CPP Group PESTLE Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

CPP Group Bundle

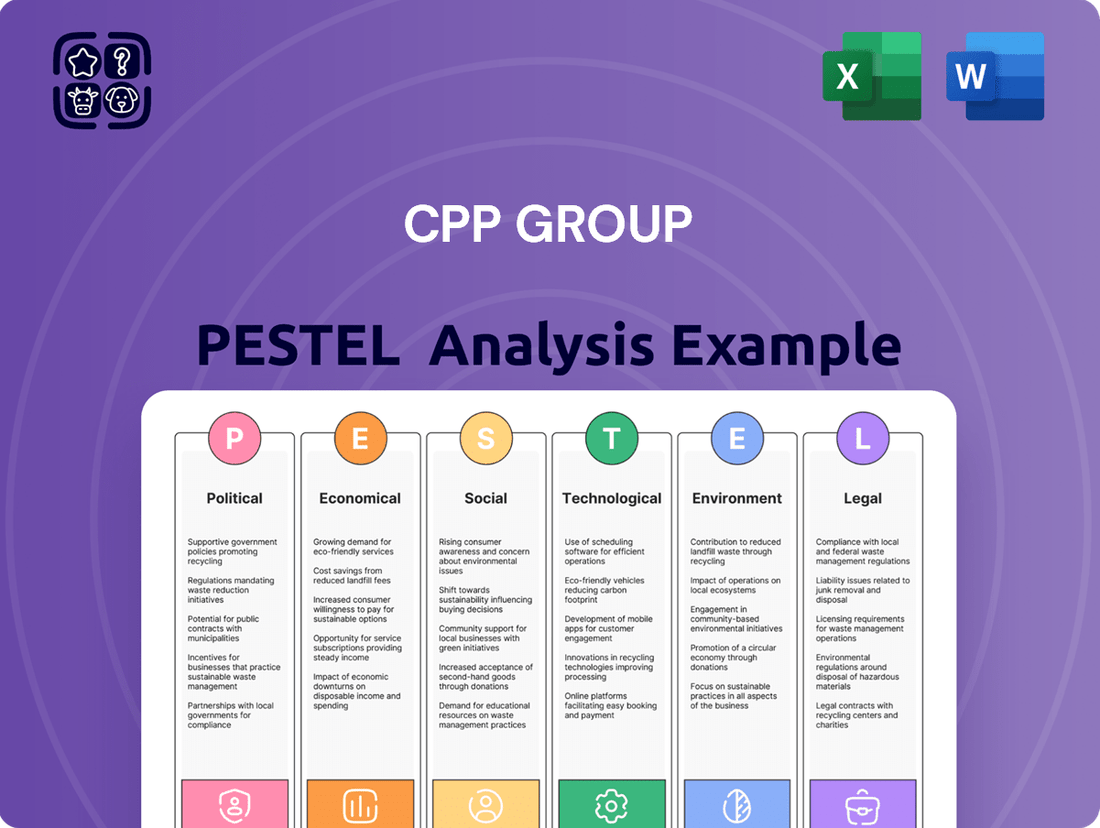

Navigate the complex external environment affecting CPP Group with our comprehensive PESTLE analysis. Understand the political, economic, social, technological, legal, and environmental factors that are shaping its strategic landscape and future opportunities. Gain a critical edge by leveraging these expert insights for your own market strategy. Download the full version now for actionable intelligence.

Political factors

Governmental stability and policy shifts are crucial for CPP Group. Changes in leadership or political ideologies can reshape economic priorities and trade agreements, directly affecting the financial services and insurance industries. This could impact CPP Group's global operations and existing partnerships.

The United Kingdom, a key market for CPP Group, is expected to see significant regulatory evolution in 2025. As the nation finalizes its post-Brexit regulatory framework, the aim is to establish a UK-centric approach. This ongoing recalibration of the financial services landscape presents both potential challenges and opportunities for companies like CPP Group.

The stringency and focus of financial regulators, like the UK's Financial Conduct Authority (FCA), significantly impact CPP Group's compliance costs and operational requirements. For instance, the FCA's Consumer Duty, fully implemented in 2024, mandates a higher standard of care for consumers, directly influencing how CPP Group designs and markets its products.

Anticipated regulatory shifts in the UK for 2025, particularly those targeting enhanced consumer protection and the fight against financial crime, will necessitate ongoing adaptation by CPP Group. These changes, aiming to foster economic growth and innovation, could introduce new compliance obligations and reporting frameworks that CPP Group must navigate.

