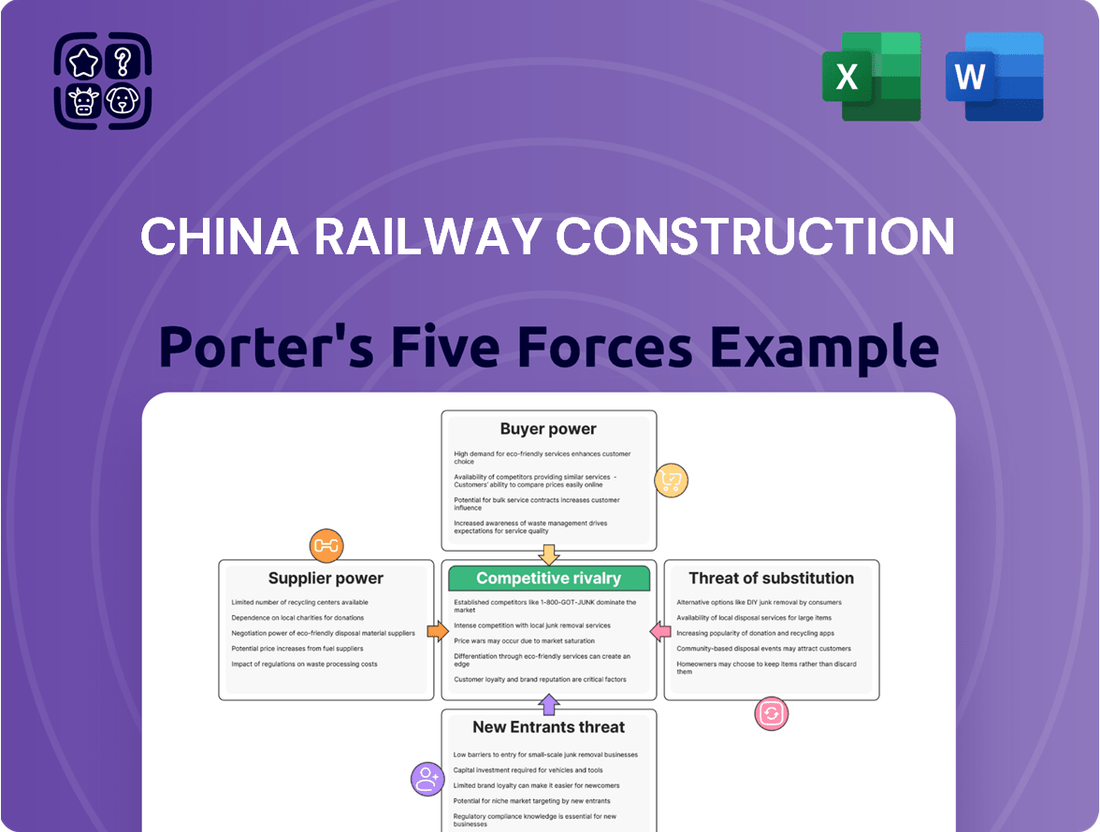

China Railway Construction Porter's Five Forces Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

China Railway Construction Bundle

China Railway Construction faces significant competitive pressures, particularly from the threat of new entrants and the bargaining power of buyers in the infrastructure sector. Understanding these dynamics is crucial for navigating its complex market landscape.

The complete report reveals the real forces shaping China Railway Construction’s industry—from supplier influence to threat of new entrants. Gain actionable insights to drive smarter decision-making.

Suppliers Bargaining Power

China Railway Construction Corporation (CRCC) undertakes vast and technically demanding infrastructure projects, including extensive high-speed rail networks and massive tunnel constructions. These projects inherently require highly specialized materials and sophisticated heavy machinery, leading to a significant demand for these specific inputs.

This elevated demand naturally empowers niche suppliers who possess the unique capabilities or proprietary technologies essential for CRCC's large-scale operations. For instance, suppliers of advanced tunneling boring machines (TBMs) or specialized high-strength concrete additives can command greater leverage.

