Covestro Porter's Five Forces Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Covestro Bundle

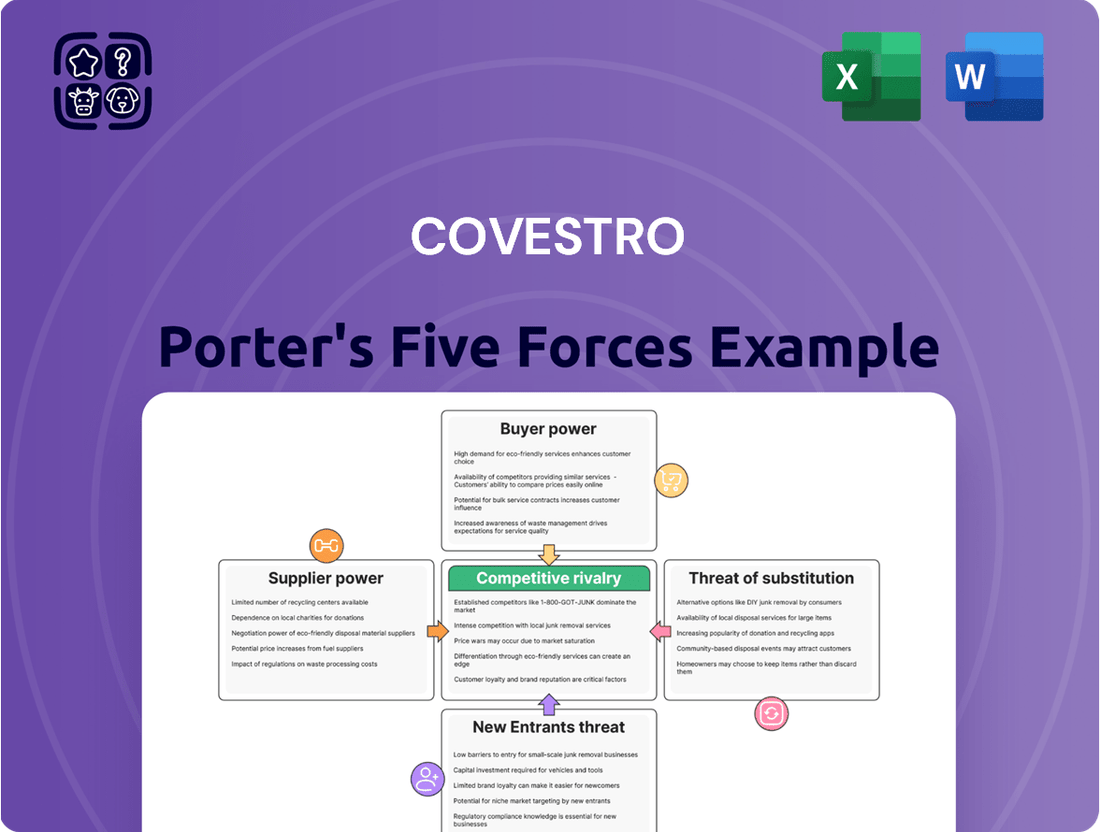

Covestro navigates a competitive landscape shaped by powerful buyer and supplier forces, alongside the constant threat of substitutes. Understanding these dynamics is crucial for any stakeholder. This brief snapshot only scratches the surface. Unlock the full Porter's Five Forces Analysis to explore Covestro’s competitive dynamics, market pressures, and strategic advantages in detail.

Suppliers Bargaining Power

Covestro's supply chain is actively transforming, with a noticeable global trend towards regionalizing production. This strategic shift aims to bolster resilience against geopolitical disruptions and simultaneously cut down on emissions from long-distance transport. For instance, in 2024, many chemical companies, including those in Covestro's sphere, have been re-evaluating their global footprints to mitigate risks identified in previous years.

The chemical sector continues to grapple with the persistent challenge of escalating feedstock and energy prices. These increases directly translate into higher production costs for companies like Covestro. In early 2024, reports indicated that energy prices in Europe, a key market for chemical production, remained volatile, impacting operational expenses significantly.

