Covestro Marketing Mix

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Covestro Bundle

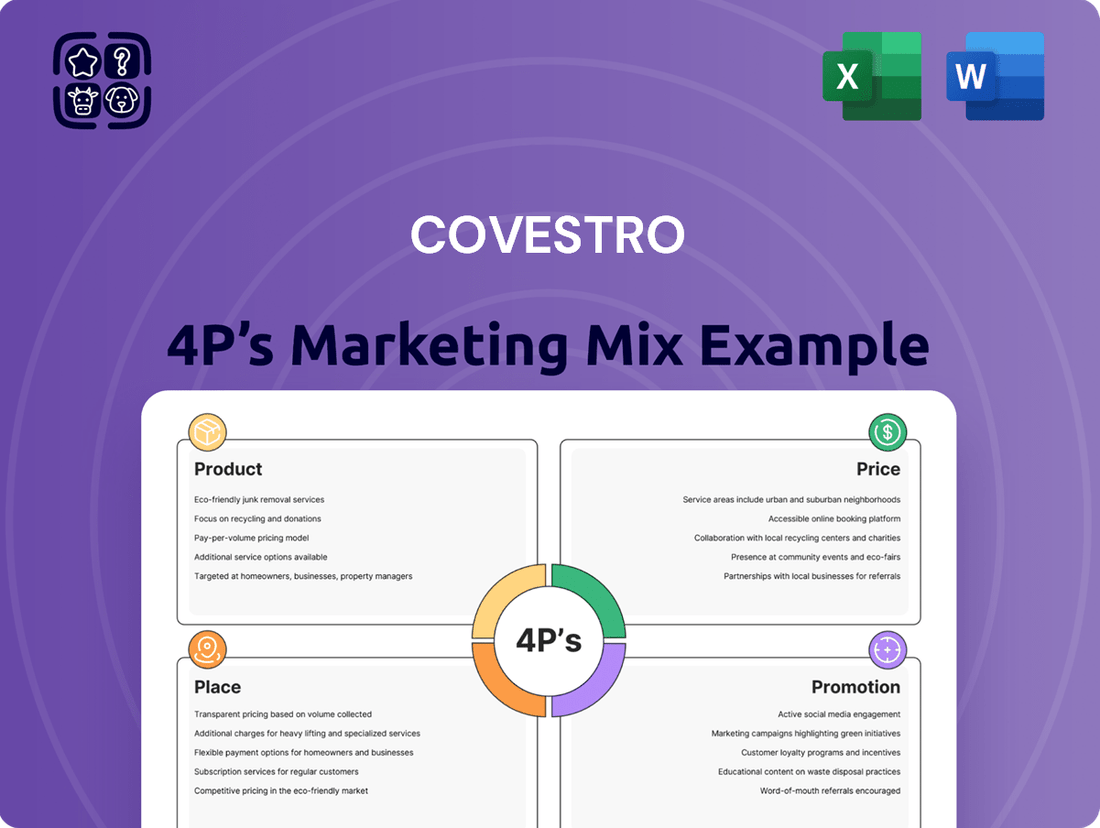

Covestro's marketing prowess is built on a strategic foundation, meticulously aligning its Product innovation, Price competitiveness, Place in the market, and Promotion efforts to capture and retain customers in the chemical industry. Understanding these interconnected elements is key to grasping their market leadership.

Dive deeper into Covestro's comprehensive 4Ps strategy, revealing how their advanced material solutions, value-based pricing, global distribution networks, and targeted communication campaigns create a powerful market presence. Unlock these insights and more in our full, ready-to-use analysis.

Gain immediate access to a detailed, editable report that dissects Covestro's marketing mix. Perfect for students, professionals, and consultants seeking actionable insights and a robust framework for their own strategic planning.

