Corebridge Financial PESTLE Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Corebridge Financial Bundle

Navigate the complex external landscape impacting Corebridge Financial with our comprehensive PESTLE analysis. Understand how political shifts, economic volatility, and evolving social trends are shaping the company's strategic direction. Gain a critical advantage by downloading the full report, equipping you with actionable intelligence for informed decision-making.

Political factors

Corebridge Financial operates within an environment of heightened regulatory scrutiny, particularly concerning financial products like annuities and retirement solutions. This increased attention from regulators is a significant political factor influencing the company's market strategy.

The focus on consumer protection, transparency, and ensuring fair value for customers is intensifying. For instance, the UK's Financial Conduct Authority (FCA) Consumer Duty, which came into full effect in July 2024, mandates higher standards for product design, pricing, and customer support, with its scope expected to broaden further by 2025, impacting how Corebridge communicates and manages customer data.

The SECURE 2.0 Act, enacted in late 2022, continues to shape retirement planning, with key provisions like increased catch-up contribution limits for those aged 50 and over becoming effective in 2025. This legislation is designed to boost retirement savings by promoting automatic enrollment and contribution escalation within employer-sponsored plans, directly influencing Corebridge Financial's group retirement solutions.

Governments globally are prioritizing financial wellness, extending beyond traditional retirement savings to encompass broader financial education and planning. This push is evident in initiatives aimed at improving financial literacy among citizens, with many countries now mandating or encouraging financial education in schools and workplaces. For instance, the U.S. Department of Labor has been actively promoting retirement security and financial well-being programs for employees, signaling a significant policy shift.

This evolving landscape compels companies like Corebridge Financial to broaden their product suites and services. The focus is shifting towards offering holistic financial solutions that address immediate needs, debt management, and long-term wealth building, not solely retirement accumulation. This strategic adaptation is crucial for remaining competitive and relevant in a market where individuals seek comprehensive support for their financial lives.

Geopolitical Stability and Economic Policy

Geopolitical stability significantly impacts investor confidence, which in turn affects demand for Corebridge Financial's offerings. For example, heightened global tensions can lead to market volatility, making consumers more cautious about long-term financial commitments. Governments' economic policies, such as interest rate adjustments or fiscal stimulus, also play a crucial role in shaping the financial landscape where Corebridge operates.

The threat of cyberattacks from hacktivist groups, often in response to political events, poses a direct risk to financial institutions. In 2024, cybersecurity breaches in the financial sector saw a notable increase, with reports indicating that the average cost of a data breach reached $4.73 million. This underscores the need for robust security measures to protect client data and maintain operational integrity.

- Increased geopolitical tensions can suppress consumer spending on financial products.

- Government economic policies directly influence interest rates and market liquidity, affecting Corebridge's investment returns.

- Cybersecurity threats, amplified by political motivations, necessitate significant investment in protective technologies.

National Security and Cybersecurity Directives

Governments worldwide are sharpening their focus on national security and cybersecurity, leading to more stringent compliance requirements for financial firms like Corebridge. This heightened scrutiny aims to safeguard sensitive data and prevent devastating cyber breaches.

These directives translate into increased oversight of data security measures and mandated reporting for any cyber incidents. For Corebridge, this means a greater emphasis on robust operational resilience to meet these evolving national security standards.

- Increased Regulatory Scrutiny: Financial institutions face tougher regulations regarding data protection and breach notification, impacting compliance costs and operational procedures.

- Mandatory Incident Reporting: Firms are now required to promptly report cybersecurity incidents to relevant authorities, adding a layer of procedural complexity.

- Focus on Operational Resilience: Corebridge must demonstrate and maintain strong defenses against cyber threats to ensure continuity of service and protect customer data.

Government policies continue to shape the retirement landscape, with the SECURE 2.0 Act's provisions, like enhanced catch-up contributions for those 50 and older effective in 2025, directly impacting Corebridge's group retirement solutions.

Heightened geopolitical tensions can dampen investor confidence and consumer spending on financial products, while government economic policies, such as interest rate adjustments, significantly influence market liquidity and Corebridge's investment returns.

