CPFL Energia Boston Consulting Group Matrix

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

CPFL Energia Bundle

Unlock the strategic power of CPFL Energia's BCG Matrix. This essential tool reveals which of their offerings are market leaders, which are generating steady profits, and which require closer examination. Don't miss out on understanding their competitive landscape.

Ready to make informed decisions about CPFL Energia's portfolio? Dive into the full BCG Matrix for detailed quadrant analysis and actionable insights. Purchase the complete report to gain a clear roadmap for growth and resource allocation.

This is your opportunity to see CPFL Energia's business through the lens of the BCG Matrix. Get the full version for a comprehensive breakdown of their Stars, Cash Cows, Dogs, and Question Marks, and equip yourself with the knowledge to strategize effectively.

Stars

CPFL Energia is strategically positioning itself in the burgeoning wind and solar energy sectors within Brazil, recognizing their high-growth potential. This focus aligns with Brazil's ambitious projections for renewable energy capacity, with significant additions expected in wind and solar by 2034, signaling a robust and expanding market.

The company's aggressive target to operate entirely on renewable energy by 2030 directly fuels its investments in these dynamic segments. For instance, by the end of 2023, CPFL Energia had already achieved a substantial portion of its renewable energy goals, demonstrating tangible progress in its transition.

CPFL Energia has significantly bolstered its presence in the extra-high voltage transmission sector, securing new transmission lines during the 2024 auctions. This strategic move capitalizes on the segment's robust growth potential within Brazil.

The high-voltage transmission segment, specifically above 230 kV, is anticipated to experience a compound annual growth rate (CAGR) of 9.65% through 2030. This expansion is driven by the necessity to enhance Brazil's grid infrastructure.

Investments in these high-voltage lines are crucial for diversifying CPFL Energia's resource base and effectively managing geographic load imbalances across the country. This strengthens the overall reliability and efficiency of the national power grid.

CPFL Energia is making substantial investments in smart grid technologies, aiming to modernize its distribution and transmission infrastructure. This strategic move is designed to boost both resilience and operational efficiency across its network. For instance, in 2023, the company allocated R$2.2 billion towards its modernization and expansion plans, with a significant portion directed towards digitalizing its grid.

These technological upgrades are vital for improving the quality of service provided to customers and for effectively addressing the challenges posed by a changing climate. By embracing these innovations, CPFL Energia is solidifying its position as a leader in technological advancement within a dynamic and expanding energy market. The company's focus on smart grids is expected to lead to reduced outage times and better management of energy flow.

Energy Solutions and Services (CPFL Soluções)

CPFL Soluções, a key player in integrated energy management and distributed generation, is strategically positioned to benefit from Brazil's expanding free energy market. This segment is experiencing significant growth as businesses increasingly opt for cost savings and renewable energy sources by migrating from the regulated to the free market.

The company's services, including energy efficiency and distributed generation, align perfectly with the demand driven by this market shift. In 2024, the Brazilian energy market continued to see substantial growth in distributed generation, with installed capacity reaching new heights. CPFL Soluções is well-equipped to capture this momentum.

- High Growth Potential: The migration to the free energy market in Brazil presents a substantial opportunity for CPFL Soluções.

- Cost Reduction Driver: Businesses are actively seeking ways to reduce energy expenditures, a primary motivator for entering the free market.

- Renewable Energy Focus: The increasing demand for sustainable energy sources further bolsters the appeal of CPFL Soluções' offerings.

- Market Expansion: As of early 2025, projections indicated continued robust growth in the free energy market, with an estimated 30% increase in consumer migration anticipated by the end of the year.

Carbon Credit and I-REC Trading

CPFL Energia actively participates in the trading of carbon credits and International Renewable Energy Certificates (I-RECs). This engagement aligns with a global surge in demand for decarbonization strategies. The company's strategic focus on these markets positions it to capitalize on the growing environmental, social, and governance (ESG) investment trends.

- Market Growth: The voluntary carbon market, where CPFL operates, saw significant activity. For instance, the market value for voluntary carbon credits was estimated to reach billions of dollars by 2023, with projections indicating continued expansion through 2025.

