China Railway Construction PESTLE Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

China Railway Construction Bundle

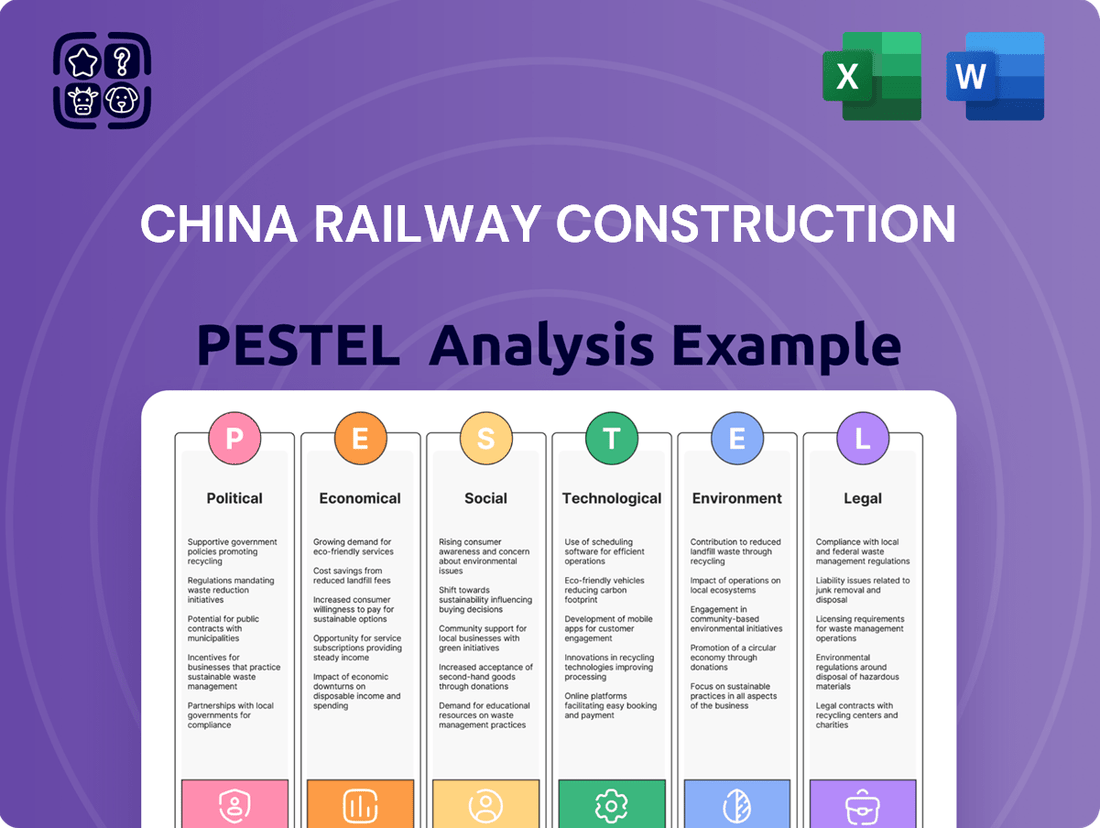

China Railway Construction operates within a dynamic global landscape, heavily influenced by political stability, economic growth, and technological advancements in infrastructure. Our PESTLE analysis delves into these critical external factors, revealing how shifts in government policy, international trade relations, and emerging construction technologies are shaping the company's strategic direction and operational efficiency. Gain a competitive edge by understanding these forces.

Unlock actionable intelligence with our comprehensive PESTLE analysis of China Railway Construction. Discover how evolving social trends, environmental regulations, and the legal framework impact its operations and future growth. This expertly crafted report is your key to informed decision-making and strategic planning. Download the full version now for immediate insights.

Political factors

China Railway Construction Corporation Limited (CRCC) is a major beneficiary of the Chinese government's substantial infrastructure investment, a cornerstone of its national development strategy. The 14th Five-Year Plan, covering 2021 to 2025, earmarks considerable funds for railway expansion, highway construction, and urban development projects. This strategic focus directly fuels CRCC's order book and ensures a consistent flow of large-scale projects for the foreseeable future.

China Railway Construction Corporation (CRCC) views the Belt and Road Initiative (BRI) as a primary engine for its global growth. The company's deep involvement in BRI projects, spanning railway and infrastructure development in numerous nations, directly fuels its international revenue streams and enhances its global standing.

CRCC has set an ambitious target: to derive 30% of its total revenue from overseas ventures by 2025. This strategic objective is heavily reliant on the continued momentum and opportunities presented by the BRI, underscoring the initiative's critical role in CRCC's future financial performance.

