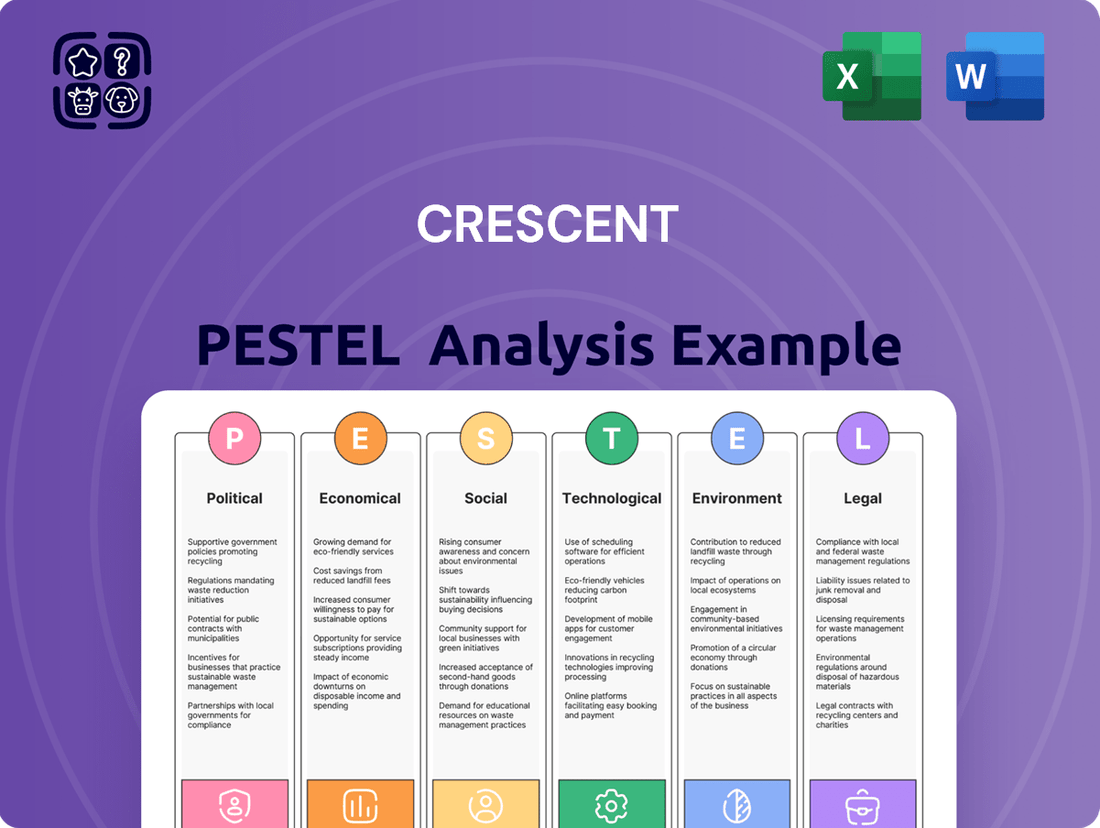

Crescent PESTLE Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Crescent Bundle

Navigate the complex external forces shaping Crescent's trajectory with our comprehensive PESTLE analysis. Understand the political, economic, social, technological, legal, and environmental factors that present both opportunities and challenges for the company. This expert-crafted report provides the crucial intelligence you need to anticipate market shifts and refine your strategic approach. Gain a competitive advantage by downloading the full PESTLE analysis today.

Political factors

Shifts in US government policy, especially with a new administration, could see deregulation in the oil and gas industry. This might include more drilling on federal lands and faster permitting, directly benefiting companies like Crescent Energy.

Relaxing methane emissions regulations is another potential change that could positively impact Crescent's operational costs and expansion plans. In 2024, the energy sector is closely watching policy pronouncements for signals on environmental compliance and resource development.

Geopolitical stability significantly impacts Crescent's operational landscape, particularly concerning energy security. The United States' focus on bolstering domestic energy production, driven by global events, directly benefits companies like Crescent by potentially creating a more favorable market. For instance, in late 2024, as global energy markets remained volatile, the U.S. Department of Energy continued to emphasize strategies supporting increased oil and gas output, aiming to insulate the nation from international supply disruptions.

Changes in US trade policies, such as the potential reintroduction of reciprocal tariffs or adjustments to existing trade agreements, can significantly alter global energy market dynamics. For instance, shifts in how the US approaches international energy agreements could impact the competitiveness of its oil and gas exports, influencing global supply and demand balances. These policy changes directly affect investment decisions within the energy sector by creating either new opportunities or increased risks.

Taxation and Subsidy Frameworks

The taxation and subsidy frameworks directly influence Crescent Energy's financial performance and strategic direction. Changes in tax incentives for fossil fuels or the introduction of new environmental taxes, such as carbon taxes, can alter project economics. For instance, in the US, federal tax credits for renewable energy, like the Investment Tax Credit (ITC) and Production Tax Credit (PTC), have been crucial drivers of growth, with the Inflation Reduction Act of 2022 extending and enhancing these incentives through 2032, providing significant tailwinds for renewable investments.

