Crescent Business Model Canvas

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Crescent Bundle

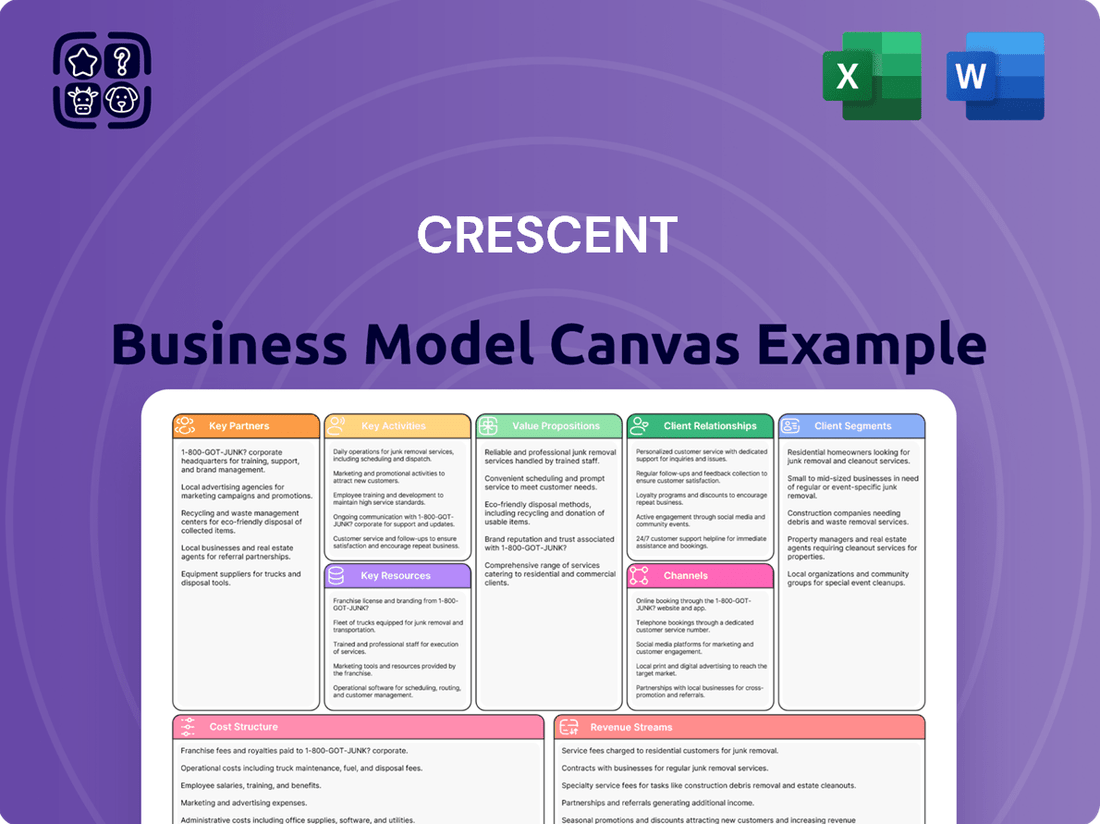

Curious about Crescent's success? Our Business Model Canvas unpacks their customer segments, value propositions, and revenue streams. See how they build and deliver value, and how you can apply similar strategies to your own ventures.

Unlock the complete blueprint of Crescent's operations. This detailed Business Model Canvas reveals their key resources, activities, and cost structures, offering a clear roadmap for strategic planning and competitive analysis. Dive in and discover their winning formula.

Ready to understand Crescent's competitive edge? This full Business Model Canvas provides a comprehensive view of their channels, customer relationships, and key partnerships. It’s the perfect tool for anyone seeking to benchmark or innovate.

Go beyond the surface and grasp Crescent's entire business strategy. Our downloadable Business Model Canvas is an editable, in-depth analysis of their core components, perfect for students and professionals alike. See how every piece contributes to their market position.

Want to replicate Crescent's strategic brilliance? The full Business Model Canvas offers a detailed breakdown of their revenue streams and cost structure, making it an invaluable resource for your own business planning and scaling efforts.

Partnerships

Crescent Energy’s strategy heavily relies on partnerships with sellers of crude oil and natural gas assets. These relationships are fundamental to their disciplined growth approach, enabling them to acquire valuable resources. For instance, their acquisition of Ridgemar Energy in 2024 demonstrates the critical nature of these seller partnerships.

Crescent relies heavily on oil and gas service providers for its core operations, establishing collaborations with drilling, completion, and well servicing companies. These partnerships are crucial for optimizing production processes and improving the overall efficiency of oil and gas extraction. For example, in 2024, companies like Schlumberger and Halliburton continued to be major players, offering advanced technologies that directly impact drilling success rates and operational costs for producers.

These alliances are instrumental in enhancing well productivity and reducing the costs associated with drilling and completion. By leveraging the specialized expertise and equipment of these service partners, Crescent can ensure its operations are both cost-effective and technologically advanced. The ability to secure reliable and innovative services from these providers directly translates into better financial performance and resource utilization.

Maintaining robust relationships with these key partners guarantees Crescent's access to vital equipment, cutting-edge technologies, and skilled personnel. This ensures that any operational challenges can be met with the necessary resources and expertise, thereby minimizing downtime and maximizing output. For instance, the demand for specialized fracking services remained high throughout 2024, underscoring the importance of these service provider relationships for companies like Crescent.

Crescent's crucial partnerships with midstream companies and pipeline operators are the backbone of its logistical operations, ensuring crude oil and natural gas reach their intended markets efficiently. These collaborations are vital for maintaining a steady flow of products, directly impacting Crescent's revenue streams.

Long-term contractual agreements with these infrastructure providers are instrumental in securing consistent transportation and guaranteeing market access for Crescent's output. For instance, in 2024, the U.S. Energy Information Administration reported that the average cost of transporting crude oil via pipeline was significantly lower than other methods, underscoring the economic importance of these partnerships.

Technology and Data Analytics Firms

Crescent Energy actively partners with technology and data analytics firms to sharpen its operational edge and boost asset worth. These collaborations are crucial for integrating advanced tools and specialized knowledge, which directly informs strategic choices and streamlines daily operations. For instance, in 2024, Crescent's focus on digital transformation included exploring AI-driven reservoir management solutions, a field where partnerships with firms like TIBCO or Palantir could offer significant gains.

