CPFL Energia Porter's Five Forces Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

CPFL Energia Bundle

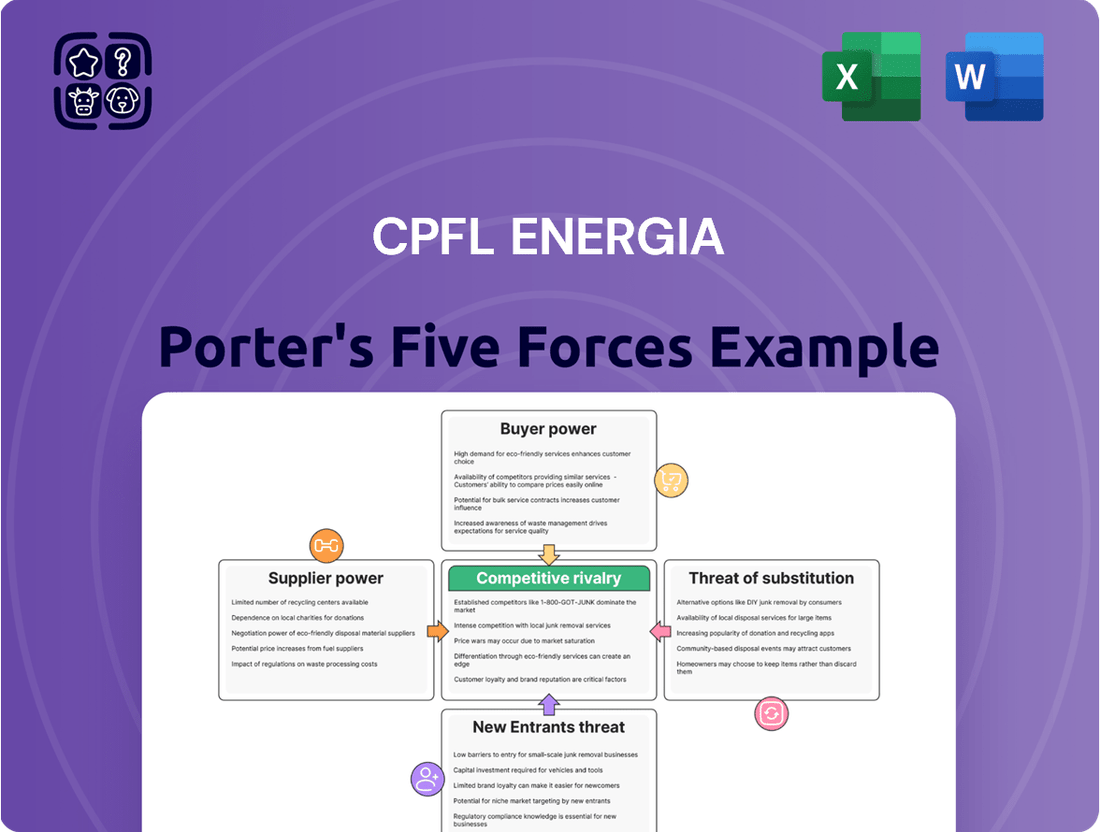

CPFL Energia navigates a dynamic energy landscape where buyer bargaining power, while present, is influenced by regulatory frameworks and essential service needs. The threat of new entrants is moderated by significant capital requirements and established infrastructure, but innovation in renewable energy presents evolving challenges.

The full analysis reveals the strength and intensity of each market force affecting CPFL Energia, complete with visuals and summaries for fast, clear interpretation. Unlock key insights into CPFL Energia’s industry forces—from supplier power to the threat of substitutes—and use this knowledge to inform strategy or investment decisions.

Suppliers Bargaining Power

CPFL Energia's reliance on a concentrated supplier base for crucial infrastructure like turbines and transmission equipment grants these suppliers considerable bargaining power. The specialized nature of these components means there are few qualified global manufacturers, limiting CPFL's options.

This concentration can translate into higher costs and less favorable contract terms for CPFL Energia. For instance, the global market for large-scale power generation turbines is dominated by a handful of major players, giving them significant pricing influence.

The substantial switching costs associated with highly specialized equipment further solidify supplier leverage. Replacing existing, integrated systems with those from alternative vendors often involves significant capital expenditure and operational disruption, making it difficult for CPFL Energia to negotiate aggressively on price or terms.