- CPFL's Position: CPFL Energia has registered projects contributing to this market, showcasing its commitment to verifiable emission reductions. Their stated goal of carbon neutrality by 2025 further solidifies their role as a key player in sustainable energy solutions.

- I-REC Significance: I-RECs provide a mechanism for consumers to verify that their electricity consumption is matched by renewable energy generation, a crucial element for corporate sustainability reporting and consumer choice.

CPFL Energia's ventures into the free energy market through CPFL Soluções are positioned as Stars within the BCG matrix. This segment is experiencing rapid expansion as businesses migrate for cost savings and renewable energy adoption. CPFL Soluções' offerings in energy efficiency and distributed generation are directly addressing this growing demand, capitalizing on the market's upward trajectory.

| Segment | CPFL Soluções (Free Energy Market) |

|---|---|

| Market Growth Rate | High (driven by business migration and renewable demand) |

| CPFL's Market Share/Position | Strong, leveraging integrated energy management and distributed generation expertise. |

| Investment Requirement | High, to capture and sustain growth in this dynamic sector. |

| Profitability Potential | High, due to cost savings for clients and increasing demand for sustainable solutions. |

| Key Drivers | Cost reduction, renewable energy mandates, market liberalization. |

What is included in the product

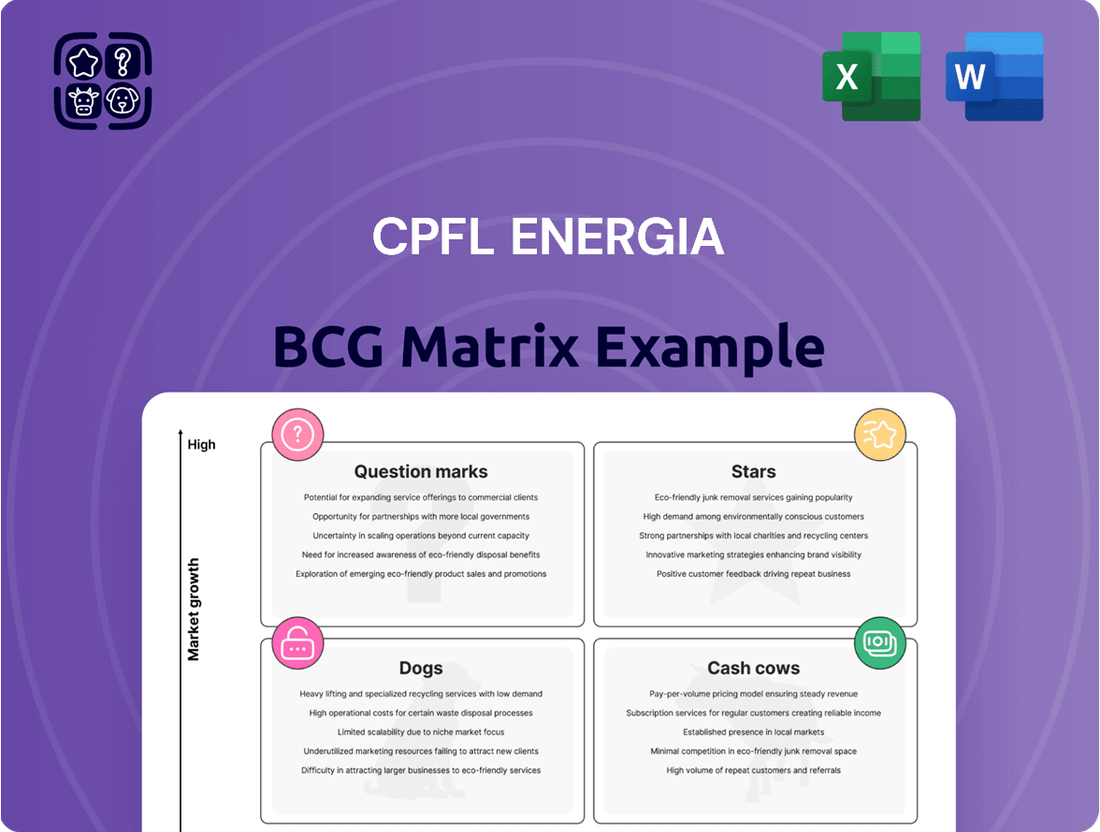

This BCG Matrix overview highlights CPFL Energia's business units, categorizing them into Stars, Cash Cows, Question Marks, and Dogs to guide strategic investment decisions.

