China Railway Construction Boston Consulting Group Matrix

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

China Railway Construction Bundle

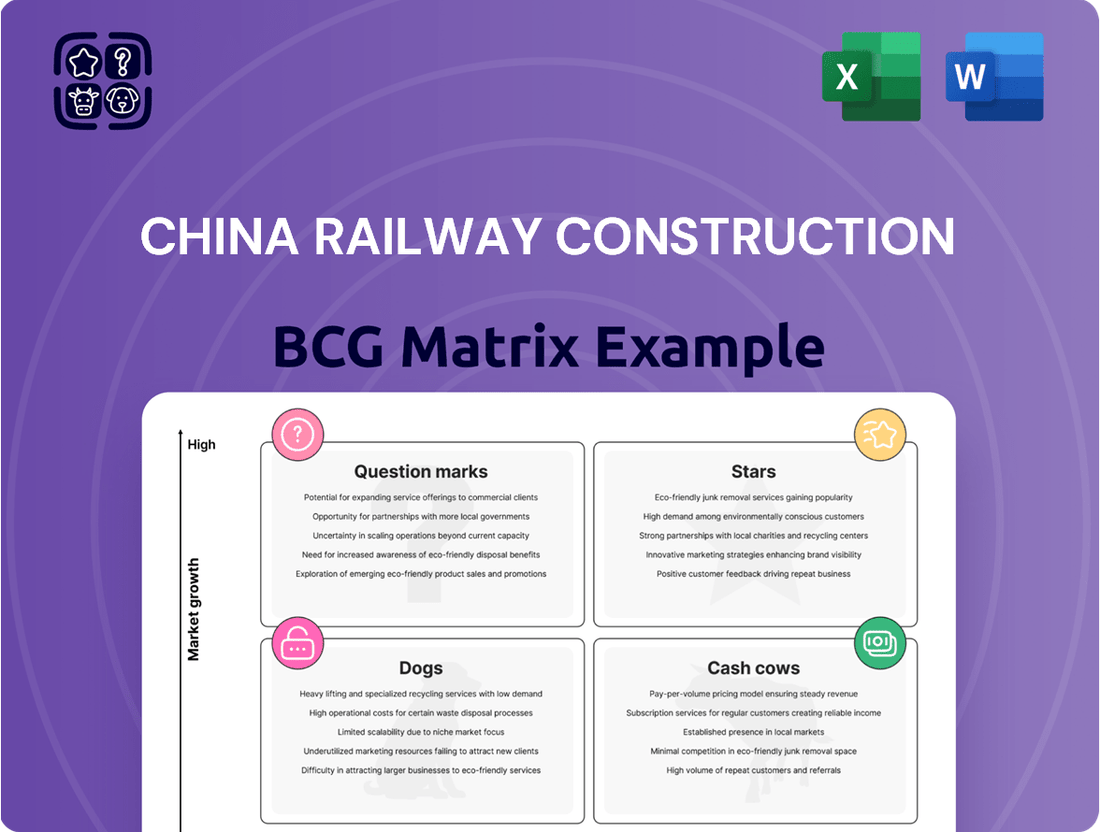

China Railway Construction's BCG Matrix provides a crucial snapshot of its diverse business units, highlighting potential growth areas and areas needing strategic attention. Understanding which segments are Stars, Cash Cows, Dogs, or Question Marks is vital for informed decision-making.

This preview offers a glimpse into the strategic positioning of China Railway Construction's operations. Purchase the full BCG Matrix for a comprehensive analysis, including detailed quadrant placements and actionable recommendations to optimize your investment and resource allocation.

Stars

China Railway Construction Corporation's (CRCC) involvement in the Belt and Road Initiative (BRI) is a cornerstone of its international strategy, positioning these projects as significant growth drivers. The company aims for overseas operations to contribute 30% of its total revenue by 2025, showcasing a strong commitment to global expansion.

CRCC has been instrumental in developing major infrastructure projects, including railways, roads, and urban transit, across diverse regions like Asia, Africa, and Europe. These undertakings are often characterized by substantial investment and long-term development potential, aligning with the strategic objectives of the BRI.

