Covestro Boston Consulting Group Matrix

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Covestro Bundle

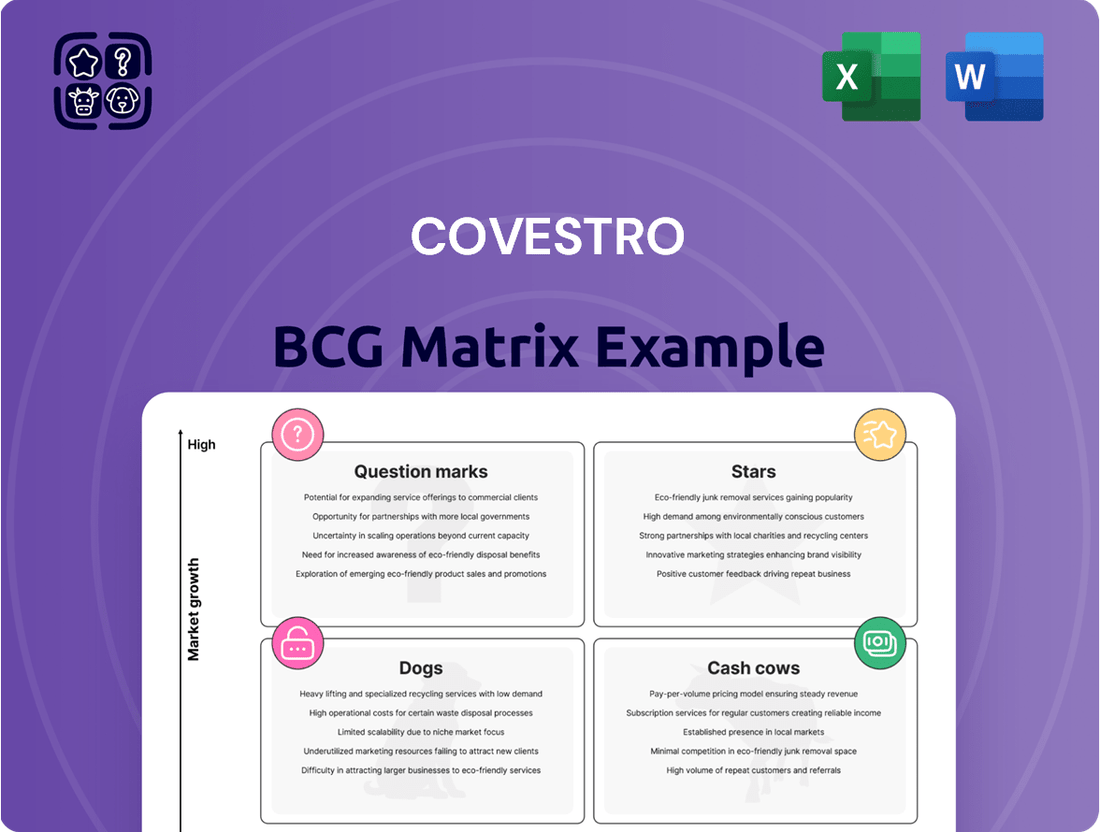

Covestro's product portfolio, when analyzed through the BCG Matrix, reveals a dynamic landscape of growth and stability. Understanding which segments are Stars, Cash Cows, Dogs, or Question Marks is crucial for informed strategic decisions. Don't miss out on the detailed breakdown and actionable insights; purchase the full BCG Matrix report to unlock Covestro's complete market positioning and future potential.

Stars

Covestro is aggressively expanding its offerings in sustainable and bio-circular materials, exemplified by bio-circular MDI and Makrolon® RE polycarbonates. These innovative products boast substantially lower carbon footprints, aligning with global environmental targets and circular economy principles.

The market reception for these eco-friendly solutions is exceptionally strong, particularly within the construction and automotive sectors. This surge in demand is fueled by a growing consumer and regulatory push for greener alternatives and a commitment to reducing environmental impact.

Covestro's strategic collaborations, including its work with Henkel on wood adhesives and Carlisle for insulation materials, highlight its pioneering role in these rapidly expanding markets. These partnerships solidify Covestro's position as a leader in delivering sustainable material solutions.

Covestro is a major player in supplying advanced polymer materials crucial for the booming electromobility market. Their offerings focus on lightweight construction, effective battery protection, and specialized parts for electric vehicles, directly addressing the industry's need for innovation and performance.

