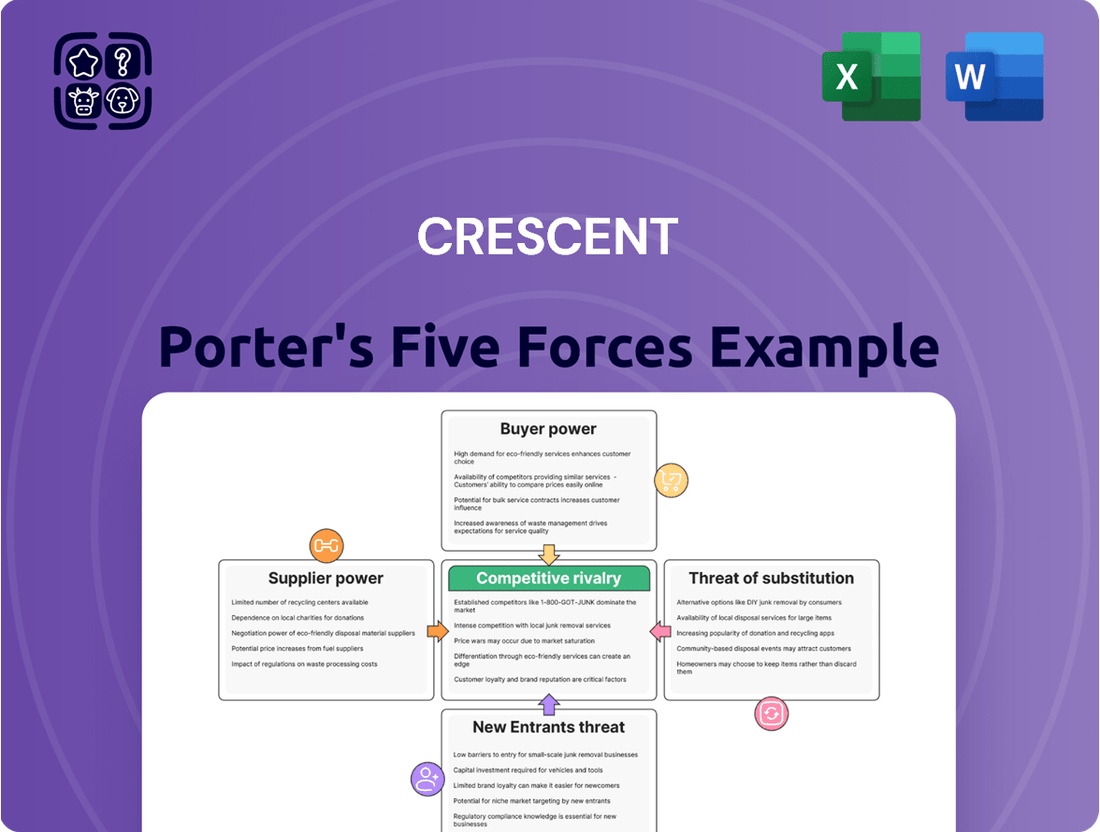

Crescent Porter's Five Forces Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Crescent Bundle

The threat of new entrants for Crescent Porter's is moderate, as high capital requirements and established brand loyalty present barriers, but the industry's profitability remains attractive. Understanding these dynamics is crucial for strategic planning.

The bargaining power of buyers for Crescent Porter's is significant due to readily available substitutes and price sensitivity, impacting pricing strategies and customer retention efforts.

Crescent Porter's faces a moderate threat from substitute products, as alternative solutions exist but often lack the same quality or convenience, requiring continuous innovation.

Supplier power for Crescent Porter's is relatively low, thanks to a fragmented supplier base and the availability of alternative inputs, offering leverage in procurement negotiations.

The intensity of rivalry within Crescent Porter's industry is high, driven by numerous competitors vying for market share, necessitating a sharp focus on differentiation and efficiency.