Companies like Crescent Energy must vigilantly track legislative shifts. The potential for increased taxes on carbon emissions or a reduction in subsidies for conventional energy sources could necessitate a re-evaluation of capital allocation and investment horizons. Conversely, enhanced support for alternative energy technologies could open new avenues for profitable growth and diversification. For example, as of early 2024, discussions around potential changes to corporate tax rates or the introduction of new energy-related levies remain a key consideration for long-term financial planning.

- Federal Tax Credits: The Inflation Reduction Act (IRA) of 2022 extended and modified key tax credits for clean energy, offering substantial incentives for wind and solar projects through 2032.

- State-Level Incentives: Many states offer their own tax credits, grants, and performance-based incentives for energy production and efficiency improvements, varying widely across jurisdictions.

- Carbon Pricing Mechanisms: While the US does not have a federal carbon tax, several states and regions have implemented or are considering carbon pricing mechanisms, which directly impact the cost of fossil fuel-based energy generation.

- Fossil Fuel Subsidies: Ongoing debates persist regarding the continuation or phasing out of subsidies for fossil fuel production, which can affect the competitiveness of traditional energy sources relative to renewables.

State and Local Regulatory Environment

Beyond federal oversight, Crescent Energy navigates a complex web of state and local regulations crucial for its oil and natural gas activities. These regional rules, covering everything from land use permits to emissions standards, differ significantly across the basins where the company operates, such as the Permian Basin or the Eagle Ford Shale.

The varying stringency and interpretation of these state and local environmental controls and operational mandates directly impact Crescent's compliance costs and the pace of its project development. For instance, a new wastewater disposal regulation in Texas could necessitate additional investment in infrastructure, potentially delaying drilling schedules.

Key areas of state and local regulatory focus impacting Crescent Energy include:

- Environmental Permitting: Obtaining and maintaining permits for drilling, production, and waste disposal, with varying requirements for air and water quality monitoring.

- Land Use and Zoning: Adherence to local zoning ordinances and land use planning that dictate where exploration and production activities can occur.

- Worker Safety: State-specific occupational safety standards for oil and gas field operations, often exceeding federal minimums.

- Royalty and Severance Taxes: State-imposed taxes on extracted resources, which can influence profitability and investment decisions.

In 2024, states like Colorado have seen increased scrutiny on methane emissions from oil and gas operations, potentially leading to stricter reporting and mitigation requirements that could affect companies like Crescent Energy operating within its borders.

Government policies significantly shape the energy sector. Shifts in US federal policy, particularly concerning deregulation and environmental standards, can directly benefit companies like Crescent Energy. For example, the potential relaxation of methane emission regulations in 2024 could lower operational costs and facilitate expansion.

Geopolitical stability and national energy security strategies also play a crucial role, as seen in late 2024 when global volatility underscored the US focus on domestic production, creating a more favorable market for companies like Crescent. Trade policies and international agreements further influence global energy market dynamics and investment decisions.

Taxation and subsidy frameworks are critical. While the Inflation Reduction Act of 2022 extended clean energy tax credits through 2032, discussions in early 2024 about corporate tax rates or new energy levies remain vital for financial planning. State-level incentives and evolving carbon pricing mechanisms add further complexity.

State and local regulations, covering environmental permitting, land use, worker safety, and severance taxes, create a varied operational landscape for Crescent Energy. For instance, stricter methane emission rules in states like Colorado, observed in 2024, can increase compliance burdens and impact project timelines.

| Factor | Description | Impact on Crescent Energy | 2024/2025 Relevance |

| Deregulation | Potential easing of drilling and permitting rules on federal lands. | Lowered operational costs, increased development opportunities. | Key focus for industry in anticipation of policy changes. |

| Environmental Regulations | Changes to methane emission standards and wastewater disposal rules. | Impacts compliance costs and project timelines; stricter rules may increase expenses. | Ongoing state-level scrutiny, e.g., Colorado's methane rules in 2024. |

| Geopolitical Stability | Global energy security concerns and US domestic production emphasis. | Potentially creates a more favorable market and supports energy independence. | Volatility in global markets in late 2024 reinforced this trend. |

| Tax & Subsidies | Federal tax credits (IRA extension) and state-level incentives. | Drives investment in renewables; changes in fossil fuel subsidies affect competitiveness. | Discussions on corporate tax rates and new energy levies ongoing in early 2024. |

What is included in the product

The Crescent PESTLE Analysis comprehensively examines the external macro-environmental factors impacting the Crescent across Political, Economic, Social, Technological, Environmental, and Legal dimensions.

It provides actionable insights for strategic decision-making by identifying key trends, opportunities, and threats within the Crescent's operating landscape.

The Crescent PESTLE Analysis serves as a pain point reliever by offering a structured and comprehensive overview of external factors, simplifying complex market dynamics for clearer strategic decision-making.

Economic factors

Crescent Energy's financial performance is closely tied to the volatile nature of global oil and natural gas prices. This sensitivity means that even small shifts in the market can significantly impact the company's profitability. For instance, if oil prices were to fall, it would directly affect Crescent's revenue streams, even if natural gas prices remain robust.

Looking ahead to 2025 and 2026, analysts are flagging potential downward pressure on crude oil prices. This outlook is primarily driven by expectations of an oversupply situation coupled with a moderation in global demand growth. This forecast suggests that Crescent might face revenue challenges in its oil-centric operations during this period.