The electromobility sector is experiencing robust growth, and Covestro's commitment to research and development, exemplified by initiatives like the 'People Mover' e-shuttle, solidifies their leading position. This dedication ensures their materials meet the evolving demands for safety, efficiency, and design in electric vehicles.

The electronics industry, especially with the rollout of 5G, is a major driver for advanced polymer materials. Covestro's polycarbonates are key here, providing the toughness and heat resistance needed for demanding applications. For instance, the global market for electronic materials was projected to reach over $700 billion by 2024, with telecommunications being a significant segment.

Covestro's specialty materials are vital for next-generation electronics, including components for lidar systems used in autonomous driving. These materials offer the optical clarity and durability essential for reliable sensor performance. The demand for lidar sensors alone is expected to grow substantially in the coming years, creating a strong market for such advanced polymers.

Sustainable Healthcare Solutions

Covestro is significantly contributing to sustainable healthcare by developing polycarbonate materials with a reduced carbon footprint. These materials are crucial for innovations like drug delivery systems and medical wearables, meeting strict biocompatibility requirements. This focus on environmental responsibility in medical devices taps into a strong market demand for eco-friendly healthcare products.

The company's commitment to sustainability in this sector is evident in their product development, which prioritizes recyclability alongside performance. For instance, Covestro's Makrolon® portfolio offers solutions designed for circularity, a key consideration for medical device manufacturers aiming to reduce waste. In 2024, the global medical plastics market was valued at approximately $45 billion, with a growing segment dedicated to sustainable materials.

- Reduced Carbon Footprint: Covestro's polycarbonate materials for healthcare offer a lower environmental impact compared to traditional plastics.

- Biocompatibility and Recyclability: Products meet essential medical standards while facilitating easier recycling processes.

- Market Alignment: Sustainable design in medical devices addresses a rising consumer and regulatory preference for greener healthcare solutions.

- Innovation in Wearables and Drug Delivery: Covestro's materials enable advancements in critical healthcare technologies.

Solutions & Specialties Segment

The Solutions & Specialties segment at Covestro is a prime example of a Star in the BCG matrix, as it concentrates on sustainable, highly specialized solutions designed for emerging future markets. This segment shows promising growth potential, even amidst broader market headwinds.

In the first quarter of 2025, the Solutions & Specialties segment notably surpassed expectations for EBITDA when compared to the Performance Materials segment. This resilience suggests a robust growth trajectory and a strong competitive position within its target markets.

Covestro is strategically focused on expanding the high-margin business units within this segment. The company is actively targeting applications and customer needs that are experiencing high growth, aiming to solidify its leadership in these specialized areas.

- Focus on Sustainable Solutions: The segment is dedicated to developing and marketing environmentally friendly and highly specialized products for future-oriented markets.

- Q1 2025 Performance: Solutions & Specialties demonstrated stronger EBITDA performance than the Performance Materials segment in Q1 2025, exceeding market expectations.

- Strategic Expansion: Covestro plans to grow its high-margin businesses within this segment by focusing on high-growth applications and specific customer demands.

- Market Positioning: This segment is designed to capture value in specialized niches, positioning Covestro for sustained growth in areas with significant future potential.

The Solutions & Specialties segment at Covestro is a prime example of a Star in the BCG matrix. It concentrates on sustainable, highly specialized solutions designed for emerging future markets, showing promising growth potential even amidst broader market headwinds.

In the first quarter of 2025, this segment notably surpassed expectations for EBITDA when compared to the Performance Materials segment, indicating a robust growth trajectory and a strong competitive position.

Covestro is strategically focused on expanding the high-margin business units within this segment, actively targeting applications and customer needs experiencing high growth to solidify its leadership.

This segment’s focus on sustainable solutions, strong Q1 2025 EBITDA performance relative to Performance Materials, and strategic expansion into high-growth applications position Covestro for sustained growth in specialized niches.

| Covestro Segment | BCG Classification | Key Characteristics | 2024/2025 Data Point |

|---|---|---|---|

| Solutions & Specialties | Star | Sustainable, highly specialized solutions for emerging markets, high-margin focus. | Exceeded EBITDA expectations in Q1 2025 compared to Performance Materials. |

| Performance Materials | Cash Cow/Question Mark (Implied) | More traditional, potentially lower-growth or higher-risk polymer materials. | Lower EBITDA performance than Solutions & Specialties in Q1 2025. |

What is included in the product

The Covestro BCG Matrix analyzes its business units based on market share and growth to guide strategic decisions.

The Covestro BCG Matrix offers a clear, one-page overview of business unit performance, alleviating the pain of complex strategic analysis.

