Central Pacific Bank PESTLE Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Central Pacific Bank Bundle

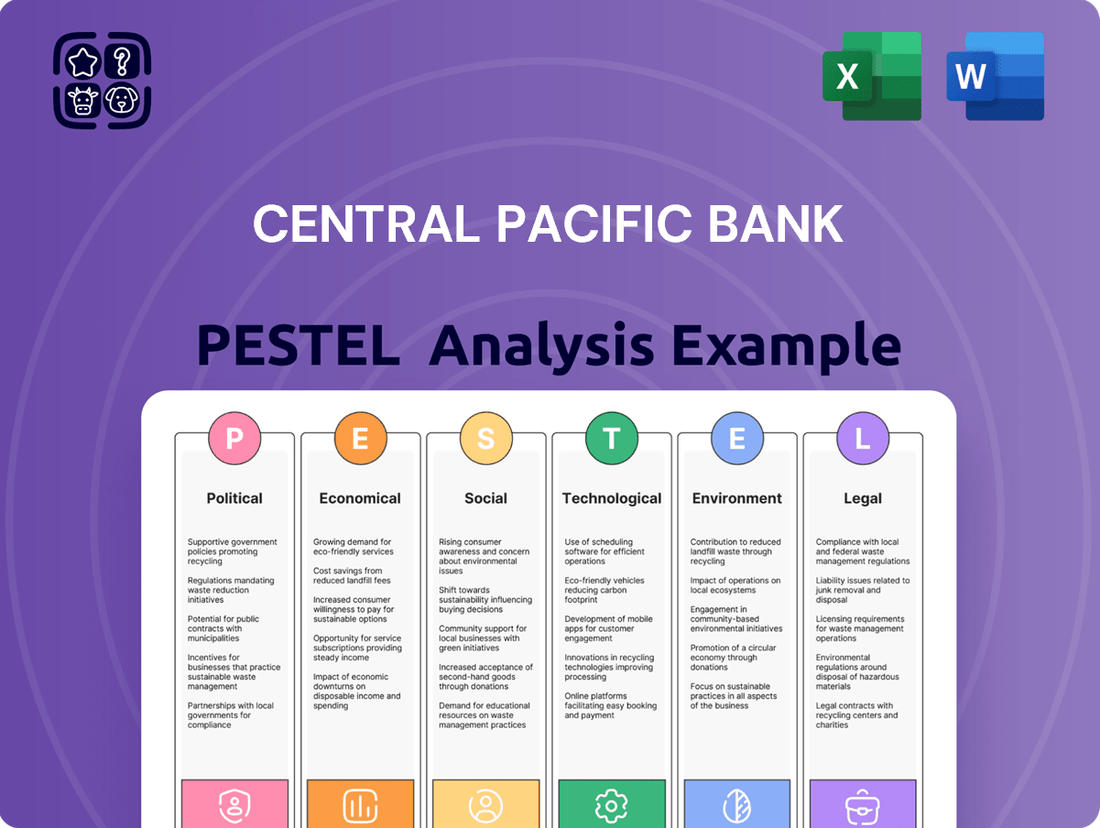

Uncover the critical political, economic, and technological forces shaping Central Pacific Bank's trajectory. Our PESTLE analysis provides a vital roadmap for understanding market dynamics and anticipating future challenges. Download the full version to equip yourself with actionable intelligence and gain a strategic advantage.

Political factors

The stability of the Hawaiian state government is a key political factor for Central Pacific Bank. For instance, in 2023, Hawaii's government operated with a budget surplus, allowing for potential investments in infrastructure and economic development initiatives that could indirectly benefit the banking sector. Any significant shifts in the state's political agenda, such as changes in leadership or policy priorities, could introduce new banking regulations or alter tax structures, directly impacting the bank's operational costs and profitability.

Federal and state fiscal policies, encompassing government spending, taxation, and budget allocations, can significantly influence economic activity and consumer spending within Hawaii. These shifts directly impact loan demand and deposit levels for Central Pacific Bank. For instance, an increase in government infrastructure spending could boost local business activity, potentially leading to higher demand for commercial loans.

Monetary policy, particularly the Federal Reserve's interest rate decisions, has a direct and substantial effect on Central Pacific Bank's financial performance. Changes in the federal funds rate influence the bank's net interest margin, which is the difference between the interest income generated and the interest paid out to its depositors. Higher rates generally mean higher lending rates, potentially increasing profitability but also raising the risk of reduced borrowing.