For instance, in 2023, CRCC secured several key BRI contracts, contributing to a notable increase in its international order book. The company's focus on high-impact infrastructure in emerging markets is a deliberate strategy to leverage the BRI's framework for sustained revenue growth and market penetration.

China Railway Construction Corporation (CRCC) is a dominant player in the burgeoning global high-speed rail construction sector. The company’s recent success in securing a substantial contract to provide steel rails for Morocco's Kenitra-Marrakech high-speed railway highlights its growing international reach and technological prowess. This deal represents a key export achievement for Chinese high-speed rail technology into the African continent.

Urban rail transit development is a significant growth area for China Railway Construction (CRCC). The company is actively involved in the rapid expansion of metro systems within China and is increasingly securing projects internationally. This sector benefits from ongoing urbanization and government investment in public transportation infrastructure.

CRCC is poised to benefit from planned metro expansions in major Chinese cities. For instance, Chengdu, Nanjing, and Tianjin have substantial urban rail transit projects slated for development, with significant investment expected in 2025. These expansions represent a strong demand for CRCC's expertise in constructing complex urban transit networks.

Advanced Tunneling and Bridge Engineering

China Railway Construction Corporation (CRCC) demonstrates a significant technological advantage in advanced tunneling and bridge engineering. This capability is crucial for the development of modern infrastructure worldwide, positioning CRCC to tackle highly demanding projects and secure a competitive edge in an expanding market for specialized construction services.

CRCC's expertise in these areas translates into a strong market position. For instance, in 2023, CRCC secured contracts for numerous high-speed rail projects, many of which involved extensive tunneling and complex bridge structures. The company's commitment to innovation in construction techniques, including the use of advanced tunnel boring machines and pre-fabricated bridge components, allows for greater efficiency and safety.

- Technological Prowess: CRCC leads in developing and implementing cutting-edge tunneling and bridge construction technologies.

- Market Dominance: The company's specialized skills enable it to win bids for complex, high-value infrastructure projects globally.

- Project Portfolio: CRCC consistently undertakes landmark projects, showcasing its capacity in challenging geological and geographical conditions.

Diversification into Renewable Energy Infrastructure

China Railway Construction Corporation (CRCC) is strategically diversifying into renewable energy infrastructure, a move with significant growth potential. A prime example is its procurement of 3 GW of TOPCon solar modules, indicating a substantial commitment to this burgeoning sector.

This diversification allows CRCC to tap into the rapidly expanding clean energy market. By leveraging its established expertise in large-scale construction projects, the company is well-positioned to undertake significant renewable energy developments.

- Strategic Entry: CRCC's 3 GW TOPCon solar module procurement marks a significant entry into the renewable energy sector.

- Growth Potential: The clean energy transition offers exponential growth opportunities for infrastructure providers.

- Leveraging Expertise: CRCC's construction prowess is a key asset for developing large-scale energy projects.

- Market Capture: This diversification aims to capture new market share within the booming renewable energy landscape.

CRCC's extensive involvement in the Belt and Road Initiative (BRI) projects, particularly in high-speed rail and urban transit development, positions these ventures as Stars in its BCG Matrix. The company's demonstrated technological prowess in tunneling and bridge engineering, evidenced by securing numerous complex infrastructure contracts globally, further solidifies this classification. For instance, CRCC's strategic diversification into renewable energy, exemplified by its 3 GW TOPCon solar module procurement, also signals strong growth potential and market leadership in emerging sectors.

| Business Segment | Market Growth | Relative Market Share | BCG Classification |

|---|---|---|---|

| Belt and Road Initiative (BRI) Infrastructure | High | High | Star |

| High-Speed Rail Construction | High | High | Star |

| Urban Rail Transit Development | High | High | Star |

| Advanced Tunneling & Bridge Engineering | High | High | Star |

| Renewable Energy Infrastructure | High | Growing | Star |

What is included in the product

This BCG Matrix analysis offers clear descriptions and strategic insights for China Railway Construction's Stars, Cash Cows, Question Marks, and Dogs.

