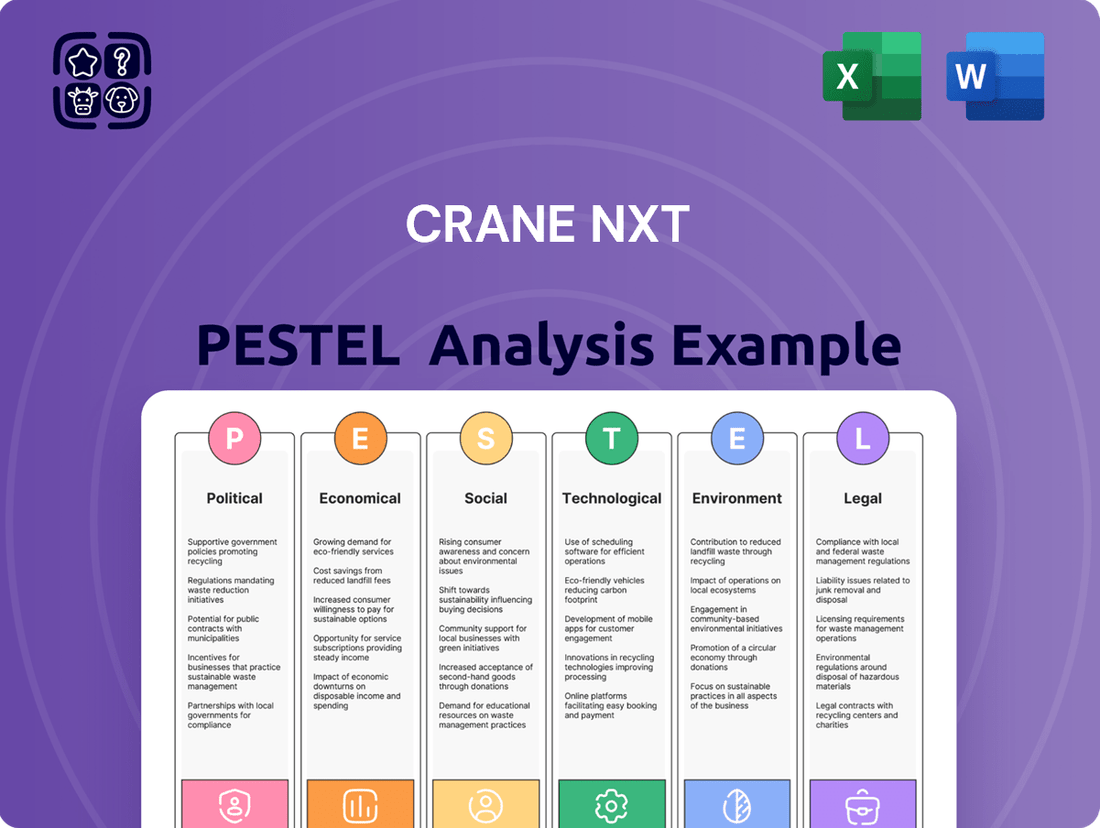

Crane NXT PESTLE Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Crane NXT Bundle

Unlock the strategic roadmap for Crane NXT by understanding the critical Political, Economic, Social, Technological, Environmental, and Legal forces at play. This comprehensive PESTLE analysis reveals how these external factors are shaping the company's operational landscape and future growth. Equip yourself with actionable intelligence to anticipate challenges and seize opportunities—download the full version now.

Political factors

Government policies significantly shape the landscape for currency production, influencing everything from design and security features to the sheer volume of banknotes printed. Crane NXT, as a key player in supplying banknotes and advanced security features, must remain agile to adapt to evolving governmental directives. For instance, a shift by a major central bank towards polymer banknotes, a trend seen in countries like Canada and Australia, could alter demand for traditional cotton-based paper and necessitate investment in new production capabilities.

The ongoing evolution of anti-counterfeiting technology, often driven by government mandates to protect national economies, directly impacts Crane NXT's product development and sales. Countries are increasingly adopting sophisticated security elements like holographic foils and advanced intaglio printing. The global market for currency paper and security features is substantial, with estimates suggesting it will continue to grow, driven by the need for secure physical cash in many economies, even as digital payments gain traction. For example, the Bank of England's continued use of polymer notes, introduced in 2016, highlights a sustained governmental preference for more durable and secure currency.

The effectiveness of anti-counterfeiting legislation and its enforcement significantly impacts the demand for Crane NXT's secure currency features. Stronger laws and more robust enforcement globally encourage governments to invest in sophisticated security technologies, directly benefiting Crane NXT's business.

For instance, the Interpol Global Complex for Innovation reported a 30% increase in seized counterfeit goods between 2022 and 2023, highlighting a growing global effort against illicit trade. This trend suggests an increased market opportunity for companies like Crane NXT that provide advanced anti-counterfeiting solutions.