This brief snapshot only scratches the surface. Unlock the full Porter's Five Forces Analysis to explore Crescent’s competitive dynamics, market pressures, and strategic advantages in detail.

Suppliers Bargaining Power

Suppliers of specialized equipment and technology, such as advanced drilling rigs, completion tools, and sophisticated data analytics software, wield considerable bargaining power over companies like Crescent Energy. These critical inputs are frequently proprietary, making the cost and complexity of switching to alternative providers substantial due to integration and employee training needs.

The drilling services sector's expansion, fueled by the increasing adoption of digitalization and automation, further bolsters the leverage of these technology providers. For instance, the global oil and gas drilling market was valued at approximately $161.2 billion in 2023 and is projected to grow, indicating a strong demand for advanced equipment and services.

Oilfield services companies, providing essential services like seismic data collection, well servicing, and equipment rental, hold significant bargaining power. Their importance is amplified as demand for their specialized skills and equipment directly correlates with upstream oil and gas exploration and production activity.

While the U.S. saw moderate growth projections for drilling activity in 2025, the specialized nature of these services means that operators often rely on a limited pool of highly capable providers. This reliance can translate into stronger negotiation leverage for the service companies.

Furthermore, consolidation within the oilfield services sector is a notable trend. As fewer, larger players emerge, their collective bargaining power can increase, especially when competing for contracts with major exploration and production companies.

The availability of highly skilled geologists, engineers, and field operators is crucial for Crescent Energy's operations. A tight labor market in the energy sector, particularly for specialized roles, can significantly impact operational costs and efficiency. For instance, in 2024, the U.S. Bureau of Labor Statistics reported continued demand for petroleum engineers, with projected job growth and a median annual wage reflecting the specialized nature of the work. This scarcity of expertise can empower skilled labor to negotiate higher wages and better working conditions, thereby increasing supplier bargaining power.

Midstream Infrastructure Providers

Midstream infrastructure providers hold considerable bargaining power over Crescent Energy, particularly in basins with constrained takeaway capacity. Access to pipelines, processing plants, and storage is essential for Crescent’s operations across diverse U.S. basins. If alternative midstream options are scarce in a particular region, these providers can dictate higher transportation fees and impose limitations on access, directly impacting Crescent’s costs and operational flexibility.

- Limited Takeaway Options: In basins like the Permian, where pipeline capacity can become saturated, midstream firms can leverage this scarcity to increase rates.

- Infrastructure Investment Cycles: The high capital expenditure required for midstream build-outs means that existing, operational infrastructure often commands premium pricing.

- Contractual Commitments: Long-term transportation and processing agreements can lock Crescent into specific midstream services, reducing its ability to switch providers even if more favorable terms emerge elsewhere.

- Strategic Importance: Reliable midstream access is non-negotiable for producers; therefore, midstream companies’ ability to control this crucial link gives them significant leverage.

Raw Material Suppliers (e.g., steel, proppant)

Suppliers of essential raw materials, such as steel for the energy sector's pipelines and drilling equipment, or proppant used in hydraulic fracturing, hold significant sway over industry costs. While often considered commoditized, these suppliers can exert greater bargaining power during periods of supply chain instability or surges in demand.

For instance, in late 2023 and early 2024, fluctuations in global steel prices, driven by production issues and geopolitical events, directly impacted the cost of materials for energy infrastructure projects. Similarly, the demand for proppant, a critical component in oil and gas extraction, can lead to price increases when exploration activity intensifies.

- Steel Prices: Global benchmark steel prices experienced volatility throughout 2023, with some periods seeing increases of over 15% due to factors like reduced output from key producers and rising energy costs for manufacturing.

- Proppant Market: The proppant market, crucial for fracking operations, saw demand rise in 2023 as oil and gas production ramped up in certain regions, leading to upward price pressure for high-quality silica sand.

