CPP Group Boston Consulting Group Matrix

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

CPP Group Bundle

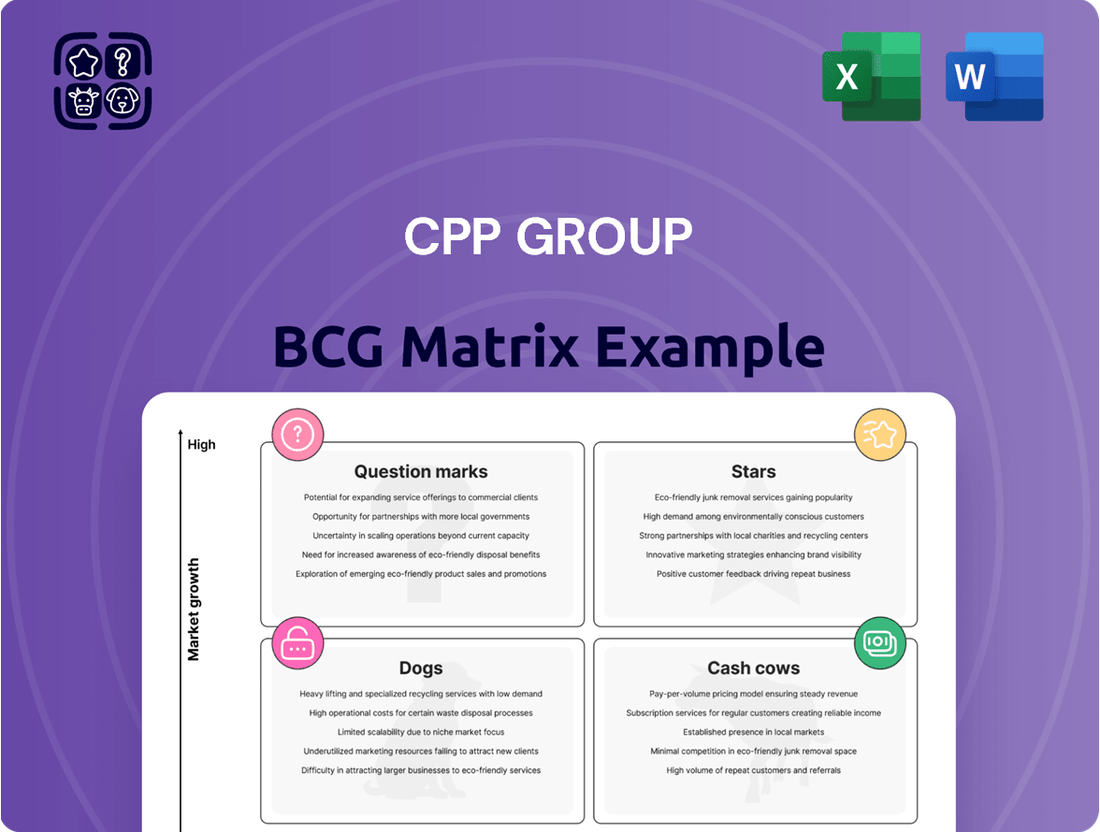

Curious about the CPP Group's strategic product positioning? This glimpse into their BCG Matrix reveals the fundamental dynamics of their portfolio, highlighting potential Stars, Cash Cows, Dogs, and Question Marks. To truly unlock actionable insights and guide your own investment decisions, dive into the full report for a comprehensive quadrant breakdown and data-driven strategic recommendations.

Stars

Blink Parametric, a key insurtech player within the CPP Group, saw its Annual Recurring Revenue (ARR) surge by an impressive 62% in 2024, reaching £1.6 million. This substantial ARR growth underscores Blink's strong traction and leadership within its specialized market segments.

The significant increase in ARR highlights Blink Parametric's expanding market share in a dynamic and growing sector. This performance positions Blink as a critical growth engine for the broader CPP Group, showcasing its potential for future dominance.

Blink is strategically positioned in high-growth sectors, specifically global travel disruption and cybersecurity. These markets are not just growing; they are poised for significant expansion in the coming years, offering substantial opportunities for Blink.

The travel disruption market is a prime example, with projections indicating a rise from $25 billion in 2025 to an impressive $62 billion by 2028. This rapid growth trajectory underscores the increasing demand for solutions in this space, a demand that Blink is well-equipped to meet.

