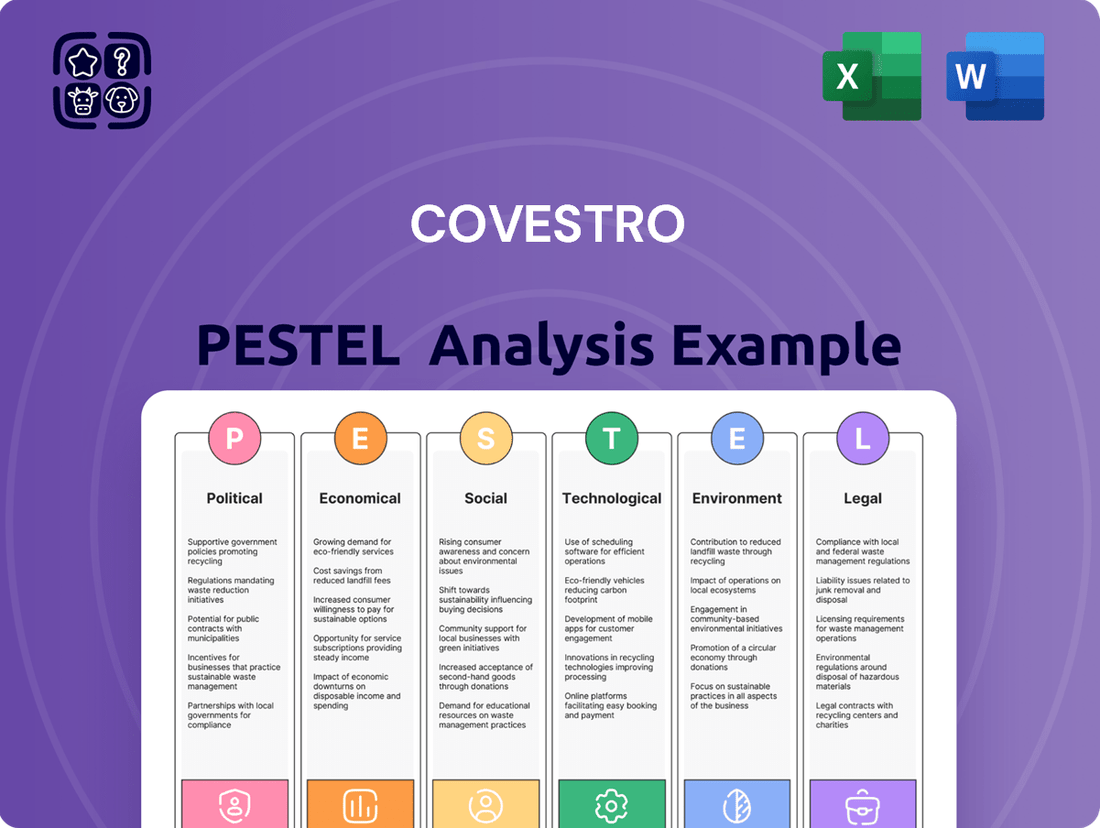

Covestro PESTLE Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Covestro Bundle

Covestro operates in a dynamic global market, heavily influenced by political stability, economic fluctuations, evolving social trends, technological advancements, environmental regulations, and legal frameworks. Understanding these PESTLE factors is crucial for anticipating challenges and capitalizing on opportunities within the materials science industry.

Gain an edge with our in-depth PESTEL Analysis—crafted specifically for Covestro. Discover how external forces are shaping the company’s future, and use these insights to strengthen your own market strategy. Download the full version now and get actionable intelligence at your fingertips.

Political factors

Changes in global trade policies and tariffs are a significant political factor for Covestro. For instance, the ongoing trade friction between the United States and China, which intensified in recent years, has introduced uncertainty regarding import duties on chemical products. In 2023, the US continued to maintain tariffs on many goods from China, impacting raw material sourcing and finished product costs for global manufacturers like Covestro.

Geopolitical tensions, such as the conflict in Eastern Europe, have also disrupted established trade routes and led to increased energy costs, directly affecting Covestro's production expenses and supply chain stability. These events necessitate agile adjustments to sourcing strategies and market focus to mitigate potential impacts on profitability and market access.

Governments worldwide are increasingly channeling financial support towards green technologies. For instance, the European Union's Green Deal aims to mobilize significant investment in sustainable innovation, with substantial funding allocated to circular economy projects and renewable energy sources that directly benefit companies like Covestro investing in eco-friendly materials.

