Central Pacific Bank Boston Consulting Group Matrix

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Central Pacific Bank Bundle

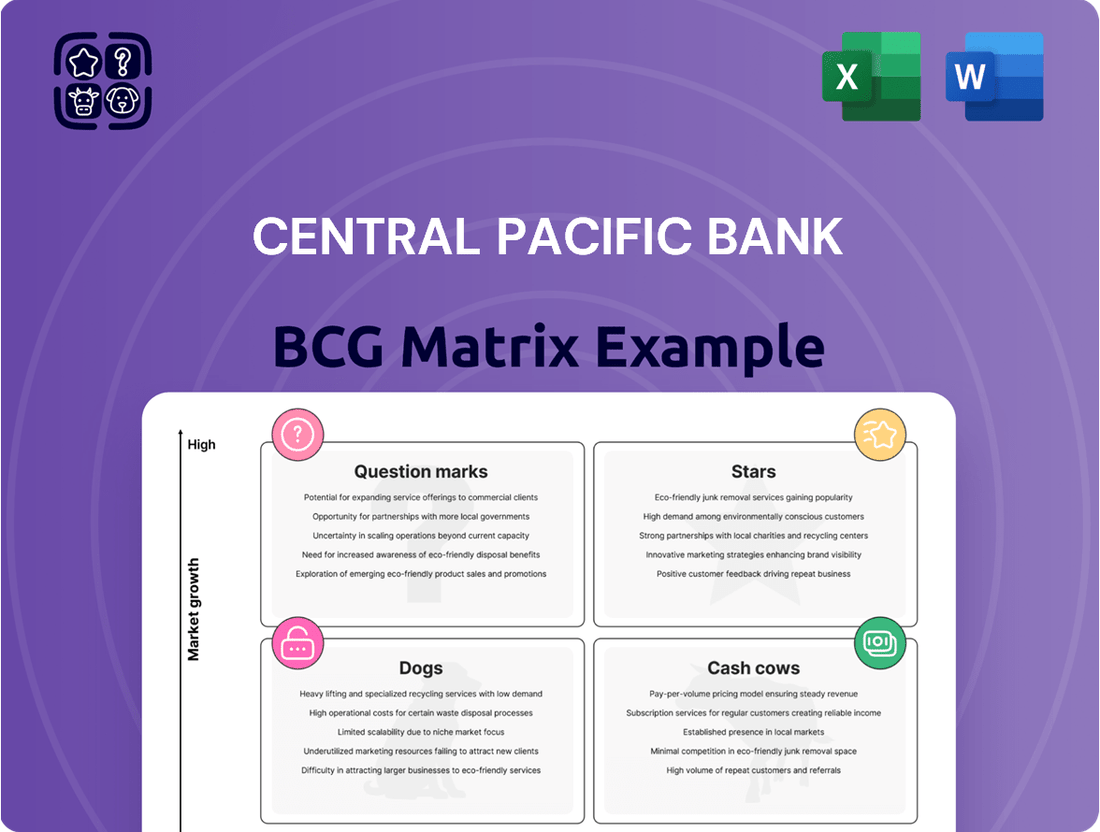

Central Pacific Bank's BCG Matrix offers a crucial snapshot of its product portfolio's market share and growth potential. Understand which of their offerings are driving revenue and which might require strategic divestment.

This preview is just the beginning. Get the full BCG Matrix report to uncover detailed quadrant placements, data-backed recommendations, and a roadmap to smart investment and product decisions for Central Pacific Bank.

Stars

Central Pacific Bank's Digital Business Express Platform, introduced in 2024, stands out as a significant player within its BCG Matrix. As Hawaii's inaugural and sole online lending portal for small businesses, it offers unparalleled 24/7 accessibility and swift loan approvals up to $50,000.

This platform is positioned as a star due to its high-growth potential. By embracing technology, Central Pacific Bank is actively capturing market share in the increasingly digital banking environment, catering to entrepreneurs who value efficiency and online convenience. Its unique status in the Hawaiian market suggests a strategic move to lead this specific segment.

Central Pacific Bank has earned the SBA Lender of the Year award in Hawaii for 2024, specifically the Category II award. This is the 16th time they've received this recognition since 2004, highlighting their substantial market share and dedication to small businesses.

This consistent leadership in SBA lending, approving a significant volume of loans each year, underscores their strong focus on this crucial economic sector. Their deep commitment positions them as a dominant player with ongoing opportunities for expansion in supporting Hawaii's entrepreneurial landscape.

