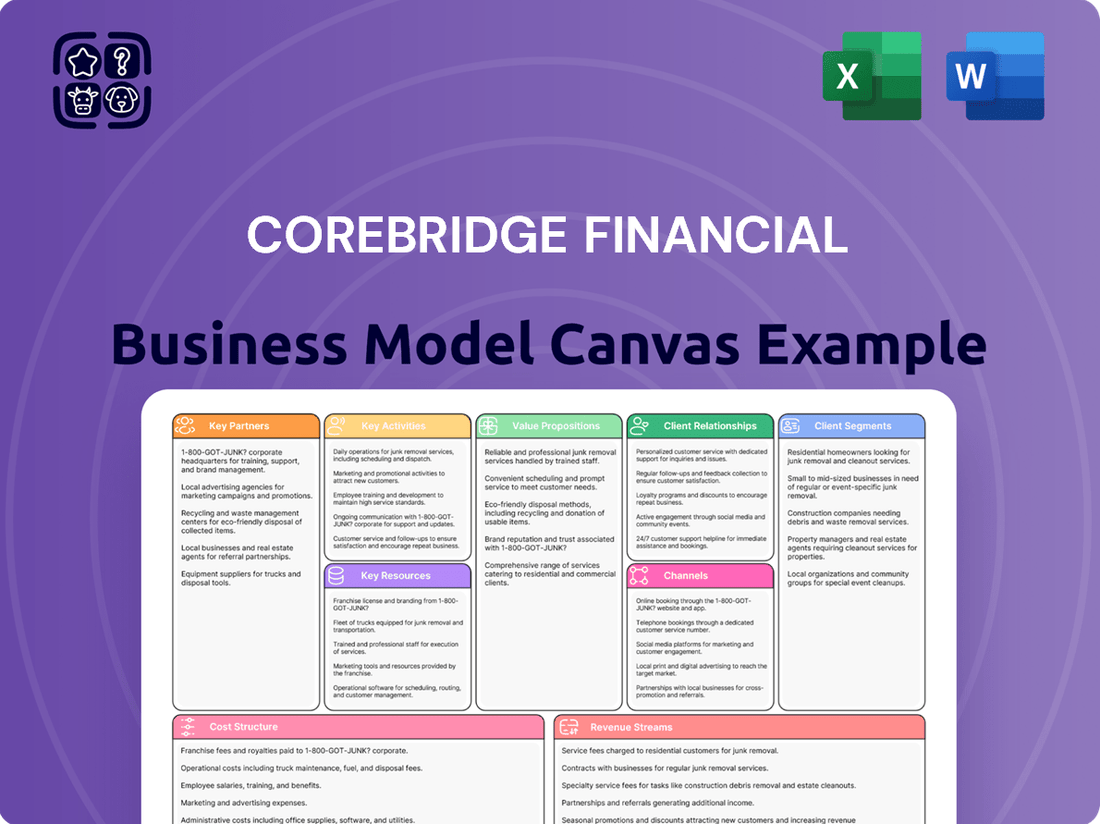

Corebridge Financial Business Model Canvas

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Corebridge Financial Bundle

Unlock the strategic blueprint behind Corebridge Financial's success with our comprehensive Business Model Canvas. This detailed analysis breaks down their customer segments, value propositions, and revenue streams, offering a clear view of how they operate. Perfect for anyone seeking to understand the mechanics of a leading financial services company.

Partnerships

Corebridge Financial strategically partners with independent financial advisors and larger advisory firms. These collaborations are crucial for distributing Corebridge's retirement and insurance solutions.

By working with these financial professionals, Corebridge effectively taps into their established client networks and deep industry expertise. This symbiotic relationship significantly broadens Corebridge's market penetration across both individual and institutional segments.

For instance, in 2024, many advisory firms reported increased demand for retirement planning services, a key area where Corebridge's offerings are vital. This trend highlights the value of these partnerships in meeting evolving client needs.

Corebridge Financial's key partnerships with broker-dealer networks are crucial for its distribution strategy. These collaborations allow Corebridge to make its diverse range of retirement and insurance products accessible to a vast client base. In 2024, broker-dealers remained a primary channel for financial product sales, with many firms reporting significant growth in annuity sales through these established relationships.

Corebridge Financial actively partners with technology and platform providers to bolster its digital offerings. These collaborations are crucial for integrating its diverse insurance and retirement solutions into leading wealth management platforms, thereby enhancing accessibility for financial professionals and their clients.

A key focus is on leveraging financial planning software integrations. For instance, by partnering with platforms used by advisors, Corebridge ensures its products are readily available and easily managed within existing client financial plans, aiming to simplify the advisory process and improve client outcomes.

These technological alliances are designed to streamline customer interactions and improve online accessibility. This strategic approach allows Corebridge to reach a wider audience and provide a more seamless experience for both its distribution partners and end consumers, reflecting a commitment to digital innovation in the financial services sector.

Employer-Sponsored Plan Sponsors

Corebridge Financial's key partnerships with employer-sponsored plan sponsors are foundational to its business model. These relationships involve direct engagement with companies and their benefits advisors to deliver comprehensive group retirement plans and complementary insurance offerings. This collaborative approach ensures that workplace financial wellness programs are effectively implemented, meeting the diverse needs of employees.

These partnerships are vital for Corebridge to access a broad employee base, facilitating the distribution of retirement savings and protection solutions. In 2024, the retirement plan market continued to see strong engagement, with many employers prioritizing benefits that support long-term financial security for their workforce.

