Corebridge Financial Boston Consulting Group Matrix

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Corebridge Financial Bundle

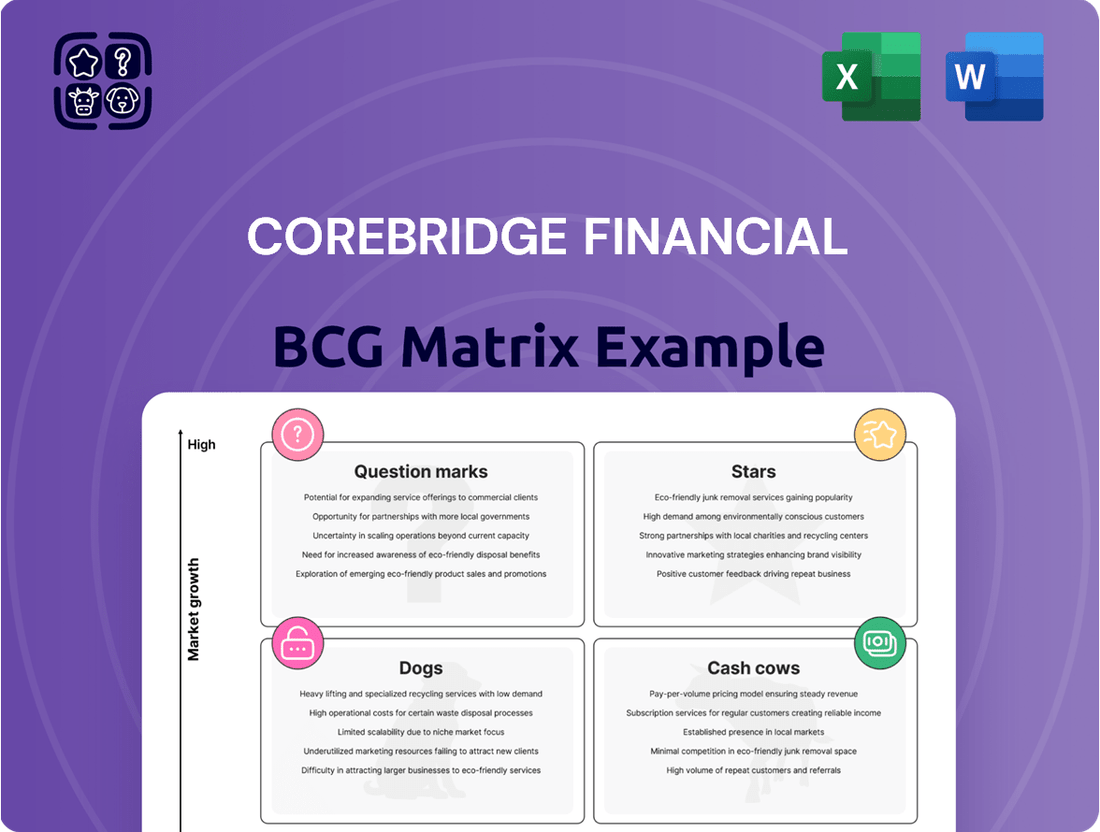

Curious about Corebridge Financial's strategic product positioning? Our BCG Matrix analysis reveals where their offerings fall as Stars, Cash Cows, Dogs, or Question Marks, offering a crucial glimpse into their market dynamics.

Don't settle for a partial view; unlock the full potential of this analysis by purchasing the complete Corebridge Financial BCG Matrix. Gain actionable insights and a clear roadmap for optimizing your investment and product strategies.

This comprehensive report provides quadrant-by-quadrant breakdowns and data-backed recommendations, empowering you to make informed decisions and navigate the competitive landscape with confidence.

Stars

Corebridge Financial's recent introduction of Registered Index-Linked Annuities (RILAs), exemplified by their Corebridge MarketLock® Annuity, signals a strategic move into a burgeoning market segment. This expansion positions them to capitalize on increasing investor interest in these hybrid products.

The company's achievement of being the sole top 3 annuity provider with offerings across all major annuity categories underscores a deliberate strategy to capture a significant share of this high-growth market. This comprehensive product suite allows Corebridge to cater to a wider range of customer needs and preferences.

