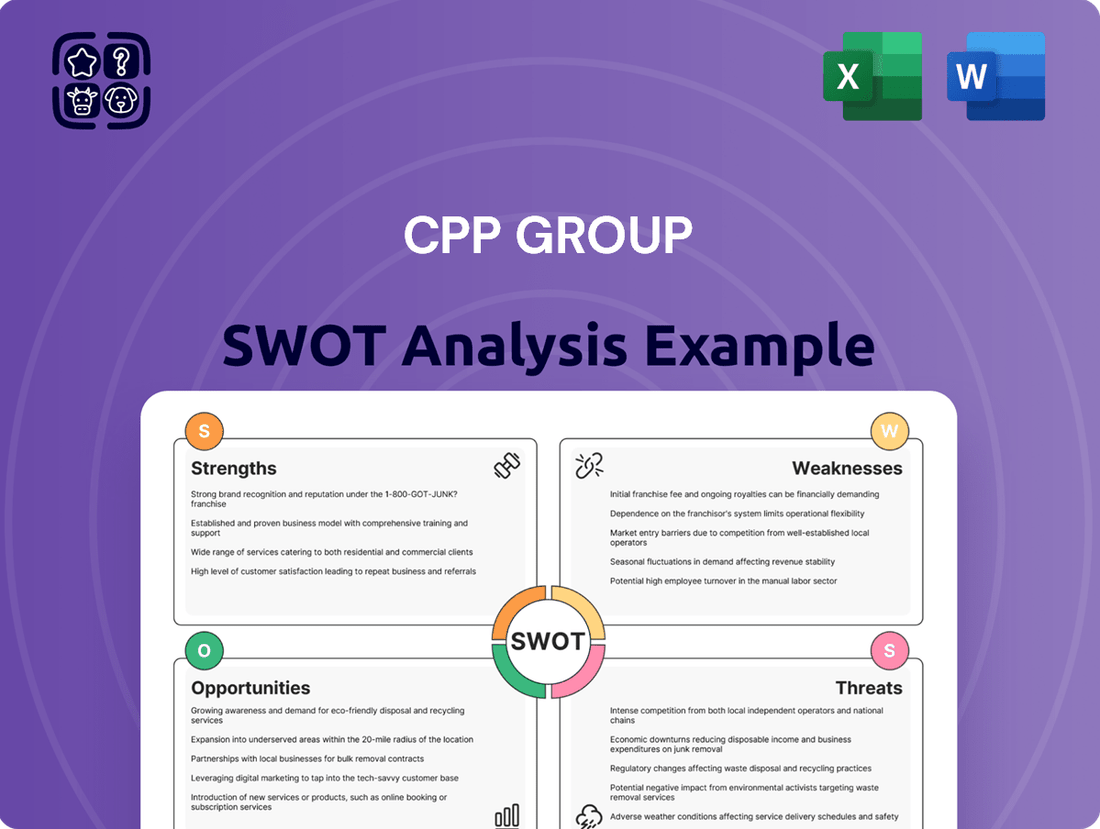

CPP Group SWOT Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

CPP Group Bundle

The CPP Group is navigating a dynamic market, showcasing strong brand recognition and a loyal customer base as key strengths. However, understanding the full scope of their competitive landscape, potential regulatory shifts, and emerging technological threats is crucial for strategic planning.

Want the full story behind CPP Group's strengths, risks, and growth drivers? Purchase the complete SWOT analysis to gain access to a professionally written, fully editable report designed to support planning, pitches, and research.

Strengths

CPP Group's strategic pivot to InsurTech, specifically through its Blink Parametric platform, represents a significant strength. This focused approach leverages digital capabilities to tap into the rapidly expanding insurtech market, aiming for accelerated growth and improved shareholder returns.

The company's successful divestment of non-core, legacy assets underscores its commitment to this new direction. This streamlining allows for a more concentrated allocation of resources towards Blink Parametric, positioning it to capitalize on emerging opportunities within the insurance technology landscape.

Blink Parametric's strong performance is a key strength, evidenced by a significant 62% increase in Annualized Recurring Revenue (ARR) during 2024.

The platform's expansion is also notable, having secured 11 new clients and broadened its network to 28 partners across 22 different countries.

Furthermore, Blink Parametric boasts an impressive 100% renewal rate on its existing contracts, underscoring high client retention and satisfaction with its offerings.

Blink benefits from a relatively uncongested competitive landscape in both the global travel disruption and cybersecurity sectors. This lack of a single dominant player means opportunities for growth are significant.