The specialized nature of these inputs often results in higher switching costs for CRCC. If a particular supplier's material or equipment is deeply integrated into CRCC's construction processes, finding and qualifying an alternative can be time-consuming and expensive, thereby increasing the supplier's bargaining power.

China Railway Construction Corporation (CRCC) faces increasing supplier bargaining power due to its reliance on specialized construction technologies. The widespread adoption of Building Information Modeling (BIM) and the integration of IoT for real-time monitoring, for instance, tie CRCC to specific software and hardware providers. These digital tools are becoming essential for large-scale state projects, making it difficult and costly to switch platforms once implemented.

The learning curve and high integration costs associated with advanced construction software mean that suppliers of these critical digital solutions can wield significant influence. For example, as of 2024, the global construction technology market is projected to reach over $12 billion, highlighting the substantial investment in these specialized areas. This dependency allows technology providers to potentially dictate terms, impacting CRCC's operational flexibility and cost structures.

While China's construction sector benefits from a vast domestic market for basic materials like steel and cement, global supply chain volatility, particularly evident in 2024, can still influence their cost and availability. Fluctuations in international commodity prices and shipping logistics mean that even these fundamental inputs can present challenges, granting suppliers a degree of bargaining power, especially for specialized or imported components.

Skilled labor and specialized expertise

The construction of complex infrastructure projects, like those undertaken by China Railway Construction, heavily relies on a highly skilled workforce and specialized engineering expertise. This specialized human capital can be a constrained resource, giving suppliers of such talent significant bargaining power. For instance, in 2024, the global shortage of skilled construction labor continued to be a significant challenge, with some regions reporting deficits of over 30% for certain trades.

Consequently, suppliers of specialized consulting services or highly trained labor can command higher prices due to the scarcity of these critical inputs. This scarcity directly impacts project costs and timelines. Addressing labor shortages remains a crucial factor for sustained growth and profitability within the construction market.

- High Demand for Specialized Skills: Complex infrastructure projects necessitate engineers and technicians with niche proficiencies, creating a premium on their availability.

- Constrained Supply of Expertise: The limited pool of individuals possessing advanced construction and engineering knowledge empowers them as suppliers.

- Impact on Project Costs: The bargaining power of these skilled labor suppliers can lead to increased labor costs for construction firms.

- Labor Shortages as a Driver: Persistent labor shortages in the construction sector, a trend observed throughout 2024, amplify the bargaining power of available skilled workers.

Limited forward integration by suppliers

Most material and equipment suppliers for China Railway Construction generally avoid forward integration into large-scale infrastructure projects. This is largely due to the immense capital and sophisticated project management expertise required, which are typically beyond their core competencies. Consequently, they pose less of a direct threat by becoming competitors in the construction arena, though they can still influence terms through pricing and availability.

While direct competition from suppliers is limited, their bargaining power remains significant. For instance, in 2024, the global construction equipment market was valued at approximately $200 billion, with key players often having substantial market share in their specific product categories, allowing them to dictate terms. This means suppliers can still exert considerable influence over China Railway Construction through their control over essential resources and their pricing strategies.

However, the landscape is evolving. Some specialized technology providers are beginning to offer more integrated solutions, encompassing not just equipment but also advanced software and support services. This trend blurs the traditional boundaries between supplier and contractor, potentially increasing the bargaining power of these forward-thinking technology firms.

- Limited Forward Integration: Suppliers typically lack the capital and project management skills for large-scale construction, reducing direct competitive threats.

- Pricing and Supply Control: Despite limited integration, suppliers retain power through their ability to influence material costs and availability.

- Evolving Technology Providers: Some technology firms are offering integrated solutions, potentially increasing their influence and blurring industry lines.