As a centrally administered state-owned enterprise, China Railway Construction Corporation (CRCC) is deeply impacted by China's ongoing State-Owned Enterprise (SOE) reforms. These reforms, spearheaded by the State-owned Assets Supervision and Administration Commission (SASAC), aim to boost efficiency and competitiveness. For instance, in 2023, SASAC announced plans to deepen reforms for 100 key SOEs, focusing on market-oriented operations and technological innovation, which directly affects how CRCC strategizes and allocates resources.

Geopolitical Risks and International Relations

China Railway Construction Corporation (CRCC) navigates a complex global landscape, with its significant international footprint, particularly through the Belt and Road Initiative (BRI), making it susceptible to geopolitical shifts. Trade disputes and changing international relations directly affect project feasibility and CRCC's operational stability in numerous countries.

Political instability within host nations presents a substantial challenge, potentially disrupting ongoing projects and impacting future investment. For instance, in 2024, ongoing geopolitical tensions in regions targeted by the BRI could lead to project delays or renegotiations, affecting CRCC's revenue streams.

- BRI Expansion: As of early 2025, over 150 countries have signed BRI cooperation agreements, increasing CRCC's exposure to diverse political environments.

- Trade Tensions: Ongoing trade friction between major economies could indirectly impact CRCC's access to financing and key materials for its international projects.

- Political Instability: Regions experiencing political unrest may halt or significantly alter the scope of infrastructure projects CRCC is involved in, impacting its project pipeline and profitability.

Government Policies on Real Estate and Urbanization

China's government policies significantly shape CRCC's real estate and urbanization endeavors. For instance, the 2024 government work report reiterated a commitment to ensuring stable and healthy development of the property market, which directly impacts demand for CRCC's construction and development services. Initiatives focused on urban renewal and the development of ‘new urbanization’ models, like the expansion of high-speed rail networks connecting major urban centers, create substantial opportunities for CRCC’s integrated infrastructure and real estate solutions.

Government directives on affordable housing and rental market regulations also play a crucial role. In 2024, policies continued to encourage the development of public rental housing and the renovation of shantytowns, areas where CRCC has historically been a major contractor. These policies aim to balance market forces with social housing needs, influencing the scale and type of projects CRCC undertakes in the urban development sector.

- Urbanization Targets: China's ongoing urbanization drive, aiming to increase the urbanization rate to around 65% by 2025, fuels demand for infrastructure and related property development, benefiting CRCC.

- Property Market Stability: Government efforts to prevent speculative bubbles and ensure housing affordability influence the pace and nature of real estate development projects undertaken by CRCC.

- Smart City Initiatives: Policies promoting smart city development, integrating technology into urban infrastructure, create new avenues for CRCC's expertise in building modern, connected urban environments.

China's government actively shapes CRCC's operational landscape through infrastructure investment policies and state-owned enterprise reforms. The 14th Five-Year Plan (2021-2025) prioritizes railway and urban development, directly bolstering CRCC's project pipeline. As a state-owned enterprise, CRCC is subject to reforms aimed at enhancing efficiency, with SASAC guiding these initiatives, impacting resource allocation and strategic direction.

The Belt and Road Initiative (BRI) remains a crucial political driver for CRCC's global expansion, with over 150 countries signed on as of early 2025, presenting both opportunities and geopolitical risks. Trade tensions can affect financing and material access for international projects. Political instability in host nations poses a significant risk, potentially leading to project delays or renegotiations, as seen in 2024 geopolitical shifts impacting BRI regions.

Government policies on urbanization and the property market directly influence CRCC's real estate and development activities. China's commitment to stable property market development in 2024 and its urbanization targets, aiming for around 65% by 2025, create consistent demand for CRCC's services. Initiatives like smart city development also offer new avenues for the company.

| Factor | Impact on CRCC | Data/Trend (2024-2025) |

| Infrastructure Investment | Directly fuels order book and revenue | 14th Five-Year Plan continues significant allocation to railways and urban development. |

| Belt and Road Initiative (BRI) | Drives international revenue and global presence | Over 150 countries signed BRI agreements by early 2025; CRCC targets 30% overseas revenue by 2025. |

| SOE Reforms | Aims to boost efficiency and competitiveness | SASAC deepening reforms for key SOEs in 2023-2024 focuses on market-oriented operations. |

| Urbanization Policies | Creates demand for construction and property development | Urbanization rate targeted around 65% by 2025; focus on urban renewal and new urbanization models. |

| Geopolitical Shifts/Trade Tensions | Introduces project feasibility and operational risks | Ongoing trade friction and regional instability can impact financing and project execution. |

What is included in the product

This PESTLE analysis delves into the Political, Economic, Social, Technological, Environmental, and Legal factors impacting China Railway Construction's operations and strategic landscape.