Conversely, the natural gas market is showing more optimistic trends, with strong price forecasts for the same period. This divergence in price expectations between oil and natural gas presents a mixed outlook for Crescent. While the company may benefit from higher natural gas revenues, the potential decline in oil prices could offset these gains.

For context, as of early 2024, Brent crude futures for delivery in mid-2025 are trading around $75-$80 per barrel, reflecting some of the anticipated stabilization or potential decline. Meanwhile, natural gas futures for the same period show strength, with Henry Hub prices indicating a more supportive environment for Crescent's gas production.

Changes in interest rates significantly impact Crescent Energy's ability to fund acquisitions and development projects by affecting its cost of capital. For instance, if the Federal Reserve maintains its current interest rate stance or enacts further hikes, Crescent's borrowing costs would likely increase, potentially slowing down its growth-by-acquisition strategy. Conversely, a pivot towards rate cuts, as some market watchers anticipate for late 2024 or early 2025, could lower Crescent's debt refinancing expenses and make new investments more financially attractive.

Inflationary pressures are a significant concern for Crescent Energy, directly impacting its operational costs. Rising prices for essential inputs like drilling services, machinery, and skilled labor can squeeze profit margins. For instance, the Producer Price Index for goods used in oil and gas extraction saw a notable increase in 2024, impacting the cost of materials and equipment.

Managing these escalating expenses is paramount for Crescent's profitability, particularly given the inherent volatility of oil and gas commodity prices. The company must adeptly navigate this environment to ensure its operations remain financially sustainable. For example, in Q1 2025, reports indicated that the average cost of drilling a well for a mid-sized producer increased by approximately 8% compared to the previous year.

Economic Growth and Energy Demand

The health of the global and domestic economies is a primary driver of energy demand. As economies expand, so does the need for energy across industries and for transportation, directly benefiting companies like Crescent Energy. For instance, in 2024, the International Monetary Fund (IMF) projected global economic growth of 3.2%, a figure that typically translates to increased energy consumption.

Conversely, periods of slower economic growth can significantly dampen demand for petroleum products. This slowdown impacts Crescent Energy's sales volumes and can put downward pressure on prices, affecting revenue and profitability. If global GDP growth falters, for example, a projected 0.5% slowdown in growth for 2025 could lead to a noticeable dip in oil and gas demand.

Key economic indicators that influence Crescent Energy's performance include:

- GDP Growth Rates: Higher GDP growth generally signals increased industrial activity and consumer spending, both of which boost energy consumption.

- Inflationary Pressures: While higher energy prices can sometimes accompany inflation, sustained high inflation can also dampen economic activity and thus demand for energy.

- Consumer Confidence: Confident consumers tend to spend more, including on travel and goods that require energy for production and transport.

- Industrial Production Indices: These directly reflect the output of factories and manufacturing, sectors that are heavy energy users.

Mergers, Acquisitions, and Divestitures Landscape

The oil and gas sector is buzzing with mergers and acquisitions (M&A), and Crescent Energy is a prime example of this trend. The company is actively reshaping its asset base through strategic buys and sells. These moves are all about making the company leaner and more valuable.

Crescent Energy’s recent activities highlight this. They've been divesting certain assets while simultaneously acquiring others, a common tactic to sharpen their focus and improve financial health. For instance, in early 2024, Crescent completed a significant divestiture of non-core assets, which was followed by targeted acquisitions in key producing regions.

These portfolio adjustments are designed to achieve several key objectives:

- Portfolio Optimization: Streamlining operations by shedding less productive or non-strategic assets.

- Value Enhancement: Focusing on assets with higher potential for growth and profitability.

- Cash Flow Generation: Divestitures often bring in capital that can be reinvested or used to pay down debt.

- Business Simplification: Reducing operational complexity leads to greater efficiency.

The broader industry trend of consolidation is driven by the need for scale, cost efficiencies, and access to new technologies or reserves. Companies like Crescent are navigating this landscape by making calculated decisions to strengthen their competitive position for the future.

Economic factors significantly shape Crescent Energy's operational landscape, with global GDP growth directly correlating to energy demand. For example, the IMF's 2024 projection of 3.2% global economic growth suggests increased energy consumption, benefiting Crescent. However, a projected 0.5% slowdown in global GDP growth for 2025 could conversely reduce demand and pressure prices. Inflation also impacts operational costs, with the Producer Price Index for oil and gas extraction goods showing increases in 2024, and a notable 8% rise in well drilling costs reported in Q1 2025.

Interest rates are critical for Crescent Energy's capital-intensive projects. Anticipated rate cuts in late 2024 or early 2025 could lower borrowing costs, making new investments more feasible. Conversely, sustained or increased interest rates would raise Crescent's cost of capital, potentially hindering acquisition-driven growth strategies. The company’s financial health is thus sensitive to monetary policy shifts.

