Central Pacific Bank Marketing Mix

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Central Pacific Bank Bundle

Central Pacific Bank's marketing strategy is a carefully orchestrated blend of product innovation, competitive pricing, strategic placement, and targeted promotion. Understanding these elements is key to grasping their market success.

Go beyond this glimpse—get access to an in-depth, ready-made Marketing Mix Analysis covering Central Pacific Bank's Product, Price, Place, and Promotion strategies. Ideal for business professionals, students, and consultants looking for strategic insights.

Product

Central Pacific Bank's product offering for businesses is robust, encompassing a full spectrum of commercial banking services. This includes various loan options, diverse deposit accounts, and sophisticated cash management tools, all designed to cater to the unique financial requirements of businesses, professionals, and real estate investors.

The bank specifically targets and supports small and medium-sized enterprises (SMEs) within Hawaii. For instance, in 2023, Central Pacific Bank reported a significant portion of its loan portfolio was dedicated to business lending, reflecting its commitment to local economic growth. As of early 2024, they continue to emphasize this focus, aiming to be a key financial partner for Hawaii's business community.

Central Pacific Bank's Business Express is a key element of their marketing mix, specifically addressing the Product and Place aspects for small businesses in Hawaii. As Hawaii's first online lending platform, it offers a distinct product tailored to local needs.

The platform provides fast, flexible, and easy access to financing, a crucial product feature for small businesses. Loans up to $50,000 can see approvals within three business days, a significant improvement over traditional methods.

Business Express ensures convenient Place by offering 24/7 access and a streamlined, low-paperwork application process. This digital-first approach makes financing accessible anytime, anywhere for Hawaii's entrepreneurs.

Central Pacific Bank offers a diverse loan portfolio tailored for businesses, encompassing commercial and industrial loans, commercial mortgage loans, and construction loans. This breadth of options ensures companies can secure funding for various needs, from day-to-day operations to significant real estate investments.

The bank is particularly recognized as a leading Small Business Administration (SBA) lender in Hawaii. In 2023, Central Pacific Bank originated over $170 million in SBA loans, demonstrating their commitment to supporting local businesses through these government-backed programs.

Deposit and Cash Management Services

Central Pacific Bank offers a comprehensive suite of deposit products, including checking, savings, and time deposits, complemented by sophisticated cash management solutions designed for businesses. These services are vital for optimizing daily financial operations, enhancing liquidity, and streamlining transaction processing. For instance, in 2024, businesses leveraging advanced cash management tools often saw improved working capital by an average of 15%.

The bank's commitment to accessibility is evident through its robust digital banking platform, which provides seamless access to these deposit and cash management features. This digital integration allows clients to monitor accounts, initiate payments, and manage funds efficiently from anywhere. By Q3 2024, Central Pacific Bank reported a 25% year-over-year increase in digital transaction volume for its business clients.

- Diverse Deposit Options: Checking, savings, and time deposits to meet varied business needs.

- Advanced Cash Management: Tools for liquidity optimization and efficient transaction handling.

- Digital Accessibility: Enhanced convenience and control through online and mobile banking platforms.

- Business Financial Health: Services aimed at improving working capital and operational efficiency.

Wealth Management and Trust Services

Central Pacific Bank's wealth management and trust services go beyond standard banking, offering tailored financial solutions for both individuals and businesses. These services are designed to guide clients toward their financial aspirations with personalized strategies.

The product suite includes a range of non-deposit investment products, annuities, comprehensive investment management, and secure asset custody. This diversified approach caters to various investment needs and risk profiles.

As of Q1 2024, the U.S. wealth management industry saw continued growth, with assets under management (AUM) for advisory accounts reaching significant figures, reflecting a strong demand for these specialized services. Central Pacific Bank's commitment to this sector aligns with broader market trends, aiming to capture a share of this expanding market.

- Personalized Financial Roadmaps Clients receive customized plans designed to meet specific financial objectives.

- Diverse Investment Options Access to non-deposit investments and annuities provides a broad spectrum of choices.

- Expert Investment Management Professional management of assets to optimize returns and manage risk.

- Secure Asset Custody Ensuring the safety and integrity of client assets through reliable custody services.