It provides a comprehensive overview of the external forces shaping the company's opportunities and challenges, supported by relevant data and forward-looking insights.

A concise PESTLE analysis of China Railway Construction's external environment, presented in a digestible format, simplifies complex market dynamics to empower strategic decision-making and mitigate potential risks.

Economic factors

China's sustained focus on infrastructure development, especially in high-speed rail and urban expansion, creates a robust domestic market for China Railway Construction Corporation (CRCC). This commitment is backed by government initiatives designed to stimulate economic activity.

Anticipated government spending on construction investment is slated to reach significant levels in 2025, further bolstering demand for CRCC's core competencies. This policy-driven growth ensures a steady pipeline of projects for the company.

The global infrastructure market is experiencing significant shifts, driven by rising urbanization and a growing emphasis on climate resilience. These forces are reshaping how nations invest in and develop their infrastructure, creating new avenues for companies like China Railway Construction Corporation (CRCC). For instance, the United Nations projects that by 2050, 68% of the world's population will live in urban areas, a trend that necessitates substantial investment in transportation, utilities, and housing.

Furthermore, the reconfiguration of global supply chains, accelerated by recent geopolitical events and a desire for greater economic security, is prompting countries to invest in port upgrades, logistics networks, and digital infrastructure. This presents a prime opportunity for CRCC to leverage its expertise in large-scale construction projects and expand its international footprint. The World Bank highlighted in 2023 that infrastructure investment needs remain substantial globally, particularly in developing economies seeking to enhance connectivity and economic competitiveness.

A slowdown in China's vast real estate sector presents a significant headwind for China Railway Construction Corporation (CRCC). This downturn directly impacts CRCC's own real estate development projects and, more broadly, reduces the demand for the construction materials and services it supplies for residential projects across the country. For instance, in early 2024, property investment in China experienced a notable decline, which would have a ripple effect on companies like CRCC heavily involved in infrastructure and development.

However, the Chinese government is actively working to stabilize the housing market, with policy interventions expected to continue into 2025. These measures, such as potential adjustments to mortgage rates or support for developers, are designed to cushion the blow and mitigate the indirect impacts on large construction firms like CRCC, aiming to foster a more predictable environment for infrastructure and property-related ventures.

Access to Funding and Financing

China Railway Construction Corporation (CRCC) thrives on its capacity to secure substantial funding for its massive infrastructure projects. This access is significantly shaped by government support, state-owned banks, and the availability of international capital. Interest rates and the general liquidity within the global financial system directly impact CRCC's ability to finance these endeavors.

In 2024, China's central bank has maintained a relatively accommodative monetary policy, which can translate to more favorable borrowing costs for state-backed enterprises like CRCC. Furthermore, the Belt and Road Initiative, a key driver for CRCC's international projects, often involves financing from multilateral development banks and bilateral agreements, though geopolitical shifts can influence these flows.

- Government Support: CRCC benefits from direct state funding and guarantees, bolstering its creditworthiness for large-scale projects.

- State Bank Financing: Major Chinese banks, such as the Industrial and Commercial Bank of China (ICBC) and China Construction Bank (CCB), are significant lenders to CRCC.

- International Capital Markets: CRCC can tap into international bond markets, though global economic conditions and investor sentiment play a crucial role.

- Interest Rate Environment: Fluctuations in benchmark interest rates, both domestic and international, directly affect the cost of borrowing for CRCC's financing.

Cost of Raw Materials and Labor

Fluctuations in the cost of essential raw materials such as steel and cement directly impact China Railway Construction Corporation's (CRCC) project profitability. For instance, global steel prices saw considerable volatility in late 2023 and early 2024, influenced by production levels and demand from major construction markets, including China's infrastructure push. Similarly, labor costs, driven by domestic policies and the availability of skilled workers, present a dynamic challenge for CRCC.

These cost pressures are further amplified by global supply chain dynamics and commodity price trends. When raw material prices surge, CRCC's project margins can shrink, especially for long-term contracts where price escalation clauses may not fully offset increases. The company's financial performance is therefore closely tied to its ability to manage these volatile input costs effectively.

- Steel prices: Global benchmark rebar prices experienced fluctuations, with some periods in 2023 seeing increases of over 10% due to energy costs and production cuts in key regions.

