Crane NXT Porter's Five Forces Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Crane NXT Bundle

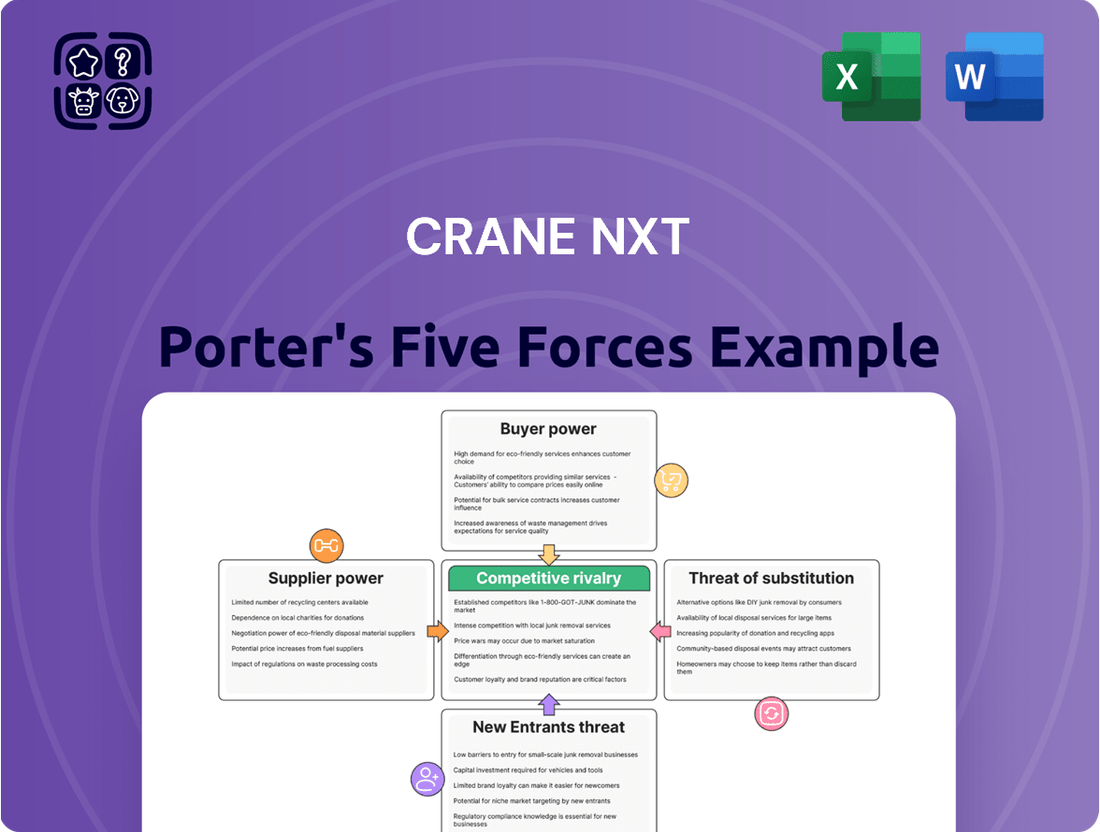

Crane NXT operates within a dynamic industrial landscape, where understanding the interplay of buyer power, supplier leverage, and competitive rivalry is crucial. This initial glimpse highlights the key pressures Crane NXT faces, but the true depth of its strategic positioning lies beneath the surface.

The complete Porter's Five Forces Analysis for Crane NXT unpacks the nuanced threat of new entrants and the ever-present danger of substitutes. Equip yourself with the comprehensive intelligence needed to navigate Crane NXT's competitive environment and make informed strategic decisions.

Suppliers Bargaining Power

Supplier concentration for specialized materials, like those Crane NXT needs for micro-optics and banknote security, can be a significant factor. When only a handful of companies provide these essential components, they gain more leverage, which can drive up costs or disrupt the flow of materials.

For instance, in 2024, the global market for advanced optical components, crucial for security features, is dominated by a few key players. This limited supply base means Crane NXT must carefully manage relationships to ensure consistent access and favorable pricing for these critical inputs.

Crane NXT’s strategy to mitigate this risk involves sourcing a wide range of raw materials, including steel, copper, aluminum, and petroleum-based products, from various global suppliers. This diversification helps reduce reliance on any single source and strengthens its position when negotiating terms.