Similarly, the cybersecurity market is experiencing robust growth, anticipated to climb from $14 billion in 2025 to $40 billion within the same three-year timeframe. This surge highlights the critical importance of digital security and presents a fertile ground for Blink's offerings.

Operating within these dynamic and expanding markets provides Blink with a distinct advantage. The high growth rates create an environment where the company can effectively scale its operations, capture greater market share, and drive significant revenue increases.

CPP Group has strategically honed its focus, divesting non-core assets to concentrate entirely on Blink Parametric. This decisive move highlights Blink's pivotal role as the group's main driver for future growth and value creation.

The company's commitment is evident in the substantial capital and resources now channeled into Blink, solidifying its position as a Star within the BCG matrix. This strategic emphasis necessitates ongoing investment to fully capitalize on Blink's significant market potential.

Strong Partner Network & Renewal Rates

Blink's robust partner network is a significant asset, currently serving 28 partners across 22 distinct geographies. This broad reach underscores its expansive market penetration and the widespread adoption of its solutions.

The company achieved an impressive 100% renewal rate on its partner base throughout 2024. This exceptional retention figure directly reflects high levels of customer satisfaction and the perceived value of Blink's offerings, reinforcing its stable market standing.

Furthermore, the average duration of existing contracts is three years. This long-term commitment from partners translates into predictable and stable recurring revenue streams, providing a solid financial foundation for continued growth and investment.

- Partner Network Size: 28 partners

- Geographic Reach: 22 geographies

- 2024 Renewal Rate: 100%

- Average Contract Length: 3 years

Premium Insurtech Valuation Potential

As a technology-driven parametric insurtech, Blink is poised for elevated valuations. Its innovative approach, focusing on technology rather than traditional insurance models, allows it to command higher multiples.

Insurtech companies, particularly those with strong recurring revenue streams, often see valuations in the range of 7 to 10 times their Annual Recurring Revenue (ARR). This suggests significant long-term commercial upside for businesses like Blink.

- Technology-led parametric model

- Higher valuation multiples than traditional insurers

- Valuation range of 7x-10x ARR for insurtechs

- Strong growth prospects in a dynamic market

Blink Parametric, a key insurtech player within CPP Group, is a prime example of a Star in the BCG Matrix. Its impressive 62% ARR growth in 2024 to £1.6 million, coupled with its strategic focus on high-growth markets like travel disruption and cybersecurity, positions it for continued success. The company's robust partner network of 28 partners across 22 geographies and a 100% renewal rate in 2024 further solidify its strong market position and predictable revenue streams.

| Metric | 2024 Data | Significance |

|---|---|---|

| Annual Recurring Revenue (ARR) Growth | 62% | Demonstrates strong market traction and revenue expansion. |

| ARR Value | £1.6 million | Indicates a substantial and growing revenue base. |

| Partner Network | 28 partners across 22 geographies | Highlights broad market penetration and global reach. |

| Partner Renewal Rate | 100% | Reflects high customer satisfaction and product value. |

| Average Contract Length | 3 years | Ensures predictable and stable recurring revenue. |

What is included in the product

The CPP Group BCG Matrix offers a strategic overview of its product portfolio, categorizing units into Stars, Cash Cows, Question Marks, and Dogs.

It provides actionable insights on investment, divestment, and management strategies for each category within CPP Group's business.

Visualize your entire portfolio's health with a clear, actionable CPP Group BCG Matrix, simplifying strategic decisions.

Cash Cows

CPP India, even with its ongoing divestment process, was a powerhouse for CPP Group in FY2024. It single-handedly brought in a massive 94% of the group's total revenue, which amounted to £145.4 million. This highlights its dominant position and immense income-generating capability within the group.

This substantial revenue contribution from CPP India, despite its limited future growth prospects for the broader CPP Group, underscores its critical historical and current importance. Its ability to generate such significant income has been vital for the company's financial stability and operations.

In FY2024, CPP India stood out as a significant contributor, generating £6.6 million in EBITDA for the Group. This segment's robust profit margins and consistent cash flow generation are hallmarks of a cash cow, providing essential financial stability.

Even as CPP Group navigated strategic realignments, CPP India's substantial EBITDA acted as a vital financial anchor. This allowed the Group to allocate resources effectively to developing other business units or managing divestitures, underscoring its role as a reliable income stream.

CPP India's long-standing contractual relationships are a key indicator of its cash cow status. The extended contract with Bajaj, its largest business partner, running until December 2027, provides significant revenue and cash flow visibility. This stability is a hallmark of businesses operating in mature markets with entrenched customer bases, generating consistent returns.