The increasing threat of cyberattacks, often politically motivated, necessitates substantial investment in protective technologies, with the average cost of a data breach in the financial sector reaching $4.73 million in 2024.

Governments are prioritizing financial wellness and literacy, pushing for broader financial education initiatives and robust retirement security programs, which encourages companies like Corebridge to offer more holistic financial solutions.

| Political Factor | Impact on Corebridge | Relevant Data/Initiative |

| Regulatory Scrutiny | Increased compliance costs and operational adjustments | UK FCA Consumer Duty (full effect July 2024, expanding by 2025) |

| Retirement Legislation | Shapes product development and market strategy | SECURE 2.0 Act (catch-up contributions effective 2025) |

| Geopolitical Stability | Influences investor confidence and market volatility | Heightened global tensions impact long-term financial commitments |

| Cybersecurity Directives | Requires significant investment in data protection | Average cost of data breach in finance: $4.73 million (2024) |

What is included in the product

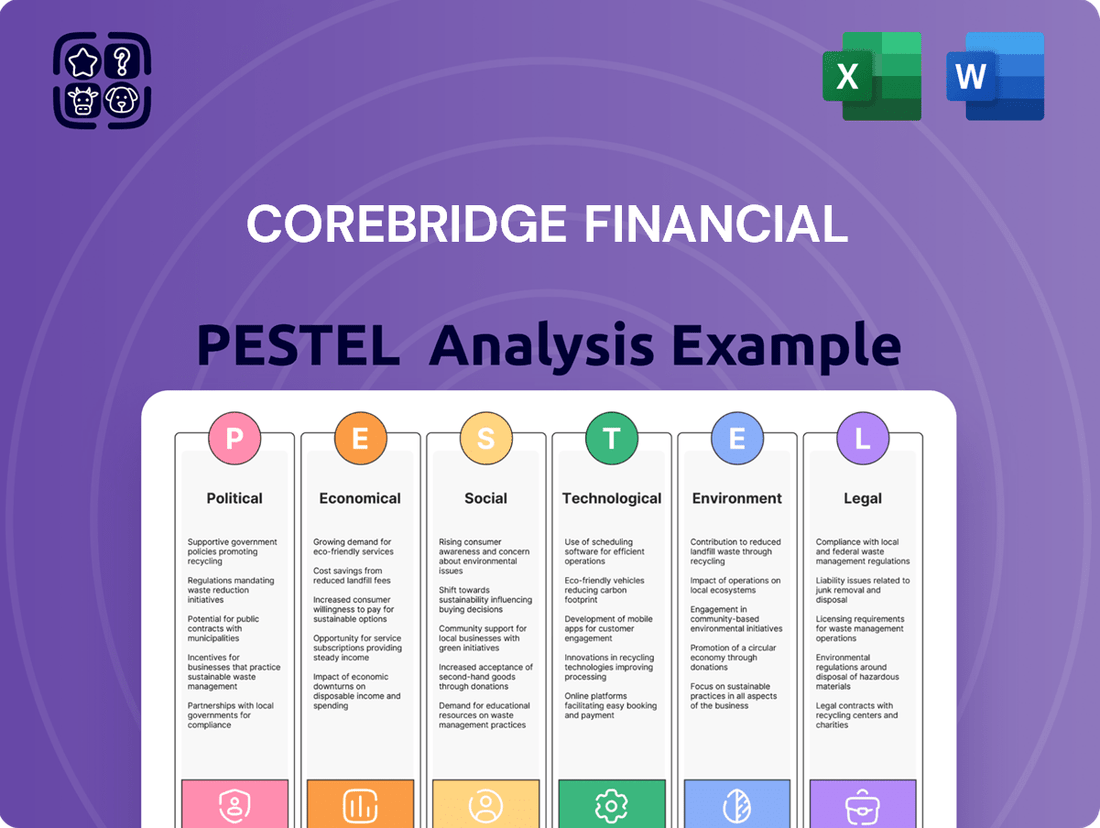

This PESTLE analysis provides a comprehensive examination of the external macro-environmental factors impacting Corebridge Financial, covering Political, Economic, Social, Technological, Environmental, and Legal dimensions.

It offers actionable insights for strategic decision-making, identifying potential threats and opportunities within Corebridge Financial's operating landscape.