These fluctuating raw material costs have a direct bearing on Covestro's profitability, creating a need for innovative and cost-effective solutions. The company's ability to navigate these price swings and maintain its competitive edge hinges on its capacity to implement efficient procurement strategies and develop more sustainable, less price-sensitive production methods.

While precise figures on Covestro's raw material supplier concentration aren't publicly detailed, the broader chemical sector is seeing continued consolidation. This trend suggests a potential for fewer, larger suppliers to emerge, thereby increasing their bargaining power. For instance, in 2023, the global chemical industry saw several mergers and acquisitions aimed at achieving greater scale and market influence.

Covestro's substantial size and its standing as a major global player in the polymers market likely grant it considerable leverage when negotiating with its suppliers. This scale can translate into better pricing and more favorable terms. However, for highly specialized or niche chemical inputs where alternative suppliers are scarce, these specialized suppliers may wield greater bargaining power over Covestro.

Switching raw material suppliers in the high-tech polymer industry, like the one Covestro operates in, can be quite costly. This is because these specialized materials often have very specific requirements, demanding stringent quality control and extensive testing before they can be approved for use.

Integrating a new material into existing production lines isn't a simple swap; it requires considerable time and financial investment to retool and recalibrate processes. For instance, in 2023, Covestro's research and development expenses were €674 million, highlighting the significant investment in material innovation and integration.

These hurdles create a substantial barrier for companies like Covestro to switch suppliers easily. Consequently, established suppliers who can consistently meet these demanding specifications often wield considerable bargaining power, as the cost and complexity of changing partners are high.

Sustainability Demands on Suppliers

Covestro's commitment to ambitious sustainability goals, such as reducing Scope 3 emissions which are heavily influenced by purchased materials, significantly impacts supplier bargaining power. Suppliers must meet rigorous environmental, social, and ethical standards, as detailed in Covestro's Supplier Code of Conduct, to maintain business relationships.

Covestro actively engages with its suppliers to foster improvements in sustainability. This collaborative approach includes joint development projects and implementing corrective actions for any identified shortcomings, demonstrating a partnership that also carries significant expectations.

- Supplier Pressure: Suppliers facing increasing demands for sustainable products and practices from major customers like Covestro may find their bargaining power strengthened if they possess unique, eco-friendly solutions.

- Cost of Compliance: The need for suppliers to invest in new technologies or processes to meet Covestro's sustainability benchmarks can increase their costs, potentially leading them to pass these onto Covestro, thereby shifting bargaining power.

- Market Trends: As sustainability becomes a more critical factor in purchasing decisions across industries, suppliers who are already ahead in these areas are in a stronger position to negotiate terms.

Technological Advancements and Supplier Influence

Suppliers who are at the forefront of technological innovation, particularly in developing sustainable and efficient raw materials, are increasingly influential. For instance, companies providing bio-based or recycled content feedstocks are gaining leverage. Covestro's strategic focus on sourcing biomaterials and chemically recycled inputs highlights the growing importance of these specialized suppliers.

The global push towards a circular economy directly impacts Covestro's material sourcing strategy, amplifying the bargaining power of suppliers who can offer pioneering solutions in this area. By 2024, the demand for sustainable materials in the chemical industry has seen significant growth, with many companies like Covestro setting ambitious targets for recycled and bio-based content in their products. This trend strengthens the position of suppliers who can meet these evolving requirements.

- Innovation in Feedstocks: Suppliers developing advanced bio-based or recycled materials enhance their bargaining power.

- Covestro's Strategic Needs: Covestro's pursuit of biomaterials and chemically recycled inputs makes these suppliers critical.

- Circular Economy Impact: The drive for sustainability empowers suppliers leading in circular economy solutions.

The bargaining power of suppliers for Covestro is influenced by several factors, including the concentration of suppliers, the uniqueness of their offerings, and the switching costs for Covestro. While specific supplier concentration data for Covestro isn't public, the chemical industry's ongoing consolidation suggests a potential increase in supplier leverage for larger, consolidated entities.

The high cost and complexity associated with integrating new, specialized raw materials into Covestro's advanced polymer production processes create significant switching costs. This inertia benefits established suppliers who consistently meet stringent quality and performance demands, granting them considerable bargaining power. For instance, Covestro's 2023 R&D expenses of €674 million underscore the investment required for material innovation and integration, highlighting the barriers to switching.