Geopolitical tensions, such as those in Eastern Europe and the Middle East, can disrupt global supply chains and impact international trade, potentially affecting CPP Group's distribution partnerships and operational costs in key markets like India and Turkey.

Fluctuations in currency exchange rates, influenced by global economic conditions and regional political instability, pose a significant risk. For instance, a weakening Indian Rupee or Turkish Lira against the Pound Sterling could negatively impact CPP Group's reported revenue and profitability when translated back to its reporting currency.

Consumer protection legislation

New consumer protection legislation, such as the UK's Digital Markets, Competition and Consumers Act 2024, significantly raises the bar for customer care and fair business practices. This act grants the Competition and Markets Authority (CMA) direct enforcement powers, meaning companies like CPP Group must rigorously adhere to these updated standards to prevent penalties and safeguard their reputation.

The implications for CPP Group are substantial, requiring a proactive approach to compliance. Failure to align products, services, and marketing with these stringent regulations could lead to significant fines and damage to customer trust. For instance, the CMA has been increasingly active in pursuing enforcement actions against companies for misleading advertising and unfair terms, underscoring the importance of robust compliance frameworks.

- Increased Scrutiny: The CMA's enhanced powers mean a higher likelihood of investigations into consumer-facing practices.

- Stricter Compliance Requirements: CPP Group must ensure all customer interactions and product offerings meet the new legal benchmarks.

- Reputational Risk: Non-compliance can result in substantial fines and a loss of consumer confidence, impacting long-term business viability.

Data privacy regulations and cybersecurity policies

Governments globally are tightening their grip on data privacy and cybersecurity. New legislation, like the GDPR in Europe and similar frameworks emerging in 2024 and 2025 across various jurisdictions, mandates stricter controls over how financial data is handled. This directly impacts CPP Group's digital offerings, requiring robust compliance measures.

These evolving regulations mean financial institutions, including those providing digital assistance, face increased responsibilities. They must ensure transparent data collection, secure usage, and controlled sharing of personal financial information. Meeting these heightened expectations for safeguarding consumer data is paramount.

- Increased Compliance Costs: Adhering to new data privacy laws can lead to significant investment in technology and personnel for CPP Group.

- Reputational Risk: Data breaches or non-compliance can severely damage customer trust and CPP Group's brand image.

- Market Access: Failure to meet cybersecurity standards in specific regions could restrict CPP Group's ability to operate or offer services there.

Governmental stability and policy shifts are crucial for CPP Group. Changes in leadership or political ideologies can reshape economic priorities and trade agreements, directly affecting the financial services and insurance industries. This could impact CPP Group's global operations and existing partnerships.

The United Kingdom, a key market for CPP Group, is expected to see significant regulatory evolution in 2025. As the nation finalizes its post-Brexit regulatory framework, the aim is to establish a UK-centric approach. This ongoing recalibration of the financial services landscape presents both potential challenges and opportunities for companies like CPP Group.

The stringency and focus of financial regulators, like the UK's Financial Conduct Authority (FCA), significantly impact CPP Group's compliance costs and operational requirements. For instance, the FCA's Consumer Duty, fully implemented in 2024, mandates a higher standard of care for consumers, directly influencing how CPP Group designs and markets its products.

Anticipated regulatory shifts in the UK for 2025, particularly those targeting enhanced consumer protection and the fight against financial crime, will necessitate ongoing adaptation by CPP Group. These changes, aiming to foster economic growth and innovation, could introduce new compliance obligations and reporting frameworks that CPP Group must navigate.

What is included in the product

This PESTLE analysis provides a comprehensive examination of the external macro-environmental factors influencing CPP Group, covering Political, Economic, Social, Technological, Environmental, and Legal dimensions.

It offers actionable insights into how these forces create both challenges and advantages for CPP Group's strategic decision-making.

A concise PESTLE analysis of the CPP Group that highlights key external factors, enabling faster strategic decision-making and risk mitigation.

Economic factors

Rising inflation directly impacts CPP Group's cost of claims for gadget insurance and other assistance products, as repair and replacement expenses climb. For instance, in early 2024, global inflation rates remained elevated, with the IMF projecting a global average of 5.9% for 2024, a slight decrease from 2023 but still above pre-pandemic levels. This sustained inflationary pressure means higher payouts for damaged or lost devices.

