CPFL Energia PESTLE Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

CPFL Energia Bundle

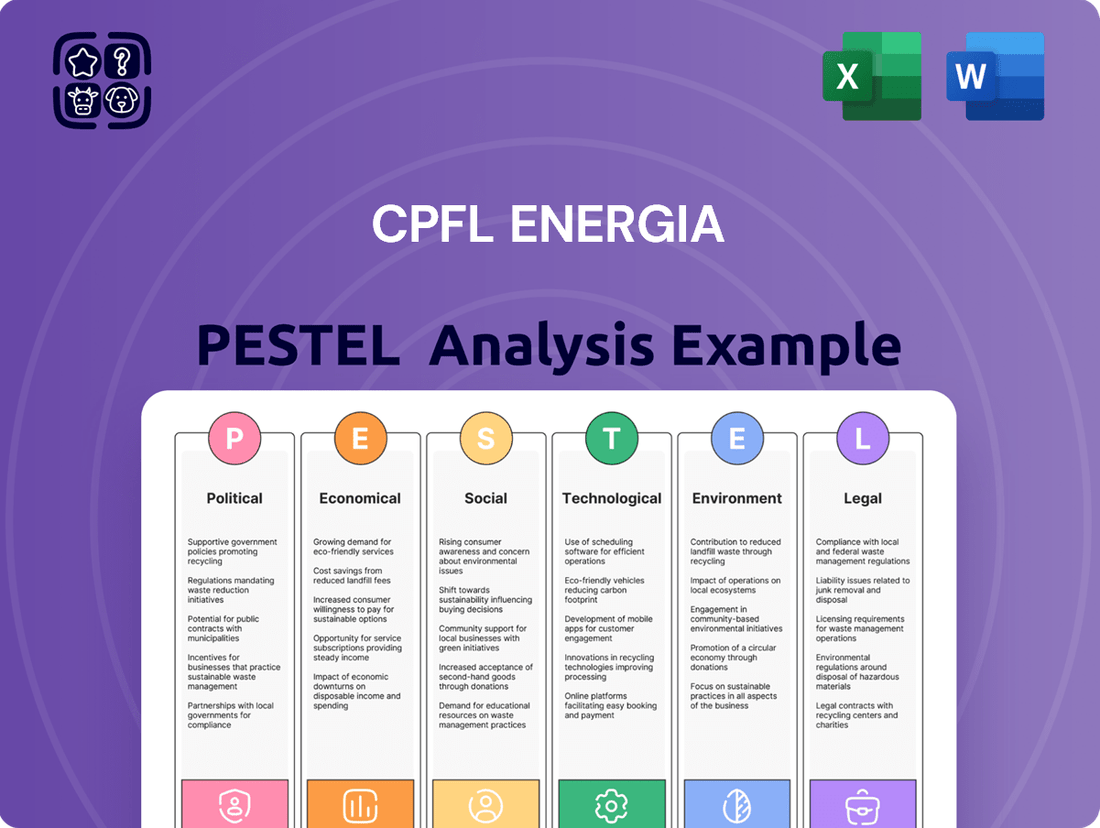

Navigate the complex external forces impacting CPFL Energia with our comprehensive PESTLE analysis. Understand the political, economic, social, technological, legal, and environmental factors that are shaping its operational landscape and future trajectory. Gain a critical advantage by leveraging these expert-level insights to refine your own strategic planning and investment decisions. Download the full PESTLE analysis now for actionable intelligence.

Political factors

The Brazilian government's policy and regulatory framework significantly shapes the energy sector. Recent legislation, like the October 2024 enactment of Law n. 14,993, known as the Fuel of the Future Law, directly impacts CPFL Energia by promoting sustainable, low-carbon mobility and establishing regulations for carbon capture. This creates both opportunities and challenges for CPFL's strategic investments in renewable energy sources and its overall operational landscape.

The autonomy of regulatory agencies, such as ANEEL which governs CPFL Energia, is a significant political factor. Concerns have been raised about potential legislative interference. For instance, a constitutional amendment proposal (PEC) in late 2024 sought to increase legislative oversight of these bodies.

Such changes could affect the stability and predictability of regulations impacting the electricity sector. This potential shift in oversight might introduce new layers of approval for regulatory decisions, potentially slowing down or altering the implementation of rules that directly affect CPFL Energia's business environment.