The cost of essential inputs like raw materials and fuel directly impacts CPFL Energia's operational expenses, especially for its thermal generation segments. Even with a strong focus on renewables, any reliance on fossil fuels means exposure to volatile global commodity prices, such as natural gas, which can influence profitability.

In 2023, global natural gas prices experienced significant fluctuations, impacting energy producers worldwide. While CPFL Energia's renewable portfolio is growing, the cost of specialized components for wind turbines and solar panels, though declining, can still be subject to the influence of a concentrated global supply base.

Suppliers with specialized technological know-how or patents in areas like advanced grid management or smart metering can wield significant influence. CPFL Energia's reliance on these firms for crucial innovations and efficiency gains can translate into increased costs and less favorable contract terms for proprietary systems. For instance, the ongoing transition to smart grids requires sophisticated technology, and suppliers holding key patents in this area can command premium pricing.

Labor and Specialized Services

The bargaining power of suppliers in labor and specialized services for CPFL Energia is significantly shaped by the availability of highly skilled professionals for complex infrastructure projects, maintenance, and specialized engineering. A scarcity of qualified personnel or specialized construction firms in Brazil can empower these service providers to negotiate higher rates, especially for large-scale renewable energy developments or intricate grid upgrades.

For instance, the demand for specialized technicians in the Brazilian energy sector has been growing, driven by the expansion of renewable sources. In 2023, Brazil saw significant investment in solar and wind power, creating a need for these niche skills. Companies like CPFL Energia, which are involved in modernizing the grid and integrating these new energy sources, face a market where specialized labor can command premium pricing due to limited supply.

- Shortage of specialized engineers: A limited pool of engineers with expertise in advanced grid management systems or large-scale renewable project deployment can increase supplier leverage.

- High demand for skilled technicians: The ongoing expansion of solar and wind farms in Brazil creates intense competition for technicians experienced in installation and maintenance, driving up labor costs.

- Contractor pricing power: Specialized construction and maintenance contractors can charge more when they possess unique capabilities or face limited competition for critical energy infrastructure projects.

Regulatory and Environmental Compliance

Suppliers offering critical regulatory and environmental compliance solutions, such as advanced emissions control systems or specialized environmental impact assessment services, wield significant bargaining power within Brazil's highly regulated electricity sector. CPFL Energia's need to adhere to stringent environmental laws, like those enforced by IBAMA, makes securing compliant and reliable suppliers paramount. For instance, in 2024, the Brazilian government continued to emphasize sustainable energy practices, increasing the demand for specialized environmental consulting and technology, thereby bolstering the leverage of providers in this niche.

The substantial penalties associated with non-compliance, including hefty fines and operational shutdowns, compel companies like CPFL Energia to depend heavily on their compliant suppliers. This dependency is further amplified by the complexity and evolving nature of environmental regulations in Brazil. Failure to meet these standards can lead to significant reputational damage and financial losses, making the assurance of compliance a non-negotiable aspect of procurement, thus strengthening the bargaining position of these specialized suppliers.

- Regulatory Dependence: CPFL Energia's reliance on suppliers for emission control and environmental impact assessments is driven by strict Brazilian environmental legislation.

- Financial Penalties: Non-compliance with regulations can result in substantial fines, impacting profitability and operational continuity.

- Market Dynamics (2024): Increased focus on sustainability and evolving environmental standards in Brazil's energy sector enhanced the bargaining power of compliant suppliers.

CPFL Energia faces significant supplier bargaining power due to the concentrated nature of its supply chain for specialized equipment like turbines and grid components. This scarcity of qualified manufacturers, coupled with high switching costs for integrated systems, allows suppliers to dictate terms and prices, impacting CPFL's profitability. The company's reliance on these specialized inputs, particularly for its expanding renewable energy portfolio, means that even with declining costs for some components, supplier influence remains a key consideration.

The bargaining power of suppliers is further amplified by the need for specialized labor and technical expertise in Brazil's energy sector. As of 2023, the rapid growth in renewable energy projects led to a high demand for skilled technicians and engineers, increasing their leverage and driving up labor costs for companies like CPFL Energia. This trend is expected to continue as Brazil further develops its clean energy infrastructure.