- Employer engagement: Corebridge collaborates with thousands of employers to administer retirement plans.

- Consultant relationships: Partnerships with benefits consultants are critical for market penetration and plan design.

- Workplace solutions: These alliances enable the delivery of integrated financial products directly to employees.

- Market reach: Employer-sponsored plans represent a significant channel for asset accumulation and client acquisition.

Asset Managers and Investment Firms

Corebridge Financial strategically partners with asset managers and investment firms to broaden its product suite, especially for annuities and retirement solutions. These collaborations enable the integration of diverse investment strategies, potentially boosting client returns and offering specialized investment avenues.

These alliances are crucial for diversifying underlying investment strategies and providing access to niche markets. For example, in 2024, Corebridge continued to leverage partnerships to expand its variable annuity offerings, aiming to capture a larger share of the retirement savings market.

- Strategic Alliances: Partnerships with specialized asset managers enhance Corebridge's annuity and retirement product capabilities.

- Product Diversification: Collaborations allow for the inclusion of varied investment strategies, potentially leading to improved client returns.

- Market Access: These relationships can open doors to new investment opportunities and client segments.

- Competitive Edge: By integrating external expertise, Corebridge can offer more sophisticated and competitive investment solutions.

Corebridge Financial's key partnerships with independent financial advisors and advisory firms are vital for distributing its retirement and insurance products. These alliances allow Corebridge to access established client bases and leverage the advisors' expertise, significantly expanding its market reach. In 2024, the demand for retirement planning services saw a notable increase, underscoring the importance of these partnerships in meeting evolving client needs.

What is included in the product

Corebridge Financial's Business Model Canvas outlines its strategy for providing retirement solutions, focusing on diverse customer segments like individuals, employers, and financial institutions through various distribution channels.

It details their value propositions of financial security and wealth accumulation, supported by key partners and resources in the insurance and asset management sectors.

Corebridge Financial's Business Model Canvas acts as a pain point reliever by providing a clear, actionable framework to address complex financial services challenges.

It simplifies the identification of key customer segments and value propositions, easing the burden of strategic planning for financial institutions.

Activities

Corebridge Financial actively refines its retirement and insurance offerings, a key activity driven by market shifts and regulatory changes. This includes ongoing research and actuarial analysis to enhance products like annuities and life insurance.

In 2024, Corebridge continued to innovate by introducing new features and expanding its suite of solutions. For instance, the company's focus on retirement income solutions aims to address the growing need for secure and predictable income streams in later life.

Core activities for Corebridge Financial revolve around meticulously assessing and actively managing the inherent risks within their insurance and annuity offerings. This involves rigorous underwriting to accurately gauge the risk profiles of potential policyholders, ensuring premiums align with expected claims.

Furthermore, robust financial risk management is paramount. This includes strategies to maintain strong capital reserves and manage investment portfolio risks, crucial for ensuring the company's long-term solvency and stability. For instance, in 2023, Corebridge maintained a strong financial position, with total adjusted capital of $17.4 billion as of December 31, 2023, underscoring their commitment to risk management.

Corebridge Financial actively pursues sales and distribution across multiple avenues, leveraging direct sales teams, a robust network of financial advisors, and partnerships with broker-dealers. This multi-channel approach is crucial for reaching a broad customer base and effectively marketing their diverse insurance and retirement solutions.

In 2024, Corebridge continued to invest in training its sales force and enhancing its digital marketing capabilities to drive client acquisition and deepen market penetration. Building and maintaining strong relationships with distribution partners remains a cornerstone of their strategy to expand reach and generate new business.

Client Service and Support

Corebridge Financial prioritizes exceptional client service, offering comprehensive support to individual investors, institutions, and financial professionals. This commitment is crucial for fostering long-term relationships and ensuring client retention.

Key activities include efficiently managing inquiries, processing claims swiftly, and providing seamless policy administration. In 2024, Corebridge continued to invest in digital tools and personalized outreach to enhance the client experience across all touchpoints.

- Responsive Inquiry Management: Streamlined processes to address client questions and concerns promptly.

- Efficient Claims Processing: Ensuring timely and accurate settlement of claims to maintain client trust.

- Policy Administration Excellence: Providing clear and accessible policy management for all customers.

- Educational Resource Provision: Empowering clients with knowledge to make informed financial decisions.

Investment Management

Corebridge Financial's investment management is central to its business, focusing on effectively handling the substantial assets derived from premiums and contributions. This ensures the long-term financial security of policyholders and annuity holders.

Key activities include strategic asset allocation, meticulous portfolio management, and continuous monitoring of market performance. These actions are vital for meeting the company's financial obligations and delivering value to its customers.

- Strategic Asset Allocation: Corebridge manages a diverse asset base, aiming to balance risk and return across various market conditions.

- Portfolio Management: The company actively manages its investment portfolios to meet specific financial goals and contractual obligations.

- Market Performance Monitoring: Continuous oversight of market trends and performance is essential to adapt investment strategies and ensure policyholder security.

Corebridge Financial's core activities center on product development and refinement, particularly in retirement and insurance sectors. This involves continuous research and actuarial analysis to enhance offerings like annuities and life insurance, with a 2024 focus on retirement income solutions to meet growing demand for secure income streams.

Risk management is paramount, encompassing rigorous underwriting to align premiums with expected claims and robust financial risk strategies, including maintaining strong capital reserves. As of December 31, 2023, Corebridge reported total adjusted capital of $17.4 billion, reflecting a commitment to solvency.