Crane NXT faces significant switching costs when sourcing unique security features and payment system components. These costs can include substantial expenses for re-tooling manufacturing lines, obtaining new certifications, or even redesigning their products to accommodate alternative suppliers. For instance, if a key supplier for their advanced currency validation technology changes terms, Crane NXT might incur millions in re-engineering and testing to integrate a new solution, thereby empowering the existing supplier.

Suppliers offering proprietary technologies or highly specialized components vital to Crane NXT's secure, detect, and authenticate solutions wield significant bargaining power. This is especially true for Crane Currency's advanced security features embedded in banknotes, where unique inputs are paramount.

The greater the uniqueness and indispensability of a supplier's input, the stronger their position to negotiate terms. For instance, if a supplier holds patents on a critical security printing technique or a unique material used in banknote authentication, Crane NXT's reliance on that input increases the supplier's leverage.

In 2024, Crane NXT's reliance on specialized inputs for its high-security printing and detection technologies means that suppliers of these niche components can command higher prices and more favorable contract terms, directly impacting Crane NXT's cost structure and operational flexibility.

Threat of Forward Integration by Suppliers

The threat of forward integration by suppliers for Crane NXT is generally considered low. This is because the industries Crane NXT operates in, such as secure printing and payment technology, are highly specialized. These sectors demand substantial capital investment and deep technical expertise, creating significant barriers to entry for potential suppliers looking to move into Crane NXT's market space.

If suppliers were to successfully integrate forward, they would essentially become direct competitors, producing security features or payment solutions themselves. This capability directly enhances their bargaining power, as they could threaten to capture a portion of Crane NXT's customer base or market share. However, the high costs and specialized knowledge required for such a move make this an unlikely scenario for most of Crane NXT's suppliers.

- High Capital Requirements: Developing advanced secure printing and payment technologies often necessitates significant upfront investment in research and development, specialized manufacturing equipment, and robust cybersecurity infrastructure.

- Specialized Expertise: The payment and security industries rely on niche technical skills, including cryptography, secure coding, and compliance with complex regulatory frameworks, which are not easily acquired.

- Limited Supplier Capabilities: Most suppliers in these fields focus on providing components or specific services, rather than possessing the integrated capabilities needed to offer a complete end-to-end solution like Crane NXT.

Importance of Crane NXT to Suppliers

The significance of Crane NXT as a customer directly impacts its suppliers' bargaining power. If Crane NXT constitutes a substantial portion of a supplier's overall revenue, that supplier will likely have less leverage to dictate terms or pricing. This is because losing Crane NXT as a client would represent a significant financial blow.

Conversely, if Crane NXT is only a small part of a supplier's business, the supplier might be less inclined to offer favorable terms or discounts. In such scenarios, the supplier has less to lose by being firm on pricing and conditions, as their overall business isn't heavily reliant on Crane NXT's patronage.

For example, if a key component supplier for Crane NXT generated 40% of its sales from Crane NXT in 2024, that supplier's bargaining power would be considerably diminished. However, if that same supplier's sales to Crane NXT represented only 5% of its total revenue, it would likely possess greater bargaining power.

- Supplier Dependence: Crane NXT's revenue contribution to its suppliers is a critical factor.

- Impact on Negotiation: High dependence weakens supplier leverage; low dependence strengthens it.

- 2024 Data Example: A supplier relying on Crane NXT for 40% of its 2024 revenue has less power than one relying on 5%.

Suppliers of highly specialized materials and proprietary technologies critical to Crane NXT's secure printing and payment solutions hold significant bargaining power. This is amplified when these inputs are unique, patented, or difficult to substitute, as seen in 2024 with advanced optical components for banknote security, where a concentrated supplier base allows for higher pricing and stringent terms.

Crane NXT faces substantial switching costs for these specialized inputs, involving re-tooling, certifications, and potential product redesigns, which further strengthens supplier leverage. The threat of forward integration by suppliers remains low due to the high capital requirements and specialized expertise needed in Crane NXT's niche markets.

The bargaining power of Crane NXT's suppliers is also influenced by Crane NXT's importance as a customer; a supplier with a large portion of its revenue tied to Crane NXT has less power, whereas a supplier with minimal dependence on Crane NXT can dictate terms more forcefully.