- Labor availability: While precise aggregate data for 2024 is still emerging, reports from late 2023 indicated a tightening labor market in certain construction sectors within China, potentially leading to wage pressures.

- Cement costs: Cement prices are often linked to energy costs and environmental regulations, which can lead to unpredictable swings impacting construction budgets.

China's economic trajectory significantly shapes the landscape for China Railway Construction Corporation (CRCC). The nation's continued investment in infrastructure, projected to see substantial government spending in 2025, provides a strong domestic demand base. However, a cooling property market, evidenced by declines in property investment in early 2024, presents a notable challenge, impacting both CRCC's direct real estate ventures and its supply chain for other projects.

The company's financial health is intrinsically linked to the broader economic climate and access to capital. Accommodative monetary policies in China during 2024 can lower borrowing costs, while international capital markets, though subject to geopolitical influences, offer another avenue for financing. CRCC's ability to manage input costs, such as volatile steel and cement prices, which saw significant swings in late 2023 and early 2024, is crucial for maintaining profitability.

| Economic Factor | Impact on CRCC | Supporting Data/Trend |

|---|---|---|

| Infrastructure Spending | Positive demand driver | Anticipated significant government spending in 2025. |

| Real Estate Market | Negative impact on development and related services | Notable decline in property investment in China in early 2024. |

| Monetary Policy | Influences borrowing costs | China's accommodative monetary policy in 2024. |

| Raw Material Costs | Affects project profitability | Volatility in steel prices (e.g., >10% increases in late 2023) and cement costs. |

What You See Is What You Get

China Railway Construction PESTLE Analysis

The preview shown here is the exact document you’ll receive after purchase—fully formatted and ready to use, detailing the Political, Economic, Social, Technological, Legal, and Environmental factors impacting China Railway Construction.

This is a real screenshot of the product you’re buying—delivered exactly as shown, no surprises, offering a comprehensive PESTLE analysis of China Railway Construction.

The content and structure shown in the preview is the same document you’ll download after payment, providing in-depth insights into the strategic landscape of China Railway Construction.

Sociological factors

China's urbanization rate reached 66.16% by the end of 2023, a significant increase from previous years. This ongoing migration to cities fuels substantial demand for infrastructure development, directly benefiting China Railway Construction Corporation (CRCC) through projects like high-speed rail, subways, and urban renewal. The sheer scale of urban expansion means a continuous pipeline of construction opportunities for CRCC.

Simultaneously, China faces evolving demographics. While the overall population is stabilizing, certain regions are experiencing an aging population. This shift could impact infrastructure planning, potentially increasing the need for healthcare facilities, accessible public transport, and elder-care housing, areas where CRCC's construction expertise can be applied.

China Railway Construction Corporation (CRCC) stands as a colossal employer, directly impacting social fabrics through job creation and labor practices. In 2023, CRCC reported a workforce of over 280,000 employees, highlighting its substantial role in providing livelihoods across China and internationally.

Maintaining robust labor relations and ensuring worker safety are paramount for CRCC's social license to operate. Adherence to China's increasingly stringent labor laws, including provisions for fair wages and benefits, is critical. For instance, the average monthly wage for construction workers in China saw an increase in 2024, a trend CRCC must navigate to retain talent and uphold its reputation.

Worker safety remains a significant concern in the construction sector. CRCC's commitment to reducing workplace accidents, which unfortunately saw incidents reported in previous years, is crucial for its social standing. Investments in advanced safety training and equipment, a growing focus in the industry, are key to mitigating risks and fostering a positive perception among stakeholders.

China Railway Construction Corporation (CRCC) faces significant sociological considerations, particularly regarding community engagement and social responsibility. Undertaking massive infrastructure projects, like high-speed rail lines or urban developments, frequently necessitates land acquisition and can disrupt local populations. CRCC's success hinges on its capacity to foster positive relationships with these communities, proactively address their concerns, and demonstrate a commitment to social responsibility through initiatives that benefit local areas.

Effective community engagement is not merely a matter of compliance but a strategic imperative for CRCC. For instance, in projects like the expansion of the Jakarta-Bandung High-Speed Railway, which saw substantial investment and community interaction, CRCC's approach to resettlement and local employment directly influenced project timelines and public perception. In 2023, CRCC reported significant community investment programs across its global operations, though specific figures for social responsibility impact are often integrated into broader project cost analyses.

