Crane NXT SWOT Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Crane NXT Bundle

Crane NXT's strengths lie in its established brand and diverse product portfolio, but its reliance on specific markets presents a significant vulnerability. Understand the full scope of their opportunities and threats to make informed decisions.

Want the complete picture of Crane NXT's strategic landscape? Purchase the full SWOT analysis to uncover actionable insights, detailed market analysis, and expert commentary designed to empower your investment or business strategy.

Strengths

Crane NXT's specialized focus on secure, detect, and authenticate technologies is a significant strength. This concentration allows for the development of deep expertise and proprietary solutions, setting it apart from broader industrial conglomerates. The company's emphasis on trust and integrity aligns with growing global market demands.

Crane NXT boasts two robust core segments that solidify its market leadership. Crane Currency, a key player in government banknote production and security features, saw a record backlog in 2024, demonstrating sustained demand for its specialized offerings. This strong performance highlights the segment's critical role in global currency supply chains.

Complementing Crane Currency, Crane Payment Innovations (CPI) stands out as a leader in unattended payment solutions. CPI's expertise spans various industries, leveraging a rich technological foundation and extensive global market knowledge. This dual strength across currency production and payment technology positions Crane NXT advantageously in its operating markets.

Crane NXT's strategic acquisition spree, notably adding OpSec Security and TruTag Smart Packaging in 2024, and finalizing the De La Rue Authentication deal in Q2 2025, is a significant strength. These moves are instrumental in establishing a dominant market position for their new Crane Authentication division, boasting a truly global reach.

This aggressive inorganic growth strategy directly enhances Crane NXT's capabilities across the entire authentication value chain. By integrating these specialized businesses, the company solidifies its leadership in a critical and expanding market segment.

Solid Financial Performance and Shareholder Returns

Crane NXT showcased robust financial health in full-year 2024, achieving a sales increase of roughly 7% and reporting adjusted earnings per share of $4.26, which aligned with prior projections. This consistent performance underscores the company's operational efficiency and market positioning.

Further reinforcing its financial strength, Crane NXT actively returned value to its shareholders. The company enacted a 6% increase in its annual dividend, signaling confidence in its ongoing profitability and commitment to rewarding investors.

- Sales Growth: Approximately 7% in full-year 2024.

- Adjusted EPS: $4.26 for full-year 2024.

- Dividend Increase: 6% raise in the annual dividend.

Robust R&D and Innovation Capabilities

Crane NXT's robust Research and Development (R&D) and innovation capabilities are a significant strength. They leverage deep expertise in micro-optics and process flow technologies, which is crucial for developing advanced security features and serving highly demanding markets. This technical prowess allows them to stay ahead in a competitive landscape.

The company's dedication to investing in its businesses, driven by the Crane Business System, is a key factor in its sustained technological advancement and operational excellence. This systematic approach ensures that innovation is not just a concept but a consistently executed strategy, leading to profitable growth and enhanced product offerings.

- Leveraging micro-optics and process flow expertise to meet stringent security application demands.

- Commitment to R&D investment fuels continuous product enhancement and market leadership.

- Crane Business System drives operational excellence and profitable growth through innovation.

Crane NXT’s strategic acquisitions in 2024 and early 2025, including OpSec Security, TruTag Smart Packaging, and the De La Rue Authentication deal, are pivotal strengths. These moves are designed to consolidate its market position, particularly within the burgeoning Crane Authentication division, establishing a formidable global presence across the entire authentication value chain.

The company's financial performance in full-year 2024 demonstrated resilience, with sales increasing by approximately 7% and adjusted earnings per share reaching $4.26. This stability is further bolstered by a 6% increase in its annual dividend, reflecting strong operational efficiency and a commitment to shareholder returns.

Crane NXT’s deep expertise in secure, detect, and authenticate technologies, coupled with its robust R&D and innovation capabilities, particularly in micro-optics and process flow technologies, allows it to develop proprietary solutions. This focus is critical for meeting the stringent demands of high-security markets and maintaining a competitive edge.

| Key Financial & Operational Metrics (2024/Early 2025) | ||

| Full-Year 2024 Sales Growth | ~7% | |

| Full-Year 2024 Adjusted EPS | $4.26 | |

| Annual Dividend Increase | 6% | |

| Key Acquisitions (2024/2025) | OpSec Security, TruTag Smart Packaging, De La Rue Authentication |

What is included in the product

Delivers a strategic overview of Crane NXT’s internal and external business factors, highlighting its strengths in specialized products, potential weaknesses in market diversification, opportunities in emerging technologies, and threats from economic downturns and competition.