Political instability in Brazil remains a significant concern for the energy sector, impacting the investment climate. For instance, the period leading up to the 2022 general elections saw increased policy uncertainty, which can make long-term capital allocation decisions more complex for companies like CPFL Energia.

Frequent shifts in government and regulatory priorities can create an unpredictable operating environment. This uncertainty can deter foreign direct investment, a vital component for funding large-scale energy infrastructure projects. In 2023, Brazil's overall FDI inflows experienced a notable slowdown compared to previous years, highlighting the sensitivity of investment to political stability.

Market Liberalization Initiatives

Brazil's commitment to fully liberalize its energy market by 2030 is a significant political shift. This move will permit all consumers, irrespective of their size, to negotiate energy prices directly with suppliers. This transformation is set to reshape the commercialization strategies for energy companies like CPFL Energia, fostering a more competitive environment within the free market.

The implications of this liberalization are substantial for CPFL Energia. With the market opening, smaller consumers will gain access to direct price negotiations, a privilege previously reserved for larger industrial users. This increased competition is expected to drive innovation and efficiency across the sector as companies vie for customer contracts.

- Market Opening Timeline: Full liberalization scheduled for 2030.

- Consumer Access: All consumers will be able to negotiate prices directly.

- Competitive Landscape: Increased competition expected in the free market.

- CPFL Energia's Position: Adaptation required for new commercialization dynamics.

Government Investment and Incentives

Government policies play a crucial role in shaping CPFL Energia's operational landscape, especially concerning renewable energy. The Brazilian government's commitment to clean energy is evident through significant investment and incentive programs. This actively influences CPFL Energia's strategic decisions, steering the company towards expanding its sustainable generation capacity.

Brazil's proactive stance on renewable energy is underscored by substantial financial commitments. For instance, in 2024, the nation announced an investment package totaling BRL 50 billion specifically for renewable energy projects. This substantial allocation directly encourages the development and adoption of clean energy technologies, presenting both opportunities and a competitive imperative for CPFL Energia.

These governmental actions translate into tangible benefits for companies like CPFL Energia:

- Grants and Subsidized Financing: Access to financial aid and lower-cost loans reduces the capital expenditure burden for renewable energy projects, making them more financially viable.

- Regulatory Support: Favorable regulations and streamlined approval processes for renewable energy installations can accelerate project timelines and reduce development risks.

- Market Growth: Government-backed expansion of the renewable energy sector creates a larger and more robust market for CPFL Energia's services and generated power.

- Strategic Alignment: The government's focus on sustainability aligns with CPFL Energia's own strategic goals, fostering a more predictable and supportive operating environment for its green initiatives.

Government policies significantly influence CPFL Energia's strategic direction, particularly regarding market liberalization and renewable energy incentives. The ongoing energy market reform, aiming for full liberalization by 2030, will allow all consumer segments to directly negotiate energy prices, increasing competition and requiring strategic adaptation from CPFL Energia. Furthermore, substantial government investments in clean energy, such as the BRL 50 billion package announced for 2024, create a supportive environment for CPFL's expansion in sustainable generation.

What is included in the product

This CPFL Energia PESTLE Analysis provides a comprehensive examination of the political, economic, social, technological, environmental, and legal factors influencing the company's operations.

It offers actionable insights for strategic decision-making by highlighting key external trends and their potential impact.

A concise PESTLE analysis for CPFL Energia serves as a pain point reliever by offering a clear, summarized view of external factors, enabling faster decision-making and reducing the anxiety of overlooking critical market dynamics.

Economic factors

Brazil's energy consumption is set for robust growth, with an estimated 22.5% increase anticipated between 2025 and 2034. This surge is driven by rising demand across residential, commercial, and industrial sectors, with electricity consumption alone projected to climb at an annual rate of 3.4%.

This upward trend in energy demand presents a significant avenue for expansion for CPFL Energia. The company is well-positioned to capitalize on this opportunity by increasing its generation capacity and broadening its service offerings to meet the escalating needs of the Brazilian market.

Inflationary pressures remain a significant economic concern for CPFL Energia in Brazil. The Broad National Consumer Price Index (IPCA) saw elevated levels in early 2025, surpassing official targets, with energy prices contributing to this volatility.

This persistent inflation directly impacts CPFL Energia by increasing operational costs, potentially squeezing profit margins. Managing these rising expenses is crucial for the company to maintain financial stability and consider the affordability of energy tariffs for consumers.