Product

Covestro's high-tech polymer materials, such as polycarbonates and polyurethanes, are the core of their product offering. These advanced materials are engineered to deliver superior performance, finding critical applications in sectors like automotive, construction, and electronics. For instance, Covestro's Makrolon® polycarbonate resins are known for their high impact resistance and clarity, essential for automotive lighting and electronic device casings.

Covestro's product strategy deeply integrates sustainability and the circular economy, evident in their development of materials derived from bio-based or recycled content. This commitment is materialized through their 'CQ' (Circular Intelligence) product line, which mandates a minimum of 25% alternative raw materials.

This focus on alternative sourcing, including chemical and mechanical recycling, showcases Covestro's dedication to minimizing fossil fuel dependence and fostering material circularity. For instance, by 2023, Covestro aimed to increase its sales share of products with alternative raw materials to 10%, with a target of reaching 25% by 2030.

Covestro's materials are foundational across critical sectors. In the automotive industry, their polycarbonates are integral to headlamps and lightweight electric vehicle components, contributing to fuel efficiency and safety. For example, by 2025, the global automotive plastics market is projected to reach over $40 billion, with advanced polymers like Covestro's playing a significant role.

The construction sector benefits from Covestro's polyurethanes, widely used for high-performance insulation that enhances energy efficiency in buildings. In 2024, the demand for sustainable building materials continues to surge, driving the adoption of such solutions. The electronics industry also relies on Covestro's specialized polymers for durable and heat-resistant components.

Furthermore, Covestro's commitment to innovation ensures their products meet the evolving needs of the healthcare industry, from medical devices to diagnostic equipment. The company's ongoing research and development efforts, evidenced by their significant R&D spending in 2023, allow them to tailor material solutions for these demanding applications.

Innovation and Development

Covestro places a strong emphasis on innovation and development, pouring significant resources into R&D to pioneer new materials and refine existing ones. This commitment is often amplified through collaborative efforts with both customers and esteemed scientific institutions.

Recent advancements highlight this dedication. For instance, Covestro has successfully developed high-purity polycarbonates derived from chemically recycled post-consumer waste. Additionally, they offer advanced thermoplastic polyurethane (TPU) solutions engineered for rigorous applications within the electronics and mobility sectors.

Covestro's investment in innovation is substantial. In 2023, the company reported its R&D expenses at €330 million, representing approximately 3.6% of its sales. This strategic allocation fuels their pipeline of sustainable and high-performance materials.

- R&D Investment: Covestro invested €330 million in research and development in 2023.

- Key Innovations: Development of high-purity polycarbonates from chemical recycling and advanced TPU solutions.

- Collaborative Approach: Partnerships with customers and scientific bodies drive material advancements.

- Focus Areas: Enhancing existing materials and creating novel solutions for demanding industries.

Specialty s and Performance Materials

Covestro's Specialty and Performance Materials segment is crucial, offering advanced solutions that cater to demanding applications. These materials are engineered for specific, high-value functionalities, driving innovation across various industries.

The product portfolio includes cutting-edge polycarbonates, vital for the electronics sector. These materials boast enhanced thermal conductivity, essential for managing heat in devices, and superior signal transparency, critical for seamless wireless communication. For instance, Covestro's Makrolon® portfolio continues to be a leader in this space, with ongoing developments in 2024 focusing on even greater heat dissipation capabilities for next-generation electronics.

Furthermore, the company provides versatile thermoplastic polyurethanes (TPUs). These are recognized for their exceptional durability and flexibility, making them ideal for demanding applications in textiles, such as high-performance sportswear, and robust industrial uses like specialized coatings and components. Covestro's Desmodur® and Desmophen® raw materials are key building blocks for these advanced TPUs, with market trends in 2025 indicating a strong demand for sustainable TPU solutions.

Key aspects of this segment include:

- High-performance polycarbonates for electronics: Offering improved thermal conductivity and signal transparency.

- Durable and versatile thermoplastic polyurethanes (TPUs): Used in textiles and industrial applications.