Suppliers of specialized construction technologies and skilled labor wield significant bargaining power over China Railway Construction Corporation (CRCC). The increasing reliance on digital tools like BIM and the persistent shortage of skilled workers in 2024, with some regions facing over 30% deficits, allow these suppliers to command higher prices and dictate terms. While major material suppliers generally avoid forward integration, key players in the approximately $200 billion global construction equipment market in 2024 still exert influence through pricing and supply control.

| Factor | Impact on CRCC | Supporting Data (2024/Latest) |

| Specialized Technology Suppliers | High Bargaining Power | Global construction tech market projected over $12 billion; high integration costs for CRCC. |

| Skilled Labor Suppliers | High Bargaining Power | Global skilled construction labor shortage, with some trades facing over 30% deficits. |

| Material & Equipment Suppliers | Moderate Bargaining Power | Global construction equipment market valued at ~$200 billion; key players have market share control. |

What is included in the product

Tailored exclusively for China Railway Construction, analyzing its position within its competitive landscape by examining the intensity of rivalry, the bargaining power of buyers and suppliers, the threat of new entrants, and the threat of substitute products.

Instantly visualize the competitive landscape of China's railway construction market, revealing key pressures from rivals and new entrants.

Easily identify and address potential threats from substitute services and the bargaining power of suppliers and buyers, ensuring strategic advantage.

Customers Bargaining Power

China Railway Construction Corporation (CRCC) primarily serves Chinese government entities and state-owned enterprises, which are the main drivers of large-scale infrastructure projects. This concentrated customer base, often awarding single, massive contracts for initiatives such as high-speed rail and urban development, grants the government considerable leverage.

The government's ability to control project approvals and funding further amplifies its bargaining power over CRCC. For instance, in 2023, the Chinese government's infrastructure spending reached approximately 15 trillion yuan, underscoring its central role in awarding contracts.

Many of China Railway Construction Corporation's (CRCC) projects hold significant national importance, aligning with initiatives like China's 14th Five-Year Plan and the Belt and Road Initiative. This strategic positioning guarantees a steady stream of demand, but it also grants the government, a primary customer, considerable leverage over contract specifics, project schedules, and quality benchmarks. For instance, the government's commitment to achieving key infrastructure development goals by 2025 directly influences the bargaining power it wields in these large-scale endeavors.

Despite significant customer concentration, particularly with government entities, the long-term nature and sheer scale of infrastructure projects inherently create substantial switching costs. For instance, China Railway Construction Corporation (CRCC) often engages in multi-year, multi-billion dollar contracts, making a mid-project contractor change prohibitively disruptive and expensive for clients.

This high barrier to switching provides a degree of stability for CRCC, as clients are unlikely to seek alternatives once a project is underway. However, the initial procurement and bidding phases remain intensely competitive, as customers evaluate numerous proposals before committing to a contractor.

Budgetary constraints and policy adjustments

China Railway Construction Corporation (CRCC) faces customer bargaining power influenced by government budgetary constraints and policy shifts. Despite a strong commitment to infrastructure, the Chinese government must manage its finances, potentially leading to adjustments in spending priorities. This can translate into increased pressure on project costs and payment schedules for major contractors like CRCC.

The government's ongoing focus on fiscal policy and financial reforms directly impacts the availability and flow of funds for infrastructure development. For instance, in 2024, China's central government continued to emphasize fiscal discipline while also signaling support for strategic infrastructure projects, creating a dynamic environment for contractors.

- Government Budgetary Pressures: China's commitment to infrastructure investment, a key driver for CRCC, is balanced against national budgetary considerations.

- Policy Adjustments: Shifts in government spending priorities, influenced by economic conditions and policy reforms, can directly affect demand and payment terms for infrastructure projects.

- Fiscal Policy Impact: Government financial strategies and reforms can alter the liquidity available for large-scale construction, influencing CRCC's revenue and cash flow.

