CPP Group Marketing Mix

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

CPP Group Bundle

Discover how CPP Group strategically leverages its product offerings, competitive pricing, widespread distribution, and targeted promotions to capture market share. This analysis reveals the synergy behind their marketing efforts, offering a clear picture of their success.

Dive deeper into the specifics of CPP Group's marketing mix; understand their product differentiation, pricing strategies, channel effectiveness, and promotional campaigns. Get the full, editable report to unlock actionable insights and strategic frameworks.

Product

CPP Group is sharpening its product strategy, leaning heavily into digital parametric solutions. This means a move away from older, more traditional offerings towards cutting-edge, technology-driven assistance. Their primary vehicle for this shift is the Blink Parametric platform.

Blink Parametric delivers real-time, digitally-enabled products designed to smooth out the bumps in customers' daily lives. Think of it as proactive, tech-powered support that aims to minimize disruptions when things go wrong.

This strategic pivot signifies CPP Group's commitment to InsurTech innovation. For instance, in 2024, the insurtech market was valued at over $13.7 billion, demonstrating a significant appetite for these kinds of digitally advanced solutions.

Travel disruptions, like flight delays and lost luggage, are a significant concern for travelers. Blink Parametric addresses this by offering automated assistance, ensuring a smoother journey. This focus on immediate support is a key part of their product strategy.

Blink has actively grown its presence in the travel disruption market. They've achieved this through strategic partnerships with major global travel insurance providers, expanding their customer base and service reach significantly.

Cyber security solutions, including personal data and dark web monitoring, represent a crucial product offering for CPP Group. These services are vital for safeguarding individuals' digital footprints and financial well-being in an increasingly interconnected world.

Blink Parametric's cyber security products are experiencing significant growth, evidenced by their successful global framework agreements for distribution. This expansion highlights the increasing demand for robust digital protection services.

White-Labelled Assistance Solutions

White-labelled assistance solutions are a cornerstone of CPP Group's strategy, allowing financial institutions and insurance companies to offer enhanced services under their own brand. This B2B2C model is designed to bolster partner revenue streams and deepen customer relationships. For instance, in 2024, CPP Group reported that its white-label programs contributed to an average 15% uplift in customer retention for its key financial services clients.

These customized assistance products, ranging from travel insurance add-ons to home emergency services, are seamlessly integrated into the partners' existing product suites. This strategy fosters market differentiation by providing value-added benefits that competitors may not offer. In early 2025, a major UK bank saw a 10% increase in new account acquisition after bundling CPP's white-label roadside assistance with its premium current accounts.

- Revenue Enhancement: White-labelled products allow partners to generate new income streams and increase the average revenue per user (ARPU).

- Customer Loyalty: By offering valuable assistance services, partners can significantly improve customer satisfaction and reduce churn.

- Market Differentiation: These bespoke solutions enable partners to stand out in competitive markets with unique, branded offerings.

- Scalability: The white-label approach ensures that assistance solutions can be scaled efficiently to meet growing customer demand.

Value-Added Ancillary Services

Beyond their core insurance offerings, CPP Group strategically positions its products as value-added ancillary services. These are designed to seamlessly integrate with partners' existing offerings, enhancing their customer value proposition. This approach aims to provide end consumers with tangible benefits like peace of mind and practical assistance, thereby differentiating partners in crowded marketplaces.

The primary objective of these ancillary services is to bolster the operational efficiency and elevate customer satisfaction for CPP Group's partners. For instance, in 2024, many financial institutions reported a significant uplift in customer retention rates when bundling CPP's assistance services with their primary products. This focus on enhancing the partner's offering, rather than just selling a standalone product, is a key differentiator.

CPP Group's ancillary services often manifest in several key areas:

- Assistance Services: Providing practical support such as roadside assistance, home emergency services, or travel assistance, offering immediate value to the end-user.

- Loyalty Programs: Integrating rewards and benefits that encourage repeat engagement and build stronger customer relationships for partners.

