China Railway Construction Business Model Canvas

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

China Railway Construction Bundle

Discover the intricate workings of China Railway Construction's success with our comprehensive Business Model Canvas. This detailed breakdown illuminates their key partners, value propositions, and revenue streams, offering a strategic roadmap for industry leaders. Unlock the full blueprint to understand how they dominate the global infrastructure market.

Partnerships

China Railway Construction Corporation (CRCC), as a major state-owned enterprise, leverages significant partnerships with government agencies and other state-owned enterprises (SOEs). These collaborations are crucial for securing large-scale infrastructure projects, both domestically and abroad, often aligning with national strategic objectives like the Belt and Road Initiative.

The Chinese government's commitment to transportation infrastructure development underscores the importance of these relationships. For instance, plans indicate an investment of CNY 1.2 trillion (roughly USD 173 billion) in transport infrastructure projects by the close of 2024, directly benefiting CRCC through these government-led initiatives.

China Railway Construction Corporation (CRCC) actively partners with both local and international construction companies to enhance its global footprint. These collaborations are vital for navigating the complexities of diverse markets and ensuring project success.

By teaming up with local entities, CRCC gains invaluable insights into regional regulations, labor practices, and supply chains. This is exemplified in projects like the Algerian Western Railway Mining Line, where CRCC integrated local Algerian workers, fostering a synergistic approach. Such partnerships allow for efficient resource allocation and risk mitigation.

International collaborations further bolster CRCC's capabilities, enabling access to specialized expertise, advanced technologies, and broader financial backing. These alliances are instrumental in undertaking large-scale, technically demanding infrastructure projects across continents, solidifying CRCC's position as a global construction leader.

China Railway Construction Corporation (CRCC) relies heavily on strong ties with banks, investment funds, and other financial institutions to secure the substantial capital needed for its massive, infrastructure-focused projects. These partnerships are crucial for accessing both domestic and international financing avenues.

In 2024, CRCC's ability to manage its significant debt financing risks is directly linked to its established relationships with these financial entities, allowing it to undertake ambitious, capital-intensive endeavors that drive its business model forward.

Technology and Equipment Suppliers

China Railway Construction Corporation (CRCC) relies heavily on partnerships with technology and equipment suppliers to stay ahead. These collaborations are crucial for acquiring advanced construction machinery, high-quality materials, and innovative solutions that boost project efficiency. For instance, CRCC actively partners with global leaders in tunnel boring machines and high-speed rail components, ensuring access to state-of-the-art equipment.

These strategic alliances extend to joint research and development initiatives. CRCC collaborates with suppliers to pioneer cutting-edge technologies specifically for railway construction, tunneling, and complex bridge engineering projects. This focus on innovation allows CRCC to tackle more challenging infrastructure projects and deliver them with greater speed and precision.

- Partnerships with manufacturers of specialized construction equipment, such as advanced tunnel boring machines and heavy-lift cranes, are vital for CRCC's large-scale projects.

- Collaborations with material science companies ensure the use of innovative and durable materials, like high-strength steel and advanced concrete composites, for railway tracks and structures.

- Joint R&D with technology firms focuses on developing smart construction solutions, including AI-powered project management tools and advanced surveying equipment, to enhance operational intelligence.

Research and Development Institutions

China Railway Construction Corporation (CRCC) actively partners with universities and research institutions to foster technological advancement in its vast infrastructure projects. These collaborations are crucial for developing cutting-edge construction methodologies and materials, ensuring CRCC remains at the forefront of the industry. For instance, CRCC has engaged with leading Chinese universities to explore innovations in high-speed rail technology and smart city infrastructure.

These partnerships are instrumental in embedding Environmental, Social, and Governance (ESG) principles into CRCC's operations. By working with academic experts, the company can research and implement more sustainable construction practices, contributing to greener infrastructure development. This focus aligns with global trends and China's own ambitious environmental targets, such as achieving carbon neutrality.

The strategic engagement with R&D institutions directly supports CRCC's long-term vision for innovation and sustainability. In 2024, CRCC continued to invest in collaborative research, focusing on areas like advanced tunneling techniques, new energy integration in transportation networks, and digital construction platforms. These efforts are vital for maintaining competitiveness and addressing the complex challenges of modern infrastructure development.

- Technological Advancement: Collaborations drive innovation in areas like high-speed rail and smart city infrastructure.

- ESG Integration: Partnerships facilitate the research and adoption of sustainable construction practices.

- Strategic Investment: CRCC's 2024 focus includes advanced tunneling, new energy integration, and digital construction.

CRCC's key partnerships extend to financial institutions, enabling access to substantial capital for its large-scale projects. These relationships are crucial for managing debt and securing funding for ambitious endeavors.

The company also collaborates with technology and equipment suppliers, ensuring it has access to advanced machinery and innovative solutions for construction efficiency. This includes joint R&D with these partners to pioneer cutting-edge techniques.

Furthermore, CRCC partners with universities and research institutions to drive technological advancement and embed ESG principles. This focus on innovation and sustainability is vital for its long-term competitiveness.

| Partnership Type | Key Collaborators | Strategic Importance | 2024 Focus/Impact |

| Government & SOEs | Chinese Government Agencies, Other SOEs | Securing large-scale projects, aligning with national strategy | Benefiting from CNY 1.2 trillion (approx. USD 173 billion) transport infrastructure investment |

| Construction Companies | Local and International Firms | Market navigation, risk mitigation, resource allocation | Enhancing global footprint, integrating local expertise |

| Financial Institutions | Banks, Investment Funds | Capital access, debt management | Supporting capital-intensive projects, managing financing risks |

| Technology & Equipment Suppliers | Manufacturers of specialized machinery, material science firms | Access to advanced technology, R&D for efficiency | Acquiring state-of-the-art equipment, developing smart construction solutions |

| Academic & Research Institutions | Universities, R&D centers | Technological advancement, ESG integration | Innovating high-speed rail, exploring sustainable practices, digital construction |

What is included in the product

A comprehensive business model canvas for China Railway Construction, detailing its customer segments, value propositions, and channels, reflecting its global infrastructure development strategy.

