CPFL Energia SWOT Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

CPFL Energia Bundle

CPFL Energia's market position is shaped by significant strengths like its extensive distribution network and a growing renewable energy portfolio, but also faces challenges from regulatory shifts and increasing competition. Understanding these dynamics is crucial for any investor or strategist looking to capitalize on opportunities within Brazil's energy sector.

Want the full story behind CPFL Energia's strengths, risks, and growth drivers? Purchase the complete SWOT analysis to gain access to a professionally written, fully editable report designed to support planning, pitches, and research.

Strengths

CPFL Energia boasts a highly diversified operational structure, encompassing generation, transmission, distribution, and commercialization of electricity. This integrated approach across the entire energy value chain significantly reduces the company's exposure to volatility in any single segment. For instance, in the first quarter of 2024, CPFL Energia reported a 13.1% increase in net revenue, reaching R$10.9 billion, demonstrating the resilience of its diverse portfolio.

CPFL Energia boasts a formidable market presence in Brazil, operating as one of the country's largest electric utility companies. It serves a substantial customer base, encompassing residential, commercial, industrial, and rural sectors, particularly within its core operating regions.

This extensive reach translates into a significant market share, solidifying its competitive standing and brand recognition. For instance, in 2023, CPFL Energia maintained its position as a leading distributor, delivering electricity to millions of consumers across its concessions.

CPFL Energia’s significant investment in renewable energy sources, including small hydroelectric plants, wind farms, and solar power, is a major strength. This strategic focus not only diversifies their energy generation portfolio but also aligns them with the global shift towards sustainability and the energy transition. For instance, by 2023, CPFL Energia had a substantial renewable energy capacity, with a significant portion coming from wind and solar, demonstrating a tangible commitment to these growing sectors.

Stable Customer Base

CPFL Energia benefits from a stable customer base, encompassing residential, commercial, and industrial segments. This broad reach translates into a predictable demand for electricity, significantly mitigating revenue volatility.

The essential nature of electricity consumption means that demand remains relatively consistent, even during economic downturns. This inherent stability supports predictable cash flows, a key factor that appeals to investors seeking reliable returns.

For instance, in 2023, CPFL Energia reported a robust customer base, serving millions of consumers across its distribution areas, underscoring the strength of its market penetration and the essentiality of its services.

- Diverse Customer Segments: Residential, commercial, and industrial clients ensure broad demand.

- Essential Service: Electricity's non-discretionary use provides consistent consumption patterns.

- Predictable Cash Flows: Stable demand underpins reliable revenue generation and operational planning.

Operational Scale and Efficiency

CPFL Energia's vast operational scale, encompassing extensive distribution networks and generation assets, translates into significant economies of scale. This allows for optimized procurement of fuel and equipment, as well as more efficient maintenance scheduling across its widespread infrastructure. For instance, in 2023, CPFL Energia reported a net revenue of R$36.4 billion, reflecting the sheer volume of its operations and its ability to leverage its size for cost advantages.

These efficiencies directly contribute to enhanced financial performance. By spreading fixed costs over a larger operational base and negotiating better terms with suppliers due to its purchasing power, CPFL Energia can achieve lower per-unit costs. This competitive edge is crucial in the energy sector, where cost management is paramount for profitability and market competitiveness.

- Economies of Scale: CPFL Energia's large footprint enables cost savings in procurement and operations.

- Infrastructure Leverage: Extensive networks facilitate efficient resource allocation and maintenance.

- Cost Efficiency: Optimized operations lead to lower per-unit costs, boosting profit margins.

- Financial Performance: Operational scale directly supports stronger financial results, as seen in its substantial 2023 revenue.

CPFL Energia's diversified operational structure, covering generation, transmission, distribution, and commercialization, significantly reduces risk across its business segments. This integrated approach was evident in Q1 2024 when the company reported a 13.1% net revenue increase to R$10.9 billion, showcasing the resilience of its varied portfolio.