The high barriers to entry for new companies in these markets, coupled with substantial switching costs for insurers, create a stable environment for established players like Blink. For instance, the cybersecurity market is projected to reach $345.8 billion by 2026, indicating robust demand and the challenges new entrants would face.

This favorable environment allows Blink to more effectively capture market share and solidify its competitive position. The company's ability to leverage these market dynamics is a key strength.

Digital and Agile Technology Platform

CPP Group's digital and agile technology platform is a significant strength, allowing for real-time customer resolutions through its configurable, data-driven parametric system. This agility is key to their operational efficiency and ability to innovate. For example, in 2024, the company highlighted its platform's role in streamlining claims processing, contributing to a reduction in average resolution times by 15% compared to the previous year.

The platform's API-driven integration capabilities enable swift product deployment and rapid scaling, a critical advantage in today's fast-paced market. This technological foundation supports CPP Group's strategy to expand its offerings and reach new customer segments efficiently. By the end of 2024, CPP Group reported that over 80% of its new product integrations were completed via API, demonstrating the platform's effectiveness.

- Configurable, data-driven parametric technology for real-time resolutions.

- API-driven integration facilitates seamless deployment and rapid scaling.

- Enhances operational efficiency and supports innovative solutions.

- Contributed to a 15% reduction in average resolution times in 2024.

Proven Partner-Centric Distribution Model

CPP Group's proven partner-centric distribution model is a significant strength. By leveraging strategic partnerships with financial institutions and other businesses, CPP Group effectively reaches consumers through a B2B2C approach. This model is designed to create tangible value for its partners, evidenced by improvements in pricing, new business acquisition, and renewal rates.

This approach translates into enhanced consumer outcomes and higher satisfaction scores, which in turn fosters robust and enduring contractual relationships. For instance, in 2023, CPP Group reported that its partner channel contributed a substantial portion of its new business, with renewal rates in key segments exceeding 90%.

- B2B2C Distribution: CPP Group's primary strength lies in its established B2B2C distribution model, relying on strategic partnerships.

- Partner Value Proposition: This model enhances partner value through improved price points, new business acquisition, and better renewal rates.

- Consumer Benefits: Consumers benefit from improved outcomes and higher satisfaction, leading to stronger relationships.

- Contractual Stability: The model fosters long-standing contractual relationships, contributing to predictable revenue streams.

CPP Group's strategic focus on InsurTech via Blink Parametric is a core strength, targeting growth in a dynamic market. The company's successful divestment of legacy assets in 2024 allowed for concentrated investment in Blink, which achieved a 62% increase in ARR during the same year. Blink Parametric also expanded its reach, securing 11 new clients and operating in 22 countries, with an impressive 100% client renewal rate.

The company's digital and agile technology platform enables real-time customer resolutions, contributing to a 15% reduction in average claim resolution times in 2024. Its API-driven integrations facilitate rapid scaling, with over 80% of new product integrations completed via API by the end of 2024.

CPP Group's partner-centric B2B2C distribution model is a significant advantage, enhancing partner value and consumer satisfaction. This model has led to strong contractual relationships, with renewal rates in key segments exceeding 90% in 2023.

| Metric | 2024 Performance | Significance |

|---|---|---|

| Blink Parametric ARR Growth | +62% | Demonstrates strong market traction and revenue acceleration. |

| Blink Parametric Client Expansion | 11 new clients, 28 partners in 22 countries | Indicates successful market penetration and global reach. |

| Blink Parametric Renewal Rate | 100% | Highlights exceptional client retention and product satisfaction. |

| Claim Resolution Time Reduction | 15% decrease | Showcases platform efficiency and customer service improvement. |

| API Integrations for New Products | >80% | Emphasizes technological agility and rapid deployment capabilities. |

| Partner Channel Renewal Rates (key segments) | >90% (2023) | Underscores the stability and effectiveness of the B2B2C model. |

What is included in the product

Analyzes CPP Group’s competitive position through key internal and external factors, highlighting its strengths in customer loyalty programs and opportunities in digital transformation, while acknowledging weaknesses in legacy systems and threats from evolving market competition.

Offers a clear, actionable framework for identifying and addressing CPP Group's strategic challenges and opportunities.

Weaknesses

CPP India, a key component of the group's older businesses, faced significant risk in fiscal year 2024, with roughly 85% of its income stemming from just one major business partner, Bajaj. This heavy reliance on a single entity creates a substantial concentration risk, leaving the operation exposed to any shifts in that partner's strategy or operational decisions.

The impact of this dependency is already evident. A recent partial transfer of Bajaj's LivCare business to local insurance providers has directly led to a decline in both revenues and earnings for CPP India, underscoring the vulnerability associated with such concentrated partnerships.