Central Pacific Bank is a dominant player in Hawaii's commercial real estate lending market. With the median single-family home price on Oahu hitting $1.13 million in June 2025, the bank is positioned in a thriving sector. Their ability to tailor loans for various property needs signifies a strong, high-growth offering.

Wealth Management Growth Initiatives

Central Pacific Bank is making significant strides in its wealth management division, recognizing its potential as a strong growth area. A key initiative involves bolstering their advisory team.

The bank appointed a new Senior Vice President and Division Manager for Central Pacific Investment Services in May 2025. This strategic hiring underscores their commitment to building a high-caliber team of wealth advisors.

These efforts are designed to capture a larger share of the expanding wealth management market.

- Investment in Talent: Hiring experienced professionals to enhance advisory capabilities.

- Market Expansion: Targeting growth within the high-net-worth segment.

- Service Enhancement: Developing a robust platform for wealth management services.

Targeted Digital Banking Solutions

Central Pacific Bank's (CPB) targeted digital banking solutions are a key component of its strategy, aiming to position the institution as a 'digital-first bank.' This involves ongoing investment in technology to refine the customer journey and boost operational effectiveness. While specific new offerings are still in development, the bank's broader commitment to advanced digital tools reflects a high-growth segment where CPB is focused on increasing its market share.

CPB's digital push aims to cater to evolving customer expectations for seamless and accessible banking experiences. This strategic focus on digital innovation is designed to capture a larger portion of a market that increasingly prioritizes convenience and technological integration in financial services. For instance, in the first quarter of 2024, digital transaction volumes across the banking sector saw a notable increase, underscoring the demand for these services.

- Investment in Technology: CPB is actively investing in its digital infrastructure to support new features and improve existing online and mobile banking platforms.

- Customer Experience Enhancement: The bank's strategy prioritizes making digital interactions intuitive and efficient for all customers.

- Market Expansion: CPB views advanced digital banking tools as a critical area for growth and aims to broaden its reach within this segment.

- Evolving Preferences: The focus on digital solutions directly addresses changing consumer habits and the growing preference for self-service banking options.

Central Pacific Bank's Digital Business Express Platform, launched in 2024, is a prime example of a Star in their BCG Matrix. As Hawaii's first and only online lending portal for small businesses, it offers 24/7 access and rapid approvals up to $50,000, tapping into a high-growth, digitally-driven market segment. This platform's unique position in the Hawaiian market, coupled with the bank's 2024 SBA Lender of the Year award in Hawaii (Category II), demonstrates strong market share and growth potential in supporting local entrepreneurs.

The bank's wealth management division is also a Star, fueled by strategic investments like the May 2025 appointment of a new Senior Vice President and Division Manager for Central Pacific Investment Services. This move is aimed at enhancing advisory capabilities and capturing a larger share of the expanding wealth management market, particularly within the high-net-worth segment.

CPB's broader digital banking initiatives, focused on becoming a 'digital-first bank,' represent another Star. The bank is investing heavily in technology to refine the customer journey and boost operational effectiveness, mirroring the first quarter of 2024's notable increase in digital transaction volumes across the banking sector. This focus on advanced digital tools is critical for growth and expanding reach in a market that increasingly values convenience and technological integration.

| Business Unit | Market Growth | Market Share | BCG Classification |

|---|---|---|---|

| Digital Business Express Platform | High | High | Star |

| Wealth Management | High | High | Star |

| Digital Banking Solutions | High | High | Star |

| Commercial Real Estate Lending | High | High | Star |

What is included in the product

Central Pacific Bank's BCG Matrix offers a tailored analysis of its product portfolio, detailing strategic insights for each quadrant.

Visualize Central Pacific Bank's portfolio with a clear BCG Matrix, alleviating the pain of unclear strategic direction.

Cash Cows

Central Pacific Bank's established retail deposit base, encompassing demand, savings, and money market accounts, stands as a significant cash cow. As of June 30, 2025, these deposits reached $5.96 billion, highlighting a substantial and stable funding source.

This mature product boasts a high market share and offers a competitive edge through its cost-effectiveness, evidenced by a declining average rate paid on deposits. The consistent liquidity generated from this base provides reliable cash flow, a hallmark of a strong cash cow.

Central Pacific Bank's strong net interest margin (NIM) performance is a key indicator of its Cash Cow status. The bank achieved a NIM of 3.44% in the second quarter of 2025, exceeding its Hawaii-based competitors. This robust NIM reflects effective management of its interest-earning assets and liabilities, directly contributing to its profitability.