Suppliers of regulatory and environmental compliance solutions also hold considerable sway. CPFL Energia's adherence to Brazil's stringent environmental regulations, which intensified in 2024 with a continued focus on sustainability, necessitates reliance on these specialized service providers. The potential for substantial financial penalties and operational disruptions due to non-compliance underscores the critical importance of these suppliers and their bargaining strength.

What is included in the product

This analysis meticulously examines the five competitive forces impacting CPFL Energia, revealing the intensity of rivalry, buyer and supplier power, threat of new entrants, and the potential of substitute products within the Brazilian energy sector.

Effortlessly identify and mitigate competitive threats by visualizing the intensity of each of Porter's Five Forces for CPFL Energia, enabling proactive strategic adjustments.

Gain a clear, actionable understanding of CPFL Energia's competitive landscape, allowing for focused strategies to alleviate pressure from rivals, new entrants, and substitute products.

Customers Bargaining Power

CPFL Energia's residential and many commercial customers historically have low bargaining power because ANEEL, the National Electric Energy Agency, sets their electricity tariffs. This regulatory framework limits their ability to negotiate prices.

However, Brazil's energy market is changing. Starting in January 2024, large consumers (Group A, those using high and medium voltage) can move to the free energy market. This liberalization is expected to gradually include lower-voltage customers in the future.

This market opening significantly boosts the bargaining power of these larger customers. They now have the freedom to select their energy providers and negotiate customized supply contracts, potentially leading to better pricing and service terms.

CPFL Energia's customer base is quite varied, encompassing residential, commercial, industrial, and rural users. This segmentation is key to understanding their influence.

While individual residential customers typically have very little sway, large industrial clients who consume substantial amounts of energy wield considerable bargaining power. These major consumers can negotiate more favorable contract terms, explore alternative energy providers in the open market, or even invest in their own power generation facilities. This capability directly pressures CPFL Energia's pricing strategies and the services it offers.

For instance, in 2024, the industrial sector represented a significant portion of CPFL Energia's revenue, with large-scale operations often having the flexibility to switch suppliers if terms are not competitive, especially as Brazil's free energy market continues to expand.

For residential and small commercial customers in Brazil's regulated electricity market, switching providers is typically not an option, effectively creating high switching costs and limiting their bargaining power. This means CPFL Energia faces minimal direct competition for these customer segments based on price alone.

However, as Brazil's free energy market continues to expand, customers who become eligible for this market may experience a reduction in perceived switching costs. This shift could lead to an increase in their bargaining power, as they gain more choices and the ability to negotiate terms.

In this evolving landscape, CPFL Energia's commitment to service quality, operational reliability, and overall customer satisfaction becomes paramount. These factors are increasingly important for retaining customers, particularly as competition intensifies within the segments of the market that are liberalized.

Distributed Generation Growth

The increasing adoption of distributed generation (DG), especially rooftop solar, significantly boosts customer bargaining power. Customers can now generate their own power, lessening their dependence on traditional utility providers like CPFL Energia. This shift offers them a viable alternative, directly impacting the utility's revenue streams and market share.

Brazil is expected to see substantial growth in solar capacity, with projections indicating continued strong additions through 2025. This trend empowers consumers by giving them more control over their energy supply and costs. As more customers embrace DG, their ability to negotiate terms or switch providers if dissatisfied grows, putting pressure on established distributors.

- Increased Customer Autonomy: Rooftop solar installations allow households and businesses to produce their own electricity, reducing reliance on the grid.

- Alternative Energy Sources: The proliferation of DG provides customers with a choice beyond traditional utility-provided power.

- Price Sensitivity: Customers with DG can more easily compare grid electricity prices to their self-generated costs, increasing price sensitivity.

- Reduced Dependence: Lower dependence on the utility for all energy needs strengthens the customer's position in any negotiation or service-related interaction.

Information Availability and Price Transparency

As the Brazilian electricity market liberalizes, consumers, especially those in the free market segment, gain significant leverage due to enhanced information availability and price transparency. This newfound access to comparative data on supplier pricing and service offerings allows customers to make more informed choices and negotiate terms more effectively. For instance, by mid-2024, the number of consumers eligible to migrate to the free market continued to expand, increasing the competitive pressure on established distributors like CPFL Energia to offer attractive pricing and service packages to retain their customer base.