Furthermore, central banks' responses to inflation, primarily through interest rate hikes, influence borrowing costs and consumer spending power. In 2024, major central banks like the US Federal Reserve and the European Central Bank continued to navigate a complex environment, balancing inflation control with economic growth. Higher interest rates can dampen consumer demand for discretionary purchases, including insurance, especially during periods of economic uncertainty or a cost-of-living crisis, potentially impacting CPP Group's revenue streams.

Economic downturns and periods of high inflation significantly curb consumer discretionary spending, directly impacting demand for non-essential insurance like gadget protection. For instance, in early 2024, persistent inflation continued to squeeze household budgets across many developed economies, forcing consumers to prioritize essential goods and services over optional coverage.

As consumers face tighter budgets, they are more likely to cancel or downgrade their insurance policies. This trend directly affects CPP Group's revenue streams, as fewer customers opt for or maintain coverage for non-essential items, potentially leading to a decline in premium income throughout 2024 and into 2025.

For CPP Group, with its significant operations in India and Turkey, fluctuations in foreign exchange rates present a notable economic factor. Adverse currency movements can directly affect the reported financial performance when earnings from these international markets are converted back to the company's reporting currency. This impact was a discussed element in CPP Group's 2024 financial disclosures.

The Indian Rupee (INR) experienced a depreciation against the Sterling Pound (GBP) throughout much of 2024, and similarly, the Turkish Lira (TRY) saw considerable volatility. For instance, if the INR depreciated by 5% against the GBP in a given period, revenue generated in India would translate to approximately 5% less in GBP terms, impacting reported top-line figures. Such headwinds can erode profitability, even if underlying operational performance remains strong.

Economic growth in key markets

Economic growth in CPP Group's key markets, particularly India and Turkey, significantly impacts its ability to attract new customers and expand operations. India's economic outlook for 2025/26 suggests a moderation in growth, influenced by global geopolitical tensions and trade dynamics.

Turkey, meanwhile, is navigating a difficult economic environment characterized by persistent high inflation, which can affect consumer spending power and the overall demand for CPP Group's services.

- India's GDP growth forecast for FY25-26 is projected to be around 6.5%, a slight dip from previous estimates.

- Turkey's inflation rate remained elevated, with projections for 2025 indicating a range of 35-40%.

- Slower economic expansion in these regions could constrain CPP Group's revenue growth potential.

- Conversely, any unexpected economic upturns could present new opportunities for market penetration.

Competition and market saturation

The assistance and insurance product markets, particularly for gadget insurance, are highly competitive. This intense rivalry directly impacts CPP Group's pricing strategies and its ability to capture and maintain market share. As new, specialized providers enter the UK electronic gadgets insurance market, which saw a significant increase in new entrants in 2023, CPP Group faces pressure to innovate and clearly articulate its unique value proposition to consumers.

The increasing number of specialized providers entering the UK electronic gadgets insurance sector is a key challenge. For instance, by early 2024, the market had seen a notable surge in niche players offering tailored policies, forcing established companies like CPP Group to refine their product differentiation. This competitive pressure necessitates a strong focus on customer retention and the development of services that go beyond basic coverage to build loyalty.

- Market Saturation: The UK electronic gadgets insurance market is becoming increasingly saturated, with an estimated 15% year-on-year growth in specialized providers as of late 2023.

- Pricing Pressure: Intense competition often leads to downward pressure on premiums, impacting profit margins for all players, including CPP Group.

- Differentiation Imperative: CPP Group must clearly distinguish its offerings through unique features, superior customer service, or innovative product bundles to stand out.

- Customer Acquisition Costs: Higher competition typically translates to increased marketing and customer acquisition costs as companies vie for consumer attention.

Economic growth in key markets like India and Turkey significantly influences CPP Group's expansion and customer acquisition. India's projected GDP growth for FY25-26 is around 6.5%, while Turkey faces persistent high inflation, with 2025 estimates ranging from 35-40%. These economic conditions directly impact consumer spending power and the demand for CPP Group's services, potentially moderating revenue growth.

Same Document Delivered

CPP Group PESTLE Analysis

The preview shown here is the exact document you’ll receive after purchase—fully formatted and ready to use. This comprehensive PESTLE analysis of the CPP Group delves into the Political, Economic, Social, Technological, Legal, and Environmental factors impacting its operations. Understand the strategic landscape with this detailed report.

Sociological factors

Consumer awareness and perception of value are critical for CPP Group. Despite a high gadget insurance claims payout rate, a persistent perception exists that insurers are reluctant to pay out. This disconnect hinders customer acquisition and retention.