Central Pacific Bank's deep roots and strong reputation in Hawaii, evidenced by its Forbes 'Best Bank in Hawaii' recognition for four consecutive years through 2025, solidify its dominant position in traditional commercial banking. This enduring market leadership translates into a substantial and loyal client base, generating predictable and robust revenue streams.

These established relationships represent a significant cash flow generator for Central Pacific Bank, requiring minimal additional investment for growth. The stability of these mature commercial banking operations allows them to function as a key cash cow, supporting other areas of the bank's strategic initiatives.

Extensive Branch and ATM Network

Central Pacific Bank's extensive branch and ATM network, comprising 27 branches and 55 ATMs across Hawaii, represents a significant asset. This mature physical infrastructure acts as a powerful distribution channel for its established banking services. Even as digital banking grows, this network continues to serve a substantial customer base and underpins core banking functions with minimal need for further investment.

This established network contributes to Central Pacific Bank's position as a cash cow within the BCG Matrix. Its high market share in traditional banking services generates consistent revenue with low ongoing capital expenditure requirements.

- Established Physical Presence: Operates 27 branches and 55 ATMs in Hawaii.

- High Market Share: Serves as a key distribution channel for traditional banking.

- Low Investment Requirement: Mature network needs minimal additional capital for maintenance.

- Consistent Revenue Generation: Supports a large customer base and core banking operations.

Overall Stable Loan Portfolio

Central Pacific Bank's loan portfolio, totaling $5.29 billion as of June 30, 2025, is a cornerstone of its financial stability. With a substantial 80% of these loans secured by real estate, the portfolio exhibits a low-risk profile, contributing reliably to the bank's cash flow generation in a well-established market.

This robust portfolio is diversified across various loan types, including commercial, residential mortgage, and consumer loans. This mix ensures a steady stream of interest income, underscoring its role as a cash cow within the bank's operations.

- Loan Portfolio Value: $5.29 billion (as of June 30, 2025)

- Real Estate Security: 80% of total loans

- Income Generation: Consistent interest income from diversified loan types

- Market Position: Stable contributor in a mature market

Central Pacific Bank's retail deposit base, valued at $5.96 billion as of June 30, 2025, functions as a significant cash cow. This mature product, characterized by a high market share and cost-effectiveness, provides a stable and reliable funding source with consistent liquidity, a hallmark of a strong cash cow.

The bank's robust net interest margin (NIM) of 3.44% in Q2 2025, exceeding competitors, further solidifies its cash cow status. This strong performance reflects efficient asset and liability management, directly contributing to consistent profitability and cash flow generation.

Central Pacific Bank's established loan portfolio, totaling $5.29 billion as of June 30, 2025, with 80% secured by real estate, acts as another key cash cow. This low-risk, diversified portfolio consistently generates interest income, underscoring its stable contribution to the bank's cash flow.

| Business Segment | BCG Category | Key Metrics |

|---|---|---|

| Retail Deposits | Cash Cow | $5.96 billion (June 30, 2025), Declining average rate paid |

| Net Interest Margin (NIM) | Cash Cow | 3.44% (Q2 2025), Exceeds Hawaii competitors |

| Loan Portfolio | Cash Cow | $5.29 billion (June 30, 2025), 80% real estate secured, Diversified types |

What You’re Viewing Is Included

Central Pacific Bank BCG Matrix

The Central Pacific Bank BCG Matrix preview you are viewing is the identical, fully formatted report you will receive upon purchase. This means no watermarks or demo content, ensuring you get a professionally designed and analysis-ready document for immediate strategic application.

What you see here is the exact Central Pacific Bank BCG Matrix file that will be delivered to you after your purchase is complete. This ensures you receive a high-quality, ready-to-use report without any hidden alterations or missing information.

This preview accurately represents the Central Pacific Bank BCG Matrix document you will download once your purchase is finalized. It's crafted for clarity and strategic insight, providing you with the complete analysis without any need for further revisions.

Dogs

Central Pacific Bank's strategic repositioning of its investment securities portfolio in Q4 2024 led to a $9.9 million pre-tax loss. This indicates that some older investment holdings were not performing well or were no longer efficient, pushing the bank to sell them off. These types of assets are typically in a low-growth, low-return category within the bank's broader operations.

Central Pacific Bank's loan portfolio, while generally stable, has seen a slight overall decrease in total loans in recent quarters. This suggests that certain niche or declining loan segments might be underperforming, potentially due to evolving market dynamics or shifts in customer preferences.

For instance, if older, less popular loan products are not being actively originated or are seeing higher repayment rates than new originations, they could be classified as Dogs. These segments may generate minimal new business or simply break even, contributing little to overall growth.