Offers a clear, actionable framework to identify and address strategic challenges, turning potential weaknesses into opportunities for growth.

Weaknesses

Crane NXT's Currency segment, despite a robust backlog, saw its core sales dip in the first quarter of 2025. This decline was largely attributed to reduced U.S. government sales.

This downturn stemmed from a necessary, planned shutdown of critical papermaking machinery. The shutdown was in preparation for the upcoming new U.S. banknote series, illustrating how the segment's performance is tied to specific government procurement schedules and strategic decisions.

Crane NXT's recent acquisitions, though strategically sound, have presented a challenge in maintaining robust operating profit margins. This was particularly evident in the fourth quarter of 2024 and the first quarter of 2025, where the company experienced a dilution in these margins.

The primary drivers behind this margin dilution were an unfavorable product mix within the acquired businesses and the inherent costs associated with integrating these new operations. For instance, the integration of Interface Inc., acquired in late 2023, contributed to a lower overall margin in early 2025 due to its different margin profile compared to Crane NXT's existing businesses.

Crane NXT's performance is showing a mixed picture across its different business areas. While the Security & Authentication Technologies (SAT) segment is poised for strong growth, partly thanks to recent acquisitions, the Crane Payment Innovations (CPI) segment is facing headwinds.

For the entirety of 2025, CPI is anticipating sales to remain flat or even decline. This trend was already visible in the first quarter of 2025, where CPI saw a sales drop. A key reason for this dip was weaker activity in the gaming sector, highlighting an uneven performance across Crane NXT's various operational segments.

Increased Financial Leverage Post-Acquisition

Crane NXT's strategic acquisitions, notably the De La Rue Authentication deal, are anticipated to increase its net leverage. This move is projected to push leverage ratios to around 2.3x by mid-2025, which could constrain immediate financial maneuverability for significant new investments or share buybacks.

The heightened financial leverage resulting from these acquisitions presents a potential weakness:

- Increased Debt Burden: The integration of De La Rue Authentication is expected to raise Crane NXT's net leverage to approximately 2.3x by mid-2025, increasing its debt obligations.

- Reduced Financial Flexibility: A higher leverage ratio may limit the company's capacity for substantial future investments or share repurchase programs in the short to medium term.

- Interest Rate Sensitivity: With increased borrowing, Crane NXT becomes more susceptible to fluctuations in interest rates, potentially impacting profitability and cash flow.

Exposure to Foreign Exchange Fluctuations

Crane NXT's global operations expose it to foreign exchange fluctuations. These currency movements have a tangible impact, as seen when unfavorable exchange rates partially offset sales growth in both the fourth quarter of 2024 and the first quarter of 2025. This volatility can introduce unpredictability into the company's reported revenues and overall profitability.

The company's financial performance is therefore subject to the whims of international currency markets.

- Currency Risk: Crane NXT's international presence means its financial results can be negatively impacted by adverse currency movements.

- Impact on Sales: For example, in Q4 2024 and Q1 2025, foreign exchange headwinds partially reduced reported sales growth.

- Profitability Uncertainty: Fluctuating exchange rates can affect the translated value of foreign earnings, adding a layer of uncertainty to profitability.

Crane NXT's Currency segment experienced a sales dip in Q1 2025 due to reduced U.S. government sales, a consequence of planned shutdowns for new banknote series production.

The company's recent acquisitions, while strategic, have led to margin dilution, with Q4 2024 and Q1 2025 showing lower operating profit margins due to unfavorable product mix and integration costs.

The Crane Payment Innovations (CPI) segment is facing flat to declining sales for 2025, with Q1 2025 sales dropping due to weakness in the gaming sector.

Increased financial leverage, projected to reach 2.3x by mid-2025 after the De La Rue Authentication deal, may constrain future investment flexibility.

| Segment | Q1 2025 Sales Trend | Key Factor | Outlook 2025 |

| Currency | Dip | Reduced U.S. Govt. sales, production shutdowns | Tied to procurement schedules |