Early market reception for Corebridge's RILAs has been notably positive, suggesting strong demand and the potential for substantial market share gains. For instance, the annuity market, in general, saw significant growth in 2023, with RILAs being a key driver.

The Individual Retirement segment is a powerhouse for Corebridge Financial, driving a substantial 59% of its Adjusted Pre-Tax Operating Income in 2024. This segment experienced a notable uptick in performance during the second quarter of 2024.

Corebridge holds the position of the second-largest annuity seller in the United States, a testament to its extensive product offerings designed to cater to a wide array of customer requirements. The company's robust sales figures, including $22.2 billion in individual annuity sales for 2024, underscore its leadership in a market energized by the demographic shift known as 'Peak 65'.

Corebridge Financial's significant investments in digital client experience and innovation are clearly positioning them for future growth. By enhancing digital capabilities and launching new online experiences for retirement plan participants, they are targeting a high-growth area with the aim of capturing future market share. These efforts are designed to make interactions more responsive and personalized, which is key in today's competitive financial services market.

Strategic Partnerships for Distribution Expansion

Corebridge Financial is actively pursuing strategic partnerships to broaden its distribution network. A prime example is their collaboration with Flourish, focusing on Multi-Year Guaranteed Annuities (MYGAs) specifically for Registered Investment Advisors (RIAs).

This move signifies a high-growth ambition, aiming to access new client bases and advisor-centric platforms. By offering flexible advisory solutions through these alliances, Corebridge intends to secure a more substantial presence within the advisory market.

- Flourish Partnership: Targeting RIAs with MYGAs expands Corebridge's reach into a key distribution channel.

- Advisor-Centric Platforms: Leveraging these platforms allows for tailored product offerings and enhanced advisor engagement.

- Market Share Growth: The strategy is designed to capture a larger segment of the growing advisory market.

- Star Product Strategy: This proactive expansion into high-growth channels aligns with a Star product classification in the BCG Matrix.

Variable Annuity Products (outside NY)

Corebridge Financial is strategically continuing to manufacture and distribute variable annuity products outside of New York. This commitment, bolstered by a flow arrangement, signals an intent to maintain and potentially expand its market share in this sector. The company's ongoing focus on these products, even amidst portfolio transformations, suggests they are viewed as a key area for continued growth and profitability.

The variable annuity market outside of New York represents a significant opportunity for Corebridge. In 2024, the U.S. variable annuity market saw continued interest, with sales figures indicating a resilient demand for these products. Corebridge's strategic positioning in this segment, leveraging existing distribution and product expertise, positions these offerings as potential stars within their portfolio.

- Market Presence: Continued distribution outside New York aims to capture a substantial portion of the broader U.S. variable annuity market.

- Product Strategy: Manufacturing and distributing these products indicates a belief in their ongoing relevance and revenue-generating potential.

- Growth Potential: The flow arrangement supports sustained sales and market share expansion in a dynamic annuity landscape.

- Financial Performance: Variable annuities often contribute significantly to fee-based revenue streams, enhancing overall financial stability.

Corebridge Financial's variable annuities, particularly those distributed outside of New York, are positioned as Stars in their BCG Matrix. The company's continued manufacturing and distribution, supported by a flow arrangement, indicate a strong commitment to this segment. This strategic focus aims to maintain and potentially grow market share in a resilient U.S. variable annuity market that saw continued interest in 2024.

| Product Category | Market Share | Growth Rate | Corebridge Position | BCG Classification |

|---|---|---|---|---|

| Variable Annuities (ex-NY) | Significant | Moderate to High | Strong | Star |

| Registered Index-Linked Annuities (RILAs) | Growing | High | Emerging Leader | Star |

| Individual Retirement Segment | Dominant (59% of 2024 Adj. Pre-Tax Op. Income) | Strong | Market Leader | Star |

What is included in the product

This BCG Matrix overview offers tailored analysis for Corebridge Financial’s product portfolio, highlighting which units to invest in, hold, or divest.

Corebridge Financial's BCG Matrix provides a clear, visual relief by instantly categorizing business units, eliminating the pain of complex analysis.

Cash Cows

Corebridge Financial's established fixed annuity products, particularly multi-year guaranteed annuities (MYGAs), are performing exceptionally well. These offerings have been a significant driver of premiums and deposits, showcasing their robust sales performance.