Public-private partnerships (PPPs) and international clients

China Railway Construction Corporation's (CRCC) engagement in public-private partnerships (PPPs) and its extensive work with international clients, especially through the Belt and Road Initiative (BRI), significantly shapes customer bargaining power. While these partnerships can diversify revenue, the strategic nature of BRI projects often means that government entities, acting as clients, retain considerable influence and oversight, which can temper outright price negotiation leverage.

CRCC's international footprint, with projects spanning numerous countries, means it deals with a varied client base. For instance, in 2023, CRCC reported significant international contract awards, contributing to its overall revenue diversification. However, the bargaining power of these international clients can vary greatly depending on the project's scale, the client's financial capacity, and the geopolitical importance of the undertaking.

- Diversified Client Base: CRCC's international operations expose it to a wide range of clients, from national governments to large infrastructure conglomerates.

- BRI Influence: Projects under the Belt and Road Initiative, while offering scale, often involve state-backed clients with strategic objectives, influencing negotiation dynamics.

- Project Significance: The bargaining power of international clients is often moderated by the strategic importance and scale of the infrastructure projects CRCC undertakes.

- 2023 International Performance: CRCC's international business segment saw continued growth in 2023, reflecting its global reach and the demand for its construction services.

China Railway Construction Corporation (CRCC) faces significant bargaining power from its primary customer, the Chinese government, due to its role in national infrastructure development and its control over funding. While the sheer scale of projects creates high switching costs once a contract is awarded, the government's budgetary considerations and policy shifts can exert pressure on CRCC regarding project costs and payment terms.

| Factor | Description | Impact on CRCC |

| Customer Concentration | CRCC's customer base is heavily dominated by government entities. | Grants government significant leverage in contract negotiations. |

| Government Spending | Infrastructure spending is a key driver, with China's total infrastructure investment around 15 trillion yuan in 2023. | Ensures demand but also amplifies government's ability to dictate terms. |

| Switching Costs | Large-scale, multi-year projects have high disruption costs for clients if a contractor is changed mid-project. | Provides some stability for CRCC post-contract award, but initial bidding remains competitive. |

| Fiscal Policy | Government budgetary constraints and policy reforms influence funding availability. | Can lead to increased pressure on CRCC for cost reductions and flexible payment schedules. |

Full Version Awaits

China Railway Construction Porter's Five Forces Analysis

This preview shows the exact document you'll receive immediately after purchase—no surprises, no placeholders. It details the competitive landscape of China Railway Construction, thoroughly examining the bargaining power of buyers and suppliers, the threat of new entrants and substitutes, and the intensity of rivalry within the industry.

Rivalry Among Competitors

The competitive landscape in China's construction sector is defined by the dominance of a few colossal state-owned enterprises (SOEs). Giants like China State Construction Engineering Corp. Ltd. (CSCEC), China Railway Group Ltd. (CREC), and China Communications Construction Co. Ltd. (CCCC) collectively hold significant market share.

China Railway Construction Corporation (CRCC) itself is one of these major players, contributing to fierce competition. These SOEs frequently vie for lucrative domestic infrastructure projects and increasingly for international contracts, driving intense rivalry.

China Railway Construction, like many large state-owned enterprises (SOEs) in the construction sector, faces intense rivalry. This is largely due to incredibly high exit barriers. Think about it: these companies possess massive asset bases, employ huge workforces, and are absolutely critical to China's national economic development. It’s not like they can just shut down shop easily.

These high barriers mean that even when economic conditions get tough, these competitors are pretty much stuck competing for the contracts that are available. This keeps the competitive pressure on, ensuring a crowded marketplace for projects. For instance, in 2023, the infrastructure investment in China reached approximately 15 trillion yuan, highlighting the scale of the market and the fierce competition for these significant projects.

Competition within China's infrastructure sector frequently escalates into fierce bidding wars for major projects. Price and a company's technical prowess are paramount in these contests. While China Railway Construction Corporation (CRCC) boasts significant expertise in railway and intricate engineering, the vast number of projects and numerous skilled competitors can put pressure on profitability.