Covestro's strong emphasis on sustainability and its ambitious Scope 3 emission reduction targets empower suppliers who offer eco-friendly or circular economy solutions. These suppliers, particularly those providing bio-based or recycled feedstocks, are increasingly influential as Covestro prioritizes sourcing these materials. For example, the growing demand for sustainable materials in the chemical sector by 2024 benefits suppliers at the forefront of these innovations.

| Factor | Impact on Supplier Bargaining Power | Supporting Data/Context |

|---|---|---|

| Supplier Concentration | Potentially Increased | Trend of consolidation in the chemical industry. |

| Switching Costs | High | Covestro's 2023 R&D expenses: €674 million. Integration complexity for specialized materials. |

| Sustainability Demands | Increased for eco-friendly suppliers | Covestro's focus on Scope 3 emissions and circular economy solutions. Growing market demand for sustainable materials by 2024. |

What is included in the product

Uncovers the intensity of competition, buyer and supplier power, threat of new entrants and substitutes, specifically for Covestro's position in the polymer industry.

Gain immediate insights into competitive pressures affecting Covestro, allowing for proactive strategy adjustments.

Understand the impact of supplier power and buyer bargaining on Covestro's profitability, enabling better negotiation tactics.

Customers Bargaining Power

Covestro's diverse customer base spans crucial sectors like automotive, construction, electronics, and healthcare. This broad reach, while generally a strength, also exposes the company to the bargaining power of customers within these large, and sometimes volatile, industries. For instance, a downturn in the automotive sector, a key market for Covestro's materials, can significantly reduce demand and put pressure on pricing.

The significant impact of industry-wide demand shifts on Covestro's performance is evident. In 2023, for example, Covestro reported a substantial decline in its earnings before interest, taxes, depreciation, and amortization (EBITDA), partly attributed to weaker demand in key end markets like construction and automotive. This illustrates how concentrated demand in these sectors can amplify customer bargaining power, especially during economic slowdowns.

Customers are increasingly demanding sustainable and circular products, directly influencing Covestro's innovation pipeline. This shift means companies like Covestro must prioritize recycled-content and bio-based materials to meet market expectations.

This growing customer preference for eco-friendly options grants them significant leverage over Covestro's product development and overall strategic path. For instance, Covestro's 2023 annual report highlighted a strong emphasis on expanding its portfolio of sustainable solutions in response to this trend.

Covestro's revised strategy actively acknowledges and aims to accelerate the development of these sustainable solutions, often through collaborative efforts with customers and partners. This customer-driven demand is a key factor in shaping the company's future product offerings and market positioning.

In a market where polymer prices have been notably low, particularly in certain segments, customers are likely to be more sensitive to price. This heightened sensitivity directly translates into increased pressure on Covestro's profit margins, as buyers seek the best possible deals.

The chemical industry as a whole has navigated economic challenges and fluctuating demand throughout 2024. This environment has empowered customers to negotiate pricing more assertively, leveraging market conditions to their advantage.

Covestro's success in preserving its margins hinges on its operational efficiency and the distinctiveness of its products. For instance, in 2023, Covestro reported adjusted EBITDA of €1.14 billion, a figure that reflects the impact of market dynamics on profitability.

Customer Switching Costs and Product Differentiation

While Covestro's advanced polymer materials are critical, customers might explore other options if the cost and hassle of switching are low, or if competitors present a more compelling value proposition. For instance, in the automotive sector, which is a significant market for Covestro, the ability for car manufacturers to easily integrate materials from different suppliers can influence their purchasing decisions. The bargaining power of customers is thus influenced by the ease with which they can find and adopt alternative solutions without significant disruption.

Covestro actively works to mitigate this by focusing on innovation and developing highly customized solutions. This approach aims to embed their products deeply into customer processes, making them harder to replace. By offering tailored materials that enhance performance or efficiency, Covestro seeks to create a strong dependency, thereby increasing customer loyalty and reducing the incentive to switch. This strategy is crucial in markets where material performance directly impacts end-product quality and manufacturing efficiency.