This increased transparency directly challenges CPFL Energia's pricing power. Customers can now easily compare CPFL's tariffs and service quality against those of competitors, forcing the company to remain highly competitive. The ability to readily access and analyze this data empowers customers to switch providers if better deals are available, thereby intensifying the bargaining power of the customer segment.

- Increased Information Access: Consumers can readily compare electricity plans and prices from various providers.

- Price Transparency: Clearer pricing structures make it easier for customers to identify the most cost-effective options.

- Negotiating Power: Informed customers are better equipped to negotiate favorable terms with CPFL Energia.

- Market Liberalization Impact: The ongoing opening of the Brazilian electricity market amplifies these customer advantages.

The bargaining power of customers for CPFL Energia is a dynamic factor, significantly influenced by market liberalization and technological advancements. While historically low for regulated customers, it's rising, particularly for larger consumers and those embracing distributed generation.

As of 2024, the expansion of Brazil's free energy market allows large consumers to negotiate directly with suppliers, increasing their leverage. This trend is expected to continue, impacting CPFL Energia's ability to dictate terms. Furthermore, the growing adoption of rooftop solar, projected to see continued strong growth through 2025, empowers customers by offering a viable alternative to grid electricity, directly influencing their price sensitivity and dependence on traditional providers.

| Customer Segment | Bargaining Power Factor | Impact on CPFL Energia |

|---|---|---|

| Residential (Regulated) | Low (ANEEL tariffs) | Minimal direct price negotiation |

| Large Industrial (Free Market Eligible) | High (Negotiation, alternative sourcing) | Pressure on pricing and contract terms |

| Distributed Generation Users | Increasing (Self-generation, price comparison) | Reduced reliance, potential revenue impact |

Preview the Actual Deliverable

CPFL Energia Porter's Five Forces Analysis

This preview showcases the comprehensive Porter's Five Forces analysis for CPFL Energia, detailing the competitive landscape, bargaining power of suppliers and buyers, threat of new entrants and substitutes, and the intensity of rivalry within the Brazilian energy sector. The document you see here is precisely the same professionally formatted analysis you'll receive immediately after purchase, ensuring complete transparency and immediate usability for your strategic decision-making.

Rivalry Among Competitors

The Brazilian electricity market, though featuring giants like CPFL Energia, remains a dynamic landscape with both private and state-owned entities operating across generation, transmission, and distribution. CPFL Energia faces robust competition from other significant players including Eletrobras, Neoenergia, Engie Brasil, and Enel Brasil, all vying for dominance.

This competitive intensity is further amplified by ongoing privatization efforts and industry consolidation. As companies acquire assets and expand their reach, the battle for market share and operational control within the sector is expected to intensify, impacting CPFL Energia's strategic positioning.

Brazil's renewable energy sector is booming, especially solar and wind power. Projections for 2025 and beyond show significant capacity increases, drawing in new players and intensifying rivalry among established companies like CPFL Energia, which is also investing in renewables.

This surge in renewable capacity, particularly in distributed generation, could lead to oversupply issues and curtailment. Such a scenario would further heat up competition as all generators vie for market share and grid access.

The ongoing liberalization of Brazil's electricity market is a game-changer, especially in the commercialization segment. This means more customers, particularly larger ones, can now pick who supplies their power. For CPFL Energia, a significant player in this area, this translates directly into tougher competition from other energy traders and even power generators who are now able to sell directly to these eligible consumers. This environment demands a sharp focus on offering competitive prices, developing unique services, and most importantly, keeping customers happy and loyal.

Investment in Transmission and Distribution

Competitive rivalry in transmission and distribution is intense, with significant investments being made across the sector. CPFL Energia, a major distributor, faces competition from other entities actively modernizing and expanding their networks. For instance, in 2024, Brazil's National Electric Energy Agency (ANEEL) approved significant investment plans for grid expansion and modernization, indicating a robust competitive landscape.

This drive for efficiency and reliability fuels rivalry among distributors. Companies are vying to offer superior customer service and minimize energy losses, which directly impacts profitability and market share. By 2023, the aggregate investment in Brazil's electricity transmission and distribution sector reached substantial figures, highlighting the commitment of various players to enhancing their infrastructure.

- Increased Investment: Companies like CPFL Energia are part of a broader trend of heightened investment in T&D infrastructure, with projected billions of dollars dedicated to upgrades and expansion in the coming years.