This model provides a strategic overview of China Railway Construction's operations, outlining key partners, activities, and revenue streams to support its expansion in infrastructure projects worldwide.

The China Railway Construction Business Model Canvas acts as a pain point reliever by providing a clear, one-page snapshot of complex operations, enabling faster identification of inefficiencies and strategic adjustments.

Activities

China Railway Construction Corporation (CRCC) is heavily involved in building diverse infrastructure, from high-speed rail and roads to bridges, tunnels, and city development. This is their main business, driving most of their income and international reach.

In the second quarter of 2025, CRCC secured new contracts worth a substantial 563.3 billion yuan, highlighting their continued strength in winning major infrastructure projects globally.

China Railway Construction Corporation (CRCC) offers extensive survey, design, and consulting services, which are fundamental to its project lifecycle. This capability enables CRCC to deliver end-to-end solutions, from the earliest planning stages through to the final execution and ongoing management of complex infrastructure projects.

In 2023, CRCC's engineering and design segment reported significant revenue, highlighting the importance of these services. For instance, the company secured major design contracts for high-speed rail lines and urban transit systems, demonstrating its technical prowess and market demand for its expertise.

These integrated services allow CRCC to provide value-added solutions, optimizing project feasibility and efficiency. By offering comprehensive consulting, CRCC also assists clients in navigating regulatory landscapes and technical challenges, solidifying its position as a full-service construction giant.

China Railway Construction Corporation (CRCC) actively manufactures specialized machinery and components vital for its extensive construction projects, a key aspect of its integrated business model.

This vertical integration allows CRCC to maintain stringent quality control over essential project elements, from specialized tunneling equipment to critical structural components.

By producing these items in-house, CRCC enhances cost efficiency and ensures the timely availability of necessary materials and machinery, directly impacting project timelines and profitability.

For instance, in 2023, CRCC's manufacturing segment played a crucial role in supporting its infrastructure development efforts, contributing to the successful completion of numerous high-profile projects both domestically and internationally.

Real Estate Development

China Railway Construction Corporation (CRCC) extends its operations beyond infrastructure into real estate development, a strategic move to broaden its revenue streams. This diversification aims to leverage its construction expertise in urban planning and building projects.

While real estate development is a significant part of CRCC's business model, its contribution to overall revenue faced challenges. Reports from early 2024 indicated a noticeable decline in this segment, suggesting a potential impact from market conditions or strategic shifts within the company.

- Diversification Strategy: CRCC's real estate segment complements its core infrastructure business, creating synergies in project management and resource allocation.

- Revenue Contribution: This segment historically contributes to CRCC's financial performance, though recent data points to a downturn.

- Market Sensitivity: The performance of the real estate development arm is closely tied to broader economic trends and government policies affecting the property market.

Logistics and Materials Trading

China Railway Construction Corporation (CRCC) actively manages logistics and engages in materials trading to ensure the smooth execution of its vast construction projects, both within China and abroad. This involves the efficient procurement, transportation, and storage of construction materials, equipment, and necessary resources, which is fundamental to maintaining project timelines and cost-effectiveness.

CRCC's materials trading arm plays a vital role in securing competitive pricing and reliable supply chains for key components. For instance, in 2023, CRCC reported significant revenue from its infrastructure development and construction segments, underscoring the sheer volume of materials handled. The company's commitment to optimizing logistics is a direct enabler of its ability to undertake complex, large-scale infrastructure endeavors, such as high-speed rail lines and urban transit systems.

- Logistics Management: CRCC oversees the end-to-end movement of materials, equipment, and personnel for its projects, ensuring timely delivery and minimizing operational disruptions.

- Materials Trading: The company actively trades in construction materials, leveraging its scale to secure favorable terms and ensure a consistent supply for its diverse project portfolio.

- Supply Chain Optimization: CRCC focuses on building resilient and efficient supply chains to support its global operations, a critical factor given the scale of projects like Belt and Road Initiative infrastructure.

- Resource Allocation: Effective management of logistics and materials trading allows for strategic resource allocation, directly impacting project profitability and successful completion.

CRCC's core activities revolve around the comprehensive execution of infrastructure projects, encompassing everything from initial survey and design to construction and maintenance. They also engage in manufacturing specialized equipment and trading construction materials to support these vast undertakings.

The company's diversification into real estate development, while facing recent headwinds, aims to capitalize on urban growth and its existing construction capabilities.

CRCC's integrated approach, from design to material sourcing and manufacturing, allows for greater control over project timelines and costs, a crucial advantage in the global infrastructure market.

| Key Activity | Description | 2023/2024 Data/Impact |

|---|---|---|

| Infrastructure Construction | Building roads, railways, bridges, tunnels, and urban infrastructure. | Secured 563.3 billion yuan in new contracts in Q2 2025; significant revenue driver. |

| Survey, Design & Consulting | Providing planning, engineering, and advisory services. | Major design contracts for high-speed rail and urban transit in 2023. |

| Manufacturing & Trading | Producing specialized machinery and trading construction materials. | Crucial for quality control and cost efficiency; 2023 saw significant revenue from infrastructure segments supported by these activities. |

| Real Estate Development | Developing residential, commercial, and industrial properties. | Revenue contribution faced a noticeable decline in early 2024, indicating market sensitivity. |