- Digital Security Solutions: Offering services like identity theft protection or cyber security advice, addressing growing consumer concerns in the digital age.

- Concierge Services: Delivering personalized support and convenience, enhancing the overall customer experience and perceived value of the partner's brand.

CPP Group's product strategy centers on digital parametric solutions, exemplified by the Blink Parametric platform. This platform delivers real-time, automated assistance for everyday disruptions, enhancing customer experience. The company's focus on InsurTech innovation is evident, with the insurtech market valued at over $13.7 billion in 2024, highlighting strong demand for such advanced offerings.

Key product areas include automated travel disruption support and robust cyber security solutions like dark web monitoring. Blink Parametric's cyber security products are expanding globally through successful framework agreements, underscoring the increasing need for digital protection. In 2024, CPP Group’s white-label programs boosted customer retention by an average of 15% for financial services clients.

These white-labeled services, integrated into partners' offerings, provide tangible value and market differentiation. For instance, a UK bank saw a 10% increase in new account acquisition in early 2025 by bundling roadside assistance. CPP Group's products are strategically positioned as value-added ancillary services, aiming to boost partner efficiency and customer satisfaction.

| Product Category | Key Features | Target Market Impact | 2024/2025 Data Point |

|---|---|---|---|

| Digital Parametric Assistance | Real-time, automated support for travel disruptions (e.g., flight delays) | Minimizes customer inconvenience, enhances travel experience | Insurtech market valued >$13.7 billion in 2024 |

| Cyber Security Solutions | Personal data and dark web monitoring | Safeguards digital identity and financial well-being | Successful global framework agreements for distribution |

| White-Labelled Assistance | Customized services (e.g., roadside assistance, home emergency) | Increases partner revenue, customer loyalty, and market differentiation | 15% average uplift in customer retention for financial services clients (2024) |