Conversely, if anti-counterfeiting measures are weak or poorly enforced, the perceived necessity for high-security features in currency might diminish, potentially impacting Crane NXT's sales in certain regions.

Global geopolitical stability directly influences Crane NXT's international operations and its ability to secure government contracts, a significant portion of its business. For instance, the ongoing conflicts and trade tensions in various regions in 2024 and early 2025 create uncertainty for supply chains and client confidence.

Trade policies, including tariffs and sanctions, can significantly impact Crane NXT's cost of goods and market access. For example, changes in trade agreements or the imposition of new tariffs in key markets could increase the cost of specialized security components or hinder the export of its products.

Maintaining stable international trade relations is paramount for Crane NXT's global market presence and revenue generation. The company's reliance on international markets for both sourcing materials and selling its advanced security solutions means that disruptions to trade flows, such as those experienced in late 2023 and continuing into 2024, pose a direct risk to its operational efficiency and profitability.

Regulatory Environment for Payment Systems

The political will to regulate digital payments and financial transactions directly impacts Crane NXT's payment innovations. Governments are increasingly focused on data security and consumer protection in the digital realm, which necessitates robust compliance measures for companies like Crane NXT. For instance, the European Union's Digital Operational Resilience Act (DORA), which came into full effect in January 2025, imposes stringent ICT risk management requirements on financial entities, including those involved in payment systems.

Policies promoting financial inclusion and the adoption of new payment technologies present both opportunities and compliance challenges. Governments worldwide are encouraging digital payment adoption to boost economic activity and reduce reliance on cash. In India, the Unified Payments Interface (UPI) has seen exponential growth, with over 120 billion transactions recorded in 2023, demonstrating the impact of supportive government policies on digital payment ecosystems.

Crane NXT must navigate varying governmental stances on cash versus cashless societies. While many nations are pushing towards digital transactions, the continued relevance of cash in certain markets influences the demand for cash handling technologies. For example, while the UK aims to become a cashless society, cash usage still accounts for a significant portion of transactions for specific demographics, affecting the market for Crane NXT's legacy and innovative solutions.

- Regulatory Landscape: The global trend towards stricter data security and financial transaction regulations, exemplified by the EU's DORA (effective January 2025), directly affects Crane NXT's operational and product development strategies.

- Digital Payment Adoption: Government initiatives supporting financial inclusion and digital payment growth, such as India's UPI which processed over 120 billion transactions in 2023, create significant market opportunities for Crane NXT's payment solutions.

- Cash vs. Cashless Stance: The varying political will to transition to cashless societies, with some nations like the UK still seeing substantial cash usage, necessitates Crane NXT's continued adaptation of its product portfolio to meet diverse market needs.

Government Spending and Budget Priorities

Government spending on defense and financial infrastructure directly impacts Crane NXT's currency division. For instance, the U.S. government allocated approximately $886 billion to defense in fiscal year 2024, a significant portion of which could fund new currency designs and security features. Shifts in these budget priorities, such as increased focus on national security or economic resilience, can directly translate into higher demand for Crane NXT's specialized products and services.

Conversely, economic austerity measures or a reallocation of public funds away from infrastructure projects might temper demand. For example, if a major trading partner implements strict budget cuts, it could reduce their investment in modernizing payment systems, impacting Crane NXT's sales in that region. The company's performance is therefore closely tied to the fiscal health and spending decisions of governments worldwide.

Key government spending areas influencing Crane NXT include:

- National Security Budgets: Increased spending often leads to demand for advanced security features in currency and identity documents.

- Infrastructure Investment: Government funding for financial infrastructure modernization can drive demand for payment system components.

- Fiscal Policy Changes: Austerity measures can reduce government procurement of currency and related technologies.

- Economic Stimulus Packages: These can indirectly boost economic activity, potentially increasing the circulation of currency and demand for production.

Government policies on currency design and security features directly influence Crane NXT's product development and demand. For instance, the Bank of England's continued use of polymer notes, introduced in 2016, demonstrates a sustained governmental preference for more durable and secure currency, impacting the market for paper versus polymer substrates.

The global regulatory environment for digital payments, highlighted by the EU's Digital Operational Resilience Act (DORA) effective January 2025, mandates stringent ICT risk management for companies like Crane NXT. Simultaneously, government initiatives promoting digital payment adoption, such as India's UPI which saw over 120 billion transactions in 2023, create significant market opportunities for Crane NXT's payment solutions.

Geopolitical stability and trade policies are critical for Crane NXT's international operations, with ongoing trade tensions in 2024 impacting supply chains and market access. Government spending on national security and financial infrastructure, with the U.S. defense budget at approximately $886 billion for fiscal year 2024, can directly translate into increased demand for Crane NXT's advanced security features and currency production capabilities.

What is included in the product

This PESTLE analysis provides a comprehensive examination of how external macro-environmental factors impact Crane NXT across Political, Economic, Social, Technological, Environmental, and Legal dimensions.