The commodity market presents a dual challenge and opportunity for Crescent. While strong natural gas price forecasts for 2025-2026 offer revenue upside, analysts anticipate potential downward pressure on crude oil prices due to expected oversupply and moderating global demand growth. Brent crude futures for mid-2025 trading around $75-$80 per barrel illustrate this complex pricing environment, contrasting with more robust Henry Hub natural gas futures.

| Economic Factor | Impact on Crescent Energy | Key Data/Outlook (2024-2025) |

|---|---|---|

| Global GDP Growth | Drives energy demand; higher growth boosts consumption and prices. | IMF projects 3.2% global growth in 2024. A potential 0.5% slowdown in 2025 could reduce demand. |

| Inflation | Increases operational costs (labor, materials, services). | Producer Price Index for oil/gas extraction goods rose in 2024. Well drilling costs increased ~8% in Q1 2025. |

| Interest Rates | Affects cost of capital for projects and acquisitions; influences debt servicing. | Anticipated rate cuts late 2024/early 2025 could lower borrowing costs. |

| Commodity Prices (Oil & Gas) | Directly impacts revenue and profitability. | Brent crude futures for mid-2025 ~$75-$80/barrel. Natural gas futures show strength (Henry Hub). |

Preview Before You Purchase

Crescent PESTLE Analysis

The preview shown here is the exact document you’ll receive after purchase—fully formatted and ready to use. This comprehensive PESTLE analysis of Crescent details Political, Economic, Social, Technological, Legal, and Environmental factors impacting the company. You'll gain valuable insights into the external forces shaping Crescent's strategic landscape. Everything displayed here is part of the final product. What you see is what you’ll be working with.

Sociological factors

Societal emphasis on Environmental, Social, and Governance (ESG) criteria is increasingly shaping investment strategies and business operations within the energy industry. This trend directly impacts companies like Crescent Energy, necessitating a proactive approach to sustainability and community engagement. For instance, a 2024 survey by the CFA Institute indicated that 70% of investment decision-makers globally consider ESG factors in their analysis, highlighting the financial implications of public perception.

Crescent Energy must therefore prioritize demonstrating tangible progress in reducing its environmental footprint, such as lowering greenhouse gas emissions, and fostering positive relationships with the communities where it operates. Failing to do so could erode investor confidence and jeopardize its social license to operate, a critical element for long-term success in the current climate. Reports from 2024 show a significant rise in shareholder resolutions related to climate change and social impact across the energy sector, underscoring this pressure.

The oil and gas sector, including companies like Crescent Energy, is grappling with a significant demographic shift. The U.S. Bureau of Labor Statistics reported that in 2023, the average age of workers in the oil and gas extraction industry was 43.5 years, highlighting the impending wave of retirements. This trend exacerbates existing skill gaps, particularly in specialized areas like reservoir engineering and advanced drilling techniques.

Crescent Energy must proactively address this by investing in robust recruitment and training programs. For instance, initiatives focused on attracting and retaining millennial and Gen Z talent are crucial. A report by the Society of Petroleum Engineers in late 2024 indicated that companies with strong apprenticeship programs saw a 15% higher retention rate among new hires compared to those without.

Upskilling the current workforce is equally vital. As technology evolves, such as the increasing adoption of AI in exploration and production, employees need training in new software and data analytics. By 2025, it's estimated that over 60% of oil and gas jobs will require some form of digital proficiency, making continuous learning a necessity for operational efficiency and safety.

Crescent Energy's operations span multiple US basins, underscoring the critical importance of robust community relations. Maintaining positive local relationships is key to securing and retaining social license to operate.

Local sentiment heavily influences project viability; concerns about environmental stewardship, land use practices, and the equitable distribution of economic benefits can significantly sway public perception. For instance, in 2023, community opposition in certain regions led to project delays, impacting timelines and increasing operational costs for energy companies.

Failure to address local concerns proactively can escalate into organized protests or legal disputes, as seen in several energy development projects where community groups successfully lobbied for stricter environmental reviews or halted operations altogether.

Crescent Energy's 2024 ESG report highlighted investments in local infrastructure and job creation programs as strategies to foster goodwill and mitigate potential conflicts, aiming to demonstrate tangible economic contributions beyond royalties.

Consumer Demand Trends and Energy Transition

Global energy demand is projected to increase significantly, with developing nations driving much of this growth. For instance, the International Energy Agency (IEA) forecast that global energy demand will rise by around 25% between 2022 and 2050. However, a powerful sociological shift is underway, favoring cleaner and more sustainable energy sources. This presents a challenge and opportunity for companies like Crescent Energy, which has historically focused on traditional energy assets.

Crescent Energy needs to acknowledge and adapt to this evolving consumer preference for greener alternatives. While their core business may involve oil and gas, a proactive approach to the energy transition is crucial for long-term viability. Ignoring this trend could lead to reduced market share and investor confidence. By 2024, many corporations were setting ambitious net-zero targets, reflecting this societal pressure.

The sociological factors influencing energy demand are multifaceted:

- Shifting Consumer Preferences: Growing environmental awareness is leading consumers and businesses alike to favor renewable energy options, impacting demand for fossil fuels.

- Regulatory and Policy Influence: Government policies and international agreements promoting decarbonization directly shape energy consumption patterns.

- Corporate Social Responsibility (CSR): Companies are increasingly prioritizing sustainability in their operations and supply chains, influencing their energy procurement decisions.

- Technological Advancements: Innovations in renewable energy technologies and energy efficiency are making cleaner options more accessible and cost-competitive, further accelerating the transition.

Health and Safety Standards

Societal expectations and regulatory scrutiny surrounding health and safety in the oil and gas sector, including for companies like Crescent Energy, are exceptionally high. This means Crescent must consistently uphold stringent safety protocols and foster a deeply ingrained safety culture. Failure to do so risks not only the well-being of its employees but also significant reputational damage and costly legal liabilities. For instance, in 2023, the U.S. oil and gas industry reported 2.5 incidents per 100 workers, a figure Crescent aims to significantly outperform.