What is included in the product

This analysis unpacks the competitive forces impacting Crane NXT, detailing the intensity of rivalry, the bargaining power of buyers and suppliers, the threat of new entrants, and the availability of substitutes.

Instantly identify and mitigate competitive threats with a dynamic, visual representation of all five forces.

Customers Bargaining Power

Crane NXT's customer concentration, particularly with government entities like the U.S. government for banknote production, presents a significant source of bargaining power for these customers. This concentration means that a substantial portion of Crane NXT's revenue can be tied to a limited number of large clients.

The reliance on a few major customers, especially those with critical infrastructure needs such as currency printing, allows these clients to negotiate favorable pricing and contract terms. For instance, in 2024, the U.S. Treasury Department's Bureau of Engraving and Printing continues to be a primary purchaser of banknote paper, giving them considerable leverage in their dealings with suppliers like Crane NXT.

The costs for governments and businesses to transition away from Crane NXT's secure solutions and payment systems are substantial. These high switching costs stem from the need to re-engineer existing infrastructure, ensure ongoing regulatory compliance, and manage complex security implications, making a move to a competitor a significant undertaking.

For instance, integrating new payment hardware and software often requires extensive testing and validation, which can take months and cost millions, especially in highly regulated sectors. This financial and operational barrier significantly diminishes the bargaining power of Crane NXT's customers, as the effort and expense involved in switching make it an unattractive option.

Crane NXT's customers show diverse price sensitivities. Government entities, particularly those procuring currency validation and processing equipment for national treasuries, often place a higher premium on security, accuracy, and long-term reliability than on immediate cost savings. This is evident in the stringent specifications and rigorous testing required for such contracts.

Conversely, clients in the commercial payment solutions sector, such as retail banks or payment processors, are generally more price-sensitive. These customers face intense competition and often seek solutions that offer a strong return on investment, making them more receptive to competitive pricing and volume discounts. For instance, in 2024, the payment processing industry saw significant price competition, influencing purchasing decisions for hardware and software solutions.

Threat of Backward Integration by Customers

The threat of customers integrating backward, meaning they start producing their own security features or payment solutions, is generally low for Crane NXT's highly specialized offerings. This is because the capital investment required for advanced secure printing and payment technology is substantial, often running into millions of dollars for specialized equipment and facilities.

Furthermore, the deep technical expertise and proprietary knowledge needed to develop and maintain these sophisticated security features present a significant barrier. Crane NXT operates in a domain where intricate knowledge of materials science, cryptography, and secure manufacturing processes is paramount.

Stringent regulatory requirements and compliance standards, particularly in the financial and government sectors where Crane NXT's products are often used, add another layer of complexity. For instance, meeting PCI DSS compliance for payment solutions or specific government security printing mandates requires dedicated teams and ongoing investment in audits and certifications.

- High Capital Investment: Establishing secure printing and payment solution manufacturing can cost upwards of $50 million for advanced facilities.

- Technical Expertise Barrier: Developing proprietary security features requires specialized knowledge in areas like advanced polymer science and embedded security.

- Regulatory Hurdles: Compliance with global standards like ISO 27001 and specific national security printing regulations is costly and time-consuming.

Customer Information and Access to Alternatives

Customers armed with detailed market pricing, competitor offerings, and available alternative technologies naturally wield greater bargaining power. This is particularly true for sophisticated buyers who can easily compare Crane NXT's products and services against those of rivals.

For Crane NXT, key customers like large government agencies and major corporations often possess significant resources for market research. This allows them to thoroughly understand pricing benchmarks and the value proposition of competing solutions, thereby enhancing their negotiation leverage. For instance, in the defense sector, where Crane NXT operates, procurement processes often involve extensive competitive bidding, giving informed customers significant power to dictate terms.

- Informed Buyers: Customers with access to market price data and competitor analysis can negotiate more effectively.

- Government and Corporate Clients: Crane NXT's major clients are typically well-resourced and conduct thorough due diligence, increasing their bargaining strength.

- Competitive Landscape: The availability of viable alternatives in Crane NXT's markets empowers customers to demand better pricing and terms.