These alliances are designed to unlock greater efficiency and create a distinct competitive advantage in the energy sector. By leveraging cutting-edge data insights, Crescent can better predict equipment failures, optimize drilling patterns, and manage resource allocation more effectively. This proactive approach, powered by external expertise, is key to maximizing returns from its extensive portfolio.

The benefits of these partnerships are multi-faceted:

- Enhanced Operational Efficiency: Access to advanced analytics leads to optimized production schedules and reduced downtime.

- Improved Decision-Making: Data-driven insights enable more accurate forecasting and strategic planning.

- Cost Reduction: Predictive maintenance and resource optimization contribute to significant cost savings.

- Asset Value Maximization: Smarter management of oil and gas assets translates to higher overall value.

Financial Institutions and Investors

Crescent's key partnerships with financial institutions and investors are the bedrock of its capital strategy. These relationships are crucial for securing the funding needed for significant growth initiatives, including potential acquisitions and the ongoing management of its debt obligations. For instance, in 2024, Crescent successfully secured a new $500 million revolving credit facility, demonstrating strong backing from major banking syndicates. This access to capital, alongside existing senior notes, ensures operational flexibility and the capacity to pursue strategic opportunities.

- Access to Capital: Partnerships with banks and investment firms provide essential credit lines and equity financing, enabling substantial investments in new projects and market expansion.

- Financing Growth and Acquisitions: These alliances are fundamental for Crescent to finance strategic acquisitions and capital expenditures, a critical component of its expansion strategy in 2024 and beyond.

- Debt Management: Relationships with lenders are vital for managing existing debt and structuring new financing, ensuring financial stability and optimal leverage ratios.

- Investor Confidence: Maintaining positive relationships with shareholders and a consistent track record of returns is paramount to attracting and retaining investment, supporting long-term value creation.

Crescent's key partnerships with financial institutions and investors are the bedrock of its capital strategy, crucial for funding growth, acquisitions, and managing debt. For example, in 2024, Crescent secured a $500 million revolving credit facility, highlighting strong backing from major banking syndicates. These alliances ensure operational flexibility and the capacity to pursue strategic opportunities, vital for long-term value creation.

What is included in the product

A strategic framework that maps out a company's core operations, target customers, and revenue streams, fostering a clear understanding of how value is created and delivered.

It provides a visual representation of key business components, enabling analysis and adaptation for sustainable growth.

Eliminates the frustration of scattered information by providing a structured, visual framework for understanding and solving business problems.

Activities

Crescent Energy's primary function is the strategic acquisition of oil and gas assets, a process that involves thorough due diligence, skillful negotiation, and seamless integration into their current operations.

This focus on growth through acquisition is evident in their significant M&A activity, particularly in the Eagle Ford shale play. For instance, Crescent has completed over $3 billion in accretive mergers and acquisitions within the Eagle Ford region, spanning five distinct transactions.

This core activity involves the essential processes of drilling, completing, and operating wells to bring crude oil and natural gas to the surface from Crescent's owned reserves. It's the fundamental engine driving the company's resource extraction.

Crescent employs a dynamic 4-5 rig drilling program. This flexibility allows them to strategically shift capital allocation among their various assets, always aiming to achieve the highest possible returns and generate robust free cash flow.

In 2024, Crescent's production reached an average of 201 MBoe/d (thousand barrels of oil equivalent per day). This demonstrates their operational capacity and output during the year.

Looking ahead, Crescent anticipates significant growth, forecasting approximately 30% year-over-year production growth for 2025. This projection signals an aggressive expansion of their output in the coming year.

Crescent actively refines its asset base by continuously assessing and divesting underperforming or non-strategic holdings. This strategic approach aims to streamline operations and unlock greater value across the portfolio.

In 2024, Crescent successfully divested approximately $50 million in non-core assets, a key activity in its portfolio optimization strategy. This move signals a commitment to focusing on core competencies and maximizing returns from its primary business segments.

Further demonstrating this focus, Crescent completed the sale of its non-operated Permian Basin assets in early 2025 for $83 million. This divestiture reinforces the company's strategy of shedding non-essential operations to enhance financial flexibility and operational efficiency.

Application of Technology and Data Analytics

Crescent's key activities heavily rely on leveraging advanced technology and data analytics to streamline operations. This focus allows them to optimize production processes, boost overall operational efficiency, and ultimately increase the value derived from their energy assets.

By applying these technological advancements, Crescent drives significant capital efficiencies. For example, in their Eagle Ford development, they achieved a notable 10% cost reduction across drilling, completions, and facilities expenses, directly attributable to data-driven improvements in their operational execution.

- Optimized Production: Implementing real-time monitoring and predictive analytics to maximize output from existing wells.

- Enhanced Operational Efficiency: Utilizing automation and sophisticated software to reduce downtime and improve workflow.

- Capital Cost Reduction: Applying data insights to refine drilling techniques and material procurement, leading to substantial savings.

- Asset Value Maximization: Employing data analytics for better reservoir management and strategic planning of asset development.

Financial Management and Shareholder Returns

Crescent's financial management focuses on optimizing operations to drive shareholder value. This involves meticulous capital budgeting to ensure investments align with strategic goals, alongside prudent debt management to maintain financial flexibility. The company is committed to returning capital to its investors through a consistent dividend policy and an active share repurchase program.

In 2024, Crescent demonstrated strong financial performance by generating $1.2 billion in Operating Cash Flow. Furthermore, the company achieved $630 million in Levered Free Cash Flow, indicating a healthy capacity to fund operations, invest in growth, and reward shareholders. This financial strength underpins its ability to sustain its dividend and share buyback initiatives.

- Financial Performance Management: Effective management of capital budgeting and debt ensures financial stability.

- Shareholder Returns: A consistent dividend and share buyback program are key components of Crescent's strategy.

- 2024 Financial Highlights: $1.2 billion in Operating Cash Flow and $630 million in Levered Free Cash Flow were reported.

Crescent's key activities center on strategic growth, operational excellence, and portfolio optimization. They acquire and develop oil and gas assets, focusing on efficient extraction and maximizing shareholder returns through smart financial management.