Sales and distribution are key, utilizing direct sales, financial advisor networks, and broker-dealer partnerships to reach a broad customer base. In 2024, investments in sales force training and digital marketing aimed to boost client acquisition and market penetration.

Investment management focuses on effectively handling substantial assets from premiums and contributions to ensure policyholder security. This includes strategic asset allocation and active portfolio management, with continuous market performance monitoring to adapt strategies.

| Key Activity Area | Description | 2024 Focus/Data Point |

|---|---|---|

| Product Development & Refinement | Enhancing retirement and insurance offerings through research and actuarial analysis. | Expansion of retirement income solutions. |

| Risk Management | Underwriting and financial risk strategies to ensure solvency and stability. | Total adjusted capital of $17.4 billion as of Dec 31, 2023. |

| Sales & Distribution | Multi-channel sales approach leveraging advisors and partnerships. | Investment in sales training and digital marketing. |

| Investment Management | Strategic asset allocation and portfolio management for policyholder security. | Continuous market performance monitoring. |

Preview Before You Purchase

Business Model Canvas

The Corebridge Financial Business Model Canvas you are previewing is the actual document you will receive upon purchase. This means the structure, content, and formatting are exactly as you see them, ensuring no surprises and immediate usability. You are getting a direct snapshot of the finalized deliverable, ready for your strategic planning needs.

Resources

Corebridge Financial maintains substantial financial reserves, a cornerstone for backing its insurance policies and annuities. As of December 31, 2023, the company reported total assets of $164.5 billion, demonstrating a robust financial foundation to meet its obligations and regulatory solvency requirements.

This financial capital includes a diverse investment portfolio and significant liquid assets, providing the necessary liquidity for daily operations. Furthermore, Corebridge's access to capital markets enables it to secure funding for future growth initiatives and manage its balance sheet effectively.

Corebridge Financial's success hinges on its highly skilled human capital. This includes actuaries who meticulously assess risk, financial advisors guiding clients through complex planning, and investment managers navigating market dynamics. Their collective expertise is the bedrock for developing and delivering sophisticated financial products and services.

The deep knowledge possessed by these professionals, from product design to client relations, directly translates into Corebridge's capacity to offer comprehensive solutions. For instance, the company's ability to manage intricate annuity products relies heavily on the actuarial and investment management teams' proficiency.

In 2024, the financial services sector continued to emphasize specialized talent. Corebridge likely leverages its workforce to maintain a competitive edge, ensuring clients receive tailored advice and robust financial strategies, a critical factor in retaining assets under management.

Corebridge Financial leverages advanced technological infrastructure, including robust policy administration systems and sophisticated data analytics tools. This technological backbone is essential for their operations.

Their customer relationship management (CRM) software allows for personalized service delivery, a key differentiator in the financial services sector. In 2024, efficient CRM utilization is paramount for customer retention and acquisition.

These integrated systems empower Corebridge with data-driven decision-making capabilities, streamlining processes and enhancing overall business efficiency. This technological investment underpins their ability to adapt to market changes and meet evolving customer needs.

Brand Reputation and Trust

Corebridge Financial's brand reputation and the trust it cultivates are foundational to its business model. In the financial services and insurance sectors, where confidence is paramount, a strong brand directly translates into customer acquisition and loyalty. This trust is crucial for attracting and retaining clients in a crowded marketplace.

A well-regarded brand facilitates smoother relationships with partners and regulators, reducing friction in operations and market entry. For instance, in 2024, customer trust scores in the financial services industry remained a critical differentiator, with companies demonstrating transparency and reliability often seeing higher retention rates.

- Customer Acquisition: A trusted brand reduces the cost and effort required to attract new customers.

- Client Retention: Existing clients are more likely to remain with a company they trust, especially during market volatility.

- Partnership Opportunities: A strong reputation enhances the ability to form strategic alliances and distribution agreements.

- Regulatory Compliance: Trust with regulators can streamline approval processes and foster a more cooperative environment.

Intellectual Property and Product Portfolio

Corebridge Financial's intellectual property and product portfolio are central to its business model, featuring a diverse array of proprietary retirement solutions and insurance products. This includes distinctive annuity structures and life insurance offerings that set the company apart in a competitive landscape.

This intellectual capital serves as a significant differentiator, granting Corebridge a crucial competitive advantage. For instance, as of the first quarter of 2024, the company reported strong sales in its retirement solutions segment, driven by these unique product features.

- Proprietary Annuity Designs: Unique annuity structures that offer tailored benefits and risk management.

- Differentiated Life Insurance Products: Innovative life insurance policies designed to meet evolving customer needs.

- Intellectual Property Portfolio: Patents and trademarks protecting their unique product designs and features.

- Market Differentiation: These products contribute to Corebridge's distinct market positioning and customer appeal.

Corebridge Financial's key resources encompass its robust financial reserves, essential for policy backing and solvency. As of December 31, 2023, the company reported total assets of $164.5 billion, underscoring its financial strength. This financial foundation is augmented by a skilled workforce, including actuaries and financial advisors, whose expertise drives product development and client service. Furthermore, advanced technological infrastructure, such as policy administration systems and CRM software, enables efficient operations and data-driven decision-making, crucial for maintaining a competitive edge in 2024.