The company commands a strong market position in Brazil, serving millions of residential, commercial, and industrial customers across its concessions, reinforcing its brand recognition and competitive standing. Its commitment to renewables, including wind and solar, further strengthens its portfolio, aligning with the global energy transition and demonstrating substantial capacity in these growing sectors by 2023.

CPFL Energia benefits from a stable, essential service that ensures predictable demand and cash flows, even during economic downturns, as evidenced by its robust customer base in 2023. Its vast operational scale allows for significant economies of scale, leading to cost efficiencies in procurement and operations, which directly contribute to its strong financial performance, highlighted by R$36.4 billion in net revenue in 2023.

| Strength | Description | Supporting Data (2023/Q1 2024) |

|---|---|---|

| Diversified Operations | Integrated value chain (generation, transmission, distribution, commercialization) | 13.1% net revenue increase to R$10.9 billion (Q1 2024) |

| Market Leadership | One of Brazil's largest electric utilities with extensive customer reach | Serves millions of consumers across concessions |

| Renewable Energy Focus | Significant investment in wind, solar, and hydro power | Substantial renewable energy capacity by 2023 |

| Stable Customer Base & Cash Flow | Essential service ensures consistent demand and predictable revenue | Robust customer base in 2023 |

| Economies of Scale | Large operational footprint enables cost efficiencies | R$36.4 billion net revenue (2023) |

What is included in the product

Analyzes CPFL Energia’s competitive position through key internal and external factors, identifying its strengths in market presence and operational efficiency, weaknesses in regulatory dependence, opportunities in renewable energy expansion, and threats from economic volatility and competition.

CPFL Energia's SWOT analysis offers a clear, actionable roadmap to navigate market complexities, transforming potential challenges into strategic advantages.

Weaknesses

CPFL Energia operates within Brazil's heavily regulated energy market, making it vulnerable to shifts in government policies, tariff structures, and overall energy sector regulations. These changes can directly affect the company's financial performance and investment planning.

Unfavorable regulatory shifts, such as unexpected tariff reductions or increased operational compliance costs, could significantly impact CPFL Energia's revenue streams and profitability. For instance, regulatory reviews of distribution concessions, which form a core part of CPFL's business, can lead to adjustments in allowed revenues, creating uncertainty.

The company’s exposure to regulatory risk is a constant consideration. For example, in 2023, the Brazilian energy sector saw ongoing discussions and potential adjustments to pricing mechanisms and regulatory frameworks, which could have implications for CPFL's financial results in 2024 and beyond.

CPFL Energia's financial performance is significantly influenced by Brazil's overall economic climate. A slowdown in industrial and commercial activity, which are key customer segments, directly translates to lower electricity consumption and, consequently, reduced revenue for the company. For instance, Brazil's GDP growth has been projected to be around 2.0% for 2024, a modest figure that could limit demand expansion.

Furthermore, economic headwinds like rising inflation or elevated interest rates pose substantial risks. Inflation can increase operational expenses for CPFL Energia, while higher interest rates make borrowing more expensive and can strain the payment capacity of its customers, potentially leading to increased defaults and impacting the company's bottom line.

CPFL Energia faces a significant hurdle with its high capital expenditure requirements. Maintaining and expanding its vast generation and distribution infrastructure demands substantial and continuous investment. For instance, in 2023, the company reported capital expenditures of R$5.1 billion, a notable increase from R$4.2 billion in 2022, reflecting ongoing infrastructure upgrades and expansion projects.

These substantial capital outlays can strain the company's financial flexibility. High investment needs often translate into elevated debt levels, which can become particularly burdensome during periods of rising interest rates, as seen with the average Selic rate hovering around 11.75% in early 2024. This pressure on cash flow management limits CPFL Energia's ability to pursue other strategic investment opportunities or to weather economic downturns effectively.

Operational Losses and Theft

CPFL Energia, like many electricity distributors in Brazil, contends with significant operational losses. These often stem from non-technical factors such as energy theft and inaccuracies in billing processes, directly eroding the company's revenue streams and profitability.