Central Pacific Bank, like many established financial institutions, faces the challenge of less engaged or inactive customer accounts. These accounts, while numerous, represent a low market share within the bank's overall customer base and contribute minimally to revenue. In 2024, it's estimated that a significant portion of dormant accounts can become a drag on profitability due to ongoing administrative expenses.

These inactive accounts are essentially cash traps if not proactively managed. They occupy system resources and incur operational costs without generating commensurate returns, impacting overall efficiency. Central Pacific Bank must strategize to either re-engage these customers or streamline the management of these low-activity segments to avoid these financial drains.

Outdated or Less Efficient Internal Processes

Areas within Central Pacific Bank that still rely on older, less efficient operational processes, especially those not yet fully integrated with recent digital transformation initiatives, can be categorized as 'dogs' in the BCG Matrix framework. These segments often consume valuable resources and time without offering a substantial competitive edge or significant growth potential. For instance, manual data entry for certain back-office functions or legacy systems for customer service inquiries might fall into this category, hindering overall bank efficiency and potentially increasing operational costs.

These 'dog' segments can be characterized by several factors:

- Low Market Share: They contribute minimally to the bank's overall revenue or customer acquisition efforts.

- Low Growth Prospects: The demand for these outdated processes is stagnant or declining as newer, more efficient alternatives emerge.

- Resource Drain: They require ongoing maintenance and human capital without yielding commensurate returns, diverting resources from more promising areas.

- Competitive Disadvantage: Competitors leveraging modern technologies offer faster, cheaper, or more convenient services, making these 'dog' areas a drag on Central Pacific Bank's market position.

Physical Services at Low-Traffic Branches

Central Pacific Bank (CPB) faces the challenge of optimizing its extensive branch network, particularly identifying branches that may be considered 'dogs' within the BCG matrix. These are typically physical locations experiencing low customer traffic, often due to the increasing prevalence of digital banking solutions. While these branches still incur operational expenses like rent and staffing, their contribution to new business generation is minimal, and they serve a shrinking customer base.

For instance, data from 2024 indicates a continued trend of customers opting for online and mobile banking, reducing the necessity for frequent in-person branch visits. This shift means that some of CPB's physical service points, especially those in less populated or rapidly digitizing areas, might be underperforming. The bank will likely need to strategically evaluate these low-traffic branches for potential consolidation or repurposing to improve overall efficiency and resource allocation.

- Low Foot Traffic: Branches in areas with declining population density or high digital service adoption.

- Operational Costs: Continued expenses for rent, utilities, and personnel despite reduced customer engagement.

- Diminishing Returns: Low generation of new business or service volume, making them candidates for strategic review.

- Optimization Potential: Future consideration for consolidation, reduced hours, or conversion to specialized service centers.

Within Central Pacific Bank's strategic framework, 'dogs' represent business segments or assets with low market share and low growth prospects. These are areas that consume resources without generating significant returns, often due to outdated processes or declining demand. For example, certain legacy IT systems or less popular loan products might fall into this category.

These 'dog' segments are characterized by their minimal contribution to overall revenue and their stagnant or declining growth potential. In 2024, the bank's focus on digital transformation highlighted areas where older, less efficient operational processes remained, acting as a resource drain. These segments hinder overall efficiency and may even increase operational costs.

Central Pacific Bank also identifies underperforming physical branches as potential 'dogs'. With the rise of digital banking, some branches experience low customer traffic and minimal new business generation, despite ongoing operational expenses. Data from 2024 reinforces the trend of decreasing in-person branch visits, making the evaluation of these low-activity locations crucial for resource optimization.

The bank's strategic repositioning in Q4 2024, which included a $9.9 million pre-tax loss from divesting underperforming investment securities, exemplifies the management of 'dog' assets. These were older holdings that were no longer efficient, pushing the bank to sell them off to reallocate capital to more promising ventures.

Question Marks

Central Pacific Bank's (CPB) expansion into Banking-as-a-Service (BaaS) since 2022 is a strategic move targeting mainland U.S. deposits, a significant growth avenue beyond its Hawaiian base. This initiative aims to leverage partnerships with fintech companies to unlock new revenue streams and enhance shareholder value.

While the BaaS market presents substantial growth potential, CPB's current market share is still in its early stages, requiring ongoing investment in infrastructure and partnerships. This means the BaaS segment is currently a cash consumer as CPB builds its presence and capabilities in this competitive landscape.

Central Pacific Bank's expansion into markets like Kahului in 2024 and Lihue in May 2025 places these branches in a 'Question Mark' category within the BCG Matrix. These are strategic moves into potentially high-growth areas, but the bank's initial market share in these new physical locations is naturally low.