Public Perception and Brand Image

China Railway Construction Corporation (CRCC) operates under significant public scrutiny, where its brand image is directly tied to project execution. Factors like the quality of infrastructure built, the company's safety protocols, and its environmental stewardship critically shape how the public, and by extension, potential clients and investors, perceive CRCC. A strong, positive public perception is a vital asset, particularly as CRCC expands its global footprint, directly impacting its ability to secure new contracts and partnerships.

CRCC's commitment to ethical business practices and transparency further bolsters its brand reputation. In 2023, CRCC reported a significant increase in its international project portfolio, with overseas revenue contributing substantially to its overall financial performance. This growth underscores the importance of a robust and trusted brand image in securing international business opportunities, where reputation often precedes contractual agreements.

- Project Quality and Safety: CRCC's track record in delivering high-quality, safe infrastructure projects is paramount to its public image.

- Environmental Responsibility: Demonstrating strong environmental performance in its construction activities enhances public trust and corporate social responsibility.

- Ethical Conduct: Adherence to ethical business standards and transparency in operations are crucial for maintaining a positive brand reputation, especially in international markets.

- International Market Perception: A favorable public perception directly translates into a competitive advantage for CRCC when bidding on global infrastructure projects.

Skills Development and Talent Acquisition

The sheer scale and complexity of China Railway Construction Corporation's (CRCC) infrastructure projects, from high-speed rail to massive urban developments, demand a highly specialized and continuously developing workforce. This means that CRCC's success hinges on its capacity to not only recruit top-tier talent, such as experienced civil engineers and sophisticated project managers, but also to invest in their ongoing training and development. In 2023, CRCC reported a significant portion of its workforce engaged in technical and engineering roles, underscoring the critical need for specialized skills.

Attracting and retaining this talent pool is paramount for CRCC's operational efficiency and its ability to drive technological innovation within the construction sector. The company's commitment to skills development directly impacts its capacity to undertake cutting-edge projects and maintain a competitive edge. As of early 2024, CRCC has highlighted its focus on digital construction technologies and sustainable building practices, necessitating a workforce proficient in these evolving areas.

- Skilled Workforce Needs: Infrastructure projects require specialized engineers, project managers, and technicians.

- Talent Acquisition Challenges: Competition for skilled labor in the construction sector remains a significant factor for CRCC.

- Training and Development Investment: CRCC's ongoing investment in upskilling its employees is crucial for technological advancement and project execution.

- Impact on Efficiency: A well-trained and motivated workforce directly contributes to improved operational efficiency and project delivery timelines.

China's rapidly urbanizing population, reaching 66.16% by the end of 2023, creates sustained demand for infrastructure, directly benefiting CRCC. The nation's evolving demographics, including an aging population, also signal future infrastructure needs in areas like healthcare and accessible transport, playing to CRCC's strengths.

Technological factors

China Railway Construction Corporation (CRCC) is actively adopting advanced technologies like Building Information Modeling (BIM) and prefabrication. This integration aims to boost efficiency and lower costs across its projects, a trend mirrored by the broader Chinese construction sector. For instance, in 2023, the adoption of BIM in large-scale infrastructure projects saw a significant uptick, with an estimated 60% of major projects utilizing BIM for design and planning.

Automation and robotics are also becoming more prevalent in CRCC's operations, enhancing safety and precision. This technological shift is crucial as China pushes for higher quality and more sustainable infrastructure development. By 2024, the Chinese government has set targets to increase the use of prefabricated construction methods by 20%, directly impacting companies like CRCC.

China Railway Construction Corporation (CRCC) consistently invests in research and development, a cornerstone for maintaining its leadership in complex engineering projects like high-speed rail and advanced infrastructure. This focus is evident in their pursuit of novel materials and innovative construction techniques, crucial for tackling demanding geological and environmental conditions. For instance, CRCC's commitment to R&D is reflected in their significant patent filings, with thousands secured annually, often related to specialized tunneling equipment and advanced concrete formulations.

The push for smart cities and digital infrastructure offers significant avenues for China Railway Construction Corporation (CRCC). By integrating technologies such as the Internet of Things (IoT), artificial intelligence (AI), and advanced data analytics, CRCC can engineer more efficient and sustainable urban development projects. This strategic focus aligns with China's national digital economy goals, aiming to create interconnected and intelligent living spaces.

CRCC is well-positioned to develop and implement intelligent transportation systems, a key component of smart urban planning. This includes smart traffic management, autonomous vehicle infrastructure, and integrated public transit solutions. For instance, in 2023, China's investment in smart city initiatives saw substantial growth, with projects focusing on digital infrastructure development, creating a robust market for CRCC's expertise.