- Focus on specific functionalities: Materials engineered for demanding performance requirements.

- Innovation in material science: Continuous development to meet evolving industry needs, with sustainability as a growing driver.

Covestro's product strategy centers on high-performance polymers like polycarbonates and polyurethanes, engineered for demanding applications in automotive, construction, and electronics. A key focus for 2024 and 2025 is the integration of sustainability, with their 'CQ' line featuring a minimum of 25% alternative raw materials, derived from chemical or mechanical recycling.

The company's commitment to innovation is evident in their development of advanced materials, such as high-purity polycarbonates from recycled waste and specialized thermoplastic polyurethanes (TPUs). Covestro invested €330 million in R&D in 2023, aiming to enhance material performance and sustainability across sectors.

Covestro's product offerings are crucial for various industries. By 2025, the global automotive plastics market is projected to exceed $40 billion, with Covestro's lightweight polymers contributing to efficiency and safety in electric vehicles. In 2024, the demand for sustainable building materials is also increasing, driving the use of Covestro's energy-efficient polyurethane insulation.

| Product Category | Key Applications | Sustainability Focus (2024/2025) | R&D Investment (2023) |

|---|---|---|---|

| Polycarbonates (e.g., Makrolon®) | Automotive lighting, electronic casings, medical devices | High-purity grades from chemical recycling | €330 million |

| Polyurethanes (e.g., Desmodur®, Desmophen®) | Building insulation, textiles, industrial coatings | Increased use of bio-based and recycled content (CQ line) | €330 million |

| Thermoplastic Polyurethanes (TPUs) | Sportswear, industrial components, electronics | Enhanced durability and flexibility with sustainable sourcing | €330 million |

What is included in the product

This analysis offers a comprehensive examination of Covestro's marketing strategies across Product, Price, Place, and Promotion, providing actionable insights for strategic decision-making.

It delves into Covestro's product innovation, pricing strategies, distribution channels, and promotional activities, offering a detailed understanding of their market positioning.

Simplifies complex marketing strategies by translating Covestro's 4Ps into actionable insights, easing the burden of strategic planning.

Provides a clear, concise overview of Covestro's marketing approach, alleviating concerns about unclear brand positioning.

Place

Covestro's global production network is a cornerstone of its strategy, with key facilities strategically located in Europe, the Middle East, Latin America (EMLA), North America (NA), and the Asia-Pacific (APAC) region. This extensive footprint allows Covestro to tailor its high-tech polymer material supply to specific market demands, ensuring timely availability for its diverse customer base across the globe.

In 2024, Covestro continued to optimize its production sites, aiming for greater efficiency and proximity to key growth markets. For instance, their APAC region, a significant driver of global demand, saw ongoing investments to enhance capacity and meet the burgeoning needs for innovative materials in sectors like automotive and construction.

Covestro's direct sales model is central to its business-to-business (B2B) strategy, focusing on supplying polymer materials and components directly to industrial clients. This direct approach fosters deep relationships and enables the creation of customized solutions, a critical factor given the highly specialized applications of their products in various manufacturing sectors.

Covestro strategically invests in its production sites to boost capacity and efficiency, with a strong focus on sustainable materials. This approach is crucial for meeting growing global demand and advancing their green initiatives.

Recent expansions highlight this commitment. For instance, a new plant for polycarbonate copolymers in Antwerp, Belgium, came online in late 2024, significantly increasing their European production capabilities for these high-performance materials. This site is designed for enhanced energy efficiency, aligning with Covestro's sustainability goals.

Furthermore, the opening of a new TPU application development center in Guangzhou, China, in early 2025, underscores their dedication to strengthening regional supply chains and fostering innovation in the Asia-Pacific market. This center will focus on developing tailored solutions for industries like automotive and footwear, leveraging their advanced thermoplastic polyurethane (TPU) portfolio.