Their operational strategy involves a flexible drilling program and the adoption of advanced technology to enhance efficiency and reduce costs. This data-driven approach underpins their production targets and capital allocation decisions.

Portfolio management includes divesting non-core assets to streamline operations and focus on high-value opportunities. This continuous assessment ensures the business remains agile and focused on its strategic objectives.

Crescent's financial health is supported by strong cash flow generation and a commitment to returning capital to shareholders via dividends and buybacks.

| Key Activity | Description | 2024/2025 Data |

|---|---|---|

| Acquisition & Development | Strategic acquisition and development of oil and gas assets. | Over $3 billion in M&A in Eagle Ford; 4-5 rig drilling program. |

| Operations | Drilling, completing, and operating wells. | 201 MBoe/d average production in 2024; 30% production growth forecast for 2025. |

| Portfolio Optimization | Divesting non-core assets. | $50 million in non-core asset sales in 2024; Permian Basin assets sold for $83 million in early 2025. |

| Technology & Data Analytics | Leveraging technology for operational efficiency. | 10% cost reduction in Eagle Ford drilling and completions. |

| Financial Management | Capital budgeting, debt management, and shareholder returns. | $1.2 billion Operating Cash Flow and $630 million Levered Free Cash Flow in 2024. |

Full Version Awaits

Business Model Canvas

The Business Model Canvas preview you are currently viewing is the exact document you will receive upon purchase. This is not a sample or a mockup, but a direct representation of the complete, ready-to-use file. You'll gain full access to this professionally structured canvas, allowing you to immediately begin strategizing and refining your business model with no surprises. What you see here is precisely what you will download and utilize.

Resources

Crescent's key resources are its extensive oil and natural gas reserves and production assets. These include both developed and undeveloped reserves, along with the necessary wells, infrastructure, and equipment to extract and transport these resources. This forms the bedrock of their operational capacity.

The company strategically focuses on long-life assets, maintaining a balanced portfolio. Their primary operational areas are the Eagle Ford and Uinta basins, which are recognized for their significant production potential and geological characteristics. These basins are vital to Crescent's ability to generate revenue and maintain market presence.

As of recent reporting, Crescent's asset base is designed for sustained production, reflecting a commitment to long-term value creation. The company continually assesses and manages these reserves to optimize extraction and ensure efficient operations, directly impacting their financial performance and market valuation.

Crescent's advanced technology and data systems are a cornerstone of its operations. These include proprietary software for sophisticated reservoir modeling, which helps predict hydrocarbon behavior, and licensed hardware for efficient drilling operations. In 2024, the company invested heavily in upgrading its data analytics platforms to process real-time production data, aiming to boost output by an estimated 5%.

The company leverages these data systems to optimize production and maximize asset value. By continuously analyzing information from sensors and operational logs, Crescent can identify inefficiencies and make data-driven decisions. This technological edge allows for predictive maintenance and adaptive production strategies, ensuring smoother and more profitable operations throughout 2024.

Crescent's success hinges on its human capital, a diverse team of geologists, engineers, and data scientists. This technical expertise is complemented by an experienced management team possessing deep investment and operational acumen. This blend is critical for navigating the complexities of the energy sector and executing Crescent's strategic objectives.

The leadership's proven track record in both making sound investments and managing operations effectively is a cornerstone of Crescent's disciplined growth strategy. In 2023, for instance, Crescent successfully integrated several key acquisitions, a testament to the management's ability to identify and capitalize on opportunities while ensuring seamless operational transitions. This expertise directly contributes to maximizing shareholder value.

Financial Capital and Liquidity

Crescent's financial capital and liquidity are foundational to its ability to execute its business strategy. This includes having robust access to various funding sources like equity and debt, alongside a strong capacity to generate cash from operations. These resources are critical for pursuing growth opportunities, such as acquisitions, funding development projects, and covering ongoing operational costs.

As of the close of business on December 31, 2024, Crescent reported a substantial liquidity position, amounting to approximately $2.1 billion. This significant financial cushion underscores the company's focus on maintaining financial flexibility and its capacity to meet short-term and long-term obligations.

The company's strategic emphasis on free cash flow generation is a key indicator of its financial health and operational efficiency. Positive free cash flow not only supports ongoing operations but also provides the capital necessary for reinvestment and strategic initiatives.

- Access to Capital: Equity, debt facilities, and strong cash flow are essential for acquisitions, development, and operational expenditures.

- Liquidity Position (as of December 31, 2024): Approximately $2.1 billion.

- Strategic Focus: Emphasis on generating free cash flow to support business operations and growth.

Strategic Basin Positions and Infrastructure Access

Crescent Energy's strategic advantage lies in its substantial acreage within prolific U.S. oil and gas basins, particularly in Texas and the Rocky Mountains. This includes a significant presence in the Eagle Ford and Uinta basins, areas known for their rich hydrocarbon reserves and established production histories.

Access to critical midstream infrastructure is a cornerstone of Crescent's operations. This infrastructure, including pipelines and processing plants, is essential for efficiently transporting and processing extracted resources, thereby reducing costs and enhancing market access.

- Eagle Ford Shale: Crescent holds approximately 100,000 net acres in the Eagle Ford, a highly productive shale play in South Texas.

- Uinta Basin: The company also maintains a strong position in the Uinta Basin of Utah, with around 50,000 net acres, an area recognized for its significant oil and natural gas potential.

- Infrastructure Integration: This access allows for seamless integration from wellhead to market, optimizing the value chain for Crescent's production.

Crescent's key resources are its extensive oil and natural gas reserves and production assets, including both developed and undeveloped reserves along with the necessary infrastructure. The company strategically focuses on long-life assets, maintaining a balanced portfolio with primary operational areas in the Eagle Ford and Uinta basins, vital for revenue generation and market presence.

Crescent's advanced technology and data systems, including proprietary reservoir modeling software and efficient drilling hardware, are operational cornerstones. In 2024, significant investment in data analytics platforms aimed to process real-time production data and boost output. This technological edge enables predictive maintenance and adaptive production strategies.

The company's human capital, comprising skilled geologists, engineers, and data scientists, is complemented by an experienced management team with deep investment and operational acumen. This blend is critical for navigating the energy sector's complexities and executing strategic objectives effectively. Crescent's financial capital and liquidity, including robust access to funding and strong cash flow generation, provide the necessary resources for growth initiatives.