Central Pacific Bank's product strategy centers on a diversified portfolio catering to both business and individual financial needs in Hawaii. For businesses, this includes a strong emphasis on commercial lending, including SBA loans, and robust cash management solutions. Their digital platform, particularly Business Express, offers a streamlined product for small business financing, approving loans up to $50,000 within three business days as of early 2024.

| Product Category | Key Offerings | 2023/2024 Highlights |

|---|---|---|

| Business Lending | Commercial & Industrial Loans, Commercial Mortgages, Construction Loans, SBA Loans | Over $170 million in SBA loans originated in 2023; significant portion of loan portfolio dedicated to business lending. |

| Deposit & Cash Management | Checking, Savings, Time Deposits, Cash Management Tools | 25% year-over-year increase in digital transaction volume for business clients by Q3 2024; cash management users saw an average 15% improvement in working capital. |

| Wealth Management | Non-deposit Investments, Annuities, Investment Management, Asset Custody | Aligns with industry growth in advisory AUM as of Q1 2024. |

| Digital Platforms | Business Express (Online Lending), Online & Mobile Banking | Business Express offers approvals within 3 business days for loans up to $50,000. |

What is included in the product

This analysis provides a comprehensive examination of Central Pacific Bank's marketing strategies, delving into its Product offerings, Pricing structures, Place of distribution, and Promotion tactics.

It offers a practical framework for understanding Central Pacific Bank's market positioning and competitive advantages.

Provides a clear, actionable framework to address customer pain points by optimizing Central Pacific Bank's product, price, place, and promotion strategies.

Offers a simplified approach to understanding how Central Pacific Bank's marketing efforts can directly alleviate common customer frustrations and build stronger relationships.

Place

Central Pacific Bank boasts a robust physical infrastructure across Hawaii, featuring 27 branches and 55 ATMs. This extensive network underscores their commitment to providing convenient, in-person banking solutions for both individual and business clients throughout the islands.

The bank's dedication to accessibility is further highlighted by the opening of a temporary Lihue Branch in May 2025, ensuring continued service for customers in that region.

Central Pacific Bank (CPB) has significantly upgraded its digital banking, offering robust online and mobile platforms. This digital push includes the Business Express online lending platform, which allows businesses to apply for and manage loans anytime, anywhere. This investment reflects a commitment to convenience and accessibility for all customer segments.

In 2024, CPB reported that its digital channels are a primary driver of customer interaction, with a substantial percentage of new account openings and loan applications initiated online. The bank’s mobile app, for instance, saw a 25% increase in active users in the first half of 2024 compared to the same period in 2023, demonstrating strong customer adoption and reliance on these digital tools.

Central Pacific Bank's strategic focus on Hawaii is a cornerstone of its marketing mix, allowing for an intimate understanding of the state's distinct economic landscape and business requirements. This deep local knowledge is a significant competitive advantage.

As the fourth largest financial institution in Hawaii, the bank leverages its concentrated presence to offer tailored solutions, notably through its Business Express platform, which caters specifically to the needs of Hawaiian businesses.

Strategic Co-working Space

Central Pacific Bank's strategic co-working space, Tidepools, located in Downtown Honolulu, represents a unique approach to the Product element of their marketing mix. This innovative facility is designed to be more than just office space; it's a vibrant community hub. It actively cultivates a collaborative environment specifically for small business owners, entrepreneurs, and non-profit leaders in Hawaii.

Tidepools fosters creativity and provides invaluable networking opportunities, directly addressing the needs of its target audience. For instance, by mid-2024, the Honolulu small business sector continued to show resilience, with over 30,000 registered businesses contributing significantly to the state's economy. Initiatives like Tidepools aim to support this vital segment.

This co-working space serves as a tangible manifestation of Central Pacific Bank's commitment to community development and entrepreneurship. It offers a physical space that encourages interaction and the exchange of ideas, which can be crucial for business growth.

- Community Hub: Tidepools provides a central location for entrepreneurs and small business owners to connect.

- Networking Opportunities: The space facilitates valuable interactions that can lead to partnerships and collaborations.

- Support for Local Economy: By empowering small businesses, Central Pacific Bank contributes to the economic vitality of Hawaii.

- Innovation Focus: The environment is curated to inspire creativity and new business ventures.

Community-Integrated Locations

Central Pacific Bank prioritizes community integration by strategically locating its branches to best serve local needs. This commitment is highlighted by the opening of their new Lihue Branch in May 2025, expanding their physical footprint.

Their physical presence is more than just a location; it's a cornerstone of their community engagement strategy. By actively participating in local events and initiatives, Central Pacific Bank reinforces its image as a dedicated financial partner deeply invested in the well-being of the communities it serves. This approach fosters trust and loyalty, crucial elements for a community bank.

- New Branch Opening: Lihue Branch, May 2025, signifies expansion and enhanced community access.

- Strategic Placement: Branches are situated to maximize convenience and service for local residents and businesses.