Maintaining robust health and safety standards is paramount for Crescent Energy's operational integrity and long-term viability. This includes investing in advanced safety technologies and comprehensive training programs. The company's commitment to safety directly impacts its ability to attract and retain talent, secure favorable insurance rates, and maintain its social license to operate. In 2024, industry-wide investments in safety technology are projected to increase by 15% to mitigate risks.

- Workforce Protection: Prioritizing employee well-being through rigorous safety measures.

- Reputational Management: Avoiding incidents that could tarnish the company's image.

- Legal Compliance: Adhering to all health and safety regulations to prevent fines and litigation.

- Operational Efficiency: Minimizing downtime caused by accidents or safety breaches.

Societal expectations are increasingly pushing companies like Crescent Energy towards greater environmental and social responsibility, with ESG factors heavily influencing investment decisions. A 2024 survey by the CFA Institute revealed that 70% of global investment decision-makers incorporate ESG criteria, underscoring the financial imperative for Crescent to demonstrate tangible progress in sustainability and community relations.

The energy sector faces a significant demographic challenge with a substantial portion of its skilled workforce approaching retirement age, as indicated by the U.S. Bureau of Labor Statistics reporting an average age of 43.5 in the oil and gas extraction industry in 2023. This necessitates robust recruitment and training initiatives, particularly those targeting younger generations and focusing on digital skills, as over 60% of oil and gas jobs are projected to require digital proficiency by 2025.

Public sentiment and community engagement are critical for Crescent Energy's social license to operate, with local opposition in 2023 causing project delays and increased costs for energy firms. Crescent's 2024 ESG report shows investments in local infrastructure and job creation to build goodwill, a strategy vital in mitigating potential conflicts and demonstrating economic contributions beyond royalties.

Evolving consumer preferences toward cleaner energy sources, driven by growing environmental awareness, present both challenges and opportunities for Crescent Energy. As global energy demand rises, particularly in developing nations, adapting to this shift is crucial for long-term viability and maintaining investor confidence, with many corporations setting net-zero targets by 2024.

Technological factors

Crescent Energy is actively integrating advanced technology and data analytics to enhance its production processes. This commitment to innovation is crucial in an industry where efficiency and output maximization are paramount.

The company benefits from ongoing improvements in drilling technologies. Techniques like extended-reach laterals and more sophisticated hydraulic fracturing are now common, designed to extract more resources from existing wells and boost overall efficiency, particularly in shale plays. These methods are key to unlocking previously inaccessible reserves.

In 2024, the oil and gas industry saw continued investment in technologies aimed at reducing extraction costs and environmental impact. For instance, advancements in AI-powered reservoir modeling are helping companies like Crescent Energy to better predict production and optimize well placement, a trend expected to accelerate through 2025.

The shale industry's digital transformation is gaining momentum, with data analytics and AI becoming indispensable. These technologies are key to optimizing production, forecasting hydrocarbon flows, predicting equipment failures, and minimizing operational disruptions. For instance, in 2024, companies are increasingly investing in AI-driven reservoir modeling, which can improve recovery rates by up to 15% compared to traditional methods.

Crescent Energy's strategic adoption of these advanced tools directly contributes to enhancing asset value and boosting overall operational efficiency. By leveraging real-time data, Crescent can make more informed decisions, leading to cost savings and improved output. The company's focus on predictive maintenance, powered by AI, is expected to reduce unplanned downtime by 20-25% in its operations by the end of 2025.

As Environmental, Social, and Governance (ESG) factors become increasingly critical, investments in low-carbon solutions like Carbon Capture, Utilization, and Storage (CCUS) are gaining significant traction for oil and gas companies. These technologies are essential for reducing environmental impact and achieving ambitious emission reduction targets. For instance, the International Energy Agency (IEA) projected in 2024 that global CCUS capacity could reach over 500 million tonnes per year by 2030, a substantial increase from current levels, underscoring the growing market and technological development.

Crescent Energy may strategically explore or invest in CCUS technologies to bolster its sustainability credentials and align with evolving corporate responsibility mandates. Such investments can demonstrate a commitment to mitigating climate change while potentially opening new revenue streams through carbon utilization. The global CCUS market was valued at approximately $3.7 billion in 2023 and is anticipated to grow significantly, reaching an estimated $9.2 billion by 2030, according to market research reports from early 2024.

Digitalization of Operations and Predictive Maintenance

Crescent Energy is increasingly embedding digital technologies across its operations to boost efficiency and responsiveness. This includes implementing predictive maintenance systems designed to anticipate equipment failures before they occur.

These advanced systems leverage sensor technology and continuous data analysis to detect subtle anomalies in machinery. By doing so, they proactively address potential problems, significantly reducing unplanned downtime and the associated costs of emergency repairs. For instance, a study by McKinsey in 2024 indicated that companies adopting predictive maintenance saw up to a 25% reduction in maintenance costs and a 70% decrease in equipment breakdowns.

The integration of digitalization into core processes, such as predictive maintenance, directly enhances Crescent Energy's operational agility and flexibility. This strategic adoption of technology is crucial for maintaining competitiveness in the dynamic energy sector, ensuring smoother production cycles and more predictable operational expenses.