A clear, actionable summary of Corebridge Financial's PESTLE analysis, presented in an easily digestible format, alleviates the pain of sifting through complex data, enabling faster strategic decision-making.

Economic factors

The Federal Reserve's monetary policy decisions, particularly regarding the federal funds rate, are crucial for Corebridge Financial. As of early 2024, interest rates have remained elevated compared to the preceding decade, impacting the cost of capital and the yields on Corebridge's investment portfolio. For instance, the Federal Reserve kept the target range for the federal funds rate between 5.25% and 5.50% through early 2024, a significant increase from near-zero levels seen in prior years.

Fluctuations in these rates directly influence Corebridge's profitability, especially for its annuity products where guaranteed rates are offered. Higher rates can increase the cost of these guarantees, while lower rates can compress net investment income. The company's ability to manage its asset-liability management effectively in this dynamic interest rate environment is paramount for maintaining strong financial performance.

Persistent inflation, a significant concern in 2024 and projected into 2025, directly impacts Corebridge Financial's customer base, particularly retirees. As the cost of living rises, the purchasing power of fixed incomes diminishes, creating a heightened demand for retirement solutions that can keep pace with inflation. This means products offering inflation protection become increasingly valuable.

The real returns on investments are also squeezed by inflation. For instance, if inflation averages 3.5% in 2024, a 5% nominal return on an investment translates to only a 1.5% real return. This dynamic affects the long-term growth of retirement savings and the ultimate value of insurance payouts, making it crucial for Corebridge to offer products that can outpace or at least match inflationary trends.

Corebridge Financial's revenue and the value of its managed assets are directly tied to equity market performance. For instance, in the first quarter of 2024, the S&P 500 saw a gain of 10.56%, which would positively impact fee income and asset valuations for Corebridge.

High market volatility can shift investor behavior, potentially increasing demand for more stable, less volatile products like fixed annuities or certain types of life insurance, which are key offerings for Corebridge.

The CBOE Volatility Index (VIX) averaged around 15.5 in Q1 2024, a relatively moderate level, but spikes can significantly alter customer preferences and product sales strategies for companies like Corebridge.

Economic Growth and Consumer Demand

The trajectory of economic growth directly impacts Corebridge Financial's market. A robust economy, characterized by rising GDP, typically translates to higher consumer confidence and increased disposable income. This scenario is favorable for financial products, as individuals are more inclined to allocate funds towards long-term savings and protection. For instance, in 2024, global economic growth is projected to remain steady, providing a supportive backdrop for the financial services sector.

Consumer spending habits are a critical driver for demand in the annuity and life insurance markets. When consumers feel financially secure and optimistic about the future, they are more likely to invest in products that offer financial security and wealth accumulation. Conversely, economic slowdowns or periods of high inflation can dampen consumer spending and shift priorities away from discretionary financial planning.

Key economic indicators relevant to Corebridge Financial's performance include:

- GDP Growth: A higher GDP growth rate generally correlates with increased consumer spending and investment in financial products. For example, if a major market for Corebridge experiences a projected GDP growth of 2.5% in 2024, this signals a positive environment for demand.

- Inflation Rates: Moderate inflation can sometimes encourage investment as a hedge, but high or unpredictable inflation can erode purchasing power and savings, negatively impacting demand for long-term financial products.

- Interest Rates: Central bank interest rate decisions significantly influence the attractiveness of savings products and the pricing of insurance policies.

- Unemployment Rates: Low unemployment signifies a healthy labor market, leading to more stable incomes and greater capacity for consumers to invest in financial planning.

Workforce Employment and Wage Growth

Workforce employment and wage growth are pivotal economic factors for Corebridge Financial, directly influencing consumer spending and investment capacity. Strong employment figures and rising wages generally translate to greater disposable income, which can bolster participation and contribution levels in retirement savings plans and increase demand for insurance products.

For instance, the U.S. unemployment rate hovered around 3.9% in early 2024, a historically low figure that supports robust consumer engagement with financial services. Concurrently, wage growth, while moderating from pandemic-era highs, continued to show positive trends, with average hourly earnings increasing by approximately 4.1% year-over-year in April 2024. These conditions are favorable for Corebridge, as more individuals with secure employment and higher earnings are better positioned to save for retirement and secure financial protection.