Cash Cows

Covestro's traditional polyurethane segment, encompassing precursors for flexible foams in furniture and automotive, and rigid foams for insulation, stands as a robust Cash Cow. This mature but significant market sees Covestro leveraging its extensive R&D and strategic expansions to maintain a dominant position.

These core products consistently generate substantial cash flow, a testament to their established market share and broad application across industries. For instance, the global polyurethane market was valued at approximately $70 billion in 2023 and is projected to grow steadily, with Covestro holding a considerable slice of this pie.

Covestro's standard polycarbonates, offered as granules and composite materials, are essential building blocks for major sectors like automotive, construction, medical technology, and lighting. These materials are vital in the transparent plastics market, a segment experiencing consistent growth, with Covestro holding a prominent position.

The robust and predictable demand for these products, coupled with Covestro's strong market foothold, ensures stable and reliable revenue generation. In 2024, the global polycarbonate market was valued at approximately $28.5 billion and is projected to grow at a compound annual growth rate (CAGR) of around 6.5% through 2030, underscoring the sustained importance of these offerings.

Covestro's Coatings, Adhesives, and Specialties segment acts as a robust cash cow. This division supplies essential precursors for automotive, wood processing, and furniture industries, sectors known for their stable, mature demand. For instance, in 2023, this segment continued to be a significant contributor to Covestro's overall revenue, demonstrating its consistent performance in established markets.

Optimized Core Production Capacities

Covestro has focused on enhancing its core production capacities, particularly in key global hubs like Baytown, USA, Shanghai, China, and Tarragona, Spain. These strategic upgrades are designed to boost energy efficiency and overall competitiveness.

By ensuring high plant availability and consistent output, these optimized facilities serve as reliable cash generators for Covestro's established product lines. This focus on operational excellence in large-scale manufacturing underpins the consistent, high-volume production necessary for robust cash flow.

- Baytown, USA: A significant hub for Covestro's production, benefiting from ongoing optimization efforts.

- Shanghai, China: Another critical location where capacity enhancements are driving efficiency.

- Tarragona, Spain: This site also plays a key role in Covestro's optimized core production strategy.

- Energy Efficiency Gains: Investments in these plants aim to reduce energy consumption per unit of output, directly impacting cost competitiveness.

Foundational Performance Materials Segment

The Performance Materials segment, despite current market challenges, represents Covestro's high-volume, foundational business. It's a significant cash generator, especially when the economy is stable, thanks to its focus on efficiency, sustainability, and keeping plants running smoothly.

This segment is key to Covestro's circular economy goals. By improving production processes and sourcing greener energy and materials, it directly supports the company's sustainability initiatives.

- Foundational Business: Houses the majority of Covestro's production, driving high volumes.

- Cash Generation: Aims for efficiency and high plant availability to ensure consistent cash flow in stable markets.

- Circularity Driver: Optimizes production and material sourcing to implement Covestro's sustainability strategy.

- Strategic Importance: Remains a core segment, vital for the company's overall operational and environmental objectives.

Covestro's established polyurethane and polycarbonate businesses are prime examples of its Cash Cows. These segments benefit from mature, stable markets with consistent demand, allowing Covestro to generate significant and predictable cash flows. The company's strategic focus on operational efficiency and capacity optimization in these core areas further solidifies their role as reliable revenue drivers.

| Segment | Key Products | Market Position | Cash Flow Generation | 2024 Market Insight |

| Polyurethanes | Flexible and rigid foams | Dominant | Substantial and stable | Global market ~$72 billion, steady growth |

| Polycarbonates | Granules, composite materials | Prominent | Consistent and reliable | Global market ~$29 billion, CAGR ~6.5% |

| Coatings, Adhesives, Specialties | Precursors for automotive, wood | Strong | Significant contributor | Mature markets with stable demand |

What You’re Viewing Is Included

Covestro BCG Matrix

The preview of the Covestro BCG Matrix you are currently viewing is the exact, fully formatted document you will receive upon purchase. This comprehensive analysis, designed for strategic decision-making, will be delivered to you without any watermarks or demo content. You can confidently expect this ready-to-use report to aid in your business planning and competitive strategy.

Dogs

Covestro's underperforming legacy product lines, particularly those not aligned with its sustainability focus, are experiencing declining demand. These older offerings often lack the differentiation needed to compete against newer, eco-friendly alternatives, impacting profitability and market share.