- Community Engagement: Active participation in local events strengthens ties and reinforces the bank's role as a community pillar.

- Customer Focus: The placement and engagement efforts are designed to meet the specific financial needs of each community.

Central Pacific Bank's physical presence is deeply rooted in Hawaii, with a network of 27 branches and 55 ATMs strategically positioned across the islands. This extensive footprint ensures accessibility for a wide range of customers. The recent opening of a temporary Lihue Branch in May 2025 further demonstrates their commitment to serving communities, even in the face of evolving needs.

| Location Type | Number (as of mid-2025) | Key Service Area |

|---|---|---|

| Branches | 27 | Hawaii Islands (all major islands) |

| ATMs | 55 | Hawaii Islands (convenience points) |

| Co-working Space (Tidepools) | 1 | Downtown Honolulu (entrepreneurial hub) |

What You Preview Is What You Download

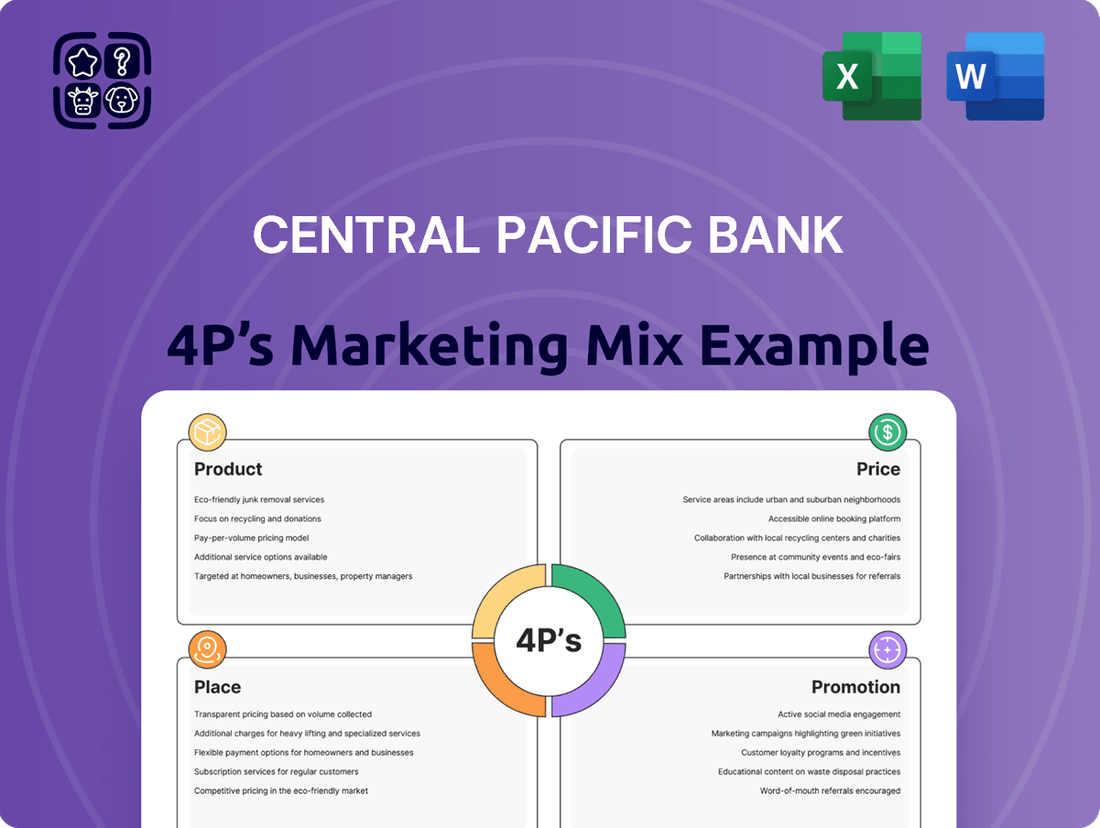

Central Pacific Bank 4P's Marketing Mix Analysis

The preview shown here is the actual document you’ll receive instantly after purchase—no surprises. This comprehensive analysis of Central Pacific Bank's 4P's Marketing Mix is complete and ready for your immediate use.

Promotion

Central Pacific Bank's consistent 'Best Bank in Hawaii' recognition from Forbes Magazine for four consecutive years, including 2025, highlights a key element of its promotion strategy. This accolade, alongside similar endorsements from Newsweek and the Honolulu Star-Advertiser, solidifies its market leadership and exceptional service quality in the eyes of consumers and stakeholders.