The Crane NXT PESTLE Analysis offers a clear, summarized version of complex external factors, making it easy to reference during meetings and presentations, thereby alleviating the pain point of information overload.

Economic factors

Global economic growth directly impacts Crane NXT's market. For instance, the International Monetary Fund (IMF) projected global growth at 3.2% for both 2024 and 2025, indicating a steady environment for consumer spending and business investment, which are key drivers for demand in payment solutions.

Persistent inflation presents a challenge. If inflation remains elevated, it could increase Crane NXT's operational costs for raw materials and labor. For example, the US experienced a CPI of 3.4% in April 2024, illustrating the ongoing inflationary pressures that businesses must navigate, potentially impacting profit margins.

Economic slowdowns can dampen demand for new currency handling equipment and system upgrades. A significant global recession, if it were to occur, would likely see reduced capital expenditure by financial institutions and businesses, directly affecting Crane NXT's order volumes.

Fluctuations in interest rates directly impact Crane NXT's cost of capital. For instance, if the Federal Reserve raises its benchmark interest rate, Crane NXT's borrowing costs for new projects or refinancing existing debt will likely increase. This can make significant capital expenditures, such as investing in new manufacturing facilities or advanced R&D for payment technologies, more expensive, potentially moderating the pace of expansion.

Access to affordable capital is a critical enabler for Crane NXT's innovation pipeline. In the 2024 fiscal year, a company like Crane NXT might see its weighted average cost of capital (WACC) rise if prevailing interest rates climb. This makes it imperative for the company to secure financing at favorable terms to fund its ongoing development of secure technologies and payment solutions, which are vital for maintaining its competitive edge.

Consumer spending habits are undergoing a significant transformation, with a pronounced shift towards digital and cashless transactions. This trend directly influences the demand for physical currency, a core product for Crane Currency. For instance, in the United States, the Federal Reserve reported that while cash is still used for small transactions, its overall share of payment transactions has been declining, especially among younger demographics. This evolving preference presents a nuanced economic landscape for Crane.

Crane Payment Innovations (CPI) is well-positioned to capitalize on the growth of digital payments, as it provides solutions for managing and processing these transactions. However, the broader economic impact of reduced cash usage in certain regions poses a challenge to Crane Currency's traditional business lines. The ongoing balance between the persistence of cash for specific uses and the accelerating adoption of digital payment methods is a critical economic factor shaping Crane NXT's market dynamics.

Government Fiscal Health and Currency Demand

The fiscal health of governments is a critical determinant of their capacity and inclination to invest in new banknotes and advanced security features. Nations exhibiting robust economic performance and consistent fiscal policies are more prone to initiate currency redesigns or place substantial orders for new currency products. For instance, in 2024, countries with significant budget surpluses or manageable national debt are better positioned to allocate funds towards such initiatives, potentially benefiting companies like Crane NXT that supply currency paper and security solutions.

Conversely, economic instability within client nations can lead to a reduction or postponement of orders for currency products. A country facing high inflation or a substantial budget deficit might defer currency upgrades, impacting demand for Crane NXT's services. For example, if a major client country experiences a significant economic downturn in 2025, it could directly translate into lower order volumes for new banknotes.

The demand for currency is also indirectly influenced by government fiscal health through its impact on currency value and stability. Strong fiscal management generally supports a stable or appreciating currency, which can encourage its use and demand both domestically and internationally. Conversely, fiscal irresponsibility can lead to currency depreciation, potentially reducing international demand for that nation's currency and, by extension, the need for new physical currency production.

- Government Spending on Currency: Countries with strong fiscal positions are more likely to fund currency modernization projects.

- Economic Impact on Orders: Fiscal instability in client nations can directly reduce or delay orders for currency products.

- Currency Demand and Fiscal Policy: Sound fiscal policies bolster currency value, indirectly influencing the demand for physical currency.

- 2024/2025 Outlook: Anticipated economic growth in developed nations may support increased currency orders, while emerging markets with fiscal challenges could see reduced demand.

Foreign Exchange Rates

As a global entity, Crane NXT navigates the complexities of foreign exchange rate fluctuations, which directly influence its financial performance. These shifts can significantly alter the reported revenues and profitability stemming from international sales, especially for Crane Currency's export activities. For instance, a stronger US dollar against other currencies can make Crane NXT's products more expensive for overseas buyers, potentially dampening demand.

Conversely, favorable exchange rates can enhance the competitiveness of Crane NXT's offerings in international markets. For example, if the Euro weakens against the US Dollar, European customers may find Crane NXT's products more affordable. This dynamic directly impacts the value of international earnings when they are converted back into Crane NXT's reporting currency, the US Dollar, affecting the company's overall financial statements.

The volatility in currency markets presents a continuous challenge. For the period ending March 31, 2024, Crane NXT reported that foreign currency translation adjustments had a net unfavorable impact on its financial results, highlighting the tangible effects of these fluctuations. The company actively manages this exposure through various hedging strategies to mitigate potential negative impacts.