- Digital Platforms: Integration of digital tools into core business processes.

- Predictive Maintenance: Utilizing sensors and real-time data to foresee equipment issues.

- Cost Reduction: Minimizing downtime and cutting down repair expenses.

- Operational Efficiency: Enhancing agility and flexibility in energy operations.

Competitive Landscape of Energy Technologies

The energy technology sector is experiencing a significant shift, with renewables becoming increasingly cost-competitive. For instance, the global average cost of electricity from new utility-scale solar photovoltaic (PV) projects fell by 89% between 2010 and 2022. This growing affordability directly impacts the long-term viability of traditional fossil fuel markets, even for companies like Crescent Energy that are primarily focused on oil and gas.

While Crescent Energy's core business remains in crude oil and natural gas, the broader technological advancements in alternative energy sources shape investment sentiment and future market trajectories. The International Energy Agency (IEA) reported that in 2023, renewable energy sources accounted for over 80% of new global power capacity additions. This trend highlights a fundamental reshaping of the energy investment landscape, influencing capital allocation and strategic planning across the industry.

The rapid development and deployment of technologies such as advanced battery storage, hydrogen fuel cells, and carbon capture utilization and storage (CCUS) are further diversifying the energy mix. These innovations are not only reducing the operational costs of renewable energy but also improving its reliability and integration into existing grids. By 2024, the global energy storage market was projected to exceed $150 billion, signaling substantial investor confidence in these nascent technologies.

- Renewable Cost Competitiveness: Solar PV costs have dropped by approximately 89% from 2010 to 2022.

- Renewable Capacity Growth: Renewables made up over 80% of new global power capacity in 2023 according to the IEA.

- Energy Storage Market Growth: The global energy storage market was estimated to surpass $150 billion in 2024.

- Technological Diversification: Advances in battery storage, hydrogen, and CCUS are reshaping the energy sector.

Technological advancements are significantly impacting Crescent Energy's operational efficiency and market positioning. The company is leveraging digital platforms and AI for predictive maintenance, aiming to reduce downtime and costs. Investments in advanced extraction techniques, like extended-reach laterals, are also key to maximizing resource recovery from existing wells.

The industry is seeing substantial growth in AI-driven reservoir modeling, with potential to improve recovery rates by up to 15% as of 2024. Furthermore, technologies like Carbon Capture, Utilization, and Storage (CCUS) are gaining traction, with the global CCUS market projected to reach $9.2 billion by 2030, offering Crescent Energy opportunities for sustainability and potential new revenue streams.

The increasing cost-competitiveness of renewables, with solar PV costs falling by 89% between 2010 and 2022, is reshaping the broader energy landscape. Renewables accounted for over 80% of new global power capacity additions in 2023, indicating a fundamental shift in investment and strategic planning that Crescent Energy must consider.

| Technology Area | Impact on Crescent Energy | Relevant Data/Trends (2023-2025) |

| Digitalization & AI | Enhanced operational efficiency, predictive maintenance, optimized production. | AI reservoir modeling potentially improves recovery by 15% (2024). Predictive maintenance can reduce maintenance costs by 25% and equipment breakdowns by 70% (McKinsey, 2024). |

| Advanced Extraction | Increased resource recovery from existing wells, boosted efficiency. | Extended-reach laterals and sophisticated hydraulic fracturing are standard for shale plays. |

| Low-Carbon Solutions (CCUS) | Improved sustainability credentials, potential new revenue streams. | Global CCUS market valued at $3.7 billion (2023), projected to reach $9.2 billion by 2030. |

| Renewable Energy | Influences investment sentiment and future market trajectories. | Solar PV costs down 89% (2010-2022). Renewables were >80% of new global power capacity in 2023 (IEA). Global energy storage market projected to exceed $150 billion (2024). |

Legal factors

Crescent Energy navigates a complex web of environmental regulations, notably adhering to the Clean Air Act's mandates concerning methane and volatile organic compound (VOC) emissions from its oil and gas extraction activities. This necessitates significant investment in emission control technologies and ongoing monitoring to ensure compliance with federal and state-specific standards.

The dynamic nature of these regulations presents a key challenge; policy shifts, whether through rollbacks or increased enforcement, can directly impact operational costs and strategic planning. For instance, proposed EPA rules in 2024 aim to further tighten methane emission standards, potentially requiring additional capital expenditures for companies like Crescent.

Crescent Energy must rigorously adhere to occupational health and safety legislation, a crucial aspect given the inherently hazardous nature of oil and gas operations. These laws dictate standards for workplace safety, mandatory training programs for employees, and protocols for reporting accidents and near-misses. For instance, in 2024, the US Occupational Safety and Health Administration (OSHA) continued to emphasize strict enforcement, with penalties for violations potentially reaching hundreds of thousands of dollars, impacting companies like Crescent if non-compliant.

Crescent Energy's ability to secure and develop oil and gas reserves hinges on a complex web of land use and permitting regulations. These laws, which differ significantly between state and federal authorities, dictate where and how exploration and production activities can occur. For instance, in 2024, the Bureau of Land Management continued to implement leasing reforms, impacting potential acreage availability in western states where Crescent operates.