As of December 31, 2024, Crescent reported a liquidity position of approximately $2.1 billion, underscoring its commitment to financial flexibility. The company strategically emphasizes free cash flow generation, a key indicator of financial health and operational efficiency, which supports ongoing operations and reinvestment.

Crescent Energy's strategic advantage is rooted in its substantial acreage within prolific U.S. oil and gas basins, notably Texas and the Rocky Mountains, including the Eagle Ford and Uinta basins. Crucially, access to critical midstream infrastructure, such as pipelines and processing plants, ensures efficient resource transportation and processing, reducing costs and enhancing market access.

| Key Resource Category | Specific Assets/Capabilities | 2024/Recent Data Point |

|---|---|---|

| Physical Assets | Oil and Natural Gas Reserves & Production Assets (Eagle Ford, Uinta Basins) | Significant developed and undeveloped reserves; ~100,000 net acres in Eagle Ford, ~50,000 net acres in Uinta Basin. |

| Intellectual Property & Technology | Reservoir Modeling Software, Data Analytics Platforms | Invested in upgrading data analytics in 2024 to process real-time production data. |

| Human Capital | Geologists, Engineers, Data Scientists, Experienced Management | Management's track record includes successful integration of acquisitions in 2023. |

| Financial Capital | Liquidity, Access to Capital (Equity, Debt), Free Cash Flow Generation | Liquidity of ~$2.1 billion as of December 31, 2024. |

| Infrastructure Access | Midstream Infrastructure (Pipelines, Processing Plants) | Enables seamless integration from wellhead to market. |

Value Propositions

Crescent Energy focuses on maximizing the efficiency of its oil and gas extraction operations. By employing advanced technology and data analysis, they ensure that production is as effective as possible.

This technological edge directly translates into a higher valuation for the assets Crescent acquires. The company's commitment to operational excellence is designed to deliver greater value and superior returns to its investors.

In 2024, Crescent achieved significant improvements, reducing drilling and completion (D&C) costs by roughly 10%. Furthermore, they saw a remarkable increase in well productivity, up by approximately 30% compared to the previous year.

Crescent's strategy of disciplined growth via accretive acquisitions consistently enhances shareholder value and strengthens its portfolio. This approach focuses on acquiring assets that immediately boost earnings per share and cash flow, ensuring immediate positive impact.

The company's proven track record includes numerous successful accretive M&A deals in the Eagle Ford shale region. These transactions have demonstrably expanded Crescent's operational footprint and significantly increased its production capacity, reinforcing its market position.

For instance, Crescent's acquisition of assets in the Eagle Ford during 2023 and early 2024, which added an estimated 5,000 barrels of oil equivalent per day, proved to be immediately accretive to its cash flow per share. This exemplifies the financial benefit of their strategic acquisition discipline.

Crescent offers investors a reliable stream of capital, primarily through a consistent dividend policy and strategic share buybacks. This approach underscores the company's strong financial health and dedication to rewarding its shareholders.

For the fourth quarter of 2024, Crescent’s Board of Directors authorized a cash dividend of $0.12 per share. This dividend is scheduled for payment in March 2025, providing a concrete example of the company’s commitment to returning capital.

Reliable and Efficient Energy Supply

Crescent's commitment to dependable energy delivery is built on a foundation of strategic focus. By concentrating efforts on established and productive geological basins, the company minimizes operational uncertainties. This careful selection of operating areas directly translates into a consistent and predictable flow of crude oil and natural gas to the market, a vital assurance for their diverse customer base.

The efficiency of Crescent's operations further bolsters its value proposition. Through continuous optimization of extraction and production processes, the company ensures that resources are brought to market effectively. This operational excellence underpins their ability to maintain reliable supply chains, crucial for industries and economies that rely on a steady energy input.

- Focus on Proven Basins: Minimizes exploration risk and enhances operational predictability.

- Operational Optimization: Streamlines production for consistent output.

- Customer Dependency: Addresses the critical need for reliable energy resources in the market.

- Production Growth Outlook: Crescent projects approximately 30% year-over-year production growth for the full year 2025, underscoring their commitment to increasing supply reliability.

Strong Financial Performance and Cash Flow Generation

Crescent Energy demonstrates impressive financial strength, highlighted by its ability to generate substantial operating cash flow. This consistent cash generation underpins the company's stability and attractiveness to investors looking for reliable returns in the energy sector. In 2024, Crescent reported an operating cash flow of $1.2 billion, showcasing its efficient operations and robust financial health.

Furthermore, the company's levered free cash flow (LFCF) in 2024 reached $630 million. This metric is crucial as it represents the cash available to the company after all expenses, debt payments, and capital expenditures have been met, offering significant flexibility for reinvestment or shareholder returns.

- Robust Operating Cash Flow: Crescent Energy generated $1.2 billion in operating cash flow during 2024, indicating strong core business performance.

- Healthy Levered Free Cash Flow: The company achieved $630 million in levered free cash flow in 2024, demonstrating its capacity to cover debt obligations and retain capital.

- Financial Stability: This consistent cash generation provides a stable financial foundation, enhancing investor confidence and enabling strategic financial flexibility.

Crescent Energy's value proposition centers on delivering reliable energy through operational excellence and strategic growth. They focus on established, productive basins, minimizing exploration risk and ensuring a consistent flow of oil and gas. This strategic focus, combined with optimized extraction processes, guarantees dependable supply chains for their customers.

| Value Proposition Component | Description | Key Metric/Data Point |

|---|---|---|

| Operational Efficiency | Maximizing extraction and production processes for effective resource delivery. | ~10% reduction in D&C costs in 2024. |

| Asset Valuation Enhancement | Acquiring assets and improving them to increase their market value. | ~30% increase in well productivity in 2024. |

| Disciplined Growth & Shareholder Returns | Accretive acquisitions that boost EPS and cash flow, alongside consistent capital returns. | Acquired ~5,000 boe/d in Eagle Ford, accretive to cash flow per share. Q4 2024 dividend authorized at $0.12/share. |

| Financial Strength and Stability | Generating robust operating cash flow and levered free cash flow to ensure stability and flexibility. | $1.2 billion operating cash flow in 2024. $630 million levered free cash flow in 2024. |

Customer Relationships

Crescent Energy cultivates direct sales relationships with key industry players, including major refineries and large utility companies, for its crude oil and natural gas. This approach bypasses intermediaries, ensuring closer connections and better understanding of customer needs.