Addressing these losses necessitates ongoing, substantial investment in specialized loss reduction initiatives and the modernization of its distribution network. For instance, in 2023, non-technical losses in Brazil's electricity sector were estimated to represent a considerable percentage of total energy distributed, impacting the financial health of companies like CPFL.

- Energy Theft: Illegal connections and meter tampering remain persistent issues, leading to unbilled energy consumption.

- Billing Inefficiencies: Errors in meter readings and administrative oversights contribute to revenue leakage.

- Network Modernization Costs: Upgrading infrastructure to detect and prevent theft is a capital-intensive undertaking.

- Impact on Profitability: These losses directly reduce the earnings available for reinvestment and shareholder returns.

Environmental and Social Compliance

CPFL Energia, as a major utility operator, is subject to continuous examination concerning its environmental footprint and societal obligations. Failure to adhere to environmental mandates or address social concerns tied to its extensive infrastructure can result in substantial financial penalties, damage to its public image, and significant project postponements, thereby amplifying operational hazards.

The company's commitment to sustainability is crucial, especially as environmental regulations become more stringent. For instance, in 2023, Brazil's environmental agencies issued fines totaling R$1.5 billion for various environmental infractions across the energy sector, highlighting the potential financial exposure for companies like CPFL Energia.

- Regulatory Fines: Potential for significant financial penalties due to non-compliance with environmental laws.

- Reputational Risk: Negative public perception can impact customer loyalty and investor confidence.

- Project Delays: Social or environmental opposition can halt or significantly delay critical infrastructure development.

- Increased Operational Costs: Implementing stricter environmental controls and social mitigation measures adds to operational expenses.

CPFL Energia faces substantial operational losses, primarily driven by energy theft and billing inefficiencies. These issues directly reduce the company's revenue and profitability, requiring significant investment in loss reduction initiatives and network modernization. For example, non-technical losses in Brazil's electricity sector remain a persistent challenge, impacting financial health.