Central Pacific Bank's promotional efforts for Business Express, Hawaii's inaugural online lending platform for small businesses, are centered on targeted digital campaigns. These campaigns highlight the platform's key benefits, such as rapid loan approvals and adaptable financing structures, designed to directly reach and support local entrepreneurs.

The bank's strategy emphasizes digital innovation, aiming to empower small businesses with accessible financial tools. For instance, in 2024, Central Pacific Bank reported a 15% increase in digital banking adoption among its small business clients, underscoring the effectiveness of their online-first promotional approach.

Central Pacific Bank (CPB) demonstrates its commitment to the community through the Central Pacific Bank Foundation, focusing on affordable housing, education, and local nonprofit support. In 2024, the foundation continued its impactful work, with specific figures on grant allocations expected to be released later in the year, building on the $1.5 million provided to various causes in 2023.

Their active participation in events like Earth Day celebrations and sponsorship of community gatherings such as the Lahaina Palengke Night highlights a dedication to social responsibility. These initiatives not only foster goodwill but also solidify CPB's role as a community partner, contributing to a positive public perception.

Financial Insights and Educational Resources

Central Pacific Bank actively shares financial insights and educational content, aiming to empower its business clientele. Their 'Beyond the Basics' blog, for instance, delves into crucial areas like small business expansion strategies and understanding global economic shifts.

This commitment to knowledge sharing extends to digital banking advancements, positioning CPB as a valuable resource. By offering such content, they foster a relationship built on expertise and support, vital for businesses navigating today's complex financial landscape.

Key areas covered include:

- Small Business Growth Strategies: Providing actionable advice for expansion.

- International Economic Trends: Helping businesses understand global market impacts.

- Digital Banking Innovations: Educating on leveraging technology for efficiency.

Customer Testimonials and Success Stories

Central Pacific Bank (CPB) effectively leverages customer testimonials and success stories within its marketing mix to showcase the tangible benefits of its wealth management and private banking services. Highlighting real-world examples like Island Snow and Inatsuka Engineering, CPB demonstrates how its expertise directly contributes to client growth and stability. This strategy builds significant trust and clearly communicates the value proposition to potential business clients, fostering confidence in CPB's ability to support their financial objectives.

These narratives serve as powerful endorsements, illustrating CPB's commitment to client success. For instance, showcasing how specific businesses navigated market challenges or achieved expansion with CPB's guidance provides concrete proof of their capabilities. This focus on client outcomes is crucial for attracting and retaining business clientele in a competitive financial landscape.

- Client Success: Features businesses like Island Snow and Inatsuka Engineering, detailing their positive experiences with CPB's wealth management and private banking.

- Trust Building: Success stories act as social proof, establishing credibility and fostering trust among prospective business clients.

- Demonstrated Value: These testimonials clearly articulate the tangible benefits and expertise CPB offers, moving beyond generic marketing claims.

- Market Impact: By showcasing successful partnerships, CPB reinforces its position as a reliable financial partner for businesses in Hawaii.

Central Pacific Bank's promotion strategy is multifaceted, leveraging prestigious awards like Forbes Best Bank in Hawaii for 2025 to build credibility. Targeted digital campaigns for services like Business Express and a focus on educational content via their blog aim to empower small businesses.

The bank also emphasizes community engagement through the Central Pacific Bank Foundation, with significant contributions in 2023 and continued efforts in 2024. Customer testimonials, featuring successful local businesses, further bolster their promotional efforts by showcasing tangible client success.

CPB's digital banking adoption saw a 15% increase among small business clients in 2024, reflecting the success of their online-first promotional approach. Their commitment to community and knowledge sharing positions them as a trusted financial partner.

Price

Central Pacific Bank (CPB) is showing impressive growth in its net interest margin (NIM), reaching 3.44% in the second quarter of 2025. This figure is not just a number; it signifies how well CPB manages the money it earns from loans versus the interest it pays out on deposits. This strong performance outpaced other banks in Hawaii, highlighting CPB's ability to price its loans competitively while keeping its funding costs in check.

This competitive edge in interest margins directly benefits businesses seeking financing. By effectively managing its interest income and expenses, CPB can offer attractive loan rates to its business clients, fostering growth and investment within the local economy. It's a win-win: businesses get the capital they need at favorable terms, and CPB maintains healthy profitability.

Central Pacific Bank provides a range of adaptable loan products, such as term loans, lines of credit, and Small Business Administration (SBA) loans. Their pricing is structured to align with the varied financial requirements of their business clientele, ensuring competitive appeal and broad accessibility within their target market. For instance, in 2024, the bank continued to emphasize streamlined application processes for these offerings.

