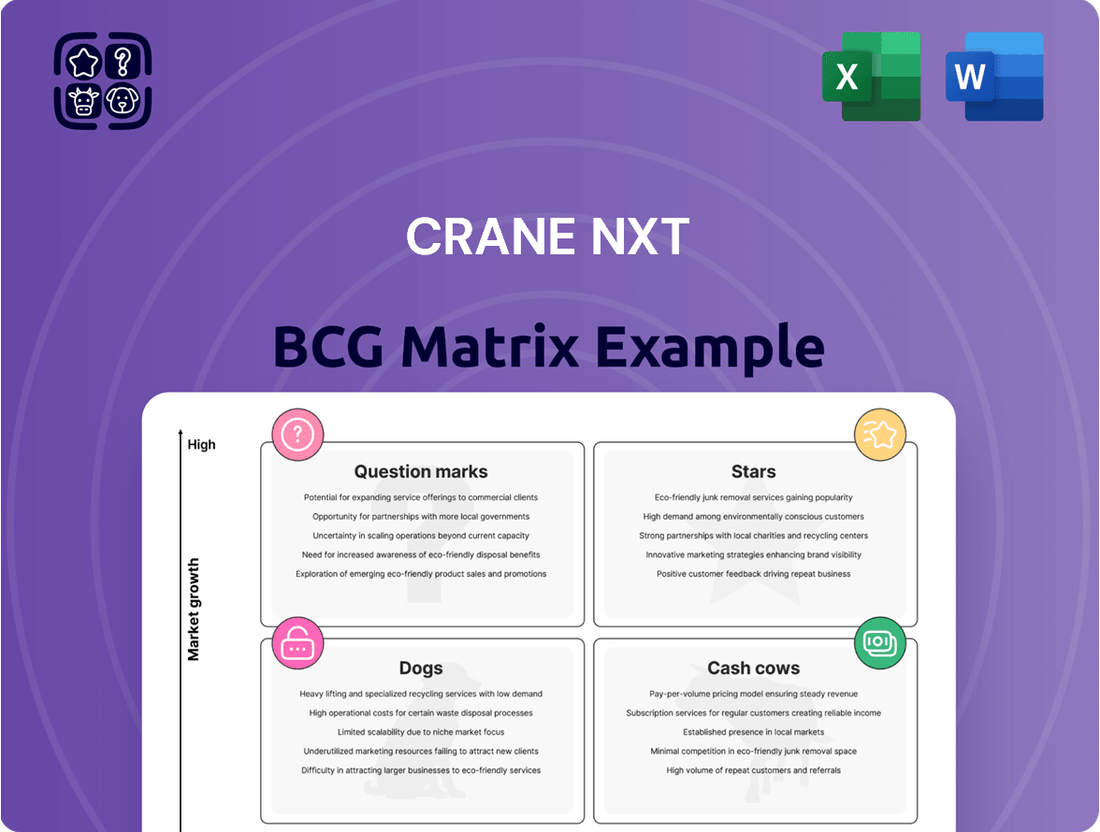

Crane NXT Boston Consulting Group Matrix

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Crane NXT Bundle

Discover the strategic positioning of Crane NXT's product portfolio with this insightful BCG Matrix preview. Understand which offerings are generating strong cash flow and which require careful consideration for future investment. This snapshot is your first step towards optimizing your business strategy.

To truly unlock the potential of Crane NXT's market presence, dive into the full BCG Matrix. Gain a comprehensive understanding of each product's quadrant placement, complete with actionable insights and data-driven recommendations. Purchase the full report to transform this knowledge into decisive action and drive sustainable growth.

Stars

Crane Authentication, following its strategic acquisitions of OpSec Security and De La Rue Authentication Solutions, is poised to become a dominant force in the security and authentication sector. This consolidation is expected to significantly boost Crane NXT's 2025 revenue, reflecting a stable and expanding income stream.