These annuities are known for providing stable, predictable returns, a valuable trait in a mature market. This stability makes them dependable sources of consistent cash flow for the company.

The continued strong customer interest is evident in the growth of fixed annuity deposits seen in 2024. This consistent influx of funds highlights their substantial market share and their role as reliable cash cows.

Corebridge Financial boasts a dominant position in the group retirement plan sector for public sector and non-profit organizations. This includes serving employees in K-12 education, higher education institutions, and healthcare providers.

While the Adjusted Profit Before Tax and Other Income (APTOI) within this segment has seen minor shifts, it remains a bedrock of stability. Corebridge's high market share in this mature market translates into predictable fee income and robust cash flow.

These established, long-term relationships and existing infrastructure mean that promotional spending needs are considerably less than in more dynamic, high-growth markets. This makes it a classic cash cow, generating consistent returns with minimal investment.

Traditional Life Insurance Products are a cornerstone of Corebridge Financial's business, positioning them as a strong Cash Cow. The company consistently ranks among the top issuers in the life insurance sector, demonstrating a solid market footprint. For instance, in 2024, Corebridge was recognized as a top 7 player in term life insurance sales and a top 11 player in overall life insurance issued, underscoring their significant market share.

Despite a projected modest growth rate for the broader life insurance market, Corebridge benefits immensely from its substantial in-force policy base. This established portfolio generates reliable underwriting margins and consistent fee income, creating a stable and predictable revenue stream. These mature products are vital for their consistent cash flow generation, a hallmark of a Cash Cow strategy.

Institutional Markets - Corporate Markets Products

Corebridge's Institutional Markets, specifically its Corporate Markets products, are a key component of its diversified income. These offerings generate an underwriting margin, reinforcing the company's balanced revenue streams. For instance, in Q2 2024, while APTOI within this segment experienced a dip, the segment's consistent contribution highlights its stable, high market share in a mature institutional financial services landscape.

These products function as cash cows, delivering reliable revenue with more modest growth potential. This stability is crucial for Corebridge's overall financial health.

- Consistent Revenue: Corporate Markets products provide predictable income, supporting Corebridge's financial stability.

- Mature Market Position: The segment holds a strong, established market share within the institutional financial services sector.

- Underwriting Margin: These products contribute directly to Corebridge's profitability through underwriting gains.

- Diversified Income: The segment enhances Corebridge's overall income mix, reducing reliance on any single product line.

Asset Management and Administration Services

Corebridge Financial's Asset Management and Administration Services represent a clear cash cow. As of December 31, 2024, the company managed and administered a substantial $404 billion in client assets. This massive scale translates directly into significant and stable fee income, a hallmark of a cash cow business. The recurring nature of these fees provides a reliable revenue stream, underpinning the company's financial stability even in fluctuating market conditions.

The substantial asset base is a testament to Corebridge's established presence and operational efficiency within the mature financial services sector. This segment consistently generates strong cash flows, allowing for reinvestment in other business areas or distribution to shareholders.

- Core Revenue Driver: $404 billion in client assets under management and administration as of December 31, 2024.

- Stable Income: Generates substantial and recurring fee income, independent of market growth rates.

- Industry Maturity: Benefits from its position in a well-established financial services industry.

- Cash Generation: A primary source of cash flow for the organization.

Corebridge Financial's fixed annuity products, particularly multi-year guaranteed annuities (MYGAs), are performing exceptionally well, driving significant premiums and deposits. These offerings provide stable, predictable returns, making them dependable sources of consistent cash flow for the company. The continued strong customer interest in 2024, evident in growing fixed annuity deposits, highlights their substantial market share and role as reliable cash cows.

Corebridge's dominant position in the group retirement plan sector for public sector and non-profit organizations, serving K-12, higher education, and healthcare providers, acts as a bedrock of stability. While Adjusted Profit Before Tax and Other Income (APTOI) in this segment has seen minor shifts, Corebridge's high market share in this mature market translates into predictable fee income and robust cash flow, with minimal promotional spending needs due to established long-term relationships.