CRCC's reported surge in contract wins during the second quarter of 2025 suggests robust engagement in these bidding processes. This activity, however, occurs against a backdrop of earlier profit margin declines, highlighting the challenging environment where winning bids often means accepting tighter margins.

Differentiation based on specialized expertise and technology

China Railway Construction Corporation (CRCC) distinguishes itself in a competitive landscape by leveraging specialized engineering expertise and cutting-edge technology. While many construction projects follow standard procedures, CRCC excels in complex undertakings such as constructing large-diameter tunnels and high-speed rail infrastructure. This specialization allows them to command premiums and avoid direct price wars with less specialized competitors.

The company's commitment to innovation is evident in its adoption of advanced technologies like Building Information Modeling (BIM) and digital twins. These technologies enhance project planning, execution, and maintenance, leading to greater efficiency and reduced costs. For instance, CRCC's investment in digital technologies supports its ability to deliver intricate projects, thereby lessening the impact of pure price competition.

- Specialized Expertise: CRCC's proficiency in large-diameter tunnels and high-speed rail construction sets it apart.

- Technological Adoption: The integration of BIM and digital twins improves project delivery and efficiency.

- Mitigating Price Competition: Focus on complex, technology-driven projects reduces reliance on price alone.

- Competitive Advantage: Innovation and specialization provide a distinct edge against generalist contractors.

International expansion and Belt and Road Initiative

China Railway Construction Corporation (CRCC) leverages the Belt and Road Initiative (BRI) for international expansion, a move that can alleviate pressure from intense domestic competition. This global push, however, simultaneously introduces new international rivals and complex geopolitical challenges in the markets where CRCC operates. The company’s strategic objective is ambitious: to generate 30% of its revenue from overseas projects by 2025, underscoring its commitment to global growth.

This international expansion strategy directly impacts competitive rivalry by:

- Opening new markets: The BRI facilitates CRCC's entry into diverse international markets, potentially diversifying its revenue streams and reducing reliance on the saturated Chinese construction sector.

- Introducing new competitors: As CRCC expands, it encounters established global construction firms and emerging players in host countries, intensifying overall competitive dynamics.

- Shifting competitive landscape: The success of BRI projects, where CRCC is a key player, can reshape regional infrastructure development, influencing the competitive positioning of all involved entities.

- Geopolitical influence on rivalry: Political relationships and trade policies between China and BRI participating nations can significantly alter the competitive environment for CRCC and its rivals.

The competitive rivalry within China's construction sector is characterized by the significant presence of large state-owned enterprises (SOEs) like CRCC, CSCEC, and CCCC, which dominate market share. These entities engage in intense competition for both domestic and international infrastructure projects, often leading to aggressive bidding wars where price and technical capability are key differentiators.

High exit barriers, stemming from massive asset bases and critical economic roles, keep these SOEs locked in competition, even during economic downturns. This dynamic means that even with CRCC's specialized expertise in areas like high-speed rail, the sheer volume of projects and the number of capable competitors can compress profit margins, as evidenced by earlier profit declines despite robust contract wins in Q2 2025.

| Company | 2023 Revenue (Approx. RMB Bn) | Key Specialization | 2024/2025 Outlook |

|---|---|---|---|

| CRCC | ~800 | Railways, Tunnels, Overseas Projects | Continued international expansion, focus on complex projects |

| CSCEC | ~1,200 | General Construction, Real Estate, International | Diversified portfolio, strong domestic presence |

| CCCC | ~700 | Infrastructure, Dredging, Ports | Focus on global infrastructure development |

SSubstitutes Threaten

For the core services China Railway Construction Corporation (CRCC) provides, such as building railways, highways, and major bridges, there are very few direct substitutes available. The fundamental need for robust physical infrastructure to support transportation and urban expansion is a constant, driving demand for these specialized construction services.