The China Railway Construction BCG Matrix provides a clear, one-page overview of business unit performance, relieving the pain of strategic uncertainty.

Cash Cows

China Railway Construction Corporation's (CRCC) domestic railway infrastructure construction, especially its high-speed rail segment, functions as a classic Cash Cow. This is a mature market where CRCC commands a leading position, contributing significantly to its revenue streams.

With China boasting the world's most extensive high-speed rail network, projected to expand to 50,000 kilometers by 2025, CRCC is a principal player in its development and ongoing operations. This established dominance ensures consistent demand for its services.

This segment reliably generates substantial cash flow. Demand remains stable, and the need for aggressive promotional investments is minimal, allowing CRCC to leverage its strong market share for consistent profitability.

Established highway and bridge construction represents a significant Cash Cow for China Railway Construction Corporation (CRCC). This segment benefits from CRCC's dominant market share in China's mature infrastructure development, ensuring a steady and predictable revenue flow.

The consistent demand for highway and bridge upkeep, coupled with substantial government backing for national transportation upgrades, solidifies this business area as a reliable profit generator. In 2023, CRCC's infrastructure construction segment, which heavily features these activities, reported revenue of approximately 750 billion yuan, underscoring its mature yet robust performance.

China Railway Construction Corporation (CRCC) leverages its survey, design, and consulting services as a significant cash cow within its broader portfolio. These integrated offerings are crucial for the planning and execution of CRCC's massive infrastructure projects, generating high-margin revenue with relatively low overhead costs.

These specialized services capitalize on CRCC's deep industry expertise and accumulated intellectual capital, providing a stable and profitable income stream. Crucially, they require minimal new capital investment, allowing CRCC to generate consistent returns without the need for substantial ongoing expenditure.

Large-Scale Urban Infrastructure Projects

China Railway Construction Corporation (CRCC) leverages its expertise in large-scale urban infrastructure beyond just rail transit. Their extensive work on municipal public works, including roads, bridges, and utilities, taps into China's ongoing urbanization trend. This segment represents a significant portion of CRCC's business, characterized by a high market share within the domestic sector.

These urban infrastructure projects, while perhaps not experiencing explosive growth, offer a stable and predictable revenue stream. The consistent demand driven by China's development needs ensures a reliable source of cash generation for CRCC, fitting the profile of a cash cow in the BCG matrix.

- Market Share: CRCC holds a dominant position in China's domestic urban infrastructure development market.

- Revenue Stability: Projects like municipal public works provide consistent demand and predictable cash flows.

- Growth Rate: While not a high-growth sector, the steady pace of urbanization ensures sustained business.

- Contribution to CRCC: This segment acts as a reliable cash generator, supporting other business units.

Maintenance and Operation of Existing Infrastructure

The maintenance and operation of China's extensive existing railway and highway infrastructure form a robust cash cow for China Railway Construction Corporation (CRCC). This segment generates a stable, recurring revenue stream as the demand for upkeep and operational management of these mature assets consistently grows.

As of the first half of 2024, CRCC reported significant contributions from its infrastructure construction and related services, which include ongoing maintenance. The company's total operating revenue reached approximately RMB 350 billion in the first half of 2024, with infrastructure operations being a foundational element of this figure, demonstrating its consistent performance.

- Stable Revenue: The ongoing need for maintenance and operational services provides a predictable and reliable income source for CRCC.

- Growing Demand: As China's infrastructure network ages and expands, the demand for these essential services naturally increases.

- Operational Efficiency: CRCC's established expertise in managing large-scale infrastructure contributes to efficient operations and profitability in this segment.

- Contribution to Profitability: This segment plays a crucial role in supporting the company's overall financial health and funding other strategic initiatives.

China Railway Construction Corporation's (CRCC) established highway and bridge construction segment, alongside its survey, design, and consulting services, are prime examples of cash cows. These areas benefit from CRCC's dominant market share in China's mature infrastructure development, ensuring steady and predictable revenue flows with minimal need for aggressive reinvestment.

