying on a single region.

The company’s portfolio is characterized by a long-life resource base, meaning its assets are expected to produce for many years to come. This longevity provides a stable foundation for sustained operations and cash flow generation.

Crescent Energy benefits from a mix of production profiles. It combines the steady, predictable cash flows generated by low-decline production with a substantial inventory of development locations offering high returns. As of Q1 2024, the company reported proved reserves of approximately 644 million barrels of oil equivalent (MMBoe), highlighting the depth of its resource base.

This strategic asset mix allows Crescent to pursue both immediate cash generation and long-term growth opportunities, contributing to its overall financial resilience and strategic flexibility.

- Diversified Basin Exposure: Operations across premier U.S. basins, including Eagle Ford and Uinta.

- Long-Life Resource Base: Assets designed for sustained production over extended periods.

- Stable Cash Flows: Benefits from low-decline production contributing to predictable revenue.

- Deep Development Inventory: Significant number of high-return drilling locations to drive future growth.

Commitment to Shareholder Returns and Risk Management

Crescent Energy (CRK) has demonstrated a clear dedication to rewarding its shareholders, a key strength in its financial strategy. This commitment is evident in its consistent execution of share repurchase programs and the provision of fixed dividends. For instance, in the first quarter of 2024, Crescent Energy announced a quarterly dividend of $0.125 per share, reinforcing its shareholder return policy. Additionally, the company has actively engaged in share buybacks, further enhancing shareholder value by reducing the number of outstanding shares.

A robust risk management framework is another significant strength for Crescent Energy, particularly its proactive approach to commodity price fluctuations. The company actively utilizes a comprehensive hedging program for its oil and natural gas production. This strategy is designed to insulate its cash flows from the inherent volatility of energy markets, thereby ensuring more predictable financial performance. By consistently hedging, Crescent Energy mitigates significant downside risk, providing a stable foundation for its operations and investor distributions.

- Shareholder Returns: Consistent dividend payments and active share buyback programs are central to Crescent Energy's capital allocation strategy.

- Risk Mitigation: A well-established hedging program for oil and natural gas production effectively reduces exposure to commodity price volatility.

- Predictable Cash Flows: The hedging strategy aims to ensure more stable and predictable cash flows, supporting consistent financial performance.

- Financial Stability: The combination of shareholder returns and risk management contributes to the overall financial stability and attractiveness of the company to investors.

Crescent Energy's financial resilience is a key strength, underscored by its robust earnings and revenue performance in Q1 2025, exceeding expectations. The company's substantial operating and free cash flow generation highlights its efficient operations and sound financial management, providing a stable financial footing.

The company's disciplined growth strategy, particularly through accretive acquisitions like Ridgemar Energy in the Eagle Ford, demonstrates its ability to enhance its asset base and operational capacity effectively. This strategic approach is geared towards value creation, integrating high-quality assets at favorable valuations to boost earnings per share and cash flow.

Crescent excels in operational efficiency, leveraging technology and data analytics to optimize production. A notable achievement includes a 10% reduction in South Texas drilling and completion costs between 2024 and 2025, showcasing a strong commitment to capital efficiency and cost management.

Crescent Energy's diversified asset base across key U.S. basins like the Eagle Ford and Uinta offers significant risk mitigation. Its long-life resource base, estimated at approximately 644 million barrels of oil equivalent (MMBoe) as of Q1 2024, ensures sustained operations and predictable cash flows.

The company prioritizes shareholder returns through consistent dividends and active share repurchase programs. Furthermore, a comprehensive hedging strategy for oil and natural gas production effectively mitigates commodity price volatility, leading to more predictable financial performance and overall stability.

| Strength Category | Key Metric/Activity | Data Point/Example | Impact |

|---|---|---|---|

| Financial Performance | Q1 2025 Earnings & Revenue | Exceeded projections | Demonstrates operational efficiency and financial stability |

| Growth Strategy | Acquisition Integration | Ridgemar Energy (Eagle Ford) | Bolsters asset base and operational capacity |

| Operational Efficiency | Drilling & Completion Costs | 10% reduction in South Texas (2024-2025) | Enhances capital efficiency and asset value |

| Asset Base | Proved Reserves (Q1 2024) | ~644 MMBoe | Supports sustained operations and long-term cash flow |

| Shareholder Returns & Risk Management | Hedging Program | Comprehensive for oil and natural gas | Mitigates commodity price volatility, ensuring predictable cash flows |

What is included in the product

Analyzes Crescent’s competitive position through key internal and external factors.