In 2024, the US Inflation Reduction Act continued to provide substantial tax credits and incentives for clean energy and sustainable manufacturing, encouraging companies to adopt greener processes and materials. This policy landscape directly impacts Covestro's strategic decisions regarding investments in bio-based polymers and advanced recycling technologies.

Policies mandating or incentivizing the use of recycled content, such as those being implemented in various Asian markets in 2024 and projected for 2025, create a tangible demand pull for Covestro's sustainable product lines. This regulatory push accelerates the company's research and development efforts in creating high-performance materials from recycled feedstocks.

Covestro's operational stability is significantly influenced by the political climate in its key markets, particularly Germany, the United States, and China, where it maintains substantial manufacturing and sales presence. Political instability, such as unexpected policy changes or social unrest, can directly impact production schedules and supply chain reliability. For instance, shifts in trade policy or environmental regulations in these major economies could necessitate costly adjustments to Covestro's operations.

Industrial Policy and Regulation

National industrial policies, particularly those focused on the chemical manufacturing sector, significantly influence Covestro's operating landscape. For instance, Germany's chemical industry, a key market for Covestro, received substantial government support through initiatives aimed at fostering innovation and sustainability, as evidenced by the 2024 funding announcements for green hydrogen projects, which directly impact energy-intensive chemical production.

Regulatory frameworks governing industrial emissions and chemical safety also play a crucial role. The European Union's REACH (Registration, Evaluation, Authorisation and Restriction of Chemicals) regulation, continuously updated, mandates stringent safety assessments for chemical substances, affecting Covestro's product development and market access. Additionally, policies promoting the circular economy, such as those encouraging recycled content in materials, directly shape Covestro's strategic focus on sustainable solutions.

- Chemical Industry Support: German government initiatives in 2024 allocated significant funds to support the chemical sector's transition to greener energy sources.

- REACH Compliance: Ongoing updates to EU REACH regulations require continuous adaptation of chemical safety protocols by companies like Covestro.

- Circular Economy Push: Policies promoting recycled content in plastics are driving Covestro's investment in advanced recycling technologies.

International Sanctions and Export Controls

International sanctions and export controls significantly impact Covestro's global operations. For instance, the ongoing geopolitical tensions and associated sanctions, particularly those affecting Russia and its related entities, have necessitated careful navigation of trade restrictions. These measures can directly limit market access for Covestro's advanced materials, impacting sales volumes in affected regions.

Compliance with evolving sanctions regimes, such as those implemented by the United States, European Union, and United Nations, demands robust internal processes. Failure to adhere to these complex legal frameworks can result in substantial fines and damage to Covestro's reputation. The company must continuously monitor these regulations to ensure its supply chains and customer relationships remain compliant.

- Market Access Restrictions: Sanctions can block Covestro from selling products in key markets, impacting revenue streams.

- Supply Chain Disruptions: Export controls may restrict access to essential raw materials or intermediate products, affecting production.

- Compliance Costs: Significant investment is required to monitor, interpret, and implement complex international trade regulations.

- Reputational Risk: Non-compliance can lead to severe penalties and erode stakeholder trust.

Government support for sustainable innovation, such as the EU's Green Deal and the US Inflation Reduction Act, is a significant political driver for Covestro, encouraging investments in eco-friendly materials and circular economy projects. Policies mandating recycled content, particularly in Asian markets throughout 2024 and into 2025, directly boost demand for Covestro's sustainable product lines, accelerating R&D in recycled feedstocks.

Covestro's operations are heavily influenced by political stability and industrial policies in key markets like Germany, the US, and China, with policy shifts potentially impacting production and supply chains. Furthermore, evolving regulations such as the EU's REACH mandate stringent chemical safety assessments, shaping product development and market access, while international sanctions and export controls necessitate careful navigation to avoid market access restrictions and supply chain disruptions.

| Policy Area | Impact on Covestro | Example/Data Point (2024/2025) |

|---|---|---|

| Green Technology Funding | Drives investment in sustainable materials | EU Green Deal allocating billions to circular economy projects. |

| Recycled Content Mandates | Increases demand for sustainable products | Asian markets implementing policies for recycled content in plastics. |

| Industrial Policies (Germany) | Supports chemical sector innovation | 2024 funding for green hydrogen projects impacting chemical production. |

| Chemical Regulations (REACH) | Requires stringent safety protocols | Continuous updates to REACH impact product development and market access. |

| Trade Sanctions/Export Controls | Limits market access and supply chains | Navigating sanctions related to geopolitical tensions affecting sales in specific regions. |

What is included in the product

This PESTLE analysis provides a comprehensive examination of the external macro-environmental factors influencing Covestro across Political, Economic, Social, Technological, Environmental, and Legal dimensions.