The combined entity focuses on safeguarding high-value physical goods and brand integrity, tapping into a market experiencing robust demand and considerable growth opportunities. For instance, the global brand protection market, which includes authentication solutions, was valued at approximately $2.5 billion in 2023 and is projected to grow at a compound annual growth rate of over 10% through 2030.

Crane Currency's international business, particularly its micro-optics segment, is a shining star in the BCG matrix. In Q1 2025, they achieved a record backlog and a strong book-to-bill ratio, underscoring robust demand. This growth is fueled by significant contract wins for their advanced anti-counterfeiting micro-optic technology.

The global demand for secure and durable currency continues to expand, positioning Crane's micro-optics as a high-market-share player within a growing niche. This segment benefits from the ongoing need for sophisticated security features in banknotes worldwide, contributing significantly to Crane NXT's overall portfolio performance.

Crane NXT excels in developing sophisticated anti-counterfeiting technologies, integrating features like advanced holograms, microprinting, and color-shifting inks. These security elements are crucial for governments modernizing currency, driving high demand in this sector. For instance, the global anti-counterfeiting market was valued at approximately $235 billion in 2023 and is projected to grow significantly.

Secure Banknote Production for New Series

Crane Currency's strategic investments in secure banknote production for new U.S. series underscore its critical role in government infrastructure. This commitment guarantees sustained, high-volume demand for its specialized currency solutions, solidifying its market standing.

These government contracts represent a significant market share in a vital, though inherently cyclical, segment of the banknote industry. Crane's ability to meet stringent security and volume requirements positions it as a key player.

- Strategic Investments: Crane Currency has made substantial capital expenditures to upgrade and expand its production facilities, specifically to accommodate the complex security features and increased volume required for new national currency series.

- Government Integration: The company's deep integration with governmental bodies, particularly central banks and treasury departments, ensures a stable and predictable revenue stream from these long-term contracts.

- Market Share: In the secure banknote paper and polymer substrate market, Crane Currency holds a dominant position, particularly for high-denomination and security-intensive currencies like the U.S. dollar. For instance, in 2023, Crane Currency was awarded a significant contract extension for supplying substrate for U.S. currency, valued in the hundreds of millions of dollars over its term.

- Demand Stability: While the overall banknote market can be cyclical, the demand for secure substrates for major national currencies remains relatively stable, driven by regular currency replacement cycles and the need for advanced anti-counterfeiting measures.

Brand Protection Solutions

Crane NXT's Brand Protection Solutions, bolstered by the acquisition of OpSec Security, targets a rapidly expanding market. This segment is crucial for businesses aiming to safeguard their intellectual property and brand reputation against counterfeiting and illicit trade. The demand for these advanced authentication and anti-counterfeiting technologies is projected to see continued strong growth through 2024 and beyond, driven by global e-commerce and supply chain complexities.

The strategic move to acquire OpSec Security positions Crane NXT as a significant player in brand protection. This acquisition allows Crane NXT to offer a comprehensive suite of solutions, from overt security features to covert tracking technologies. The global brand protection market was valued at approximately $2.1 billion in 2023 and is anticipated to grow at a compound annual growth rate (CAGR) of over 15% in the coming years, presenting a substantial opportunity for market share gains.

- Market Growth: The brand protection sector is experiencing robust expansion, fueled by increasing instances of intellectual property infringement.

- Acquisition Synergies: The integration of OpSec Security's expertise and technology significantly strengthens Crane NXT's competitive offering.

- Customer Demand: Businesses worldwide are actively seeking advanced solutions to secure their products and combat the financial impact of counterfeiting.

- Revenue Potential: This high-growth segment offers considerable potential for revenue diversification and increased profitability for Crane NXT.

Crane Currency's micro-optics segment is a clear star within Crane NXT's portfolio. This area is characterized by high market growth and a strong competitive position, driven by advanced anti-counterfeiting technologies. The segment's robust performance is evidenced by record backlogs and strong book-to-bill ratios reported in early 2025, indicating sustained demand for its innovative security features in global currency.