The company also emphasizes its role as a strategic partner, highlighting the total value delivered rather than just the price of the polymer itself. This includes technical support, collaborative R&D, and supply chain reliability. For example, Covestro's work in developing sustainable material solutions for the construction industry, such as energy-efficient insulation, demonstrates a commitment to providing value that extends beyond the material's basic function, aiming to build long-term relationships and reduce customer sensitivity to price alone.

- Customer Switching Costs: The ease with which customers can switch to alternative suppliers without incurring significant costs (financial, operational, or technical) directly impacts their bargaining power.

- Product Differentiation: Covestro's ability to offer unique, high-performance, or customized polymer solutions can create switching barriers and reduce customer power.

- Value Proposition: Beyond the material itself, the overall value provided through technical support, innovation, and partnership influences customer loyalty and bargaining leverage.

- Market Dynamics: The availability of comparable alternatives and the competitive landscape within specific end-markets (e.g., automotive, construction) shape customer options and their ability to negotiate.

Potential for Backward Integration by Customers

Large industrial customers, especially those in developed markets, could potentially develop the technical know-how and financial muscle to produce certain polymer components themselves. For instance, a major automotive manufacturer might evaluate the feasibility of producing specific plastic parts in-house.

However, the substantial capital outlay and the specialized knowledge needed for polymer manufacturing present considerable hurdles. Covestro's customers would need to invest heavily in research and development, production facilities, and skilled personnel, which are significant barriers to entry.

This high barrier means backward integration is generally not an immediate or widespread threat for most of Covestro's clientele. The complexities involved often outweigh the perceived benefits for many customers.

- Customer Backward Integration Potential: While some large industrial clients possess the financial clout and technical capacity for backward integration, the high capital expenditure and specialized expertise required for polymer production remain significant deterrents.

- Market Maturity Impact: In mature markets, customers with established operations and a deep understanding of their supply chain might more readily explore in-house production of certain polymer components.

- Deterrents to Integration: The substantial investment in advanced manufacturing technology, stringent quality control processes, and ongoing research and development in polymer science makes direct backward integration a challenging proposition for most customers.

Covestro's customer base, particularly large players in the automotive and construction sectors, wield significant bargaining power. This is amplified when demand falters, as seen in 2023 when Covestro's EBITDA declined partly due to weaker demand in these key markets. Customers can leverage market conditions to negotiate lower prices, especially when polymer prices are already low, impacting Covestro's profit margins. For instance, Covestro reported adjusted EBITDA of €1.14 billion in 2023, reflecting these pressures.

| Customer Segment | Bargaining Power Factors | Impact on Covestro |

| Automotive | High volume purchases, potential for backward integration, ease of switching suppliers | Price pressure, demand for customized solutions, focus on total value proposition |

| Construction | Sensitivity to economic cycles, increasing demand for sustainable materials | Influence on product development, pricing sensitivity during downturns |

| Electronics | Need for specialized, high-performance materials, but also potential for alternative sourcing | Requirement for innovation, balancing cost with performance |

Full Version Awaits

Covestro Porter's Five Forces Analysis

This preview displays the exact Covestro Porter's Five Forces Analysis you will receive upon purchase, offering a complete and professionally formatted document ready for immediate use. You'll gain a comprehensive understanding of the competitive landscape, including the bargaining power of buyers and suppliers, the threat of new entrants and substitutes, and the intensity of rivalry within the industry. This detailed analysis will equip you with the insights needed to make informed strategic decisions for Covestro.

Rivalry Among Competitors

Covestro operates in a high-tech polymer market, especially polyurethanes, which is quite concentrated. A few big global companies hold a large chunk of the market share, making it a tough playing field.

Key competitors for Covestro include giants like BASF SE, Dow Inc., Huntsman Corporation, and Wanhua Chemical Group. These companies are all vying for the same customers and market dominance, leading to fierce rivalry.

This concentration means that competition is intense, with companies constantly battling for market share and trying to win over customers. For instance, in 2024, the global polyurethane market was valued at approximately USD 75 billion, with these major players capturing a substantial portion.