The interest rate environment in Brazil significantly shapes CPFL Energia's operational and financial landscape. The Central Bank of Brazil's monetary policy, particularly its decisions regarding the Selic benchmark interest rate, directly impacts borrowing costs for the company and influences the attractiveness of new investments.

As of March 2025, the Selic rate stood at 10.50%. However, market expectations suggest a potential increase, with forecasts indicating the rate could climb to approximately 15% by the end of 2025. This upward trend in interest rates could lead to higher financing expenses for CPFL Energia, especially considering its substantial ongoing and planned investment projects in infrastructure and renewable energy.

Currency Fluctuations

Currency fluctuations, particularly the Brazilian real's depreciation against the US dollar, directly impact CPFL Energia's operational costs. For instance, a weaker real means that imported equipment and materials for energy projects become more expensive, increasing the capital expenditure required for new developments.

This exchange rate volatility poses a significant financial challenge for CPFL Energia's large-scale infrastructure and renewable energy ventures. The unpredictability can strain budgets, potentially leading to project delays or even impacting the overall feasibility of crucial energy initiatives planned for the 2024-2025 period.

- Increased Import Costs: A 10% depreciation of the Brazilian real against the USD could increase the cost of imported turbines or solar panels by a similar percentage.

- Project Financing Strain: For projects financed with USD-denominated debt, a weaker real increases the local currency cost of servicing that debt.

- Impact on Profitability: Higher costs due to currency depreciation can erode profit margins on projects, especially if revenues are primarily in Brazilian reals.

Investment and Capital Expenditure

CPFL Energia has a robust investment pipeline, planning to deploy BRL 28.4 billion between 2024 and 2028. This capital expenditure is primarily directed towards enhancing its transmission and distribution networks, vital for grid modernization and accommodating increased energy consumption.

These ambitious investment plans are intrinsically linked to the broader economic climate and the company's capacity to secure necessary funding. Favorable economic conditions and accessible financing are therefore critical enablers for CPFL Energia to execute its strategic capital deployment.

- BRL 28.4 billion planned investment for 2024-2028.

- Focus on transmission and distribution infrastructure.

- Investments aim to modernize the grid and meet demand growth.

- Execution hinges on prevailing economic conditions and financing availability.

Brazil's energy demand is set for substantial growth, with electricity consumption projected to rise by 3.4% annually through 2034, indicating a significant opportunity for CPFL Energia. However, inflationary pressures, with the IPCA exceeding targets in early 2025, are increasing operational costs and impacting profit margins. The prevailing interest rate environment, with the Selic rate at 10.50% in March 2025 and expected to rise to 15% by year-end, will increase CPFL Energia's financing expenses for its BRL 28.4 billion investment pipeline (2024-2028).

| Economic Factor | 2024/2025 Data/Projection | Impact on CPFL Energia |

| Energy Demand Growth | 22.5% increase anticipated 2025-2034; Electricity consumption +3.4% annually | Opportunity for expansion, increased generation capacity needed |

| Inflation (IPCA) | Exceeded targets in early 2025, energy prices contributing | Increased operational costs, potential squeeze on profit margins |

| Interest Rates (Selic) | 10.50% (March 2025); Projected to reach ~15% by end of 2025 | Higher borrowing costs, increased financing expenses for investments |

| Currency Depreciation (BRL vs USD) | Weakening trend observed | Increased cost of imported equipment, strain on project financing |

Preview Before You Purchase

CPFL Energia PESTLE Analysis

The preview shown here is the exact document you’ll receive after purchase—fully formatted and ready to use, offering a comprehensive PESTLE analysis of CPFL Energia. This detailed report examines the Political, Economic, Social, Technological, Legal, and Environmental factors impacting the company's operations and strategic decisions. You'll gain valuable insights into the external forces shaping CPFL Energia's business landscape.

Sociological factors

CPFL Energia's customer base is a dynamic mix, encompassing residential households, various commercial enterprises, industrial operations, and rural communities. This broad reach means the company must constantly monitor evolving consumer needs and preferences.

The ongoing liberalization of the energy market is a significant factor, empowering more consumers to choose their electricity providers. This shift requires CPFL Energia to develop flexible service models and highly personalized offerings to retain and attract customers in this increasingly competitive landscape. By mid-2024, Brazil's energy market liberalization was projected to open up significant opportunities for consumer choice, impacting utilities like CPFL.