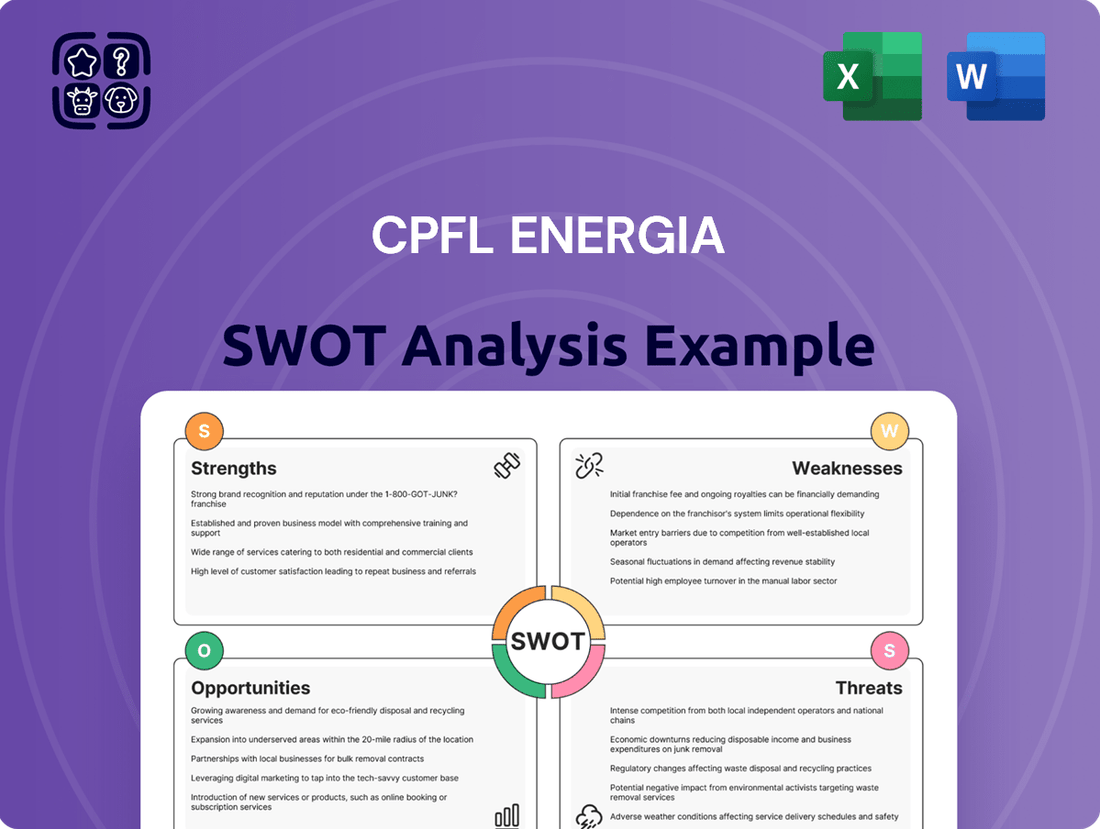

What You See Is What You Get

CPFL Energia SWOT Analysis

This is the actual CPFL Energia SWOT analysis document you’ll receive upon purchase—no surprises, just professional quality. You're getting a direct look at the comprehensive insights into CPFL Energia's Strengths, Weaknesses, Opportunities, and Threats.

The preview below is taken directly from the full CPFL Energia SWOT report you'll get. Purchase unlocks the entire in-depth version, providing a complete strategic overview.

This preview reflects the real CPFL Energia SWOT analysis document you'll receive—professional, structured, and ready to use for strategic planning.

Opportunities

CPFL Energia has a substantial opportunity to grow its renewable energy generation capacity. Brazil's strong natural resources, including ample sunlight and wind, coupled with the global drive towards decarbonization, create a fertile ground for expansion in solar, wind, and hydroelectric projects. This strategic move can lead to stable, long-term revenue and bolster the company's environmental, social, and governance (ESG) credentials.

CPFL Energia can leverage the ongoing adoption of smart grid technologies to significantly boost operational efficiency. Digitalization of its operations, including advanced metering infrastructure and real-time data analysis, is projected to reduce energy losses. For instance, by 2024, smart meter deployment across Brazil is expected to reach over 70 million connections, enabling better monitoring and faster fault detection.

These technological advancements, particularly the integration of advanced analytics, offer a pathway to enhanced customer service and new revenue streams. CPFL can explore demand response programs, incentivizing customers to adjust energy usage during peak times, which could generate additional income. Furthermore, improved grid reliability through smart grid implementation is a key selling point, potentially leading to higher customer satisfaction and retention.

Strategic acquisitions of smaller utilities or renewable energy developers present a significant opportunity for CPFL Energia. For instance, acquiring companies with established renewable portfolios, like solar or wind farms, could rapidly expand CPFL's clean energy capacity, aligning with Brazil's growing demand for sustainable power sources. This inorganic growth can also bring valuable technological expertise and operational efficiencies.

Consolidating market share through mergers and acquisitions, especially in regions with fragmented utility ownership, can bolster CPFL's competitive standing. By integrating acquired entities, CPFL can achieve economies of scale, optimize its operational footprint, and potentially reduce costs, leading to improved profitability. This strategy is particularly relevant given the ongoing energy transition in Brazil.

The Brazilian market, with its evolving regulatory landscape and increasing focus on distributed generation, offers fertile ground for M&A. CPFL could target companies with strong customer bases in high-growth areas or those possessing innovative grid management technologies. These moves would not only diversify its asset base but also position it to capitalize on emerging market trends, potentially enhancing its overall valuation.

Distributed Generation Growth

The burgeoning distributed generation (DG) market, especially rooftop solar, offers CPFL Energia a significant avenue for expansion. As more consumers become prosumers, CPFL can leverage this by providing value-added services such as sophisticated energy management platforms, streamlined grid interconnection assistance, and advanced battery storage solutions. These offerings can unlock substantial new revenue streams, moving beyond traditional electricity sales.