Hawaii's fiscal landscape saw a notable update with its conformity to the Internal Revenue Code (IRC) as of December 31, 2024, enacted through legislation passed on May 29, 2025. This conformity impacts businesses operating in Hawaii, potentially affecting their tax liabilities and investment decisions, which in turn can influence the banking sector through corporate borrowing and investment patterns.

Hawaii's economy, heavily reliant on tourism and international trade, is directly impacted by global trade policies and international relations. For instance, in 2023, Hawaii welcomed over 9.6 million visitors, with a significant portion originating from international markets like Japan and Canada. Changes to trade agreements or heightened geopolitical tensions could deter these visitors and international investors, thereby affecting Central Pacific Bank's loan portfolio and deposit base.

Government Support for Local Industries

Government initiatives and subsidies play a crucial role in shaping lending opportunities for Central Pacific Bank. For instance, in 2024, Hawaii's state government continued to invest in sectors like renewable energy, with a target of 100% clean energy by 2045, potentially creating new avenues for commercial lending and project financing.

Conversely, shifts in government policy or a reduction in support for key Hawaiian industries, such as tourism or agriculture, could present headwinds. A decline in federal grants for affordable housing, for example, might limit the scope for community development lending, a segment where Central Pacific Bank is active.

Central Pacific Bank's commitment to community development is evident in its foundation's work. In 2024, the bank continued its partnerships with organizations like the Federal Home Loan Bank of Des Moines, which provided significant funding for housing initiatives across the Pacific region, demonstrating a tangible link between government-backed programs and the bank's lending activities.

- Government Support for Local Industries: Initiatives like Hawaii's clean energy targets (100% by 2045) create new lending opportunities in renewable energy projects.

- Impact of Policy Shifts: Reduced federal funding for affordable housing could constrain Central Pacific Bank's community development lending.

- Partnerships for Growth: Collaborations with entities like the Federal Home Loan Bank of Des Moines in 2024 facilitated significant housing finance in the Pacific.

Political Initiatives for Housing and Community Development

Political initiatives aimed at tackling Hawaii's persistent housing shortage and fostering community development directly influence Central Pacific Bank's lending strategies and its commitment to community reinvestment. Government funding and incentives for affordable housing projects, for example, can significantly boost the bank's opportunities to grow its loan book while meeting regulatory and social expectations. In 2023, Hawaii's state legislature allocated over $100 million towards affordable housing initiatives, a figure expected to see continued or increased investment in 2024 and 2025.

These governmental programs can create substantial avenues for Central Pacific Bank to expand its mortgage and construction lending portfolios. Furthermore, the bank's active participation in these initiatives helps it fulfill its Community Reinvestment Act (CRA) obligations. The Central Pacific Bank Foundation has demonstrably supported this mission, awarding grants to local non-profits actively engaged in addressing the housing crisis. For instance, in late 2023, the foundation provided a $50,000 grant to a Honolulu-based organization focused on developing transitional housing, highlighting a tangible commitment to community betterment.

Key political factors impacting Central Pacific Bank include:

- Federal and State Funding for Affordable Housing: Increased government investment in affordable housing programs provides direct lending opportunities and supports community development projects.

- Regulatory Environment for Community Reinvestment: Compliance with and exceeding CRA requirements, often influenced by political priorities, drives bank engagement in underserved communities.

- Local Zoning and Permitting Reforms: Political efforts to streamline development processes can accelerate the pace of construction, impacting the bank's construction loan pipeline.

- Economic Development Incentives: Government programs designed to stimulate local economies, such as tax credits for businesses or infrastructure development, can indirectly benefit the bank through increased economic activity and lending demand.

Government policies directly shape Central Pacific Bank's operating environment, influencing everything from lending regulations to economic development. For example, Hawaii's conformity to the Internal Revenue Code as of December 31, 2024, impacts corporate tax liabilities and investment decisions, potentially altering demand for business loans. Furthermore, federal and state fiscal policies, such as infrastructure spending, can boost local business activity and thus loan demand.

Political support for key industries, like renewable energy targets aiming for 100% clean energy by 2045, creates new lending opportunities for Central Pacific Bank in project financing. Conversely, shifts in policy, such as reduced federal grants for affordable housing, could limit the bank's community development lending. In 2023, Hawaii's state legislature allocated over $100 million towards affordable housing, a critical area for the bank's community reinvestment efforts.