CPP Group must actively work to demonstrate the tangible value of its products. Publishing concrete data, such as claims approval rates, could be a powerful tool. For instance, if CPP Group's claims approval rate for gadget insurance in 2024 was 95%, highlighting this figure could directly counter negative perceptions.

Furthermore, sharing relatable case studies that illustrate successful claims and the benefits received by customers can significantly enhance the perceived value. This approach builds trust and reinforces the practical advantages of CPP Group's offerings, potentially leading to a stronger market position.

Consumers increasingly depend on electronic devices, with global smartphone shipments expected to reach 1.2 billion units in 2024, according to Statista. This reliance fuels demand for gadget insurance. The surge in remote work and digital learning, accelerated by events in recent years, further amplifies the need for protection against device failure and cyber threats, creating a strong market for CPP Group's assistance products.

CPP Group's digitally delivered assistance solutions are well-positioned to capitalize on these evolving consumer behaviors. The widespread adoption of smartphones, with over 6.7 billion users globally anticipated by 2024, means a significant portion of the population is already engaged with digital platforms. This digital fluency makes them receptive to the convenience and accessibility of CPP's online service offerings.

As financial services increasingly rely on data, consumers are more vocal about their privacy concerns. A 2024 survey indicated that over 70% of individuals are worried about how their personal financial data is being used by companies.

CPP Group, operating in identity and personal finance protection, faces a critical need to foster robust consumer trust. Demonstrating a commitment to data security and ethical data handling is paramount for maintaining customer loyalty and attracting new clients in this environment.

Demand for seamless digital solutions

Consumers now expect seamless digital interactions for all their service needs, including insurance and assistance. This means easy online policy management, quick claims, and accessible support through digital channels. A 2024 report indicated that over 75% of consumers prefer digital self-service options for routine tasks.

CPP Group's strategic direction, particularly with its Blink offering, directly addresses this societal shift. Blink provides digitally delivered assistance and parametric solutions, fitting perfectly into the modern consumer's expectation for immediate and convenient digital services. This focus is crucial for maintaining relevance and capturing market share in the evolving digital landscape.

- Digital Preference: Over 75% of consumers favor digital self-service for insurance and assistance tasks as of 2024.

- CPP's Alignment: CPP Group's Blink platform offers digitally delivered assistance, meeting this demand.

- Market Expectation: Consumers anticipate online policy management and fast digital claims processing.

Demographic shifts and evolving needs

Demographic shifts are significantly reshaping consumer needs, directly impacting companies like CPP Group. For instance, the aging population in many developed nations, including the UK and parts of Europe where CPP Group operates, is increasing demand for health and protection products tailored to older individuals. Conversely, a growing digitally-native generation, often referred to as Gen Z and younger Millennials, expects seamless online experiences and personalized digital assistance services. In 2024, the UK’s population aged 65 and over was projected to reach 13.4 million, highlighting a substantial market segment with specific insurance and assistance requirements.

CPP Group must therefore adapt its product portfolio to meet these diverging needs. This involves not only offering traditional protection products but also innovating in areas like digital identity protection and cyber security services, which are increasingly relevant to younger, tech-savvy consumers. The company’s ability to segment its market effectively and tailor its assistance and insurance solutions will be crucial for sustained growth.

- Aging Population: Increasing demand for health and eldercare-related assistance services.

- Digitally-Native Generations: Growing preference for online-first, personalized digital protection and assistance.

- Evolving Lifestyles: Changes in work patterns (e.g., remote work) and family structures influence the types of risks individuals face and the assistance they require.

- Global Demographic Trends: Awareness of differing demographic profiles in key operating regions allows for targeted product development and marketing.

Consumer trust is a significant sociological factor for CPP Group. While the company processes many claims, a perception of insurer reluctance persists, impacting customer acquisition. Demonstrating high claims approval rates, for example, a hypothetical 95% in 2024, could directly address this, alongside sharing success stories that highlight customer benefits and build confidence.

Societal reliance on technology, with global smartphone shipments predicted at 1.2 billion units in 2024, fuels demand for gadget insurance. Increased remote work and digital learning further amplify the need for device protection and cyber security, creating a robust market for CPP Group's assistance products.

Consumers now expect seamless digital interactions for all services, including insurance. A 2024 report showed over 75% of consumers prefer digital self-service for routine tasks, aligning with CPP Group's Blink offering which provides immediate, convenient digital assistance.