| CPI | Drop | Weaker gaming sector activity | Flat to declining |

| SAT | Strong Growth | Acquisitions | Poised for growth |

Preview the Actual Deliverable

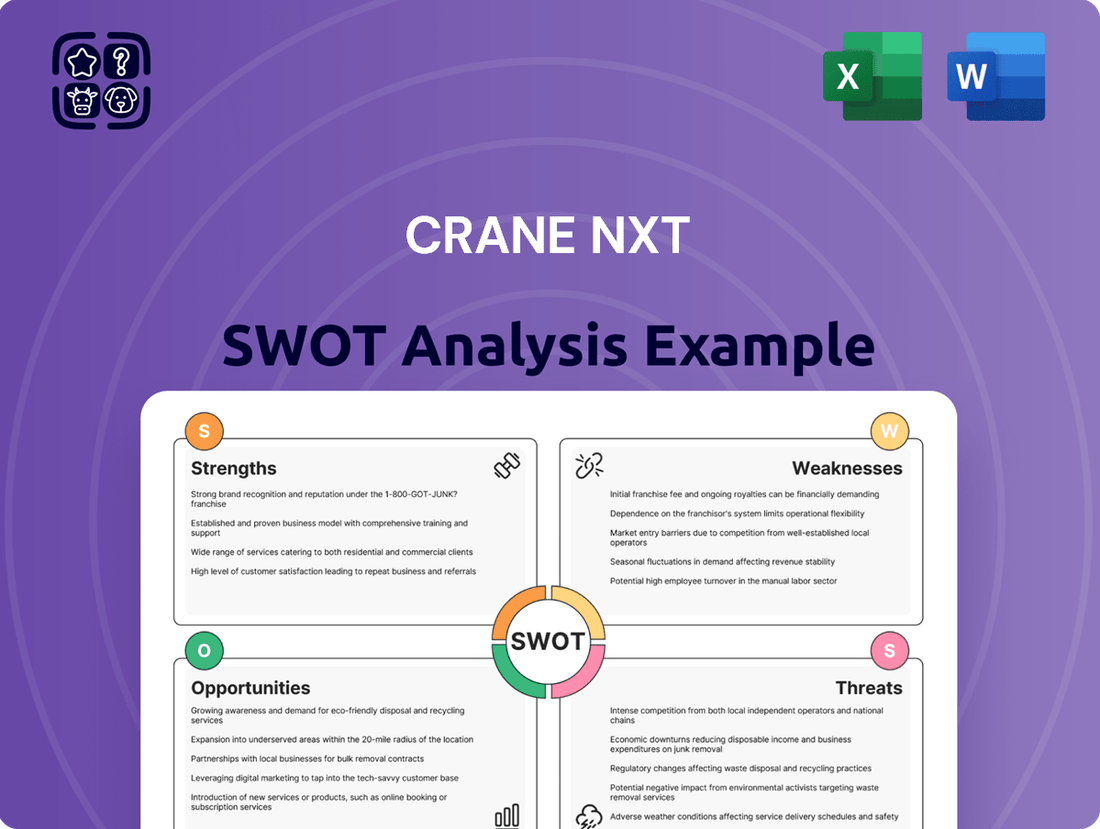

Crane NXT SWOT Analysis

This is the actual SWOT analysis document you’ll receive upon purchase—no surprises, just professional quality. You can see the detailed breakdown of Crane NXT's Strengths, Weaknesses, Opportunities, and Threats right here.

The preview below is taken directly from the full SWOT report you'll get. Purchase unlocks the entire in-depth version, providing a comprehensive understanding of Crane NXT's strategic position.

This preview reflects the real document you'll receive—professional, structured, and ready to use. It showcases the thoroughness of the Crane NXT SWOT analysis, ensuring you get exactly what you need.

Opportunities

The global demand for brand protection and anti-counterfeiting measures is on a consistent upward trajectory. This trend is driven by the increasing need for product security across various sectors. Crane NXT is well-positioned to leverage this growth through strategic moves like acquiring OpSec Security and De La Rue Authentication, thereby expanding its reach into critical areas like government and consumer goods authentication.

The payment industry is rapidly evolving, with biometric, AI-driven, and invisible payment systems becoming increasingly popular. Embedded finance, where financial services are integrated into non-financial platforms, is also a significant growth area. For instance, the global embedded finance market was projected to reach $7.2 trillion by 2030, according to some estimates.

Crane Payment Innovations (CPI) is well-positioned to capitalize on these shifts. By integrating its existing technological strengths with innovations in areas like biometric authentication and AI for fraud detection, CPI can offer more secure and seamless payment experiences. This strategic alignment with emerging trends can significantly expand CPI's market share and customer base.

The global push towards Central Bank Digital Currencies (CBDCs) offers a compelling avenue for Crane NXT. As more nations, including China with its e-CNY and discussions intensifying in the US and Europe, explore digital fiat, Crane's expertise in secure currency features becomes highly relevant.

Crane NXT's established capabilities in banknote security and authentication can be leveraged to support the integrity and trust required for CBDC infrastructure. This could involve providing advanced security elements or authentication technologies for digital currency transactions, potentially opening new revenue streams in a rapidly evolving financial landscape.