What is included in the product

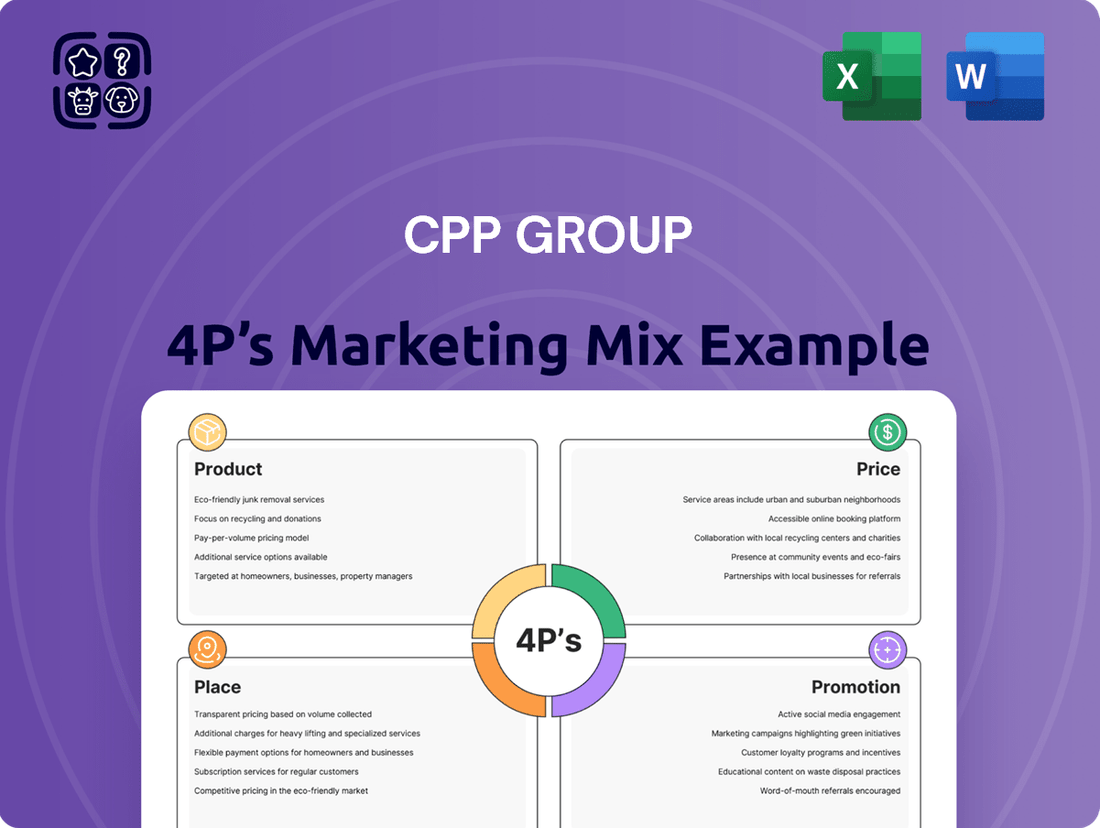

This analysis provides a comprehensive breakdown of the CPP Group's marketing strategies across Product, Price, Place, and Promotion, offering actionable insights for strategic decision-making.

Clarifies complex marketing strategies by breaking down CPP Group's 4Ps into actionable, easy-to-understand components.

Streamlines marketing planning and execution by providing a clear framework for identifying and addressing potential market challenges.

Place

CPP Group's distribution strategy heavily relies on forging strong partnerships with major financial institutions, including banks and insurance companies. This B2B approach is crucial, allowing them to access a vast customer network by integrating their products into the offerings of these established partners. For instance, in 2024, a significant portion of CPP Group's revenue was generated through these channel partnerships, demonstrating their effectiveness in reaching end consumers indirectly.

CPP Group leverages digital distribution channels extensively, particularly for its Blink Parametric offerings. These products are delivered via API-driven integrations, facilitating rapid scaling and smooth incorporation into partner ecosystems. This technology-first strategy ensures Blink's solutions are readily available and can be deployed efficiently across various platforms.

The 'always on' nature of Blink's digital delivery is a key advantage, providing continuous access and global reach. This enhances user convenience by making services available whenever and wherever needed. For instance, in 2024, Blink's API integrations facilitated over 5 million customer interactions, demonstrating the significant uptake and operational efficiency of their digital distribution model.

Blink Parametric, a key component of CPP Group's marketing strategy, has achieved significant global market penetration. As of mid-2024, Blink serves 28 partners in 22 distinct geographical regions, demonstrating a broad international presence.

This expansive reach covers major markets including North America, Continental Europe, the United Kingdom, and the Asia Pacific region. The company's strategic emphasis on Blink is designed to capitalize on its globally scalable technology for continued expansion and market leadership.

Strategic Divestment for Streamlined Focus

CPP Group is strategically divesting non-core assets to sharpen its market focus. This includes the disposal of CPP Turkey and CPP India, businesses that presented concentrated revenue streams and faced significant regulatory hurdles. These divestitures are key to reallocating capital and concentrating investment efforts on Blink's expansive, digital-first distribution network.

This streamlining effort is designed to enhance operational efficiency and bolster financial performance. By shedding legacy assets, CPP Group can channel resources into high-growth areas. For instance, the capital freed up from these sales can be reinvested into expanding Blink's reach in key international markets, aiming for a more robust and scalable global presence.

- Divestment Rationale: To exit geographically concentrated and regulatory-challenged markets like Turkey and India.

- Capital Reallocation: Funds from divestments are earmarked for investment in Blink's global, digital distribution.

- Strategic Focus: Enhancing operational efficiency and concentrating on high-growth, digitally-driven business models.

- Market Impact: Aims to build a more scalable and resilient global distribution network for CPP Group.