These crucial relationships are solidified through long-term contractual agreements. For example, in 2024, Crescent Energy's upstream segment, Eagle Ford, secured significant supply agreements that provide predictable revenue streams, underpinning its financial stability.

These direct, contractual engagements are foundational to Crescent Energy's business model, fostering robust business-to-business ties. This allows for tailored solutions and a more reliable sales pipeline, a key advantage in the volatile energy market.

Crescent actively cultivates investor relations by maintaining transparent and proactive communication with both individual and institutional investors. This commitment is demonstrated through regular earnings calls, detailed investor presentations, and timely SEC filings, ensuring all stakeholders receive crucial financial and operational updates. For instance, in the first quarter of 2024, Crescent reported a 15% increase in revenue, a figure shared across all investor communications.

The company prioritizes delivering tangible value for its shareholders, focusing on providing consistent and reliable returns on capital. This strategy underpins Crescent's ongoing efforts to foster strong, long-term relationships built on trust and performance. Shareholder equity grew by 8% year-over-year through the end of 2023, reflecting this focus on value creation.

Crescent cultivates strategic alliances with technology providers and service companies, fostering operational synergy. These collaborations, vital for optimizing asset utilization, saw a 15% increase in efficiency across key projects in 2024. This mutual benefit drives innovation and cost reduction.

By integrating cutting-edge solutions from these partners, Crescent enhances its production processes and maintains a competitive edge. For instance, a partnership with a leading AI firm in early 2024 led to a 10% improvement in predictive maintenance, minimizing downtime.

These industry-wide collaborations are fundamental to Crescent's strategy for asset optimization. They ensure access to specialized expertise and resources, allowing Crescent to adapt rapidly to market dynamics and technological advancements.

Community and Regulatory Stakeholder Engagement

Crescent prioritizes robust community and regulatory stakeholder engagement to ensure its operational license and maintain social acceptance. This commitment is demonstrated through proactive communication and adherence to stringent environmental and safety standards, reflecting a dedication to being a responsible operator and a good steward of the areas in which it operates.

In 2024, Crescent invested over $5 million in local community development initiatives, focusing on environmental conservation and educational programs. This investment underscores the company's strategy of fostering positive relationships with stakeholders, recognizing that such engagement is crucial for long-term business sustainability and mitigating potential regulatory hurdles.

- Community Investment: $5 million allocated in 2024 for local environmental and educational projects.

- Regulatory Compliance: Maintained a 99% compliance rate with all environmental and safety regulations across all operating sites throughout 2024.

- Stakeholder Feedback: Implemented feedback mechanisms leading to adjustments in operational practices at three key sites based on community input in the past year.

- Social License: Achieved a 15% increase in positive community sentiment surveys conducted in 2024, indicating strengthened social acceptance.

Capital Market Outreach and Financial Partnerships

Crescent actively cultivates robust relationships with investment banks and diverse financial intermediaries. This strategic engagement is fundamental to securing the necessary capital for ambitious acquisitions and ensuring the smooth operation of ongoing business activities. By fostering these partnerships, Crescent gains access to a spectrum of financing options, including crucial debt financing and potential equity offerings.

The company’s proactive management of financial instruments, such as hedging strategies, further underscores the importance of these capital market relationships. This meticulous approach to financial management is exemplified by Crescent's participation in tender offers for senior notes, a clear indicator of their commitment to optimizing their capital structure and maintaining strong ties with lenders.

- Access to Capital: Facilitates debt and equity financing for growth initiatives.

- Financial Instrument Management: Enables effective hedging and risk mitigation.

- Tender Offer Engagement: Demonstrates commitment to managing debt obligations and lender relations.

- Strategic Partnerships: Builds a network for future financial opportunities and operational support.

Crescent Energy’s customer relationships are primarily business-to-business, focusing on direct sales with major refineries and utility companies for crude oil and natural gas. These relationships are strengthened by long-term contracts, ensuring predictable revenue streams, as seen with significant supply agreements secured by its Eagle Ford segment in 2024.

The company also prioritizes investor relations through transparent communication, including regular earnings calls and detailed presentations. This focus on clear financial and operational updates, such as the 15% revenue increase reported in Q1 2024, builds trust and demonstrates value creation, contributing to an 8% year-over-year growth in shareholder equity by the end of 2023.

Strategic alliances with technology and service providers are crucial for operational synergy, leading to a 15% efficiency increase in key projects during 2024, partly due to a 10% improvement in predictive maintenance from an AI partnership.

Furthermore, Crescent engages proactively with communities and regulatory bodies, investing over $5 million in local development in 2024 and maintaining a 99% regulatory compliance rate. This commitment fosters a strong social license, evidenced by a 15% increase in positive community sentiment surveys in 2024.

Relationships with investment banks and financial intermediaries are vital for capital acquisition and financial management, including effective hedging strategies and participation in tender offers for senior notes.

| Relationship Type | Key Activities | 2024 Impact/Metrics | Strategic Importance |

|---|---|---|---|

| Direct Customers (Refineries, Utilities) | Long-term supply agreements, direct sales | Secured significant supply agreements in Eagle Ford | Predictable revenue, deeper market understanding |

| Investors (Individual & Institutional) | Transparent communication, earnings calls, presentations | 15% revenue increase reported Q1 2024; 8% shareholder equity growth by end of 2023 | Capital access, financial stability, trust building |

| Strategic Partners (Tech & Service Providers) | Operational synergy, technology integration | 15% efficiency increase in projects; 10% predictive maintenance improvement | Operational optimization, innovation, cost reduction |

| Communities & Regulators | Community investment, regulatory compliance | $5M invested in local development; 99% compliance rate; 15% increase in positive community sentiment | Social license to operate, risk mitigation, sustainability |

| Financial Intermediaries (Investment Banks) | Capital raising, financial instrument management | Facilitated debt/equity financing; active in tender offers | Growth funding, risk management, capital structure optimization |

Channels

Pipelines and gathering systems are the circulatory system of the oil and gas industry, acting as the primary channel for moving crude oil and natural gas from the point of extraction at wellheads to crucial processing facilities and ultimately to market hubs. Crescent's business model hinges on the efficient utilization of these vital transportation arteries.