This shift is already evident in market trends. For instance, Brazil's distributed solar generation capacity saw a notable increase, reaching over 35 GW by early 2024, with residential and commercial sectors leading the charge. This growth underscores the demand for integrated solutions that CPFL can supply.

- Expanding Service Portfolio: Offering energy management, grid connection, and battery storage to prosumers.

- New Revenue Streams: Diversifying income beyond traditional electricity supply.

- Market Growth: Capitalizing on Brazil's rapidly expanding distributed solar generation capacity, which surpassed 35 GW by early 2024.

ESG Investment Appeal

CPFL Energia's dedication to sustainability and renewable energy sources significantly boosts its appeal to the growing segment of investors prioritizing Environmental, Social, and Governance (ESG) criteria. This alignment with responsible investing principles can translate into a more favorable cost of capital and enhanced access to specialized green financing avenues. For instance, as of early 2024, global ESG assets were projected to reach $50 trillion by 2025, demonstrating the substantial market demand for companies with strong ESG profiles. This trend suggests CPFL Energia is well-positioned to attract these capital flows, potentially improving its valuation and long-term financial stability.

The company's proactive stance on ESG matters can unlock several opportunities:

- Attracting responsible investors: Increased interest from funds and individuals seeking sustainable investments.

- Lower cost of capital: Potential for reduced borrowing costs due to favorable ESG ratings.

- Access to green financing: Opportunities for dedicated loans and bonds tied to environmental projects.

- Enhanced brand reputation: Improved public perception and stakeholder trust stemming from its sustainability commitments.

CPFL Energia is well-positioned to capitalize on Brazil's abundant renewable resources, particularly solar and wind power, to expand its generation capacity. The global push for decarbonization further strengthens this opportunity, promising stable long-term revenues and improved ESG standing.

The company can enhance operational efficiency by adopting smart grid technologies, a trend supported by Brazil's projected deployment of over 70 million smart meter connections by 2024. This digitalization can reduce energy losses and improve grid management.

Strategic acquisitions of smaller utilities or renewable energy developers offer a path to rapid expansion of clean energy assets and integration of new technologies. This inorganic growth strategy aligns with Brazil's increasing demand for sustainable power and can lead to economies of scale.

The growing distributed generation market, especially rooftop solar, presents a chance for CPFL to offer value-added services like energy management platforms and battery storage, creating new revenue streams. Brazil's distributed solar capacity exceeded 35 GW by early 2024, highlighting this market's potential.

CPFL's strong ESG profile is attractive to investors prioritizing sustainability, potentially lowering its cost of capital and improving access to green financing. Global ESG assets were projected to reach $50 trillion by 2025, indicating significant capital availability for such companies.

Threats

Brazil's political climate presents a significant challenge for CPFL Energia. Fluctuations in government policies and economic stability can lead to unpredictable shifts in energy regulations and tariff structures. For instance, in late 2023 and early 2024, discussions around potential changes to the regulatory framework for distributed generation and the impact of inflation on operational costs created a degree of uncertainty for energy companies operating in the country.

This political and regulatory instability directly impacts CPFL Energia's long-term planning and investment strategies. Changes in government intervention or unexpected policy shifts can alter the expected returns on capital projects, making it harder to forecast profitability. The company must remain agile to adapt to these evolving conditions, which can affect its ability to secure financing and execute ambitious growth plans, particularly concerning renewable energy investments which often rely on stable regulatory support.

The Brazilian energy sector is experiencing a significant uptick in competition, particularly with new companies entering both the generation and commercialization spheres. This intensified rivalry, especially within the burgeoning free market segment, presents a considerable challenge for established entities like CPFL Energia.

This heightened competition can directly impact CPFL Energia by exerting downward pressure on energy prices, potentially leading to a reduction in its market share. Furthermore, the need to remain competitive may force the company to accept lower profit margins, affecting overall profitability.

Brazil's vulnerability to climate change presents a significant threat to CPFL Energia. Droughts, like those experienced in recent years, directly impact hydroelectric power generation, a crucial source for the company. For instance, the severe drought in 2021 led to historically low reservoir levels, increasing reliance on more expensive thermal power sources.