- Focus on Efficiency: The competitive pressure necessitates a strong focus on reducing technical and non-technical losses, a key performance indicator for distributors.

- Customer Service as Differentiator: Reliability and quality of service are becoming critical differentiators in attracting and retaining customers in a competitive market.

- Technological Advancements: Investments in smart grid technologies and digitalization are also a point of competition, enabling better monitoring and management of the distribution network.

Diversification into Energy Solutions

The competitive rivalry within the energy sector is intensifying as companies move beyond traditional electricity supply to offer integrated energy solutions. This diversification includes services like energy efficiency programs, distributed generation installations, and sophisticated energy management. CPFL Energia, through its subsidiary CPFL Soluções, is actively participating in this evolving market, facing competition from established utilities and specialized energy service providers.

This shift broadens the competitive arena, requiring companies to innovate and develop comprehensive service portfolios to attract and retain customers. For instance, in 2024, the Brazilian distributed generation market saw significant growth, with solar photovoltaic capacity alone increasing by approximately 10 GW, according to preliminary industry reports. CPFL Soluções, by offering these expanded services, positions itself to capture a larger share of this dynamic market, directly competing with firms that have historically focused on niche energy solutions.

- Expanded Service Offerings: Companies like CPFL Energia are moving into energy efficiency, distributed generation, and energy management, broadening competition.

- New Competitors: The diversification attracts specialized service providers, increasing rivalry beyond traditional utility companies.

- Market Growth: The Brazilian distributed generation market, particularly solar PV, experienced substantial growth in 2024, highlighting the opportunities and competitive pressures in integrated energy solutions.

- Innovation Demand: A broader service portfolio necessitates continuous innovation to meet diverse customer needs in the evolving energy landscape.

CPFL Energia operates in a highly competitive Brazilian electricity market, facing rivals like Eletrobras and Neoenergia across generation, transmission, and distribution segments. The ongoing liberalization of the market, particularly in commercialization, allows more large consumers to choose their suppliers, intensifying direct competition. This dynamic is further fueled by significant investments in grid modernization and expansion, with ANEEL approving substantial plans in 2024 to enhance network efficiency and reliability, pushing companies to differentiate through service quality and technological adoption.

| Competitor | Primary Segments | 2024 Focus Areas |

|---|---|---|

| Eletrobras | Generation, Transmission | Renewable integration, Grid modernization |

| Neoenergia | Generation, Transmission, Distribution | Smart grid deployment, Customer service enhancement |

| Engie Brasil | Generation, Transmission | Renewable energy expansion, Energy efficiency solutions |

| Enel Brasil | Distribution, Generation | Digitalization of services, Distributed generation |

SSubstitutes Threaten

The most significant threat of substitution for CPFL Energia stems from distributed generation (DG), particularly solar photovoltaic systems. Customers, ranging from homes to large businesses, can increasingly generate their own electricity, thereby diminishing their need for grid-supplied power from CPFL.

Brazil has seen remarkable expansion in solar DG installations. In 2023 alone, the distributed solar generation capacity in Brazil surpassed 37 GW, a substantial increase that directly competes with traditional utility services by offering an alternative source of power.

The increasing adoption of energy-efficient technologies, from smart thermostats to advanced industrial insulation, presents a significant threat of substitution for traditional energy providers like CPFL Energia. For instance, in 2024, the global market for energy-efficient building technologies was projected to reach hundreds of billions of dollars, indicating a strong consumer and industrial drive towards reducing energy consumption. This trend directly impacts utilities by lowering overall demand for electricity, a core product.

Demand-side management (DSM) programs, actively promoted by regulators and some utilities, further exacerbate this substitution threat. By incentivizing customers to reduce usage during peak hours or shift consumption, DSM effectively lessens the need for the utility to supply that power. While CPFL Energia participates in some DSM initiatives, the fundamental challenge remains: customers actively seeking to use less of their core service, thereby substituting their need for traditional supply with conservation and efficiency.

While large-scale substitution is less common, alternative energy sources like biomass or small-scale wind turbines can serve as substitutes for grid electricity, especially in rural or industrial areas. These localized options bypass CPFL Energia's distribution network, even though the company invests in renewables.