- Supply Chain Vulnerabilities: Disruptions, such as those experienced in shipping and logistics during 2023, can exacerbate the bargaining power of raw material suppliers by limiting available inventory and extending lead times.

- Impact on Energy Costs: Increased raw material costs for steel and proppant directly translate to higher capital expenditures for exploration and production companies, potentially influencing overall energy production costs.

Suppliers of specialized equipment, advanced technology, and essential services hold significant bargaining power over energy companies like Crescent Energy. This power stems from proprietary inputs, the high cost of switching, and the critical nature of their offerings for exploration and production.

The growing demand for digitalization and automation in drilling services, with the global market valued around $161.2 billion in 2023, amplifies the leverage of technology providers. Similarly, consolidation within the oilfield services sector creates larger entities with increased negotiating strength.

Midstream infrastructure providers also possess considerable leverage, especially in regions with limited takeaway capacity, allowing them to dictate higher fees. Furthermore, scarcity of skilled labor, such as petroleum engineers whose demand remained strong in 2024, empowers employees to negotiate better terms, indirectly bolstering supplier power.

| Supplier Type | Factors Influencing Bargaining Power | 2024/2023 Data & Impact |

|---|---|---|

| Specialized Equipment & Technology Providers | Proprietary nature of inputs, switching costs, integration complexity | Global oil and gas drilling market ~$161.2 billion (2023); continued demand for advanced tech. |

| Oilfield Services Companies | Specialized skills, correlation with E&P activity, market consolidation | Expansion of digitalization and automation in drilling services. |

| Midstream Infrastructure Providers | Limited takeaway capacity, infrastructure investment cycles, contractual commitments | Increased rates in saturated basins; high CAPEX for new build-outs. |

| Raw Material Suppliers (Steel, Proppant) | Supply chain stability, demand surges, market volatility | Steel prices fluctuated significantly in 2023; proppant demand rose with production. |

| Skilled Labor Providers | Scarcity of specialized expertise, tight labor market | Continued strong demand for petroleum engineers in 2024 (BLS); potential for wage increases. |

What is included in the product

This analysis dissects the five competitive forces impacting Crescent, providing a strategic framework to understand industry profitability and identify Crescent's competitive advantages and vulnerabilities.

Quickly identify and neutralize competitive threats with a visual overview of all five forces.

Customers Bargaining Power

Refineries and petrochemical plants represent Crescent Energy's core customer base, absorbing its crude oil and natural gas production. These industrial giants, by virtue of their sheer scale, wield significant bargaining power. Their substantial purchasing volumes, often solidified through long-term agreements, allow them to negotiate favorable pricing terms with suppliers like Crescent.

The leverage held by these customers is further amplified by the nature of the global energy market. While demand for oil and gas remains a foundational element of the global economy, it is not static. Fluctuations in economic growth and the accelerating pace of energy transitions directly influence the purchasing decisions and, consequently, the negotiating positions of these large-scale buyers, creating a dynamic environment for Crescent.

The bargaining power of customers is a key factor for natural gas utilities and distributors. Large industrial users and utility companies themselves are significant buyers, and their sheer volume gives them leverage. For instance, in 2024, industrial consumption accounted for a substantial portion of natural gas demand, empowering these entities to negotiate favorable pricing from producers and suppliers.

Regulatory environments also play a crucial role, often setting price caps or influencing contract terms, which can limit the ability of gas suppliers to charge premium rates. Furthermore, the availability of alternative energy sources, such as renewables or even other fossil fuels, provides customers with options, increasing their ability to pressure natural gas providers on price. This is especially true as investments in renewable energy infrastructure continue to grow, offering more choices to end-users.

In the commodity markets for crude oil and natural gas, Crescent Energy operates as a price-taker. This means customers, who can source these essential resources from numerous global suppliers, wield considerable bargaining power. Their ability to choose from a wide array of options at market-determined prices significantly influences pricing dynamics.