- Employment Stability: A low unemployment rate, such as the 3.9% seen in early 2024, indicates a healthy labor market where more individuals are earning income.

- Wage Increases: Positive wage growth, exemplified by the 4.1% average hourly earnings increase in April 2024, enhances individuals' ability to save and invest.

- Impact on Retirement Plans: Higher employment and wages directly correlate with increased contributions to group retirement plans offered by Corebridge.

- Demand for Insurance: Economic prosperity driven by employment and wage growth typically fuels demand for life, disability, and other insurance products.

Economic factors significantly shape Corebridge Financial's operating environment. Elevated interest rates, maintained by the Federal Reserve through early 2024 at a 5.25%-5.50% range, influence investment yields and product pricing. Persistent inflation in 2024 impacts consumer purchasing power, increasing demand for inflation-protected retirement solutions and squeezing real investment returns.

Robust GDP growth, projected to remain steady globally in 2024, supports consumer confidence and disposable income, benefiting demand for financial products. Favorable employment conditions, with the U.S. unemployment rate around 3.9% in early 2024 and wage growth at 4.1% year-over-year in April 2024, enhance individuals' capacity to save and invest in retirement and insurance solutions.

| Economic Factor | 2024 Data/Projection | Impact on Corebridge Financial |

|---|---|---|

| Federal Funds Rate (Target Range) | 5.25% - 5.50% (Early 2024) | Affects investment income and cost of guarantees on annuities. |

| Inflation Rate (Estimated) | ~3.5% (2024 projection) | Reduces real returns, increases demand for inflation-protected products. |

| S&P 500 Return (Q1 2024) | +10.56% | Boosts fee income and asset valuations. |

| U.S. Unemployment Rate | ~3.9% (Early 2024) | Indicates strong consumer income and capacity for financial planning. |

| Average Hourly Earnings Growth (YoY) | +4.1% (April 2024) | Enhances consumer ability to save and invest in Corebridge products. |

Preview Before You Purchase

Corebridge Financial PESTLE Analysis

The preview shown here is the exact Corebridge Financial PESTLE Analysis you’ll receive after purchase—fully formatted and ready to use. This comprehensive document breaks down the Political, Economic, Social, Technological, Legal, and Environmental factors impacting Corebridge Financial. Gain immediate access to actionable insights for strategic planning.

Sociological factors

The United States is experiencing a significant demographic shift, with a substantial increase in individuals reaching retirement age. Projections indicate that from 2024 through 2027, more Americans will turn 65 each year, creating a surge in demand for retirement planning and financial services. This trend directly impacts companies like Corebridge Financial, requiring them to adapt their product offerings to meet the evolving needs of an older demographic.

Longer life expectancies are a key factor, meaning many individuals are living well beyond their initial retirement savings plans. This longevity trend necessitates a fundamental reassessment of financial roadmaps, encouraging a greater focus on sustained income strategies and long-term investment management. Corebridge Financial must innovate to provide solutions that support individuals throughout extended lifespans, ensuring financial security well into their later years.

Traditional retirement is no longer a one-size-fits-all model. Many Americans are choosing to work longer, either out of necessity or for personal satisfaction, with some even transitioning into phased retirement or embarking on entirely new career paths. This shift means Corebridge must develop more adaptable financial products and services that support these varied post-work journeys.

The trend of working longer is significant. For instance, data from the U.S. Bureau of Labor Statistics indicated that the labor force participation rate for those aged 65 and over was projected to reach 22.1% by 2032, a notable increase from 18.7% in 2022. This growing segment of experienced workers presents opportunities for retirement solutions that accommodate continued income generation and flexible benefit structures.

Societies are increasingly prioritizing financial literacy and holistic financial wellness, extending beyond retirement planning to encompass overall financial health. This shift encourages companies like Corebridge to offer more robust financial education and resources, empowering individuals to navigate their financial journeys effectively.

For instance, a 2024 survey indicated that 65% of adults feel more motivated to improve their financial knowledge, a significant jump from previous years. This growing demand for financial guidance presents an opportunity for Corebridge to expand its educational offerings, potentially increasing customer engagement and loyalty.