Significant investment will be needed to build brand awareness and attract customers in these new branches. For instance, the Kahului branch, opened in 2024, represents an investment in a market with anticipated growth, but it will take time and resources to establish a strong customer base and compete effectively.

Central Pacific Bank (CPB) is actively focusing on environmental initiatives, specifically by increasing its financing for renewable energy and climate change adaptation projects. This strategic move aligns with a global push towards sustainability, creating a rapidly expanding market segment. For instance, the global renewable energy market was valued at approximately $1,283.7 billion in 2023 and is projected to reach $2,173.1 billion by 2030, showcasing significant growth potential.

Within the context of the BCG Matrix, CPB's involvement in renewable energy and climate change adaptation financing can be categorized as a 'Question Mark'. This means the bank is in an early stage of participation in a high-growth market. While the sector offers substantial future prospects, CPB currently holds a relatively low market share in this specialized financing area, indicating a need for strategic investment and development.

'WE by Rising Tide' Women Entrepreneur Program

The 'WE by Rising Tide' Women Entrepreneur Program, launched in 2025, represents a strategic investment in a burgeoning market segment for Central Pacific Bank. This 10-week, no-cost initiative is designed to cultivate relationships with women business owners, a demographic showing increasing economic influence.

While the program is currently in its growth phase, characterized by significant investment and limited immediate financial returns, its long-term potential is substantial. It aims to capture future market share and build a strong pipeline of potential business banking clients.

- Program Focus: A 10-week, free support initiative for women entrepreneurs.

- Strategic Goal: To attract and foster relationships within a growing business segment.

- BCG Matrix Placement: Positioned as a 'Question Mark' due to high growth potential but low current market share and returns.

- Investment Phase: Currently in an investment stage, prioritizing relationship building and future growth over immediate profitability.

Emerging Fintech Partnerships and Digital Payment Solutions

Central Pacific Bank's pursuit of fintech partnerships and digital payment advancements places it in a dynamic, high-growth sector. This strategic focus on digital transformation, including exploring collaborations with emerging fintech players, signals a commitment to evolving payment solutions.

While these initiatives are positioned in a rapidly expanding technological landscape, CPB's current market share within these specific, fast-paced fintech-driven payment solutions is likely nascent. This necessitates ongoing investment and strategic maneuvering to solidify its position and capture market share.

- Digital Payment Growth: The global digital payments market was projected to reach over $15 trillion by 2024, highlighting the significant growth potential.

- Fintech Collaboration: Banks are increasingly partnering with fintechs to leverage specialized technology and reach new customer segments.

- Market Entry Challenges: Entering established or rapidly evolving digital payment segments often requires substantial investment and a clear differentiation strategy.

- CPB's Digital Focus: Central Pacific Bank's stated commitment to digital transformation indicates a strategic allocation of resources towards these areas.

Central Pacific Bank's (CPB) expansion into new physical markets like Kahului (2024) and Lihue (May 2025) positions these branches as 'Question Marks' in the BCG Matrix. These represent investments in potentially high-growth geographic areas where CPB's initial market share is naturally low, requiring dedicated resources to build brand awareness and customer acquisition.

Similarly, CPB's strategic focus on financing renewable energy and climate adaptation projects, alongside its 'WE by Rising Tide' Women Entrepreneur Program launched in 2025, also falls into the 'Question Mark' category. These initiatives target expanding market segments with significant future potential, but CPB's current market share and immediate financial returns are limited, necessitating ongoing investment and strategic development to capture future growth.

| BCG Category | CPB Initiative | Market Growth | CPB Market Share | Investment Need |

|---|---|---|---|---|

| Question Mark | Kahului Branch Expansion (2024) | High (Anticipated) | Low (Initial) | High (Brand building, customer acquisition) |

| Question Mark | Lihue Branch Expansion (May 2025) | High (Anticipated) | Low (Initial) | High (Brand building, customer acquisition) |

| Question Mark | Renewable Energy Financing | High (Global market projected to grow from ~$1.28T in 2023 to ~$2.17T by 2030) | Low (Specialized financing area) | High (Market penetration, expertise development) |

| Question Mark | 'WE by Rising Tide' Program (2025) | High (Growing segment of women entrepreneurs) | Low (Early stage) | High (Relationship building, future client pipeline) |

BCG Matrix Data Sources

Our BCG Matrix is built on verified market intelligence, combining financial data, industry research, official reports, and expert commentary to ensure reliable, high-impact insights.