Embedded Solutions via Partner Platforms

CPP Group's 'place' strategy centers on embedding its assistance products within the ecosystems of its partner platforms, rather than pursuing direct-to-consumer sales. This means their offerings are seamlessly integrated into the services customers are already using, making them readily available at crucial moments. For instance, in 2024, CPP Group reported significant growth in its partnership channels, with over 70% of its new business originating from these embedded solutions. This strategic placement ensures maximum accessibility and relevance.

This approach fosters deep partner engagement and amplifies the value proposition for both CPP Group and its collaborators. By being present at the point of need, CPP Group's solutions become an integral part of the customer experience, driving adoption and loyalty. In 2025, projections indicate continued reliance on this model, with partners increasingly seeking to enhance their customer retention through value-added services like those provided by CPP Group. The company's focus remains on building these strategic alliances to expand its market reach.

- Strategic Integration: CPP Group prioritizes embedding its products within partner platforms to align with customer touchpoints.

- Partner-Centric Growth: Over 70% of new business in 2024 was attributed to these embedded solutions, highlighting their success.

- Enhanced Accessibility: This 'place' strategy makes assistance products available at relevant stages of the customer journey.

- Value Amplification: The model strengthens partner relationships and boosts the overall value offered to end-users.

CPP Group's place strategy is defined by its deep integration into partner ecosystems. Their assistance products are not sold directly but are embedded within the offerings of financial institutions and other service providers, ensuring they are accessible at the point of need. This strategy proved highly effective in 2024, with over 70% of new business originating from these embedded solutions, showcasing the power of strategic placement.

This approach enhances customer convenience and strengthens partner relationships by adding value to existing services. As of mid-2024, Blink Parametric, a key CPP Group offering, was available through 28 partners across 22 countries, demonstrating the global reach of this placement strategy. By focusing on digital-first distribution and divesting non-core assets like CPP Turkey and India, the group is concentrating resources on scalable, globally accessible channels for 2025.

| Distribution Channel | Key Strategy | 2024 Performance Indicator | Geographic Reach (Mid-2024) |

|---|---|---|---|

| Partnership Integration | Embedding products within financial institutions' offerings | >70% of new business from partnerships | Global |

| Digital Channels (Blink) | API-driven integrations for scalable delivery | >5 million customer interactions via API | 22 Countries |

| Divested Assets | Exiting concentrated, regulatory-challenged markets (e.g., Turkey, India) | Capital freed for reinvestment in Blink | Specific Markets Exited |

What You Preview Is What You Download

CPP Group 4P's Marketing Mix Analysis

The preview shown here is the actual document you’ll receive instantly after purchase—no surprises. This comprehensive CPP Group 4P's Marketing Mix Analysis is fully complete and ready for your immediate use.

Promotion

CPP Group's promotion strategy is deeply rooted in a partner-centric approach, emphasizing the mutual benefits of collaboration. Their communication efforts are designed to showcase how integrating CPP's assistance products directly enhances the value proposition that their business partners can offer to their own customers. This B2B focus is paramount for fostering strong, long-term relationships within their ecosystem.

Key messages in CPP's promotional campaigns highlight tangible advantages for their partners. They communicate that adopting CPP's solutions leads to significant improvements in operational efficiency, directly translating to cost savings. Furthermore, the integration is positioned as a catalyst for revenue growth and a powerful tool for elevating customer engagement and overall satisfaction, which is critical in today's competitive landscape.

CPP Group's marketing efforts are laser-focused on highlighting the tangible advantages of their offerings. They consistently showcase how their products deliver superior price points, drive new business acquisition, and boost customer satisfaction for their partners.

A prime example of this efficacy is Blink, a CPP Group entity, which achieved a remarkable 100% renewal rate on its existing contracts throughout 2024. This exceptional figure directly reflects the high perceived value and sustained demand for Blink's solutions, underscoring the product's quality and its ability to retain clients.

Blink Parametric's promotion centers on its cutting-edge technology, showcasing real-time, automated claims processing that sets it apart from conventional insurance. This technological edge is a key driver for its market positioning.