Generational Wealth Transfer and Savings Behavior

A substantial shift in wealth is anticipated as Baby Boomers, a generation known for its accumulated assets, pass down fortunes to younger demographics. This intergenerational wealth transfer, estimated to be in the trillions, could significantly alter savings behaviors and investment strategies for recipients. For instance, projections suggest over $70 trillion could be transferred in the US alone by 2045, impacting how Millennials and Gen Z approach their finances.

The 'sandwich generation' faces a dual financial burden, supporting both aging parents and their own children. This strain on their resources can hinder their personal savings capacity, necessitating specialized financial planning and advice. Many in this demographic are delaying retirement or taking on additional debt to manage these competing financial demands.

- Projected Wealth Transfer: Over $70 trillion expected in the U.S. by 2045.

- Impact on Savings: Potential for increased savings rates among inheritors, but also pressure on the sandwich generation.

- Financial Pressures: The sandwich generation often juggles childcare costs with eldercare expenses.

- Tailored Advice Needed: Financial strategies must account for diverse generational financial realities and responsibilities.

Demand for Personalized and Accessible Solutions

A growing segment of the population, including seniors, is increasingly comfortable with technology and expects more tailored and convenient ways to handle their retirement and financial matters. This translates to a demand for better customer service, automated enrollment in financial plans, and user-friendly digital platforms that allow for self-management.

This shift in consumer expectation is pushing financial institutions like Corebridge Financial to innovate. The need for personalized financial advice and accessible digital tools is paramount. For instance, by the end of 2024, it's projected that over 60% of retirement plan participants will engage with digital tools for managing their accounts, highlighting the urgency for enhanced online capabilities.

- Technological Adoption: A significant portion of individuals across age groups are now using smartphones and online portals for financial management.

- Demand for Convenience: Customers expect 24/7 access to their financial information and the ability to make changes or seek advice through digital channels.

- Personalization: Generic financial advice is no longer sufficient; individuals are seeking solutions tailored to their specific life stages, risk tolerance, and financial goals.

Societal attitudes towards work and retirement are evolving, with a growing number of individuals opting for phased retirements or continuing employment beyond traditional retirement ages. This trend, evidenced by the U.S. Bureau of Labor Statistics projecting a rise in labor force participation for those 65 and older to 22.1% by 2032, necessitates flexible financial solutions that accommodate ongoing income streams and varied work arrangements.

Financial literacy is increasingly valued, with a 2024 survey revealing 65% of adults are more motivated to improve their financial knowledge, creating an opportunity for Corebridge to expand its educational resources and enhance customer engagement.

A substantial intergenerational wealth transfer is underway, with over $70 trillion projected to change hands in the U.S. by 2045, potentially reshaping savings behaviors and investment strategies for younger generations.

The sandwich generation, balancing care for both children and aging parents, faces significant financial pressures, highlighting the need for specialized financial planning that addresses these complex responsibilities.

Technological factors

Artificial intelligence and digital tools are fundamentally reshaping retirement income planning, enabling more personalized, real-time projections and strategies for individuals. Corebridge Financial is actively embracing this shift, having launched enhanced digital experiences for retirement plan participants. This strategic investment in technology aims to significantly improve client experience and optimize its operational platforms, reflecting a broader industry trend towards digital-first financial solutions.

The financial services industry, including companies like Corebridge Financial, remains a prime target for sophisticated cyber threats. In 2024, cyberattacks such as ransomware, phishing, and API exploits saw a notable increase in both frequency and complexity. Protecting sensitive customer data against these evolving threats is paramount for maintaining trust and operational integrity.

The financial planning landscape is being reshaped by technology, with a significant surge in automated solutions and robo-advisors. These digital platforms leverage artificial intelligence to analyze vast amounts of employee data and market trends, offering personalized retirement guidance. For instance, by mid-2024, many retirement plan providers reported over 40% of new accounts being opened through digital channels, highlighting a clear shift towards tech-enabled advice.