The maintenance and operation of China's vast existing railway and highway networks also represent a significant cash cow. This segment generates a stable, recurring revenue stream as the demand for upkeep and operational management of these mature assets consistently grows, contributing to CRCC's overall profitability.

| CRCC Cash Cow Segments | Market Share | Revenue Stability | Growth Rate | Contribution to CRCC |

|---|---|---|---|---|

| High-Speed Rail Construction | Leading domestic position | High, consistent demand | Mature, steady | Significant revenue generator |

| Highway and Bridge Construction | Dominant domestic share | High, predictable cash flow | Mature, stable | Reliable profit generator |

| Survey, Design, and Consulting | High industry expertise | Stable, high-margin revenue | Low capital investment | Consistent returns |

| Infrastructure Maintenance & Operation | Established expertise | Stable, recurring revenue | Growing demand | Foundational to profitability |

Full Transparency, Always

China Railway Construction BCG Matrix

The China Railway Construction BCG Matrix preview you are viewing is the complete, unwatermarked document you will receive immediately after purchase. This comprehensive analysis, meticulously crafted for strategic insight, is ready for immediate download and integration into your business planning. You can confidently expect the same level of detail and professional formatting in the final file, enabling you to leverage its findings for informed decision-making without any alterations or additional content.

Dogs

Within China Railway Construction Corporation's (CRCC) diverse operations, certain older or less technologically advanced manufacturing lines, especially those not directly supporting its core high-tech construction projects, might be classified as Dogs. These segments could face a low-growth environment and a limited market share.

The broader manufacturing sector in China, as of recent reports, has been grappling with increasing operational costs, persistent supply chain disruptions, and a noticeable shortage of skilled labor. These macroeconomic headwinds can particularly impact CRCC's non-core manufacturing areas, potentially diminishing their profitability and competitive edge.

Traditional, low-tech construction methods, while familiar, face significant challenges in today's rapidly evolving global construction landscape. As smart construction and digital design gain traction, these older techniques risk becoming obsolete, potentially leading to a shrinking market share for companies heavily reliant on them. For instance, in 2024, the global construction market saw a significant investment in Building Information Modeling (BIM), with its adoption projected to reach 70% in major projects by 2025, highlighting the growing demand for digital integration.

Within China Railway Construction Corporation's (CRCC) real estate portfolio, certain domestic ventures may fall into the Non-Strategic, Low-Return category. These are projects that, while in real estate, do not directly support CRCC's core infrastructure business or are situated in less dynamic property markets.

For instance, a standalone residential development in a mature, low-demand city might require substantial upfront investment for construction and marketing but struggle to achieve significant price appreciation or rental yields. Such ventures can become cash traps, tying up capital with minimal profitability, especially if market conditions stagnate or worsen.

In 2024, while CRCC's overall real estate segment contributed to revenue, specific projects with limited strategic synergy and in oversupplied domestic markets exemplify this BCG classification. These ventures may see slower sales cycles and reduced profit margins compared to strategically aligned or high-growth area developments.

Small-Scale, Highly Competitive Local Projects

China Railway Construction Corporation (CRCC) often engages in numerous small-scale, highly competitive local infrastructure projects. These tend to have limited technological differentiation and may not be strategically critical to CRCC's long-term growth. Participating in these can spread resources thin, leading to lower profit margins.

For instance, in 2024, CRCC reported a significant portion of its revenue derived from a broad base of domestic projects, many of which fall into this category. While contributing to overall sales volume, the profitability on individual contracts within this segment can be modest, impacting the overall efficiency of capital deployment.

- Low Profitability: These projects typically operate on thin margins due to intense competition, often involving local construction firms.

- Resource Dilution: A large number of small projects can divert management attention and operational resources away from more strategic, high-growth opportunities.

- Limited Market Share Impact: Individually, these projects contribute little to CRCC's overall market share in key infrastructure sectors, though collectively they form a substantial part of the business.

- 2024 Data Point: Reports from early 2024 indicated that while CRCC's domestic order book remained robust, a significant percentage of new contracts were for smaller, localized projects with an average contract value lower than previous years.