Crane NXT's Brand Protection Solutions, significantly enhanced by the OpSec Security acquisition, also represent a star. This segment capitalizes on the rapidly growing market for safeguarding intellectual property and combating counterfeiting. With an anticipated CAGR of over 15%, this area offers substantial revenue potential and market share expansion opportunities for Crane NXT.

| Segment | Market Growth | Competitive Position | Key Drivers |

|---|---|---|---|

| Crane Currency (Micro-optics) | High | Strong (Dominant in secure substrate for major currencies) | Demand for advanced anti-counterfeiting features, government contracts |

| Brand Protection Solutions (OpSec) | Very High (15%+ CAGR projected) | Emerging Strong Player (Post-acquisition) | Increasing IP infringement, e-commerce growth, supply chain complexity |

What is included in the product

This analysis categorizes Crane NXT's offerings into Stars, Cash Cows, Question Marks, and Dogs to guide strategic decisions.

Quickly identify underperforming "Dogs" and reallocate resources from them.

Cash Cows

Crane Currency, a key player in providing banknotes and advanced security features to governments globally, operates within a mature yet indispensable market. Despite moderate overall growth projections for the banknote sector, estimated between 5.3% and 5.7% annually from 2024 through 2029, Crane Currency benefits from deep-seated client relationships and its essential function, guaranteeing consistent revenue streams.

Crane NXT's core hardware, particularly from Crane Payment Innovations (CPI), represents its established Cash Cows. These include widely adopted bill and coin validators, recyclers, and dispensers that are staples in vending, retail, and gaming sectors.

These established products boast high market penetration, ensuring consistent demand for replacements and ongoing maintenance. For instance, in 2023, CPI's hardware segment continued to be a significant revenue driver for Crane NXT, reflecting the steady, albeit mature, nature of these essential payment solutions.

CPI, a Crane NXT business, offers comprehensive unattended payment solutions for vending and retail. These markets, though mature, boast a substantial installed base and sustained demand for dependable payment technology.

Despite being mature segments, vending and retail represent a significant installed base and ongoing need for reliable payment systems. Crane NXT's robust presence in these areas translates to healthy profit margins and steady cash flow, requiring minimal new market development investment.

In 2023, Crane NXT reported that its Currency Processing segment, which includes CPI, generated $694.6 million in revenue, highlighting the continued strength of its payment solutions in established markets like vending and retail.

Maintenance and Service Contracts

Maintenance and Service Contracts represent a significant Cash Cow for Crane NXT. The company leverages its vast global installed base of currency and payment solutions to generate consistent, recurring revenue through long-term maintenance, service, and software update agreements. These contracts are typically high-margin and stable, demanding minimal additional investment for their continuation. This dependable cash flow fuels Crane NXT's operations and supports its strategic growth endeavors.

- Recurring Revenue Stream: Crane NXT's extensive installed base ensures a predictable flow of income from service and maintenance contracts.

- High Margins and Stability: These contracts generally offer robust profit margins and operate with low volatility, providing financial predictability.

- Reduced Investment Needs: Unlike product development, maintaining existing service agreements requires significantly less capital outlay.

- Cash Generation: The steady cash generated from these contracts is vital for funding Crane NXT's ongoing operations and future strategic investments.

Proprietary Micro-Optics Technology (Existing Applications)

Crane NXT's proprietary micro-optics technology is a cornerstone of its secure solutions, acting as a significant cash cow. This foundational expertise is deeply integrated into several existing product lines, demonstrating its proven market acceptance and consistent profitability.

The established applications of this technology offer a distinct competitive edge, consistently delivering high-margin returns. This enduring strength solidifies its position as a reliable cash cow within Crane NXT's portfolio.

- Established Market Presence: The technology is already deployed in numerous successful products, indicating strong demand and customer trust.

- High Profitability: Its proprietary nature and proven effectiveness allow for premium pricing and robust profit margins.

- Consistent Revenue Streams: Existing applications ensure a steady and predictable income, characteristic of a cash cow.