Full Document Unlocks After Purchase

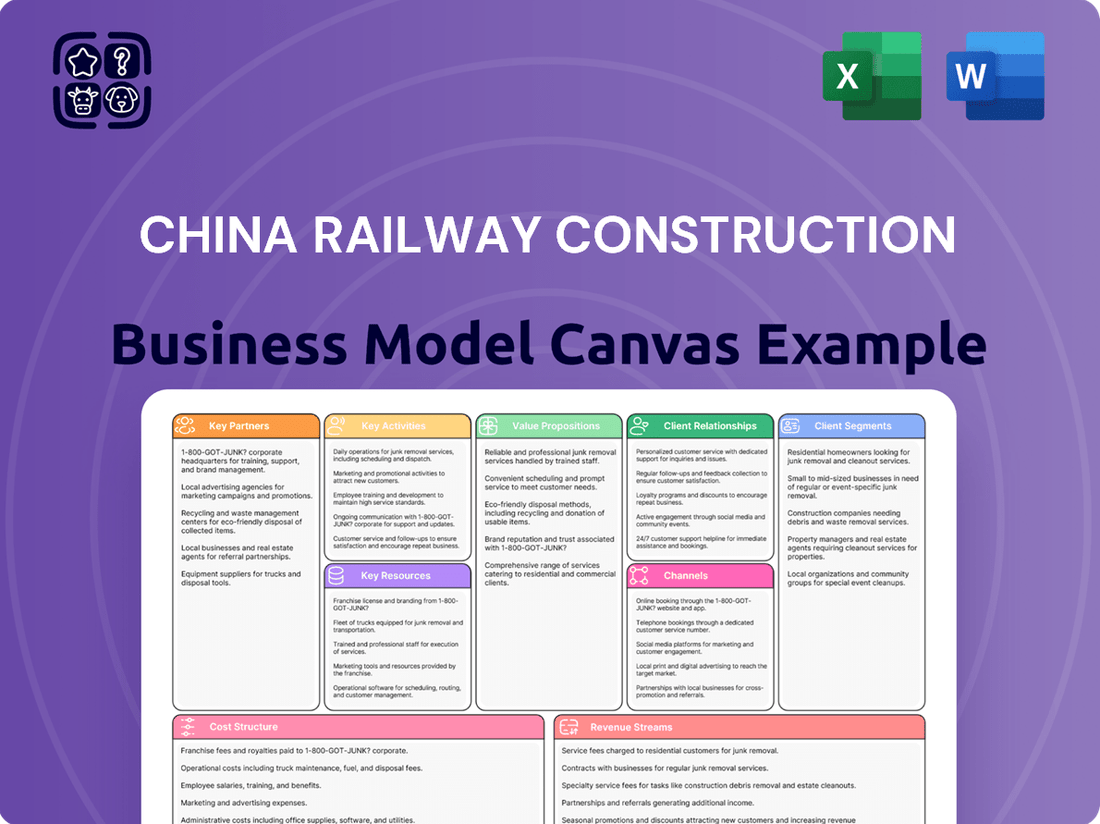

Business Model Canvas

The preview you're seeing is a direct representation of the China Railway Construction Business Model Canvas you will receive upon purchase. This is not a sample or mockup; it's an authentic snapshot of the complete document. Once your order is processed, you'll gain full access to this exact, professionally structured, and ready-to-use Business Model Canvas, allowing you to immediately leverage its insights for your strategic planning.

Resources

China Railway Construction Corporation (CRCC) leverages its extensive human capital, boasting over 264,000 full-time employees as of 2024. This massive workforce includes a deep pool of skilled engineers, experienced project managers, and a robust contingent of construction workers, all critical for executing challenging and expansive infrastructure projects across the globe.

China Railway Construction Corporation (CRCC) relies heavily on its extensive fleet of advanced construction equipment, including specialized tunnel boring machines (TBMs), to undertake massive infrastructure projects. This technological edge allows for efficient and high-quality execution, a critical component of their business model.

CRCC’s commitment to technological advancement is evident in their continuous investment in innovation. In 2023, their capital expenditure on equipment and technology was a significant factor in their ability to secure and deliver complex projects, contributing to their reported revenue of approximately $119 billion for the year.

China Railway Construction Corporation (CRCC) possesses robust financial capital, a cornerstone of its business model. This strength is underpinned by substantial undistributed profits and diverse financing avenues, enabling CRCC to effectively fund its extensive portfolio of domestic and international infrastructure projects. The company's financial resilience is evident in its 2024 performance, where it achieved a net profit of RMB 13.79 billion.

Intellectual Property and Technical Expertise

China Railway Construction Corporation (CRCC) leverages significant intellectual property and deep technical expertise, particularly in high-speed rail, bridges, and tunnels. This allows them to tackle complex infrastructure projects globally, solidifying their competitive advantage.

Their capabilities include leading positions in the design and construction of bridges, tunnels, and electrified railways. For instance, CRCC played a pivotal role in constructing sections of China's extensive high-speed rail network, a testament to their specialized knowledge.

- Patented Technologies: CRCC holds numerous patents related to advanced construction techniques and materials, especially for railway infrastructure.

- Engineering Prowess: Expertise in complex geological conditions and large-scale projects, such as the Beijing-Shanghai High-Speed Railway, demonstrates their technical depth.

- Research & Development: Continuous investment in R&D ensures they remain at the forefront of construction innovation, particularly in sustainable and efficient building methods.

Extensive Land and Project Portfolio

China Railway Construction Corporation (CRCC) leverages an extensive land and project portfolio as a core resource. This includes a significant number of ongoing and completed infrastructure projects, alongside substantial land reserves primarily for real estate development.

This vast asset base is crucial for CRCC's business model, enabling it to undertake large-scale, complex projects and capitalize on urban development opportunities. The company's deep involvement in critical national and international infrastructure initiatives underscores the strategic importance of its project pipeline and land holdings.

- Vast Project Pipeline: CRCC is actively involved in numerous infrastructure projects globally. For instance, it is a key player in the development of the China-Kyrgyzstan-Uzbekistan Railway, a significant Belt and Road Initiative project.

- Real Estate Development: The company holds substantial land reserves, particularly in China, which are strategically utilized for real estate ventures, contributing significantly to its revenue diversification.

- International Presence: CRCC's portfolio extends beyond China, with landmark projects like the Diriyah masterplan in Saudi Arabia showcasing its capability to manage and execute large international developments.

- Resource Integration: The integration of construction expertise with land resource management allows CRCC to create synergistic value across its diverse projects.

CRCC's key resources are its vast human capital, advanced equipment, strong financial standing, intellectual property, and extensive project/land portfolio.