The competitive rivalry in the advanced materials sector, particularly for companies like Covestro, is intensely fueled by a relentless pursuit of innovation. This innovation isn't just about new products; it's deeply embedded in enhancing product properties, boosting performance metrics, and crucially, driving sustainability. Companies are channeling significant resources into research and development, aiming to pioneer advanced materials that offer superior functionality and environmental benefits.

This R&D focus translates into substantial investments. For instance, many players in the specialty chemicals industry, including those in polymers and coatings, allocate a considerable portion of their revenue to innovation. While specific figures for 2024 are still emerging, historical trends show R&D spending in this sector often exceeding 3-5% of sales for leading companies. Covestro, for example, has been a vocal proponent of developing bio-based solutions and advanced recycling technologies, viewing these as essential for future growth and market positioning.

Covestro's strategic emphasis on circular economy principles and achieving climate neutrality is a prime example of how innovation serves as a competitive differentiator. By investing in and promoting solutions that reduce environmental impact and enable material reuse, Covestro aims to capture market share and build brand loyalty among increasingly environmentally conscious customers. This commitment to sustainability, backed by tangible R&D advancements, directly addresses a growing demand for greener alternatives in industries ranging from automotive to construction.

Covestro, operating in the specialty chemicals and polymers sector, faces significant price competition. This pressure is exacerbated by volatile raw material costs, which directly impact production expenses. For instance, the price of key feedstocks like benzene and ethylene can fluctuate considerably, squeezing margins for producers.

The demand across various end-markets, such as automotive and construction, is not always consistent. This uneven demand can lead to oversupply in certain segments, forcing companies to lower prices to move inventory. In 2024, the global engineering polymers market experienced this dynamic, with some producers reporting single-digit percentage declines in average selling prices for certain product lines due to these market conditions.

Consequently, companies like Covestro are compelled to focus on rigorous cost-reduction initiatives and enhancing operational efficiency. This includes optimizing production processes, streamlining supply chains, and investing in automation to maintain profitability amidst the ongoing margin erosion.

Global Reach and Regional Dynamics

Covestro operates in a globally competitive landscape where companies vie for market share across continents. While the competition is international, regional dynamics significantly shape market strategies and success. For instance, the Asia-Pacific region is a powerhouse in specialty chemicals and polymers, experiencing rapid growth and attracting substantial investment, thereby intensifying competition.

Companies like Covestro must navigate these diverse regional demands and evolving regulatory environments. This necessitates a flexible approach, tailoring product offerings and operational strategies to meet specific local needs and compliance requirements. The sheer volume of activity in regions like Asia-Pacific, which is projected to continue its growth trajectory, underscores the importance of this adaptability.

- Global Competition: Specialty chemical and polymer markets are intensely competitive worldwide.

- Asia-Pacific Dominance: This region is a leading and rapidly expanding market, drawing significant investment.

- Regional Adaptation: Companies must tailor strategies to diverse regional demands and regulatory frameworks.

- Market Share Battles: Players actively compete for market share across various geographical areas.

Sustainability and Circular Economy Focus

The drive towards sustainability and a circular economy has intensified competition within the materials sector. Companies demonstrating a strong commitment to eco-friendly products, reduced emissions, and innovative recycling methods are increasingly differentiating themselves.

Covestro, for instance, is actively investing in these areas. Their efforts include utilizing carbon dioxide as a feedstock, a move that aligns with circular economy principles. Furthermore, their significant investments in advanced recycling technologies aim to capture value from waste streams.

- Environmental Innovation as a Differentiator: Companies like Covestro are leveraging sustainable practices, such as using CO2 as a raw material, to gain a competitive advantage.

- Recycling Technology Investment: Significant capital is being channeled into advanced recycling processes, aiming to create closed-loop systems for materials.

- Market Demand for Green Products: Growing consumer and regulatory pressure is pushing the industry towards more environmentally responsible solutions, making sustainability a key battleground.

Covestro faces formidable rivalry from major global players like BASF, Dow, Huntsman, and Wanhua Chemical. This intense competition is driven by a constant pursuit of innovation, particularly in high-performance, sustainable materials. For example, the global polyurethane market, a key area for Covestro, was valued at approximately USD 75 billion in 2024, with these leading companies actively vying for market share.