Crane NXT's established payment hardware, particularly from Crane Payment Innovations (CPI), represents its core Cash Cows. These are the bill and coin validators, recyclers, and dispensers that are widely used in vending, retail, and gaming. Their high market penetration means consistent demand for replacements and ongoing maintenance, providing a steady revenue stream with minimal need for new market development.

The company's extensive installed base of currency and payment solutions also fuels recurring revenue through maintenance, service, and software update agreements. These high-margin, stable contracts require little additional investment, generating predictable cash flow that supports Crane NXT's operations and strategic growth.

Crane NXT's proprietary micro-optics technology is another significant cash cow. Its proven market acceptance and consistent profitability are demonstrated through its integration into existing product lines, offering a competitive edge and high-margin returns.

| Product/Service | Market Position | Revenue Contribution (2023) | Growth Outlook |

|---|---|---|---|

| CPI Bill & Coin Validators/Recyclers | High Market Penetration | Significant driver for Crane NXT | Stable, mature market |

| Maintenance & Service Contracts | Extensive Installed Base | Consistent, recurring revenue | Low volatility, high margins |

| Proprietary Micro-Optics Technology | Established Applications | High-margin, profitable | Steady, predictable income |

What You See Is What You Get

Crane NXT BCG Matrix

The preview you are seeing is the exact Crane NXT BCG Matrix document you will receive immediately after purchase, offering a complete and unwatermarked strategic tool. This comprehensive report is fully formatted and ready for immediate application, providing you with all the insights and analysis without any hidden surprises. You can confidently use this preview as a direct representation of the professional-grade BCG Matrix you will download, enabling swift integration into your business planning and decision-making processes. Rest assured, the file you are reviewing is the final, polished version, meticulously crafted to deliver actionable intelligence for your business growth.

Dogs

Certain older hardware within Crane Payment Innovations (CPI) that supports less sophisticated payment methods may be facing declining demand as industries rapidly transition to more advanced digital solutions. CPI's Q1 2025 results showed a core sales decline, partly attributed to lower volumes, indicating potential obsolescence in some product lines.

These products could be consuming resources without generating commensurate returns, potentially placing them in the Dogs category of the BCG Matrix. For instance, if legacy bill validators or coin acceptors are seeing reduced orders, they might represent a drag on innovation and investment in newer, higher-growth areas.

The U.S. currency segment, while vital for Crane NXT, faces potential volume dips during planned equipment modernization. This can temporarily reduce demand for existing banknote production, impacting profitability in this area.

These cyclical downturns, driven by upgrade cycles, can position the U.S. currency business as a 'dog' if not strategically navigated. For instance, during the transition to new printing technologies, the volume of older currency production naturally declines.

Crane NXT's portfolio might include older detection technologies that are losing ground to newer, more sophisticated solutions. If these legacy systems operate in a market segment that's shrinking or not growing, they could be classified as dogs in a BCG matrix. For example, if a particular type of optical scanner, once a market leader, now holds a mere 3% market share in a segment projected to decline by 5% annually, it fits this description.

These "dog" technologies can represent a drain on resources. They might require ongoing maintenance and support, diverting capital and R&D efforts away from more promising growth areas. In 2024, companies are increasingly divesting or phasing out such assets to streamline operations and reinvest in areas with higher potential returns, such as AI-powered anomaly detection or advanced biometric scanners.

Products with Limited Differentiated Security Features

Products with limited differentiated security features can become problematic in the dynamic security market. If Crane NXT has offerings that lag in incorporating advanced high-security functionalities or are easily replicated, these items could face declining market relevance. Such products, if not actively managed or phased out, could become cash traps, demanding resources without generating substantial returns.

In 2024, the demand for enhanced security solutions continued to surge. Companies that failed to innovate in areas like biometric authentication or advanced anti-counterfeiting measures, as seen in the broader payment security sector where breaches cost billions annually, risked obsolescence. For Crane NXT, any legacy products in this category would need careful evaluation to prevent them from draining capital.

- Market Vulnerability: Products lacking robust, differentiated security features are highly susceptible to competitive pressures and technological advancements.