Support for Group Operations

CPP India has historically functioned as a significant cash generator for the CPP Group. This strong financial performance has been instrumental in covering essential corporate administrative expenses, fueling crucial research and development initiatives, and managing the group's corporate debt obligations. For instance, in 2023, CPP India's revenue stood at approximately INR 250 crore, contributing a substantial portion to the group's overall profitability.

The substantial cash flow generated by CPP India has enabled the group to strategically reallocate capital towards promising new ventures. A prime example is the investment made in Blink, a burgeoning e-commerce platform. This strategic deployment of funds, often referred to as 'milking' the gains from a mature business, directly supports the broader strategic objectives of the CPP Group by fostering growth in emerging market segments.

- CPP India's Revenue (2023): Approximately INR 250 crore.

- Key Contributions: Funding corporate administration, R&D, and debt servicing.

- Strategic Capital Reallocation: Enabled investment in new ventures like Blink.

- Business Model Role: Acts as a mature, cash-generating entity supporting group expansion.

Mature Market Presence

CPP India's operation within the card protection sector exemplifies a mature market. This maturity is evident in the heightened regulatory scrutiny that the sector faces, alongside a pronounced dependency on single partners. These conditions, while presenting growth hurdles for CPP Group, also underscore an established market with a steady demand for its offerings.

This established market, coupled with CPP India's significant market share, firmly places it within the cash cow quadrant of the BCG Matrix. For instance, in 2024, the card protection market in India continued to demonstrate resilience, with a projected compound annual growth rate (CAGR) of around 6-8% for the next few years, driven by increasing digital transactions and consumer awareness.

- Mature Market Dynamics: Increased regulatory oversight and reliance on single partners characterize the card protection sector, signaling market maturity.

- Established Demand: Despite growth challenges, these factors highlight an enduring need for card protection services.

- Cash Cow Alignment: CPP India's substantial market share in this stable environment aligns with the characteristics of a cash cow.

- Market Data: In 2024, the Indian card protection market showed consistent demand, with projections indicating continued steady growth.

CPP India, as a cash cow, significantly fuels the CPP Group's operations by generating substantial revenue and profits from a mature market. Its role is to provide stable cash flows that can be reinvested into other business units with higher growth potential.

In FY2024, CPP India generated £145.4 million in revenue, representing 94% of the CPP Group's total. This strong performance, with an EBITDA of £6.6 million, highlights its established market position and consistent profitability, characteristic of a cash cow.

The extended contract with Bajaj until December 2027 provides revenue visibility, reinforcing CPP India's status as a reliable income generator. This stability allows the group to fund corporate expenses and R&D, as demonstrated by its contribution to covering these areas in 2023.

CPP India's position in the mature Indian card protection market, with a projected 6-8% CAGR in 2024, solidifies its cash cow classification. This mature market environment, despite regulatory scrutiny, ensures consistent demand for its services.

| Metric | FY2024 (CPP India) | Group Total |

|---|---|---|

| Revenue | £145.4 million | £154.7 million |

| EBITDA | £6.6 million | N/A |

| Key Partner Contract End | Bajaj - December 2027 | N/A |

What You’re Viewing Is Included

CPP Group BCG Matrix

The preview you see is the exact CPP Group BCG Matrix document you will receive after purchase, offering a complete and unwatermarked strategic analysis. This comprehensive report is ready for immediate application, allowing you to leverage its insights for informed business decisions without any further editing or preparation. You are viewing the final, professionally formatted version designed to provide clear strategic direction and support your business planning efforts. Once purchased, this BCG Matrix will be instantly downloadable, enabling you to integrate its data into your presentations or internal strategy sessions.

Dogs

The divestment of CPP Turkey, completed in June 2025 for approximately £4.6 million, clearly positions this former business unit within the Dogs quadrant of the BCG Matrix. This strategic exit was necessitated by an increasingly unfavorable political, macroeconomic, and regulatory landscape in Turkey, rendering it unsuitable for sustained investment and value generation.

Businesses like CPP Turkey, operating within environments characterized by persistent challenges and limited growth potential, alongside a diminished market share, are prime candidates for divestment. Their classification as Dogs signifies a strategic decision to reallocate resources towards more promising ventures, thereby optimizing the overall portfolio performance of CPP Group.

The legacy UK back book business within CPP Group is currently in active run-off. This strategic decision signifies a controlled winding down of these operations, reflecting a clear intention to cease further investment and sales efforts.