The company's 264,000+ employees in 2024 provide the skilled labor for complex projects, while its advanced machinery, including TBMs, ensures efficient execution.

CRCC's financial strength, evidenced by a RMB 13.79 billion net profit in 2024, allows it to fund global operations, complemented by its deep technical expertise in areas like high-speed rail.

Its substantial project pipeline and land reserves further bolster its capacity to undertake large-scale developments and real estate ventures.

| Key Resource | Description | 2024/2023 Data Point |

| Human Capital | Skilled workforce including engineers and construction workers | Over 264,000 full-time employees |

| Equipment | Advanced construction machinery, including TBMs | Significant capital expenditure on equipment and technology in 2023 |

| Financial Capital | Undistributed profits and diverse financing | Net profit of RMB 13.79 billion (2024) |

| Intellectual Property | Technical expertise in rail, bridges, tunnels | Leading positions in design and construction of complex infrastructure |

| Project/Land Portfolio | Ongoing and completed projects, land reserves | Involvement in China-Kyrgyzstan-Uzbekistan Railway; Diriyah masterplan in Saudi Arabia |

Value Propositions

China Railway Construction Corporation (CRCC) provides a complete suite of infrastructure services, encompassing everything from initial design and expert consulting to the actual construction and manufacturing of necessary components. This means clients can rely on CRCC for the entire project lifecycle, simplifying coordination and ensuring a unified vision.

This all-in-one approach is designed to boost efficiency and uphold high-quality standards throughout complex infrastructure development. By managing all phases internally, CRCC can streamline processes, leading to potential cost savings for its clients.

For instance, in 2023, CRCC's revenue from its construction operations reached approximately 777.6 billion yuan, underscoring the scale and breadth of its integrated service delivery. This financial performance highlights the market's trust in their comprehensive capabilities.

China Railway Construction Corporation (CRCC) demonstrates proven expertise in large-scale and complex projects, evidenced by its extensive portfolio. The company has a significant track record in building high-speed railways, intricate bridges, and extensive tunnel networks, highlighting its advanced technical skills and capacity to manage demanding construction conditions.

CRCC's operational footprint is substantial across various infrastructure sectors, including railways, highways, municipal works, and urban rail transit systems. For instance, by the end of 2023, CRCC had undertaken the construction of over 10,000 kilometers of high-speed railways, a testament to its project execution prowess.

As a prominent state-owned enterprise, China Railway Construction Corporation (CRCC) offers unparalleled reliability and stability, directly aligning with national strategic infrastructure development goals. This state-backed assurance is a significant draw for government clients and international partners seeking dependable execution on large-scale projects.

The Chinese government's sustained commitment to infrastructure investment, evidenced by continued funding allocations, directly bolsters the operational capacity and market position of SOEs like CRCC. For instance, in 2023, CRCC reported a substantial revenue of approximately 930.5 billion yuan, underscoring its significant role and the government's ongoing support for its endeavors.

Global Reach and International Project Delivery

China Railway Construction Corporation (CRCC) leverages its vast international presence to offer clients unparalleled expertise in global project execution. This extensive footprint, particularly amplified through its involvement in the Belt and Road Initiative, positions CRCC as a contractor adept at navigating varied geographic, economic, and regulatory environments worldwide.

CRCC's ambition is to solidify its international standing, with a strategic target of deriving 30% of its total revenue from overseas projects by 2025. This focus underscores their commitment to becoming a truly global player.

- Global Expertise: CRCC's experience spans numerous countries, offering clients a contractor familiar with diverse operational challenges.

- Belt and Road Initiative: Significant participation in this initiative has expanded CRCC's reach and project delivery capabilities across Asia, Africa, and Europe.

- Revenue Diversification: The company aims for 30% of its revenue to originate from international projects by 2025, highlighting a strong global growth strategy.

- Project Scale: CRCC has a proven track record of delivering large-scale infrastructure projects, demonstrating its capacity for complex international undertakings.

Commitment to Quality and Sustainability

China Railway Construction Corporation (CRCC) places a significant emphasis on delivering high-quality construction outcomes. This dedication is evident in their adherence to stringent international standards and their focus on robust project execution, ensuring the longevity and reliability of their infrastructure developments.

Furthermore, CRCC is actively integrating sustainable practices and green technologies across its diverse portfolio of projects. This forward-thinking approach addresses growing global environmental concerns and meets the increasing client demand for development that is both economically viable and environmentally responsible.

- Quality Assurance: CRCC implements rigorous quality control measures throughout the project lifecycle, from material sourcing to final inspection.

- Sustainable Technologies: The company actively explores and deploys energy-efficient designs, waste reduction strategies, and the use of eco-friendly materials.

- Environmental Stewardship: CRCC's commitment extends to minimizing the environmental impact of its operations, including pollution control and biodiversity protection.

- Client Alignment: This focus on quality and sustainability directly aligns with the expectations of international clients and governments prioritizing responsible infrastructure growth.

CRCC offers comprehensive, end-to-end infrastructure solutions, simplifying project management for clients by covering design, consulting, construction, and component manufacturing. This integrated approach ensures efficiency and quality from start to finish.

The company's proven expertise in executing large-scale, complex projects, including extensive high-speed rail networks and intricate bridge and tunnel systems, demonstrates its advanced technical capabilities. This track record instills confidence in clients undertaking challenging infrastructure developments.

As a state-backed entity, CRCC provides exceptional reliability and stability, directly supporting national infrastructure goals and offering a dependable partner for government and international clients. This state backing is a key differentiator in securing large-scale, strategic projects.

CRCC's global reach, amplified by its significant involvement in initiatives like the Belt and Road Initiative, equips it to manage projects in diverse international environments. The company's strategic aim to derive 30% of its revenue from overseas projects by 2025 highlights its commitment to global expansion and expertise.

Customer Relationships

China Railway Construction Corporation (CRCC) cultivates deep, long-term strategic partnerships with national and local governments. These collaborations are crucial for CRCC's role as a key implementer of national infrastructure development plans and strategic global initiatives such as the Belt and Road Initiative.