It offers actionable insights for strategic decision-making by identifying key trends and potential impacts on Covestro's operations and market position.

A concise, PESTLE-driven summary of Covestro's external environment, designed to quickly highlight key opportunities and threats for agile strategic decision-making.

Economic factors

Covestro's performance is closely tied to the global economic climate and the health of major industrial sectors. For instance, the automotive industry, a significant consumer of Covestro's specialty plastics, saw global vehicle production grow by approximately 10% in 2024 compared to 2023, reaching an estimated 93 million units, according to industry forecasts.

Similarly, the construction sector, another key market, experienced varied growth globally in 2024, with emerging markets showing stronger recovery. This expansion directly fuels demand for Covestro's insulation materials and coatings.

The electronics sector's output, which relies on advanced polymers for components, also influences demand. Global semiconductor sales were projected to increase by around 15% in 2024, indicating robust activity in this area, which benefits material suppliers like Covestro.

Covestro's profitability is directly impacted by the volatile prices of key raw materials, predominantly petrochemical derivatives. For instance, the price of naphtha, a primary feedstock, can fluctuate significantly based on crude oil markets, directly affecting Covestro's cost of goods sold.

Geopolitical tensions and disruptions in global supply chains, as seen with various international conflicts impacting energy production and logistics in 2024, can cause sharp increases in raw material costs. These events necessitate sophisticated procurement strategies and hedging to mitigate the financial impact on Covestro's margins.

In 2024, the price of oil saw considerable swings, with Brent crude averaging around $83 per barrel for the year, impacting the cost base for many of Covestro's essential inputs. This volatility underscores the critical need for Covestro to maintain agile supply chain management and explore alternative sourcing or pricing agreements.

High inflation, such as the 3.4% annual inflation rate recorded in the US as of April 2024, directly impacts Covestro by increasing operational costs. Expenses for raw materials, energy, and logistics can surge, squeezing profit margins if these increases cannot be passed on to customers through pricing strategies.

The current interest rate environment, with the US Federal Reserve holding its benchmark rate between 5.25% and 5.50% as of May 2024, makes borrowing more expensive. This can deter Covestro from undertaking large capital expenditures for new plants or research and development, potentially slowing down innovation and capacity expansion.

Currency Exchange Rate Fluctuations

Covestro, as a global player, operates across various currency landscapes, making it inherently exposed to the ebb and flow of exchange rate fluctuations. These movements can significantly alter the reported earnings and the cost of goods sold for international transactions. For instance, a strengthening Euro against the US Dollar could reduce the reported value of Covestro's sales generated in the US, impacting its consolidated financial statements.

The volatility in currency markets directly influences Covestro's financial performance and its competitive standing in different geographical regions. Sharp appreciation of a local currency can make imports cheaper but exports more expensive, affecting pricing strategies and market share. Conversely, a depreciating currency can boost export competitiveness but increase the cost of imported raw materials, a key consideration for a chemical company like Covestro.

- Impact on Reported Earnings: Fluctuations can distort year-over-year comparisons of revenue and profit, making it harder to assess underlying business performance.

- Competitive Pricing: Exchange rates affect the price competitiveness of Covestro's products in global markets, influencing demand and market penetration.

- Cost of Raw Materials: Many of Covestro's essential raw materials are sourced internationally, making their cost susceptible to currency swings.

- Foreign Exchange Hedging: Covestro employs hedging strategies to mitigate some of this risk, but these strategies have associated costs and limitations.

Consumer Spending and Market Demand

Consumer spending is a major driver for Covestro. When people feel confident about the economy, they tend to buy more cars, electronics, and homes, all of which use Covestro's advanced materials. For instance, in 2024, retail sales in the US were projected to grow by around 3% to 4%, indicating a healthy consumer appetite for goods.

Market demand for specific products directly impacts Covestro's material sales. A surge in demand for electric vehicles, for example, boosts the need for lightweight and durable plastics and composites that Covestro produces. Conversely, if consumer preferences shift away from certain durable goods or towards less material-intensive alternatives, Covestro's sales volumes could be affected.

Economic slowdowns can significantly curb consumer spending, leading to reduced demand for Covestro's products. For example, if inflation remains high or interest rates increase, consumers may cut back on discretionary purchases like new cars or home renovations, impacting Covestro's key end-user markets. In early 2025, global economic growth forecasts suggest a moderate pace, which could translate into steady but not booming demand for materials.