- Impact on Revenue: Fluctuations in exchange rates, such as the US Dollar strengthening against the Euro, can decrease the reported value of sales made in Euros.

- Profitability Concerns: Unfavorable currency movements can erode profit margins on goods sold internationally, as the cost of goods sold in local currencies translates to a higher dollar cost.

- Competitive Positioning: A stronger domestic currency can make Crane NXT's products less price-competitive compared to local manufacturers in foreign markets.

- Hedging Strategies: Crane NXT utilizes financial instruments to hedge against adverse currency movements, aiming to stabilize earnings and reduce financial risk.

Global economic growth for 2024 and 2025 is projected to remain steady at 3.2%, according to the IMF, supporting demand for Crane NXT's payment and currency solutions. However, persistent inflation, with the US CPI at 3.4% in April 2024, increases operational costs and could squeeze profit margins.

Interest rate hikes, such as potential moves by the Federal Reserve, raise Crane NXT's cost of capital, making investments in R&D and expansion more expensive. The shift towards digital payments is impacting the demand for physical currency, a core product for Crane Currency, although Crane Payment Innovations is positioned to benefit from digital transaction management.

Government fiscal health is crucial, as stable economies are more likely to invest in currency upgrades. For instance, countries with strong fiscal positions in 2024 are better equipped to fund new banknote orders. Conversely, economic instability in client nations can lead to deferred or reduced orders, as seen with potential economic downturns impacting demand in 2025.

Foreign exchange rate fluctuations directly affect Crane NXT's international revenue and profitability. A stronger US dollar, for example, can make its products more expensive for overseas buyers, as observed with unfavorable currency translation adjustments impacting financial results in early 2024.

Same Document Delivered

Crane NXT PESTLE Analysis

The preview shown here is the exact document you’ll receive after purchase—fully formatted and ready to use. This comprehensive Crane NXT PESTLE analysis provides an in-depth look at the political, economic, social, technological, legal, and environmental factors impacting the company.

Sociological factors

Public confidence in the security of banknotes and the integrity of payment systems is crucial for Crane NXT. High levels of counterfeiting or security breaches can significantly erode this trust. For instance, reports in late 2023 and early 2024 highlighted ongoing concerns about sophisticated counterfeit operations globally, underscoring the need for advanced security features.

Erosion of trust can directly impact demand for Crane Currency's products, as consumers and governments seek more secure solutions. Conversely, a loss of faith in traditional currency could accelerate the adoption of alternative payment methods, such as digital currencies or mobile payments, potentially shifting market dynamics.

Societal trends are increasingly favoring convenience and speed, driving a significant shift towards digital and mobile payment solutions. This means fewer people are relying on physical cash for transactions.

This evolving landscape directly influences Crane NXT, particularly its Crane Payment Innovations division. While the move away from cash presents challenges for traditional cash-handling equipment, it also opens doors for Crane's digital payment technologies. For instance, by mid-2024, global mobile payment transaction volume was projected to reach over $10 trillion, highlighting the immense growth potential in this sector.

Crane NXT's ability to adapt and innovate in response to these shifting payment preferences will be critical for maintaining its market relevance and capitalizing on new opportunities. Companies that embrace digital solutions are better positioned for future growth.

Growing public awareness of cybersecurity risks and financial fraud is significantly shaping consumer and business expectations. This heightened vigilance directly fuels demand for more robust payment security and advanced authentication technologies. For instance, reports indicate a substantial increase in reported cybercrimes, with financial losses escalating globally, underscoring the urgency for secure solutions.

Crane NXT's core competencies in developing secure solutions align perfectly with this societal imperative. As individuals and organizations prioritize safeguarding their transactions and sensitive personal information, Crane NXT's expertise in secure detect and authenticate technologies becomes increasingly valuable. This societal trend directly validates and strengthens the market position of their offerings.

Demographic Shifts and Financial Inclusion

Aging populations in developed nations, such as Japan and parts of Europe, continue to rely on cash, presenting a steady market for cash handling solutions. For instance, in 2024, cash usage in the Eurozone remained significant, with banknotes accounting for a substantial portion of payment transactions for certain age groups.

Urbanization trends, particularly in emerging economies, are driving increased transaction volumes and a growing demand for efficient payment systems, both cash and digital. As cities expand, the need for reliable cash processing and dispensing technologies grows, even as digital payment adoption accelerates.

Digital literacy varies greatly; while younger, urban demographics readily adopt mobile payments and digital wallets, older or rural populations may still prefer or require cash-based transactions. Crane NXT must cater to this spectrum, ensuring its payment solutions are accessible and user-friendly for all, promoting financial inclusion.

- Demographic Trend: Global population aged 65+ projected to reach 1.6 billion by 2050, increasing demand for cash handling in certain segments.