Traditional Life Insurance Products are a cornerstone, with Corebridge consistently ranking among the top issuers. In 2024, they were a top 7 player in term life insurance sales and top 11 in overall life insurance issued. Despite modest market growth projections, their substantial in-force policy base generates reliable underwriting margins and consistent fee income, creating a stable revenue stream vital for cash flow generation.

Corebridge's Asset Management and Administration Services are a clear cash cow, managing and administering $404 billion in client assets as of December 31, 2024. This scale generates substantial and stable fee income, a hallmark of a cash cow business, providing a reliable revenue stream independent of market growth rates.

| Product Segment | BCG Category | 2024 Key Performance Indicator | Market Position | Cash Flow Contribution |

|---|---|---|---|---|

| Fixed Annuities (MYGAs) | Cash Cow | Strong premium and deposit growth | Significant market share | Stable, predictable returns |

| Group Retirement Plans (Public Sector/Non-Profit) | Cash Cow | Consistent fee income from established relationships | Dominant position | Robust and predictable cash flow |

| Traditional Life Insurance | Cash Cow | Top 7 in term life sales, Top 11 overall life insurance issued | Strong market footprint | Reliable underwriting margins and fee income |

| Asset Management & Administration | Cash Cow | $404 billion in client assets managed/administered (as of Dec 31, 2024) | Established presence | Substantial and recurring fee income |

What You See Is What You Get

Corebridge Financial BCG Matrix

The Corebridge Financial BCG Matrix preview you are viewing is the definitive, unwatermarked document you will receive immediately after purchase. This comprehensive analysis, meticulously crafted for strategic insight, will be delivered in its entirety, ready for immediate application in your business planning.

Rest assured, the BCG Matrix report you see here is the exact, fully formatted file you will download upon completing your purchase. It contains no demo content or alterations, providing you with a professional and actionable strategic tool without any hidden surprises.

What you are previewing is the actual Corebridge Financial BCG Matrix document that will be yours to use after purchase. This professionally designed, analysis-ready file is instantly downloadable, allowing you to leverage its strategic insights without delay.

Dogs

Corebridge Financial's strategic move to transfer a substantial part of its legacy variable annuity portfolio to Venerable highlights a significant portfolio adjustment. These portfolios, often burdened by tail risk and unpredictable GAAP earnings, are classified as Dogs in the BCG Matrix. This classification stems from their high capital requirements and limited potential for future growth or stable returns.

The decision to divest these legacy assets underscores a deliberate effort by Corebridge to shed products that act as cash traps. In 2024, such strategic divestitures are crucial for optimizing capital allocation and focusing resources on more promising business lines. This move aligns with a broader industry trend of de-risking and enhancing financial flexibility.

Within Corebridge Financial's life insurance portfolio, certain niche or older products might be classified as Dogs. These are offerings that have a small share in a slow-growing segment of the life insurance market, potentially struggling to gain traction against newer, more competitive products. For example, a specialized annuity product with declining demand and limited market penetration would fit this category.

These underperforming niche offerings typically yield minimal profits, or may even operate at a break-even point. They can tie up valuable capital and resources that could be better allocated to high-growth areas of the business. In 2023, Corebridge reported a net income of $3.3 billion, highlighting its overall strength, but the focus remains on optimizing the performance of all product lines.

The strategic approach for these Dog products involves careful evaluation for potential divestiture or a complete overhaul to revitalize their market position. This proactive management ensures that Corebridge's capital is deployed where it can generate the most significant returns and contribute to overall business growth, rather than being diluted by stagnant or declining product lines.

Certain outdated group retirement plans within Corebridge Financial's portfolio may be experiencing declining participation. These legacy offerings, often characterized by less competitive features or higher fees compared to newer alternatives, could represent a low market share in a mature segment. For instance, if a plan launched in the early 2000s hasn't been updated, it might struggle to attract younger employees or even retain existing participants who have access to more modern, flexible options.

Specific Low-Yielding Investment Strategies

Specific low-yielding investment strategies within Corebridge Financial's general account, if identified, would represent areas consistently underperforming benchmarks without a clear recovery plan. These might include certain legacy fixed-income allocations or alternative investments that have become cash traps, failing to meet desired risk-adjusted returns.