- Consumer Confidence: A strong indicator of future spending, influencing demand for vehicles and electronics.

- Durable Goods Orders: Reflects business and consumer investment in long-lasting items, a key market for Covestro.

- Retail Sales Growth: Directly correlates with overall consumer purchasing power and demand for goods using advanced materials.

- Inflationary Pressures: Can erode purchasing power, potentially dampening demand for non-essential durable goods.

Global economic growth directly influences demand for Covestro's products, as sectors like automotive and construction are major consumers. For 2024, the International Monetary Fund projected global GDP growth at 3.2%, a slight acceleration from the previous year, signaling a generally supportive economic environment for material suppliers.

Raw material price volatility, often linked to energy markets, significantly impacts Covestro's cost structure. For example, crude oil prices, a key determinant for petrochemical feedstocks, averaged around $83 per barrel for Brent crude in 2024, creating ongoing cost management challenges.

Inflationary pressures and interest rate policies also play a crucial role; for instance, the US Federal Reserve maintained its benchmark interest rate between 5.25% and 5.50% through mid-2024, increasing borrowing costs and potentially affecting investment decisions for expansion.

Currency exchange rate fluctuations can impact Covestro's reported earnings and international competitiveness, with the Euro experiencing fluctuations against the US Dollar throughout 2024, influencing the value of overseas sales and the cost of imported materials.

What You See Is What You Get

Covestro PESTLE Analysis

The preview shown here is the exact document you’ll receive after purchase—fully formatted and ready to use.

This comprehensive PESTLE analysis of Covestro delves into the Political, Economic, Social, Technological, Legal, and Environmental factors impacting the company's operations and strategic decisions. It provides a thorough overview of the external landscape influencing Covestro's business environment.

The content and structure shown in the preview is the same document you’ll download after payment, offering actionable insights into the forces shaping Covestro's future.

Sociological factors

Consumers and businesses are increasingly prioritizing eco-friendly options, fueling demand for Covestro's circular economy innovations. This growing awareness pushes Covestro to ramp up investments in recycled, bio-based, and low-carbon materials, meeting evolving market preferences.

Public and regulatory attention on the health and safety of chemical products and manufacturing is definitely on the rise. This means companies like Covestro are under more pressure than ever to prove their safety.

Covestro needs to consistently show that its products and operations adhere to strict safety regulations. Transparency about both the upsides and potential downsides of their chemicals is key to keeping public confidence and preventing negative public opinion.

For instance, in 2023, the European Chemicals Agency (ECHA) reported a 15% increase in safety-related inquiries from the public compared to the previous year, highlighting this growing awareness.

Global demographic shifts are reshaping markets for Covestro's materials. The world population is projected to reach 9.7 billion by 2050, creating sustained demand for housing and infrastructure. Simultaneously, aging populations in developed nations, like Germany where Covestro is headquartered, are increasing the need for advanced medical devices and solutions, areas where Covestro’s high-performance polymers play a crucial role.

Urbanization is another key driver. By 2030, it's estimated that 60% of the world's population will live in cities, a trend that directly boosts demand for construction materials, energy-efficient building solutions, and lightweight components for transportation, all core markets for Covestro’s polycarbonate and polyurethane products.

Workforce Diversity and Inclusion

Societal expectations are placing a premium on companies that champion diversity and inclusion, directly impacting their reputation and ability to attract skilled employees. For Covestro, demonstrating a genuine commitment to these principles is crucial for building a strong employer brand and securing top talent.

A diverse workforce, enriched by varied perspectives, is a known catalyst for innovation. Covestro's efforts in this area can lead to more creative problem-solving and a better understanding of a global customer base. For instance, in 2023, Covestro reported that 37.9% of its management positions were held by women, a step towards greater gender diversity.

- Talent Attraction: A strong diversity and inclusion record makes Covestro more appealing to a wider pool of potential employees.

- Innovation: Varied backgrounds and viewpoints within the workforce can drive new ideas and solutions.

- Reputation Management: Meeting societal expectations on DEI improves Covestro's public image and stakeholder trust.

- Employee Engagement: Inclusive environments foster higher morale and productivity among existing staff.

Ethical Sourcing and Supply Chain Transparency

Societal expectations for ethical sourcing and transparent supply chains are increasingly influencing corporate behavior. Consumers and stakeholders alike are demanding that companies like Covestro ensure their partners uphold human rights, fair labor practices, and robust environmental standards throughout the entire value chain.