Digital Transformation of Customer Experience

Corebridge Financial is heavily investing in digital transformation to elevate its customer experience. This includes optimizing platforms with features like streamlined wellness centers and redesigned administration portals, making it easier for clients to access information and manage their plans. For instance, in 2024, the company continued to roll out enhancements to its digital tools, aiming for a more intuitive user journey.

The focus on digital access extends to providing both participants and plan sponsors with enhanced digital access to crucial plan information and resources. This commitment is reflected in their ongoing platform updates designed to simplify interactions and provide greater transparency. By late 2024, Corebridge reported a significant uptick in digital engagement across its participant portals, indicating successful adoption of these improved services.

- Enhanced Digital Access: Corebridge is prioritizing digital channels for plan information and resources.

- Platform Optimization: Investments are being made in user-friendly interfaces like redesigned administration portals.

- Improved Client Experience: The goal is to create a more seamless and efficient interaction for all users.

- Digital Engagement Growth: Early 2025 data suggests a positive trend in users utilizing digital platforms for plan management.

Big Data Analytics for Product Development and Risk Management

Corebridge Financial leverages big data analytics to refine product development and enhance risk management. By analyzing vast datasets, the company gains a granular understanding of customer preferences and emerging market trends, enabling the creation of highly tailored financial solutions. This analytical capability is crucial for developing personalized income strategies that cater to individual client needs.

The application of big data extends to robust risk management frameworks. Corebridge can identify and mitigate potential risks more effectively by processing and interpreting complex data patterns. For instance, in 2024, the insurance industry saw a significant increase in the use of AI and big data for underwriting, with some reports indicating a 15% improvement in risk assessment accuracy for new policies when advanced analytics were employed.

This data-driven approach allows for more precise segmentation of customer bases and a deeper insight into their financial behaviors and risk appetites. Consequently, Corebridge can offer more competitive and suitable products, such as variable annuities with dynamic features that adjust based on market performance and individual risk tolerance. By mid-2025, it's projected that over 70% of financial institutions will have integrated advanced analytics into their core risk management operations.

- Enhanced Customer Insights: Big data analytics provides granular understanding of customer needs and market shifts.

- Personalized Product Development: Facilitates the creation of customized income strategies and financial products.

- Improved Risk Management: Enables more accurate identification and mitigation of financial and operational risks.

- Competitive Advantage: Data-driven decision-making leads to more effective product offerings and client engagement.

Technological advancements are driving significant shifts in how financial services are delivered and consumed. Corebridge Financial is leveraging artificial intelligence and digital tools to personalize retirement income planning, offering real-time projections and strategies. By mid-2024, many retirement plan providers reported over 40% of new accounts being opened through digital channels, underscoring the industry's move towards tech-enabled advice.

The company is also enhancing its digital platforms to improve customer experience, with streamlined wellness centers and redesigned administration portals being key features. Early 2025 data indicates a positive trend in user engagement with these digital tools for plan management. Furthermore, big data analytics are being employed to refine product development and risk management, with projections suggesting over 70% of financial institutions will integrate advanced analytics into core risk operations by mid-2025.

| Technological Factor | Impact on Corebridge Financial | Supporting Data/Trends (2024-2025) |

| Artificial Intelligence & Digital Tools | Personalized retirement income planning, enhanced customer experience | 40%+ new accounts via digital channels (mid-2024); Increased digital engagement across participant portals (late 2024) |

| Cybersecurity | Protection of sensitive customer data against increasing threats | Notable increase in frequency and complexity of cyberattacks (2024) |

| Big Data Analytics | Refined product development, enhanced risk management, personalized solutions | 15% improvement in risk assessment accuracy for new policies using advanced analytics (2024); 70%+ financial institutions integrating advanced analytics into core risk operations (projected mid-2025) |

Legal factors

The insurance and retirement industries are seeing substantial shifts in their regulatory frameworks. For instance, 2025 will introduce new mandates, including efforts towards aligning regulations across different countries and more stringent consumer protection rules. Corebridge Financial needs to adapt to these evolving requirements.

A key development is the full rollout of Solvency UK reforms, which are expected to be in effect by the close of 2024. This signifies a critical period for financial institutions like Corebridge to ensure full compliance with updated capital and risk management standards.