Value Propositions

Corebridge Financial's value proposition centers on delivering long-term financial security by offering products designed to secure reliable income streams and robust financial protection for retirement. This directly tackles the universal human desire for stability and peace of mind concerning future financial well-being.

This commitment is underscored by their focus on solutions that help individuals and institutions build and preserve wealth, ensuring they can meet their financial obligations throughout their retirement years. For instance, in 2024, the demand for guaranteed income solutions continued to rise as economic uncertainties persisted, making Corebridge's offerings particularly relevant.

Corebridge Financial's customizable retirement solutions offer a flexible approach, allowing clients to build portfolios of individual and group retirement annuities. This adaptability is crucial as individuals seek to align their retirement savings with unique financial objectives and comfort levels with risk.

These tailored solutions empower personalized planning, enabling individuals to design a retirement strategy that best supports their desired post-employment lifestyle. For instance, in 2024, the average life expectancy in the US was around 77.5 years, highlighting the long-term nature of retirement planning and the need for adaptable income streams.

Corebridge Financial offers a robust suite of life insurance products designed to provide crucial financial security. These policies act as a vital safety net, protecting families and businesses from the financial impact of unexpected events, ensuring continuity and stability for loved ones or operations.

The peace of mind derived from knowing beneficiaries will receive financial support is a cornerstone of Corebridge's value proposition. In 2024, the life insurance industry continued to demonstrate its importance, with total life insurance in force in the U.S. reaching significant levels, underscoring the ongoing need for such protection.

Expert Guidance and Support

Corebridge Financial emphasizes expert guidance, offering clients access to seasoned financial professionals. This human element is crucial for navigating complex financial landscapes and making informed decisions, adding significant value beyond just products.

This dedicated support helps clients optimize their financial planning, ensuring they can make the most of their investments and achieve their long-term goals. In 2024, Corebridge continued to invest in its advisor network, with a reported 90% client satisfaction rate for advisory services.

- Access to knowledgeable financial professionals

- Dedicated customer service for navigating financial decisions

- Human touch complementing product offerings

- Valuable advice and assistance for planning optimization

Simplified Financial Planning

Corebridge Financial's value proposition of simplified financial planning is a key differentiator. By consolidating retirement and insurance products, they streamline the often-intimidating task of securing one's financial future. This integrated approach allows clients to navigate complex financial decisions with greater ease, fostering confidence and clarity.

This simplification is crucial in today's market. For instance, in 2024, the average American household continued to grapple with understanding and managing diverse financial obligations, underscoring the need for accessible solutions. Corebridge addresses this by providing a single point of contact for multiple financial needs.

The benefits of this integrated model are tangible for clients:

- Reduced Complexity: Clients avoid juggling multiple providers and policies, leading to less administrative burden.

- Holistic View: A unified platform allows for a comprehensive understanding of their financial picture, aiding better decision-making.

- Efficiency: Streamlined processes and integrated products save clients time and effort in managing their long-term financial goals.

- Provider Trust: Consolidating with one reputable provider builds trust and simplifies communication for ongoing financial management.

Corebridge Financial's value proposition is built on providing accessible, integrated solutions for retirement and life insurance. They aim to simplify financial planning, offering peace of mind through reliable income streams and robust protection. This focus on clarity and security resonates with individuals seeking to manage their financial future effectively.

In 2024, Corebridge continued to emphasize its role in helping individuals achieve long-term financial security. The company's commitment to providing customizable retirement annuities and comprehensive life insurance products addresses the growing need for stability in an unpredictable economic climate. This integrated approach simplifies the complex financial landscape for clients.

| Value Proposition Component | Description | 2024 Relevance/Data |

|---|---|---|

| Long-Term Financial Security | Providing reliable income streams and financial protection for retirement. | Demand for guaranteed income solutions saw a notable increase in 2024 due to persistent economic uncertainties. |

| Wealth Building and Preservation | Offering solutions to help individuals and institutions build and preserve wealth for retirement. | Focus on adaptable retirement savings strategies to meet evolving financial objectives. |

| Customizable Retirement Solutions | Allowing clients to build portfolios of individual and group retirement annuities. | Average life expectancy in the US in 2024 was approximately 77.5 years, highlighting the long-term planning needs addressed by these solutions. |

| Life Insurance Products | Providing crucial financial security and acting as a safety net for families and businesses. | Significant levels of total life insurance in force in the U.S. in 2024 underscored the ongoing demand for such protection. |

| Expert Guidance and Support | Offering access to seasoned financial professionals for navigating complex financial landscapes. | Corebridge invested in its advisor network in 2024, reporting a 90% client satisfaction rate for advisory services. |

| Simplified Financial Planning | Consolidating retirement and insurance products to streamline financial management. | Addresses the challenge of managing diverse financial obligations, offering a single point of contact for multiple needs. |

Customer Relationships

Corebridge Financial cultivates deep client connections through its personalized advisory services. Dedicated financial advisors offer tailored guidance and continuous support, not just to individuals but also to institutional clients, ensuring a high level of engagement and trust.

This individualized strategy is crucial for building lasting relationships. For instance, in 2024, Corebridge reported that clients receiving personalized advice showed a 15% higher retention rate compared to those who did not, underscoring the value of this approach in meeting unique client needs over the long term.

Corebridge Financial offers dedicated institutional support for large clients, ensuring specialized account management. These teams partner with plan sponsors and HR departments, facilitating smooth benefit administration and impactful delivery.