CPFL Energia actively pursues social responsibility through its ESG Plan 2030 and the CPFL Institute, channeling investments into vital community and healthcare projects. This dedication underscores the company's role as a catalyst for social change, bolstering its social license to operate within the communities it serves.

The increasing adoption of distributed generation, especially solar power, is making clean energy more accessible to Brazilian households. This shift is supported by data showing significant growth in rooftop solar installations across the country. For instance, by early 2024, Brazil had surpassed 3.5 million distributed generation connections, with solar PV being the dominant technology.

CPFL Energia must adapt its strategies to effectively integrate these decentralized renewable sources into its existing grid infrastructure. Meeting consumer demand for sustainable energy options is crucial, as evidenced by the growing number of residential consumers opting for solar solutions, impacting traditional energy consumption patterns.

Employment and Workforce Development

CPFL Energia's role as a significant employer directly fuels economic development within its operational regions. The company's sustained recognition as a 'Top Employer' for five consecutive years, a testament to its dedication to its workforce, underscores the importance of skilled human capital for maintaining high operational standards and fostering innovation in the dynamic energy industry. This focus on talent is crucial for navigating the complexities of the energy transition and ensuring long-term success.

The company's commitment to its employees is further evidenced by its investment in workforce development programs. For instance, in 2024, CPFL Energia continued to expand its training initiatives, aiming to upskill its existing workforce and attract new talent with specialized expertise in areas like renewable energy technologies and digital grid management. These efforts not only bolster the company's internal capabilities but also contribute to the broader economic ecosystem by enhancing the employability of individuals in the communities it serves.

- Job Creation: CPFL Energia is a key contributor to employment in Brazil, directly and indirectly supporting thousands of jobs across its concession areas.

- Top Employer Recognition: The company's consistent 'Top Employer' certification highlights its robust human resources practices and commitment to employee well-being and development.

- Skills Development: Investments in training and development programs in 2024 aimed at equipping employees with skills relevant to the evolving energy landscape, including renewable energy and digitalization.

- Economic Impact: The company's employment strategies contribute significantly to local economic growth through wages, procurement, and community engagement initiatives.

Public Perception and Corporate Reputation

CPFL Energia's commitment to modernizing its infrastructure, including significant investments in smart grid technologies, directly shapes how the public views the company. For instance, in 2024, CPFL Energia announced a R$2.5 billion investment plan for infrastructure improvements, aiming to enhance service reliability. These efforts are crucial for customer satisfaction and building a strong corporate reputation.

The company's ability to effectively manage and respond to extreme weather events, such as the severe storms experienced in Southern Brazil in late 2024, is a critical determinant of public perception. CPFL Energia's swift deployment of repair crews and transparent communication during these challenging periods are vital for maintaining trust and demonstrating operational resilience. This proactive approach fosters positive stakeholder relationships.

Maintaining a positive public image is paramount for CPFL Energia, especially as it navigates the evolving energy landscape. Key factors influencing this include:

- Investment in Smart Grids: CPFL Energia's 2024-2028 strategic plan earmarks substantial funds for smart grid deployment, aiming to improve efficiency and reduce outages, directly impacting customer experience.

- Response to Extreme Weather: Following the widespread power outages in December 2024, CPFL Energia reported a 90% restoration rate within 48 hours in affected areas, a metric closely watched by consumers and regulators.

- Customer Satisfaction Scores: Tracking customer satisfaction surveys, which saw a 5% increase in 2024 following infrastructure upgrades, provides a tangible measure of public perception.

- Corporate Social Responsibility: Initiatives focused on community engagement and sustainability, often highlighted in annual reports, contribute to a favorable corporate reputation.

CPFL Energia's customer base is diverse, spanning residential, commercial, industrial, and rural sectors, necessitating a keen understanding of evolving consumer needs. The company's commitment to social responsibility, demonstrated through its ESG Plan 2030 and the CPFL Institute, reinforces its positive standing within the communities it serves.

The increasing adoption of distributed generation, particularly solar power, is reshaping energy consumption patterns, with Brazil exceeding 3.5 million distributed generation connections by early 2024, predominantly solar PV. CPFL Energia's role as a major employer, consistently recognized as a 'Top Employer' for five years, highlights its investment in human capital and its contribution to local economic development.