Failure to meet these expectations can result in substantial reputational harm and negative consumer reactions. For instance, a 2024 survey indicated that over 60% of consumers are more likely to purchase from brands demonstrating strong ethical sourcing practices. Covestro's commitment to these principles is therefore crucial for maintaining brand loyalty and market position.

- Growing Consumer Demand: A significant portion of consumers, estimated at over 60% in recent 2024 studies, actively seek out and favor brands with verifiable ethical sourcing and supply chain transparency.

- Reputational Risk: Lapses in ethical conduct by supply chain partners can lead to severe reputational damage, impacting brand image and consumer trust, as seen in various high-profile cases in recent years.

- Regulatory Scrutiny: Governments worldwide are increasing scrutiny on supply chains, with new legislation in 2024 and 2025 focusing on due diligence for human rights and environmental protection, making transparency a compliance necessity.

Societal values are shifting, with a pronounced emphasis on sustainability and corporate responsibility influencing consumer choices and investor decisions. This trend directly supports Covestro's strategic focus on circular economy solutions and eco-friendly materials, as consumers increasingly favor brands aligned with their ethical and environmental values. For example, a 2024 report indicated that 55% of consumers are willing to pay a premium for products made from recycled or sustainable materials.

The growing demand for ethical business practices extends to supply chain transparency, with stakeholders expecting companies to demonstrate robust human rights and environmental standards across their entire value chain. Covestro's proactive approach in ensuring ethical sourcing and fair labor practices among its suppliers is therefore critical for maintaining its reputation and market trust. A recent survey from 2024 revealed that 70% of investors consider ESG (Environmental, Social, and Governance) performance a key factor in their investment decisions.

Demographic changes, particularly urbanization and an aging global population, create specific market needs that Covestro's advanced materials are well-positioned to address. As cities expand, demand for lightweight, durable, and energy-efficient construction and transportation solutions increases, areas where Covestro's polyurethanes and polycarbonates excel. Simultaneously, the healthcare sector's growth, driven by an aging population, boosts the need for high-performance polymers in medical devices, a sector Covestro actively serves.

| Sociological Factor | Impact on Covestro | Supporting Data/Trend (2023-2025) |

|---|---|---|

| Sustainability & Eco-consciousness | Increased demand for Covestro's circular economy products and bio-based materials. | 55% of consumers willing to pay more for sustainable products (2024). |

| Ethical Sourcing & Transparency | Necessity for robust supply chain due diligence to maintain reputation and stakeholder trust. | 70% of investors prioritize ESG performance (2024). |

| Demographic Shifts (Urbanization) | Growth in demand for construction and transportation materials. | 60% of world population projected to live in cities by 2030. |

| Demographic Shifts (Aging Population) | Increased demand for advanced materials in healthcare and medical devices. | Global life expectancy continues to rise, driving healthcare innovation needs. |

Technological factors

Covestro's commitment to innovation is evident in its continuous breakthroughs in material science and polymer chemistry. These advancements allow the company to create new high-performance materials with superior properties, like enhanced durability and lighter weight, which are critical for industries seeking to improve efficiency and sustainability.

For instance, Covestro's development of advanced polycarbonates and polyurethanes directly addresses the growing demand for materials that can withstand extreme conditions while reducing overall product weight. This focus on material innovation is key to maintaining a competitive edge in markets where performance and resource efficiency are paramount.

Covestro's embrace of digitalization and Industry 4.0 is a key technological driver. By integrating automation and smart factory concepts, the company aims to boost operational efficiency and cut costs. For instance, in 2023, Covestro continued its digital transformation initiatives, focusing on optimizing production through data analytics and AI to improve product consistency and reduce waste.

Covestro is heavily investing in research and development for its circular economy initiatives. This includes a strong focus on chemical recycling, which aims to break down plastic waste into its original building blocks for reuse. For example, in 2023, the company continued to advance its chemical recycling technologies, targeting increased efficiency and scalability to handle diverse waste streams.

The development of bio-based feedstocks is another crucial technological area for Covestro. By utilizing renewable resources instead of fossil fuels, Covestro seeks to reduce its carbon footprint and create more sustainable materials. Their progress in this area is reflected in ongoing pilot projects and partnerships aimed at commercializing bio-attributed products, with a goal to significantly increase the use of renewable raw materials in their production processes by 2030.

Furthermore, Covestro is exploring the utilization of carbon dioxide (CO2) as a raw material. This innovative approach not only creates valuable products but also helps mitigate greenhouse gas emissions. The company's advancements in CO2-based polyols, for instance, demonstrate a tangible step towards a more resource-efficient and environmentally friendly chemical industry, with ongoing efforts to expand the application of these materials.