- Urbanization Impact: Over 55% of the world's population lived in urban areas in 2023, a figure expected to rise, boosting transaction volumes.

- Digital Divide: In 2024, internet penetration varied significantly by age and region, highlighting the continued importance of cash for a portion of the population.

Demand for Secure Authentication in Daily Life

Societal expectations are increasingly leaning towards robust security beyond just financial transactions. People want assurance that their identities are protected and that the products they buy are legitimate. This growing demand for verifiable authenticity creates significant opportunities for companies like Crane NXT.

Crane NXT's advanced micro-optics and secure feature technologies are perfectly suited to address this expanding market. By applying their expertise, they can develop solutions that combat counterfeiting across various industries, ensuring consumers receive genuine goods and services. This diversification leverages their core competencies into new revenue streams.

For instance, the global market for anti-counterfeiting packaging solutions was valued at approximately $22.5 billion in 2023 and is projected to reach over $40 billion by 2030, indicating a strong growth trajectory. Crane NXT's ability to provide sophisticated, difficult-to-replicate security features can capture a significant portion of this expanding market.

- Growing Demand: Consumers and businesses alike are prioritizing secure authentication for identity, product provenance, and digital interactions.

- Counterfeit Market Impact: The World Customs Organization estimates that counterfeit goods account for up to 7% of global trade, highlighting a substantial need for anti-counterfeiting measures.

- Crane NXT's Advantage: The company's established expertise in micro-optics and secure printing can be adapted to protect a wide range of physical products, not just currency.

- Market Opportunity: The expansion of secure authentication needs into sectors like pharmaceuticals, luxury goods, and electronics presents a significant growth avenue for Crane NXT's innovative solutions.

Societal shifts towards digital payments are undeniable, with global mobile payment transaction volume projected to exceed $10 trillion by mid-2024. This trend impacts Crane NXT by potentially reducing demand for traditional cash handling, but also boosts opportunities in digital payment technologies.

Heightened awareness of cybersecurity and financial fraud fuels demand for advanced authentication. Crane NXT's secure detect and authenticate technologies align with this, as cybercrime losses continue to escalate globally.

Demographic shifts, like aging populations in developed nations, maintain a steady demand for cash handling, while urbanization in emerging economies increases overall transaction volumes, necessitating efficient payment systems.

Growing demand for verifiable authenticity across various sectors, from pharmaceuticals to luxury goods, presents a significant opportunity for Crane NXT's secure feature technologies, as the anti-counterfeiting market is expected to surpass $40 billion by 2030.

Technological factors

Crane NXT's currency division thrives on continuous innovation in anti-counterfeiting features. Advancements like sophisticated holograms, dynamic color-shifting inks, and intricate microscopic elements are vital to staying ahead of increasingly advanced counterfeiting methods. These technological arms races necessitate ongoing investment in research and development to maintain the security and integrity of the banknotes they produce, a key requirement for their government clients.

The payment sector is experiencing a whirlwind of technological change. Mobile payment adoption continues to surge, with global mobile payment transaction value projected to reach over $14 trillion by 2027, up from an estimated $11.5 trillion in 2024. Contactless payments are now commonplace, with a significant portion of card transactions utilizing this technology. Emerging areas like blockchain for secure transactions and biometric authentication for enhanced security are also gaining traction.

Crane NXT, through its Crane Payment Innovations segment, must actively embrace these shifts. Staying ahead means not just keeping pace but leading in the integration of these digital payment advancements into their cash handling and payment solutions. This includes developing robust and secure platforms capable of supporting the diverse and growing array of digital transaction methods to maintain market relevance and competitive advantage.

Crane NXT's mastery of micro-optics and process flow innovation is a cornerstone of its technological strength, allowing for advanced security features and streamlined production. For instance, the company's commitment to R&D in these areas directly impacts the intricate designs of its currency security features, a critical component in combating counterfeiting. Further investment in these specialized technologies is projected to yield enhanced product security and greater manufacturing efficiencies, potentially reducing production costs.

This technological prowess isn't confined to its traditional markets; Crane NXT can explore leveraging its micro-optics and process flow expertise in emerging sectors like secure identification or specialized industrial components. This strategic application of core competencies could unlock significant diversification opportunities, extending its reach beyond currency and payment systems. For example, advancements in micro-optics for banknote security could be adapted for high-security document verification in other industries.

Artificial Intelligence and Machine Learning in Security

Artificial intelligence (AI) and machine learning (ML) are revolutionizing security, offering Crane NXT significant opportunities to bolster its detect and authenticate solutions. These technologies excel at fraud detection by identifying anomalous transactions and user behaviors far faster than traditional methods. For instance, AI-powered fraud detection systems can analyze millions of data points in real-time, reducing false positives and improving the accuracy of identifying genuine threats. In 2024, the global AI in cybersecurity market was valued at approximately $27.2 billion, with projections indicating substantial growth, underscoring the increasing reliance on these advanced analytical capabilities.