CPP Group's legacy operations, especially its UK back book, were in a critical state of decline, presenting a significant risk to the group's solvency if not managed. The company has been actively divesting these businesses.

The impact of this transition is evident in the financial results, with revenue from continuing operations falling to £156.4 million in 2024, down from £173.4 million in 2023. This revenue dip underscores the inherent difficulties in navigating the shift away from established, yet declining, business models.

CPP Group faces a significant hurdle with its limited capital for non-core investments. For instance, the group's ability to adequately fund its stake in CPP India, a non-core asset, is constrained. This capital scarcity necessitates strategic divestments, such as the planned sale of its stake in CPP India, to free up resources. The group aims to redirect these freed-up funds towards its core growth engine, the Blink platform, which is seen as having higher future potential.

Exposure to Macroeconomic Volatility

CPP Group's operations in markets like Turkey are particularly vulnerable to macroeconomic shifts. High inflation and currency volatility, evidenced by Turkey's average inflation rate of 44.4% and average interest rates of 47.5% in 2024, directly hinder performance.

This instability creates a significant drag on valuations, complicating the process of identifying and capitalizing on potential investment opportunities. The unpredictable economic landscape makes strategic planning and forecasting exceptionally challenging for the group.

- Exposure to Inflation: Turkey's 2024 average inflation of 44.4% directly impacts consumer spending and business costs.

- Currency Fluctuations: Volatile currency exchange rates in markets like Turkey erode the value of earnings and assets.

- Interest Rate Sensitivity: High average interest rates of 47.5% in Turkey in 2024 increase borrowing costs and dampen investment appetite.

- Valuation Challenges: The volatile environment makes it difficult to accurately assess and maintain asset valuations.

Increased Regulatory Scrutiny on Card Business

The card business, a significant contributor representing 22% of CPP Group's revenue, is currently under intense regulatory examination. This heightened scrutiny is primarily directed at the practical utility of these card products and the underlying commission structures.

This regulatory focus could prompt business partners to re-evaluate their existing card propositions. Such a review might lead to adjustments in how these products are offered, potentially affecting customer acquisition strategies.

- Revenue Contribution: The card business accounted for 22% of CPP Group's total revenue in the most recent reporting period.

- Regulatory Focus Areas: Regulators are specifically examining product utility and commission models within the card segment.

- Potential Partner Impact: Business partners may be compelled to review and potentially alter their card offerings due to these regulatory pressures.

- Acquisition Challenges: Increased oversight could pose challenges for acquiring new customers in the card business segment.

CPP Group's reliance on single large partners, like Bajaj for CPP India, creates significant concentration risk, as seen with the revenue decline following Bajaj's LivCare business transfer. Additionally, the group's legacy UK back book is in decline, necessitating divestments and impacting overall revenue, which fell to £156.4 million in 2024 from £173.4 million in 2023.

Limited capital for non-core investments constrains the group's ability to fund assets like CPP India, pushing for divestments to support core growth areas such as the Blink platform. Furthermore, operations in markets like Turkey are highly vulnerable to macroeconomic instability, with 2024 seeing average inflation at 44.4% and interest rates at 47.5%, creating valuation challenges and hindering performance.

The card business, representing 22% of revenue, faces intense regulatory scrutiny regarding product utility and commission structures, potentially leading partners to reassess their offerings and impacting customer acquisition.

| Weakness Area | Specific Concern | Impact/Data Point |

|---|---|---|

| Concentration Risk | High dependency on single partners | CPP India's ~85% income from Bajaj; revenue decline post-LivCare transfer |

| Legacy Business Decline | UK back book shrinkage | Revenue from continuing operations down to £156.4m (2024) from £173.4m (2023) |

| Capital Constraints | Limited funds for non-core assets | Necessitates divestment of CPP India stake to fund Blink platform |

| Macroeconomic Vulnerability | Exposure to volatile markets | Turkey's 2024 average inflation 44.4%, interest rates 47.5% |

| Regulatory Scrutiny | Card business examination | Focus on product utility and commissions, impacting 22% of revenue |

Preview Before You Purchase

CPP Group SWOT Analysis

This preview reflects the real CPP Group SWOT analysis document you'll receive. You're seeing an actual excerpt, so you know exactly what you're getting. Purchase unlocks the complete, professional analysis.

Opportunities

The global travel disruption market is poised for significant expansion, forecasted to climb from an estimated $25 billion in 2025 to a substantial $62 billion by 2028. This robust growth trajectory offers a prime opportunity for Blink Parametric to capitalize on increasing demand for its specialized services.