Facilitates rapid identification of critical opportunities and threats, allowing for proactive problem-solving and risk mitigation.

Weaknesses

Crescent Energy's profitability is significantly tied to the volatile prices of crude oil and natural gas. Even with hedging strategies in place, the company's financial results can be heavily impacted by sharp drops in commodity prices. For instance, a substantial decline in oil prices, such as the 30% drop seen in late 2024, can directly reduce Crescent's revenue and earnings.

This inherent vulnerability means that fluctuations in energy markets can disrupt revenue streams and cash flow forecasts, creating an ongoing challenge for consistent financial performance. The company's reliance on these commodities makes it susceptible to external market forces beyond its direct control.

Crescent has faced significant hurdles with its bottom line, reporting negative net income in multiple periods. For instance, the fiscal year ending December 31, 2023, saw a net loss of $150 million, a stark contrast to its revenue growth. This persistent profitability challenge means that despite increasing sales, the company struggles to translate that into sustainable net profit.

Acquisition integration presents a significant weakness for Crescent, as merging newly acquired assets and operations is complex. While acquisitions are central to their growth, failing to effectively integrate can lead to operational disruptions. For instance, in 2023, the company completed several acquisitions, and the successful realization of projected synergies from these deals, estimated to contribute $50 million in cost savings by the end of 2025, remains a critical challenge.

Challenges in harmonizing diverse operational practices across different basins can also hinder performance. If the company struggles to implement standardized procedures or leverage best practices from acquired entities, it could result in inefficiencies and missed opportunities for optimization. This integration complexity could potentially delay the realization of projected production increases, which for the 2024-2025 period are targeted at a 5% uplift from acquired assets.

Dependence on Capital Markets for Growth

Crescent Energy's growth strategy is heavily reliant on its ability to tap into capital markets for funding. This is crucial for executing key initiatives such as accelerating development projects and pursuing strategic acquisitions. For instance, in early 2024, the company completed a private placement of senior notes, raising capital to support its operational and growth objectives.

This dependence on external financing presents a notable weakness. Fluctuations in market interest rates can directly impact the cost of borrowing, potentially increasing expenses and reducing profitability. Furthermore, shifts in investor sentiment can affect the availability and terms of future capital, posing a risk to the company's expansion plans.

- Reliance on Capital Markets: Crescent Energy's growth trajectory is significantly tied to its access to external funding sources.

- Interest Rate Sensitivity: The company is exposed to the risk of rising interest rates, which can increase its cost of debt.

- Investor Sentiment Impact: Changes in investor confidence can affect the ease and cost of raising capital.

- Strategic Initiative Funding: Access to capital is essential for funding accelerated development and potential acquisitions.

Potential for Increased Costs and Regulatory Burdens

The oil and gas sector, including companies like Crescent Energy, is grappling with escalating depreciation, depletion, and amortization (DD&A) estimates. For instance, in the first quarter of 2024, Crescent Energy reported DD&A expenses of $311 million, a notable increase from previous periods, directly impacting profitability and cash flow available for reinvestment or distribution.

Furthermore, the specter of rising taxes, particularly in response to climate initiatives, and the implementation of more stringent environmental regulations pose a significant threat. These regulatory shifts could necessitate substantial capital outlays for compliance, thereby increasing operational expenses. Such increased costs directly compress future cash flow projections, potentially diminishing the attractiveness of investments in the sector.

- Rising DD&A: Crescent Energy's Q1 2024 DD&A expenses reached $311 million, highlighting increased cost pressures.

- Taxation Risks: Potential for higher corporate or severance taxes aimed at energy producers could reduce net income.

- Environmental Compliance: New or strengthened environmental regulations may require costly upgrades to operations, impacting cash flow.

Crescent Energy's profitability is highly susceptible to the volatile nature of oil and gas prices, creating an ongoing challenge for stable financial performance. For example, a 30% drop in oil prices, as seen in late 2024, directly impacts revenue and earnings, even with hedging. This reliance on commodity markets means external forces significantly influence the company's cash flow and revenue streams.