Demographic shifts, such as an aging population in developed nations, are increasing demand for tailored health and protection products. Simultaneously, younger generations expect personalized digital assistance, requiring CPP Group to adapt its offerings to meet these diverse needs.

| Sociological Factor | Impact on CPP Group | Supporting Data (2024/2025) |

|---|---|---|

| Consumer Perception of Value | Negative perceptions hinder acquisition; positive reinforcement is key. | Persistent belief that insurers are reluctant to pay claims. |

| Digital Dependency | Drives demand for gadget insurance and digital assistance. | Global smartphone shipments expected to reach 1.2 billion units in 2024. |

| Consumer Preference for Digital Services | Necessitates seamless online policy management and claims processing. | Over 75% of consumers prefer digital self-service for routine tasks (2024). |

| Demographic Shifts | Creates demand for specialized products for aging populations and digital-first generations. | UK population aged 65+ projected at 13.4 million in 2024. |

Technological factors

The evolution of InsurTech, especially parametric insurance, represents a key technological driver for CPP Group. These advancements facilitate immediate, automated claims settlement and introduce novel methods for delivering assistance products, thereby boosting operational efficiency and customer experience.

Parametric insurance, like CPP Group's Blink Parametric offering, leverages technology to trigger payouts based on pre-defined, verifiable events rather than traditional loss assessments. This streamlined approach is transforming the delivery of insurance and assistance services, making them more responsive and transparent.

The ever-changing landscape of cyber threats demands continuous investment in sophisticated cybersecurity for CPP Group and its collaborators, safeguarding sensitive personal finance and identity data. The global cybersecurity market is projected to reach $300 billion by 2025, underscoring the critical need for robust cyber assistance services.

Data analytics and AI are transforming how companies like CPP Group operate. By leveraging these technologies, CPP Group can refine its product development, streamline internal processes, and create more tailored customer interactions. For instance, in 2024, the financial services sector saw a significant uptick in AI adoption for customer service, with many firms reporting improved response times and customer satisfaction.

The integration of AI into areas such as risk assessment and targeted marketing campaigns is becoming standard practice. This necessitates CPP Group to actively investigate and implement these advanced tools to maintain a competitive edge. Reports from late 2024 indicate that financial institutions employing AI for fraud detection experienced a reduction in fraudulent transactions by an average of 15%.

Digital distribution channels and mobile platforms

The rise of mobile insurance platforms significantly boosts convenience and accessibility for policyholders. This trend directly supports CPP Group's partnership-driven distribution model, leveraging the widespread adoption of these digital channels.

Mobile platforms allow for seamless policy acquisition and management, a key advantage for businesses partnering with CPP Group to offer these services. For instance, the global mobile payment market was projected to reach over $2 trillion in 2024, indicating a massive user base comfortable with digital transactions.

- Enhanced Accessibility: Mobile apps make insurance products easier to find and purchase.

- Partnership Leverage: CPP Group's strategy benefits from the increasing use of digital channels by its partners.

- Market Growth: The expanding digital economy supports the growth of mobile-first financial services.

Cloud computing and infrastructure

The increasing reliance on cloud computing offers CPP Group significant advantages in scaling its digital operations and enhancing service flexibility. This shift is crucial for financial services firms aiming to manage vast datasets effectively and drive their digital transformation agendas, as highlighted by the projected growth in the global cloud computing market, which is expected to reach over $1 trillion by 2025.

Cloud infrastructure is fundamental for modern financial institutions, enabling them to bolster operational resilience and support evolving customer demands. For instance, a significant portion of financial services companies, around 70% as of 2024, are actively migrating core workloads to the cloud to leverage its benefits.

- Scalability: Cloud platforms allow CPP Group to dynamically adjust computing resources based on demand, ensuring smooth service delivery during peak periods.

- Cost-Efficiency: Moving to the cloud can reduce capital expenditure on physical hardware and optimize operational costs through pay-as-you-go models.

- Digital Transformation: Cloud adoption is a key enabler for developing and deploying new digital products and services rapidly.

- Operational Resilience: Cloud providers offer robust disaster recovery and business continuity solutions, enhancing the reliability of CPP Group's systems.