The CPFL Energia BCG Matrix offers a clear, one-page overview, instantly clarifying which business units require strategic attention, thus relieving the pain of complex portfolio analysis.

Cash Cows

CPFL Energia's electricity distribution segment is a true Cash Cow, holding the title of Brazil's largest distributor by energy volume sold. It reliably serves around 10.7 million customers across various states, generating substantial and steady cash flow. This mature segment is a cornerstone of CPFL's operations, demonstrating consistent performance and stability in the market.

In 2024, CPFL Energia continued its strategic investments in this segment, focusing on maintaining and optimizing its extensive network. These investments, amounting to significant capital expenditures, are crucial for ensuring operational efficiency and reliability, further solidifying its position as a dependable cash generator. The segment's maturity and scale allow for predictable revenue streams, making it a vital contributor to the company's overall financial health.

Hydropower generation is a cornerstone of CPFL Energia's portfolio, representing a substantial 55% of Brazil's power market share in 2024. This mature and dependable energy source is a true cash cow, consistently generating stable cash flows for the company.

In 2023, hydropower accounted for a significant portion of CPFL Energia's total generation, with 99.82% of its 15,000 GWh output coming from renewable sources, largely driven by its hydropower assets. The low operational investment required for these established facilities, compared to more volatile or developing energy segments, solidifies its position as a reliable cash generator.

CPFL Energia's regulated transmission assets are considered cash cows within its business portfolio. These assets benefit from long-term regulated contracts, which provide a highly predictable and stable revenue stream. For instance, in 2024, CPFL's transmission segment continued to be a cornerstone of its financial performance, contributing significantly to its overall profitability through these secured revenue streams.

Large Industrial and Commercial Customer Base

CPFL Energia's large industrial and commercial customer base acts as a significant cash cow. This segment provides a stable, high-volume demand, underpinning consistent revenue generation for the company.

While the broader commercial sales experienced flat growth in 2024, the industrial sector within this customer base showed robust expansion. This divergence highlights the resilience and growth potential within specific segments of CPFL's established client relationships.

- Industrial Sector Growth: The industrial segment of CPFL Energia's customer base demonstrated strong growth in 2024, contributing significantly to revenue stability.

- Commercial Sector Stability: Despite flat overall growth in the commercial sector in 2024, the established nature of these clients ensures a predictable revenue stream.

- High-Volume Demand: The sheer volume of consumption from these large industrial and commercial entities solidifies their position as a cash cow for CPFL Energia.

- Revenue Predictability: The long-term relationships and essential nature of energy supply to these businesses create a high degree of revenue predictability.

Established Operational Efficiency

CPFL Energia's distribution segment is a prime example of an established operational efficiency, consistently demonstrating strong performance. This segment is characterized by its mature market position and optimized processes, contributing significantly to the company's overall financial health.

The company has achieved high profit margins in its distribution operations due to rigorous cost management and effective resource allocation. For instance, in 2024, CPFL Energia reported a substantial contribution from its distribution segment to its consolidated results, reflecting its robust operational efficiency.

- High Quality and Reliability: CPFL Energia's distribution network consistently ranks among the best in Brazil for quality and reliability, minimizing outages and ensuring customer satisfaction.

- Efficient Cash Flow Generation: The mature nature of the distribution business allows for predictable and stable cash flow, supporting investments in other areas of the company.

- Profitability: Operational excellence translates directly into strong profit margins, with the distribution segment being a key driver of CPFL Energia's overall profitability.

- Market Leadership: CPFL Energia holds a significant market share in the Brazilian electricity distribution sector, leveraging its established infrastructure and operational expertise.