Customer-Centric Pull Supply Chain

Covestro’s customer-centric pull supply chain ensures that production and distribution are directly tied to what customers actually want. This approach is key to making things convenient for them and boosting sales by having products ready when and where they’re needed. In 2023, Covestro reported a revenue of approximately €14.4 billion, reflecting the effectiveness of their market-responsive strategies.

This focus on customer demand helps Covestro avoid overstocking and reduces waste, aligning with their sustainability goals. By reacting to market signals, they can better manage inventory and logistics. For instance, their digital solutions for supply chain visibility, implemented across various regions, aim to provide real-time tracking and demand forecasting, crucial for a pull system.

- Demand-Driven Production: Manufacturing schedules are directly influenced by confirmed customer orders, not just forecasts.

- Optimized Inventory: Reduces holding costs and the risk of obsolescence by matching supply closely with demand.

- Enhanced Customer Satisfaction: Ensures product availability, leading to fewer stockouts and quicker fulfillment times.

- Agility and Responsiveness: Allows Covestro to adapt quickly to changing market conditions and customer preferences.

Logistics and Supply Chain Optimization

Covestro places significant emphasis on logistics and supply chain optimization as a core element of its marketing mix, directly supporting its overarching sustainability objectives. The company is actively engaged in transforming its supply chain operations to achieve ambitious climate targets, notably the reduction of Scope 3 carbon emissions. This transformation necessitates a meticulous approach to optimizing raw material sourcing and the efficiency of transportation networks.

A key area of focus for Covestro's logistics strategy is the reduction of its carbon footprint throughout the value chain. For instance, in 2023, Covestro reported a significant portion of its emissions falling under Scope 3, underscoring the importance of supply chain improvements. The company is exploring and implementing innovative solutions, including the use of lower-emission transport modes and more efficient route planning, to mitigate environmental impact.

- Supply Chain Decarbonization: Covestro aims to reduce Scope 3 emissions by 11% by 2030 compared to a 2022 baseline, with logistics playing a crucial role.

- Logistics Efficiency Gains: By optimizing transportation routes and modes, Covestro seeks to not only lower emissions but also improve delivery times and reduce costs.

- Sustainable Procurement: The company is working with suppliers to ensure raw materials are sourced and transported with minimal environmental impact.

- Digitalization of Logistics: Covestro is investing in digital tools and platforms to enhance visibility, traceability, and overall efficiency within its supply chain operations.

Covestro's global production network, with facilities in EMLA, NA, and APAC, ensures tailored material supply to meet diverse market demands. In 2024, the company continued optimizing sites for efficiency and market proximity, with APAC receiving significant investment to meet growing demand for innovative materials.

The direct sales model fosters deep B2B relationships, enabling customized solutions for specialized industrial applications. Covestro's customer-centric pull supply chain, which aligns production with actual customer orders, was effective in 2023, contributing to approximately €14.4 billion in revenue.

Logistics optimization is central to Covestro's strategy, focusing on reducing its carbon footprint, particularly Scope 3 emissions. By 2030, Covestro aims for an 11% reduction in Scope 3 emissions from a 2022 baseline, with logistics playing a key role through efficient transport and sustainable sourcing.

| Region | Key Investments/Focus | Impact |

|---|---|---|

| APAC | New TPU application development center in Guangzhou (opened early 2025) | Strengthens regional supply chains, fosters innovation in automotive and footwear sectors. |

| Europe | New polycarbonate copolymer plant in Antwerp, Belgium (operational late 2024) | Significantly increases European production capabilities, enhances energy efficiency. |

| Global Supply Chain | Scope 3 Emission Reduction Target | 11% reduction by 2030 (vs. 2022 baseline), driven by logistics efficiency and sustainable procurement. |

Preview the Actual Deliverable

Covestro 4P's Marketing Mix Analysis

The preview shown here is the actual document you’ll receive instantly after purchase—no surprises. This comprehensive analysis of Covestro's 4P's Marketing Mix is fully complete and ready for your immediate use.