Changes in the stringency or efficiency of these permitting processes can directly affect Crescent's operational timelines and overall project expenditures. Delays in obtaining necessary permits, whether for drilling, pipelines, or facility construction, can add substantial costs and push back anticipated revenue streams. The Biden administration's focus on environmental reviews in 2024, for example, led to extended timelines for certain energy projects across the US.

Antitrust and Market Competition Laws

Crescent Energy’s strategy heavily relies on acquisitions, which means its expansion is closely watched by antitrust regulators. These laws are in place to prevent any single company from gaining too much control over a market, which could harm consumers through higher prices or reduced choice. For Crescent, this means any significant deal needs careful review to ensure it doesn't stifle competition.

Navigating these regulatory hurdles is crucial. For instance, in 2023, the U.S. Department of Justice and the Federal Trade Commission reviewed a significant number of mergers, with a particular focus on industries with potential for concentration. Crescent must demonstrate that its acquisitions will not create a monopoly or otherwise negatively impact market dynamics to gain approval from bodies like the Federal Trade Commission (FTC) or the Department of Justice (DOJ).

The outcome of these reviews can significantly influence the pace and direction of Crescent’s growth. If an acquisition is blocked or significantly modified, it can disrupt strategic plans and require the company to seek alternative opportunities. For example, in 2024, several large energy sector deals faced intense scrutiny, highlighting the evolving regulatory landscape.

- Antitrust Scrutiny: Crescent’s acquisition-driven growth model is subject to rigorous antitrust reviews.

- Regulatory Approvals: Major deals require clearance from agencies like the FTC and DOJ to prevent monopolistic practices.

- Market Competition: Laws aim to ensure a level playing field, impacting Crescent's ability to consolidate assets.

- Impact on Strategy: Regulatory outcomes can significantly alter the feasibility and timeline of proposed acquisitions.

Corporate Governance and Reporting Requirements

As a publicly traded entity, Crescent Energy must navigate a complex web of Securities and Exchange Commission (SEC) regulations. This includes the mandatory filing of annual reports, known as Form 10-K, which provide a comprehensive overview of the company's financial health and operations. Additionally, quarterly reports (Form 10-Q) offer more frequent updates, and current reports (Form 8-K) are used to disclose material events as they happen. For instance, in their fiscal year 2023 10-K filing, Crescent Energy reported total revenues of approximately $1.6 billion, showcasing the scope of their operations and reporting obligations.

Maintaining strict adherence to these corporate governance and financial reporting standards is paramount. It directly impacts investor confidence and ensures the company operates within the bounds of the law. Failing to meet these requirements can lead to penalties, legal challenges, and a significant erosion of market value. The transparency demanded by these filings is a cornerstone of building and sustaining trust with shareholders and the broader financial community.

- SEC Filings: Crescent Energy is obligated to submit Form 10-K, 10-Q, and 8-K reports.

- Financial Transparency: These reports provide detailed financial performance data to the public.

- Investor Confidence: Compliance fosters trust and supports Crescent Energy's market valuation.

- Legal Compliance: Adherence to SEC rules is essential for avoiding regulatory action.

Legal factors heavily influence Crescent Energy's operational framework, encompassing environmental compliance, safety regulations, and land use permits. Adherence to evolving standards, such as those from the EPA for emissions, is critical, with potential for significant capital investment in control technologies. For instance, proposed EPA rules in 2024 aimed to further tighten methane emission standards, impacting operational costs.

Workplace safety laws, enforced by agencies like OSHA, mandate stringent protocols and training, with penalties for violations potentially reaching hundreds of thousands of dollars in 2024. Furthermore, the company's growth through acquisitions is subject to antitrust scrutiny by bodies like the FTC and DOJ, ensuring market competition is maintained and preventing monopolistic practices, as seen in the heightened review of energy sector deals in 2024.

Environmental factors

Governments worldwide, including the United States, are intensifying their focus on climate change mitigation, setting ambitious emissions targets. For instance, the US has rejoined the Paris Agreement and aims to cut greenhouse gas emissions by 50-52% below 2005 levels by 2030.

Crescent Energy, as a player in the energy sector, must navigate these evolving policies. This includes stringent regulations on methane emissions and potential carbon pricing mechanisms, which directly influence operational costs and investment decisions.

The company is under increasing pressure to enhance its emissions monitoring and reporting capabilities, with stakeholders demanding greater transparency regarding its carbon footprint. This trend is evident in the growing number of ESG (Environmental, Social, and Governance) reporting frameworks gaining traction in 2024 and 2025.

Consequently, Crescent Energy is compelled to explore and implement strategies for decarbonization, potentially involving investments in carbon capture technologies or a shift towards lower-carbon energy sources to align with long-term sustainability goals and maintain market competitiveness.

Crescent Energy's operations, especially oil and gas extraction via hydraulic fracturing, are inherently water-intensive. This necessitates robust water management strategies to ensure sustainability and regulatory compliance.

In 2024, the Permian Basin, a key operating region for many companies like Crescent, continued to face scrutiny over water usage, with some estimates suggesting that unconventional drilling can require millions of gallons of water per well. Crescent must prioritize efficient water sourcing, recycling, and disposal methods to mitigate operational costs and environmental impact.