CPFL Energia's electricity distribution segment is a prime cash cow, boasting the largest market share in Brazil by energy volume. This mature business consistently generates substantial, stable cash flows, serving over 10.7 million customers. In 2024, strategic investments focused on network optimization, further solidifying its position as a reliable cash generator.

Hydropower generation, representing 55% of Brazil's power market in 2024, is another significant cash cow for CPFL Energia. With 99.82% of its 2023 generation from renewables, these low-operational-cost assets provide consistent, predictable revenue streams.

Regulated transmission assets also function as cash cows, secured by long-term contracts that ensure stable and predictable revenues. This segment remained a financial cornerstone for CPFL Energia in 2024, contributing significantly to profitability.

The company's large industrial and commercial customer base acts as a vital cash cow, driven by high-volume demand and stable relationships. While commercial sales were flat in 2024, the industrial sector showed robust expansion, underscoring the resilience of these established client segments.

| Business Segment | BCG Category | 2024 Performance Highlight | Key Financial Characteristic |

| Electricity Distribution | Cash Cow | Largest distributor by volume, serving 10.7M+ customers | Stable, substantial cash flow |

| Hydropower Generation | Cash Cow | 55% of Brazil's power market share | Predictable revenue from low-cost assets |

| Regulated Transmission | Cash Cow | Long-term regulated contracts | Highly predictable revenue streams |

| Large Industrial/Commercial Customers | Cash Cow | Robust industrial sector growth in 2024 | High-volume demand, revenue stability |

Delivered as Shown

CPFL Energia BCG Matrix

The CPFL Energia BCG Matrix preview you are viewing is the complete, unedited document you will receive immediately after your purchase. This means the analysis, strategic insights, and formatting are identical to the final version, ensuring you get exactly what you need for your business planning without any surprises.

Dogs

Residential energy sales for CPFL Energia saw a 1.7% decrease in 2024. This segment, a key part of their distribution operations, is characterized by sluggish growth and faces headwinds from the rise of distributed generation and fluctuating temperatures.

The challenges in this sector, particularly the potential for declining or stagnant market share due to these external factors, position Residential Energy Sales as a potential 'Dog' within CPFL Energia's business portfolio. Continued underperformance could necessitate strategic reevaluation.

CPFL Energia is actively retiring its EPASA thermoelectric plants, a strategic move aligned with its ambitious goal of operating with 100% renewable energy by 2030. These older, less efficient thermal power facilities are typically categorized as Dogs in a BCG matrix analysis.

These assets are characterized by low market share in a mature, declining industry segment (fossil fuels) and offer minimal growth prospects. In 2023, CPFL Energia continued its divestment strategy, marking a significant step away from these legacy operations, which often require substantial capital for maintenance and compliance without generating substantial profits.

CPFL Energia experienced significant distribution delinquency in 2024, with volumes exceeding historical averages, largely attributed to severe weather events like storms and floods. This surge in late payments directly impacts the company's financial health.

High delinquency rates, particularly within specific customer segments or geographic areas, can effectively classify these as 'Dog' components within a BCG matrix framework. These segments are capital intensive, tying up resources that could be better utilized elsewhere, while simultaneously diminishing overall cash flow generation.

Certain Legacy Infrastructure with High Maintenance Costs

CPFL Energia faces challenges with certain legacy infrastructure components that carry high maintenance costs. While the company is investing in grid modernization, specific older assets may demand significant capital for upkeep but offer limited returns or market share growth. These can be viewed as cash cows that are draining resources without contributing to future expansion. For instance, in 2023, CPFL Energia reported significant investments in its distribution network, but a portion of this expenditure was allocated to maintaining aging substations and transmission lines that are nearing the end of their operational life.

This situation highlights a potential area of concern within CPFL Energia's portfolio, where older, less efficient infrastructure might be categorized as question marks or even dogs in a BCG matrix analysis, depending on their growth prospects and market share. The ongoing expenditure on these assets, while necessary for operational continuity, diverts funds that could be reinvested in more promising growth areas or in the modernization of the grid to improve efficiency and reliability. The company's strategic focus on innovation and digital transformation in its distribution networks, as seen in its 2024 investment plans, underscores the need to address these high-maintenance legacy assets.