Crane NXT's bargaining power of customers is moderate, influenced by customer concentration and price sensitivity. While large government clients like the U.S. Treasury have significant leverage due to their volume and the high switching costs, commercial clients in payment solutions are more price-sensitive, especially in 2024's competitive market.

The threat of backward integration by customers is low due to the substantial capital investment and specialized expertise required for Crane NXT's secure solutions. For example, setting up advanced secure printing facilities can cost over $50 million, a significant barrier for most potential competitors or customers looking to self-produce.

Customers' ability to compare offerings and access market pricing also enhances their bargaining power. Crane NXT's major clients, often well-resourced government agencies and corporations, conduct extensive due diligence, allowing them to negotiate more effectively based on competitive benchmarks.

| Customer Segment | Price Sensitivity | Bargaining Power Influence | Key Considerations |

|---|---|---|---|

| Government (e.g., U.S. Treasury) | Low to Moderate | High | High volume, critical infrastructure needs, stringent security requirements, high switching costs. |

| Commercial Payment Solutions (e.g., Banks) | Moderate to High | Moderate | Price competition, ROI focus, need for efficient payment processing hardware and software. |

| General Market Buyers | Moderate | Moderate | Access to market pricing, competitor analysis, value proposition assessment. |

Preview the Actual Deliverable

Crane NXT Porter's Five Forces Analysis

This preview displays the complete, professionally crafted Porter's Five Forces analysis for Crane NXT, offering an in-depth examination of the competitive landscape. The document you see here is precisely what you will receive immediately after purchase, ensuring full transparency and immediate usability. You'll gain access to a comprehensive breakdown of industry rivalry, the threat of new entrants, the bargaining power of buyers and suppliers, and the threat of substitute products, all formatted and ready for your strategic planning.

Rivalry Among Competitors

Crane NXT operates within markets characterized by a number of established competitors, which naturally intensizes competitive rivalry. In the specialized area of currency printing, for instance, significant players like Giesecke+Devrient (G+D), Note Printing Australia, and De La Rue are active. These companies possess considerable experience and global reach, directly impacting Crane NXT's market share and pricing power.

Furthermore, the Crane Payment Innovations segment faces competition from a diverse set of companies. This includes entities such as Gusto, Jack Henry & Associates, SpotOn, and StoneX, among others. The existence of multiple, well-resourced competitors across its operational segments means Crane NXT must continually innovate and maintain cost efficiencies to remain competitive.

The growth rate of the secure, detect, and authenticate solutions market directly impacts how fiercely companies compete. When the market is expanding robustly, there's typically enough business for everyone, which tends to keep rivalry in check. However, in slower-growth or declining markets, companies often become more aggressive, battling harder for each available customer, thus intensifying competition.

The security printing market, a key segment for companies like Crane NXT, is generally projected for growth. For instance, the global secure document market was valued at approximately $30 billion in 2023 and is expected to grow at a CAGR of around 5% through 2028. Despite this overall positive outlook, certain factors, such as a potential decline in traditional print volumes for some applications, could still lead to heightened competitive pressures as firms vie for a shrinking piece of specific print-related markets.

Crane NXT differentiates its products through proprietary micro-optics and advanced process flow technologies, crucial for security and payment solutions. This focus on unique features, like enhanced banknote security or cutting-edge contactless payment systems, helps to lessen direct competition by offering distinct advantages to customers.

Exit Barriers

High exit barriers can trap even struggling competitors within the secure printing and payment technology market, thereby intensifying rivalry for companies like Crane NXT. These barriers often stem from specialized, capital-intensive assets, like advanced printing presses or secure data processing infrastructure, which have limited alternative uses. For instance, in 2024, the global secure printing market, valued at approximately $40 billion, features significant investments in proprietary technology and specialized machinery.

Furthermore, long-term contracts and regulatory commitments can act as substantial exit barriers. Companies might be bound by agreements to supply specific security features or maintain certain operational standards for governments or financial institutions. Failure to fulfill these obligations can lead to severe penalties, making it economically unfeasible to exit the market prematurely. This contractual lock-in ensures that even companies experiencing declining profitability remain active participants, continuing to exert competitive pressure.

- Specialized Assets: High upfront investment in unique machinery and technology for secure printing.