Energy Storage Solutions

The increasing availability and falling costs of energy storage solutions, like batteries, present a significant threat. These technologies empower consumers to store electricity, whether from their own distributed generation or during cheaper off-peak periods, lessening their reliance on constant grid supply and potentially substituting utility-provided peak demand services. Brazil is actively engaged in discussions around regulating these energy storage systems, indicating a growing market presence.

This trend is underscored by the global decline in battery costs. For instance, the average cost of lithium-ion battery packs for electric vehicles, a key indicator for broader storage applications, has seen a dramatic decrease. In 2023, these costs were reported to be around $155 per kilowatt-hour, a substantial drop from over $1,000 per kilowatt-hour a decade prior. This cost reduction makes energy storage increasingly viable for residential and commercial use, directly impacting utility revenue streams by reducing the need for grid-supplied power, especially during peak demand periods.

- Declining Battery Costs: Lithium-ion battery pack costs dropped to approximately $155/kWh in 2023, down from over $1,000/kWh in 2013.

- Consumer Independence: Energy storage allows consumers to store self-generated or off-peak electricity, reducing reliance on continuous grid supply.

- Substitution of Peak Demand Services: Stored energy can be used during peak hours, directly competing with services traditionally offered by utilities.

- Regulatory Environment in Brazil: Discussions around energy storage regulation in Brazil signal an evolving market and potential for increased adoption.

Fuel Switching by Industrial Consumers

Large industrial consumers, especially those with substantial heat or process energy needs, pose a significant threat through fuel switching. If natural gas or other alternative fuels become more cost-effective or reliable, these major clients could shift away from electricity. This represents a direct loss of load for CPFL Energia, impacting its revenue streams.

In 2024, the price of natural gas in Brazil, influenced by global supply dynamics and domestic production, has seen fluctuations. For instance, the average price of natural gas for industrial consumers in Brazil during early 2024 hovered around $X per MMBtu, a figure that needs constant monitoring against electricity tariffs. For CPFL Energia, a substantial portion of its revenue is derived from industrial clients, making any shift in their energy source a critical concern.

- Fuel Switching Risk: Industrial users with high thermal energy demands can opt for natural gas or other fuels if economically advantageous.

- Impact on CPFL Energia: This switching directly translates to a loss of electricity load, reducing the company's sales volume.

- Market Dynamics (2024): Fluctuations in natural gas prices versus electricity tariffs are key drivers for industrial fuel choices.

- Revenue Vulnerability: CPFL Energia's reliance on industrial customers makes it susceptible to this substitution threat.

The threat of substitutes for CPFL Energia is considerable, primarily driven by distributed generation, energy efficiency, and fuel switching. These alternatives allow customers to reduce their reliance on traditional grid electricity, directly impacting CPFL's customer base and revenue.

Distributed solar photovoltaic systems are a major substitute, with Brazil's distributed solar capacity exceeding 37 GW in 2023. Energy-efficient technologies are also reducing overall electricity demand, with the global market for these solutions reaching hundreds of billions of dollars in 2024. Furthermore, industrial clients may switch to more cost-effective fuels like natural gas, a trend influenced by 2024 energy price dynamics.

| Substitute Type | Key Driver | Impact on CPFL Energia | Relevant Data Point |

|---|---|---|---|

| Distributed Generation (Solar PV) | Falling costs, customer desire for independence | Reduced demand for grid electricity | Brazil exceeded 37 GW of distributed solar in 2023 |

| Energy Efficiency | Cost savings, environmental concerns | Lower overall electricity consumption | Global market for energy-efficient building tech in hundreds of billions (2024 projection) |

| Fuel Switching (Industrial) | Price competitiveness of alternatives (e.g., natural gas) | Loss of industrial load and revenue | Natural gas prices vs. electricity tariffs in Brazil (2024) |

Entrants Threaten

The electricity sector, especially in areas like distribution and transmission, demands enormous upfront investments. Think about building power plants, laying down extensive transmission lines, and creating a robust distribution network. These infrastructure needs are a huge hurdle for anyone wanting to enter the market.

For CPFL Energia, this high capital intensity is a major shield against new competition. To even begin to match CPFL's existing, vast operational network, a new player would need to secure vast sums of money and make a serious, long-term financial commitment. For instance, in 2023, Brazil's electricity sector saw significant investment needs, with companies like CPFL Energia continuing to upgrade and expand their grids to meet growing demand and regulatory requirements.