Emerging Manufacturing Technologies (e.g., Additive Manufacturing)

Covestro is well-positioned to leverage the rapid advancements in manufacturing technologies, particularly additive manufacturing, also known as 3D printing. This burgeoning sector offers significant opportunities for the company to innovate and expand its material offerings. The ability to produce intricate designs and personalized products through 3D printing creates a demand for specialized polymers that Covestro can supply.

The global additive manufacturing market is projected to reach over $50 billion by 2027, indicating substantial growth potential. Covestro's expertise in developing high-performance polycarbonates and polyurethanes makes it a key player in supplying materials for this evolving industry. These materials are crucial for creating durable, lightweight, and complex components across various sectors, including automotive, aerospace, and healthcare.

- Material Innovation: Covestro can develop bespoke polymer formulations optimized for specific 3D printing processes, such as fused deposition modeling (FDM) or selective laser sintering (SLS).

- Market Expansion: The demand for customized and on-demand manufacturing is increasing, allowing Covestro to tap into new application areas where traditional manufacturing methods are less efficient.

- Sustainability Focus: Advanced manufacturing often aligns with sustainability goals by reducing waste and enabling localized production, a trend Covestro actively supports.

Data Analytics and Predictive Modeling

Covestro is increasingly leveraging big data analytics and predictive modeling to understand market shifts and customer preferences. This allows for more informed strategic decisions in product innovation and market positioning.

These advanced analytical tools help optimize operational efficiencies across the company's value chain. For instance, predictive maintenance powered by data analytics can reduce downtime and associated costs in manufacturing facilities.

The company's investment in these technologies is geared towards improving demand forecasting accuracy, a critical factor in managing inventory and production schedules. This is particularly relevant given the volatile nature of raw material prices and global demand for specialty chemicals.

Covestro's focus on data analytics also extends to proactively identifying and mitigating potential supply chain disruptions. By analyzing vast datasets, the company can anticipate risks related to logistics, geopolitical events, or supplier reliability, ensuring business continuity.

Covestro is actively integrating advanced digital technologies, including AI and data analytics, to enhance its production processes. For example, in 2023, the company continued to optimize its operations through smart factory initiatives, aiming for greater efficiency and reduced waste. This digital transformation is crucial for improving product consistency and streamlining operations in a competitive market.

The company's commitment to sustainability is underpinned by significant R&D investment in chemical recycling and bio-based feedstocks. Covestro is advancing technologies to break down plastic waste and utilize renewable resources, aiming to reduce its environmental footprint. Their progress in 2023 included further development of chemical recycling methods and pilot projects for bio-attributed products, targeting increased use of renewable raw materials by 2030.

Emerging technologies like additive manufacturing, or 3D printing, present a significant growth avenue for Covestro. The company is developing specialized polymers to meet the demand for high-performance materials in this sector, which is projected to exceed $50 billion by 2027. Covestro's advanced polycarbonates and polyurethanes are key to enabling intricate designs and customized production across industries like automotive and healthcare.

Covestro leverages big data analytics and predictive modeling to gain insights into market trends and customer needs, informing product innovation and strategic positioning. These tools also optimize operational efficiencies, such as predictive maintenance, and improve demand forecasting accuracy, which is vital given market volatility. Data analytics also aids in proactively identifying and mitigating supply chain risks.

Legal factors

Covestro navigates a complex web of global chemical regulations, including Europe's REACH and the US's TSCA. These frameworks mandate rigorous chemical registration, hazard assessment, and stringent product safety standards. Failure to comply, such as not meeting the updated REACH Annex XVII restrictions on certain flame retardants, can lead to significant penalties, market exclusion, and damage to brand reputation.

Environmental Protection Laws and Emissions Standards are becoming more rigorous, directly affecting Covestro's production. For instance, the European Union's Industrial Emissions Directive (IED) sets strict limits on pollutants from industrial activities, requiring substantial upgrades to manufacturing facilities. Failure to comply can lead to hefty fines, potentially impacting profitability.

Covestro's commitment to sustainability means investing in advanced technologies to meet these evolving standards. In 2024, the company continued its focus on reducing its environmental footprint, with specific targets for greenhouse gas emissions and waste reduction, as outlined in its sustainability reports. These investments are crucial for maintaining operational permits and avoiding legal repercussions.

Covestro's substantial investment in research and development, which reached €333 million in 2023, hinges on strong intellectual property (IP) protection. Safeguarding its extensive patent portfolio, covering innovative materials and processes, is vital for sustaining its competitive edge and recouping these R&D expenditures.