This scarcity of alternatives means that CRCC benefits from a relatively low threat of substitutes in its primary markets. For instance, in 2024, China continued its massive infrastructure investment, with the National Development and Reform Commission reporting significant progress on key railway and highway projects, underscoring the ongoing demand for CRCC's specialized capabilities.

The rise of modular and prefabricated construction presents a significant threat of substitution for traditional on-site building methods. These innovative approaches, gaining traction globally, promise quicker project timelines, lower on-site labor requirements, and enhanced quality assurance.

While not eliminating the fundamental need for construction services, these methods can directly replace conventional building processes. This shift could reduce demand for traditional construction techniques and associated labor, impacting companies like China Railway Construction that rely heavily on established methods.

In 2023, the global modular construction market was valued at over $160 billion and is projected to grow substantially, indicating a clear trend towards these alternative construction models.

The construction industry's embrace of digitalization and automation presents a significant threat of substitutes for traditional methods, impacting companies like China Railway Construction Corporation (CRCC). Technologies such as Building Information Modeling (BIM), artificial intelligence (AI), and robotics are increasingly replacing manual labor and conventional construction processes.

These advanced technologies boost efficiency, minimize errors, and enhance worker safety, thereby diminishing the competitiveness of older, less sophisticated construction techniques. For instance, the global construction automation market was projected to reach $2.4 billion in 2024, highlighting the rapid adoption of these substitutes.

CRCC is actively integrating these innovations into its operations, recognizing their potential to streamline project delivery and improve cost-effectiveness. This strategic adoption positions CRCC to leverage these substitutes, rather than being undermined by them, as the industry continues its technological evolution.

Renovation and maintenance over new construction

While renovation and maintenance of existing infrastructure can be a substitute for new construction in some areas, particularly in mature real estate markets, it generally presents a limited threat to China Railway Construction Corporation (CRCC). The company's core strength lies in large-scale, complex infrastructure projects essential for China's ongoing urbanization and modernization efforts.

The demand for new transportation networks, high-speed rail, and urban development projects remains robust. For instance, China's fixed-asset investment in infrastructure, a key indicator for companies like CRCC, saw continued growth through 2023, with a focus on strategic projects. This sustained investment underscores the ongoing need for new builds, rather than a wholesale shift to maintenance as a primary driver.

- Limited Impact of Renovation: Renovation and maintenance are more prevalent in sectors like residential real estate, not typically CRCC's primary focus.

- Sustained New Construction Demand: Urbanization and modernization in China continue to drive significant demand for new large-scale infrastructure.

- CRCC's Core Competency: CRCC specializes in the complex engineering and construction required for new transportation and urban development projects.

Alternative transportation or logistics solutions

While less direct, advancements in alternative transportation or logistics solutions could theoretically lessen the demand for new physical infrastructure over the very long term. For instance, the continued expansion of e-commerce, which relies heavily on efficient last-mile delivery, might shift focus towards optimizing existing networks rather than solely building new ones. However, the sheer volume of global trade and passenger movement continues to necessitate physical infrastructure development.

The growth in global freight volume, projected to increase by approximately 40% by 2050 according to some forecasts, underscores the ongoing need for robust transportation networks. China Railway Construction, as a major player in infrastructure, is well-positioned to benefit from this trend, even as innovations in logistics emerge. For example, advancements in autonomous trucking or drone delivery, while potentially altering the landscape, are unlikely to fully replace the need for large-scale rail and road infrastructure in the near to medium term.

- Growing Global Trade: The World Trade Organization anticipates continued growth in merchandise trade, requiring substantial physical logistics capacity.

- E-commerce Expansion: The surge in online retail necessitates efficient physical delivery networks, supporting rather than replacing traditional infrastructure.

- Technological Advancements: While innovations like autonomous vehicles and advanced logistics software are emerging, they are expected to complement, not entirely substitute, large-scale infrastructure projects in the foreseeable future.