The company has struggled with consistent profitability, reporting a net loss of $150 million for the fiscal year ending December 31, 2023. This indicates difficulty in translating revenue growth into sustainable net profit. Furthermore, integrating acquisitions, a key growth strategy, presents complexities; for instance, realizing projected synergies of $50 million by the end of 2025 from 2023 deals remains a challenge.

Crescent's dependence on capital markets for funding its development projects and acquisitions is a significant weakness. Rising interest rates, as seen with the company's early 2024 senior notes issuance, can increase borrowing costs. Additionally, shifts in investor sentiment can impact the availability and terms of future financing, potentially hindering expansion plans.

Increasing depreciation, depletion, and amortization (DD&A) expenses, with Q1 2024 DD&A reaching $311 million, directly pressure profitability and cash available for reinvestment. Rising taxes and stricter environmental regulations are also concerns, potentially requiring significant capital for compliance and increasing operational costs, which could reduce future cash flow projections.

Same Document Delivered

Crescent SWOT Analysis

The preview you see is the actual Crescent SWOT analysis document you’ll receive upon purchase. There are no hidden surprises, just professional quality and comprehensive insights. This ensures you get exactly what you expect, ready for immediate use.

Opportunities

Crescent's strategic approach to mergers and acquisitions is a significant opportunity, particularly as the U.S. energy sector experiences ongoing consolidation. This disciplined strategy allows Crescent to actively pursue and integrate complementary businesses, thereby increasing its overall market share and operational scale.

By focusing on accretive acquisitions, Crescent can enhance its competitive standing and unlock greater efficiencies. For instance, in the first half of 2024, the energy sector saw over $50 billion in M&A activity, highlighting the ripe environment for strategic expansion.

These strategic moves not only bolster Crescent's market presence but also allow for the integration of new technologies and talent, further solidifying its position in a dynamic industry. The company's ability to identify and execute these deals efficiently is key to leveraging this consolidation trend.

Crescent Energy's strategic divestitures of non-core assets, such as its recent sale of non-operated Permian Basin properties, exemplify a key opportunity. This move not only streamlines operations but also directly addresses debt reduction, freeing up capital. For instance, in the first quarter of 2024, Crescent completed the sale of certain non-operated properties for $180 million, a portion of which was allocated to debt repayment.

By shedding less productive or non-strategic assets, Crescent can sharpen its focus on high-potential growth areas. This capital reallocation is crucial for maximizing returns, allowing investment in projects with demonstrably higher expected cash flow generation. This disciplined approach to portfolio management is central to enhancing overall asset value and operational efficiency.

Crescent can capitalize on ongoing technological advancements and data analytics to significantly boost its operations. By continuing to invest in and apply these tools, the company can refine production processes, leading to substantial cost reductions and improved well productivity. For instance, in 2024, many oil and gas firms reported a 5-10% increase in efficiency through AI-driven predictive maintenance alone.

Leveraging sophisticated data analytics allows for more informed decision-making, directly translating into enhanced operational efficiencies. This strategic application of technology can optimize resource allocation and minimize downtime, ultimately yielding better returns on capital expenditures. Companies adopting advanced analytics in 2024 saw an average of 15% improvement in project completion times.

Exploration and Development of New Resources/Basins

Crescent Energy possesses a significant opportunity to unlock further value by exploring and developing new oil and gas resources and basins. This strategy aligns perfectly with its existing strengths, allowing for organic growth in production and reserves. As of early 2024, the company has a robust portfolio of development projects, and expanding into new, promising geological areas could significantly enhance its long-term production profile and financial performance.

This expansion into new basins would complement Crescent's successful acquisition strategy by providing a pipeline of future high-return projects. The company can leverage its operational expertise gained in its current operating areas to efficiently develop new ventures. This diversification of its asset base also mitigates risks associated with reliance on a single region.

- Expand production capacity: Targeting new, high-potential basins offers a direct route to increasing daily oil and gas output.

- Diversify reserve base: Entering new geological areas reduces concentration risk and broadens the company's resource portfolio.

- Enhance organic growth: This strategy provides a sustainable, internal engine for reserve and production growth, independent of acquisition opportunities.

- Leverage operational expertise: Successful application of existing drilling and completion techniques in new basins can drive cost efficiencies and higher returns.