- Legacy Infrastructure Costs: Older grid components require substantial ongoing capital for maintenance.

- Low Return on Investment: These assets may not generate commensurate returns relative to their upkeep expenses.

- Resource Diversion: High maintenance costs for legacy infrastructure can divert funds from growth initiatives.

- Strategic Re-evaluation: CPFL Energia may need to assess the long-term viability and potential divestment of certain aging assets.

Wind Generation with Curtailment Issues

Wind generation within CPFL Energia faced significant headwinds in 2024, with production dropping by 6% due to curtailment. This issue directly impacted the profitability and operational efficiency of these renewable assets, casting a shadow over the growth segment.

If these curtailment challenges continue to restrict output and profitability, CPFL's wind assets could be reclassified. Despite operating in a growing renewable energy market, persistent limitations on generation due to grid constraints or other factors could push them into the 'Dog' category of the BCG matrix. This would signify low returns relative to their market potential.

- Curtailment Impact: A 6% reduction in wind production in 2024 highlights the severity of curtailment issues.

- Financial Strain: Persistent curtailment limits revenue generation and erodes the profitability of wind farms.

- BCG Matrix Reclassification: Assets facing ongoing output restrictions may shift from 'Question Mark' or 'Star' to 'Dog' if returns remain low.

- Market Context: The renewable energy sector's growth makes these curtailment issues particularly concerning for future investment and performance.

CPFL Energia's legacy thermoelectric plants, such as EPASA, represent 'Dogs' due to their low market share in a declining fossil fuel industry and minimal growth prospects. The company's strategic divestment of these older, less efficient facilities, a process ongoing since 2023, underscores their classification as assets requiring significant capital for maintenance without substantial profit generation.

Residential energy sales, experiencing a 1.7% decrease in 2024, also fall into the 'Dog' category. This segment faces stagnation due to distributed generation and weather impacts, suggesting a potential decline in market share and necessitating a strategic review.

Furthermore, specific legacy infrastructure components within CPFL Energia's distribution network, characterized by high maintenance costs and limited returns, can be considered 'Dogs'. These aging assets, while requiring capital for upkeep, divert resources from more promising growth areas.

High distribution delinquency rates observed in 2024, exceeding historical averages due to severe weather, can also classify affected customer segments as 'Dogs'. These segments tie up capital and diminish overall cash flow, presenting a challenge to efficient resource allocation.

Question Marks

CPFL Energia's new renewable energy projects, particularly those in early stages, represent exciting but capital-intensive ventures. These are positioned as question marks in the BCG matrix due to their presence in a high-growth sector with significant future potential, yet currently holding a low market share as they are not yet operational or fully established. For instance, CPFL's 2024 investments are heavily geared towards expanding its renewable portfolio, with a substantial portion allocated to these nascent projects, underscoring the company's strategic bet on future market leadership in clean energy.

CPFL Energia is actively investigating green hydrogen as a key component of the energy transition, with notable investments channeled into this sector during 2024. This strategic focus aligns with the company's commitment to sustainable energy solutions.

Green hydrogen represents a high-growth, albeit nascent, market within the broader energy landscape. While its potential is significant, current market share for green hydrogen projects remains low, reflecting the early stage of development and the substantial capital expenditure required. The immediate returns on these investments are therefore subject to considerable uncertainty.

CPFL Energia's strategic positioning for distributed generation (DG) among residential consumers, particularly solar, acknowledges Brazil's strong growth trajectory in this sector. However, the anticipated market opening for all residential consumers from 2028 is projected to moderate this rapid expansion.

CPFL's proactive approach to bolstering its residential DG offerings, including innovative compensation models, is a calculated move. This strategy aims to capture significant market share before the anticipated slowdown in growth, driven by the dynamic regulatory environment. For instance, as of early 2024, Brazil's distributed solar generation capacity surpassed 30 GW, with the residential segment showing robust year-over-year increases.