These enduring relationships are solidified through a consistent track record of successful project execution and a clear alignment with national strategic objectives. For instance, CRCC's involvement in major infrastructure projects, often funded by government entities, demonstrates this symbiotic relationship.

By 2024, CRCC's extensive portfolio includes numerous high-speed rail lines, airports, and urban transit systems, many of which were initiated and heavily supported by government mandates and funding. This deep integration into national development strategies underscores the strength and longevity of these governmental partnerships.

China Railway Construction Corporation (CRCC) typically structures its relationships with private sector clients on a project-by-project basis. These engagements are characterized by detailed contractual agreements tailored to the specific scope of work, emphasizing customized construction and engineering solutions designed to meet the unique requirements of each client.

Performance-based metrics are frequently incorporated into these contracts, ensuring accountability and alignment with client expectations. For instance, in 2024, CRCC's involvement in infrastructure development projects for private developers often included milestones tied to completion timelines and quality standards, reflecting this project-based approach.

China Railway Construction Corporation (CRCC) deploys dedicated international client management teams to navigate the complexities of global projects. These specialized units are crucial for understanding and addressing the unique cultural nuances, diverse regulatory frameworks, and intricate logistical challenges inherent in operating across different countries.

These teams foster effective communication and ensure smooth project execution by acting as a bridge between CRCC and its international clientele. For instance, in 2024, CRCC secured significant infrastructure contracts in Southeast Asia and Africa, where localized client management was paramount to overcoming regulatory hurdles and building trust with local stakeholders.

After-Sales Support and Maintenance Services

China Railway Construction Corporation (CRCC) extends its customer relationships beyond project completion by offering comprehensive after-sales support and maintenance services. This commitment ensures the long-term operational efficiency and reliability of the infrastructure it builds, fostering enduring client satisfaction.

These services are crucial for generating recurring revenue streams and solidifying client trust, transforming one-off projects into long-term partnerships. For instance, CRCC's involvement in high-speed rail projects, like the Jakarta-Bandung High-Speed Railway, often includes extended maintenance contracts, guaranteeing the smooth operation of these vital transportation networks.

- Extended Maintenance Contracts: CRCC secures long-term agreements for the upkeep of completed projects, ensuring continuous operational performance.

- Technical Support and Upgrades: Providing ongoing technical assistance and facilitating necessary upgrades to infrastructure systems.

- Asset Management: Offering services that help clients manage and optimize the lifecycle of their infrastructure assets.

- Client Retention: Building loyalty through reliable post-construction support, leading to repeat business and referrals.

Engagement with Local Communities

China Railway Construction Corporation (CRCC) actively engages with the local communities surrounding its extensive projects. This engagement is a cornerstone of their strategy, aiming to build goodwill and ensure smoother project execution. For instance, in 2024, CRCC's projects across Africa directly created over 150,000 local jobs, significantly boosting economies in regions like Nigeria and Kenya.

These initiatives extend beyond mere employment. CRCC often implements targeted training programs, equipping local workforces with valuable construction skills. In Southeast Asia, particularly in Vietnam and Malaysia, CRCC invested approximately $50 million in 2024 in vocational training centers, enhancing the employability of thousands of individuals. Community development is also a key focus, with CRCC contributing to infrastructure improvements such as schools and healthcare facilities.

- Job Creation: In 2024, CRCC provided employment for over 150,000 local workers on its global projects.

- Skills Development: Approximately $50 million was invested in vocational training programs in 2024 across various regions.

- Community Investment: CRCC supported local infrastructure projects, including schools and clinics, as part of its social responsibility efforts.

CRCC maintains strategic, long-term partnerships with governments, vital for implementing national infrastructure plans and global initiatives like the Belt and Road. These relationships are reinforced by a proven history of successful project delivery and alignment with national goals, evident in CRCC's extensive portfolio of government-backed projects by 2024.

For private clients, CRCC typically engages on a project-by-project basis, using tailored contracts with performance metrics. This approach ensures alignment with client needs, as seen in 2024 infrastructure projects for private developers where milestones were tied to timelines and quality standards.

CRCC utilizes dedicated international client management teams to navigate global complexities, ensuring effective communication and smooth execution. These teams were instrumental in 2024 for securing contracts in Southeast Asia and Africa by addressing local nuances and regulatory challenges.

Beyond project completion, CRCC offers after-sales support and maintenance, fostering client satisfaction and recurring revenue. For example, extended maintenance contracts for high-speed rail projects, like the Jakarta-Bandung High-Speed Railway, ensure long-term operational efficiency.

Channels

China Railway Construction Corporation (CRCC) heavily relies on direct bidding and government procurement for its project pipeline, particularly within China's extensive public infrastructure development. This channel is fundamental, given CRCC's status as a state-owned enterprise deeply integrated with national development plans.

In 2024, CRCC continued to secure significant contracts through these government-led processes. For instance, the company was awarded numerous high-speed rail and urban transit projects, reflecting the ongoing government investment in transportation networks. These procurements often involve large-scale, multi-year commitments, providing a stable revenue base.

CRCC's success in these channels is bolstered by its established reputation and extensive experience in executing complex infrastructure projects. The company's ability to meet stringent government requirements and deliver on time and within budget makes it a preferred bidder in many public tenders.

China Railway Construction Corporation (CRCC) actively pursues international tenders to fuel its overseas expansion. In 2024, the company secured a significant contract worth approximately $2.4 billion for a high-speed rail project in Saudi Arabia, demonstrating its growing presence in key global markets.

Leveraging strategic global partnerships is crucial for CRCC's international strategy, particularly within the Belt and Road Initiative. These collaborations enable CRCC to access new markets and secure large-scale infrastructure projects, such as the ongoing railway expansion in Algeria, which is projected to involve billions in investment by 2025.

Strategic alliances and joint ventures are crucial channels for China Railway Construction Corporation (CRCC) to expand its reach and mitigate risks. By partnering with local and international firms, CRCC can effectively enter new markets and tackle complex projects, leveraging combined expertise and local insights. For example, in 2023, CRCC actively pursued joint ventures for major infrastructure projects, aiming to share the substantial capital requirements and operational complexities.