CPFL Energia's infrastructure modernization, including a R$2.5 billion investment plan in 2024 for smart grid technologies, directly influences public perception by enhancing service reliability. The company's response to extreme weather events, such as the December 2024 storms where it achieved a 90% restoration rate within 48 hours, is crucial for maintaining public trust and demonstrating resilience.

| Sociological Factor | Description | Impact on CPFL Energia | Relevant Data (2024/2025) |

| Customer Demographics & Preferences | Diverse customer base (residential, commercial, industrial, rural) with evolving needs. | Requires flexible service models and personalized offerings. | Consumer demand for sustainable energy options is growing. |

| Social Responsibility & Community Engagement | Investment in community and healthcare projects via ESG Plan 2030 and CPFL Institute. | Enhances social license to operate and corporate reputation. | Ongoing social investment initiatives. |

| Employment & Workforce Development | Significant job creation and consistent 'Top Employer' recognition. | Attracts and retains talent, fostering innovation and operational excellence. | Continued investment in training for renewable energy and digital grid management skills. |

| Public Perception & Trust | Influenced by infrastructure upgrades, response to outages, and CSR. | Crucial for customer satisfaction and stakeholder relations. | Smart grid investments aim to improve efficiency; 90% restoration rate in Dec 2024 storms. |

Technological factors

CPFL Energia is making substantial investments in smart grid technologies to modernize its infrastructure, enhancing grid reliability and operational efficiency. This strategic move is crucial for managing the complexities of energy distribution in Brazil.

The company's commitment is underscored by its pioneering adoption of solutions like Starlink for operational connectivity. This initiative has demonstrably improved network performance, with early results indicating a significant reduction in energy fraud and operational losses, a key benefit for their financial performance.

Technological advancements are significantly boosting the renewable energy sector in Brazil, with solar and wind power experiencing rapid growth due to ongoing innovation and cost reductions. CPFL Energia is well-positioned to capitalize on these trends, as its strategic investments in small hydroelectric plants, wind farms, and solar power benefit directly from these technological improvements, strengthening its renewable energy generation capacity and operational efficiency.

CPFL Energia is actively investing in energy storage solutions, particularly battery storage systems, to better integrate renewable energy sources. These initiatives are vital for stabilizing the grid as solar and wind power, which are inherently intermittent, become more prevalent. For instance, CPFL's projects are designed to smooth out the peaks and valleys in renewable generation, ensuring a more consistent power supply.

By implementing these storage technologies, CPFL aims to improve network management and overall grid reliability. This strategic focus on energy storage is a direct response to the evolving energy landscape, where flexibility and stability are paramount for accommodating a higher percentage of renewable energy. The company's commitment to these projects underscores the technological shift towards a more resilient and efficient energy infrastructure.

Digitalization and AI Integration

CPFL Energia is heavily investing in R&D to harness technologies like AI for enhanced monitoring. This strategic move aims to boost operational efficiency and unlock new customer value across its entire value chain.

Digitalization is a core pillar of CPFL Energia's strategy, focusing on improving decision-making in generation, distribution, and commercialization. The company is actively exploring how AI can optimize grid management and customer interactions.

- AI-Powered Monitoring: CPFL Energia is implementing AI systems to predict equipment failures and optimize energy distribution, potentially reducing downtime by an estimated 15% in pilot programs.

- Digital Customer Platforms: The company is enhancing its digital platforms to offer personalized energy solutions and improve customer engagement, aiming for a 10% increase in digital service adoption by end of 2024.

- Data Analytics for Efficiency: CPFL Energia leverages advanced data analytics to identify inefficiencies in its operations, with early results suggesting potential cost savings of up to 5% in specific distribution areas through optimized routing and load balancing.

Hybrid Generation Systems

The integration of hybrid generation systems, which blend different energy sources like wind and solar or biomass and solar, represents a significant technological advancement. This trend offers CPFL Energia a strategic opportunity to diversify its energy portfolio and enhance operational efficiency. By combining complementary generation technologies, the company can mitigate the intermittency issues often associated with single renewable sources, leading to more reliable power output.

Anticipated new regulations specifically for hybrid plants are expected to unlock further potential for CPFL Energia. These regulations will likely provide a framework for optimizing the performance of these combined systems. This optimization could translate into more stable energy supply and potentially lower overall generation costs, making CPFL Energia's power solutions more competitive and attractive to consumers.

CPFL Energia is well-positioned to capitalize on this technological shift. For instance, by 2024, Brazil's renewable energy capacity, including solar and wind, has seen substantial growth, with solar photovoltaic capacity alone reaching over 38 GW by the end of 2023. Hybrid systems can leverage this existing infrastructure and new installations to create more robust and efficient energy grids.