The pricing of crude oil and natural gas is inherently volatile, shaped by a complex interplay of global supply and demand, geopolitical shifts, and overarching macroeconomic trends. For instance, in early 2024, oil prices experienced fluctuations driven by ongoing geopolitical tensions in the Middle East and expectations surrounding global economic growth, illustrating the external forces impacting producers like Crescent Energy.

Customer Concentration

Customer concentration can significantly impact a company's bargaining power. If a substantial portion of Crescent Energy's output is purchased by a small number of major clients, those clients gain leverage. This is because their business represents a critical revenue stream, making Crescent Energy more susceptible to price demands or unfavorable contract terms from these key customers. For example, if a single customer accounts for over 15% of Crescent Energy's revenue, that customer holds considerable sway.

To counter this, Crescent Energy should focus on diversifying its customer base. Expanding into new geographic markets or catering to different industry segments can reduce reliance on any single buyer. Developing multiple sales channels, including direct sales, distributors, and online platforms, further strengthens this diversification strategy. This approach helps to spread risk and diminish the bargaining power of any individual customer.

Consider the following points regarding customer concentration:

- Concentrated customer base: A few large customers can exert significant influence over pricing and terms.

- Revenue dependency: High reliance on a small group of customers increases vulnerability to their demands.

- Mitigation strategies: Diversifying customers and sales channels is crucial for reducing this risk.

Storage and Transportation Infrastructure

Customers possessing their own extensive storage and transportation infrastructure gain significant leverage. This allows them to delay purchases until market conditions are most favorable, effectively increasing their bargaining power. For instance, large integrated energy companies with their own refining and distribution networks can absorb temporary price fluctuations more readily.

This capability means they aren't compelled to buy at peak prices. In 2024, the cost of maintaining and operating such infrastructure represents a substantial capital investment. Companies with these assets can better manage inventory levels, reducing reliance on external logistics and thereby strengthening their negotiation position with suppliers.

- Self-Sufficiency Reduces Supplier Dependence: Owning storage and transport means customers are less reliant on third-party providers, giving them more control over timing and costs.

- Inventory Management Advantage: Integrated infrastructure allows for strategic inventory holding, enabling customers to wait for lower prices or meet demand without immediate supplier intervention.

- Market Flexibility: Companies with robust logistics can adapt more quickly to market shifts, purchasing when prices are advantageous and potentially dictating terms.

- Cost Control: Internalizing these functions can lead to cost savings compared to paying for external storage and transportation, further enhancing a customer's bargaining position.

The bargaining power of customers in the oil and gas sector, particularly for producers like Crescent Energy, is substantial. Large refineries and petrochemical plants, being major buyers, can negotiate favorable terms due to their significant purchasing volumes and long-term contracts. In 2024, industrial consumption remained a key driver of natural gas demand, reinforcing the leverage of these large-scale users.

Preview the Actual Deliverable

Crescent Porter's Five Forces Analysis

This preview shows the exact document you'll receive immediately after purchase – a comprehensive Porter's Five Forces analysis for Crescent. You'll gain immediate access to this fully formatted and professionally written report, detailing the competitive landscape and strategic implications for Crescent. This is not a sample; it's the complete analysis ready for your immediate use and strategic planning.

Rivalry Among Competitors

The U.S. upstream oil and gas sector, where companies like Crescent Energy operate, is notably fragmented. This means there are many independent players, all vying for the same resources and opportunities. This high number of competitors naturally fuels intense rivalry.

Companies are constantly competing for prime drilling locations, or acreage, and for the chance to develop those reserves. This competition can impact pricing and profit margins for everyone involved. For instance, in 2024, the Permian Basin, a key U.S. oil-producing region, saw numerous smaller E&P companies actively bidding on lease sales, demonstrating this competitive dynamic.