Technological advancements, particularly in InsurTech and AI, are reshaping CPP Group's operational landscape. The adoption of parametric insurance, like Blink Parametric, streamlines claims and enhances customer experience. Furthermore, robust cybersecurity measures are paramount given the escalating cyber threats, with the global cybersecurity market expected to hit $300 billion by 2025.

| Technology Area | Impact on CPP Group | Supporting Data/Trend |

|---|---|---|

| InsurTech (Parametric Insurance) | Automated claims, improved customer service | Transforming insurance delivery, increasing efficiency |

| Cybersecurity | Data protection, risk mitigation | Global market projected at $300 billion by 2025 |

| AI & Data Analytics | Product refinement, tailored customer interactions | AI adoption in financial services improved response times in 2024 |

| Mobile Platforms | Enhanced accessibility, partnership leverage | Global mobile payment market exceeded $2 trillion in 2024 |

| Cloud Computing | Scalability, operational resilience, cost-efficiency | 70% of financial services companies migrating core workloads to cloud by 2024 |

Legal factors

CPP Group navigates a complex web of financial services and insurance regulations, demanding rigorous compliance with both national and international standards. This regulatory landscape is constantly evolving, with significant shifts anticipated in the UK. For instance, the Financial Services and Markets Act 2023 is set to usher in a UK-focused regulatory framework post-Brexit, impacting how firms like CPP Group operate and manage risk.

The Financial Conduct Authority's (FCA) Consumer Duty, implemented in 2023, significantly elevates expectations for firms like CPP Group regarding customer outcomes, particularly focusing on fair value and consumer vulnerability. This means CPP Group must rigorously assess and demonstrate that its products and services consistently deliver fair value throughout their lifecycle, ensuring they meet the needs of their target consumers.

Compliance necessitates a proactive approach to product design and ongoing monitoring, with a keen eye on identifying and supporting vulnerable customers. For instance, the FCA's own data from early 2024 indicates a continued focus on firms' ability to identify and support consumers in vulnerable circumstances, making this a critical area for CPP Group's regulatory adherence.

Global data protection laws, like the EU's GDPR and similar regulations in other markets where CPP Group operates, significantly impact how the company handles customer information. These laws dictate strict rules for collecting, processing, and storing personal data, making compliance a critical operational factor for CPP Group, especially given its business model centered on financial and identity protection.

Anti-money laundering (AML) and financial crime legislation

The increasing regulatory spotlight on financial crime necessitates that CPP Group maintains stringent anti-money laundering (AML) and anti-fraud protocols. This heightened scrutiny, particularly concerning authorized push payment (APP) fraud, demands robust internal controls and compliance frameworks to mitigate risks and adhere to evolving legal mandates. For instance, the UK's Payment Systems Regulator (PSR) has been actively pushing for greater protections against APP fraud, with new reimbursement rules coming into effect in October 2024, impacting how firms like CPP Group must handle and prevent such incidents.

CPP Group must navigate a landscape where regulators are intensifying their focus on financial crime prevention. This includes adapting to new obligations designed to combat sophisticated fraud schemes and money laundering activities. The evolving regulatory environment means continuous investment in technology and training is crucial to stay ahead of emerging threats and maintain compliance. The Financial Conduct Authority (FCA) in the UK, for example, has consistently emphasized the importance of firms proactively identifying and reporting suspicious activities, with significant fines levied for non-compliance.

- Enhanced AML Compliance: CPP Group must ensure its AML procedures are robust, covering customer due diligence, transaction monitoring, and suspicious activity reporting to combat money laundering effectively.

- APP Fraud Prevention: The company needs to implement and refine measures to prevent and address authorized push payment (APP) fraud, aligning with new regulatory expectations for reimbursement and consumer protection.

- Regulatory Scrutiny: Expect increased oversight from financial regulators regarding the effectiveness of CPP Group's anti-financial crime strategies and adherence to evolving legislation.

- Data Security and Reporting: Maintaining secure data handling practices and accurate, timely reporting of financial crime indicators is paramount for regulatory compliance.

Partnership and contractual law

CPP Group's reliance on a distribution model built through partnerships with financial institutions and other businesses means that the legal frameworks governing these relationships are paramount. Contractual law dictates the terms of these alliances, covering aspects like service level agreements, revenue sharing, and intellectual property rights. For instance, the enforceability and clarity of these contracts directly impact CPP Group's ability to operate smoothly and manage potential disputes.

Liability and regulatory responsibilities within these partnerships are also crucial legal considerations. CPP Group must ensure that its partners adhere to relevant financial regulations, data protection laws (like GDPR), and consumer protection statutes. Failure to do so can expose CPP Group to significant legal and financial penalties, underscoring the importance of robust due diligence and ongoing compliance monitoring in its partnership agreements.