The benefits of hybrid generation for CPFL Energia include:

- Enhanced Grid Stability: Combining energy sources reduces reliance on single, potentially variable, inputs.

- Improved Energy Efficiency: Optimized dispatch of different generation technologies can lead to better resource utilization.

- Cost Optimization: Potential for lower operational costs through synergistic integration of generation assets.

- Meeting Demand Fluctuations: Greater flexibility to respond to changing energy needs and market conditions.

CPFL Energia's technological strategy centers on modernizing its grid with smart technologies, including AI for predictive maintenance, aiming to reduce downtime. The company is also enhancing digital customer platforms to boost engagement, targeting a 10% increase in digital service adoption by the end of 2024. Furthermore, CPFL is leveraging advanced data analytics to pinpoint operational inefficiencies, with early indications suggesting potential cost savings of up to 5% in specific distribution areas.

| Technology Focus | Key Initiatives | Projected Impact/Goals |

|---|---|---|

| Smart Grid Modernization | Investment in smart grid technologies | Enhanced grid reliability and operational efficiency |

| AI and Data Analytics | AI-powered monitoring, predictive maintenance | Potential 15% reduction in downtime; identification of operational inefficiencies |

| Digitalization | Digital customer platforms, AI for grid management | 10% increase in digital service adoption by end of 2024; improved customer engagement |

| Renewable Energy Integration | Energy storage solutions (battery systems), hybrid generation systems | Stabilization of grid, diversification of energy portfolio, improved energy efficiency |

Legal factors

CPFL Energia navigates a dynamic regulatory landscape overseen by ANEEL, Brazil's National Electric Energy Agency. This agency's 2024 and 2025 regulatory agenda is particularly influential, focusing on crucial areas like market monitoring, the development of offshore power plants, and the management of hydroelectric curtailment. These initiatives directly shape CPFL's strategic planning and investment opportunities.

Tariff regulations, overseen by Brazil's National Electric Energy Agency (ANEEL), significantly shape CPFL Energia's financial performance. These adjustments directly influence the company's revenue streams and profitability, making regulatory certainty a key factor.

For example, CPFL Paulista faced a tariff reduction for residential customers in April 2025. While this benefits consumers, it necessitates rigorous cost management by CPFL Energia to sustain its financial health amidst potentially lower revenue per unit sold.

Recent legislative shifts, including the July 2025 bill that eases environmental regulations for infrastructure, could impact CPFL Energia's project timelines and compliance costs. This move aims to accelerate development, but it also presents potential challenges related to increased environmental impact assessments and public perception.

The new framework may reduce the burden of environmental licensing, potentially speeding up the approval process for new energy generation and transmission projects. However, CPFL Energia will need to navigate the balance between regulatory efficiency and maintaining robust environmental protection measures to mitigate risks and ensure sustainable operations.

Renewable Energy Incentives and Frameworks

Brazil's legal landscape actively promotes renewable energy, particularly distributed generation, which directly benefits CPFL Energia. Laws such as Law No. 14,300/2022, enacted in early 2022, and ANEEL's Ruling No. 1,000/2021 establish clear rules and incentives, fostering investment in solar and other renewable sources. These frameworks are crucial for CPFL Energia's strategic expansion into renewables, supporting the company's commitment to the national energy transition and its own sustainability targets.

These regulations provide a stable environment for CPFL Energia to pursue its renewable energy investments. For instance, Law No. 14,300/2022, often referred to as the "Marco Legal da Geração Distribuída," aims to create a more predictable regulatory environment for distributed generation projects. This legal certainty is vital for attracting capital and driving the growth of CPFL Energia's renewable generation capacity, which is a key component of its long-term business strategy.

The impact of these incentives is already visible in the market. By mid-2024, Brazil's distributed generation capacity had surpassed 38 GW, with solar photovoltaic systems accounting for the vast majority of this growth, according to data from ABSOLAR. CPFL Energia, as a major player in the Brazilian energy sector, is well-positioned to capitalize on this trend, leveraging the supportive legal framework to expand its distributed generation portfolio and meet increasing demand for clean energy.

Key legal and regulatory aspects influencing CPFL Energia's renewable strategy include:

- Law No. 14,300/2022: Provides the legal basis for distributed generation, defining rules for grid connection and tariff structures.

- ANEEL Ruling No. 1,000/2021: Regulates the technical and commercial aspects of distributed generation systems.