Price sensitivity and fluctuating raw material costs, such as benzene and ethylene, further intensify this rivalry, often leading to margin pressures. In 2024, some segments of the global engineering polymers market saw single-digit percentage declines in average selling prices due to these dynamics, compelling companies to focus on cost efficiencies and operational optimization.

The global nature of the specialty chemicals market means companies must also adapt to regional differences, with Asia-Pacific being a particularly dynamic and rapidly growing competitive hub. Covestro's strategic focus on sustainability, including the use of CO2 as a feedstock and investments in advanced recycling, serves as a key differentiator in this highly competitive environment.

| Competitor | Key Product Areas | 2024 Market Presence Indicator (Illustrative) |

|---|---|---|

| BASF SE | Polyurethanes, Coatings, Petrochemicals | Significant global market share, strong R&D in sustainable solutions |

| Dow Inc. | Polyurethanes, Performance Materials, Plastics | Major player with broad product portfolio and integrated value chains |

| Huntsman Corporation | Polyurethanes, Performance Products, Advanced Materials | Key supplier in various industrial applications, focus on differentiated products |

| Wanhua Chemical Group | Polyurethanes (MDI, TDI), Petrochemicals, Fine Chemicals | Leading MDI producer globally, expanding international footprint and product offerings |

SSubstitutes Threaten

The increasing global focus on environmental responsibility is fueling the rise of bio-based and recycled polymers, presenting a significant threat to traditional fossil-fuel-derived plastics. These alternatives offer a more sustainable path, directly challenging the market share of conventional polymer products.

Innovations in biodegradable and bio-based polymer technology, coupled with sophisticated recycling processes, are making these substitutes increasingly viable and competitive. For example, the global bioplastics market was valued at approximately USD 50 billion in 2023 and is projected to grow substantially, indicating a clear shift in material preferences.

This transformation within the plastics and polymers sector, driven by consumer demand and regulatory pressures for greener solutions, means companies like Covestro must adapt by incorporating these sustainable materials into their offerings or face erosion of their market position.

The threat of substitutes for Covestro's high-tech polymers is a notable concern, particularly as innovation in alternative materials accelerates. In sectors like packaging, there's a clear shift away from traditional plastics, with wood fiber alternatives gaining traction. This trend highlights how environmental considerations and new material development can directly impact demand for polymers.

While Covestro's polymers offer distinct advantages such as lightweighting and superior durability, crucial for industries like automotive and construction, ongoing advancements in material science present a constant challenge. For example, the automotive industry is exploring advanced composites and even bio-based materials that could potentially match or exceed the performance of current polymers in certain applications, impacting market share.

The attractiveness of potential substitutes for Covestro's products hinges significantly on their price-performance trade-off. While some alternatives might offer enhanced sustainability, they often fall short when compared to the cost-effectiveness, robustness, or specialized functionalities of Covestro's advanced polymers. For instance, bio-based plastics may appeal environmentally, but their production costs and performance in demanding applications can still be prohibitive for widespread adoption against established materials.

However, this dynamic is not static. Continuous advancements in research and development, coupled with increasing economies of scale in the production of alternative materials, are steadily narrowing the performance and cost gap. For example, innovations in recycled content composites are improving their structural integrity and reducing their price point, making them more competitive with virgin materials in sectors like automotive and construction.

Regulatory and Consumer Pressure for Greener Alternatives

Growing environmental regulations and consumer demand for greener products are significantly pushing industries towards substitutes for traditional materials. For instance, policies like the EU's Circular Economy Action Plan, which aims to promote circularity and reduce plastic waste, directly incentivize the adoption of more sustainable alternatives. This societal and legislative push creates a powerful incentive for companies to explore and implement these substitute options.

The increasing pressure for sustainability directly impacts companies like Covestro, as it accelerates the development and market penetration of alternative materials. This trend is evident in the automotive sector, where there's a growing interest in bio-based or recycled plastics to meet both regulatory demands and consumer preferences for eco-conscious vehicles. By 2024, the global market for sustainable plastics is projected to reach substantial growth, further highlighting the threat of substitutes.