These collaborations allow CRCC to tap into specialized knowledge, such as understanding local regulations, labor markets, and supply chains, which is vital for successful project execution. In 2024, CRCC's strategy continues to emphasize these partnerships, particularly in Belt and Road Initiative countries, where local collaboration is often a prerequisite for securing large-scale contracts and ensuring smooth project development.

Industry Conferences and Trade Fairs

China Railway Construction Corporation (CRCC) actively participates in key industry gatherings to bolster its brand and foster new business relationships. These events are crucial for demonstrating its extensive engineering and construction expertise to a global audience.

In 2024, CRCC's presence at major international forums, such as the International Union of Railways (UIC) events and various infrastructure expos, highlighted its role in mega-projects. For instance, CRCC secured significant contracts following its showcase at the Belt and Road Forum, demonstrating the direct business development impact of such engagements.

- Showcasing Capabilities: CRCC uses these platforms to exhibit its advanced technologies and successful project completions, reinforcing its image as a leading global construction firm.

- Networking and Partnerships: Participation facilitates crucial connections with potential clients, suppliers, and strategic partners, vital for expanding its international footprint and securing future projects.

- Market Intelligence: These events provide invaluable insights into emerging industry trends, technological advancements, and competitive landscapes, enabling CRCC to adapt its strategies effectively.

- Brand Visibility: Consistent engagement in high-profile conferences and trade fairs significantly enhances CRCC's brand recognition and reputation within the global infrastructure and construction sectors.

Company Website and Investor Relations Platforms

China Railway Construction Corporation Limited (CRCC) leverages its official website and dedicated investor relations platforms as a crucial communication channel. These platforms serve as the primary conduit for disseminating vital company information, including detailed financial reports, annual statements, and updates on ongoing major projects.

This transparent approach ensures that a broad spectrum of stakeholders, encompassing investors, financial analysts, media outlets, and potential business partners, have access to accurate and timely data. For instance, CRCC's 2023 annual report, readily available online, provided comprehensive insights into its financial performance, with revenue reaching RMB 1,011.14 billion, a 3.04% increase year-on-year.

- Information Dissemination: CRCC's website and IR platforms are central to sharing financial results, project progress, and strategic announcements.

- Stakeholder Engagement: These channels facilitate direct communication with investors, media, and potential clients, fostering transparency.

- Building Trust: Consistent and open communication through these digital avenues helps cultivate investor confidence and attract capital.

- Accessibility: Providing easy access to reports and updates, such as their 2023 financial disclosures, supports informed decision-making by stakeholders.

China Railway Construction Corporation (CRCC) utilizes industry events and forums as key channels for business development and brand enhancement. These platforms are essential for showcasing expertise and forging new relationships within the global infrastructure sector.

In 2024, CRCC actively participated in significant international conferences, including those focused on Belt and Road Initiative projects, leading to the acquisition of new contracts. For example, the company secured several new infrastructure projects in Southeast Asia following its presence at a major regional infrastructure summit.

These engagements not only highlight CRCC's capabilities in complex engineering and construction but also serve as vital avenues for market intelligence and strategic partnership development, crucial for its continued international growth.

Customer Segments

National and local governments within China represent China Railway Construction Corporation's (CRCC) most significant customer base. These government entities commission and finance vast infrastructure undertakings, from high-speed rail networks to urban transit systems and major road construction. In 2023, CRCC secured a substantial number of new contracts from these governmental bodies, reflecting ongoing investment in national development strategies aimed at boosting connectivity and economic expansion across the country.

China Railway Construction Corporation (CRCC) actively partners with foreign governments and international organizations, primarily focusing on large-scale infrastructure development. These collaborations are a cornerstone of CRCC's global expansion, particularly within the framework of initiatives like the Belt and Road Initiative (BRI).

In 2024, CRCC's international revenue continued to be significantly driven by projects secured through these governmental and organizational partnerships. For instance, CRCC secured contracts for major railway and infrastructure projects in countries participating in the BRI, contributing substantially to its overseas order book.

State-owned enterprises (SOEs) represent a significant customer segment for China Railway Construction Corporation (CRCC). These entities, both within China and in countries partnering with China on infrastructure initiatives, rely on CRCC's expertise for major construction and engineering projects. For instance, CRCC's involvement in the Belt and Road Initiative (BRI) frequently sees it collaborating with the state-owned infrastructure companies of participating nations.

These collaborations are crucial for executing large-scale, strategic infrastructure development. In 2023, CRCC reported overseas revenue of approximately 248.4 billion yuan, with a substantial portion likely stemming from projects involving foreign SOEs. These partnerships are vital for advancing national development agendas and strengthening international economic ties.

Private Developers and Corporations

China Railway Construction Corporation (CRCC) also serves a vital segment of private developers and corporations, addressing their diverse construction and engineering requirements. This includes the development of commercial buildings, industrial facilities, and privately funded infrastructure projects. In 2024, CRCC's engagement with the private sector highlights its adaptability beyond public works.

- Diversified Project Portfolio: CRCC undertakes a range of private sector projects, from high-rise office towers and shopping complexes to manufacturing plants and logistics hubs.

- Private Infrastructure Development: The company is involved in building private roads, bridges, and utilities, often through public-private partnerships or direct contracts with corporations.

- Market Reach: CRCC's ability to secure contracts with private entities demonstrates its broad market appeal and capacity to meet varied client specifications.

This segment allows CRCC to tap into the growing demand for sophisticated construction solutions driven by private investment. For instance, in 2023, CRCC reported significant revenue from its infrastructure construction segment, which includes private sector projects, underscoring its importance to the company's overall financial performance.

Local Communities and Public Beneficiaries

Local communities and public beneficiaries are crucial stakeholders for China Railway Construction Corporation (CRCC). While not direct revenue generators, their well-being is intrinsically linked to the success and social license of CRCC's vast infrastructure projects. For instance, CRCC's involvement in urban rail transit development, such as the expansion of subway lines in major Chinese cities, directly enhances local mobility and reduces commute times for millions of residents. These projects often lead to significant job creation during construction phases, providing employment opportunities for local populations.