Central Pacific Bank's engagement with government-backed programs, such as partnerships with the Federal Home Loan Bank of Des Moines in 2024, facilitated significant housing finance. This highlights how political initiatives and collaborations directly influence the bank's ability to support community development and meet its regulatory obligations.

What is included in the product

This PESTLE analysis provides a comprehensive examination of the external macro-environmental factors influencing Central Pacific Bank across political, economic, social, technological, environmental, and legal dimensions.

It offers actionable insights for strategic planning by identifying emerging threats and opportunities within the bank's operating landscape.

Central Pacific Bank's PESTLE analysis offers a clear, summarized version of external factors, acting as a pain point reliever by providing easy referencing during strategic meetings and planning sessions.

Economic factors

Hawaii's economic vitality, tracked by its Gross Domestic Product (GDP) growth, is a key indicator for Central Pacific Bank's business landscape. The state's real GDP is projected to see a 1.2 percent increase in 2025, according to the Department of Business, Economic Development, and Tourism (DBEDT).

This forecast, however, is tempered by uncertainties stemming from national policy shifts and broader global economic trends. Such moderated growth suggests a more reserved environment for overall business operations and consumer spending power across Hawaii.

The tourism sector is a vital engine for Hawaii's economy, directly influencing Central Pacific Bank's commercial and retail banking operations. By the close of 2024, tourism-related sectors had recovered to 94.3 percent of their pre-pandemic GDP levels.

Looking ahead to 2025, visitor arrivals are anticipated to see a slight decrease of 0.1 percent. This projected slowdown in tourism could potentially dampen loan demand from businesses heavily reliant on the sector and also affect overall consumer spending.

The health of Hawaii's real estate market directly influences Central Pacific Bank's core business. Home prices in Hawaii are anticipated to stay robust in 2025, likely within the $850,000 to $1 million range, reflecting sustained demand. This stability, however, is tempered by the ongoing impact of higher interest rates and a persistent shortage of available homes, which collectively challenge affordability and could moderate mortgage lending volumes.

Inflation Rates and Consumer Purchasing Power

Persistent consumer inflation in Hawaii significantly impacts the purchasing power of Central Pacific Bank's customers. Inflation, which reached 4.4 percent in 2024 and is projected to remain elevated at 3.8 percent in 2025, directly affects how much goods and services consumers can afford.

This inflationary environment can create a dual effect for the bank. On one hand, higher prices might increase the demand for credit as individuals and businesses seek financing to cover rising costs. However, it can also strain the ability of some borrowers to repay existing loans, potentially leading to increased default risks.

- Consumer inflation in Hawaii reached 4.4% in 2024.

- Inflation is forecast to be 3.8% in 2025.

- Higher inflation can boost credit demand but strain repayment ability.

- Bank operations face increased costs due to inflation.

Interest Rate Environment and Bank Profitability

The prevailing interest rate environment, shaped by federal monetary policy, significantly impacts Central Pacific Bank's net interest margin (NIM) and overall profitability. Higher rates generally boost NIM by increasing the spread between loan income and deposit costs, though this can be tempered by increased funding costs.

As of the fourth quarter of 2024, Central Pacific Bank reported a NIM of 3.17%, showing a 10 basis point increase from the prior quarter. This improvement was partly attributed to a decrease in the average rates the bank paid on its interest-bearing deposits, suggesting a favorable pricing environment for the bank.

Fluctuations in interest rates directly influence the bank's capacity to attract customer deposits and offer competitive loan products. For instance, if rates rise sharply, the bank might need to increase deposit rates to remain competitive, potentially compressing its NIM, while higher loan rates could slow demand.

- Net Interest Margin (NIM) Q4 2024: 3.17%

- NIM Change from Previous Quarter: +10 basis points

- Key Factor for NIM Increase: Decline in average rates paid on interest-bearing deposits

- Impact of Rate Fluctuations: Affects deposit attraction and loan product competitiveness

Hawaii's economic outlook for 2025, with a projected real GDP growth of 1.2 percent, suggests a stable but not booming environment for Central Pacific Bank. While tourism is recovering, reaching 94.3 percent of pre-pandemic GDP levels by late 2024, a slight anticipated dip in visitor arrivals for 2025 could temper loan demand. Persistent inflation, forecast at 3.8 percent for 2025 after 4.4 percent in 2024, will continue to affect consumer purchasing power and potentially increase credit needs while posing repayment risks.