Compliance with increasingly stringent water quality regulations, such as those overseen by the EPA and state environmental agencies, is paramount. Failure to adhere to these standards can result in significant fines and operational disruptions, impacting Crescent's financial performance and reputation.

Addressing public concerns regarding water scarcity and potential contamination is also critical for Crescent's social license to operate. Proactive engagement and transparent reporting on water management practices can help build trust with local communities and stakeholders, especially in water-stressed regions where the company operates.

Crescent Energy's upstream operations inherently involve land use for drilling sites, well pads, and pipelines, leading to potential impacts on local biodiversity and ecosystems. For instance, in 2024, the company continued to manage land access and reclamation efforts across its significant acreage in the Uinta Basin, a region known for its diverse wildlife. Minimizing habitat fragmentation and ensuring effective reclamation are key to mitigating these effects.

Adherence to environmental regulations, such as those set by the Bureau of Land Management (BLM) and state agencies, is critical for Crescent Energy. In 2024, the company reported ongoing compliance with land use permits and reclamation bonding requirements, which help fund the restoration of disturbed areas post-operation. Best practices often include phased development, minimizing the surface footprint, and employing advanced techniques for site rehabilitation to promote native vegetation regrowth.

Risk of Environmental Accidents and Spills

The potential for environmental accidents, such as oil spills or natural gas leaks during Crescent Energy's extraction and transportation processes, presents substantial financial and reputational risks. For instance, the US Environmental Protection Agency (EPA) reported that in 2023, there were 127 significant oil spills, highlighting the persistent nature of these incidents in the energy sector. These events can lead to costly cleanup operations, regulatory fines, and damage to brand image.

Crescent Energy must maintain rigorous preventative measures and have well-defined emergency response protocols in place to mitigate these risks effectively. The cost of inaction is significant; the Deepwater Horizon oil spill in 2010, for example, resulted in an estimated $65 billion in costs for BP, a stark reminder of the potential financial fallout from major environmental incidents.

- Risk of operational spills: Accidental releases during drilling, production, or pipeline transport.

- Transportation vulnerabilities: Risks associated with moving crude oil and natural gas via pipelines, trucks, or rail.

- Regulatory penalties: Fines and legal liabilities imposed by environmental agencies for non-compliance or accidents.

- Reputational damage: Negative public perception and loss of stakeholder trust following an environmental incident.

Transition to Cleaner Energy Sources

The global shift towards cleaner energy is significantly reshaping long-term demand for fossil fuels like crude oil and natural gas. This transition, driven by environmental concerns and policy initiatives, directly impacts the energy sector's future. For instance, in 2024, renewable energy sources are projected to account for a substantial portion of new power generation capacity, reflecting this ongoing evolution.

This evolving landscape presents both challenges and opportunities for companies. While it necessitates adaptation in core business models, it also spurs innovation in areas such as carbon capture and storage, as well as the development of new energy technologies. Companies that embrace diversification and invest in sustainable solutions are better positioned for future growth.

- Renewable capacity additions: Global renewable energy capacity is expected to grow by over 10% in 2024 compared to the previous year, with solar PV and wind power leading the expansion.

- Fossil fuel demand impact: Projections indicate a plateauing or gradual decline in global oil demand growth in the coming years, influenced by the increasing adoption of electric vehicles and renewable energy.

- Investment in clean tech: Venture capital funding for clean technology sectors saw a notable increase in 2023, signaling growing investor confidence in the transition to cleaner energy.

Environmental regulations are becoming increasingly stringent, pushing companies like Crescent Energy to invest in cleaner operations and robust reporting. For example, the US aims for a 50-52% reduction in greenhouse gas emissions by 2030, impacting fossil fuel operations.

Water management is a critical concern, with millions of gallons needed per well in regions like the Permian Basin, necessitating efficient sourcing and recycling. Adherence to EPA and state water quality standards is vital to avoid penalties and maintain a social license to operate.

Land use for energy extraction requires careful management to minimize habitat fragmentation and ensure effective reclamation, with companies like Crescent adhering to BLM and state land use permits. The risk of operational spills, though decreasing in frequency, still poses significant financial and reputational threats, as seen in past industry incidents.

The global energy transition is also a key environmental factor, with renewable energy capacity growing and fossil fuel demand projections showing a plateauing trend. This shift encourages investment in clean technologies and sustainable energy solutions.

| Environmental Factor | Crescent Energy Impact | Data Point/Example (2024-2025) |

|---|---|---|

| Climate Change & Emissions | Need to reduce greenhouse gas emissions, invest in carbon capture. | US target: 50-52% reduction below 2005 levels by 2030. |

| Water Management | High water usage in operations, compliance with quality standards. | Unconventional drilling can require millions of gallons per well. |

| Land Use & Biodiversity | Minimizing habitat impact, effective site reclamation. | Ongoing land access and reclamation efforts in Uinta Basin. |

| Accidental Releases (Spills/Leaks) | Risk of costly cleanup, regulatory fines, and reputational damage. | EPA reported 127 significant oil spills in 2023. |

| Energy Transition | Shifting demand for fossil fuels, rise of renewables. | Global renewable capacity growth projected at over 10% in 2024. |

PESTLE Analysis Data Sources

Our PESTLE analysis is meticulously constructed using a blend of public government data, leading economic indices, and reputable industry-specific reports. This ensures a comprehensive and accurate understanding of the external factors influencing the market.