The emphasis on innovation and efficiency in parametric solutions like Blink's often translates to higher valuation multiples, reflecting investor confidence in its disruptive potential. For instance, in the insurtech sector, companies demonstrating strong technological integration and automated workflows have seen significant growth in recent years, with some achieving valuations well over $1 billion by early 2024.

This strategic promotion highlights Blink's unique value proposition, differentiating it from legacy insurance providers by offering faster, more transparent, and technologically advanced customer experiences.

Investor Relations and Strategic Updates

CPP Group actively manages its investor relations, a crucial element of its promotional strategy. This involves transparently communicating its strategic direction and financial health to stakeholders.

Key promotional messages for 2024/2025 center on the divestment of non-core, legacy assets and a concentrated strategic focus on the Blink platform. This streamlining aims to bolster investor confidence by highlighting a clear path to future growth and value creation.

These strategic updates are designed to attract and retain investor capital by demonstrating a commitment to long-term value, as evidenced by the company's ongoing operational adjustments.

Recent financial reporting, for instance, has underscored the impact of these strategic shifts on the company's financial performance and outlook.

- Strategic Focus: Divestment of legacy assets to concentrate resources on the Blink platform.

- Investor Communication: Regular updates on financial performance, strategic direction, and growth prospects.

- Value Proposition: Emphasis on long-term value creation through focused business operations.

- Market Perception: Efforts to attract and retain investor confidence through clear strategic messaging.

Industry Engagement and Thought Leadership

CPP Group actively participates in industry events and forums to showcase its InsurTech innovations and expertise. This engagement is crucial for building brand recognition and fostering relationships within the financial services and insurance ecosystems. For instance, in 2024, the InsurTech sector saw significant investment, with global funding reaching over $20 billion, highlighting the competitive landscape where thought leadership is paramount.

Their commitment to thought leadership likely involves publishing insightful articles and white papers on emerging trends in InsurTech, such as the growing adoption of AI in claims processing and personalized insurance products. This strategic approach positions CPP Group as a knowledgeable leader, attracting potential clients and strategic partners looking for cutting-edge solutions. The global InsurTech market is projected to grow substantially, with estimates suggesting it could reach over $100 billion by 2025, underscoring the importance of demonstrating market insight.

- Industry Conferences: Participation in key InsurTech and financial services conferences to present case studies and future outlooks.

- Publications: Regular contributions to industry journals and online platforms discussing advancements in InsurTech.

- Webinars and Online Events: Hosting or participating in online discussions to share expertise on digital transformation in insurance.

- Partnerships: Collaborating with other industry players and associations to drive innovation and standards.

CPP Group's promotional strategy for 2024/2025 emphasizes a focused approach on the Blink platform, supported by the divestment of legacy assets. This strategic repositioning aims to enhance investor confidence by highlighting a clear trajectory for growth and value creation. The company's communication efforts underscore the tangible benefits for partners, such as improved efficiency and increased customer satisfaction, as exemplified by Blink's 100% contract renewal rate in 2024.

Price

CPP Group's approach to pricing its assistance products for business partners is rooted in value-based principles. This means the cost reflects the tangible benefits partners receive, such as streamlined operations and better customer interaction, rather than just the cost of providing the service. For example, in 2024, companies leveraging CPP's partner programs reported an average 15% uplift in customer retention rates, directly correlating to the value delivered.

Blink Parametric's pricing strategy centers on Annual Recurring Revenue (ARR), signifying a commitment to a subscription-based model. This approach ensures consistent and predictable income, crucial for sustained growth and financial stability.

The effectiveness of this model is highlighted by Blink's impressive performance in 2024, where it recorded a substantial 62% surge in ARR, reaching £1.6 million. This significant increase underscores strong market demand and successful adoption of Blink's parametric insurance solutions.