- Environmental Regulations: Policies mandating reduced plastic usage and increased recycled content directly favor substitutes.

- Consumer Demand: A significant portion of consumers, particularly in developed markets, are willing to pay a premium for eco-friendly products.

- Circular Economy Initiatives: Programs promoting material reuse and recycling create a viable pathway for substitute materials to gain market share.

- Technological Advancements: Innovations are making bio-based and recycled materials more competitive in terms of performance and cost.

Covestro's Proactive Innovation Against Substitution

Covestro actively combats the threat of substitutes by developing its own innovative, sustainable alternatives. A prime example is their work with CO2 as a feedstock for polyurethanes, a significant step towards reducing reliance on traditional fossil fuels. This proactive approach aims to preemptively address market shifts by offering customers environmentally friendly options directly from Covestro.

The company is also heavily invested in circular economy principles and bio-based materials. This strategy allows Covestro to create 'green' versions of its existing products, effectively turning a potential threat into an opportunity for product differentiation and market leadership. By leading in sustainable material science, Covestro seeks to retain and grow its market share.

- Sustainable Innovation: Covestro is investing in technologies like CO2-based polyurethanes to create differentiated, eco-friendly products.

- Circular Economy Integration: The company is incorporating circular economy principles and bio-based materials to offer sustainable alternatives.

- Preemptive Strategy: By developing its own 'green' solutions, Covestro aims to capture market demand for sustainable materials and mitigate losses to external substitutes.

- Market Leadership: This focus on sustainability positions Covestro to lead in a market increasingly demanding environmentally responsible material solutions.

The threat of substitutes for Covestro's polymer products is significant, driven by growing environmental concerns and technological advancements. Alternative materials, such as bio-based plastics and advanced composites, are increasingly competitive, especially in sectors like packaging and automotive. For instance, the global bioplastics market, valued at approximately USD 50 billion in 2023, is expected to see substantial growth, indicating a clear shift in material preferences.

While Covestro's high-performance polymers offer distinct advantages, innovations in material science are continuously narrowing the performance and cost gap with substitutes. The automotive industry, for example, is actively exploring bio-based and recycled materials that could potentially rival traditional polymers in certain applications. This dynamic necessitates that Covestro remains at the forefront of sustainable material development to maintain its market position.

The increasing adoption of circular economy principles and stricter environmental regulations further bolster the appeal of substitutes. Policies promoting reduced plastic usage and increased recycled content directly favor these alternatives, creating a powerful incentive for industries to explore and implement them. Covestro's proactive development of CO2-based polyurethanes and integration of circular economy principles are key strategies to counter this threat by offering its own sustainable solutions.

| Substitute Material Category | Key Advantages | Potential Impact on Covestro | Market Trend Example (2023/2024) |

|---|---|---|---|

| Bio-based Plastics | Sustainability, reduced carbon footprint | Erosion of market share for fossil-fuel-based polymers | Global bioplastics market valued at ~USD 50 billion in 2023, with strong growth projections. |

| Recycled Polymers | Circular economy alignment, waste reduction | Increased competition, pressure on virgin material pricing | Growing investment in advanced recycling technologies to improve quality and cost-effectiveness. |

| Advanced Composites | High strength-to-weight ratio, specific performance characteristics | Substitution in demanding applications (e.g., automotive lightweighting) | Continued R&D in composites for automotive and aerospace sectors, aiming for cost parity with polymers. |

Entrants Threaten

The chemical industry, especially for advanced materials like Covestro's high-tech polymers, demands massive upfront investment. Think billions of dollars for state-of-the-art plants and the complex infrastructure to support them.

This high capital intensity acts as a significant deterrent for potential new players. It's not just about having a good idea; it's about having the financial muscle to build and operate large-scale production facilities, a hurdle that naturally limits the number of new entrants.

For instance, building a new polycarbonate plant, a key product area for Covestro, can easily cost over $1 billion. This substantial financial barrier means only well-funded companies can even consider entering the market, giving established players like Covestro a significant advantage due to their existing scale and operational efficiencies.