Automation and Robotics in Construction

The construction industry, including giants like China Railway Construction Corporation (CRCC), is increasingly embracing automation and robotics. This technological shift promises enhanced precision, accelerated project timelines, and a marked improvement in worker safety. For CRCC, integrating these advanced tools is not just an upgrade but a fundamental reshaping of its operational strategies and overall productivity.

By adopting automated systems, CRCC can expect to see tangible benefits. For instance, robotic bricklaying systems have demonstrated the potential to increase laying speeds by up to 10 times compared to manual labor, while also reducing material waste. Furthermore, the use of autonomous vehicles for site surveying and material transport can cut down on human error and operational downtime, contributing to more efficient project execution. In 2024, investments in construction automation globally were projected to grow significantly, with a particular focus on AI-driven project management and robotic assembly.

- Enhanced Precision: Robotic systems can perform tasks with millimeter accuracy, reducing rework and improving structural integrity.

- Increased Speed: Automation can accelerate critical path activities, leading to earlier project completion and cost savings.

- Improved Safety: Robots can handle hazardous tasks, such as working at heights or in dangerous environments, minimizing risks to human workers.

- Productivity Gains: CRCC's adoption of these technologies is expected to boost output per worker, improving overall project profitability.

Sustainable and Green Construction Technologies

China Railway Construction Corporation (CRCC) is increasingly integrating sustainable and green construction technologies into its projects, a move directly influenced by the global emphasis on environmental responsibility. This strategic shift is not only about meeting international standards but also about aligning with China's own ambitious goals for ecological civilization and carbon neutrality. For instance, by 2023, China had already committed to peaking carbon emissions before 2030 and achieving carbon neutrality before 2060, creating a strong domestic impetus for green building practices.

CRCC's adoption of these technologies is crucial for its long-term competitiveness and its ability to secure future contracts, especially in an era where environmental, social, and governance (ESG) factors are paramount for investors and governments alike. The company's commitment to energy-efficient designs and the use of environmentally friendly materials can lead to reduced operational costs and a smaller ecological footprint, making its infrastructure projects more appealing and sustainable.

- Green Building Standards: CRCC's projects are increasingly adhering to national and international green building standards, such as China's Three Star system or LEED, aiming for higher sustainability ratings.

- Energy Efficiency: Investments in energy-efficient building materials and construction techniques are becoming standard, reducing the energy consumption of infrastructure throughout its lifecycle.

- Material Innovation: The company is exploring and utilizing recycled materials and low-carbon alternatives in its construction processes, contributing to circular economy principles.

- Environmental Impact Mitigation: CRCC is implementing technologies to minimize pollution, manage waste effectively, and protect biodiversity at construction sites, reflecting a growing awareness of environmental stewardship.

China Railway Construction Corporation (CRCC) is leveraging advanced digital technologies like BIM and prefabrication to improve efficiency and reduce costs, with BIM adoption in major Chinese infrastructure projects reaching an estimated 60% in 2023.

Automation and robotics are enhancing safety and precision in CRCC's operations, supporting China's goal to increase prefabricated construction methods by 20% by 2024.

CRCC's significant investment in R&D, evidenced by thousands of annual patent filings, focuses on novel materials and construction techniques for complex projects, ensuring its leadership in areas like high-speed rail.

The company is capitalizing on the smart city trend by integrating IoT, AI, and data analytics for more efficient and sustainable urban development, aligning with national digital economy objectives.

| Technology Area | CRCC Adoption/Focus | Impact/Target | 2023/2024 Data/Projection |

|---|---|---|---|

| BIM & Prefabrication | Integrated into design and construction | Boost efficiency, lower costs, improve quality | BIM adoption in major projects ~60% (2023); Prefabrication target +20% (2024) |

| Automation & Robotics | Increasing use in operations | Enhance safety, precision, speed, reduce waste | Robotic bricklaying up to 10x faster; Global automation investment growing |

| Digital Infrastructure (IoT, AI) | Key for smart city projects | Create intelligent, sustainable urban environments | China's smart city investment growing significantly (2023) |

| R&D and Innovation | Continuous investment | Develop novel materials, advanced techniques | Thousands of patents filed annually |

Legal factors

China Railway Construction Corporation (CRCC) navigates a robust legal landscape, primarily guided by national legislation like the Civil Code, the Bidding Law, and the Construction Law. These foundational statutes dictate operational standards and contractual obligations for all domestic construction endeavors undertaken by CRCC.

Compliance with these stringent regulations is paramount for CRCC's successful execution of projects within China. For instance, the Bidding Law ensures fair competition and transparency in project procurement, impacting how CRCC secures new contracts and manages its supply chain.