Brazil's electricity sector is under the strict purview of the National Electric Energy Agency (ANEEL), which meticulously oversees all aspects from generation to commercialization. This robust regulatory environment, coupled with the intricate and time-consuming process of securing licenses and concessions, acts as a significant deterrent for any new companies looking to enter the market.

Incumbent companies like CPFL Energia enjoy substantial economies of scale across generation, transmission, and distribution. This scale allows for greater operational efficiency and lower per-unit costs, creating a significant hurdle for any new entrant attempting to compete on price. For instance, in 2024, CPFL Energia's extensive network likely facilitated cost savings that a smaller, newer operator would struggle to match initially.

CPFL Energia's century-long operational history in Brazil translates into deeply embedded experience and established relationships. This accumulated knowledge of the market, regulatory landscape, and customer needs is a formidable barrier. New entrants would find it challenging and time-consuming to build a comparable level of expertise and trust, which are crucial for success in the energy sector.

Access to Grid and Existing Infrastructure

New companies looking to enter the energy generation or commercialization sectors face a significant hurdle in gaining access to the existing transmission and distribution grid. CPFL Energia, like other established utilities, controls this vital infrastructure. This control means new entrants must negotiate access, which can be complex and costly.

While regulatory frameworks are in place to facilitate grid access, the practicalities can still pose a challenge. Building entirely new transmission and distribution networks is often economically unviable for newcomers.

- Grid Access Costs: Negotiating terms and paying for grid connection can represent a substantial upfront investment for new energy producers.

- Infrastructure Duplication: The high cost and logistical difficulties of duplicating existing grid infrastructure make it an unattractive option for most potential entrants.

- Regulatory Hurdles: Navigating the regulatory landscape for grid access, even with established rules, can be time-consuming and require significant legal and technical expertise.

Brand Recognition and Customer Loyalty

CPFL Energia benefits from decades of operation in Brazil, cultivating strong brand recognition and deep customer loyalty. This is particularly true in the utility sector, where consistent service and reliability are crucial for customer retention. For instance, as of early 2024, CPFL Energia serves over 10 million customers across its distribution concession areas.

The significant investment in time and resources required to build comparable trust and loyalty presents a substantial barrier for potential new entrants. In regulated segments of the Brazilian energy market, this established reputation translates into a more stable customer base, making it difficult for newcomers to gain immediate traction and market share.

- Established Brand: CPFL Energia's long history fosters trust.

- Customer Loyalty: Millions of customers rely on their services.

- High Entry Barrier: Replicating this trust is costly and time-consuming for new competitors.

- Regulated Market Advantage: Loyalty in regulated segments provides a stable customer base.

The threat of new entrants for CPFL Energia is considerably low, primarily due to the immense capital requirements and established infrastructure within Brazil's electricity sector. Building new power generation facilities, transmission lines, and distribution networks demands billions in investment, a significant barrier for any prospective competitor. For example, in 2023, the Brazilian energy sector continued to see substantial capital expenditure as companies like CPFL invested in grid modernization and expansion to meet demand.

The stringent regulatory environment, overseen by agencies like ANEEL, adds another layer of complexity, making market entry a lengthy and intricate process involving numerous licenses and concessions. Furthermore, CPFL Energia's established economies of scale and long-standing brand reputation, serving over 10 million customers as of early 2024, create a formidable challenge for newcomers seeking to gain market share and customer loyalty.

| Factor | Impact on CPFL Energia | Barrier Level |

|---|---|---|

| Capital Intensity | Extremely High (e.g., grid expansion costs) | High |

| Regulatory Hurdles | Significant (licensing, concessions) | High |

| Economies of Scale | Substantial (operational efficiency) | High |

| Brand Loyalty & Reputation | Strong (10M+ customers) | High |

| Grid Access Control | Critical (negotiation for newcomers) | High |

Porter's Five Forces Analysis Data Sources

Our Porter's Five Forces analysis for CPFL Energia is built upon a foundation of publicly available financial statements, annual reports, and regulatory filings from both CPFL Energia and its key competitors. We also incorporate insights from reputable industry research reports and market intelligence databases to provide a comprehensive view of the competitive landscape.