Strategic Mergers and Acquisitions Pipeline

Crane NXT is actively pursuing a disciplined mergers and acquisitions strategy, focusing on markets with strong, long-term growth potential and businesses that possess unique technological advantages. This approach aims to enhance their portfolio and broaden their reach into related sectors that support their core secure, detect, and authenticate mission.

The company has cultivated a robust pipeline of potential acquisitions, signaling its readiness to capitalize on strategic opportunities. This capacity for M&A allows Crane NXT to not only diversify its offerings but also to expand into adjacent markets, reinforcing its overall business strategy. For instance, in 2023, Crane NXT completed the acquisition of OpSec Security Group for $1.265 billion, a significant move that bolstered its authentication technologies and expanded its global footprint.

- Disciplined M&A Focus: Targeting secular growth markets and differentiated technologies.

- Robust Pipeline: Ample capacity and a strong pipeline of potential acquisition targets.

- Strategic Expansion: Diversification and entry into near-adjacent markets.

- Portfolio Alignment: Opportunities that fit the secure, detect, and authenticate strategy.

Digital Transformation Driving Demand for Security Solutions

The accelerating digital transformation across industries is fundamentally increasing the need for strong security, detection, and authentication. This pervasive trend directly fuels consistent demand for Crane NXT's specialized products, as organizations worldwide prioritize safeguarding valuable physical assets, digital information, and secure financial exchanges.

For instance, the global cybersecurity market was projected to reach $231.7 billion in 2024, highlighting the immense scale of this opportunity. Crane NXT's expertise in secure payment technologies and authentication solutions positions it to capitalize on this growing market need.

- Increased Demand for Secure Payment Solutions: As digital transactions surge, the need for tamper-evident and secure payment technologies, a Crane NXT specialty, grows.

- Growing Need for Authentication: The rise of digital identities and the need to prevent fraud in both physical and digital realms drives demand for advanced authentication methods.

- Protection of High-Value Assets: Businesses are investing more in securing physical goods and sensitive data, aligning with Crane NXT's product development in secure currency handling and identification.

Crane NXT is strategically positioned to benefit from the increasing global emphasis on brand protection and anti-counterfeiting measures. The company's proactive acquisition strategy, including significant investments like the $1.265 billion purchase of OpSec Security in 2023, directly addresses this growing market need. This expansion allows Crane NXT to offer enhanced authentication solutions across diverse sectors, from government documents to consumer goods, solidifying its role in safeguarding product integrity.

The rapid evolution of payment systems, particularly the rise of biometric and AI-driven technologies, presents a substantial opportunity for Crane NXT. The company can integrate its existing secure payment innovations with these emerging trends, such as the projected $7.2 trillion global embedded finance market by 2030, to deliver more secure and user-friendly payment experiences. This forward-looking approach is designed to capture greater market share and attract a broader customer base.

The global exploration of Central Bank Digital Currencies (CBDCs) offers a significant new frontier for Crane NXT's expertise. As nations like China advance their e-CNY initiatives and others, including the US and Europe, intensify discussions, Crane NXT's proven capabilities in banknote security and authentication become highly relevant. The company is poised to contribute essential technologies that ensure the integrity and trustworthiness of digital currency transactions, potentially creating substantial new revenue streams.

Crane NXT's commitment to a disciplined mergers and acquisitions strategy, targeting secular growth markets and unique technologies, is a key driver of its future opportunities. The company maintains a robust pipeline of potential acquisition targets, enabling strategic diversification and expansion into adjacent markets that align with its core mission of secure detection and authentication. This approach ensures continuous portfolio enhancement and market penetration.

| Opportunity Area | Market Trend | Crane NXT Relevance | Example/Data Point |

|---|---|---|---|

| Brand Protection & Anti-Counterfeiting | Increasing global demand for product security | Acquisition of OpSec Security (2023) for $1.265B | Global brand protection market growth |

| Payment Innovation | Rise of biometrics, AI, and embedded finance | Integration of existing tech with new payment trends | Embedded finance market projected at $7.2T by 2030 |

| Digital Currencies | Global exploration of CBDCs | Leveraging banknote security and authentication expertise | Advancements in e-CNY and digital dollar discussions |

| Strategic M&A | Focus on secular growth and differentiated tech | Robust acquisition pipeline and capacity | Expansion into near-adjacent markets |

Threats

The payment technology landscape is evolving at breakneck speed. New digital payment methods, mobile wallets, and alternative systems are constantly emerging, making the industry incredibly dynamic. Crane Payment Innovations (CPI) must keep pace with these changes.