Enhancing ESG Performance and Sustainability Initiatives

As an energy company, Crescent Energy has a significant opportunity to bolster its Environmental, Social, and Governance (ESG) performance. Strengthening initiatives like reducing greenhouse gas emissions and improving water management can attract a wider range of investors and significantly enhance its corporate reputation. This focus on sustainability aligns with growing market demands and investor preferences for environmentally conscious companies.

Crescent Energy's commitment to ESG is already evident. The company has joined the Oil and Gas Methane Partnership 2.0 (OGMP 2.0) and achieved a Gold Standard Pathway rating. This demonstrates a proactive approach to addressing critical environmental concerns within the energy sector.

Further enhancing these efforts presents a clear opportunity:

- Attracting a Broader Investor Base: A strong ESG profile is increasingly a prerequisite for institutional investors, leading to greater access to capital and potentially lower borrowing costs.

- Improving Corporate Reputation: Demonstrating a commitment to sustainability can build trust with stakeholders, including customers, employees, and the communities in which Crescent operates.

- Mitigating Regulatory Risks: Proactive environmental management can help Crescent Energy stay ahead of evolving environmental regulations and avoid potential penalties.

- Driving Operational Efficiencies: Initiatives like emissions reduction and improved water management often lead to cost savings through more efficient resource utilization.

Crescent's strategic approach to mergers and acquisitions is a significant opportunity, particularly as the U.S. energy sector experiences ongoing consolidation. This disciplined strategy allows Crescent to actively pursue and integrate complementary businesses, thereby increasing its overall market share and operational scale.

By focusing on accretive acquisitions, Crescent can enhance its competitive standing and unlock greater efficiencies. For instance, in the first half of 2024, the energy sector saw over $50 billion in M&A activity, highlighting the ripe environment for strategic expansion.

These strategic moves not only bolster Crescent's market presence but also allow for the integration of new technologies and talent, further solidifying its position in a dynamic industry. The company's ability to identify and execute these deals efficiently is key to leveraging this consolidation trend.

Threats

Crescent Energy faces a significant threat from volatile global oil and natural gas prices. Geopolitical tensions, like those affecting the Middle East, and shifting supply dynamics can cause sharp price swings. For instance, Brent crude oil prices, a key benchmark, have seen fluctuations throughout 2024, impacting revenue forecasts.

These price fluctuations directly affect Crescent's revenue streams and profitability. A sustained period of low oil and gas prices, as seen in some periods of 2023, could seriously strain the company's financial health and ability to invest in future projects. For example, if prices were to fall below $60 per barrel for an extended duration, it would significantly challenge earnings projections.

The intensifying global focus on sustainability and climate action presents a significant threat. Stricter environmental regulations, such as those targeting greenhouse gas emissions, are likely to elevate operational and compliance costs for oil and gas firms. For instance, the International Energy Agency (IEA) projected in its 2024 outlook that investments in clean energy technologies are expected to reach $2 trillion globally by 2024, highlighting the shift away from traditional energy sources. This regulatory pressure could also curtail future exploration and development projects, impacting long-term growth prospects.

Crescent Energy faces significant rivalry from a multitude of independent producers and major oil and gas corporations. This crowded market intensifies the cost of acquiring new drilling rights and makes it harder to secure promising undeveloped land. For instance, in 2023, the Permian Basin, a key operating area for many, saw an average lease bonus payment of over $5,000 per acre, reflecting this competitive pressure.

This intense competition directly impacts Crescent’s profitability by creating downward pressure on the prices it can command for its oil and gas. As more companies vie for market share, supply can outstrip demand, especially during periods of robust production. In early 2024, West Texas Intermediate (WTI) crude oil prices, while volatile, have generally traded in a range that squeezes margins for producers with higher operating costs.

Operational Risks and Supply Chain Disruptions

Crescent faces significant operational risks inherent in oil and gas exploration, drilling, and production. These can include unexpected equipment malfunctions, safety incidents, or severe weather events, all of which can halt operations and escalate expenses. For instance, in 2023, the energy sector globally experienced increased downtime due to extreme weather patterns impacting offshore and onshore activities.

Supply chain vulnerabilities also pose a considerable threat. Disruptions in the global flow of materials, specialized equipment, and skilled labor can lead to project delays and inflated costs. The ongoing geopolitical tensions and trade policy shifts in 2024 continue to create uncertainty around the availability and pricing of critical components, directly affecting project timelines and profitability for companies like Crescent.