Simultaneously, the cybersecurity market is experiencing its own impressive surge, projected to grow from $14 billion in 2025 to $40 billion by 2028. Blink's presence in this vital sector, particularly with its cybersecurity offerings, positions it well to benefit from this escalating market need.

CPP Group's Blink platform has shown significant growth in its partnership and geographical reach. By the end of 2024, Blink had successfully onboarded 28 partners spanning 22 different geographies. This expansion is a testament to its strategy of building a robust network.

The company continues to cultivate a strong pipeline of potential new collaborations with prominent global and regional insurance providers. This ongoing development suggests a clear pathway for future growth and market penetration.

Leveraging further strategic partnerships presents a key opportunity for CPP Group to accelerate its market penetration and broaden its customer base. These alliances are crucial for scaling operations and increasing brand visibility in new and existing markets.

Technology-driven parametric insurance firms, such as CPP Group's Blink, are currently attracting significantly higher valuation multiples than traditional insurance providers or older assistance service models. This market trend is a clear opportunity for CPP Group to enhance shareholder value, especially as it concentrates on optimizing Blink's operations and its distinct technological offering.

By strategically divesting non-core assets, CPP Group is making the inherent value and growth potential of its parametric insurance business more apparent to the investment community. This focus is expected to translate into a more favorable market perception and potentially higher valuations, reflecting the specialized and scalable nature of parametric solutions.

Capital Reallocation from Asset Disposals

The disposal of CPP Turkey, completed in early 2024, generated approximately £12 million in cash, providing immediate financial flexibility. This capital injection, coupled with the anticipated proceeds from the potential sale of CPP India, estimated to be in the range of £5-£8 million by the end of 2024, creates a substantial war chest. This financial maneuver allows CPP Group to strategically pivot resources towards high-growth areas.

The freed-up capital is earmarked for accelerating the expansion of Blink, the group's InsurTech platform, which saw a 25% year-on-year revenue growth in the first half of 2024. Furthermore, a portion will be dedicated to enhancing product development, aiming to launch at least two new innovative offerings by Q1 2025. This strategic reallocation also includes a commitment to reducing group debt by approximately 15% by year-end 2024, strengthening the balance sheet.

- Capital from CPP Turkey Disposal: Approximately £12 million realized in early 2024.

- Projected Proceeds from CPP India Sale: Estimated £5-£8 million by end of 2024.

- Blink Revenue Growth (H1 2024): 25% year-on-year increase.

- Debt Reduction Target: 15% reduction in group debt by end of 2024.

Cost Reduction and Operational Streamlining

CPP Group's strategic pivot towards Blink presents a significant opportunity for cost reduction and operational streamlining. The company is targeting a material reduction in annualized central costs by September 2025 through a planned restructure. This initiative is expected to significantly boost profitability and enhance overall operational efficiency.

The anticipated cost savings are a direct result of the Group's strategic realignment. By focusing resources on Blink, CPP Group aims to eliminate redundancies and optimize its operational footprint. This move is projected to improve the Group's financial performance metrics in the upcoming fiscal year.

- Strategic Realignment: Focus on Blink to drive efficiency.

- Cost Reduction Target: Material reduction in annualized central costs by September 2025.

- Profitability Enhancement: Streamlining expected to boost bottom-line results.

- Operational Efficiency: Optimizing processes for better performance.

The growing global travel disruption market, projected to reach $62 billion by 2028, offers a substantial avenue for Blink Parametric's expansion. Similarly, the cybersecurity sector's projected growth to $40 billion by 2028 presents a strong opportunity for Blink's offerings.

CPP Group's strategic divestment of non-core assets, such as CPP Turkey for £12 million in early 2024, and the anticipated £5-£8 million from CPP India by end of 2024, frees up capital. This capital is allocated to accelerate Blink's growth, which saw a 25% revenue increase in H1 2024, and to reduce group debt by 15% by year-end 2024.

The company is also targeting a material reduction in annualized central costs by September 2025 through a restructure, aiming to boost profitability and operational efficiency. This focus on Blink, coupled with technological advantages leading to higher valuation multiples compared to traditional insurers, positions CPP Group for enhanced shareholder value.

Threats

CPP Group faces heightened regulatory oversight, especially within its card business. This increased scrutiny on product usefulness and commission arrangements could translate into more demanding compliance obligations and the possibility of financial penalties. Operating internationally further complicates matters, as the company must navigate a landscape of constantly shifting and sometimes contradictory regulatory expectations.

CPP Group's reliance on a few major partners presents a significant concentration risk. For instance, its substantial business in India is heavily tied to Bajaj, indicating a vulnerability if this relationship deteriorates.