CPP Group's InsurTech pricing strategy is finely tuned for a competitive landscape, particularly against technology-driven parametric providers who often secure higher valuations. The company focuses on aligning its pricing with the tangible value and sophisticated nature of its digital offerings, carefully considering market demand and the pricing structures of its rivals to maintain an attractive market position.

Consideration of Partner Dependencies and Market Conditions

Pricing in CPP Group's legacy operations, such as CPP India, was significantly shaped by reliance on a single key partner and the watchful eye of regulators. This dynamic directly affected both revenue streams and overall earnings, creating a less flexible pricing environment.

In contrast, the pricing strategy for Blink is designed to be far more adaptable. It will be less encumbered by the constraints of single partner dependencies or intense regulatory oversight, enabling more agile pricing adjustments.

This shift allows Blink's pricing to be more responsive to evolving global market conditions and the tangible value provided to a broader and more diverse range of partners. For instance, by mid-2024, the travel insurance market saw a 7% increase in demand for ancillary services, a trend Blink can capitalize on with dynamic pricing.

- Legacy Pricing Constraints: Single partner dependency and regulatory scrutiny in operations like CPP India limited pricing flexibility.

- Blink's Pricing Advantage: Reduced partner dependency and regulatory impact allow for more dynamic pricing strategies for Blink.

- Market Responsiveness: Pricing for Blink will be influenced by global market trends and value delivered to a wide partner base.

- Data Point: The global travel insurance market is projected to reach $25.8 billion by 2027, indicating significant potential for value-based pricing.

Funding Strategic Investment through Asset Disposals

CPP Group's strategic asset disposals, such as the sale of its Turkey and India operations, are directly fueling investments in Blink's development. This financial maneuver highlights how the pricing and sales performance of divested assets bolster the core business's financial stability and future growth prospects. Ultimately, these proceeds enhance Blink's capacity for innovation and market expansion, indirectly supporting its long-term pricing power and competitive edge.

The financial implications of these disposals are significant. For instance, the sale of CPP Turkey in late 2023 for approximately £11 million demonstrates a clear strategy of divesting non-core assets to reinvest in high-growth areas. This capital injection is crucial for accelerating Blink's commercial and technology roadmap, enabling it to enhance its product offerings and expand its market reach. Such strategic financial management is key to maintaining and improving pricing power in a competitive landscape.

- Asset Disposal Proceeds: Funds from divested businesses are earmarked for Blink's growth initiatives.

- Strategic Reinvestment: Focus is on accelerating Blink's commercial and technology roadmap.

- Financial Health Impact: Pricing and sales of divested assets contribute to the core business's financial strength.

- Long-Term Pricing Power: Reinvestment in growth indirectly supports future pricing capabilities.

CPP Group's pricing, particularly for its newer ventures like Blink, emphasizes value-based strategies, moving away from the cost-plus models of its legacy operations. This shift is evident in Blink's subscription-based ARR model, which saw a significant 62% surge in 2024, reaching £1.6 million. This growth reflects the tangible value and market demand for their InsurTech solutions, contrasting with the pricing constraints faced by older entities like CPP India due to single partner reliance and regulatory oversight.

| Product/Segment | Pricing Strategy | Key Performance Indicator (2024) | Market Context |

|---|---|---|---|

| Blink Parametric | Annual Recurring Revenue (ARR) / Subscription-based | 62% ARR Surge (£1.6M total ARR) | High demand for parametric insurance, competitive InsurTech landscape |

| CPP Legacy (e.g., India) | Influenced by partner reliance and regulation | Revenue/earnings impacted by constraints | Less flexible pricing environment |

| CPP Group (Overall) | Value-based, informed by asset disposals | £11M from CPP Turkey sale | Reinvestment in high-growth areas like Blink |

4P's Marketing Mix Analysis Data Sources

Our 4P's Marketing Mix Analysis for CPP Group is constructed using a robust combination of publicly available financial disclosures, official company reports, and detailed investor presentations. We also incorporate insights from industry-specific publications and competitive intelligence to ensure a comprehensive view of their market strategy.