Stringent data privacy laws, like the NAIC Insurance Data Security Model Law, now in effect in numerous U.S. states, and the UK's post-Brexit data protection framework, demand transparency in data collection and enhanced security measures. Corebridge must maintain robust data handling practices to avoid significant penalties for non-compliance.

The European Union's Digital Operational Resilience Act (DORA) is a significant regulatory development impacting financial institutions like Corebridge. DORA aims to bolster the financial sector's defenses against cyber threats and ICT disruptions. Corebridge must navigate extensive compliance requirements, with a critical deadline for submitting its DORA information register by April 30, 2025, directly influencing its operational resilience strategies.

AI Regulation and Ethical Guidelines

Regulators are intensifying scrutiny of artificial intelligence (AI), with the European Union's landmark AI Act officially adopted in May 2024. Key provisions, particularly those concerning prohibited AI practices, are set to take effect starting February 2025, signaling a significant shift in how AI can be deployed. This evolving legal landscape necessitates that Corebridge Financial meticulously aligns its AI applications within financial products and services to these burgeoning ethical standards and comprehensive regulatory frameworks to ensure compliance and mitigate risks.

Corebridge must proactively adapt its AI strategies to comply with the EU AI Act's risk-based approach, which categorizes AI systems based on their potential harm. For instance, AI systems deemed to pose an unacceptable risk, such as social scoring by governments, will be prohibited. Corebridge's commitment to ethical AI deployment will be paramount in navigating these new regulations.

- EU AI Act Adoption: May 2024, with prohibitions effective February 2025.

- Corebridge's Obligation: Ensure AI use in financial products and services aligns with emerging ethical guidelines and regulatory frameworks.

- Risk Mitigation: Proactive adaptation to the EU AI Act's risk-based approach is crucial for compliance.

Shareholder Governance and Corporate Amendments

Corebridge Financial stockholders approved significant amendments to its certificate of incorporation on July 9, 2025. These changes specifically address board authorization procedures and the process for shareholder written consent, aiming for greater corporate agility.

The amendments are designed to strike a balance, granting management enhanced flexibility in decision-making while ensuring robust shareholder rights are maintained. This governance evolution reflects a commitment to adapting to evolving market dynamics and stakeholder expectations.

Key aspects of these governance shifts include:

- Streamlined Board Authorization: Amendments facilitate more efficient board decision-making processes.

- Shareholder Written Consent: The process for shareholders to provide written consent has been updated to improve clarity and efficiency.

- Balancing Authority: The changes aim to empower management with greater operational flexibility without undermining shareholder oversight.

Corebridge Financial operates within a dynamic legal landscape, requiring constant adaptation to new regulations. The Solvency UK reforms, fully effective by the end of 2024, mandate updated capital and risk management standards. Furthermore, the EU's AI Act, adopted in May 2024, with key provisions effective February 2025, imposes strict ethical guidelines on AI deployment, impacting Corebridge's use of AI in financial products.

Data privacy laws, such as the NAIC Insurance Data Security Model Law and the UK's post-Brexit framework, demand enhanced security and transparency in data handling. Corebridge must also navigate the EU's Digital Operational Resilience Act (DORA), with compliance deadlines like the April 30, 2025, information register submission impacting its operational resilience strategies.

Shareholder approval of amendments to Corebridge's certificate of incorporation on July 9, 2025, streamlined board authorization and shareholder consent processes, aiming for greater corporate agility and a balance between management flexibility and shareholder rights.

Environmental factors

The financial world is increasingly focused on Environmental, Social, and Governance (ESG) factors. This trend is substantial, with the global ESG investment market anticipated to surpass $53 trillion by 2025, highlighting a significant shift in investment priorities.

Corebridge Financial is actively embracing this sustainability movement. The company is committed to weaving environmental considerations into its core business operations and actively investing in financial products designed for sustainability.

Climate change presents significant financial risks to businesses, including potential asset damage, operational disruptions, and diminished cash flows. For an insurance company like Corebridge Financial, these physical risks directly impact underwriting, as the frequency and severity of extreme weather events can lead to higher claims. In 2023, natural catastrophes caused an estimated $250 billion in economic losses globally, according to Swiss Re, highlighting the growing exposure for insurers.