Promotion

Covestro leverages industry trade fairs and exhibitions like Chinaplas and K as key promotional tools. These events are vital for showcasing their advanced material solutions and fostering direct engagement with customers and industry stakeholders.

In 2024, Covestro continued its presence at major global events, demonstrating its commitment to innovation and market presence. For instance, their participation at Chinaplas 2024 highlighted advancements in sustainable plastics, a growing focus for the company.

These exhibitions provide Covestro with a significant opportunity to not only display new products and technologies but also to gather market intelligence and strengthen relationships within the chemical and materials sector.

Covestro heavily promotes its dedication to sustainability and the circular economy through comprehensive reporting. The company's annual and sustainability reports, including those for 2023 and expected for 2024, detail progress on ESG metrics and outline ambitious goals for climate neutrality and the adoption of alternative raw materials.

These reports serve as a key promotional tool, showcasing Covestro's commitment to a more sustainable future. For instance, their 2023 report highlighted a reduction in Scope 1 and 2 greenhouse gas emissions by 12.9% compared to 2021, demonstrating tangible progress towards their climate targets.

Covestro actively utilizes digital marketing to showcase its groundbreaking innovations, such as sophisticated digital twins of its advanced materials. These digital representations allow for realistic design simulations and virtual prototyping, enabling customers to visualize and test material performance before physical production. This digital-first approach to product demonstration is key to their promotion strategy.

The company's online presence serves as a vital hub for disseminating crucial information. Covestro shares up-to-date news, detailed financial reports, and insightful analyses of their technological progress. This commitment to transparency and accessibility through digital channels ensures they effectively reach a wide audience, including investors and industry professionals seeking data-driven insights.

Strategic Partnerships and Collaborations

Covestro actively cultivates strategic partnerships with its customers, suppliers, and academic institutions. This approach is central to their strategy for fostering innovation and effectively promoting their advanced material solutions.

These collaborations are frequently showcased in their public communications, often detailing joint initiatives aimed at developing more sustainable materials and accelerating the adoption of circular economy principles across diverse industrial sectors. For instance, in 2023, Covestro announced a collaboration with a leading automotive manufacturer to develop lightweight, high-performance components using their advanced polycarbonates, contributing to vehicle fuel efficiency and reduced emissions.

Key areas of collaboration include:

- Co-development of sustainable materials: Working with partners to create and implement eco-friendly alternatives in product design and manufacturing.

- Advancing circular economy solutions: Joint projects focused on recycling, upcycling, and extending the lifecycle of chemical products and materials.

- Driving industry-wide innovation: Engaging with research bodies and industry leaders to push the boundaries of material science and application.

Thought Leadership and Industry Engagement

Covestro actively cultivates its image as a leading voice in the polymer sector. Its executives frequently share expert perspectives on emerging market trends, the critical importance of sustainability, and groundbreaking technological innovations. This strategic engagement solidifies their position as influential figures in the chemical and materials industries.

The company's commitment to thought leadership is evident through its proactive involvement in key industry forums and collaborative initiatives. By participating in these discussions, Covestro not only shares its expertise but also shapes the broader industry narrative, reinforcing its reputation for innovation and forward-thinking solutions. For instance, in 2024, Covestro executives were prominent speakers at major chemical industry conferences, discussing advancements in circular economy solutions for plastics.

- Industry Influence: Covestro executives contribute to shaping industry dialogue on sustainability and innovation.

- Market Trend Insights: The company provides valuable perspectives on future market directions and technological advancements.

- Active Participation: Engagement in industry events and initiatives demonstrates leadership and expertise.

- Reputation Building: Thought leadership efforts enhance Covestro's standing as a knowledgeable and influential player.

Covestro's promotional strategy heavily relies on showcasing its commitment to sustainability and innovation at major industry events. Their participation in trade fairs like Chinaplas and K in 2024 highlighted advancements in sustainable plastics and fostered direct customer engagement. Furthermore, the company actively uses digital platforms to demonstrate innovations, such as digital twins of their materials, enabling virtual prototyping and design simulations.