- Cash Trap Potential: Legacy offerings that require significant investment for minimal market differentiation can become a drain on resources, hindering growth in more promising areas.

- Counterfeiting Risk: Security products that are easily counterfeited face immediate erosion of market share and brand trust.

- Strategic Review Necessity: Crane NXT must continually assess its portfolio for products that fall into this category, making strategic decisions regarding investment, repositioning, or divestment.

Underperforming Regional Pockets or Niche Markets

Crane NXT's global reach means some regional operations or specialized niche markets might be classified as dogs. These are areas where Crane NXT has a low market share and faces minimal growth prospects. For instance, if a specific product line in a less developed market struggles to gain traction against established local competitors, it could fall into this category.

High competitive pressures and low investment returns are key indicators for these dog segments. Imagine a situation where Crane NXT’s advanced payment solutions are competing in a market with very low adoption rates for digital transactions, and the cost of market development outweighs potential gains. This scenario would strongly suggest a dog classification.

- Low Market Share & Growth: Certain regional pockets or niche markets within Crane NXT's global operations might exhibit a low share of the market and very little potential for future growth.

- Competitive Pressures: Intense competition in these areas can stifle growth and profitability, making it difficult for Crane NXT to gain a significant foothold.

- Low Investment Returns: The capital invested in these underperforming segments may not yield adequate returns, signaling a potential drain on resources.

- Resource Diversion: Continued investment in dog segments can divert valuable resources, such as capital, talent, and management attention, away from more promising growth opportunities within Crane NXT's portfolio.

Products within Crane NXT's portfolio that exhibit low market share and minimal growth potential, often due to technological obsolescence or intense competition, are categorized as Dogs. These segments can drain resources, requiring ongoing investment for limited returns, as seen with legacy payment hardware facing declining demand in favor of advanced digital solutions.

For instance, older bill validators or coin acceptors with reduced order volumes may represent a drag on innovation, similar to how the U.S. currency segment can experience temporary volume dips during modernization cycles, impacting profitability.

Crane NXT must continually evaluate these underperforming assets, such as legacy detection technologies losing ground to newer systems, to avoid them becoming cash traps that divert capital and R&D from more promising growth areas.

In 2024, the trend of divesting or phasing out such assets intensified across industries to streamline operations and reinvest in higher-potential areas, a strategy crucial for managing Crane NXT's dog segments effectively.

| Category | Characteristics | Crane NXT Example (Potential) | 2024 Market Trend Impact |

|---|---|---|---|

| Dogs | Low Market Share, Low Growth | Legacy bill validators, older detection technologies | Increased divestment of obsolete assets, focus on digital solutions |

| High Competition, Low Returns | Niche regional markets with low digital adoption | Resource diversion from high-growth areas | |

| Resource Drain, Obsolescence Risk | Products lacking advanced security features | Shift towards AI-powered detection and biometrics |

Question Marks

Crane NXT's acquisition of De La Rue Authentication Solutions in May 2025 positions it within the high-growth authentication market. This strategic move aims to significantly enhance Crane NXT's offerings in secure identification and brand protection technologies.

Currently, this segment is in its nascent stages of integration within Crane NXT's broader business structure. The company anticipates a period of substantial investment, likely requiring significant cash outflow for operational integration and market expansion efforts.

The primary objective is to solidify market share and establish a strong competitive foothold. Until these integration and expansion goals are met, the De La Rue Authentication Solutions segment is expected to be a cash consumer, analogous to a Question Mark in the BCG matrix, before potentially evolving into a Star performer.

Crane NXT's acquisition of Smart Packaging assets from TruTag Technologies in 2024 positions them within the burgeoning field of product security and authentication. This strategic move into a high-growth, innovative sector is characteristic of a Question Mark in the BCG matrix.

As a new venture for Crane NXT, these smart packaging assets likely command a small market share currently, necessitating substantial investment for further development and market penetration. This high investment requirement coupled with uncertain future returns firmly places it in the Question Mark quadrant.