If CPI fails to innovate its hardware-centric solutions, they risk becoming outdated. Competitors offering more flexible, software-driven payment options could gain market share, leading to reduced demand for CPI's existing products. For instance, the global digital payments market was valued at approximately $7.5 trillion in 2023 and is projected to grow significantly, highlighting the imperative to adapt.

As Crane NXT's reliance on interconnected digital solutions grows, so does the threat of cyberattacks and fraud. A 2024 report indicated a 40% rise in cyber threats targeting industrial control systems, a sector relevant to Crane NXT's operations. Such breaches could compromise sensitive data, leading to significant financial losses and reputational damage.

The increasing sophistication of fraud schemes also presents a substantial risk. For instance, in 2024, financial institutions reported a 25% increase in business email compromise scams, highlighting the evolving landscape of financial crime that Crane NXT must actively defend against. Protecting against these evolving threats is crucial for maintaining customer trust and operational integrity.

Operating globally, Crane NXT faces a complex web of regulatory landscapes. For instance, evolving data privacy laws like GDPR and CCPA can necessitate significant compliance investments, impacting operational efficiency. In 2024, we've seen continued scrutiny on digital payment systems, a key area for Crane NXT's Payment and Merchandising Technologies segment, potentially leading to new operational requirements.

Geopolitical shifts also present a tangible threat. Trade disputes and tariffs, such as those that have impacted global supply chains in recent years, could increase manufacturing costs for Crane NXT's diverse product lines, from secure payment solutions to industrial technologies. The ongoing trade tensions between major economies in 2024 continue to create uncertainty regarding market access and import/export costs.

Intense Competition in Niche Markets

Crane NXT faces significant threats from intense competition within its specialized markets. Established rivals and agile new entrants are constantly vying for market share, often by introducing alternative technologies or more cost-effective solutions. This competitive pressure directly impacts Crane NXT's pricing power and necessitates ongoing investment in innovation to maintain its edge.

For instance, in the highly specialized area of payment technologies, Crane NXT contends with a landscape where competitors like VeriFone and Ingenico have historically held strong positions. Emerging fintech companies also pose a threat by developing disruptive payment solutions. Crane NXT's ability to differentiate through advanced features and reliable service is crucial to counter these competitive forces, especially as the market for secure payment processing continues to evolve rapidly.

- Competitive Landscape: Crane NXT operates in niche segments like payment terminals and banknote validators, where competition is fierce from both global conglomerates and specialized technology firms.

- Pricing Pressure: Competitors frequently introduce lower-cost alternatives or innovative features, forcing Crane NXT to manage pricing strategies carefully to maintain profitability and market share.

- Innovation Imperative: The need for continuous technological advancement to counter competitive threats requires substantial R&D investment, impacting margins and requiring strategic focus on differentiation.

Economic Downturns and Market Volatility

Economic downturns and market volatility present significant threats to Crane NXT. A general economic slowdown could reduce customer spending, particularly impacting government contracts for currency and capital expenditures on payment solutions. For instance, if government budgets tighten due to recessionary pressures, Crane NXT might see a decrease in orders for its currency processing equipment.

Inflation and fluctuating raw material costs, such as metals and electronic components, directly compress profit margins. If the cost of goods sold rises faster than Crane NXT can pass those costs onto customers, profitability will suffer. Energy price volatility also adds to operational expenses, further squeezing margins.

- Reduced Government Spending: Economic slowdowns can lead to budget cuts in government sectors, impacting demand for currency handling systems.

- Inflationary Pressures: Rising costs for raw materials and energy directly affect Crane NXT's cost of goods sold and operational expenses.

- Market Volatility Impact: Unpredictable market conditions can lead to decreased capital expenditures by customers in the payment solutions sector.

- Margin Compression: The inability to fully pass on increased costs to customers due to competitive pressures can lead to lower profit margins.

Crane NXT faces significant threats from a rapidly evolving payment technology landscape, where new digital methods could render its hardware-centric solutions obsolete. Intense competition from both established players and agile fintech startups necessitates continuous innovation, often leading to pricing pressure and the need for substantial R&D investment to maintain market share.

Cybersecurity risks and sophisticated fraud schemes pose a growing danger, potentially leading to data breaches, financial losses, and reputational damage. Additionally, navigating complex and changing global regulations, coupled with geopolitical instability and trade disputes, can increase operational costs and create market access uncertainties.

Economic downturns also present a threat, potentially reducing customer spending, particularly in government sectors, and leading to inflationary pressures on raw materials and energy, which can compress profit margins if costs cannot be fully passed on.

SWOT Analysis Data Sources

This analysis is built upon a foundation of verified financial statements, comprehensive market research reports, and expert industry commentary to ensure a robust and insightful SWOT assessment for Crane NXT.