Outdated Logistics and Support Services

If China Railway Construction Corporation's (CRCC) logistics and other support services haven't modernized effectively, they could be classified as dogs in the BCG matrix. These segments might exhibit low growth and a small market share, especially when compared to more efficient, specialized third-party logistics providers.

These underperforming areas could become a financial burden, consuming resources without generating significant returns. For instance, CRCC's logistics segment, while supporting core construction projects, might lag behind industry advancements in areas like digital tracking or optimized warehousing, impacting overall efficiency.

- Low Growth Potential: CRCC's logistics segment may face limited expansion opportunities if it fails to adopt new technologies and operational models.

- Weak Market Position: Competition from agile, specialized logistics firms could further erode CRCC's market share in these support services.

- Resource Drain: Outdated infrastructure and processes in logistics could lead to higher operating costs and reduced profitability for CRCC.

Segments of CRCC's operations that are characterized by low market share and low growth potential are considered Dogs. These might include older manufacturing lines or less technologically advanced construction methods that struggle to compete in the modern market. For example, traditional construction techniques face increasing obsolescence as digital integration, like BIM, becomes standard, with BIM adoption projected to reach 70% in major projects by 2025.

These Dog segments can become a drain on resources, diverting capital and attention from more promising ventures. In 2024, CRCC's domestic order book showed a trend towards smaller, localized projects with lower average contract values, potentially indicating a larger proportion of such low-margin activities.

The company's logistics and support services, if not modernized, could also fall into this category, facing limited expansion and competition from specialized firms, leading to higher operating costs.

CRCC's real estate portfolio might contain specific domestic ventures, such as standalone residential developments in mature markets, that require significant investment but offer minimal returns due to stagnant market conditions or oversupply.

| CRCC Business Segment | BCG Classification | Rationale | 2024 Data/Trend |

|---|---|---|---|

| Older Manufacturing Lines | Dog | Low market share, low growth, potentially outdated technology. | Facing increased operational costs and skilled labor shortages impacting profitability. |

| Traditional Construction Methods | Dog | Low market share, low growth, risk of obsolescence. | BIM adoption projected at 70% by 2025, highlighting the shift away from traditional methods. |

| Small-Scale Local Projects | Dog | Low profitability, resource dilution, limited market share impact. | Trend in 2024 towards smaller projects with lower average contract values. |

| Underperforming Logistics | Dog | Low growth potential, weak market position, resource drain. | May lag behind industry advancements in digital tracking and optimized warehousing. |

| Non-Strategic Real Estate Ventures | Dog | Low market share, low growth, limited strategic synergy. | Standalone residential projects in mature, low-demand cities may see slower sales and reduced margins. |

Question Marks

China Railway Construction Corporation (CRCC) is actively investing in smart construction technologies, such as digital design and Building Information Modeling (BIM). These are considered high-growth sectors globally. For instance, the global construction technology market was valued at approximately $12.2 billion in 2023 and is projected to reach $35.7 billion by 2028, growing at a CAGR of 23.9%.

While CRCC is positioning itself in these advanced areas, its current market share in these emerging digital solutions is likely still establishing itself. Significant capital expenditure is necessary to foster innovation and secure a leading position in this competitive and rapidly evolving technological landscape.

New Frontier International Markets represent China Railway Construction Corporation's (CRCC) strategic push into regions where its footprint is currently small but the growth prospects are significant. These markets are characterized by high potential but also demand considerable upfront investment in establishing local presence and trust, often with delayed profitability.

For CRCC, these ventures are akin to question marks in the BCG matrix. While the potential upside is substantial, the significant upfront costs and the uncertainty of market acceptance mean these projects carry a higher risk profile. For instance, CRCC's reported international contract value in 2023 reached approximately $32.5 billion, with a portion of this likely allocated to exploring these nascent markets.

China Railway Construction Corporation (CRCC) is actively pursuing opportunities in specialized green and sustainable infrastructure. While the company has a strong foundation in traditional infrastructure, its market share in niche areas like advanced carbon capture or sophisticated renewable energy grid integration may still be developing. These sectors are experiencing significant growth, fueled by global decarbonization targets and government incentives.