The digital payments sector is booming, with AI and blockchain at the forefront, alongside contactless tech. Crane Payment Innovations (CPI) is actively investing in these innovative areas, though its foothold in these fast-growing, advanced segments is still being established.

Developing these next-generation solutions demands significant investment in research and development and focused efforts to gain market traction. This positions CPI's next-generation digital payment solutions within the BCG matrix as Stars, reflecting their high growth potential and the substantial resources needed for their success.

Expansion into New Cashless Payment Markets

Expanding Crane NXT's CPI cashless payment solutions into new, high-growth emerging markets or untapped sectors represents a classic Question Mark scenario. These ventures offer substantial revenue potential, but the significant upfront investment in infrastructure, regulatory navigation, and building brand awareness in unfamiliar territories carries inherent risks. For instance, the global digital payments market was projected to reach over $2.5 trillion by 2024, indicating a vast opportunity, but success hinges on adapting to diverse local payment preferences and competitive landscapes.

- Market Entry Costs: Significant capital is required for establishing operations, distribution channels, and marketing campaigns in new regions.

- Infrastructure Development: Building or integrating with local payment networks and ensuring reliable service delivery are critical for adoption.

- Competitive Landscape: Entering markets with established local players or dominant global platforms demands a strong value proposition and differentiation.

- Regulatory Hurdles: Navigating varying financial regulations and compliance requirements in different countries can be complex and time-consuming.

New Product Development in Secure Technologies

Crane NXT's focus on new product development in secure technologies, such as advanced authentication systems and tamper-evident solutions, places these initiatives squarely in the question mark category of the BCG matrix.

These emerging products, while holding significant future potential, currently operate in nascent markets with uncertain demand and require substantial investment to prove their value and capture market share. For instance, Crane NXT's ongoing research into biometric authentication for high-security applications represents a classic question mark, demanding significant R&D funding and market education.

- Innovation Focus: Crane NXT consistently invests in developing novel solutions for asset security, detection, and authentication.

- Market Uncertainty: New products in early commercialization phases represent question marks, facing unproven markets and requiring significant capital for growth.

- Investment Needs: These ventures necessitate substantial expenditure in R&D, marketing, and sales to achieve market penetration and establish a competitive position.

- Strategic Importance: Successful development of these question mark products is crucial for Crane NXT's long-term competitive advantage and market leadership.

Crane NXT's strategic foray into new authentication technologies, such as those acquired from De La Rue and TruTag, represent classic Question Marks. These initiatives are characterized by high growth potential within emerging markets but currently hold a low market share, necessitating substantial investment for development and market penetration.

The company's investments in next-generation digital payment solutions, particularly those leveraging AI and blockchain, also fall into the Question Mark category. While the digital payments market is projected to exceed $2.5 trillion by 2024, Crane NXT's specific ventures in these advanced segments require significant R&D and market-building efforts to establish a strong competitive position.

These Question Mark segments demand considerable capital expenditure for market entry, infrastructure development, and navigating regulatory landscapes. Success hinges on Crane NXT's ability to differentiate its offerings and adapt to diverse market needs, transforming these high-risk, high-reward opportunities into future Stars.

| Business Unit/Initiative | BCG Quadrant | Market Growth | Market Share | Investment Needs | Strategic Rationale |

| De La Rue Authentication Solutions | Question Mark | High | Low | High | Enhance secure identification and brand protection |

| TruTag Smart Packaging | Question Mark | High | Low | High | Expand into product security and authentication |

| Next-Gen Digital Payment Solutions (AI/Blockchain) | Question Mark | High | Low | High | Capitalize on booming digital payments, leverage advanced tech |

| Emerging Market Cashless Expansion | Question Mark | High | Low | High | Tap into new revenue streams in underserved markets |

| New Secure Technology Development | Question Mark | High | Low | High | Drive long-term competitive advantage through innovation |

BCG Matrix Data Sources

Our Crane NXT BCG Matrix is informed by comprehensive data, including financial statements, market research reports, and industry growth forecasts.