- Contractual Clarity: Ensuring all partnership agreements clearly define responsibilities, liabilities, and performance metrics is vital for operational stability.

- Regulatory Compliance: Adherence to financial services regulations and data privacy laws across all jurisdictions where CPP Group operates through partners is non-negotiable.

- Liability Management: Legal frameworks must address potential liabilities arising from partner actions, including data breaches or mis-selling, to protect CPP Group's reputation and financial health.

- Dispute Resolution: Well-defined dispute resolution mechanisms within partnership contracts are essential for efficiently addressing and resolving any disagreements that may arise.

The legal landscape for CPP Group is shaped by evolving consumer protection laws and financial crime regulations. The UK's Financial Services and Markets Act 2023, for example, introduces a new regulatory framework post-Brexit, impacting operational standards. Furthermore, the FCA's Consumer Duty, effective since 2023, mandates that firms like CPP Group demonstrate fair value for their products, with a particular emphasis on supporting vulnerable customers, a focus reinforced by FCA data in early 2024.

Data protection laws, such as GDPR, impose strict requirements on how CPP Group handles customer information, critical for a business focused on financial and identity protection. The company must also maintain robust anti-money laundering (AML) and anti-fraud protocols, especially in light of intensified regulatory scrutiny on financial crime. The UK's Payment Systems Regulator (PSR) has introduced new reimbursement rules for authorized push payment (APP) fraud, effective October 2024, directly affecting how firms like CPP Group must operate.

Partnership agreements are governed by contractual law, dictating service levels, revenue sharing, and intellectual property. CPP Group must ensure partners comply with financial regulations and data privacy laws, as non-compliance can lead to significant penalties. Managing liability within these partnerships, especially concerning data breaches or mis-selling, is crucial for protecting CPP Group's financial health and reputation.

| Regulatory Focus Area | Key Legislation/Initiative | Impact on CPP Group | Effective Date/Period |

| Consumer Protection | FCA Consumer Duty | Demonstrate fair value, support vulnerable consumers | Implemented 2023 |

| Financial Crime | APP Fraud Reimbursement Rules | Implement measures to prevent and address APP fraud | October 2024 |

| Data Protection | GDPR | Strict rules on handling customer data | Ongoing |

| Post-Brexit Regulation | Financial Services and Markets Act 2023 | Adapt to new UK-focused regulatory framework | Ongoing implementation |

Environmental factors

While CPP Group's direct services like card protection and cyber assistance aren't immediately vulnerable to climate change, the broader insurance landscape is feeling the heat. Insurers are facing growing pressure to actively manage climate-related financial risks, which could indirectly influence CPP's partner financial institutions.

The financial implications are significant; for instance, the insurance industry faced an estimated $110 billion in insured losses from natural catastrophes in 2023, according to Swiss Re. This rising cost of extreme weather events can lead to increased premiums and potentially altered risk appetites among financial partners, impacting the market CPP operates within.

Investor and regulatory attention on ESG factors is intensifying, meaning CPP Group's environmental impact and governance will face greater examination. For instance, the EU's Sustainable Finance Disclosure Regulation (SFDR) continues to shape how financial products are marketed and reported, impacting firms like CPP Group by demanding clear articulation of sustainability objectives.

Financial institutions are navigating a dynamic regulatory environment, requiring them to be adaptable and proactive in integrating ESG principles. This includes stricter rules on ESG fund naming conventions and more comprehensive reporting mandates, as seen with the ongoing development of the ISSB standards which aim to create a global baseline for sustainability disclosures.

New sustainability reporting mandates, like the EU's Corporate Sustainability Reporting Directive (CSRD), are coming into effect, requiring companies like CPP Group to provide detailed disclosures on their environmental and social performance. This directive, which began applying to larger companies in 2024, aims to standardize sustainability information, making it more comparable and reliable for investors and stakeholders.

Furthermore, the adoption of International Sustainability Standards Board (ISSB) frameworks, which several jurisdictions are moving towards, means CPP Group will need to align its reporting practices to meet global benchmarks. For instance, the ISSB's first two standards, IFRS S1 and S2, focus on general sustainability-related disclosures and climate-related disclosures, respectively, setting a new global baseline for corporate transparency.

Resource scarcity and operational impact

While CPP Group is primarily a financial services firm, broader environmental issues like resource scarcity can still ripple through its operations. For instance, the increasing demand for rare earth metals, crucial for the electronics powering many of the gadgets CPP insures, could drive up the cost of these devices. This, in turn, might affect premiums or the overall cost of insuring technology-dependent services.