Furthermore, climate change affects investment portfolios through transition risks and market volatility. Corebridge's investment strategy must account for the potential devaluation of assets tied to carbon-intensive industries or those vulnerable to physical climate impacts. This necessitates a robust integration of climate risk assessment into their overall risk management and capital allocation strategies to ensure long-term solvency and the ability to meet financial obligations.

Regulatory bodies worldwide are intensifying mandates for climate-related disclosures among financial institutions. For instance, the UK's Financial Conduct Authority (FCA) has introduced rules requiring listed companies to report on climate-related financial risks, with similar trends emerging in the EU and US. The Securities and Exchange Commission (SEC) in the United States has also proposed rules for climate-related disclosures, aiming to standardize reporting for publicly traded companies.

The European Union's Corporate Sustainability Reporting Directive (CSRD) and the associated European Sustainability Reporting Standards (ESRS) are significant drivers of this change. These regulations will necessitate comprehensive reporting from a broad range of insurance companies, including many that will be subject to these requirements starting with the 2024 financial year. This means companies like Corebridge Financial will need to provide detailed information on their environmental impact and climate-related strategies.

Demand for Green and Sustainable Products

There's a noticeable shift towards green and sustainable financial products, with both individual consumers and large institutions increasingly seeking out these options. This trend directly impacts companies like Corebridge Financial.

Corebridge has responded by introducing insurance product lines specifically designed with Environmental, Social, and Governance (ESG) principles in mind. This strategic move aligns with the company's broader objective of fostering sustainable investments and capitalizing on this growing market demand.

For instance, by the end of 2024, global sustainable investment assets were projected to reach over $50 trillion, highlighting the significant market opportunity. Corebridge's ESG-focused offerings are positioned to capture a portion of this expanding segment.

- Growing Consumer Preference: A significant percentage of investors, particularly younger demographics, now prioritize ESG factors in their investment decisions.

- Institutional Mandates: Many large institutional investors, such as pension funds and endowments, are increasingly incorporating ESG criteria into their investment strategies and mandates.

- Product Innovation: Corebridge's development of ESG-focused insurance products demonstrates a proactive approach to meeting this evolving demand.

- Market Growth: The sustained growth in sustainable finance indicates a long-term trend that Corebridge is strategically addressing.

Operational Carbon Footprint and Sustainability Initiatives

Corebridge Financial is actively addressing its operational carbon footprint, a growing concern for businesses worldwide. The company has set an ambitious target to achieve 100% carbon neutrality in its operations by 2025. This commitment is underscored by tangible progress, with Corebridge reporting a significant 30% reduction in its carbon footprint as of 2022.

These sustainability initiatives are not merely aspirational; they reflect a strategic imperative to align with global environmental standards and investor expectations. The focus on reducing emissions is a key component of their broader sustainability strategy, aiming for responsible business practices.

- Operational Carbon Footprint: Corebridge is committed to minimizing its impact on the environment.

- Carbon Neutrality Goal: The company aims to be 100% carbon neutral in its operations by 2025.

- Progress to Date: Corebridge achieved a 30% reduction in its carbon footprint in 2022.

Environmental factors significantly shape Corebridge Financial's operational landscape and strategic planning. The increasing frequency and severity of extreme weather events, which caused an estimated $250 billion in global economic losses in 2023, directly impact Corebridge's underwriting by increasing potential claims. Furthermore, regulatory pressures, such as the EU's CSRD and proposed SEC rules, are mandating more transparent climate-related financial disclosures, requiring companies like Corebridge to integrate climate risk assessment into their core strategies.

The growing demand for sustainable financial products, with global sustainable investment assets projected to exceed $50 trillion by the end of 2024, presents a significant market opportunity. Corebridge's commitment to achieving 100% carbon neutrality in its operations by 2025, evidenced by a 30% carbon footprint reduction by 2022, aligns with these market trends and investor expectations.

PESTLE Analysis Data Sources

Our PESTLE analysis for Corebridge Financial is built upon a robust foundation of data from leading financial institutions, government regulatory bodies, and reputable market research firms. We integrate insights from economic forecasts, demographic trends, technological advancements, and legislative updates to provide a comprehensive view.