For instance, if a particular bond portfolio within Corebridge held a significant allocation to long-duration, low-coupon corporate bonds issued during a period of very low interest rates, its yield might be substantially below current market opportunities. In 2024, such a portfolio might be yielding only 2.5% while comparable new issues offer 4.5% or more. This would represent a clear underperformance and a drag on overall portfolio returns.

- Underperforming Asset Classes: Historically, certain segments of the high-yield bond market, particularly those with weaker credit quality, have shown periods of underperformance and volatility, potentially fitting this description if not actively managed.

- Static Allocation Strategies: Portfolios that employ rigid, buy-and-hold strategies without periodic rebalancing or adaptation to changing market conditions can become entrenched in low-yielding positions.

- Sub-Optimal Alternative Investments: Some private equity or venture capital funds, especially those with long lock-up periods and high fees, might fail to generate sufficient returns to justify their illiquidity and risk profile.

- Legacy Insurance Products: Certain older, guaranteed annuity products with fixed, low crediting rates can represent a low-yielding liability within the general account, particularly if interest rates have risen significantly since their inception.

Non-Core or Divested International Businesses

Corebridge Financial’s divestiture of international operations, a move contributing to a reported decrease in aggregate core sources of income in Q4 2024, highlights a strategic pruning of its portfolio. These divested businesses, especially those in less dynamic markets or with limited market penetration, would likely have been classified as Dogs within the BCG Matrix framework prior to their sale. This strategic exit signals a focus on optimizing resources and shedding underperforming or non-core assets to bolster overall financial health and future growth prospects.

The sale of these international entities reflects a deliberate strategy to streamline operations and concentrate on more profitable ventures. For instance, if these divested businesses consistently generated lower returns compared to their market potential, their classification as Dogs would be appropriate. This proactive approach to asset management is crucial for improving the company's financial performance and positioning it for stronger growth in its core markets.

- Divested International Businesses: Likely classified as Dogs in the BCG Matrix due to low growth or market share.

- Q4 2024 Impact: Contributed to a decrease in Corebridge's aggregate core sources of income.

- Strategic Rationale: Decision to exit indicates these were considered non-performing or underperforming assets.

- Focus Shift: Divestment allows Corebridge to concentrate resources on higher-potential core businesses.

Dogs within Corebridge Financial's portfolio represent business units or products with low market share in slow-growing industries. These are often characterized by minimal profitability or even losses, consuming resources without significant returns. The company's strategic divestiture of certain international operations in 2024, which impacted Q4 income, exemplifies the management of these Dog assets by exiting less promising markets.

Corebridge's sale of a substantial portion of its legacy variable annuity portfolio to Venerable also illustrates the management of Dog assets. These older products, often carrying tail risk and exhibiting volatile earnings, require significant capital while offering limited growth potential. This proactive approach aims to free up capital for more strategic investments.

Identifying and managing these Dog segments is crucial for Corebridge to optimize its capital allocation. By shedding underperforming or stagnant assets, the company can redirect resources towards areas with higher growth prospects and better returns, thereby enhancing overall financial health and shareholder value.

In 2023, Corebridge Financial reported a net income of $3.3 billion, demonstrating its overall financial strength. However, the ongoing management of its portfolio, including the identification and potential divestiture of Dog segments, remains a key element of its strategy to drive future growth and profitability.

Question Marks

Newly launched Guaranteed Minimum Withdrawal Benefit (GMWB) annuities, like Corebridge Financial's MarketLock Annuity, represent a high-growth 'Star' category within their portfolio. However, these innovative products are currently in their nascent adoption phase, meaning their market share is still relatively small compared to Corebridge's established annuity offerings.

Despite this current lower market share, the significant growth potential of these GMWB products necessitates substantial investment in marketing and distribution channels. This strategic push is crucial for capturing a larger portion of the market and successfully elevating them into the 'Star' quadrant of the BCG matrix.

Corebridge Financial's ambition to tap into new retirement market segments, like expanding employer-sponsored retirement plans to include broader financial wellness solutions or developing innovative annuity products for younger demographics, falls squarely into the Question Mark category of the BCG Matrix. These initiatives are characterized by their potential for high future growth, but currently represent nascent efforts with minimal market penetration for Corebridge.