Commodity price volatility, particularly in benchmarks like West Texas Intermediate (WTI) crude oil, significantly shapes competitive rivalry. For instance, in early 2024, WTI prices hovered around $75-$80 per barrel, experiencing fluctuations that directly affected energy producers' margins and strategic decisions. When prices dip, the pressure to maintain profitability can escalate, leading to more aggressive pricing strategies among competitors as they vie for market share and cash flow, potentially triggering consolidation through mergers and acquisitions.

Crescent Energy's aggressive acquisition strategy, particularly evident in its substantial Eagle Ford M&A activities throughout 2024 and into early 2025, directly fuels competitive rivalry. This pursuit of growth through acquiring assets intensifies the battle for desirable oil and gas properties.

The heightened demand for these assets, driven by companies like Crescent Energy, inevitably leads to increased acquisition costs. This financial pressure, in turn, escalates the rivalry among industry players vying to expand their operational footprints and secure future production.

Basin-Specific Competition

Competitive rivalry is particularly intense within specific, high-potential geological basins where companies like Crescent Energy operate. For instance, the Permian Basin and Eagle Ford Shale regions are prime examples of this localized but fierce competition.

Companies are locked in a battle for the most desirable drilling locations, essential infrastructure access like pipelines and processing facilities, and skilled labor, all of which are crucial for operational success and cost efficiency. This competition directly impacts a company's ability to secure and exploit resources effectively.

In 2024, the Permian Basin continued to be a focal point for this rivalry, with numerous operators actively bidding for acreage and competing for drilling permits. For example, rig counts in the Permian have consistently remained among the highest in the US, reflecting the ongoing competition for drilling opportunities.

- Permian Basin Rig Count: As of late 2024, the Permian Basin typically maintained over 300 active drilling rigs, showcasing the significant operational presence and competitive intensity from multiple players.

- Infrastructure Bottlenecks: Competition for pipeline capacity in the Permian has driven up transportation costs, impacting profitability for all operators vying for market access.

- Talent Acquisition: The demand for experienced geoscientists and field engineers in these basins leads to intense competition for talent, often resulting in higher compensation packages.

Operational Efficiency and Cost Management

Companies that excel at operational efficiency, particularly in reducing drilling and completion costs while boosting well productivity, secure a notable competitive edge. This focus is paramount for sustained success in a dynamic market.

Crescent Energy has actively pursued improvements in this domain, demonstrating a commitment to cost control and enhanced output. For instance, in the first quarter of 2024, Crescent Energy reported capital expenditures of $213 million, with a significant portion allocated to optimizing existing production and drilling new wells, aiming for greater efficiency.

- Cost Reduction Initiatives: Crescent Energy's strategy includes streamlining operations to lower per-barrel costs, a key differentiator.

- Productivity Optimization: The company focuses on maximizing output from each well, directly impacting profitability.

- Capital Allocation: Strategic deployment of capital in Q1 2024 towards efficiency-boosting projects underscores this competitive driver.

- Industry Benchmarking: Superior operational metrics allow companies to outperform rivals on cost per barrel and production volumes.

The U.S. upstream oil and gas sector is characterized by a high degree of fragmentation, leading to intense rivalry among numerous independent players competing for resources. This competition escalates in prime geological basins like the Permian and Eagle Ford, where companies vie for acreage, infrastructure, and talent.

Price volatility, as seen with WTI crude oil around $75-$80 per barrel in early 2024, intensifies this rivalry, forcing producers to focus on efficiency and cost control to maintain profitability. Companies like Crescent Energy actively engage in mergers and acquisitions, such as their Eagle Ford activities in 2024-2025, further fueling the competition for desirable assets and driving up acquisition costs.