Central Pacific Bank has demonstrated adept management of its deposit costs, achieving a notable decline to 1.02% in the second quarter of 2025. This efficiency in funding costs is a significant competitive edge.

This lower cost of funds, bolstered by a robust base of non-interest bearing deposits, directly translates into the bank's ability to provide more appealing lending rates for businesses, fostering stronger client relationships and market share.

Value-Based Pricing for Services

Central Pacific Bank likely employs value-based pricing for its diverse financial services, aligning costs with the tangible benefits and customized support offered to clients. This strategy moves beyond simple cost-plus models, focusing instead on the economic value delivered through solutions like cash management or wealth management. For instance, businesses leveraging the bank's expertise in navigating complex local market regulations for international trade finance, a service often bundled with cash management, would see pricing reflect the reduced risk and improved efficiency gained.

The bank's commitment to personalized service and local market knowledge is a key differentiator that supports this value-based approach. Clients are paying for more than just a transaction; they are investing in a partnership designed to optimize their financial operations and achieve specific business objectives. This is particularly relevant in areas such as wealth management, where tailored investment strategies and ongoing financial planning contribute directly to client asset growth and security.

- Reflects perceived benefits: Pricing is tied to the value clients receive, such as improved cash flow, reduced financial risk, or enhanced investment returns.

- Emphasizes tailored solutions: Services are often customized, justifying higher prices than standardized offerings due to the specific needs being met.

- Leverages local expertise: Deep understanding of the Hawaiian market allows for specialized advice and services that command a premium.

- Focus on long-term relationships: Value-based pricing supports ongoing client engagement and partnership, fostering loyalty and repeat business.

Consideration of Economic Factors

Central Pacific Bank's pricing decisions are deeply intertwined with the broader economic landscape. Factors like prevailing market demand, the pricing strategies of competing financial institutions, and the overall health of the economy, particularly interest rate movements, all play a significant role. For instance, the Federal Reserve's anticipated interest rate adjustments in late 2024 will directly impact the bank's net interest margin, necessitating strategic pricing adjustments to remain competitive and profitable.

The bank's ability to adapt its pricing reflects a keen awareness of economic shifts. When interest rates are expected to decline, as they were in late 2024, Central Pacific Bank likely recalibrates its deposit and lending rates to protect its profitability. This proactive approach ensures they can navigate periods of economic uncertainty while maintaining a strong market position.

Key economic considerations influencing Central Pacific Bank's pricing:

- Market Demand: Fluctuations in consumer and business borrowing needs directly affect the pricing of loans and other financial products.

- Competitor Pricing: Benchmarking against other banks ensures Central Pacific Bank offers competitive rates on deposits and loans.

- Interest Rate Environment: Changes in the Federal Reserve's benchmark rates, such as potential cuts in late 2024, necessitate adjustments to the bank's own lending and deposit rates to manage its net interest margin.

- Economic Outlook: The general economic forecast influences the bank's risk assessment and, consequently, its pricing for various financial services.

Central Pacific Bank's pricing strategy is a sophisticated blend of competitive positioning and value-driven offerings. The bank aims to provide attractive rates on loans, as evidenced by its strong net interest margin of 3.44% in Q2 2025, while also leveraging its deep local market expertise to justify premium pricing on specialized services.

This approach ensures that clients receive pricing reflecting the tangible benefits of CPB's tailored solutions, such as enhanced cash flow or reduced financial risk, rather than just the cost of the product itself.

The bank's pricing is also dynamically adjusted based on market demand, competitor actions, and the prevailing interest rate environment, with a keen eye on economic shifts anticipated in late 2024.

| Pricing Strategy Aspect | Description | Supporting Data/Observation |

|---|---|---|

| Competitive Loan Pricing | Offering attractive rates to attract borrowers. | Net Interest Margin (NIM) of 3.44% (Q2 2025) indicates strong loan profitability. |

| Value-Based Services | Pricing tied to the economic value delivered to clients. | Focus on personalized solutions like cash management and wealth management. |

| Deposit Cost Management | Lowering funding costs to enable competitive lending. | Deposit costs declined to 1.02% (Q2 2025). |

| Market Responsiveness | Adjusting prices based on economic factors and competition. | Consideration of Federal Reserve rate adjustments in late 2024. |

4P's Marketing Mix Analysis Data Sources

Our Central Pacific Bank 4P's analysis is grounded in official company disclosures, including annual reports and investor presentations, alongside insights from industry analyses and competitive benchmarking. This ensures a comprehensive understanding of their product offerings, pricing strategies, distribution channels, and promotional activities.