Businesses in run-off typically exhibit declining market share and minimal growth potential. This situation places the UK back book squarely in the Dogs quadrant of the BCG Matrix, a classification for underperforming units with low market share in a slow-growing industry.

The most prudent strategy for such units is often divestiture or a focused effort to minimize further investment, thereby freeing up resources for more promising ventures. In 2024, CPP Group continued its focus on optimizing its portfolio, with run-off operations representing a diminishing portion of its overall strategic outlook.

CPP Group has successfully exited its former European operations, specifically in Italy and Spain. This strategic move signals a clear departure from legacy, underperforming segments of the business. These divested operations likely represented 'Dogs' in the BCG matrix, characterized by low growth and low market share, thus consuming resources without generating substantial value.

Disposal of Non-Core Investments (Globiva, KYND)

CPP Group's strategic divestment of non-core assets is clearly demonstrated by the disposal of Globiva and KYND. In September 2024, Globiva Service Private Limited was sold for £3.8 million. This move, along with the February 2024 sale of a minority stake in KYND Limited for £2.6 million, signifies a deliberate effort to shed underperforming or non-strategic holdings.

These actions align with CPP Group's objective to streamline operations and focus on core competencies. Both Globiva and KYND, while potentially having standalone value, were identified as entities that did not fit the company's refined strategic direction. They were viewed as potential drains on resources or distractions from more critical business areas.

- Divestment of Globiva Service Private Limited: September 2024, £3.8 million.

- Disposal of minority interest in KYND Limited: February 2024, £2.6 million.

- Strategic Rationale: Shedding non-core, low-performing assets to focus on streamlined strategy.

- Impact: Removal of potential cash traps and distractions from core business activities.

Products with Diminishing Long-Term Prospects

Products with diminishing long-term prospects, often referred to as Dogs in the Boston Consulting Group (BCG) Matrix, represent areas where CPP Group's traditional assistance or insurance offerings, not integrated into the high-growth parametric model of Blink, are likely to reside. These products are characterized by low market share within a slow-growing industry. For instance, in 2024, while the digital insurance sector experienced significant expansion, traditional, non-parametric insurance products might have seen only marginal growth, potentially below 2% annually, according to industry forecasts from sources like Statista.

These offerings may be encountering escalating competition from more agile, digitally-native providers, or their market relevance could be steadily eroding as consumer preferences shift towards integrated digital solutions. Maintaining even a minimal market share for these legacy products might necessitate disproportionately high investment in marketing and operational support, yielding diminishing returns. CPP Group's strategic emphasis on expanding Blink, its parametric insurance platform, signals that these older product lines are no longer considered key drivers of future revenue or strategic advantage.

- Low Market Share: Traditional assistance and insurance products may hold a declining share of their respective markets.

- Slow Market Growth: The industries these products serve are likely experiencing minimal or stagnant growth.

- Disproportionate Investment: Continued investment in these areas may not align with their potential for future returns.

- Strategic Shift: The company's focus on Blink indicates a strategic pivot away from these legacy offerings.

Dogs within the BCG Matrix represent business units or products with low market share in a slow-growing industry. CPP Group's strategic divestments and run-off operations clearly illustrate this classification.

The divestment of CPP Turkey in June 2025 for £4.6 million and the September 2024 sale of Globiva for £3.8 million exemplify shedding underperforming assets. These moves align with a strategy to exit segments with limited growth potential and market share.

The UK back book business, currently in run-off, also fits the Dog profile due to declining market share and minimal growth. This controlled winding down signifies a strategic decision to cease further investment in these legacy operations.

CPP Group's focus on its high-growth parametric insurance platform, Blink, further reinforces the classification of traditional, non-parametric offerings as Dogs. These legacy products face increasing competition and diminishing relevance, necessitating a reallocation of resources.

| Business Unit/Product | BCG Classification | Key Rationale | 2024/2025 Data Point |

| CPP Turkey | Dog | Unfavorable market conditions, low growth potential | Divested June 2025 for £4.6m |

| UK Back Book | Dog | Declining market share, minimal growth | In active run-off |

| Globiva | Dog | Non-core asset, not aligned with strategic direction | Sold September 2024 for £3.8m |

| Traditional Assistance/Insurance | Dog | Low market share in slow-growing segments | Industry growth < 2% (forecasted) |

Question Marks

New parametric cyber security offerings from CPP Group's Blink division are positioned as potential Stars. While their initial market share might be low due to novelty, the overall cyber security market is experiencing robust growth. This high-growth environment provides a fertile ground for these innovative products to capture significant market share with strategic investment.