Operational efficiency, including cost reduction and productivity optimization, is a critical differentiator. Crescent Energy's Q1 2024 capital expenditures of $213 million reflect this focus on enhancing output and efficiency to gain a competitive edge.

| Metric | Value (Late 2024/Early 2025) | Significance |

|---|---|---|

| Permian Basin Active Rigs | ~300+ | Indicates high operational activity and intense competition for drilling opportunities. |

| WTI Crude Oil Price (Early 2024) | ~$75-$80/barrel | Price fluctuations directly impact profit margins and competitive strategies. |

| Crescent Energy Q1 2024 Capex | $213 million | Demonstrates investment in efficiency and growth, key drivers of competitive advantage. |

SSubstitutes Threaten

The growing prevalence of renewable energy sources like solar and wind presents a significant threat to traditional fossil fuels. By 2024, global renewable energy capacity additions are projected to reach new heights, directly impacting the long-term demand for crude oil and natural gas, especially in sectors like power generation and transportation.

As renewable technologies continue to advance, their cost-effectiveness and efficiency improve, making them increasingly attractive substitutes for fossil fuels. For instance, the levelized cost of electricity for solar PV has seen dramatic reductions, making it competitive with, and often cheaper than, new fossil fuel power plants in many regions.

This shift is not just theoretical; many countries are setting ambitious targets for renewable energy integration. For example, in 2024, several nations are expanding their electric vehicle infrastructure and phasing out internal combustion engine sales, further diminishing the market for oil-based fuels.

The burgeoning popularity of electric vehicles (EVs) is a significant threat of substitution for traditional gasoline-powered automobiles. By 2024, global EV sales are projected to reach over 16 million units, a substantial increase that directly erodes demand for crude oil derivatives used in internal combustion engines.

Furthermore, widespread adoption of energy-efficient technologies in homes and industries further curtails the need for fossil fuels. For instance, improved insulation and smart thermostats in residential buildings can reduce heating and cooling energy consumption by up to 30%, lessening reliance on natural gas and electricity generated from hydrocarbons.

These combined trends, the shift to EVs and enhanced energy efficiency, represent powerful substitutes for conventional energy sources. This substitution dynamic exerts downward pressure on the demand and pricing of crude oil and natural gas, impacting the profitability of companies within the hydrocarbon value chain.

Government policies and incentives are increasingly steering the market toward alternative energy sources, presenting a significant threat of substitution for traditional fossil fuel products. For instance, the Inflation Reduction Act of 2022 in the United States offers substantial tax credits and incentives for renewable energy projects and electric vehicles, directly encouraging adoption of alternatives to fossil fuels. This regulatory push, coupled with global carbon reduction targets, can accelerate the migration of consumers and industries away from oil and gas, impacting Crescent Energy's long-term market viability.

Hydrogen and Alternative Fuels

The threat of substitutes for natural gas, particularly from emerging alternative fuels like hydrogen, is a growing concern, especially as investments in these sectors accelerate. While currently a minor threat, the long-term potential for hydrogen to replace natural gas in industrial applications, heating, and transportation is significant. For instance, by 2030, the global hydrogen market is projected to reach $243 billion, indicating substantial growth and a potential shift away from traditional fuels.

These alternative fuels represent a future challenge to natural gas demand. The ongoing technological advancements and increasing governmental support for green hydrogen production, often through electrolysis powered by renewable energy, are making these substitutes more viable. By 2050, hydrogen could supply 20% of the world's energy, a substantial portion that could displace natural gas in many of its current uses.

- Hydrogen's growing role in industry: Many industrial processes currently reliant on natural gas, such as ammonia production and steel manufacturing, are exploring hydrogen as a cleaner alternative.

- Transportation sector adoption: Hydrogen fuel cell vehicles are gaining traction, potentially reducing the demand for natural gas in certain transportation segments.

- Heating and power generation: While further development is needed, blending hydrogen with natural gas for heating or using pure hydrogen in power generation are being actively researched and piloted.

- Investment trends: Global investment in hydrogen technologies saw significant increases in 2023, with projections for continued exponential growth, signaling a strong commitment to its development as a substitute fuel.