- Long-Term Contracts: Commitments to supply secure documents or payment solutions for extended periods.

- Regulatory Compliance: Adherence to stringent security and data protection regulations that are costly to abandon.

- Brand Reputation: The risk of damaging a brand's reputation by prematurely exiting key markets or contracts.

Strategic Stakes

The markets Crane NXT serves, particularly in the defense and aerospace sectors, are highly strategic. Competitors recognize these areas as crucial for sustained growth and technological advancement, leading to intense rivalry. This strategic importance fuels aggressive competition through pricing strategies, significant investments in research and development, and strategic acquisitions.

For instance, the global defense market was valued at approximately $2.2 trillion in 2023 and is projected to grow, making it a prime battleground for companies like Crane NXT and its rivals. Companies are vying for market share and technological dominance, especially in areas like advanced materials and propulsion systems, which are critical for future defense capabilities.

- Defense Market Growth: The global defense market's projected growth underscores the high stakes for players like Crane NXT.

- Technological Leadership: Competitors are aggressively pursuing R&D to secure leadership in advanced technologies relevant to Crane NXT's core markets.

- Strategic Acquisitions: The pursuit of market share and technological edge often leads to consolidation through acquisitions within the defense and aerospace industries.

- Pricing Pressure: The strategic nature of these markets can result in intensified pricing competition as companies seek to win contracts and gain a foothold.

Competitive rivalry for Crane NXT is significant due to established players in currency printing like Giesecke+Devrient and De La Rue, and numerous competitors in payment innovations such as Gusto and Jack Henry & Associates. The overall secure document market, valued at approximately $30 billion in 2023 with a projected 5% CAGR through 2028, indicates robust growth but also intense competition for market share. High exit barriers, including specialized assets and long-term contracts, keep even less profitable firms engaged, intensifying rivalry.

| Competitor | Primary Market Segment | Key Differentiators |

|---|---|---|

| Giesecke+Devrient (G+D) | Currency Printing, Secure Documents | Global reach, extensive experience in banknote security features |

| De La Rue | Currency Printing, Security Features | Long history in banknote and identity document security |

| Gusto | Payment Innovations (POS, Payment Processing) | Integrated payroll and payment solutions for small businesses |

| Jack Henry & Associates | Payment Innovations (Financial Institution Technology) | Core processing and technology solutions for banks and credit unions |

SSubstitutes Threaten

The threat of substitutes for Crane NXT's businesses is significant. For Crane Currency, the increasing global adoption of central bank digital currencies (CBDCs) and the broader trend towards cashless societies directly challenge the demand for physical banknotes. For instance, several countries, including China with its digital yuan, are actively piloting and expanding CBDC usage, potentially diminishing the long-term need for printed currency.

Crane Payment Innovations faces substitutes from a rapidly evolving digital payments landscape. Mobile payment solutions like Apple Pay and Google Pay, alongside peer-to-peer payment apps, offer convenient alternatives to traditional cash or card transactions. The growth of fintech innovation continues to introduce new payment methods, creating a competitive pressure that could impact the reliance on Crane's existing payment technologies.

The attractiveness of substitutes for Crane NXT's payment solutions hinges on their relative price and performance. If digital payment alternatives, such as mobile wallets or contactless cards, offer superior convenience, reduced transaction fees, or improved security features, they represent a substantial threat.

Crane NXT's strategic emphasis on advanced security and robust performance is designed to bolster the perceived value and necessity of its hardware-based payment systems. For instance, in 2024, the global digital payments market saw continued growth, with transaction volumes projected to reach trillions, highlighting the increasing adoption of alternative payment methods.

Customers are increasingly open to alternatives if they offer greater convenience, build trust, and are easy to understand technologically. This willingness to switch is a key driver in assessing the threat of substitutes.

The rapid shift towards digital payments, with a significant portion of global transactions now occurring online, highlights this trend. For instance, in 2024, the global digital payments market was projected to reach over $11 trillion, demonstrating a clear customer comfort with non-traditional payment methods.

Furthermore, government pushes for central bank digital currencies (CBDCs) and the general public’s growing familiarity with digital wallets and online banking further reduce the perceived barriers to adopting substitute payment solutions.