CRCC's commitment extends to improving the overall quality of life within these communities. By building essential public services like hospitals, schools, and public transportation networks, the company contributes to socio-economic development. In 2023, CRCC reported undertaking numerous projects that directly benefited local populations, including the construction of affordable housing and the revitalization of public spaces. These initiatives foster community engagement and support sustainable urban growth.

- Improved Quality of Life: CRCC's infrastructure projects, like new subway lines in cities such as Guangzhou, aim to reduce travel times and enhance daily commutes for residents.

- Job Creation: The company's extensive construction activities, including those in 2023, generated thousands of local employment opportunities across various skill levels.

- Economic Development: By investing in public transportation and urban development, CRCC stimulates local economies and creates new commercial opportunities.

China Railway Construction Corporation (CRCC) primarily serves national and local governments, both domestically and internationally, as its core customer base for infrastructure development. Foreign governments and international organizations also represent a significant segment, especially through initiatives like the Belt and Road Initiative (BRI). State-owned enterprises (SOEs) in partner countries further contribute to CRCC's project pipeline, particularly in large-scale international endeavors.

CRCC also engages with private developers and corporations for a diverse range of construction needs, including commercial and industrial facilities. While not direct revenue generators, local communities and public beneficiaries are crucial stakeholders whose well-being is tied to CRCC's project success and social impact. In 2023, CRCC's overseas revenue reached approximately 248.4 billion yuan, highlighting the global reach of its customer base.

| Customer Segment | Key Characteristics | 2023/2024 Relevance |

|---|---|---|

| National & Local Governments (China) | Commissioning major infrastructure projects (rail, roads, urban transit). | Core customer, driving domestic investment in connectivity and economic growth. |

| Foreign Governments & International Organizations | Partners in large-scale infrastructure, often linked to BRI. | Significant contributor to global expansion and overseas order book. |

| State-Owned Enterprises (SOEs) | Partners in infrastructure projects in various countries. | Integral to executing strategic international development initiatives. |

| Private Developers & Corporations | Require construction of commercial, industrial, and private infrastructure. | Demonstrates adaptability and broad market appeal beyond public works. |

Cost Structure

China Railway Construction Corporation (CRCC) incurs substantial costs related to raw materials and supplies. Key expenditures include steel, cement, and aggregates, essential for infrastructure projects. For instance, in 2023, global steel prices saw volatility, impacting the cost of structural components for CRCC's extensive projects.

Labor costs represent a significant portion of China Railway Construction Corporation's (CRCC) expenses due to the inherently labor-intensive nature of the construction industry. Wages, comprehensive benefits, and ongoing training for its substantial workforce are major operational outlays. As of recent reports, CRCC directly employs over 264,000 individuals, underscoring the scale of its human capital investment.

China Railway Construction's cost structure heavily relies on the acquisition, upkeep, and depreciation of its extensive fleet of heavy machinery, vehicles, and specialized construction equipment. These assets are critical for large-scale infrastructure projects, making their procurement a significant capital outlay. For instance, in 2023, the company invested heavily in new tunneling machines and high-speed rail components, reflecting the ongoing need for advanced equipment.

Maintenance costs are a continuous drain, ensuring these complex machines operate efficiently and safely. This includes regular servicing, repairs, and replacement of worn parts. Depreciation, the gradual reduction in an asset's value over time, is also a substantial non-cash expense that impacts profitability. The company's commitment to modernizing its equipment fleet, evident in its 2024 capital expenditure plans, underscores the significant and ongoing financial commitment to its physical assets.

Subcontracting and Partner Payments

China Railway Construction Corporation (CRCC) frequently utilizes subcontractors and partners, making payments for specialized services and collaborative ventures a significant cost component. This strategy is especially prevalent in overseas projects where tapping into local knowledge and resources is crucial for success.

For instance, in 2023, CRCC reported significant expenses related to subcontracting and partner payments, reflecting its extensive global operations. These payments are essential for managing project scope and accessing niche expertise.

- Subcontracting Costs: CRCC's reliance on subcontractors for specific construction phases, such as foundation work or specialized installations, contributes substantially to its overall project expenditure.

- Partner Payments for Joint Ventures: Payments to partners in joint ventures, often for shared risk and capital investment, form another key part of the cost structure.

- International Project Dependencies: In 2023, CRCC's international projects saw a notable increase in subcontracting fees, as it leveraged local firms for their on-ground expertise and regulatory navigation.

Research and Development (R&D) and Technology Investment

China Railway Construction Corporation (CRCC) significantly invests in Research and Development (R&D) and technology to drive innovation and efficiency. This commitment is crucial for developing new construction technologies, implementing sustainable practices, and optimizing operational processes, all vital for maintaining a competitive advantage.

In 2024, CRCC's expenditure on R&D reached an impressive 1.1 trillion yuan. This substantial investment underscores the company's focus on technological advancement and its dedication to staying at the forefront of the construction industry.

- Investment in R&D for new construction technologies

- Focus on sustainable practices and operational efficiencies

- CRCC's R&D spending reached 1.1 trillion yuan in 2024

- Essential for maintaining competitive edge and innovation

CRCC's cost structure is heavily influenced by project financing and administrative overheads. Interest expenses on loans for large-scale projects and the operational costs of managing its vast network of subsidiaries and international operations are significant. In 2023, the company's financial expenses, including interest, were a notable factor in its overall cost of doing business.

The company also incurs substantial costs related to marketing, sales, and business development, particularly for securing new domestic and international contracts. These expenditures are vital for maintaining its market position and expanding its global footprint. For instance, CRCC's efforts to win bids for major infrastructure projects in emerging markets in 2024 involved considerable investment in proposal development and client engagement.

Administrative and general expenses, covering management salaries, office operations, legal fees, and compliance, form another core component of CRCC's cost base. These are essential for the smooth functioning of the organization. The company's commitment to corporate governance and international standards also adds to these overheads.