| Economic Indicator | 2024 (Actual/Estimate) | 2025 (Projection) | Impact on Central Pacific Bank |

|---|---|---|---|

| Hawaii Real GDP Growth | N/A | 1.2% | Indicates moderate business expansion potential. |

| Tourism Recovery (GDP Basis) | 94.3% of pre-pandemic | Slight decrease in arrivals anticipated | Potential dampening of loan demand from tourism-reliant businesses. |

| Hawaii Consumer Inflation | 4.4% | 3.8% | Increased credit demand, but potential strain on borrower repayment ability. |

Preview the Actual Deliverable

Central Pacific Bank PESTLE Analysis

The preview shown here is the exact document you’ll receive after purchase—fully formatted and ready to use. This comprehensive PESTLE analysis of Central Pacific Bank delves into the Political, Economic, Social, Technological, Legal, and Environmental factors impacting its operations. You'll gain a clear understanding of the strategic landscape for Central Pacific Bank.

Sociological factors

Hawaii's population is experiencing notable demographic shifts, with an aging demographic and slower overall population growth impacting the demand for banking services. For instance, by 2023, over 18% of Hawaii's population was estimated to be 65 years or older, a trend expected to continue. This evolving age structure directly influences the types of financial products and services Central Pacific Bank needs to prioritize.

A slower-growing labor force, coupled with an aging population, presents a dual challenge and opportunity. This demographic trend could potentially limit long-term job growth, but it also signals a growing demand for specialized financial services like wealth management and retirement planning. Central Pacific Bank must proactively adapt its offerings to effectively cater to these shifting demographic needs and preferences.

Central Pacific Bank must adapt to evolving consumer preferences, with a growing demand for digital banking services. A significant portion of consumers, particularly younger demographics, now expect seamless mobile and online banking experiences. For instance, a 2024 survey indicated that over 70% of U.S. consumers prefer using mobile apps for everyday banking tasks.

Consumers are increasingly valuing financial app functionality and seeking guided financial tools over traditional in-person interactions. This shift means Central Pacific Bank's investment in user-friendly interfaces and personalized digital financial management tools is paramount. By offering robust online platforms and mobile solutions, the bank can better attract and retain customers throughout Hawaii.

Central Pacific Bank's strong connection to Hawaii means its community engagement and cultural alignment are key to its brand. Its dedication to ESG principles, as shown in its 'Caring for our 'Aina and People' report, underscores a commitment to Hawaii's well-being. This focus on responsible stewardship is crucial for maintaining customer loyalty and a positive brand image.

Income Levels and Wealth Distribution

The distribution of income and wealth across Hawaii significantly shapes demand for financial products. For instance, while the median sale price for single-family homes in Hawaii reached approximately $950,000 in early 2025, indicating sustained demand, the impact of inflation on real incomes remains a key consideration for many households.

Central Pacific Bank must develop a strategy that addresses this economic disparity. This means offering a range of services, from financial products supporting affordable housing to sophisticated wealth management solutions for affluent clients.

- Income Disparity: Hawaii's Gini coefficient, while fluctuating, generally indicates a notable gap between high and low earners, influencing product uptake.

- Housing Market Dynamics: Persistent demand, evidenced by rising home prices in early 2025, suggests a segment with significant purchasing power, while others face affordability challenges.

- Inflationary Pressures: Continued inflation can diminish the real value of savings and wages, impacting the disposable income available for investment and borrowing.

- Service Customization: Tailoring financial solutions to various income brackets is crucial for market penetration and customer retention.

Social Responsibility and Community Expectations

There's a rising expectation for banks like Central Pacific Bank to be more than just financial service providers; they're increasingly seen as community partners. This means actively contributing to social well-being, not just offering loans and accounts.

Central Pacific Bank demonstrates this commitment through various philanthropic activities. For instance, their support for housing initiatives, educational programs, and economic development projects directly addresses community needs. In 2023, the bank contributed over $3.5 million to community causes, reflecting a significant investment in local progress.

Their response to the Maui wildfires in late 2023, where they established a relief fund and encouraged customer donations, further solidified their role as a supportive community member. This kind of direct action builds trust and enhances their reputation among the people they serve, especially during times of crisis.

- Growing Stakeholder Demand: Customers, employees, and investors increasingly favor institutions with strong Environmental, Social, and Governance (ESG) profiles.

- Community Investment: Central Pacific Bank's 2023 community contributions exceeded $3.5 million, supporting housing, education, and economic advancement.

- Disaster Relief: The bank's rapid response to the Maui wildfires, including establishing a relief fund, demonstrates a commitment to immediate community support.