Switching Costs for Customers to Adopt Substitutes

While adopting new payment technologies can incur initial setup expenses, the enduring advantages of digital solutions often eclipse these, effectively diminishing the perceived switching costs for consumers over the long haul. For instance, the convenience and enhanced security offered by contactless payments or mobile wallets can make the transition from traditional cash or card methods increasingly appealing.

The societal move away from physical cash represents a significant, albeit gradual, substitution impacting the currency handling industry. In 2023, the Bank for International Settlements (BIS) reported that while cash usage remained prevalent in some regions, digital payment volumes continued their upward trajectory globally, indicating a sustained shift in consumer behavior.

- Decreasing Digital Adoption Costs: As digital payment infrastructure matures, initial setup and integration costs for businesses and consumers are expected to decline, further reducing barriers to switching.

- Evolving Consumer Preferences: A growing preference for speed, convenience, and integrated digital experiences drives adoption of substitute payment methods, making traditional currency less attractive for certain transactions.

- Impact of Digital Currencies: The potential rise of central bank digital currencies (CBDCs) and widespread adoption of stablecoins could further accelerate the shift away from physical banknotes, presenting a significant substitute threat.

Technological Advancements in Substitutes

Rapid advancements in technology are significantly increasing the threat of substitutes for Crane NXT's offerings. For instance, blockchain technology is enabling new forms of digital currencies and secure transaction methods that could bypass traditional payment systems. By the end of 2024, the global blockchain market is projected to reach over $15 billion, highlighting the rapid growth and potential disruption.

Biometric authentication, such as fingerprint and facial recognition, offers increasingly secure and convenient alternatives to physical key systems or traditional access controls, areas where Crane NXT has a strong presence. The global biometrics market was valued at approximately $35 billion in 2023 and is expected to grow substantially, presenting a direct substitute threat.

Furthermore, the continuous improvement in online payment security and digital wallet solutions provides readily available substitutes for physical currency handling and transaction processing. As of early 2025, digital payment transaction volumes continue to surge globally, indicating a growing preference for digital alternatives.

- Technological Disruption: Blockchain, biometrics, and advanced digital payments are emerging as potent substitutes.

- Market Growth of Substitutes: The blockchain market is projected to exceed $15 billion by the end of 2024, while the biometrics market reached around $35 billion in 2023.

- Competitive Imperative: Crane NXT must prioritize ongoing innovation to maintain its competitive edge against these rapidly evolving technological alternatives.

The threat of substitutes for Crane NXT is substantial, driven by digital payment evolution and new technologies. For Crane Currency, the rise of Central Bank Digital Currencies (CBDCs) poses a direct challenge to physical banknotes, with countries like China actively piloting their digital yuan. Crane Payment Innovations faces substitutes from mobile payment solutions and peer-to-peer apps, a trend underscored by the global digital payments market projected to exceed $11 trillion in 2024.

| Substitute Category | Examples | Market Data/Trend (2023-2024) | Impact on Crane NXT |

| Digital Currencies | CBDCs, Stablecoins | China's digital yuan pilots expanding; Global digital payments market projected >$11 trillion (2024) | Reduced demand for physical banknotes |

| Digital Payment Solutions | Mobile Wallets (Apple Pay, Google Pay), P2P Apps | Continued growth in transaction volumes; Increasing consumer preference for convenience | Pressure on traditional payment hardware |

| Emerging Technologies | Blockchain, Biometrics | Blockchain market projected >$15 billion (2024); Biometrics market ~$35 billion (2023) | Potential bypass of traditional systems; Secure alternatives to physical access |

Entrants Threaten

The secure printing and payment technology sectors, especially those dealing with high-security items like banknotes, demand significant upfront capital. This includes investments in specialized manufacturing equipment, ongoing research and development, and robust, secure facilities. For instance, the global banknote printing market, a key area for Crane NXT, is characterized by these extensive capital needs.

Established players like Crane NXT leverage significant economies of scale in manufacturing, research and development, and global distribution networks. For instance, their extensive production capacity for banknote paper and security features allows for lower per-unit costs, a barrier that new entrants would struggle to surmount. This cost advantage is crucial in competitive markets where price is a key differentiator.