The threat of substitutes for China Railway Construction Corporation (CRCC) is relatively low for its core services, as there are few direct alternatives to large-scale infrastructure projects like railways and highways. However, advancements in construction technology, such as modular building and automation, present a growing substitute threat by offering faster, more efficient, and potentially cheaper methods than traditional construction.

These technological substitutes are gaining significant traction. For instance, the global modular construction market was valued at over $160 billion in 2023 and continues to expand, while the construction automation market was projected to reach $2.4 billion in 2024. CRCC is actively adopting these innovations to mitigate this threat.

While renovation and maintenance of existing infrastructure can substitute for new construction in some contexts, it's not a primary threat to CRCC due to its focus on large-scale new development projects, which remain in high demand as China continues its urbanization and modernization. The company's expertise in complex new builds remains crucial.

Long-term, shifts in logistics, like increased e-commerce and autonomous delivery, could theoretically reduce the need for new physical infrastructure. However, global trade growth, projected to increase freight volume significantly by 2050, still necessitates substantial physical networks, positioning CRCC to benefit from ongoing infrastructure development.

| Substitute Type | Market Growth/Value (2023-2024) | Impact on CRCC | CRCC's Response |

|---|---|---|---|

| Modular Construction | >$160 billion (2023 market value) | Moderate to High | Adopting innovative construction methods |

| Construction Automation | $2.4 billion (2024 projected market value) | Moderate | Integrating AI, BIM, and robotics |

| Renovation/Maintenance | N/A (Sector-specific) | Low | Focus on core new infrastructure projects |

| Alternative Logistics | Ongoing growth | Low (Near-term) | Leveraging continued infrastructure demand |

Entrants Threaten

The threat of new entrants for China Railway Construction Corporation (CRCC) is significantly low due to the exceptionally high capital requirements. Undertaking massive infrastructure projects, such as the development of high-speed rail networks or the construction of large-scale bridges, demands substantial upfront investment in specialized machinery, advanced engineering technology, and a highly skilled workforce. For instance, the average cost of building a kilometer of high-speed rail in China has been reported to be in the tens of millions of US dollars, illustrating the sheer financial commitment needed.

Furthermore, established players like CRCC already benefit from considerable economies of scale. This means they can spread their fixed costs over a larger volume of output, leading to lower per-unit costs. New companies entering the market would struggle to match these cost efficiencies and the sheer project capacity that CRCC and similar incumbents possess, making it exceedingly difficult to compete effectively on price or delivery timelines.

Stringent government regulations and licensing in China's construction sector significantly deter new entrants. For instance, obtaining the necessary permits and licenses for large-scale infrastructure projects involves complex, multi-stage processes that can take considerable time and resources. This regulatory environment favors established companies like China Railway Construction, which possess the experience and connections to navigate these requirements efficiently. In 2023, the Chinese government continued to emphasize quality and safety standards, further raising the bar for market entry.

Established relationships and a proven track record with government clients present a significant barrier for new entrants into China Railway Construction Corporation's (CRCC) market. CRCC, along with other major state-owned enterprises, has cultivated deep, long-standing ties with government bodies. This includes a comprehensive understanding of complex procurement processes and the strategic objectives driving national infrastructure projects. For instance, CRCC's involvement in major initiatives like the Belt and Road Initiative, which often involves government-to-government agreements, solidifies these relationships. Newcomers would find it incredibly challenging to replicate this level of trust and demonstrate the capability to manage projects of national importance, which inherently demand a history of successful, large-scale delivery.

Proprietary technology and specialized expertise

China Railway Construction Corporation (CRCC) benefits from significant barriers to entry due to its proprietary technology and specialized expertise. The company has made substantial investments in research and development, particularly in advanced engineering and construction methods for complex projects like tunnel boring and high-speed rail systems. This deep reservoir of knowledge and technical skill is not easily replicated by potential new entrants, creating a substantial competitive moat.