- Reputation and Trust: Proactive social responsibility efforts directly correlate with enhanced brand image and customer loyalty in the Hawaiian market.

Hawaii's aging population, with over 18% over 65 in 2023, necessitates a focus on services like wealth management and retirement planning. This demographic shift also impacts the labor force, potentially limiting growth but increasing demand for specialized financial advice.

Consumer preferences are leaning heavily towards digital banking, with over 70% of U.S. consumers in a 2024 survey preferring mobile apps for banking. Central Pacific Bank must invest in user-friendly digital platforms to meet these expectations and retain customers.

Central Pacific Bank's strong community ties are vital, as demonstrated by over $3.5 million in community contributions in 2023 and its response to the Maui wildfires. This commitment to social well-being and ESG principles builds trust and enhances brand loyalty.

| Sociological Factor | Impact on Central Pacific Bank | Supporting Data/Trend |

|---|---|---|

| Demographics | Growing demand for retirement and wealth management services; potential labor force constraints. | Over 18% of Hawaii's population was 65+ in 2023. |

| Consumer Preferences | Increased need for robust digital and mobile banking solutions. | 70%+ of U.S. consumers prefer mobile banking (2024 survey). |

| Community Engagement | Enhanced brand loyalty and trust through social responsibility and local support. | $3.5M+ in community contributions (2023); Maui wildfire relief efforts. |

Technological factors

The banking sector's digital transformation is a paramount technological driver. Customers in Hawaii, like elsewhere, demand seamless online and mobile banking experiences, pushing institutions to innovate. Central Pacific Bank is actively responding by enhancing its digital offerings, which include advanced budgeting tools and mobile wallet capabilities, to meet these evolving expectations.

Central Pacific Bank, like all financial institutions, navigates a landscape increasingly defined by sophisticated cybersecurity threats. The rise of digital banking means a greater attack surface, with ransomware, cloud vulnerabilities, and even AI-driven attacks posing significant risks. For instance, the global cost of cybercrime was projected to reach $10.5 trillion annually by 2025, underscoring the scale of this challenge.

Protecting customer data is not just a regulatory requirement but a cornerstone of trust. A breach could lead to substantial financial penalties, as seen with various data privacy fines levied globally, and severe reputational damage. Maintaining the integrity of its IT infrastructure is therefore critical for Central Pacific Bank's continued operation and customer confidence.

To counter these evolving threats, Central Pacific Bank must invest in and continuously update its cybersecurity protocols. This includes robust defenses against known attack vectors and proactive measures like continuous monitoring and employee training. The bank's ability to adapt its security posture will be key to its resilience in the face of persistent and increasingly advanced cyber threats.

Central Pacific Bank can leverage AI to streamline operations and offer more personalized customer service. For instance, AI-powered chatbots can handle routine inquiries, freeing up human staff for complex issues. Furthermore, AI's predictive capabilities can bolster fraud detection systems, a critical area for financial institutions.

The bank also faces the challenge of evolving cyber threats, including those amplified by AI. As AI becomes more sophisticated, so do the methods used by malicious actors. This necessitates continuous investment in advanced cybersecurity measures to protect customer data and maintain trust.

Hawaii's evolving regulatory landscape for blockchain and cryptocurrency presents both opportunities and uncertainties for Central Pacific Bank. The state's recent clarification on crypto activities signals a move towards a more defined framework, potentially opening doors for innovative financial products and services built on blockchain technology.

Fintech Competition and Innovation

The financial technology, or fintech, landscape is a major force reshaping the banking industry, presenting both opportunities and challenges for institutions like Central Pacific Bank. Fintech companies are rapidly introducing specialized, user-friendly digital services that directly compete with traditional banking offerings. For instance, by mid-2024, global fintech investment continued to show resilience, with significant funding rounds in areas like digital payments and wealth management, indicating sustained innovation and market penetration.

To stay relevant, Central Pacific Bank must actively engage with this fintech surge. This could involve integrating cutting-edge fintech solutions into its existing services, developing proprietary innovative digital products to meet evolving customer expectations, or forming strategic partnerships with agile fintech firms. The bank's ability to adapt to these technological shifts is crucial for maintaining market share and enhancing customer experience in the competitive 2024-2025 period.

Key areas of fintech competition impacting banks include:

- Digital Payments: Fintechs are simplifying and accelerating payment processes, both for consumers and businesses.