Public Perception and ESG Factors

Growing public awareness and a heightened investor focus on Environmental, Social, and Governance (ESG) factors are increasingly driving demand for cleaner energy alternatives. This societal shift directly influences corporate strategies and consumer choices, making renewable energy sources and other sustainable options more appealing. Consequently, this can lead to a devaluation of traditional hydrocarbon assets as the market prioritizes environmentally conscious investments.

In 2024, the global renewable energy market continued its robust expansion. For instance, solar power installations saw significant growth, with some reports indicating a substantial increase in capacity additions compared to previous years, driven by policy support and falling technology costs. This trend makes solar and wind power increasingly viable substitutes for traditional energy sources.

- ESG Investment Growth: Global ESG-focused assets under management reached new highs in early 2024, exceeding trillions of dollars, indicating strong investor demand for sustainable companies and technologies.

- Renewable Energy Adoption: By mid-2024, renewable energy sources accounted for a growing percentage of new power generation capacity globally, often outperforming fossil fuel additions.

- Consumer Preference Shifts: Surveys from late 2023 and early 2024 showed a marked increase in consumer willingness to pay a premium for products and services from companies with strong sustainability credentials, impacting energy choices.

- Policy and Regulation: Many governments in 2024 continued to implement or strengthen regulations favoring renewable energy and penalizing carbon-intensive industries, thus enhancing the attractiveness of substitutes.

The availability and increasing competitiveness of alternative energy sources pose a significant threat of substitution to traditional fossil fuels. By 2024, advancements in renewable technologies and supportive government policies have made solar, wind, and electric vehicles increasingly viable replacements for oil and gas in power generation, transportation, and heating sectors.

These substitutes are not only becoming cost-competitive but are also driven by a growing global focus on ESG factors and sustainability. For instance, the levelized cost of solar PV continues to fall, making it a more attractive option than new fossil fuel plants in many regions. Furthermore, global ESG-focused assets under management exceeded trillions of dollars by early 2024, signaling strong investor preference for greener alternatives.

The rise of electric vehicles is a prime example, with global sales projected to surpass 16 million units in 2024, directly impacting demand for gasoline. Simultaneously, emerging alternative fuels like hydrogen are gaining momentum, with the global hydrogen market expected to reach $243 billion by 2030, presenting a long-term substitute for natural gas in industrial processes and transportation.

| Substitute Technology | 2024 Status/Projection | Impact on Fossil Fuels |

|---|---|---|

| Solar PV | Continued cost reductions and capacity additions | Displaces fossil fuels in power generation |

| Electric Vehicles (EVs) | Global sales projected > 16 million units | Reduces demand for gasoline and diesel |

| Hydrogen | Growing investment and pilot projects | Potential long-term substitute for natural gas in industry and transport |

| Energy Efficiency | Improved building standards and smart technologies | Reduces overall energy consumption, lessening reliance on fossil fuels |

Entrants Threaten

High capital requirements act as a significant deterrent for new companies looking to enter the crude oil and natural gas acquisition and development sector. The sheer cost of acquiring exploration rights, drilling wells, and building essential infrastructure like pipelines and processing facilities can easily run into billions of dollars. For instance, a single offshore oil platform can cost upwards of $1 billion to construct, and that's just one component of the necessary investment.

Established players, like Crescent Energy, have a significant advantage due to their existing access to proven oil and gas reserves and prime acreage in productive basins. This historical advantage makes it difficult for newcomers to compete effectively.

New entrants often struggle to acquire comparable high-quality assets. The most attractive and productive areas are typically already claimed by established companies, making acquisitions costly and scarce.

For instance, in 2024, the Permian Basin, a highly sought-after region, continued to see high acquisition costs. Companies looking to enter this market would face substantial capital outlays to secure acreage comparable to what existing major players already control.

The oil and gas sector's reliance on cutting-edge technology presents a formidable barrier. Modern operations demand sophisticated drilling techniques, advanced data analytics, and specialized operational know-how. For instance, the adoption of AI in seismic data interpretation, a trend accelerating into 2024, requires substantial investment in both software and highly skilled geoscientists.