Covestro's thought leadership, exemplified by executive participation in industry forums in 2024 discussing circular economy solutions, solidifies its market influence. Strategic partnerships with customers and academic institutions, like their 2023 collaboration with an automotive manufacturer on lightweight components, are also central to promoting their advanced material solutions and driving industry innovation.

The company's sustainability reports, including those for 2023, serve as key promotional tools, detailing progress on ESG metrics and climate targets. For instance, their 2023 report indicated a 12.9% reduction in Scope 1 and 2 greenhouse gas emissions compared to 2021, underscoring tangible progress.

| Promotional Activity | Key Focus/Event | Year | Impact/Example |

|---|---|---|---|

| Trade Fairs & Exhibitions | Chinaplas, K | 2024 | Showcased sustainable plastics, fostered direct customer engagement. |

| Digital Marketing | Digital Twins of Materials | Ongoing | Enabled virtual prototyping, visualized material performance. |

| Thought Leadership | Industry Forums, Conferences | 2024 | Executives discussed circular economy solutions, shaping industry dialogue. |

| Sustainability Reporting | Annual & Sustainability Reports | 2023 | Detailed ESG progress, highlighted 12.9% GHG emission reduction (Scope 1 & 2 vs. 2021). |

| Strategic Partnerships | Customer & Academic Collaborations | 2023 | Co-developed lightweight automotive components, advancing sustainable materials. |

Price

Covestro's value-based pricing strategy centers on the superior performance and sustainability of its advanced polymer materials. This approach means prices are set based on the tangible benefits customers receive, such as increased energy efficiency or extended product lifespans, rather than just production costs. For instance, their specialty coatings might command a premium due to their durability and reduced environmental impact, reflecting the total value delivered to the end-user's application.

Covestro's pricing strategy is significantly shaped by market demand and the broader economic climate. When demand softens, as seen in various segments during late 2023 and early 2024, average selling prices tend to decline. This is partly due to a ripple effect where lower raw material costs are passed on to customers, a trend observed in the coatings and adhesives sector.

The global economic slowdown has been a persistent factor influencing Covestro's pricing power. A weak global economy typically translates to reduced industrial activity and consumer spending, directly impacting the demand for Covestro's specialty chemicals and materials. For instance, the automotive and construction industries, key end-markets for Covestro, have experienced headwinds, contributing to pricing pressures.

Fluctuations in raw material and energy costs are a major driver for Covestro's pricing and profitability. For instance, in the first half of 2024, the company experienced a notable increase in energy expenses, which partially offset the benefits from lower raw material prices in certain segments. This dynamic directly influences their ability to maintain competitive pricing while safeguarding margins.

Competitive Landscape

The global polymer market is intensely competitive, impacting Covestro's pricing. Companies like BASF, Dow, and SABIC are major players, often competing on volume and cost, which Covestro must counter by emphasizing its premium offerings. This dynamic requires Covestro to balance market price pressures with the need to reflect the value of its advanced materials and sustainable solutions.

Covestro’s pricing strategy is shaped by this competitive environment. For instance, in the polycarbonates segment, where it holds a strong position, pricing needs to remain attractive against alternatives, even as Covestro invests in higher-margin, specialized grades. This is particularly relevant as the demand for high-performance polymers continues to grow, driven by industries like automotive and electronics.

- Market Share: Covestro is a leading global supplier of polymers, but faces significant competition from established chemical giants.

- Price Sensitivity: While Covestro targets premium segments, overall market price trends, influenced by raw material costs and competitor actions, still play a crucial role in its pricing decisions.

- Innovation Premium: Covestro aims to command higher prices for its innovative and sustainable product lines, such as its CO2-based polyols, differentiating itself from less specialized competitors.