Crane NXT's significant investment in proprietary technology, particularly in micro-optics and advanced security features for currency handling, creates a formidable barrier for potential new entrants. The company holds numerous patents and trade secrets protecting its specialized payment technologies, making it difficult and costly for newcomers to develop comparable products. For instance, their expertise in creating intricate optical security features, which are crucial for preventing counterfeiting in currency processing, is a key differentiator that requires substantial R&D and manufacturing precision.

Access to Distribution Channels

Crane NXT's access to distribution channels, particularly for its payment solutions, presents a significant barrier to new entrants. Building relationships with central banks, governments, and various industries is a time-consuming and intricate undertaking. For instance, securing contracts with national mints or major financial institutions requires extensive vetting and proven reliability, which new companies lack.

Newcomers would struggle to replicate Crane NXT's established networks and the trust it has cultivated over years of operation. This deep integration into critical financial infrastructure means that gaining comparable market access would be exceptionally difficult and costly. In 2023, the global payment solutions market saw significant investment, but dominance remains with established players who have these deep-rooted channel relationships.

- Established Relationships: Crane NXT has long-standing ties with central banks and government entities for currency processing and management.

- Industry Penetration: The company serves a diverse range of industries requiring secure payment and cash handling solutions.

- Trust and Reliability: Years of consistent performance have built significant trust, a key factor in securing and maintaining distribution channels.

Regulatory and Compliance Barriers

Crane NXT operates in sectors like secure printing for currency and payment processing, which are heavily regulated. These regulations, including stringent security standards and government mandates, act as significant hurdles for any new company looking to enter these markets.

For instance, compliance with Payment Card Industry Data Security Standard (PCI DSS) is essential for payment processing, and failing to meet these requirements can result in hefty fines, as seen in various data breach incidents. In 2023, the global cybersecurity market was valued at over $200 billion, with a significant portion dedicated to compliance and security infrastructure, highlighting the substantial investment required.

- High Capital Investment: Meeting regulatory requirements necessitates substantial upfront investment in secure facilities, advanced technology, and specialized personnel.

- Certification Hurdles: Obtaining necessary certifications, such as those for secure printing or payment processing, can be a lengthy and complex process.

- Ongoing Compliance Costs: Beyond initial setup, continuous adherence to evolving regulations and security protocols incurs ongoing operational expenses.

The threat of new entrants for Crane NXT is relatively low due to substantial barriers. High capital requirements for specialized equipment and secure facilities, coupled with significant R&D investments in proprietary security technologies, make market entry difficult. For example, the global banknote printing market, a core area for Crane NXT, demands extensive upfront capital for advanced manufacturing and security features.

Existing economies of scale in production and distribution, along with established relationships with central banks and governments, further deter new players. Crane NXT's patented technologies and deep industry penetration, built over years of operation, create a strong competitive moat. In 2023, the payment solutions market saw continued dominance by established entities with these deep-rooted channel relationships.

Stringent regulatory environments and compliance costs, such as PCI DSS for payment processing, add another layer of difficulty. Obtaining necessary certifications is a lengthy and complex process, requiring substantial investment in secure infrastructure and specialized personnel. The global cybersecurity market, valued at over $200 billion in 2023, underscores the significant investment needed for compliance.

| Barrier Type | Description | Impact on New Entrants |

|---|---|---|

| Capital Requirements | High investment in specialized equipment, R&D, and secure facilities for banknote and payment technology. | Significant financial hurdle, limiting the number of potential entrants. |

| Proprietary Technology & IP | Patents and trade secrets in micro-optics and advanced security features for currency. | Makes it costly and time-consuming for newcomers to develop comparable offerings. |

| Economies of Scale | Lower per-unit costs achieved through large-scale manufacturing and distribution. | New entrants struggle to match the cost advantages of established players. |

| Distribution Channels & Relationships | Established networks with central banks, governments, and financial institutions. | Difficult and time-consuming for new companies to gain market access and trust. |

| Regulatory Compliance | Adherence to strict security standards and government mandates in secure printing and payment processing. | Requires substantial investment and can be a lengthy certification process. |

Porter's Five Forces Analysis Data Sources

Our Porter's Five Forces analysis for Crane NXT is built upon a foundation of comprehensive data, including Crane NXT's annual reports and SEC filings, alongside industry-specific research from sources like IBISWorld and market intelligence platforms.