New companies entering this arena must either invest heavily in developing these complex technological capabilities or acquire established firms possessing them. This technological gap is significant, as evidenced by the multi-billion dollar investments major oil companies continue to pour into digital transformation initiatives, aiming to optimize production and reduce costs through advanced analytics and automation.

Furthermore, attracting and retaining experienced personnel with expertise in areas like reservoir engineering, offshore operations, and advanced geological modeling is a major challenge. The global shortage of experienced oil and gas professionals, a concern that has persisted and intensified in recent years, means that new entrants face stiff competition for talent, driving up labor costs and further increasing the initial investment required.

Regulatory and Environmental Hurdles

The oil and gas sector faces significant regulatory and environmental hurdles that act as a substantial barrier to new entrants. Companies must navigate a complex web of environmental regulations, including emissions standards and land use policies, often requiring extensive permitting processes. For instance, in 2024, the U.S. Environmental Protection Agency (EPA) continued to enforce strict rules on methane emissions from oil and gas facilities, impacting operational costs and compliance strategies for all players.

These intricate regulatory landscapes are not only time-consuming but also financially demanding for new companies. The cost of securing necessary permits, conducting environmental impact assessments, and ensuring ongoing compliance can represent a significant upfront investment. This can deter potential new entrants who may lack the capital or expertise to manage these requirements effectively.

- Stringent Environmental Regulations: Compliance with standards for air and water quality, waste disposal, and land reclamation is mandatory.

- Complex Permitting Processes: Obtaining permits for exploration, drilling, and production can involve multiple agencies and lengthy review periods.

- High Compliance Costs: New entrants must allocate substantial resources to meet regulatory requirements, including technology upgrades and ongoing monitoring.

- Evolving Climate Policies: Shifting government policies and international agreements on climate change can introduce new compliance burdens and uncertainties.

Market Volatility and Price Risk

The inherent volatility of crude oil and natural gas prices poses a significant threat to new entrants. Without the established hedging strategies and deep financial reserves of companies like Crescent Energy, newcomers are particularly vulnerable to sharp price downturns.

For instance, in early 2024, West Texas Intermediate (WTI) crude oil prices experienced fluctuations, trading within a range that could significantly impact a new producer's profitability and investment recovery timeline. This price uncertainty can act as a powerful deterrent, making it difficult for new players to secure financing and plan for long-term operations.

- Price Volatility: Crude oil prices can swing dramatically, impacting revenue streams for new entrants.

- Hedging Disadvantage: New companies often lack the sophisticated hedging tools and experience of incumbents.

- Financial Resilience: Established players can better absorb price shocks, a luxury not afforded to newcomers.

- Deterrent Effect: The risk of price collapse discourages potential new companies from entering the market.

The threat of new entrants in the oil and gas sector is generally low, largely due to the immense capital required for exploration, drilling, and infrastructure development, often reaching billions of dollars. Established companies also benefit from existing access to prime acreage and proven reserves, making it difficult for newcomers to secure comparable assets.

Technological sophistication, including advanced drilling techniques and data analytics, further raises the barrier, demanding significant investment in both hardware and specialized talent. Furthermore, navigating complex regulatory and environmental compliance, alongside the inherent price volatility of commodities, deters many potential new players.

For instance, in 2024, acquiring high-quality acreage in regions like the Permian Basin continued to demand substantial upfront capital, and the need for advanced technologies like AI in seismic interpretation added another layer of investment. The ongoing shortage of experienced oil and gas professionals also increases labor costs for any new company attempting to enter the market.

Porter's Five Forces Analysis Data Sources

Our Porter's Five Forces analysis utilizes a comprehensive blend of primary research, industry-specific reports from reputable firms, and publicly available financial data from companies to accurately assess competitive intensity.