- Lending Platforms: Online lending platforms offer faster, often more accessible loan origination compared to traditional banks.

- Personal Finance Management: Apps providing budgeting tools, investment tracking, and financial advice are gaining traction.

- Neobanks: Digital-only banks are attracting customers with lower fees and streamlined online experiences.

Investment in IT Infrastructure and Digital Services

Central Pacific Bank's commitment to upgrading its IT infrastructure and digital services is a key technological driver. For instance, in 2024, the bank continued to invest in modernizing its core banking systems, aiming to enhance processing speeds and data security. This ongoing investment is vital for maintaining operational efficiency and offering competitive digital banking solutions to its customers.

These technological advancements are not just about keeping pace; they are about enabling growth and improving customer interaction. By enhancing data analytics, Central Pacific Bank can gain deeper insights into customer behavior and market trends, allowing for more personalized product offerings and proactive risk management. This focus on digital capabilities directly impacts the bank's ability to scale its operations effectively.

- IT Infrastructure Investment: Continued upgrades to core banking systems and data analytics platforms.

- Digital Service Development: Focus on enhancing online platforms for reliability and security.

- Operational Efficiency: Investments aim to streamline transaction processing and risk management.

- Customer Experience: Improved digital tools and services are designed to deliver a superior customer experience.

Technological advancements are reshaping banking, with Central Pacific Bank focusing on digital transformation. The bank is enhancing its online and mobile platforms, investing in IT infrastructure upgrades to improve efficiency and security. This includes modernizing core banking systems and leveraging data analytics for better customer insights and risk management.

Legal factors

Central Pacific Bank navigates a stringent regulatory environment, encompassing federal mandates and state-specific rules. A significant development was its final approval to join the Federal Reserve system on January 10, 2025, a move that subjects it to enhanced oversight and capital requirements.

Adherence to these complex banking regulations, including those set by the Federal Reserve, is paramount for Central Pacific Bank to prevent substantial fines, retain its operating licenses, and safeguard its overall financial health. Failure to comply can lead to significant financial and reputational damage.

The financial sector's regulatory framework is constantly evolving, necessitating proactive engagement from Central Pacific Bank. This includes continuous tracking of legislative changes and adapting internal policies and procedures to meet new compliance demands.

Central Pacific Bank operates under a stringent legal framework, particularly concerning consumer protection and data privacy. Federal regulations like the Gramm-Leach-Bliley Act and state-specific laws, such as California's Consumer Privacy Act (CCPA), which influences practices even for banks operating outside the state, mandate how customer data is collected, stored, and utilized. Non-compliance can lead to significant penalties and reputational damage.

Maintaining robust data security is paramount, especially in light of recent data security incidents impacting businesses in Hawaii. These events underscore the critical need for continuous investment in cybersecurity infrastructure and employee training to prevent breaches and safeguard sensitive customer information, thereby preserving customer trust and regulatory standing.

Central Pacific Bank operates under strict Anti-Money Laundering (AML) and Know Your Customer (KYC) regulations, crucial for deterring financial crime. These rules mandate rigorous customer identification and verification processes, along with the monitoring and reporting of suspicious transactions. For instance, the Bank Secrecy Act in the US, which influences many global financial regulations, imposes significant obligations on financial institutions.

Lending and Credit Regulations

Regulations governing lending practices, credit reporting, and fair lending are critical legal factors influencing Central Pacific Bank's loan portfolio. These rules ensure equitable treatment for borrowers and set terms for diverse loan products, including mortgages and commercial loans. For instance, the Consumer Financial Protection Bureau (CFPB) actively enforces regulations like the Fair Credit Reporting Act, impacting how banks assess creditworthiness.

Modifications to these regulations can directly affect the bank's lending capacity, its risk assessment methodologies, and ultimately, its profitability. For example, changes in capital requirements or reserve mandates, such as those influenced by the Dodd-Frank Act's ongoing implementation, can alter the cost of lending and the volume of credit the bank can extend.

- Fair Lending Laws: Compliance with the Equal Credit Opportunity Act (ECOA) prevents discrimination in lending based on race, color, religion, national origin, sex, marital status, or age.

- Credit Reporting Accuracy: Adherence to the Fair Credit Reporting Act (FCRA) ensures the accuracy and privacy of consumer credit information used in loan decisions.

- Loan Origination Standards: Regulations like those from the Office of the Comptroller of the Currency (OCC) dictate prudent standards for originating various loan types, impacting underwriting processes.