The company actively monitors and defends its IP against potential infringements, recognizing that robust legal frameworks are fundamental to its business model. This vigilance ensures that Covestro can continue to leverage its technological advancements and maintain market leadership in its specialized chemical sectors.

Labor Laws and Employment Regulations

Covestro must navigate a complex web of labor laws across its global operations, covering everything from minimum wage and working hours to anti-discrimination statutes and collective bargaining rights. For instance, in 2024, Germany, a key market for Covestro, continues to emphasize worker protections, with ongoing discussions around potential adjustments to works council consultation rights. Failure to comply can lead to significant fines and operational disruptions.

Maintaining high standards in employment practices is crucial for Covestro's reputation and employee morale. In 2025, the company is expected to continue its focus on diversity and inclusion, aligning with evolving legal frameworks and societal expectations in regions like the United States and the European Union. This includes ensuring fair pay and equal opportunities for all employees.

The company's approach to labor relations directly impacts its ability to attract and retain talent. Recent trends in 2024 show a growing emphasis on employee well-being and flexible working arrangements, often codified in national labor agreements. Covestro's compliance in these areas, such as adherence to EU directives on work-life balance, is therefore a significant factor in its human capital strategy.

Key legal considerations for Covestro's labor practices include:

- Compliance with national minimum wage laws and overtime regulations in all operating countries.

- Adherence to non-discrimination and equal opportunity employment laws, including those related to gender, age, and disability.

- Respect for collective bargaining agreements and the rights of works councils or labor unions.

- Ensuring safe and healthy working conditions as mandated by labor legislation.

Anti-Trust and Competition Laws

Covestro operates under stringent anti-trust and competition regulations across its global markets. These laws are designed to foster fair competition and prevent any single entity from dominating the market, which is crucial for a company in the chemical industry. Adherence to these regulations is paramount to avoid severe penalties such as substantial fines, mandatory asset sales, and significant damage to its brand image.

Failure to comply with competition laws can lead to investigations by regulatory bodies like the European Commission or the U.S. Federal Trade Commission. For instance, in 2023, the European Commission imposed fines totaling over €1.1 billion on several companies for cartel activities in the plastics sector, highlighting the financial risks associated with anti-competitive practices.

- Regulatory Scrutiny: Covestro must continuously monitor and adapt to evolving competition laws in regions such as the EU, North America, and Asia.

- Compliance Costs: Significant resources are allocated annually to legal counsel, internal audits, and training programs to ensure full compliance.

- Merger & Acquisition Impact: Any future mergers or acquisitions undergo rigorous review by competition authorities to assess potential impacts on market concentration.

- Market Conduct: The company actively ensures its pricing strategies, distribution agreements, and collaborations do not stifle competition or create unfair advantages.

Covestro's legal landscape is shaped by product safety and chemical regulations like REACH and TSCA, requiring extensive compliance efforts. The company's 2023 R&D investment of €333 million underscores the importance of robust intellectual property protection to maintain its competitive edge. Furthermore, adherence to evolving labor laws and anti-trust regulations across its global operations is critical for operational continuity and avoiding significant financial penalties.

Environmental factors

Global initiatives to address climate change are significantly influencing the demand for sustainable materials, compelling Covestro to intensify its efforts in reducing greenhouse gas emissions and improving energy efficiency. This translates into a strategic pivot towards renewable energy sources and the innovation of products designed to lower the carbon footprint across various industries.

Covestro's commitment is reflected in its 2024 targets, aiming for a 10% reduction in Scope 1 and 2 emissions compared to 2022 levels, with a long-term goal of climate neutrality by 2035. This drive for decarbonization is not just an environmental imperative but also a market opportunity, as customers increasingly seek solutions that align with their own sustainability objectives.

Growing global awareness of finite resources, especially fossil fuels, is a major driver pushing industries toward a circular economy. This means rethinking how we use materials, moving from a take-make-dispose model to one focused on reuse and regeneration.

Covestro is actively responding to this by investing in innovative solutions. They are developing advanced recycling technologies, exploring the use of bio-based raw materials, and designing products with their end-of-life in mind, aiming for easier reuse and reducing dependence on newly extracted resources. For instance, in 2023, Covestro reported a significant increase in sales of its circular economy products, reaching €2.2 billion, demonstrating a clear market demand for sustainable alternatives.