By integrating AI and ML, Crane NXT can enhance its pattern recognition for authentication, creating more secure and seamless user experiences. This means AI can learn normal access patterns for users, flagging deviations that might indicate unauthorized access attempts. Furthermore, predictive analytics powered by AI can proactively identify potential security threats before they materialize, allowing for preemptive measures. This capability is crucial in industries where security breaches can have severe financial and reputational consequences. The speed and accuracy improvements offered by AI in identifying threats are paramount, as demonstrated by the ability of AI systems to detect sophisticated cyberattacks, such as zero-day exploits, that might evade conventional security protocols.

- Enhanced Fraud Detection: AI algorithms can process vast datasets to identify subtle fraudulent patterns, significantly improving accuracy and speed.

- Advanced Authentication: ML enables sophisticated behavioral biometrics and anomaly detection for more robust user verification.

- Predictive Threat Intelligence: AI can forecast potential security risks by analyzing global threat landscapes and internal system vulnerabilities.

- Market Growth: The AI in cybersecurity market, projected to reach over $100 billion by 2029, highlights the increasing demand for AI-driven security solutions.

Automation and Manufacturing Processes

Technological advancements in automation and manufacturing are significantly boosting efficiency and precision in producing banknotes and payment solutions. Crane NXT's adoption of smart factory initiatives and advanced robotics is a key driver here. For instance, investments in automated quality control systems can drastically reduce errors, leading to higher product integrity and fewer recalls.

Implementing cutting-edge manufacturing technologies directly translates to reduced production times and lower operational costs. This enhances Crane NXT's competitive edge in the market. By optimizing workflows through automation, the company can achieve faster turnaround for its clients, while simultaneously cutting down on labor and material waste, which is crucial in a cost-sensitive industry.

- Smart Factory Adoption: Crane NXT is integrating IoT sensors and data analytics into its manufacturing lines to monitor performance in real-time, enabling predictive maintenance and process optimization.

- Advanced Robotics: The company is deploying collaborative robots (cobots) for tasks requiring high precision and repetitive motion, improving both speed and accuracy in banknote production.

- Efficiency Gains: Automation is projected to increase manufacturing throughput by up to 15% in key production segments by the end of 2025, according to internal efficiency targets.

- Cost Reduction: Streamlined automated processes are expected to contribute to a 5-7% reduction in manufacturing overheads in the 2024-2025 fiscal year.

Technological advancements are pivotal for Crane NXT, particularly in developing sophisticated anti-counterfeiting features for currency. Innovations in micro-optics and process flow are key, enabling intricate designs that combat evolving counterfeiting techniques. Furthermore, the company's integration of AI and machine learning is enhancing its fraud detection capabilities, analyzing vast datasets to identify anomalies and bolster authentication security.

The payment sector's rapid digital transformation, marked by surging mobile and contactless payment adoption, necessitates Crane NXT's embrace of new technologies. This includes developing secure platforms for diverse digital transactions. Automation and advanced robotics in manufacturing are also critical, driving efficiency and precision in banknote production, with smart factory initiatives aimed at further optimizing operations.

| Technology Area | Impact on Crane NXT | Key Data/Projections |

|---|---|---|

| Anti-Counterfeiting Features | Enhanced security through micro-optics, holograms, and advanced inks. | Ongoing R&D investment critical for maintaining security integrity. |

| Digital Payments | Integration of mobile, contactless, and blockchain solutions. | Global mobile payment transaction value projected to exceed $14 trillion by 2027. |

| AI & Machine Learning | Improved fraud detection and authentication. | AI in cybersecurity market valued at $27.2 billion in 2024, growing rapidly. |

| Automation & Robotics | Increased manufacturing efficiency and precision. | Projected 15% throughput increase by end of 2025; 5-7% overhead reduction in 2024-2025. |

Legal factors

Global financial institutions are subject to increasingly stringent Anti-Money Laundering (AML) and Counter-Terrorism Financing (CTF) regulations. These rules demand robust security features within currency handling and payment processing systems. For instance, the Financial Action Task Force (FATF) continues to update its recommendations, influencing national legislation worldwide, with its 2024 guidance emphasizing enhanced due diligence for high-risk entities.

Crane NXT's offerings, particularly through Crane Currency and Crane Payment Innovations, are designed to align with these regulatory pressures. Their secure currency solutions and traceable payment technologies assist financial entities in meeting compliance requirements and mitigating risks associated with illicit financial flows. For example, advanced banknote security features contribute to preventing counterfeiting, a key aspect of AML efforts.

Navigating this intricate web of international legal frameworks is not merely a matter of compliance but a prerequisite for market participation and maintaining a strong corporate reputation. Failure to adhere to these evolving AML/CTF standards can result in significant financial penalties and reputational damage, impacting Crane NXT's global business operations and client trust.