These ventures demand significant capital allocation and dedicated strategic planning to assess their viability. For instance, Corebridge's 2024 strategy likely involves piloting new digital platforms or partnerships aimed at reaching underserved segments of the retirement market. The success of these investments will determine if they evolve into Stars with substantial market share or are divested as Dogs.

Corebridge Financial is investing heavily in advanced digital platforms designed to assist plan sponsors. These tools aim to boost participation in retirement plans, clarify benefit details, and foster greater engagement among employees. This focus on digital enhancement represents a strategic move to capture a larger share of the group retirement market and strengthen ties with existing clients.

These digital initiatives are considered high-growth potential areas for Corebridge, positioning them to gain a competitive edge. However, as relatively new offerings, their current market penetration and revenue generation are likely modest. This means they require substantial ongoing investment to reach their full potential and achieve widespread adoption within the industry.

Specific New Life Insurance Product Innovations

Corebridge Financial is strategically targeting growth in specific life insurance segments through product innovation. Their focus on Indexed Universal Life (IUL) and final expense products represents an effort to capture market share in areas with potentially higher growth, even if the broader life insurance market is experiencing slower expansion. This approach positions these innovative offerings as potential stars within their product portfolio, requiring significant investment in marketing and customer education to drive adoption.

The company's strategy in these niches acknowledges that while the potential for growth exists, their current market penetration might be limited. This necessitates a proactive approach to building brand awareness and demonstrating the value proposition of their new products. For instance, in 2024, the life insurance industry saw continued interest in IUL policies, with sales showing a steady upward trend, indicating a favorable market environment for such innovations.

- Indexed Universal Life (IUL): Corebridge is developing IUL products that offer potential for cash value growth linked to market indexes, appealing to consumers seeking upside potential with downside protection.

- Final Expense Insurance: Innovations in this space focus on simplifying the application process and offering flexible coverage options to meet the needs of individuals planning for end-of-life expenses.

- Market Penetration: While these segments offer growth opportunities, Corebridge's current market share within these specific innovative niches might be low, requiring substantial marketing and sales efforts.

- Growth Drivers: The success of these new products hinges on Corebridge's ability to effectively communicate their benefits and differentiate them from competitors in a dynamic market.

Strategic Investments in Technology and Digitization for Advisors

Corebridge Financial is strategically investing in digitizing its advisors' toolkits, aiming to create unique, interactive client experiences. This focus on financial technology aligns with a high-growth sector, with the goal of attracting new clients and improving overall financial well-being. As of 2024, the financial technology market continues to expand, with projections indicating substantial growth in digital wealth management solutions.

These technology initiatives are classified as question marks within the BCG matrix. While the potential for significant returns and market share expansion is high, the actual impact and profitability of these investments are still developing. For instance, in 2024, many financial services firms are reporting increased spending on AI-driven client engagement platforms, but the long-term ROI is often still under evaluation.

- Investment Focus: Digitizing advisor end-to-end toolkits for differentiated client experiences.

- Market Alignment: Targeting the high-growth financial technology sector to win new business.

- Objective: Enhance financial wellness for clients and expand market reach.

- BCG Classification: Question Mark, due to unproven return on investment and market share impact.

Corebridge Financial's ventures into new retirement market segments and innovative product development for younger demographics are prime examples of Question Marks in their BCG Matrix. These initiatives, while holding significant future growth potential, currently have minimal market penetration for the company.

These ventures require substantial capital allocation for development and market testing, with their ultimate success uncertain. For instance, Corebridge's 2024 strategy likely includes piloting new digital platforms or partnerships aimed at reaching underserved retirement market segments.

The outcome of these investments will dictate whether they evolve into Stars with significant market share or are eventually divested as Dogs, highlighting the inherent risk and reward associated with Question Mark products.

| Initiative | BCG Category | Market Growth | Market Share | Investment Rationale |

|---|---|---|---|---|

| New Retirement Segments | Question Mark | High | Low | Capture future growth, build new customer base |

| Annuities for Younger Demographics | Question Mark | High | Low | Tap into emerging market needs, long-term revenue |

| Digital Retirement Solutions Pilot | Question Mark | High | Low | Enhance client engagement, competitive edge |

BCG Matrix Data Sources

Our BCG Matrix leverages a robust data foundation, incorporating Corebridge Financial's annual reports, market share data, and industry growth projections to inform strategic positioning.