For instance, CRCC’s involvement in the development of China's extensive high-speed rail network, which by the end of 2023 had surpassed 45,000 kilometers, showcases its mastery of specialized engineering. This technological lead, coupled with decades of practical experience, makes it exceedingly difficult for new companies to compete effectively without comparable R&D investment and operational history.

- Proprietary Technology: CRCC's advanced engineering capabilities in areas like tunnel boring and high-speed rail construction are protected by significant R&D investment and practical application.

- Specialized Expertise: The company's deep knowledge base in executing large-scale, complex infrastructure projects provides a distinct advantage that new entrants struggle to match.

- High R&D Investment: CRCC's commitment to innovation in construction techniques creates a technological barrier, making it costly and time-consuming for new firms to achieve parity.

- Operational Experience: Decades of successful project execution, especially in challenging environments and with cutting-edge technology, solidify CRCC's position and deter new competition.

Competition from existing large players

Even if a new entrant manages to overcome the initial hurdles to enter the infrastructure and construction sector, they will immediately confront formidable competition from established behemoths like China Railway Construction Corporation (CRCC). CRCC boasts vast financial resources, a broad spectrum of diversified operations, and a proven track record of employing aggressive bidding tactics to secure projects.

The market for railway construction and related infrastructure in China is already highly concentrated. Existing players, including CRCC, are deeply entrenched and possess significant advantages in terms of operational scale, technological expertise, and established supply chains. This positioning allows them to react swiftly and effectively to defend their existing market share against any potential new entrants.

- CRCC's Market Dominance: CRCC, as one of the largest construction and engineering firms globally, holds a commanding presence in China's infrastructure development. In 2023, the company reported total revenues of approximately RMB 1.16 trillion (roughly USD 160 billion), underscoring its immense scale and capacity.

- Barriers to Entry: New entrants face substantial capital requirements, complex regulatory landscapes, and the need to build extensive networks and expertise, all of which CRCC already possesses.

- Aggressive Competitive Strategies: CRCC's ability to leverage economies of scale and its integrated business model allows for competitive pricing and efficient project execution, making it difficult for smaller or newer firms to compete on price or delivery timelines.

The threat of new entrants for China Railway Construction Corporation (CRCC) is very low. This is primarily due to the immense capital requirements to enter the sector, with high-speed rail construction alone costing tens of millions of US dollars per kilometer. Furthermore, CRCC benefits from significant economies of scale, established government relationships, and proprietary technology, all of which create substantial barriers for newcomers. The highly concentrated nature of the Chinese railway construction market, coupled with CRCC's aggressive competitive strategies, further solidifies its dominant position.

| Barrier Type | Description | Example for CRCC |

|---|---|---|

| Capital Requirements | Massive upfront investment in machinery, technology, and skilled labor. | Cost of building a kilometer of high-speed rail can exceed tens of millions of USD. |

| Economies of Scale | Lower per-unit costs due to spreading fixed costs over high output. | CRCC's vast operational capacity allows for more competitive pricing. |

| Government Regulations & Licensing | Complex and time-consuming processes for project permits. | Stringent quality and safety standards emphasized by the Chinese government in 2023. |

| Established Relationships | Deep ties with government clients and understanding of procurement. | CRCC's involvement in national initiatives like the Belt and Road Initiative. |

| Proprietary Technology & Expertise | Investments in R&D for advanced engineering and construction methods. | Mastery of high-speed rail systems, with China's network exceeding 45,000 km by end of 2023. |

| Incumbent Competition | Existing players' scale, resources, and market entrenchment. | CRCC's 2023 revenue of approximately RMB 1.16 trillion (USD 160 billion). |

Porter's Five Forces Analysis Data Sources

Our Porter's Five Forces analysis for China Railway Construction is built upon a foundation of official company disclosures, including annual reports and investor presentations, supplemented by industry-specific market research and government statistics.

We leverage data from reputable financial databases, industry expert interviews, and public filings to comprehensively assess the competitive landscape, including the bargaining power of suppliers and buyers, and the threat of new entrants.