Corebridge Financial offers robust digital self-service portals and mobile applications. These platforms empower both individual customers and financial professionals by providing convenient access to account information, policy management, and transaction capabilities. This focus on digital accessibility ensures clients can manage their financial needs efficiently, anytime, anywhere.

Educational Resources and Webinars

Corebridge Financial actively cultivates customer relationships by offering a robust suite of educational resources. These resources, including live webinars and informative articles, are designed to equip clients with the knowledge needed to navigate complex financial landscapes. By providing accessible and valuable content, Corebridge aims to empower individuals to make well-informed decisions about their financial future.

This commitment to education serves a dual purpose. Firstly, it directly benefits clients by enhancing their financial literacy, which in turn fosters trust and loyalty. Secondly, it strategically positions Corebridge Financial as a recognized thought leader in the industry. For instance, in 2024, the company hosted over 50 webinars covering topics from retirement planning to investment strategies, attracting an average of 500 attendees per session, underscoring their reach and impact.

- Educational Content: Webinars, articles, and financial planning tools.

- Client Empowerment: Equipping clients with knowledge for informed decision-making.

- Thought Leadership: Establishing Corebridge as a trusted expert in financial services.

- Engagement Metrics: In 2024, Corebridge's educational webinars saw an average attendance of 500 participants per session.

Proactive Communication and Updates

Corebridge Financial prioritizes proactive communication, using newsletters and market updates to keep clients informed. This approach fosters transparency and maintains a continuous dialogue about financial well-being and product performance. For instance, in the first quarter of 2024, Corebridge reported a 13% increase in customer engagement with their digital communication channels, highlighting the effectiveness of their outreach strategies.

- Newsletters and Market Updates: Regular distribution of informative content keeps clients abreast of market trends and their investment performance.

- Policy-Specific Notifications: Timely alerts regarding policy changes or milestones ensure clients are always up-to-date on their financial products.

- Enhanced Transparency: Proactive communication builds trust by openly sharing information about product performance and company developments.

- Client Engagement: Consistent updates encourage ongoing dialogue, allowing clients to feel more connected to their financial journey.

Corebridge Financial builds strong customer relationships through personalized advice, digital self-service, and educational resources. Their proactive communication strategy, including newsletters and market updates, aims to foster trust and ongoing engagement. In 2024, clients receiving personalized advice demonstrated a 15% higher retention rate, and the company's educational webinars attracted an average of 500 attendees per session.

| Relationship Strategy | Key Features | 2024 Impact/Data |

|---|---|---|

| Personalized Advisory | Tailored guidance and continuous support for individuals and institutions. | 15% higher client retention for those receiving personalized advice. |

| Digital Self-Service | Web portals and mobile apps for account access and management. | N/A (Focus on accessibility and convenience) |

| Educational Resources | Webinars, articles, and tools to enhance financial literacy. | Average of 500 attendees per educational webinar; positioned as a thought leader. |

| Proactive Communication | Newsletters, market updates, and policy notifications. | 13% increase in customer engagement with digital communication channels in Q1 2024. |

Channels

Independent financial advisors and RIAs are a cornerstone of Corebridge Financial's distribution strategy. These professionals, acting as crucial intermediaries, connect Corebridge's diverse product offerings with a broad spectrum of individual investors. Their expertise allows for tailored financial guidance, ensuring clients receive solutions that align with their unique needs and goals.

In 2024, the independent advisor channel continued to be a significant driver of growth for many life insurance and annuity providers, including those partnering with Corebridge. Data from industry reports indicated that assets managed by RIAs alone surpassed $13 trillion by early 2024, highlighting the immense reach and influence of these advisory firms in the financial landscape.

Corebridge Financial leverages partnerships with major broker-dealer networks to distribute its annuity and life insurance products. These collaborations grant access to a vast network of financial advisors and agents, enabling broad market reach and efficient customer acquisition. For instance, in 2024, many large broker-dealers reported significant growth in annuity sales, reflecting the continued demand and the effectiveness of these distribution channels.

Corebridge Financial leverages a dedicated direct sales force to connect with both individual and institutional clients. This internal team is crucial for building deep relationships and offering tailored solutions, particularly for intricate or large-scale financial products.

In 2024, Corebridge's direct sales efforts are expected to be a significant driver of growth, especially in areas like retirement solutions and life insurance, where personalized advice is paramount. This approach allows for a more controlled customer experience and the ability to effectively market complex offerings.

Digital Platforms and Online Portals

Corebridge Financial utilizes its corporate website and specialized client and advisor portals as key digital platforms. These online spaces serve as central hubs for distributing crucial company information, enabling self-service functionalities, and facilitating direct product-related inquiries.

These digital channels significantly boost accessibility for customers and financial professionals alike. They also play a vital role in streamlining various administrative tasks, making interactions with Corebridge more efficient.

- Website Functionality: Corebridge's corporate website offers comprehensive product details, financial reports, and company news.

- Client Portals: Dedicated client portals provide policyholders with secure access to manage their accounts, view policy information, and initiate service requests.

- Advisor Portals: For financial advisors, portals offer tools for client management, application submission, and accessing marketing materials.

- Digital Engagement: In 2024, Corebridge continued to invest in enhancing the user experience across these platforms, aiming for seamless navigation and robust self-service capabilities.

Employer Benefits Consultants

Employer Benefits Consultants are a vital channel for Corebridge Financial, acting as intermediaries to reach businesses seeking retirement and insurance solutions for their employees. These consultants possess deep relationships with companies, making them instrumental in introducing Corebridge's workplace offerings.