The sheer volume of infrastructure development in China, with total fixed-asset investment in the construction industry reaching an estimated 30.7 trillion yuan in 2023, underscores the critical importance of adhering to these evolving legal frameworks. CRCC's ability to adapt to regulatory changes directly influences its project timelines and profitability.

China's commitment to environmental protection is evident in its increasingly stringent regulations. For instance, new standards for carbon-neutral construction are being implemented, directly influencing infrastructure projects undertaken by companies like China Railway Construction Corporation (CRCC). Penalties for exceeding emission limits are also becoming more severe, pushing for cleaner operational practices.

The anticipated Ecological and Environmental Code, slated for release in 2026, represents a significant consolidation and strengthening of existing environmental laws. This unified legislation will undoubtedly affect CRCC's material sourcing and construction methodologies, requiring greater adherence to sustainable practices and potentially increasing compliance costs.

China Railway Construction Corporation (CRCC) faces a complex legal landscape for its global ventures. Navigating diverse international contract laws, from FIDIC standards to bespoke agreements, is paramount. For instance, CRCC's involvement in the Belt and Road Initiative (BRI) means adhering to the legal frameworks of numerous participating nations, each with unique regulatory environments.

Effective dispute resolution is equally critical. CRCC must be adept at utilizing international arbitration forums like the ICC or SIAC, or engaging in local judicial processes. Failure to manage these legal intricacies can lead to significant project delays and financial penalties, impacting CRCC's overall profitability and reputation on the international stage.

Labor Laws and Worker Protections

China Railway Construction Corporation (CRCC) must meticulously adhere to labor laws, encompassing wage regulations, mandated working hours, and stringent safety standards. This compliance is paramount for CRCC's operations, both within China and across its global projects. For instance, the nationwide enforcement of regulations such as the 'Regulation on Wage Payment for Migrant Workers' in China directly influences the company's approach to managing its vast workforce.

Recent developments highlight the increasing focus on worker welfare. In 2024, China continued to emphasize the protection of migrant workers' rights, with reports indicating a 5% increase in government inspections related to wage arrears and working conditions. CRCC's commitment to these regulations is crucial for maintaining operational licenses and avoiding penalties that could disrupt project timelines and financial performance.

- Wage Compliance: CRCC faces scrutiny over timely and accurate wage payments, particularly for its large migrant worker population.

- Working Hours: Adherence to legal limits on daily and weekly working hours is a key compliance area, impacting labor costs and productivity.

- Safety Standards: Ensuring a safe working environment, in line with national and international benchmarks, is critical, with significant investments made in safety training and equipment by leading construction firms.

- International Labor Practices: When operating abroad, CRCC must navigate and comply with the labor laws of host countries, which can vary significantly and require tailored management strategies.

Anti-Corruption and Compliance Regulations

China Railway Construction Corporation Limited (CRCC), as a major state-owned enterprise with extensive international operations, faces significant scrutiny under anti-corruption and compliance regulations. These rules apply both within China and in the numerous countries where CRCC undertakes projects, making robust compliance a critical operational imperative.

Failure to comply can lead to severe consequences, including substantial fines, debarment from future projects, and significant damage to CRCC's global reputation. For instance, in 2023, China's National Supervisory Commission continued to emphasize strict enforcement of anti-corruption laws across state-owned enterprises, signaling a continued focus on accountability.

- Global Compliance Standards: CRCC must navigate a complex web of international anti-bribery laws such as the U.S. Foreign Corrupt Practices Act (FCPA) and the UK Bribery Act, alongside China's own anti-corruption framework.

- Reputational Risk Management: Maintaining a strong compliance record is vital for securing contracts and partnerships, especially in markets sensitive to corporate governance issues.

- Enforcement Trends: Regulatory bodies worldwide, including those in key CRCC operating regions, have shown increased activity in investigating and prosecuting corruption cases involving state-linked entities.

China Railway Construction Corporation (CRCC) operates within a legal framework that is increasingly focused on environmental protection and sustainability. New standards for carbon-neutral construction are being implemented, directly impacting infrastructure projects, with penalties for exceeding emission limits becoming more severe. The anticipated Ecological and Environmental Code, slated for release in 2026, will further consolidate and strengthen these environmental laws, potentially increasing compliance costs for CRCC.

Environmental factors

China's ambitious goal of reaching carbon neutrality by 2060 directly influences China Railway Construction Corporation (CRCC). This commitment translates into increasingly stringent emission reduction targets for the construction industry, a sector historically associated with significant carbon output.