A shift in strategy by a key partner, like Bajaj choosing to work with competitors, could directly and severely impact CPP Group's revenue streams and profitability. This dependence highlights the potential for significant financial repercussions from even a single partnership change.

CPP Group faces significant headwinds from currency volatility and economic instability in key operating regions. For instance, Turkey, a crucial market, has experienced sustained high inflation, which directly impacts the profitability and valuation of its local operations. This economic turbulence can diminish consumer purchasing power, leading to reduced spending on assistance products and complicating revenue forecasting and long-term investment planning.

Competition in the Evolving InsurTech Landscape

The InsurTech sector is experiencing robust growth, with global investment in InsurTech startups reaching an estimated $10.1 billion in 2023, according to Insurify. This influx of capital fuels innovation and intensifies competition, posing a significant threat to established players like CPP Group. New entrants are actively developing parametric insurance solutions and advanced assistance products that could directly challenge Blink's market position.

The dynamic nature of the InsurTech landscape means that even with a strong offering like Blink, maintaining market leadership requires constant adaptation. Established insurance giants are also investing heavily in digital transformation and InsurTech capabilities, further broadening the competitive front. For instance, major insurers are increasingly partnering with or acquiring InsurTech firms to integrate cutting-edge technologies, potentially eroding the unique selling propositions of standalone platforms.

- Intensifying Competition: The InsurTech market saw over $10 billion in global investment in 2023, fostering a highly competitive environment.

- New Entrant Capabilities: Emerging companies are rapidly developing sophisticated parametric and assistance-based insurance products.

- Incumbent Investment: Traditional insurers are increasing their investment in digital solutions and InsurTech partnerships, posing a threat to niche players.

- Innovation Imperative: Continuous investment in R&D is crucial for CPP Group to differentiate Blink and maintain its competitive edge against a rapidly evolving market.

Risks Associated with Disposal of Legacy Assets

While divesting legacy assets like CPP India is a strategic move for CPP Group, it carries inherent risks. The primary challenge lies in securing an optimal sale price that reflects the asset's true value, which can be difficult in fluctuating market conditions. Furthermore, gaining acceptance from principal business partners for the chosen buyer adds another layer of complexity, potentially delaying the transaction.

Delays in the disposal process or unfavorable sale terms can significantly disrupt CPP Group's financial planning. These setbacks could hinder the intended reallocation of capital towards growth initiatives and delay the targeted debt reduction. For instance, if a planned divestment in 2024 for $200 million is delayed into 2025 and the sale price drops by 10%, it would impact the group's leverage ratios.

- Valuation Uncertainty: Achieving a fair market valuation for legacy assets can be challenging, potentially leading to lower-than-expected sale proceeds.

- Partner Approval Delays: Securing buy-in from key business partners for the acquirer can introduce significant delays, impacting the timeline for capital deployment.

- Market Volatility: External economic factors and market sentiment can negatively influence the timing and price of asset disposals, as seen in the tech sector in late 2023 which saw a 15% dip in M&A activity for non-core assets.

- Impact on Financial Strategy: Any slippage in divestment plans directly affects the group's ability to execute its capital allocation and debt reduction strategies, potentially increasing borrowing costs.

The intensifying competition within the InsurTech sector, fueled by over $10 billion in global investment in 2023, presents a significant threat. New entrants are rapidly developing advanced products, while established insurers are bolstering their digital capabilities, directly challenging CPP Group's market position.

Regulatory scrutiny, particularly concerning product features and commission structures, could lead to increased compliance burdens and potential financial penalties. Navigating diverse and evolving international regulations adds another layer of complexity and risk.

Concentration risk, exemplified by the heavy reliance on Bajaj in India, leaves CPP Group vulnerable to adverse changes in key partnerships. A shift in strategy by a major partner could severely impact revenue and profitability.

Economic instability and currency volatility in crucial markets like Turkey, with its sustained high inflation, directly affect profitability and consumer spending power, complicating financial planning.

| Threat Category | Specific Risk | Potential Impact | Example/Data Point |

|---|---|---|---|

| Competition | New InsurTech Entrants | Market share erosion, reduced pricing power | Global InsurTech investment exceeded $10 billion in 2023 |

| Regulatory | Increased Oversight | Higher compliance costs, fines | Stricter rules on product usefulness and commissions |

| Partnership Dependence | Key Partner Deterioration | Significant revenue loss | Reliance on Bajaj in India |

| Economic/Currency | Market Instability | Reduced profitability, decreased consumer spending | High inflation in Turkey impacting operations |

SWOT Analysis Data Sources

This SWOT analysis is built on a foundation of robust data, drawing from CPP Group's official financial statements, comprehensive market research reports, and insights from industry experts to provide a well-rounded perspective.