- Interest Rate Caps: State and federal laws may impose limits on interest rates, affecting the pricing and profitability of certain loan products.

Environmental, Social, and Governance (ESG) Reporting Requirements

The global regulatory environment is increasingly mandating detailed Environmental, Social, and Governance (ESG) disclosures for financial institutions. For instance, the EU's Corporate Sustainability Reporting Directive (CSRD) became applicable to large companies starting in 2025, setting a precedent for more rigorous reporting standards. Central Pacific Bank's proactive approach, highlighted in its 'Caring for our 'Aina and People' report, demonstrates an awareness of these evolving legal obligations.

These new requirements mean financial firms must provide more transparency on their sustainability performance. This includes data on carbon emissions, social impact, and corporate governance practices. Central Pacific Bank's existing ESG framework is likely to be a strong foundation for meeting these upcoming and ongoing regulatory demands.

Central Pacific Bank's commitment to ESG aligns with a broader legal trend toward accountability in corporate sustainability. As of early 2025, many jurisdictions are either implementing or strengthening ESG reporting mandates, influencing how banks like Central Pacific Bank must communicate their environmental and social impact to stakeholders.

Central Pacific Bank is subject to a complex web of legal and regulatory requirements that directly shape its operations and risk management strategies. Adherence to these rules is not merely a compliance exercise but a fundamental aspect of maintaining its license to operate and its reputation. For example, the bank's successful integration into the Federal Reserve system by January 2025 means it now faces heightened capital adequacy and oversight standards, influencing its lending capacity and operational flexibility.

The bank's commitment to data privacy and security is legally mandated, with frameworks like the Gramm-Leach-Bliley Act and state-level regulations such as the CCPA setting strict guidelines for handling customer information. Given the increasing frequency of data breaches across industries, Central Pacific Bank must continually invest in robust cybersecurity measures to avoid substantial penalties and preserve customer trust, a critical asset in the financial sector.

Furthermore, stringent Anti-Money Laundering (AML) and Know Your Customer (KYC) regulations, exemplified by the Bank Secrecy Act, are integral to preventing financial crime. These requirements necessitate thorough customer due diligence and transaction monitoring, impacting the efficiency of account opening and the cost of compliance for the bank.

Central Pacific Bank must also navigate evolving lending regulations, including fair lending laws like the Equal Credit Opportunity Act (ECOA) and credit reporting standards under the Fair Credit Reporting Act (FCRA). These regulations ensure equitable access to credit and data accuracy, directly influencing the bank's risk assessment models and loan product development. Changes in capital requirements, influenced by acts like Dodd-Frank, can also alter the cost and availability of credit, impacting the bank's profitability and market competitiveness.

Environmental factors

Hawaii faces significant environmental challenges due to climate change, with rising sea levels posing a direct threat to coastal infrastructure. Projections indicate that even a modest sea-level rise could inundate significant portions of low-lying coastal areas by 2050, impacting properties and businesses across the islands.

The increasing frequency and intensity of extreme weather events, such as hurricanes and droughts, also present substantial risks. These events can disrupt supply chains, damage property, and strain the financial resources of individuals and businesses, potentially affecting loan portfolios and insurance claims for institutions like Central Pacific Bank.

These environmental shifts necessitate a thorough assessment of climate-related financial risks for Central Pacific Bank. Understanding the potential impact on physical assets, real estate collateral values, and the creditworthiness of clients in vulnerable sectors is crucial for strategic planning and risk mitigation efforts in the coming years.

Central Pacific Bank operates within an evolving landscape of environmental regulations and a growing emphasis on sustainability. These factors directly impact its operational strategies and investment choices, from managing energy consumption to waste disposal and supporting eco-friendly development projects. For instance, the bank's commitment to environmental stewardship, as detailed in its 'Caring for our 'Aina and People' report, signals a proactive approach to aligning with these critical trends.

In Hawaii's island setting, the availability and careful management of natural resources like water and energy are paramount. For instance, Hawaii's reliance on imported fossil fuels for energy means fluctuations in global prices directly impact local businesses and consumers, affecting their spending power and loan demand at Central Pacific Bank.

The potential costs associated with extreme drought, such as increased water utility charges or the need for expensive desalination, can strain business operations and individual finances. This, coupled with rising demand for public utilities driven by climate change impacts, could lead to higher operating costs for businesses and increased borrowing needs, influencing their financial health and their relationship with Central Pacific Bank.