For instance, in 2024, Covestro continued its strategic repositioning, which involved evaluating the portfolio for less innovative or environmentally impactful segments. While specific figures for legacy product line divestitures are not publicly detailed, the company's ongoing investment in circular economy initiatives, such as its €1 billion commitment to sustainable innovation, signals a clear intent to phase out or restructure less competitive legacy businesses.

Covestro's Performance Materials segment includes commodity-oriented sub-segments that are particularly sensitive to the chemical industry's cycles. When commodity prices surge or there's an oversupply, these areas can see their profit margins shrink considerably, impacting the company's overall financial health.

Even with ongoing optimization efforts, these vulnerable sub-segments might struggle to perform well, especially when global demand is sluggish and competition is fierce. This underperformance can directly contribute to a company's negative net income and lower its projected EBITDA.

For instance, in 2024, the global chemical market has faced headwinds from slower economic growth, leading to increased price volatility for key raw materials like crude oil derivatives. This environment directly pressures the margins of commodity-based performance materials within Covestro's portfolio.

Covestro's planned closure of its Maasvlakte production facility in Q1 2025 exemplifies a divested or phased-out operation within its BCG Matrix. This move, resulting in significant one-time expenses, signals the divestment of an asset that was likely underperforming or no longer strategically aligned with the company's evolving business objectives.

Products Heavily Reliant on Fossil-Based Raw Materials

Covestro's product lines heavily reliant on fossil-based raw materials are positioned in the 'Dogs' quadrant of the BCG matrix. As the company pivots towards a circular economy and aims to minimize its dependence on conventional inputs, these offerings face significant headwinds. For instance, products derived from naphtha crackers, a primary source of petrochemicals, are directly impacted by the drive away from fossil fuels.

These 'Dogs' may encounter escalating regulatory scrutiny and carbon pricing mechanisms, making them less competitive. Customer demand is also shifting towards more sustainable alternatives, further pressuring these product groups. By 2024, the chemical industry saw increased investment in bio-based and recycled feedstocks, highlighting this trend.

- Regulatory Pressure: Increasing carbon taxes and emissions standards directly impact the cost and viability of fossil-fuel-dependent products.

- Market Shift: Growing consumer and business preference for sustainable materials erodes the market share of conventional products.

- Cost Volatility: Reliance on fossil fuels exposes these product lines to price fluctuations in oil and gas markets.

- Strategic Imperative: Covestro must strategically re-evaluate or divest these 'Dogs' to align with its circular economy goals and maintain long-term profitability.

Segments Impacted by Persistent Weak Global Economy

The persistent weakness in the global economy, exacerbated by ongoing geopolitical uncertainties and trade tensions, has significantly impacted Covestro's financial outlook. This challenging environment has forced the company to revise its 2025 earnings forecasts downwards, affecting key metrics like EBITDA and free operating cash flow.

Certain Covestro segments are feeling this economic strain more acutely. Those with less differentiated product offerings or substantial ties to cyclical industries are particularly vulnerable. These segments, in the short to medium term, are exhibiting characteristics akin to question marks within the BCG matrix, indicating potential for low growth and market share.

- Weak Global Demand: Reduced consumer spending and industrial production globally directly dampen demand for Covestro's materials.

- Geopolitical Instability: Conflicts and political tensions disrupt supply chains and create economic uncertainty, impacting investment and demand.

- Trade Restrictions: Tariffs and trade barriers increase costs and limit market access, especially for commodity-like products.

- Cyclical Industry Exposure: Segments serving sectors like automotive or construction, which are highly sensitive to economic cycles, face steeper downturns.

Covestro's product lines heavily reliant on fossil-based raw materials are positioned in the 'Dogs' quadrant of the BCG matrix. As the company pivots towards a circular economy and aims to minimize its dependence on conventional inputs, these offerings face significant headwinds. For instance, products derived from naphtha crackers, a primary source of petrochemicals, are directly impacted by the drive away from fossil fuels.

These 'Dogs' may encounter escalating regulatory scrutiny and carbon pricing mechanisms, making them less competitive. Customer demand is also shifting towards more sustainable alternatives, further pressuring these product groups. By 2024, the chemical industry saw increased investment in bio-based and recycled feedstocks, highlighting this trend.

Question Marks

Covestro is actively exploring and investing in advanced recycling methods for its core materials like polyurethanes and polycarbonates. A key initiative is their collaboration with BioBTX, aiming to build a demonstration plant for chemical recycling, signaling a strong commitment to circular economy principles.