- Regional Dynamics: Pricing strategies are also adapted to regional market conditions and competitive intensity, with Asia-Pacific often presenting a different pricing landscape than Europe or North America.

Cost Reduction Initiatives

Covestro's global transformation program, 'STRONG,' is a key initiative focused on cost reduction. This program aims to achieve substantial annual savings in material and personnel expenses by 2028. These efforts are designed to directly combat margin erosion and bolster the company's competitive standing.

The successful implementation of 'STRONG' is projected to yield significant financial benefits. For instance, Covestro has already reported achieving approximately €200 million in cost savings by the end of 2023, a testament to the program's early traction. These savings are crucial for enhancing profitability and providing greater flexibility in pricing strategies.

- Global Transformation Program: 'STRONG' targets significant annual savings by 2028.

- Cost Savings Achieved: Approximately €200 million in savings reported by the end of 2023.

- Strategic Impact: Aims to counteract margin erosion and improve competitiveness.

- Pricing Influence: Reduced costs can indirectly support more competitive pricing and enhance profitability.

Covestro's price strategy is fundamentally value-based, reflecting the advanced performance and sustainability of its polymer materials. This means prices are set by the benefits customers gain, like improved energy efficiency or longer product life, rather than just production costs. For example, their specialized coatings can fetch higher prices due to their durability and reduced environmental impact, aligning with the total value delivered.

Market demand and the overall economic climate heavily influence Covestro's pricing. Weak demand, as seen in late 2023 and early 2024, typically leads to lower average selling prices. This is partly because reduced raw material costs are often passed on to customers, a trend evident in sectors like coatings and adhesives.

The global economic slowdown has consistently pressured Covestro's pricing power. Reduced industrial activity and consumer spending directly impact demand for their specialty chemicals. Key markets like automotive and construction have faced challenges, contributing to these pricing pressures.

Raw material and energy cost fluctuations are critical to Covestro's pricing and profitability. For instance, in the first half of 2024, higher energy expenses partially offset savings from lower raw material costs in certain areas, directly affecting their ability to offer competitive prices while maintaining margins.

Covestro operates in a highly competitive global polymer market, facing rivals like BASF, Dow, and SABIC. This necessitates balancing market price pressures with highlighting the value of its advanced materials and sustainable solutions. In segments like polycarbonates, where Covestro holds a strong position, pricing must remain competitive against alternatives, even as the company invests in higher-margin, specialized grades.

Covestro's 'STRONG' transformation program, targeting substantial annual cost savings by 2028, aims to combat margin erosion and enhance competitiveness. By the end of 2023, the company had already achieved approximately €200 million in cost savings, demonstrating the program's early success and providing greater pricing flexibility.

| Factor | Impact on Covestro Pricing | Example/Data Point (2023-2024) |

|---|---|---|

| Value-Based Pricing | Premium pricing for enhanced performance and sustainability | Specialty coatings with superior durability and eco-friendliness |

| Market Demand | Lower demand leads to price reductions | Weak demand in late 2023/early 2024 resulted in lower average selling prices. |

| Economic Climate | Global slowdown pressures pricing | Headwinds in automotive and construction sectors contributed to pricing pressures. |

| Cost Fluctuations | Energy costs can offset raw material savings | Increased energy expenses in H1 2024 partially negated benefits from lower raw material prices. |

| Competition | Need to balance price with value proposition | Maintaining attractive pricing in polycarbonates against competitors while emphasizing premium grades. |

| Cost Reduction Programs | Improved margins can support pricing flexibility | 'STRONG' program achieved ~€200 million in savings by end of 2023. |

4P's Marketing Mix Analysis Data Sources

Our Covestro 4P's Marketing Mix analysis leverages a robust blend of primary and secondary data. We meticulously examine Covestro's official investor relations materials, annual reports, and press releases to understand their product portfolio and strategic pricing. Furthermore, we incorporate insights from industry publications and market research reports to assess their distribution channels and promotional activities.