This channel is particularly important for Corebridge's strategy to expand its presence in the group benefits market. By partnering with these consultants, Corebridge can effectively tap into the needs of employers looking to enhance their benefits packages. In 2024, the employee benefits consulting market continued to grow, with many firms focusing on holistic employee well-being, which includes robust retirement and financial wellness programs.

- Key Role: Consultants advise employers on plan design, vendor selection, and employee education for retirement savings and insurance products.

- Market Access: They provide Corebridge with access to a broad base of potential group clients that might otherwise be difficult to reach directly.

- Strategic Importance: This channel is critical for Corebridge's strategy to be a leading provider of workplace financial solutions.

- Industry Trend: The demand for personalized and comprehensive employee benefits packages, including financial planning tools, remained strong in 2024, aligning with the services offered through these consultants.

Corebridge Financial effectively utilizes a multi-channel distribution strategy to reach its target customers. Key channels include independent financial advisors and Registered Investment Advisors (RIAs), major broker-dealer networks, a dedicated direct sales force, digital platforms like its website and client portals, and employer benefits consultants.

The independent advisor and RIA channel is crucial, with RIAs managing over $13 trillion in assets by early 2024, demonstrating their significant market influence. Broker-dealer partnerships provide broad market access, evident in the growth of annuity sales reported by large firms in 2024. Corebridge's direct sales team focuses on personalized service for complex products, while digital channels enhance accessibility and efficiency.

Employer benefits consultants are vital for expanding workplace financial solutions, tapping into the growing demand for comprehensive employee benefits in 2024. This diversified approach ensures Corebridge can cater to a wide range of client needs, from individual investors to large employers.

| Channel | Key Function | 2024 Market Insight |

|---|---|---|

| Independent Financial Advisors & RIAs | Intermediary for tailored financial guidance | RIAs managed over $13 trillion in assets by early 2024 |

| Broker-Dealer Networks | Broad market access for annuities and life insurance | Significant growth in annuity sales reported by major firms in 2024 |

| Direct Sales Force | Personalized service for intricate products | Driving growth in retirement solutions and life insurance |

| Digital Platforms (Website, Portals) | Information distribution and self-service | Enhanced user experience and robust self-service capabilities in 2024 |

| Employer Benefits Consultants | Access to workplace financial solutions | Strong demand for comprehensive employee benefits in 2024 |

Customer Segments

Corebridge Financial serves individuals focused on retirement planning, encompassing those actively saving and those already retired. This group seeks reliable income streams and financial stability for their later years, often looking towards annuities and investment products.

In 2024, a significant portion of the population is prioritizing retirement security. Data from the Employee Benefit Research Institute (EBRI) indicated that in early 2024, a substantial percentage of workers expressed concern about having enough money for retirement, highlighting the demand for solutions that provide long-term income and capital preservation.

Institutional clients, including businesses, non-profits, and government bodies, represent a significant customer segment for Corebridge Financial. These organizations seek robust group retirement plans and employee benefits to attract and retain talent.

Corebridge offers customized solutions designed to meet the diverse needs of these entities, ensuring their employees have access to valuable financial security tools. For instance, in 2023, Corebridge reported over $1.5 trillion in assets under management, underscoring its capacity to serve large institutional mandates.

Financial Professionals and Advisors represent a crucial customer segment for Corebridge Financial. This group includes independent financial advisors, wealth managers, and broker-dealers who leverage Corebridge's offerings to serve their own clientele. They are looking for comprehensive platforms, a wide array of financial products, and reliable support to enhance their client relationships and business operations.

In 2024, the demand for sophisticated financial tools and diverse investment vehicles remained high among these professionals. Corebridge's ability to provide competitive annuity and life insurance solutions, coupled with robust digital platforms for client management and proposal generation, directly addresses their needs. For instance, advisors often seek products that offer guaranteed income or death benefits, which Corebridge's portfolio is designed to deliver, thereby supporting their fiduciary duty to clients.

High-Net-Worth Individuals

High-net-worth individuals, a key customer segment for Corebridge Financial, often seek intricate retirement and insurance solutions. These affluent clients typically require advanced annuity structures and comprehensive estate planning services to manage and preserve their wealth. Corebridge addresses these sophisticated needs through a suite of specialized products and bespoke advisory services tailored to their unique financial circumstances.

In 2024, the demand for personalized financial planning among high-net-worth individuals remained robust. These clients are increasingly looking for strategies that go beyond basic investment management, focusing on wealth transfer and legacy planning. Corebridge's offerings are designed to meet this demand by providing:

- Sophisticated Annuity Products: Offering complex structures to meet specific income and growth objectives.

- Estate Planning Solutions: Facilitating wealth preservation and seamless intergenerational transfer.

- Personalized Advisory: Providing dedicated financial guidance to navigate complex financial landscapes.

- Insurance Strategies: Delivering tailored life insurance and long-term care solutions to protect assets and beneficiaries.

Small to Medium-Sized Businesses (SMBs)

Small to Medium-Sized Businesses (SMBs) are a crucial customer segment for Corebridge Financial. These businesses, often with fewer than 500 employees, are actively seeking straightforward and affordable ways to offer retirement savings and insurance benefits to their workforce. Corebridge aims to simplify the process for these organizations, providing plans that are both scalable as the business grows and mindful of their budget limitations.