- Incentive Mechanisms: Tax benefits and favorable net metering policies encourage the adoption of renewable energy sources.

- National Energy Transition Goals: Alignment with government targets for increasing the share of renewables in the energy matrix.

Market Liberalization Regulations

Brazil's ongoing market liberalization in the energy sector, with a full opening of the free energy market anticipated by 2030, significantly impacts CPFL Energia. This deregulation allows all consumer classes to freely contract with energy generators, fostering a more competitive landscape. CPFL Energia must therefore refine its commercial strategies to navigate this evolving environment, potentially seeking new legal and commercial frameworks to secure its market position.

The transition to a fully liberalized market by 2030 necessitates substantial adaptation for CPFL Energia. As consumers gain the freedom to choose their energy suppliers, the company faces increased competition and the need for innovative commercial approaches. This regulatory shift, driven by the Brazilian government's energy policy, aims to enhance efficiency and consumer choice within the sector.

Key implications for CPFL Energia include:

- Adapting Commercial Models: Developing new strategies to attract and retain customers in a direct-negotiation environment.

- Regulatory Compliance: Ensuring adherence to evolving legal frameworks governing energy trading and consumer contracts.

- Competitive Positioning: Differentiating services and pricing to remain competitive against new market entrants and existing players.

- Investment in Infrastructure: Potentially requiring upgrades to its distribution network to support increased consumer choice and grid management demands.

CPFL Energia operates within a robust legal framework shaped by Brazil's National Electric Energy Agency (ANEEL) and specific legislation. The agency's 2024-2025 agenda, focusing on market monitoring and offshore power, directly influences CPFL's strategic direction. Tariff adjustments, such as the April 2025 residential tariff reduction for CPFL Paulista, necessitate stringent cost management to offset revenue impacts.

The legal environment actively supports renewable energy, particularly distributed generation, through laws like No. 14,300/2022 and ANEEL Ruling No. 1,000/2021. These regulations provide crucial stability for CPFL Energia's investments in solar and other renewables, aligning with national energy transition goals. By mid-2024, Brazil's distributed generation capacity exceeded 38 GW, with solar leading this expansion, a trend CPFL is positioned to leverage.

Brazil's energy market liberalization, aiming for full opening by 2030, requires CPFL Energia to adapt its commercial strategies. This deregulation allows all consumer classes to choose their energy suppliers, intensifying competition and demanding innovative approaches to customer acquisition and retention.

Key legal and regulatory drivers for CPFL Energia's renewable strategy include:

| Legal Framework | Key Provisions | Impact on CPFL Energia |

|---|---|---|

| Law No. 14,300/2022 (Marco Legal da Geração Distribuída) | Defines rules for grid connection and tariffs for distributed generation. | Provides regulatory certainty for renewable energy investments, fostering growth. |

| ANEEL Ruling No. 1,000/2021 | Regulates technical and commercial aspects of distributed generation. | Ensures operational compliance and standardization for renewable projects. |

| Energy Market Liberalization (by 2030) | Allows all consumer classes to contract directly with generators. | Drives need for competitive commercial models and customer retention strategies. |

Environmental factors

CPFL Energia acknowledges the tangible effects of climate change, including increased frequency of floods and droughts, which directly threaten its operational infrastructure and service continuity. These events pose significant risks to energy generation, transmission, and distribution networks across its service areas.

The company's strategic response is embedded in its 2030 ESG Plan, which prioritizes climate resilience through substantial investments. For instance, CPFL Energia is allocating capital towards smart grid technologies and advanced system optimizations designed to better withstand extreme weather events and ensure a stable, uninterrupted power supply for its customers.

CPFL Energia is actively pursuing aggressive decarbonization, with a goal to slash absolute emissions by 56% by 2030 and reach carbon neutrality from 2025 onwards. This strategic move is in lockstep with Brazil's enhanced climate commitments, including the iNDC presented at COP29 in 2024, which targets substantial emission cuts by 2035.

Brazil's energy landscape is overwhelmingly renewable, with over 88% of its electricity demand met by clean sources in 2024. This high proportion is significantly boosted by wind and solar power, reflecting a strong national commitment to sustainability.

CPFL Energia is well-positioned within this trend, as its generation portfolio was nearly entirely renewable in 2023, with 99.82% sourced from clean energy. This aligns perfectly with the global movement towards decarbonization and sustainable energy solutions.