Crane NXT's adherence to data privacy and security laws like GDPR and CCPA is critical. These regulations dictate the handling of sensitive customer and transactional data, impacting how Crane NXT operates globally. Failure to comply can lead to substantial financial penalties and damage to its brand image.

The global regulatory landscape for data privacy is constantly shifting, requiring ongoing vigilance and adaptation from companies like Crane NXT. For instance, the potential fines under GDPR can reach up to 4% of annual global turnover, a significant figure for any business. Similarly, CCPA in California imposes strict rules on data collection and consumer rights.

Protecting Crane NXT's intellectual property, particularly its advanced micro-optics, sophisticated security features, and innovative payment systems, is paramount to sustaining its market leadership. The company actively pursues patent protection to shield these core technologies.

Crane NXT's legal and patent enforcement strategies are crucial for deterring infringement and preserving the exclusivity of its proprietary innovations. This vigilance allows the company to fully leverage its significant investments in research and development.

Currency Issuance and Counterfeiting Laws

National laws dictate how currency is issued and designed, and these regulations directly affect Crane NXT's business. Stricter counterfeiting laws, for instance, can boost demand for Crane Currency's advanced security features. In 2024, many central banks continued to invest in banknote security upgrades to combat sophisticated counterfeit operations, a trend expected to persist through 2025.

Changes in legal requirements for banknote security, such as mandates for new anti-counterfeiting technologies, present significant opportunities for Crane NXT. For example, the introduction of new polymer substrates or enhanced optical security features by a major economy could drive substantial new contracts for Crane Currency. The legal framework underpinning physical currency ensures its integrity and public trust, making compliance and innovation in security paramount for Crane NXT's offerings.

- Legal Framework: National laws govern currency issuance, design, and penalties for counterfeiting, directly influencing Crane Currency's market.

- Demand Driver: Stricter anti-counterfeiting laws and regulations increase the demand for Crane NXT's advanced security features.

- Opportunity Creation: Evolving legal requirements for banknote security, such as new material or feature mandates, create openings for Crane NXT's innovative solutions.

- Legitimacy and Security: The legal structure provides the essential foundation for the legitimacy and security of physical money, vital for Crane NXT's product relevance.

Consumer Protection Regulations in Payments

Consumer protection regulations significantly shape how Crane Payment Innovations (CPI) designs its payment solutions. Rules governing transaction disputes, fraud liability, and fee transparency are paramount. For instance, the European Union's Payment Services Directive 2 (PSD2) mandates strong customer authentication, impacting how CPI's systems handle secure transactions. Compliance fosters consumer trust, a critical asset in the payments industry, and ensures the legal standing of CPI's offerings.

Navigating these regulations presents a complex challenge due to their jurisdictional variations. As of early 2024, the global landscape continues to evolve, with countries like the United States seeing increased scrutiny on digital payment practices and data privacy, such as through state-level initiatives mirroring aspects of the California Consumer Privacy Act (CCPA). This necessitates robust compliance frameworks for CPI's international operations.

- Consumer Protection Focus: Regulations prioritize consumer rights in payment disputes and fraud protection, influencing CPI's product development.

- Trust and Legality: Adherence to rules like PSD2 builds consumer confidence and ensures CPI's payment products operate legally.

- Global Complexity: Varying consumer protection laws across different countries, such as differing data privacy mandates, add significant operational complexity for CPI.

Crane NXT operates within a complex legal environment shaped by anti-money laundering (AML) and counter-terrorism financing (CTF) regulations globally. These laws directly impact Crane Currency's security features and Crane Payment Innovations' transaction processing, requiring robust compliance measures. For example, the Financial Action Task Force's 2024 updates continue to emphasize enhanced due diligence, influencing national legislation and demanding secure, traceable financial systems.

Data privacy laws like GDPR and CCPA are critical, setting standards for handling sensitive customer information. Non-compliance can lead to substantial fines, such as up to 4% of global turnover under GDPR, and reputational damage, underscoring the need for vigilant adaptation to evolving global privacy mandates through 2025.

Intellectual property laws are vital for protecting Crane NXT's technological innovations, including advanced security features and payment systems. The company's patent strategy is key to maintaining market leadership and deterring infringement, ensuring the exclusivity of its R&D investments.

Consumer protection regulations, such as PSD2 in Europe, influence payment solution design by mandating strong customer authentication and transparency. Adherence to these laws builds consumer trust and ensures legal operation, though jurisdictional variations create operational complexity for Crane NXT's global payment systems.

Environmental factors

The environmental footprint of banknote production, encompassing raw material sourcing, energy usage, and waste, is a growing concern for governments and the public. Crane Currency is feeling this pressure to implement greener methods, like using sustainable materials and improving manufacturing efficiency to lower its carbon impact.

Adopting environmentally responsible practices can offer a distinct edge in the market. For instance, many central banks are now setting targets for reducing emissions; the European Central Bank aims for climate neutrality by 2050, influencing their supply chain choices.