These cutting-edge recycling technologies are positioned for future growth, addressing a clear market demand for sustainable solutions. However, they are currently in nascent stages of development or demonstration, necessitating substantial capital outlay before they can reach commercial viability and generate profits.

Covestro's venture capital arm actively seeks out startups and scale-ups driving innovation, especially in circular economy solutions and emerging technologies. These strategic investments are inherently high-risk, targeting nascent markets with significant growth potential where Covestro's current market presence is minimal.

For instance, in 2024, Covestro continued to allocate capital to ventures focused on advanced recycling technologies and bio-based materials, aiming to secure early access to disruptive innovations. The success of these ventures is critical, as their ability to demonstrate market viability and achieve scalable growth directly influences Covestro's future competitive positioning in these specialized areas.

Covestro is actively pursuing niche applications in emerging markets, focusing on specialized materials for advanced medical wearables and unique components for future mobility. These sectors, while offering high growth potential, represent areas where Covestro is still establishing its market presence. For instance, the global medical device market, including wearables, was projected to reach over $600 billion by 2024, highlighting the significant opportunity.

Significant investment in research and development is crucial for Covestro to gain traction in these nascent fields. The company's commitment to innovation in areas like advanced polymers for lightweight automotive components is a key strategy. In 2023, Covestro's R&D spending was a substantial portion of its revenue, reflecting this focus on future growth drivers.

Digitalization and AI-Driven Solutions for New Opportunities

Covestro is strategically leveraging digitalization and artificial intelligence to unlock new avenues for growth. These investments are designed to streamline internal processes and speed up material development, paving the way for innovative solutions.

A key area of focus is the creation of digital twins for materials, enabling virtual prototyping and accelerating product innovation. This digital approach is crucial for exploring and capitalizing on emerging market opportunities.

While the potential for AI and digitalization is significant, the full commercial realization of these technologies and their contribution to new revenue streams are still developing. Covestro's commitment to continuous investment in these high-growth areas underscores their importance for future success.

- Digitalization Investment: Covestro aims to enhance operational efficiency and accelerate innovation through significant investments in digital technologies.

- AI for Material Science: The company is exploring AI to create realistic digital twins of materials, facilitating virtual prototyping and faster product development cycles.

- New Revenue Streams: While AI and digitalization represent high-growth potential, their impact on generating new revenue is still being actively pursued and requires ongoing investment.

- Market Impact: The full commercialization and market share capture from these advanced technologies are expected to grow as development and integration continue.

Geographical Expansion into Unproven High-Growth Regions

Covestro is strategically directing three-fourths of its Asia-Pacific investment over the next three years, signaling a strong commitment to high-growth regions. This expansion includes bolstering its presence in emerging markets, which, while promising significant upside, also present inherent risks.

The company is also expanding its Hebron, Ohio, USA site for differentiated polycarbonates, demonstrating a dual approach to growth. This geographical expansion into unproven markets, while potentially lucrative, necessitates substantial upfront capital.

The challenge lies in translating high growth prospects into tangible market share and profitability. Covestro's investment in Asia-Pacific, particularly in regions with rapidly developing economies, highlights a calculated risk for future returns.

- Asia-Pacific Investment: Three-fourths of Covestro's investment over the next three years is allocated to the Asia-Pacific region.

- Ohio Expansion: Covestro is expanding its Hebron, Ohio, USA site for differentiated polycarbonates.

- Growth vs. Risk: High-growth regions offer potential but require significant initial investment and face challenges in establishing market share and profitability.

- Strategic Focus: The company is balancing expansion in unproven high-growth regions with strengthening existing specialized production capabilities.

Covestro's advanced recycling initiatives, like the BioBTX collaboration, represent significant investments in future growth. These are high-potential but currently capital-intensive ventures, aiming to capture emerging markets for sustainable materials.

Similarly, venture capital investments in startups drive innovation in circular economy solutions. These are high-risk, early-stage bets targeting markets where Covestro has minimal current presence, with 2024 seeing continued allocation to these disruptive technologies.

Niche applications in medical wearables and future mobility also fall into this category. While the medical device market was projected to exceed $600 billion by 2024, Covestro is still building its footprint in these specialized, high-growth sectors.

These "Question Marks" require substantial R&D and market development. Covestro's 2023 R&D spending reflects this commitment to fostering growth in these nascent areas, essential for future competitive positioning.

BCG Matrix Data Sources

Our BCG Matrix is built on verified market intelligence, combining financial data, industry research, official reports, and expert commentary to ensure reliable, high-impact insights.