Developing advanced polymer materials requires significant investment in research and development, creating a substantial hurdle for newcomers. Companies must innovate continuously to compete, often needing to acquire existing technologies, which is an expensive undertaking. Covestro's commitment to R&D, evidenced by its substantial innovation pipeline, further solidifies this barrier.

The chemical industry faces a formidable barrier to entry due to its complex regulatory landscape, particularly concerning environmental, health, and safety standards. New companies must invest heavily to understand and adhere to these global regulations, which are continuously evolving, especially regarding sustainability and decarbonization. For instance, the European Union's Green Deal and its associated chemical strategies impose rigorous compliance demands, requiring substantial upfront investment in research, development, and operational adjustments.

Established Supply Chains and Customer Relationships

Covestro benefits from deeply entrenched relationships with a global customer base spanning critical sectors like automotive, construction, and electronics. These long-standing partnerships are built on trust and consistent performance, making it difficult for newcomers to penetrate the market. For instance, Covestro's commitment to innovation and tailored solutions has fostered loyalty among key clients, who rely on their specialized materials.

New entrants would face significant hurdles in replicating Covestro's extensive and resilient supply chains. The company's global network ensures reliable access to raw materials and efficient distribution, a capability that takes years and substantial investment to develop. This operational strength provides a competitive advantage by minimizing disruptions and ensuring timely delivery, factors crucial for large industrial customers.

The threat of new entrants is further mitigated by Covestro's customer-centric approach, which prioritizes understanding and meeting specific client needs. This focus on service and technical support solidifies customer loyalty and creates high switching costs. In 2024, Covestro continued to emphasize collaborative innovation with its partners, reinforcing these bonds and presenting a formidable barrier to new competition.

- Established Global Customer Base: Covestro serves a diverse international clientele across vital industries, making it hard for new players to gain traction.

- Resilient Supply Chain Networks: The company's well-developed logistics and sourcing capabilities are a significant barrier to entry.

- Customer Loyalty and Switching Costs: Covestro's focus on customer relationships and tailored solutions increases the difficulty for new entrants to win over established clients.

Specialized Expertise and Talent Acquisition

The production of advanced polymer materials, like those Covestro specializes in, demands a highly specialized technical workforce. New companies entering this market would struggle to find and keep the necessary talent, as experienced chemists, engineers, and material scientists are in high demand. This talent acquisition hurdle is significant, as it directly impacts innovation and operational efficiency.

Established players such as Covestro benefit from a deep bench of experienced professionals and a wealth of institutional knowledge. This accumulated expertise acts as a substantial barrier to entry, making it difficult for newcomers to replicate the level of technical proficiency and problem-solving capabilities that incumbents possess. For instance, the chemical industry, in general, saw a shortage of skilled workers, with some reports indicating a need to fill hundreds of thousands of roles globally in the coming years, underscoring the challenge for new entrants.

- Talent Scarcity: The global demand for specialized chemical engineers and material scientists outstrips supply, making recruitment a major challenge for new market entrants.

- Experience Gap: New entrants lack the decades of accumulated practical knowledge and problem-solving experience that established companies like Covestro have cultivated in their workforce.

- Retention Costs: Attracting and retaining top-tier talent in specialized fields often requires competitive compensation packages and attractive career development opportunities, increasing the initial investment for new companies.

The threat of new entrants in Covestro's advanced materials sector is significantly low due to immense capital requirements for manufacturing facilities, often exceeding $1 billion for a single plant. Furthermore, extensive research and development investments are critical for innovation, creating a substantial financial barrier for potential competitors. For example, the chemical industry's need for continuous innovation means new entrants must not only match existing product quality but also invest heavily in future material science, a challenge that limits market entry.

Regulatory compliance, particularly concerning environmental and safety standards, presents another formidable hurdle. New companies must allocate considerable resources to understand and adhere to evolving global regulations, such as those driven by the EU's Green Deal. This complexity, coupled with the need for specialized talent and established customer relationships, makes it exceptionally difficult for new players to challenge incumbents like Covestro.

Porter's Five Forces Analysis Data Sources

Our Covestro Porter's Five Forces analysis is built upon a robust foundation of data, drawing from publicly available annual reports, investor presentations, and industry-specific market research from reputable firms like IHS Markit and Wood Mackenzie.