Public Awareness and Environmental Responsibility

Public awareness regarding environmental issues is significantly shaping corporate behavior. Central Pacific Bank, like many financial institutions, faces increasing pressure from consumers and investors to demonstrate strong environmental responsibility. This heightened scrutiny directly impacts brand reputation and customer loyalty, as stakeholders actively seek out organizations committed to sustainability. For instance, a 2024 survey indicated that over 60% of consumers consider a company's environmental impact when making purchasing decisions.

Central Pacific Bank's proactive engagement with environmental initiatives, such as its annual Earth Day celebrations and a stated commitment to Environmental, Social, and Governance (ESG) principles, are crucial for maintaining public trust and a positive brand image. These efforts signal the bank's dedication to operating in an environmentally conscious manner, which can be a key differentiator in a competitive market.

- Growing Consumer Demand: Data from 2024 shows a marked increase in consumer preference for sustainable banking practices.

- Investor Scrutiny: ESG funds saw substantial inflows in 2024, highlighting investor focus on environmental performance.

- Reputational Impact: A strong environmental record can enhance brand perception, while a poor one can lead to negative publicity and customer attrition.

- ESG Integration: Central Pacific Bank's alignment with ESG principles is vital for attracting socially conscious investors and customers.

Green Financing Opportunities and Sustainable Investments

Central Pacific Bank can capitalize on the growing demand for green financing, with the global sustainable finance market projected to reach $50 trillion by 2025. This shift presents clear opportunities for the bank to finance renewable energy installations, such as solar farms, and support energy-efficient retrofits for residential and commercial properties across Hawaii.

By developing and promoting sustainable investment products, Central Pacific Bank can attract a segment of customers increasingly prioritizing environmental, social, and governance (ESG) factors in their financial decisions. For instance, the bank could offer specialized loans for businesses committed to reducing their carbon footprint or investing in circular economy models.

- Green Financing Growth: The sustainable finance market is experiencing rapid expansion, offering significant potential for banks like Central Pacific Bank.

- Renewable Energy Focus: Opportunities exist in financing solar, wind, and other renewable energy projects crucial for Hawaii's energy independence.

- Energy Efficiency Incentives: Supporting energy-efficient housing and business upgrades aligns with sustainability goals and attracts environmentally conscious clients.

- Attracting ESG Investors: Offering sustainable investment options can draw in a growing base of investors and customers who value ESG principles.

Hawaii's unique island ecosystem faces escalating environmental pressures, notably from climate change. Rising sea levels threaten coastal infrastructure, with projections indicating inundation of low-lying areas by 2050, impacting properties and businesses. Extreme weather events like hurricanes and droughts are also intensifying, disrupting supply chains and straining financial resources, which directly affects Central Pacific Bank's loan portfolios and insurance operations.

These environmental shifts necessitate a robust assessment of climate-related financial risks for Central Pacific Bank. Understanding the potential impact on physical assets, collateral values, and client creditworthiness in vulnerable sectors is paramount for strategic planning and risk mitigation. The bank's commitment to environmental stewardship, as highlighted in its 'Caring for our 'Aina and People' report, demonstrates a proactive stance on these critical trends.

Public and investor demand for environmental responsibility is growing, with a 2024 survey showing over 60% of consumers considering a company's environmental impact. Central Pacific Bank's engagement in initiatives like Earth Day celebrations and its adherence to ESG principles are vital for maintaining public trust and a positive brand image, differentiating it in a competitive market. The global sustainable finance market is projected to reach $50 trillion by 2025, presenting significant opportunities for green financing.

| Environmental Factor | Impact on Central Pacific Bank | Data/Trend |

|---|---|---|

| Sea-Level Rise | Risk to coastal property collateral, business disruption | Inundation of low-lying areas by 2050 |

| Extreme Weather | Increased loan defaults, insurance claims, supply chain disruption | Rising frequency and intensity of hurricanes/droughts |

| Consumer/Investor Demand for Sustainability | Reputational risk/opportunity, attraction of ESG investors | 60%+ consumers consider environmental impact (2024); ESG funds saw substantial inflows (2024) |

| Green Financing Opportunities | Revenue growth through sustainable investment products | Global sustainable finance market projected to reach $50 trillion by 2025 |

PESTLE Analysis Data Sources

Our PESTLE analysis for Central Pacific Bank draws from a comprehensive blend of official government publications, reputable financial news outlets, and industry-specific market research reports. Each factor, from political stability to technological advancements, is grounded in current and verifiable data.