The potential for CRCC in these specialized green segments is substantial, given the projected expansion of the global green infrastructure market, which was valued at over $10 trillion in 2023 and is expected to grow significantly by 2030. However, to capture a larger portion of this market, CRCC will need to make substantial investments in research and development, new technologies, and specialized expertise. This strategic focus is crucial for CRCC to transition from a general infrastructure provider to a leader in high-value, sustainable solutions.

Intelligent Manufacturing and Shipbuilding Ventures

China Railway Construction Corporation (CRCC) is making strategic moves into intelligent manufacturing and shipbuilding, a sector exhibiting robust growth potential. Their recent involvement in constructing 7,000-TEU container ships signifies a bold diversification into a high-tech, high-growth industry. This venture positions CRCC's shipbuilding efforts as a potential 'Question Mark' within the BCG matrix.

As a relatively new player in this specialized field, CRCC's current market share in smart shipbuilding is likely to be modest. Significant capital investment and successful execution of complex projects are crucial for CRCC to gain traction, increase its market share, and eventually transition these ventures into 'Stars'.

- High Growth Potential: The global smart shipbuilding market is projected to grow significantly, driven by demand for automation, efficiency, and sustainability.

- Low Market Share: CRCC's recent entry means it holds a small percentage of the current smart shipbuilding market.

- Investment Needs: To compete effectively, CRCC will need substantial investment in research and development, advanced manufacturing technologies, and skilled labor.

- Strategic Importance: Success in this sector could unlock new revenue streams and enhance CRCC's overall technological capabilities.

Integrated Smart City Solutions

Integrated Smart City Solutions represent a significant opportunity for China Railway Construction (CRCC) within a BCG Matrix framework. This sector is characterized by high growth potential due to increasing urbanization and the demand for efficient, data-driven urban management. CRCC's existing strengths in physical infrastructure development provide a solid foundation for expanding into these more complex, digitally integrated offerings.

While CRCC has a strong presence in building the physical components of cities, its market share in providing comprehensive, end-to-end smart city platforms might still be developing. This means it could be considered a question mark or a nascent star, requiring strategic investment to capture a larger share of this burgeoning market. For example, by 2024, global smart city investments were projected to reach hundreds of billions of dollars, with a significant portion allocated to digital infrastructure and data analytics.

- High Growth Potential: The global smart city market is expanding rapidly, driven by technological advancements and government initiatives.

- CRCC's Existing Capabilities: CRCC's experience in large-scale infrastructure projects provides a competitive edge in building the physical backbone for smart cities.

- Digital Integration Challenge: Success hinges on CRCC's ability to integrate digital technologies, data management, and urban planning into cohesive solutions.

- Market Share Development: CRCC's current market share in fully integrated smart city platforms is likely still in its early stages, necessitating focused investment and strategy.

CRCC's ventures into new international markets and specialized green infrastructure represent classic "Question Marks" in the BCG matrix. These areas offer substantial growth potential, but CRCC's market share is still developing, requiring significant upfront investment and strategic focus to mature. For instance, CRCC's international contract value in 2023 was approximately $32.5 billion, with a portion dedicated to these high-potential, nascent markets.

Similarly, CRCC's expansion into intelligent manufacturing and shipbuilding, as evidenced by their construction of 7,000-TEU container ships, also falls into the Question Mark category. While the global smart shipbuilding market is poised for significant growth, CRCC's current market penetration is modest, necessitating substantial capital and technological advancement to compete effectively.

Integrated smart city solutions are another key area for CRCC that fits the Question Mark profile. The global smart city market is expanding rapidly, with projections indicating hundreds of billions of dollars in investment by 2024. CRCC's existing infrastructure expertise is a strong foundation, but its market share in providing comprehensive, digitally integrated smart city platforms is still in its formative stages, demanding strategic investment to capitalize on this high-growth sector.

BCG Matrix Data Sources

This BCG Matrix is informed by a blend of financial statements, industry growth rates, and project portfolio data from China Railway Construction. We also incorporate market analysis and expert opinions to ensure a comprehensive view.