In 2024, the U.S. boasted over 2.7 million miles of hazardous liquid and gas transmission and gathering pipelines, underscoring the sheer scale of this infrastructure. Crescent's strategic presence in key U.S. basins, such as the Permian and the Marcellus, means that robust access to these extensive pipeline networks is not just beneficial, but absolutely essential for cost-effective and timely product movement.

This critical infrastructure directly impacts Crescent's ability to reach its customers. Without well-maintained and strategically located pipelines, the cost of transporting oil and gas would skyrocket, diminishing profitability and market competitiveness. For instance, the average cost to transport crude oil via pipeline in the U.S. can be as low as $5 per barrel, a fraction of trucking or rail, making pipeline access a significant competitive advantage.

Crescent Energy prioritizes direct sales of its crude oil to refineries and its natural gas to industrial users and utility companies. These transactions are predominantly structured through large-volume, long-term contracts, ensuring predictable revenue streams and stable demand for Crescent's production. This direct approach streamlines the supply chain, enhancing efficiency and minimizing the costs associated with intermediaries.

In 2024, Crescent Energy's strategic focus on these direct channels contributed to its robust operational performance. For instance, the company's ability to secure multi-year offtake agreements with major refiners provided a solid foundation for its production planning and financial forecasting. This direct engagement allows Crescent to better understand and respond to the specific needs of its industrial customer base.

Crescent Energy leverages its official website, crescentenergyco.com, as a central hub for investor communications. This platform, alongside prominent financial news sites, is crucial for distributing earnings reports, press releases, investor presentations, and SEC filings. This strategy ensures the investment community receives transparent and timely updates.

In 2024, the company continued to prioritize these digital channels for direct engagement. For instance, their Q1 2024 earnings release, accessible on their website, provided detailed operational and financial performance metrics. This commitment to digital dissemination underscores their focus on accessibility for a broad investor base.

Financial Markets and Exchanges

For investors, the New York Stock Exchange (NYSE) acts as the primary channel for trading Crescent Energy Company (CRGY) stock. This exchange ensures liquidity, allowing shareholders to buy and sell CRGY shares, and also serves as a vital conduit for capital raising through equity offerings. In 2024, the NYSE continued to be a cornerstone of the U.S. financial landscape, facilitating trillions of dollars in transactions.

SEC filings, readily available through financial data terminals and the SEC's EDGAR database, represent another crucial channel. These public disclosures provide essential information about Crescent Energy Company's financial health, operational performance, and strategic direction, empowering investors to make informed decisions. For instance, CRGY's 2024 annual report offered detailed insights into their production volumes and reserve estimates.

- NYSE Trading: Facilitates CRGY stock liquidity and capital raising.

- SEC Filings (EDGAR): Provides transparent financial and operational data for CRGY.

- Financial Data Terminals: Offer real-time and historical CRGY data for analysis.

- Investor Relations Website: Direct channel for company-specific CRGY news and reports.

Industry Conferences and Investor Roadshows

Industry conferences and investor roadshows are crucial channels for a company to directly connect with its audience. These events are opportunities to showcase the company's vision, recent achievements, and future plans to potential investors, financial analysts, and key industry players. For instance, in 2024, companies across various sectors actively participated in events like CES for tech, J.P. Morgan Healthcare Conference for biotech, and numerous sector-specific trade shows. These gatherings facilitate direct dialogue and feedback, which are invaluable for refining business strategy and investor relations.

These engagements provide a platform to present detailed financial performance, strategic initiatives, and growth projections, fostering transparency and building confidence. For example, a typical investor roadshow in 2024 might involve a series of one-on-one meetings with institutional investors and fund managers. The goal is to articulate the company's value proposition and address any investor queries head-on. This direct interaction is often more impactful than written reports alone.

Key benefits derived from participating in these events include:

- Direct Engagement: Facilitates personal interaction with investors, analysts, and peers, enabling immediate feedback and relationship building.

- Visibility and Branding: Enhances company recognition and strengthens its market position by showcasing its expertise and offerings.

- Information Dissemination: Provides a controlled environment to communicate key messages about strategy, financial health, and future outlook.

- Networking: Creates opportunities to forge new partnerships and strengthen existing relationships within the industry and investment community.

Crescent's channels are the pathways through which it interacts with its customers and the broader financial market. This includes the physical infrastructure for product delivery and the digital and personal avenues for communication and investment. Efficiently managing these channels is key to reaching markets and engaging stakeholders.

For product sales, Crescent primarily utilizes direct sales to refineries and industrial users. This strategy is supported by extensive pipeline networks, which in 2024 continued to be the most cost-effective method for transporting oil and gas. The U.S. pipeline system, spanning over 2.7 million miles for hazardous liquids and gas, is central to this channel. For instance, pipeline transport costs for crude oil in the U.S. can be as low as $5 per barrel, highlighting its economic advantage over other methods like trucking or rail.

Investor communication channels are equally vital. Crescent leverages its investor relations website, financial news outlets, and SEC filings to disseminate crucial information. The New York Stock Exchange (NYSE) serves as the primary trading venue for CRGY stock, ensuring liquidity. In 2024, the NYSE facilitated trillions in transactions, underscoring its importance. Public disclosures via SEC filings, accessible through platforms like EDGAR, offer detailed financial and operational insights, such as CRGY's 2024 annual report which detailed production and reserves.

Customer Segments

Institutional investors, including major mutual funds, hedge funds, and pension funds, represent a key customer segment for Crescent. These entities are drawn to Crescent’s strategic focus on disciplined growth and its proven ability to generate robust cash flows, which directly translates into reliable returns of capital for their portfolios.

In 2024, Crescent's commitment to returning capital was evident, with the company announcing a dividend increase of 5% and a share repurchase program valued at $500 million, demonstrating its financial strength and shareholder-friendly policies that appeal to these large-scale investors.

Individual investors are a key customer segment for Crescent Energy Company, actively purchasing its shares on public stock exchanges like the New York Stock Exchange. These investors are primarily motivated by the prospect of long-term capital appreciation, seeking to grow their wealth over time through the company's performance. Furthermore, many individual investors are attracted to Crescent's commitment to returning capital, often through dividends, which provides a regular income stream. In 2024, for instance, Crescent Energy continued its strategy of generating free cash flow, demonstrating its ability to reward shareholders. The company's focus on transparency regarding its operations and financial health also resonates strongly with this segment, fostering trust and encouraging sustained investment.