Furthermore, increasingly frequent and intense storms pose a risk to CPFL Energia's extensive distribution networks. These events can cause widespread power outages, necessitating costly repairs and leading to potential revenue disruptions. The company's operational resilience and financial performance are directly challenged by these weather-related risks.

Cybersecurity Risks

CPFL Energia, as a vital operator of critical infrastructure, is increasingly vulnerable to sophisticated cybersecurity threats targeting both its operational technology (OT) and information technology (IT) systems. The evolving landscape of cyberattacks poses a significant danger to the company's ability to maintain uninterrupted service delivery. For instance, the global cost of cybercrime was projected to reach $10.5 trillion annually by 2025, highlighting the pervasive nature of these risks for all industries, including utilities.

A successful cyberattack could have severe repercussions, leading to widespread service disruptions for millions of customers. Beyond operational impacts, such an event could compromise sensitive customer data and proprietary company information, resulting in substantial financial penalties and irreparable reputational damage. In 2023, the average cost of a data breach reached $4.45 million globally, a figure that underscores the financial stakes involved.

- Operational Disruption: Potential for power outages and service interruptions impacting a large customer base.

- Data Compromise: Risk of sensitive customer and corporate data being stolen or leaked.

- Financial Penalties: Significant costs associated with remediation, regulatory fines, and legal liabilities.

- Reputational Damage: Erosion of public trust and customer confidence following a security incident.

Fluctuations in Energy Prices and Supply

CPFL Energia faces significant threats from the volatility of energy prices. For instance, a dry spell in Brazil, which heavily relies on hydropower, could dramatically increase the cost of alternative energy sources for CPFL's commercialization segment. In 2023, Brazil experienced a period of lower reservoir levels, which historically correlates with higher spot market energy prices, potentially impacting CPFL's margins.

Fluctuations in global fuel costs, such as natural gas and oil, also directly affect CPFL's operational expenses and the pricing of electricity. If these commodity prices surge, CPFL's purchasing costs will rise, squeezing profitability, especially in its energy trading operations. The company's exposure to these external market forces remains a key vulnerability.

Market imbalances due to supply or demand shocks present another threat. Unexpected surges in demand, perhaps driven by economic recovery, or disruptions in supply chains for critical equipment could create price spikes or shortages. CPFL must navigate these potential market disruptions to maintain stable operations and pricing.

- Hydrological Risk: Lower rainfall in Brazil can increase reliance on more expensive thermal power generation, impacting CPFL's cost structure.

- Fuel Price Volatility: Global price swings in natural gas and oil directly influence the cost of energy CPFL might need to purchase.

- Market Imbalances: Sudden shifts in energy supply or demand can lead to unpredictable price movements and operational challenges.

Intensified competition within Brazil's energy sector, particularly in the free market segment, poses a threat to CPFL Energia's market share and profitability. New entrants can drive down prices, forcing established players to accept lower margins. This dynamic requires CPFL to continuously innovate and optimize its services to maintain a competitive edge.

CPFL Energia is susceptible to operational disruptions stemming from Brazil's vulnerability to climate change, such as droughts impacting hydroelectric power generation and severe weather events affecting its distribution networks. For instance, the 2021 drought significantly increased reliance on costlier thermal power. Furthermore, the company faces substantial cybersecurity risks, with global cybercrime costs projected to reach $10.5 trillion annually by 2025, potentially leading to service interruptions, data breaches costing an average of $4.45 million in 2023, and reputational damage.

The company must also contend with the volatility of energy prices, influenced by factors like rainfall levels affecting hydropower and global fuel costs. Market imbalances due to supply or demand shocks can further exacerbate price unpredictability and operational challenges for CPFL.

SWOT Analysis Data Sources

This CPFL Energia SWOT analysis is built upon a foundation of credible data, drawing from official financial statements, comprehensive market research reports, and expert industry forecasts to ensure a robust and insightful assessment.