Energy E-commerce Platform and Digital Solutions

CPFL Soluções' energy e-commerce platform, launched in 2023, represents a new venture into digital solutions for energy contracting and carbon credit transactions. This initiative places CPFL within the rapidly expanding digital transformation market, a sector characterized by high growth potential.

The platform's current market penetration is likely low, necessitating substantial investment in marketing and user adoption strategies to achieve significant traction. Despite these challenges, the digital nature of the offering positions it as a potential future star within CPFL's portfolio, aligning with broader industry shifts towards online energy marketplaces.

- Market Position: The energy e-commerce platform is a nascent offering in a high-growth digital market.

- Growth Potential: Digital transformation in the energy sector is a key trend, indicating strong future growth prospects.

- Challenges: Initial market penetration is expected to be low, requiring significant effort for adoption.

- Strategic Fit: Aligns with CPFL's broader digital transformation goals and the evolving energy market landscape.

Innovation Projects (R&D and POCs)

CPFL Energia actively invests in Research and Development (R&D) and executes Proof of Concepts (POCs) for forward-looking energy solutions. These initiatives span critical areas like smart city infrastructure and the burgeoning electric vehicle (EV) ecosystem. For instance, in 2023, CPFL Energia reported significant investments in innovation, with a substantial portion allocated to R&D projects aimed at enhancing grid efficiency and integrating renewable energy sources, reflecting a commitment to future growth sectors.

These innovation projects, while targeting high-growth potential markets such as smart grids and EV charging infrastructure, carry inherent risks. Their commercial viability and the pace of market adoption remain uncertain, classifying them as question marks in the BCG matrix. This necessitates ongoing capital allocation without immediate or guaranteed returns, a common characteristic of exploratory ventures in emerging technologies.

- R&D Investment Focus: CPFL Energia's 2023 R&D expenditure supported projects exploring advanced metering infrastructure and distributed energy resource management systems.

- POC Examples: Successful POCs in 2024 included pilot programs for smart street lighting optimization and integrated EV charging solutions within residential condominiums.

- Market Uncertainty: The long-term success of smart city technologies and widespread EV adoption is still subject to regulatory frameworks, consumer acceptance, and technological advancements, posing a question mark for these investments.

CPFL Energia's ventures into new renewable energy projects, green hydrogen, and its energy e-commerce platform are all classic examples of question marks in the BCG matrix. These initiatives are in high-growth sectors but currently have low market share due to their early stages of development and the substantial capital required. For instance, CPFL's 2024 investment strategy heavily favors these nascent areas, signaling a strategic bet on future market leadership in clean and digital energy solutions.

The company's commitment to R&D and proof-of-concept projects for smart cities and EV infrastructure also falls into this category. While these target high-growth potential markets, their commercial viability and market adoption pace remain uncertain, necessitating ongoing investment without immediate guaranteed returns.

CPFL's distributed generation efforts, particularly in the residential solar segment, also exhibit question mark characteristics. Although Brazil's DG capacity is growing rapidly, with over 30 GW by early 2024, the anticipated market opening from 2028 is expected to moderate this expansion, creating a dynamic environment for capturing market share.

| Business Unit | BCG Category | Key Characteristics | 2024 Strategic Focus | Market Context |

| New Renewable Energy Projects | Question Mark | High growth potential, low current market share, capital intensive | Significant investment in early-stage ventures | Growing clean energy sector |

| Green Hydrogen | Question Mark | Nascent market, high growth potential, low market share, substantial CAPEX | Active investigation and investment | Emerging sustainable energy solution |

| Energy E-commerce Platform | Question Mark | High growth digital market, low initial penetration, requires marketing investment | Launched in 2023, focus on user adoption | Expanding digital transformation in energy |

| R&D and POCs (Smart Cities, EV) | Question Mark | Targeting high-growth sectors, uncertain commercial viability and adoption pace | Allocation to grid efficiency and renewable integration | Future-oriented technology integration |

BCG Matrix Data Sources

Our CPFL Energia BCG Matrix is built on a robust foundation of verified market intelligence, integrating financial disclosures, industry growth forecasts, and regulatory filings to provide a comprehensive view.