CRCC's cost structure is also impacted by the significant investments in property, plant, and equipment, including land acquisition, construction of facilities, and depreciation of these assets. These capital expenditures are foundational to its operational capacity.

| Cost Category | Description | 2023 Impact/Focus |

|---|---|---|

| Raw Materials & Supplies | Steel, cement, aggregates | Volatility in steel prices affected component costs. |

| Labor Costs | Wages, benefits, training for 264,000+ employees | Significant outlay due to labor-intensive operations. |

| Equipment & Depreciation | Heavy machinery, vehicles, specialized equipment | Ongoing investment in new tunneling machines and rail components in 2023. |

| Subcontracting & Partnerships | Specialized services, joint ventures, overseas project support | Increased subcontracting fees in international projects in 2023. |

| R&D and Technology | New construction tech, sustainability, operational optimization | 1.1 trillion yuan invested in 2024 for technological advancement. |

| Financing & Administration | Project finance, interest expenses, overheads, legal, compliance | Interest expenses a notable factor in 2023. |

| Marketing & Sales | Securing domestic and international contracts | Investment in proposal development for emerging market projects in 2024. |

| Property, Plant & Equipment | Land acquisition, facilities, asset depreciation | Capital expenditures foundational to operational capacity. |

Revenue Streams

China Railway Construction Corporation (CRCC) primarily generates revenue through securing and executing massive infrastructure projects. These contracts span the development of critical transportation networks such as high-speed railways, national highways, expansive bridges, complex tunnel systems, and essential urban transit infrastructure.

The sheer scale of CRCC's operations is evident in its contract wins. For instance, in the second quarter of 2025, the company announced new contracts valued at an impressive 563.3 billion yuan, underscoring its dominant position in the infrastructure construction sector.

China Railway Construction Corporation (CRCC) generates revenue through fees for expert survey, design, and consulting services. These specialized offerings are crucial for the planning and execution of complex engineering and construction projects, both domestically and internationally.

These services can be contracted independently, providing a direct income stream, or bundled as part of larger construction projects. This dual approach allows CRCC to capture value at different stages of a project lifecycle. For instance, in 2023, CRCC reported significant growth in its engineering and consulting segment, contributing substantially to its overall revenue, reflecting the demand for its technical expertise.

China Railway Construction Corporation (CRCC) generates significant revenue by selling its manufactured construction equipment, machinery, and specialized components. This stream serves both CRCC's extensive internal projects, ensuring efficiency and cost control, and a broad base of external clients in the construction sector.

In 2024, CRCC's robust manufacturing capabilities contributed to this revenue stream, reflecting the company's integrated approach to infrastructure development. The sale of these high-quality, specialized products directly supports the global construction industry, underscoring CRCC's role as a key supplier.

Real Estate Sales and Development Profits

Profits generated from developing and selling various types of properties, including homes, offices, and factories, are a key part of China Railway Construction Corporation's (CRCC) overall revenue. This diversification helps spread their income sources.

While this segment is important, it experienced a downturn in 2024. For instance, CRCC's real estate segment saw a decrease in its contribution to the company's total revenue compared to previous years.

- Revenue Diversification: Real estate sales and development offer CRCC a way to earn money beyond its core construction activities.

- 2024 Performance: The real estate segment faced challenges in 2024, with reported declines in sales volume and profit margins for some projects.

- Market Impact: This decline is partly attributed to broader shifts in China's property market, impacting developers' profitability.

Logistics and Materials Trading Income

China Railway Construction Corporation (CRCC) diversifies its revenue through logistics services and the trading of construction materials. This dual approach not only supports CRCC's extensive internal project needs but also taps into broader market demands, generating significant income. In 2023, CRCC reported a substantial increase in its logistics and trading segments, reflecting robust demand for infrastructure development and material supply chains.

- Logistics Services: CRCC leverages its vast network and infrastructure to offer comprehensive logistics solutions, including transportation, warehousing, and supply chain management. This segment benefits from the efficient movement of goods for both internal construction projects and external clients, contributing to overall revenue stability.

- Materials Trading: The company actively engages in the trading of various construction materials, such as steel, cement, and equipment. This not only ensures a steady supply for CRCC's operations but also capitalizes on market price fluctuations and demand, creating an additional revenue stream.

- Market Reach: CRCC's logistics and trading operations extend beyond its own project sites, serving a wider range of industries and customers. This broad market engagement enhances revenue potential and solidifies CRCC's position as a key player in the materials and logistics sectors.

Beyond its core construction, CRCC also generates revenue from selling manufactured construction equipment and specialized components. This stream serves both CRCC's internal needs and external clients, with robust manufacturing capabilities contributing significantly in 2024.

CRCC's revenue is further diversified through property development and sales, though this segment experienced a downturn in 2024 due to broader market shifts impacting profitability.

Logistics services and the trading of construction materials also contribute to CRCC's income. In 2023, these segments saw substantial growth, highlighting strong demand for infrastructure development and supply chain solutions.

| Revenue Stream | Primary Activity | 2024/2023 Data Point | Significance |

|---|---|---|---|

| Infrastructure Projects | Building railways, highways, bridges | New contracts valued at 563.3 billion yuan (Q2 2025) | Core revenue driver |

| Engineering & Consulting | Survey, design, technical advice | Significant growth in 2023 segment | Leverages technical expertise |

| Equipment Manufacturing & Sales | Producing and selling construction machinery | Robust manufacturing contribution in 2024 | Supports internal and external markets |

| Property Development & Sales | Building and selling real estate | Downturn in 2024 segment performance | Diversification with market sensitivity |

| Logistics & Materials Trading | Transportation, warehousing, material sales | Substantial increase in 2023 segments | Supports operations and external demand |

Business Model Canvas Data Sources

The China Railway Construction Business Model Canvas is built upon a foundation of extensive market research, financial disclosures from industry leaders, and operational data from major infrastructure projects. These sources provide a comprehensive view of the competitive landscape, revenue streams, and cost structures inherent in the sector.