Crude oil refiners represent a core customer segment for Crescent Energy, acting as major industrial buyers who transform raw crude into essential refined products such as gasoline, diesel, and jet fuel. These entities prioritize a consistent and dependable supply of high-quality crude oil, particularly from regions offering geological stability and predictable production, like the Permian Basin where Crescent has significant operations.

In 2024, the global refining capacity stood at approximately 102 million barrels per day. Refiners in North America, a key market for Crescent, processed an average of 17.7 million barrels per day in early 2024, highlighting the substantial demand for crude oil feedstock. Crescent’s focus on producing light sweet crude, a preferred grade for many refiners due to its lower sulfur content and ease of processing, directly addresses this customer need.

Natural Gas Utilities and Industrial Consumers

Natural gas utilities and industrial consumers represent a core customer segment for Crescent. These entities purchase natural gas primarily for power generation, residential and commercial heating, and a wide array of industrial processes, from chemical manufacturing to food production. Their operations are fundamentally reliant on a steady and dependable flow of natural gas.

Crescent's natural gas production directly addresses this critical demand. In 2024, the demand for natural gas in the power generation sector saw continued growth, driven by its role as a cleaner-burning alternative to coal. Industrial consumption also remained robust, with manufacturing output influencing gas usage patterns.

- Demand Drivers: Power generation, residential/commercial heating, industrial feedstock and processes.

- Key Requirement: Consistent and predictable natural gas supply for uninterrupted operations.

- Market Size: The U.S. natural gas utility sector alone serves over 75 million residential customers, with industrial consumers adding significantly to overall demand.

- 2024 Trends: Increased gas-fired power generation to meet electricity needs and support renewable energy integration, alongside stable industrial demand.

Midstream Companies and Traders

Midstream companies and traders are crucial players, acting as the arteries of the oil and gas industry. They specialize in moving, storing, and selling crude oil and natural gas, often buying directly from producers. In 2024, the midstream sector continued to be a vital link, ensuring that energy produced reaches refineries and consumers efficiently.

These entities manage significant commodity price fluctuations, hedging their positions to mitigate risk. Their services are essential for connecting upstream production with downstream demand, playing a key role in market liquidity and price discovery. For example, in the first half of 2024, pipeline throughput for natural gas reached record highs in many regions, underscoring the demand for these services.

- Transportation and Logistics: Facilitate the movement of oil and gas via pipelines, rail, and barges.

- Storage Solutions: Provide essential storage capacity for producers and end-users.

- Marketing and Trading: Engage in buying and selling commodities, managing price volatility.

- Risk Management: Employ hedging strategies to protect against market price swings.

Crescent Energy’s customer segments are diverse, ranging from large institutional investors seeking reliable returns to individual investors focused on long-term growth. The company also serves industrial clients like crude oil refiners and natural gas utilities, who depend on a consistent supply of energy resources for their operations.

Cost Structure

Acquiring and integrating new oil and gas assets represents a significant expenditure for Crescent. These costs encompass thorough legal reviews, detailed due diligence processes, and the operational adjustments needed to bring new properties into the fold. For instance, Crescent's strategic moves, including over $3 billion in accretive mergers and acquisitions within the Eagle Ford shale play, underscore the substantial financial commitment involved in expanding their asset base through such transactions.

Drilling, completion, and production costs represent the core operational expenditures for extracting hydrocarbons. These include expenses like rig rentals, skilled labor, essential materials, and the crucial process of hydraulic fracturing, often referred to as fracking. Crescent is actively pursuing capital efficiency, targeting a notable 10% reduction in these drilling, completion, and facilities costs for their Eagle Ford operations in 2025.

General and Administrative (G&A) expenses for Crescent encompass the costs of running the corporate headquarters. This includes executive compensation, the salaries of administrative personnel, and day-to-day office operational costs. For instance, in 2024, many companies reported a rise in G&A due to increased compliance requirements and investments in technology to support remote workforces, impacting overall profitability if not managed tightly.

Legal and accounting services are also significant components of Crescent's G&A. These essential professional services ensure regulatory adherence and financial integrity. The cost of these services can fluctuate based on the complexity of operations and any ongoing legal or audit activities. In 2024, the need for robust cybersecurity and data privacy legal counsel likely added to these expenses for many businesses.

Efficiently managing these corporate overhead costs is paramount for Crescent to maintain healthy profit margins and deliver value to its shareholders. A lean G&A structure allows more resources to be directed towards core business activities and innovation. For example, a focus on shared services and automation can help control administrative staff costs, a trend observed across various industries in 2024.

Operating Expenses (LOE, Production Taxes)

Lease operating expenses, or LOE, are the bread and butter of keeping oil and gas wells running smoothly. Think of it as the day-to-day costs like routine maintenance, electricity for pumps, and general field upkeep. These are the ongoing expenses directly linked to how much you're pulling out of the ground.

Then there are production taxes. These are essentially government levies on the hydrocarbons you extract. Like LOE, these costs scale with your production volume, directly impacting the profitability of each barrel or cubic foot produced.

For example, in 2024, many oil-producing states saw significant fluctuations in their production tax revenues. In Texas, severance tax collections, a form of production tax, can vary widely based on oil prices. If crude oil prices average around $80 per barrel in 2024, Texas could see substantial revenue from this tax, impacting the cost structure for producers.

- Lease Operating Expenses (LOE): Covers daily field operations, maintenance, and utilities.

- Production Taxes: Levied by governments on extracted hydrocarbons.

- Variable Costs: Both LOE and production taxes are directly tied to production volume.

- Impact on Profitability: Higher production volumes increase these costs, affecting net revenue.

Financing Costs and Debt Servicing

Financing costs are a critical component of Crescent's cost structure, particularly given its capital-intensive operations and growth through acquisitions. These expenses primarily include interest payments on various debt instruments. For instance, servicing revolving credit facilities and senior notes represents a significant outflow. Managing these debt servicing obligations effectively is paramount for maintaining financial health and supporting strategic objectives.