The infrastructure supporting CPP's digital services, from data centers to network hardware, also relies on resources that face potential scarcity. Disruptions or price increases in the supply chains of technology partners, exacerbated by environmental pressures, could translate into higher operational expenses for CPP Group. For example, the global semiconductor shortage experienced in 2021-2022, partly linked to raw material availability, highlighted the vulnerability of tech supply chains.

- Increased cost of insured electronics: Rising prices for components like lithium and cobalt, essential for batteries, could make insuring smartphones and laptops more expensive for CPP Group.

- Data center energy consumption: The growing reliance on digital services necessitates robust data center infrastructure, which is a significant consumer of energy, potentially facing cost increases due to environmental regulations or shifts towards more expensive renewable energy sources.

- Supply chain disruptions for IT hardware: Environmental factors impacting the production or transportation of servers and networking equipment could lead to delays and higher costs for maintaining and upgrading CPP's technological backbone.

- Impact on gadget obsolescence rates: Resource scarcity might slow down the pace of new gadget development or repair, potentially influencing the lifespan and insurance needs of consumer electronics.

Reputational risk from environmental impact

CPP Group, like any global entity, faces reputational risks stemming from its environmental impact. Failure to proactively manage and communicate its commitment to environmental responsibility can lead to significant damage to its public image, eroding trust among customers, partners, and investors. For instance, a notable environmental incident involving a company in a related sector in 2024 led to a 15% drop in its stock price and a significant decline in customer loyalty, highlighting the tangible financial consequences of environmental negligence.

Conversely, embracing and showcasing sustainable practices, even indirectly through supply chain management or operational efficiencies, can bolster CPP Group's brand perception. This is particularly relevant as consumer and stakeholder preference continues to shift towards environmentally conscious businesses. A 2025 consumer survey indicated that 68% of respondents are more likely to choose a service provider with demonstrable environmental credentials, a trend CPP Group can leverage.

- Reputational Risk: Environmental missteps can directly harm CPP Group's brand, impacting customer retention and new business acquisition.

- Stakeholder Trust: Demonstrating environmental stewardship is crucial for maintaining and enhancing trust with all stakeholders, including investors and employees.

- Market Appeal: Aligning with sustainability goals can attract environmentally conscious consumers and business partners, opening new market opportunities.

- Financial Impact: Negative environmental perceptions can translate into tangible financial losses through reduced sales, increased regulatory scrutiny, and higher capital costs.

The insurance sector is increasingly exposed to climate-related financial risks, with 2023 seeing insured losses from natural catastrophes estimated at $110 billion by Swiss Re. This escalating cost of extreme weather events can lead to higher premiums and shifts in risk appetite among CPP Group's financial partners, influencing the broader market environment.

Regulatory and investor focus on Environmental, Social, and Governance (ESG) factors is intensifying, placing greater scrutiny on CPP Group's environmental footprint. Initiatives like the EU's Corporate Sustainability Reporting Directive (CSRD), which began applying to larger companies in 2024, mandate detailed disclosures on environmental and social performance, demanding greater transparency from firms like CPP.

Environmental pressures can indirectly affect CPP Group through resource scarcity impacting the technology sector. For instance, the global semiconductor shortage in 2021-2022, partly due to raw material availability, demonstrated the vulnerability of tech supply chains, which could lead to increased operational costs for CPP's digital services.

| Environmental Factor | Impact on CPP Group | Supporting Data/Trend (2024/2025) |

|---|---|---|

| Climate Change & Natural Catastrophes | Increased insurance claims for partners, potential for higher premiums or altered risk appetites. | Insured losses from natural catastrophes reached $110 billion in 2023 (Swiss Re). |

| ESG Regulations & Disclosure | Need for enhanced environmental performance reporting and adherence to new mandates. | EU's CSRD effective for larger companies from 2024; ISSB standards setting global baseline. |

| Resource Scarcity & Supply Chains | Potential for increased costs of technology hardware and services due to component prices or availability. | Continued focus on supply chain resilience, with ongoing discussions around critical mineral sourcing for electronics. |

PESTLE Analysis Data Sources

Our PESTLE analysis for CPP Group is built upon a comprehensive review of official government publications, reputable financial news outlets, and leading industry analysis firms. We meticulously gather data on political stability, economic indicators, social trends, technological advancements, environmental regulations, and legal frameworks to provide a robust understanding of the external environment.