- Equipment Failure: Incidents like pump failures or rig malfunctions can cause significant downtime, impacting production targets.

- Safety Incidents: Accidents at operational sites can lead to temporary shutdowns, regulatory scrutiny, and increased insurance premiums.

- Weather Impact: Extreme weather, such as hurricanes or severe cold, can halt drilling and production, leading to lost revenue. For example, Gulf of Mexico operations often face significant weather-related disruptions during hurricane season.

- Supply Chain Bottlenecks: Delays in receiving crucial parts or services, exacerbated by global logistics challenges, can push project completion dates further out and increase overall capital expenditure.

Geopolitical Instability and Economic Downturns

Geopolitical instability poses a significant threat to Crescent Energy. Global events can disrupt supply chains and alter energy demand, directly impacting pricing and investment. For instance, the ongoing conflicts in Eastern Europe have led to considerable volatility in global oil and gas markets, with Brent crude prices fluctuating throughout 2024, sometimes exceeding $90 per barrel, creating an unpredictable operating environment.

Broader economic downturns further exacerbate these risks. A global recession, which many analysts have warned could materialize in late 2024 or early 2025 due to persistent inflation and high interest rates, would likely reduce overall energy consumption. This could translate into lower revenues and reduced capital availability for Crescent Energy, potentially delaying crucial development projects.

The impact on investor confidence is also substantial. Periods of geopolitical tension and economic uncertainty often lead investors to seek safer assets, making it harder for companies like Crescent Energy to secure the financing needed for large-scale projects. For example, during periods of heightened geopolitical risk in early 2024, the cost of capital for energy companies saw an increase.

- Market Volatility: Geopolitical events in 2024 have caused significant price swings in energy commodities, impacting revenue forecasts.

- Reduced Investment: Economic slowdowns can decrease investor appetite for capital-intensive energy projects, limiting growth opportunities.

- Project Delays: Uncertainty stemming from global instability may force Crescent Energy to postpone or cancel planned developments.

- Capital Scarcity: A downturn can tighten credit markets, making it more expensive and difficult for Crescent Energy to raise necessary funds.

Crescent Energy faces a heightened risk from evolving regulatory landscapes and increasing environmental scrutiny. New mandates on emissions, methane reduction, and carbon capture could increase compliance costs. For example, the U.S. Environmental Protection Agency (EPA) has been strengthening methane regulations, impacting operational expenditures for oil and gas producers.

The transition to cleaner energy sources also presents a significant threat to long-term demand for fossil fuels. Global investments in renewables are accelerating, with the International Energy Agency (IEA) forecasting that renewable energy capacity additions will grow by over 50% in 2024 compared to 2023, potentially dampening oil and gas price appreciation.

Intense competition within the energy sector, especially in key shale plays, continues to pressure margins. Increased production from rivals can lead to oversupply, driving down commodity prices. For instance, in the Permian Basin, production levels in 2024 have remained robust, contributing to a competitive pricing environment.

Operational hazards remain a constant concern, with potential for equipment failures, safety incidents, or weather disruptions to halt production and incur costs. Supply chain vulnerabilities, including shortages of specialized equipment or labor, further complicate project execution and budget management, as seen with disruptions impacting global logistics throughout 2023 and into 2024.

| Threat Category | Specific Risk | Potential Impact | Illustrative Data/Example |

| Market Volatility | Oil and Gas Price Fluctuations | Reduced revenue, lower profitability | Brent crude averaged around $80-$85/barrel in early 2024, with potential for sharp drops on supply news. |

| Regulatory & Environmental | Stricter Emissions Standards | Increased compliance costs, potential project delays | Methane emission regulations are tightening globally, potentially adding 5-10% to operational costs for some producers. |

| Competition | Oversupply from Rivals | Downward pressure on prices, reduced market share | Permian Basin output exceeding 6 million barrels per day in early 2024 contributes to a competitive market. |

| Operational Risks | Supply Chain Disruptions | Project delays, increased capital expenditure | Global shipping costs and lead times for specialized drilling equipment saw significant increases in late 2023 and early 2024. |

SWOT Analysis Data Sources

This analysis draws from a robust blend of internal financial statements, comprehensive market research reports, and validated industry expert opinions to provide a well-rounded perspective.