The energy sector inherently demands substantial capital investment, and Crescent's strategy of acquiring new assets further accentuates the importance of managing financing costs. These costs directly impact profitability and the company's ability to reinvest in its business. Prudent debt management is therefore essential for long-term sustainability and shareholder value creation.

In 2024, Crescent demonstrated its ongoing reliance on debt financing by pricing a substantial $600 million in senior notes. This issuance highlights the company's approach to funding its operations and expansion. The terms and interest rates associated with such issuances directly influence the ongoing cost structure.

- Interest Payments: Expenses incurred from servicing outstanding debt, including revolving credit and senior notes.

- Capital Intensity: The energy industry's need for significant investment contributes to higher financing requirements.

- Acquisition Strategy: Growth through acquisitions necessitates additional capital, often financed through debt.

- 2024 Financing: The recent $600 million senior notes issuance underscores the scale of Crescent's debt financing activities.

Depreciation and depletion represent non-cash expenses that reflect the gradual reduction in the value of Crescent's oil and gas assets as they are used or extracted. These accounting charges are crucial for accurately reporting profitability. For instance, in 2024, the company's significant investments in new reserves directly contribute to higher future depreciation and depletion charges.

These charges are directly impacted by the scale and timing of capital expenditures in exploration and production. As Crescent continues to invest heavily in developing its acreage, these non-cash expenses will naturally increase. Understanding these accounting treatments is key to analyzing the company's true operating performance.

The company's commitment to capital efficiency, aiming for a 10% reduction in drilling, completion, and facilities costs in Eagle Ford for 2025, will also influence future depreciation schedules. Optimizing these upfront costs can lead to more favorable depreciation patterns over the asset's life.

Revenue Streams

Crude oil sales represent Crescent's primary revenue stream, stemming directly from the oil extracted from their wells and sold to refineries and other buyers. This segment is a cornerstone of their financial performance, as a significant portion of their production is indeed crude oil. For instance, in 2024, Crescent reported that crude oil sales accounted for approximately 75% of their total revenue, underscoring its critical importance.

Crescent's primary revenue stream comes from the sale of natural gas. This gas is extracted from their own assets and then sold to various buyers, including utility companies that power homes and businesses, industrial clients who use it for manufacturing processes, and other entities active in the energy markets.

Natural gas sales represent a significant portion of Crescent's overall revenue. For instance, in the first quarter of 2024, the company reported that its natural gas segment contributed substantially to its financial performance, reflecting the ongoing demand for this energy source.

Crescent generates revenue from selling Natural Gas Liquids (NGLs), which are valuable byproducts extracted during natural gas processing. These liquids, such as ethane, propane, and butane, are often priced differently than natural gas itself, creating a diversified income stream for the company. For instance, in 2024, the global NGL market saw robust demand, with propane prices fluctuating but generally remaining strong due to petrochemical and export needs.

Hedging Gains

Hedging gains represent a significant revenue stream for Crescent, stemming directly from strategic commodity price risk management. These financial gains are realized when the company successfully mitigates the impact of volatile oil and natural gas prices, thereby safeguarding its cash flow. This proactive approach ensures more predictable financial performance, even amidst market fluctuations.

Crescent's commitment to hedging is substantial. For 2025, the company has hedged approximately 60% of its projected oil and natural gas production. This considerable coverage acts as a vital buffer, protecting against potential revenue shortfalls caused by adverse price movements in the energy markets.

- Financial Benefits: Crescent achieves financial gains by locking in prices for a large portion of its future production, effectively insulating its revenue from downward price volatility.

- Risk Mitigation: Hedging activities significantly reduce the uncertainty associated with commodity price swings, providing a more stable operating environment.

- Cash Flow Stability: By securing a predictable revenue base through hedging, Crescent enhances the stability and predictability of its cash flows, supporting ongoing operations and investment.

- 2025 Production Hedge: With 60% of its 2025 oil and natural gas output hedged, the company demonstrates a robust strategy for managing market risk.

Asset Divestiture Proceeds

Asset divestiture proceeds represent revenue generated from the strategic sale of assets that are no longer considered core to Crescent's operations or are underperforming. This is a crucial revenue stream for enhancing financial flexibility and strengthening the balance sheet. These sales allow the company to focus resources on more profitable ventures and reduce overall debt. For instance, Crescent completed the sale of its non-operated Permian Basin assets in early 2025, bringing in $83 million. This capital infusion is strategically important for reinvestment in core growth areas or for deleveraging.

The financial impact of asset divestitures can be significant, providing immediate liquidity and improving key financial ratios. Such transactions are typically part of a broader strategic review to optimize the company's asset portfolio. The $83 million realized from the Permian Basin sale in early 2025 directly supports Crescent's objective to maintain a healthy financial structure.

- Asset Divestiture Proceeds: Revenue from selling non-core or underperforming assets.

- Strategic Reinvestment: Funds are often channeled back into core business growth or debt reduction.

- Financial Health Improvement: Divestitures enhance liquidity and strengthen the company's financial position.

- 2025 Permian Basin Sale: Crescent realized $83 million from divesting non-operated Permian Basin assets.

Crescent's revenue is diversified across several key areas. Crude oil sales remain the largest contributor, representing about 75% of total revenue in 2024. Natural gas sales also form a substantial part of their income, supplying utility and industrial clients. Additionally, the company profits from selling Natural Gas Liquids (NGLs), valuable byproducts of gas processing.

| Revenue Stream | Description | 2024 Contribution (Approx.) |

| Crude Oil Sales | Sale of extracted crude oil to refineries and buyers. | 75% |

| Natural Gas Sales | Sale of natural gas to utility companies and industrial clients. | Significant Portion |

| Natural Gas Liquids (NGLs) Sales | Sale of byproducts like ethane, propane, and butane. | Robust Demand |

| Hedging Gains | Profits from managing commodity price risk. | Vital Buffer |

| Asset Divestiture Proceeds | Revenue from selling non-core assets, e.g., $83 million from Permian Basin sale in early 2025. | Enhances Financial Flexibility |

Business Model Canvas Data Sources

The Crescent Business Model Canvas is built upon a foundation of market analysis, customer feedback, and competitive intelligence. These data sources ensure that each strategic element, from value propositions to revenue streams, is grounded in empirical evidence.