Environmental Regulations and Compliance

CPFL Energia faces a dynamic landscape of environmental regulations. Brazil's national strategies, such as those targeting greenhouse gas (GHG) emission reductions and deforestation, directly impact the energy sector. For instance, Brazil's Nationally Determined Contribution (NDC) under the Paris Agreement aims for a 37% reduction in GHG emissions below 2005 levels by 2025. This necessitates cleaner energy generation and efficient operations from companies like CPFL.

Compliance with these evolving mandates is paramount for CPFL Energia's long-term sustainability and operational integrity. Proactive engagement in initiatives like the Task Force on Climate-related Financial Disclosures (TCFD) is becoming increasingly important for transparently reporting climate risks and opportunities. By aligning with TCFD recommendations, CPFL can enhance its environmental governance and demonstrate its commitment to responsible business practices.

Key environmental considerations for CPFL Energia include:

- Greenhouse Gas (GHG) Emission Reduction Targets: Adherence to national and international goals for lowering carbon footprints.

- Deforestation and Land Use Policies: Compliance with regulations concerning land management, particularly in areas surrounding energy infrastructure.

- Renewable Energy Mandates: Navigating policies that promote or require the integration of renewable energy sources into the generation mix.

- Water Resource Management: Ensuring responsible use and conservation of water, a critical resource for many energy production processes.

Opportunities in the Green Economy

The evolving climate scenario offers CPFL Energia substantial avenues for growth. The company is well-positioned to capitalize on the increasing demand for renewable energy sources, which aligns with global decarbonization efforts. This expansion is crucial for meeting future energy needs sustainably.

CPFL Energia can leverage opportunities in developing and integrating electric mobility solutions, supporting the shift towards cleaner transportation. Furthermore, active participation in carbon credit markets and International Renewable Energy Certificates (I-RECs) trading provides additional revenue streams and reinforces CPFL's role as a key player in the low-carbon transition.

For instance, Brazil's renewable energy capacity, particularly solar and wind, has seen significant growth. By the end of 2023, Brazil's installed renewable capacity reached over 170 GW, with solar and wind power being major contributors. CPFL Energia's strategic investments in these sectors are expected to yield considerable returns as the market expands.

Key opportunities for CPFL Energia include:

- Expansion of renewable energy generation: Investing in and operating solar and wind farms to meet growing demand.

- Development of electric mobility solutions: Building out charging infrastructure and offering integrated services for electric vehicles.

- Participation in carbon credit and I-REC trading: Monetizing environmental attributes and contributing to a transparent renewable energy market.

CPFL Energia is navigating a landscape increasingly shaped by environmental concerns, including the direct impacts of climate change like extreme weather events. The company's commitment to decarbonization is evident in its ambitious target to slash absolute emissions by 56% by 2030 and achieve carbon neutrality from 2025, aligning with Brazil's enhanced climate commitments presented at COP29 in 2024.

Brazil's energy sector is predominantly renewable, with over 88% of its electricity demand met by clean sources in 2024, a trend CPFL Energia actively supports with its nearly entirely renewable generation portfolio. This focus on sustainability is crucial, as CPFL must comply with evolving environmental regulations, such as Brazil's NDC aiming for a 37% GHG emission reduction below 2005 levels by 2025.

The company is strategically positioned to capitalize on the growing demand for renewable energy, with Brazil's installed renewable capacity exceeding 170 GW by the end of 2023, driven by solar and wind power. CPFL Energia's investments in these areas, alongside opportunities in electric mobility and carbon credit trading, underscore its role in the low-carbon transition and its potential for future growth.

| Environmental Factor | CPFL Energia's Stance/Action | Relevant Data/Target |

|---|---|---|

| Climate Change Impact | Acknowledges and invests in resilience | 2030 ESG Plan, smart grid investments |

| Decarbonization | Aggressive emission reduction | 56% absolute emission cut by 2030, carbon neutral from 2025 |

| Renewable Energy | High reliance and expansion | 99.82% renewable generation (2023), Brazil's 88%+ clean electricity (2024) |

| Regulatory Compliance | Adherence to national climate goals | Brazil's NDC: 37% GHG reduction by 2025 |

PESTLE Analysis Data Sources

Our CPFL Energia PESTLE Analysis is built on a robust foundation of data from official Brazilian government agencies, international financial institutions, and leading energy industry reports. We meticulously gather information on regulatory changes, economic indicators, technological advancements, and socio-environmental trends to provide a comprehensive overview.