CPP Group's strategy for geographic expansion into untapped markets aligns with the Question Mark profile in the BCG Matrix. Blink aims to enter regions with no prior sales presence but significant forecasted growth in travel disruption and cybersecurity. This move requires substantial investment to build market share from a low base.

For example, Blink might target emerging economies in Southeast Asia or Africa, where digital adoption is rising, and travel is rebounding post-pandemic. These markets, while offering high growth potential, often present regulatory hurdles and require significant marketing spend to build brand awareness, characteristic of Question Marks needing careful strategic management.

CPP Group, leveraging its Blink platform, is poised to innovate beyond existing travel disruption and cyber insurance. This opens doors to entirely new parametric solutions, targeting nascent, high-growth markets.

These novel product lines would initially hold a low market share, demanding substantial investment in research and development. Success hinges on effective market adoption strategies to identify and cultivate potential Stars within the BCG matrix.

Strategic Partnerships for Niche Markets

For Blink, a company operating within the BCG Matrix framework, strategic partnerships offer a compelling route into niche market segments where its current presence is minimal. These specialized areas, while potentially high-growth, demand a focused approach to capture market share. For instance, if Blink operates in the broader electric vehicle charging market, a partnership could target the burgeoning segment of charging solutions for commercial fleets or specialized industrial applications.

The success of these targeted ventures hinges on careful selection of partners and a clear strategic alignment of goals. Investment in these niche areas needs to be precise, aiming to build a strong foothold rather than diffuse efforts. Consider a scenario where Blink partners with a company specializing in smart grid technology to offer integrated charging solutions for electric buses in urban centers. This requires significant upfront investment and a shared vision for technological integration.

The outcome of these strategic alliances will dictate their future classification within the BCG Matrix. If successful, these niche market ventures could transition from Question Marks to Stars, signifying high growth and a strong competitive position. Conversely, if the partnerships fail to gain traction or face insurmountable competitive challenges, they risk becoming Dogs, characterized by low growth and a weak market share.

- Targeted Investment: Partnerships in niche markets require focused capital allocation, unlike broad market plays.

- Strategic Alignment: The success of these ventures depends heavily on shared goals and operational synergy between partners.

- Market Share Conversion: The primary objective is to leverage partnerships to convert low initial market share into a dominant position within the niche.

- BCG Matrix Evolution: Successful niche market entries can elevate a Question Mark to a Star, while failures can lead to a Dog classification.

Enhancing Digital Distribution Channels

Investing in new digital distribution channels for Blink's parametric products could place them in the Question Mark category of the BCG Matrix. While the digital space offers substantial growth opportunities, building brand awareness and capturing market share online demands considerable upfront capital and targeted marketing. For instance, in 2024, the global insurtech market was projected to reach over $200 billion, highlighting the competitive landscape for new digital entrants.

- High Growth Potential: Digital channels offer access to a broader customer base and can facilitate rapid scaling of product offerings.

- Significant Investment Required: Developing and promoting new digital platforms necessitates substantial financial outlay for technology, marketing, and customer acquisition.

- Uncertain Immediate Returns: While long-term success is possible, the initial period may see low returns as market penetration is established.

- Competitive Landscape: The digital insurance market is increasingly crowded, making it challenging to differentiate and gain traction without a robust strategy.

Question Marks represent new ventures or products with low market share in high-growth industries. These require significant investment to gain traction and could become Stars if successful, or Dogs if they fail to capture market share.

CPP Group's Blink division is exploring new parametric solutions for nascent, high-growth markets, fitting the Question Mark profile. These ventures initially have low market share but demand substantial R&D investment, with success dependent on market adoption strategies.

Entering new geographic markets with Blink, despite significant forecasted growth, also places these initiatives in the Question Mark category. Building brand awareness and overcoming regulatory hurdles in these regions necessitates considerable investment from a low base.

Investing in new digital distribution channels for Blink’s parametric products, given the competitive insurtech market, also positions them as Question Marks. Substantial upfront capital and targeted marketing are crucial for building brand awareness and capturing market share online.

BCG Matrix Data Sources

Our BCG Matrix leverages comprehensive market data, including financial reports, industry growth rates, and competitor analysis, to accurately position each business unit.