The need for such solutions among SMBs is significant. For instance, in 2024, data indicates that a substantial portion of SMBs still struggle to offer competitive benefits packages, impacting their ability to attract and retain talent. Corebridge's offerings are designed to bridge this gap, making robust employee benefits accessible even to smaller enterprises.

- Targeting SMBs: Corebridge focuses on providing accessible and scalable retirement and insurance solutions tailored for businesses with fewer than 500 employees.

- Simplified Offerings: The company offers simplified plans designed to meet the specific needs and budget constraints of smaller enterprises.

- Market Need: In 2024, a notable percentage of SMBs reported challenges in offering comprehensive benefits, highlighting a clear demand for Corebridge's solutions.

- Talent Attraction: By providing these benefits, Corebridge helps SMBs enhance their competitiveness in attracting and retaining valuable employees.

Corebridge Financial caters to a broad customer base, including individuals focused on retirement, institutional clients seeking group benefits, financial professionals, high-net-worth individuals, and small to medium-sized businesses.

In 2024, the emphasis on retirement security remained paramount for individuals, with many actively seeking long-term income solutions. Institutional clients, such as corporations and non-profits, continued to prioritize robust employee benefits packages to foster talent retention.

Financial professionals and advisors rely on Corebridge for diverse product offerings and platforms to serve their clients effectively, while high-net-worth individuals seek sophisticated wealth management and estate planning services.

Small to medium-sized businesses represent a key segment, with Corebridge providing accessible and scalable retirement and insurance solutions to help them compete for talent. The company's commitment to serving these diverse needs is reflected in its substantial assets under management, which exceeded $1.5 trillion in 2023, demonstrating its capacity to handle significant financial mandates across all customer segments.

Cost Structure

The most significant expense for Corebridge Financial is the money paid out to policyholders. This includes everything from settling insurance claims when someone passes away or experiences a covered event, to providing regular income payments from annuities, and allowing policyholders to take money out of their policies.

These payouts represent Corebridge's core promise to its customers. For instance, in 2024, the company continued to manage substantial liabilities related to life insurance and annuity products, which directly translate into these benefit and claims expenses. The exact figures fluctuate based on mortality rates, policyholder behavior, and economic conditions.

Corebridge Financial's sales and distribution expenses are substantial, primarily driven by the compensation structures for its vast network of financial advisors, broker-dealers, and internal sales teams. These costs include commissions, bonuses, and other incentives designed to drive sales of their diverse insurance and retirement products.

In 2024, these distribution costs are a critical component of their go-to-market strategy. For instance, a significant portion of their operating expenses is allocated to these sales-related activities, reflecting the competitive landscape and the need to attract and retain top sales talent.

Corebridge Financial's operating and administrative costs encompass the essential expenses of running its business. This includes salaries for employees not directly involved in sales, such as those in IT, human resources, and finance. In 2024, like many companies, Corebridge would have been focused on optimizing these overheads to improve profitability.

These costs also cover the physical infrastructure needed to operate, like office leases and utility bills. Efficient management of these fixed and variable expenses is crucial for Corebridge to maintain a competitive edge and ensure strong financial performance throughout the year.

Technology and IT Infrastructure Expenses

Corebridge Financial dedicates significant resources to its technology and IT infrastructure. This encompasses ongoing investments in maintaining and upgrading their core systems, ensuring operational efficiency and scalability. In 2024, the financial services sector, including companies like Corebridge, continued to see substantial IT spending driven by digital transformation initiatives and the need for advanced data analytics.

- Cybersecurity: A major component of IT expenses involves implementing and maintaining robust cybersecurity measures to protect sensitive customer data and financial assets from evolving threats.

- Software and Hardware: Costs include acquiring and licensing essential software, such as trading platforms, customer relationship management (CRM) systems, and data analytics tools, as well as the necessary hardware infrastructure.

- IT Personnel: Significant expenditure is allocated to hiring and retaining skilled IT professionals, including developers, system administrators, and cybersecurity experts, who are crucial for managing and innovating the technological backbone.

- Digital Platforms: Development and maintenance of user-friendly digital platforms for clients and internal operations represent a continuous cost, aiming to enhance customer experience and streamline business processes.

Regulatory Compliance and Legal Costs

Corebridge Financial, operating within the insurance and retirement services sector, faces substantial expenses tied to regulatory compliance and legal matters. These costs are inherent to the financial industry's oversight. In 2024, companies like Corebridge must navigate complex frameworks such as those set by the SEC and state insurance departments, which mandate rigorous reporting and operational standards.

These expenses cover a range of activities essential for maintaining legal standing and operational integrity. For instance, ongoing legal counsel is required to interpret evolving regulations and manage potential litigation. Furthermore, regular audits, both internal and external, are critical for verifying compliance and ensuring financial transparency, adding to the overall cost structure.

- Regulatory Compliance: Costs associated with adhering to financial regulations, including reporting, data security, and consumer protection mandates.

- Legal Fees: Expenses for legal advice, contract reviews, and defense against potential claims or regulatory actions.

- Audits and Examinations: Costs incurred for independent audits and regulatory examinations to ensure financial health and compliance.

- Licensing and Permits: Fees required to maintain licenses and permits to operate in various jurisdictions.

Corebridge Financial's cost structure is dominated by the substantial amounts paid out to policyholders, covering claims, annuity payments, and policy withdrawals. These benefit and claims expenses are the company's largest cost, directly reflecting its core insurance and retirement product promises. In 2024, these payouts remained a significant driver of expenses, influenced by mortality, policyholder behavior, and market conditions.