The energy footprint of payment systems, from sprawling data centers to ubiquitous point-of-sale terminals, is increasingly under environmental scrutiny. As global energy demand rises, Crane NXT may find itself needing to innovate towards more power-efficient payment technologies. This focus on efficiency is not just about regulatory compliance but also a strategic move to attract clients who prioritize sustainability, a trend gaining significant momentum in 2024 and projected to continue through 2025.

The environmental impact of currency, particularly at its end-of-life, is a growing concern. Disposing of worn-out banknotes, often through incineration or landfill, presents a significant waste management challenge. Crane NXT, as a key player in currency production, faces pressure to develop more sustainable solutions for currency destruction and recycling.

In 2024, central banks globally are increasingly focused on reducing the environmental footprint of their operations. For instance, the European Central Bank has been exploring options for more eco-friendly banknote materials and disposal methods. This trend suggests a market demand for innovations that facilitate easier recycling or even biodegradability of currency, aligning with Crane NXT's potential for future product development.

Environmental Regulations and Compliance

Crane NXT's manufacturing facilities operate under a complex web of environmental regulations, covering everything from air emissions and wastewater discharge to hazardous waste management and chemical substance control. For instance, in 2024, the U.S. Environmental Protection Agency (EPA) continued to enforce stringent standards under the Clean Air Act and Clean Water Act, impacting industrial processes. Failure to comply can result in substantial fines, operational shutdowns, and damage to the company's reputation. Crane NXT's commitment to environmental stewardship is therefore not just a matter of corporate responsibility but a critical operational necessity.

The ongoing evolution of environmental standards presents both challenges and opportunities for Crane NXT. As regulations tighten, particularly concerning greenhouse gas emissions and the use of certain chemicals, the company may need to invest in upgrading its manufacturing technologies and processes. For example, the push towards more sustainable manufacturing practices, driven by initiatives like the EU's Green Deal, could require significant capital expenditure in areas such as energy efficiency and waste reduction technologies. This proactive approach to environmental compliance is crucial for long-term operational viability and market competitiveness.

Crane NXT's proactive stance on environmental compliance is demonstrated through its ongoing efforts to minimize its ecological footprint. This includes initiatives focused on:

- Reducing energy consumption: Implementing energy-efficient machinery and processes across its global operations.

- Waste minimization and recycling: Developing robust waste management programs to reduce landfill waste and increase recycling rates.

- Responsible chemical management: Ensuring safe handling, storage, and disposal of chemicals used in manufacturing, adhering to regulations like REACH in Europe.

- Emissions control: Investing in technologies to monitor and reduce air and water pollutants from its facilities.

Climate Change and Supply Chain Resilience

Climate change poses a significant threat to Crane NXT's supply chain. The increasing frequency and intensity of extreme weather events, such as hurricanes and floods, can disrupt the availability of critical raw materials. For instance, a severe drought in a region supplying key metals could halt production lines.

Crane NXT must proactively assess and mitigate these environmental risks. This involves strategies like diversifying its supplier base across different geographic regions and optimizing logistics to reduce reliance on vulnerable transportation routes. Building a resilient supply chain is essential for maintaining operational continuity and ensuring timely product delivery to customers.

- Increased extreme weather events: Global average temperatures are projected to rise, leading to more frequent and severe weather patterns impacting supply routes.

- Supply chain diversification: Crane NXT is exploring partnerships with suppliers in regions less susceptible to climate-related disruptions to secure a stable flow of materials.

- Logistics optimization: Investments in advanced tracking and alternative transportation methods are being made to circumvent potential weather-related delays.

Environmental regulations are tightening globally, impacting Crane NXT's operations. For example, the EU's Green Deal aims for climate neutrality by 2050, pushing for more sustainable manufacturing and materials. This trend is influencing supply chain choices for entities like the European Central Bank, which is exploring eco-friendly banknote options.

Crane NXT is actively addressing its environmental footprint by focusing on energy efficiency, waste reduction, responsible chemical management, and emissions control. These initiatives are not just about compliance but are strategic moves to align with growing market demand for sustainability, a trend that gained significant momentum in 2024 and is expected to continue through 2025.

Climate change presents supply chain risks, with extreme weather events potentially disrupting raw material availability. Crane NXT is mitigating this by diversifying suppliers and optimizing logistics to ensure operational continuity and timely delivery.

Crane NXT's environmental initiatives for 2024-2025 include investments in energy-efficient machinery, robust waste management programs, safe chemical handling adhering to regulations like REACH, and technologies to reduce air and water pollutants.

PESTLE Analysis Data Sources

Our Crane NXT PESTLE Analysis draws from a robust dataset including official government publications, leading financial institutions, and reputable industry-specific research. This ensures our insights into political, economic, social, technological, legal, and environmental factors are grounded in verifiable, current information.