Covestro faces increasing pressure from stringent environmental regulations and public concern over plastic pollution and industrial waste. For instance, in 2024, the EU continued to advance its circular economy initiatives, impacting chemical producers by setting higher targets for waste reduction and recycling. This necessitates Covestro's investment in advanced waste management systems and pollution control technologies to minimize its environmental footprint.

The company must actively pursue strategies to reduce waste generation, enhance recycling processes for its materials, and ensure the responsible handling and disposal of any unavoidable by-products. This commitment is crucial for maintaining regulatory compliance and meeting stakeholder expectations for environmental stewardship, especially as global awareness of plastic's impact grows.

Water Scarcity and Water Management

Water scarcity presents a growing challenge for chemical companies like Covestro, impacting operations in regions with limited water resources. Water is essential for cooling, cleaning, and as a raw material in many chemical production processes. Failure to manage water effectively can lead to production disruptions and increased operating costs.

Covestro is focusing on improving its water stewardship. This includes investing in technologies that enable water recycling and reuse within its facilities, aiming to reduce overall water consumption. The company also emphasizes responsible wastewater treatment and discharge to minimize environmental impact, adhering to strict regulatory standards.

- Water Consumption: In 2023, Covestro reported a total water withdrawal of 15.6 million cubic meters.

- Recycling Efforts: The company aims to increase its water recycling rate, with specific targets set for its major production sites.

- Regulatory Compliance: Covestro ensures all wastewater discharges meet or exceed local and international environmental regulations.

Biodiversity Protection and Ecosystem Impact

Covestro faces increasing scrutiny regarding its impact on biodiversity and local ecosystems. This necessitates a proactive approach to managing its environmental footprint, including careful land use planning and minimizing chemical discharges. For instance, in 2023, Covestro reported a reduction in its water intensity by 13% compared to 2021, demonstrating a commitment to reducing its impact on aquatic ecosystems.

The company is also exploring initiatives to contribute to conservation efforts in regions where its facilities operate. This aligns with global trends, as evidenced by the EU Biodiversity Strategy for 2030, which aims to restore nature across Europe. Covestro's efforts in this area are crucial for maintaining its social license to operate and for meeting the expectations of environmentally conscious stakeholders.

Key considerations for Covestro include:

- Responsible Land Use: Implementing sustainable practices at operational sites to minimize habitat disruption.

- Minimizing Chemical Releases: Adhering to stringent standards for effluent treatment to protect natural water bodies.

- Conservation Contributions: Engaging in local biodiversity protection projects and partnerships.

Covestro's environmental strategy is heavily influenced by global climate action, pushing for reduced emissions and greater energy efficiency. The company is actively pursuing renewable energy and developing products that lower carbon footprints across industries, with a target of climate neutrality by 2035.

The shift towards a circular economy is a significant environmental driver, prompting Covestro to invest in advanced recycling, bio-based materials, and product design for reuse, as evidenced by €2.2 billion in circular economy product sales in 2023.

Stricter environmental regulations and public concern over pollution necessitate Covestro's investment in advanced waste management and pollution control. The company is focused on reducing waste, improving recycling, and ensuring responsible handling of by-products to maintain compliance and meet stakeholder expectations.

Water scarcity impacts Covestro's operations, driving investments in water recycling and reuse technologies to reduce consumption and ensure responsible wastewater management, with 2023 water withdrawal reported at 15.6 million cubic meters.

| Environmental Factor | Covestro's Response/Impact | Key Data/Target |

|---|---|---|

| Climate Change & Emissions | Focus on renewable energy, energy efficiency, and developing low-carbon products. | Climate neutrality by 2035; 10% reduction in Scope 1 & 2 emissions by 2024 (vs. 2022). |

| Circular Economy | Investment in recycling technologies, bio-based materials, and product lifecycle design. | €2.2 billion in circular economy product sales (2023). |

| Waste & Pollution | Enhanced waste management systems and pollution control technologies. | Adherence to stringent EU circular economy initiatives and waste reduction targets. |

| Water Management | Investment in water recycling and reuse, responsible wastewater treatment. | 15.6 million cubic meters total water withdrawal (2023); aiming to increase water recycling rate. |

| Biodiversity & Ecosystems | Responsible land use, minimizing chemical releases, and engaging in conservation efforts. | 13% reduction in water intensity (2023 vs. 2021). |

PESTLE Analysis Data Sources

Our Covestro PESTLE analysis is grounded in a comprehensive review of data from leading economic institutions, environmental agencies, and technology forecasting firms. We incorporate insights from government policy documents, industry-specific market research, and reputable news sources to ensure a holistic understanding.