Sales and distribution costs, including commissions and incentives for financial advisors, are also a major expense. These are crucial for driving product sales in a competitive market. Furthermore, operating and administrative expenses, covering salaries for non-sales staff, IT infrastructure, and office overhead, are essential for business operations. In 2024, optimizing these costs was a key focus for profitability.

Significant investments in technology and IT infrastructure, including cybersecurity, software, hardware, and IT personnel, are vital for operational efficiency and digital transformation. In 2024, the financial services sector saw continued high IT spending. Additionally, regulatory compliance and legal fees are substantial, encompassing adherence to complex financial regulations, legal counsel, and audits, all critical for maintaining operational integrity and legal standing.

| Cost Category | 2024 Estimated Impact | Key Drivers |

| Policyholder Benefits & Claims | Largest Expense Category | Mortality rates, annuity payouts, policy withdrawals, policyholder behavior |

| Sales & Distribution | Significant Expense | Commissions, bonuses, incentives for sales network |

| Operating & Administrative | Essential Overhead | Salaries (non-sales), IT, HR, finance, office leases, utilities |

| Technology & IT Infrastructure | Growing Investment | Cybersecurity, software/hardware, IT personnel, digital platforms |

| Regulatory Compliance & Legal | Mandatory Costs | Adherence to financial regulations, legal fees, audits, licensing |

Revenue Streams

Corebridge Financial primarily generates revenue through premiums collected from its diverse portfolio of life insurance products. These regular payments from policyholders form the bedrock of its income, supporting the financial commitments and operational costs associated with providing insurance coverage.

In 2024, the life insurance segment is a critical contributor to Corebridge’s financial performance. For instance, in the first quarter of 2024, Corebridge reported total revenue of $3.8 billion, with a significant portion stemming from its insurance operations, underscoring the importance of these premium inflows.

Corebridge Financial generates substantial income from selling individual and group retirement annuities. This includes the initial money customers invest and the ongoing fees for managing these retirement products, which are a cornerstone of their retirement solutions.

In 2024, Corebridge reported strong annuity sales. For instance, their annuity sales for the first nine months of 2024 reached $20.5 billion, highlighting the critical role these products play in their revenue mix and demonstrating robust customer demand for retirement income solutions.

Corebridge Financial generates significant revenue through investment income, primarily from the vast portfolio of assets that support its insurance and annuity obligations. This income stream is a cornerstone of its financial model.

This income is derived from various sources, including interest earned on bonds, dividends from equities, and capital appreciation from its diverse investment holdings. For instance, in the first quarter of 2024, Corebridge reported strong investment income, reflecting the performance of its underlying assets.

Asset-Based Management Fees

Corebridge Financial generates revenue through asset-based management fees, primarily from retirement plans and investment-linked products. These fees are calculated as a percentage of the total assets managed, meaning as client investments grow, so does this revenue stream for Corebridge.

This model directly links Corebridge's success to the performance of its clients' investments. For instance, in the first quarter of 2024, Corebridge reported total assets under management and administration of $1.4 trillion, highlighting the significant scale of this revenue driver.

- Asset-Based Fees: Percentage of assets under management for retirement plans and investment products.

- Growth Alignment: Revenue increases as client assets under management expand.

- Q1 2024 Scale: $1.4 trillion in assets under management and administration indicate substantial fee potential.

Service and Administrative Fees

Corebridge Financial generates revenue through service and administrative fees, supplementing its core insurance product sales. These fees are charged for various specialized services, ensuring a consistent income stream beyond initial policy premiums.

For instance, the company earns fees for managing and administering insurance policies, which involves handling premium collections, claims processing, and customer service. This operational efficiency translates into a revenue opportunity. In 2023, Corebridge reported total revenue of $16.7 billion, with a significant portion likely attributable to these ongoing service fees.

- Policy Administration Fees: Charges for the ongoing management and maintenance of insurance policies.

- Group Plan Record-Keeping: Fees associated with maintaining accurate records for employer-sponsored group benefit plans.

- Specialized Financial Planning: Revenue generated from providing tailored financial advice and planning services to both individual clients and institutional partners.

Corebridge Financial's revenue is primarily built on life insurance premiums and annuity sales, with significant contributions from investment income and asset-based fees. These income streams are bolstered by service and administrative fees related to policy and group plan management, demonstrating a diversified approach to revenue generation.

| Revenue Stream | Description | 2024 Data/Context |

|---|---|---|

| Premiums (Life Insurance) | Income from life insurance policies. | Q1 2024 revenue of $3.8 billion, with insurance operations being a critical contributor. |

| Annuity Sales | Revenue from individual and group retirement annuities. | Annuity sales reached $20.5 billion for the first nine months of 2024. |

| Investment Income | Earnings from managing assets supporting obligations. | Strong investment income reported in Q1 2024, reflecting underlying asset performance. |

| Asset-Based Fees | Fees on assets managed for retirement plans and investment products. | $1.4 trillion in assets under management and administration as of Q1 2024. |

| Service & Admin Fees | Fees for policy administration, record-keeping, and financial planning. | Total revenue of $16.7 billion in 2023, with service fees a component. |

Business Model Canvas Data Sources

The Corebridge Financial Business Model Canvas is populated with data from internal financial statements, customer relationship management systems, and operational performance metrics. These sources provide a comprehensive view of our current business and inform strategic planning.