CRCC must therefore prioritize the adoption of low-carbon construction techniques and enhance energy efficiency throughout its projects and supply chain. For instance, in 2023, China's construction sector accounted for approximately 20% of its total carbon emissions, highlighting the substantial challenge and opportunity for companies like CRCC to innovate.

China Railway Construction, like many in the sector, faces growing pressure for sustainable resource management. This includes a significant push towards utilizing recycled materials in construction projects and implementing highly efficient waste reduction strategies. The emphasis is on minimizing the environmental footprint throughout the project lifecycle.

The introduction of China's new Environmental Code is a pivotal development, actively promoting a circular economy model. This code imposes stringent recycling obligations, particularly targeting key industries such as construction, directly impacting how companies like China Railway Construction must operate and manage their waste streams.

By 2023, China's construction sector generated an estimated 2.3 billion tons of construction waste annually. The new regulations aim to divert a substantial portion of this through mandatory recycling and reuse programs, presenting both challenges and opportunities for efficient resource utilization.

China Railway Construction Corporation (CRCC) faces scrutiny over the ecological footprint of its vast infrastructure projects. In 2024, China's Ministry of Ecology and Environment reinforced regulations mandating comprehensive environmental impact assessments for all major construction, with specific attention to biodiversity. CRCC is thus compelled to integrate robust biodiversity protection strategies, such as habitat restoration and species monitoring, into its project planning and execution to mitigate disruption to natural ecosystems.

Water Management and Pollution Control

China Railway Construction Corporation (CRCC) faces significant environmental scrutiny regarding water management and pollution control. Strict regulations govern wastewater discharge from construction sites, compelling CRCC to invest in advanced treatment technologies. For instance, in 2024, China's Ministry of Ecology and Environment continued to enforce stringent standards, with fines for non-compliance impacting project budgets. Efficient water usage is also paramount, particularly in water-scarce regions where CRCC operates, driving the adoption of water recycling and conservation techniques.

CRCC's commitment to sustainability necessitates proactive measures to mitigate water pollution. This includes:

- Implementing advanced wastewater treatment systems at all major construction sites to meet or exceed national discharge standards.

- Developing and enforcing site-specific water management plans that prioritize water conservation and reuse, aiming to reduce overall water consumption by 15% by 2025.

- Conducting regular environmental monitoring and impact assessments to identify and address potential sources of water contamination.

- Investing in research and development for innovative, eco-friendly construction materials and methods that minimize water pollution risks.

Adaptation to Extreme Weather Events

Climate change presents a significant challenge for China Railway Construction Corporation (CRCC), with an anticipated rise in extreme weather events directly impacting its operations. These events, such as intensified typhoons and heavier rainfall, can cause substantial delays in construction timelines, lead to costly damage to ongoing projects, and create serious safety hazards for workers. For instance, the devastating floods in Henan province during July 2021, which caused billions in damages, highlighted the vulnerability of infrastructure projects to extreme precipitation.

CRCC must proactively integrate climate resilience into its strategic planning and project design phases. This involves not only anticipating potential disruptions but also developing robust mitigation strategies.

- Increased frequency of extreme weather events: Studies suggest a continued upward trend in the intensity and occurrence of events like heavy rainfall and typhoons affecting China.

- Infrastructure vulnerability: Past events have demonstrated significant financial losses and project setbacks due to weather-related damage.

- Need for resilient design: Incorporating advanced engineering solutions to withstand harsher environmental conditions is crucial for long-term project viability.

China's commitment to achieving carbon neutrality by 2060 directly impacts CRCC, pushing for reduced emissions in construction, a sector that accounted for around 20% of China's carbon emissions in 2023. This necessitates a shift towards low-carbon techniques and enhanced energy efficiency across its operations.

CRCC is increasingly focused on sustainable resource management, emphasizing recycled materials and waste reduction, especially given that the construction sector generated an estimated 2.3 billion tons of waste annually by 2023. The new Environmental Code promotes a circular economy, mandating stricter recycling practices.

The company must also address biodiversity concerns, with reinforced regulations in 2024 requiring comprehensive environmental impact assessments and biodiversity protection strategies for major projects. Furthermore, CRCC faces stringent water management regulations, compelling investment in advanced wastewater treatment and water conservation technologies to mitigate pollution and address scarcity.

PESTLE Analysis Data Sources

Our PESTLE Analysis for China Railway Construction is built on data from official Chinese government ministries, the World Bank, and prominent economic forecasting agencies. We incorporate reports on infrastructure spending, environmental regulations, and technological advancements to ensure a comprehensive view.