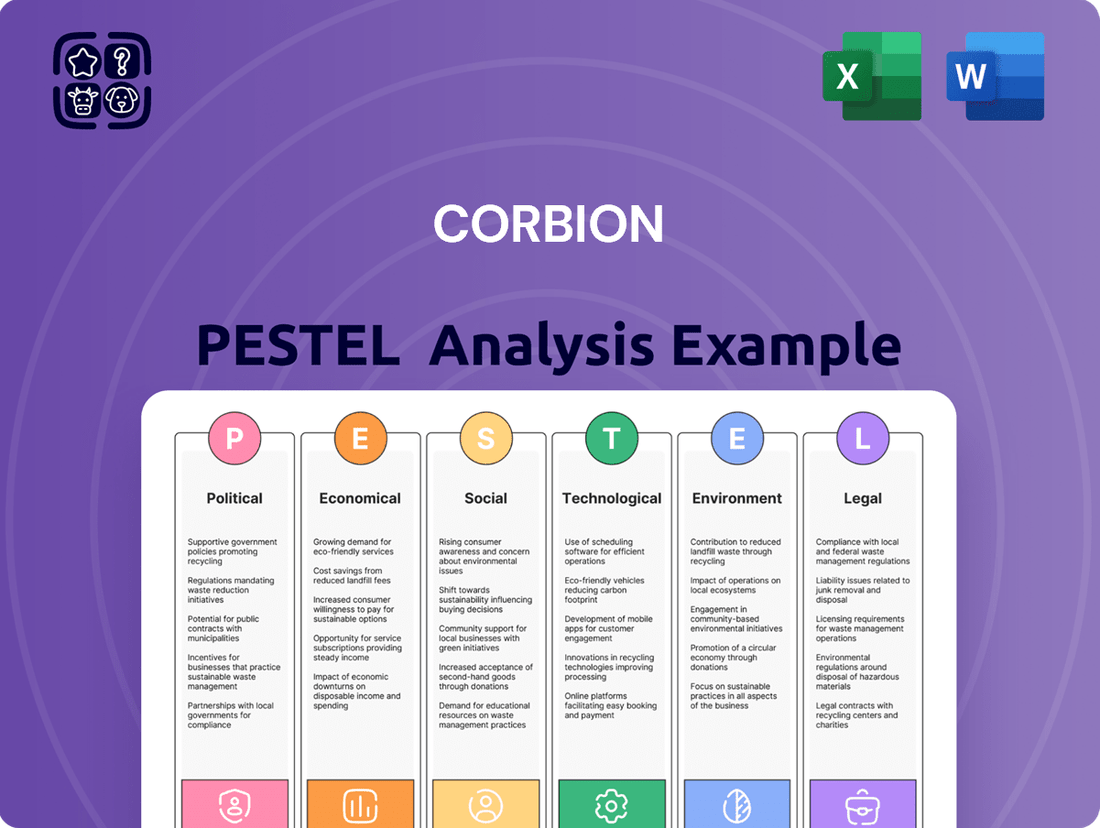

Corbion PESTLE Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Corbion Bundle

Uncover the critical Political, Economic, Social, Technological, Legal, and Environmental factors shaping Corbion's trajectory. Our expert-crafted PESTLE analysis provides a clear roadmap to navigate these external forces, empowering you to anticipate challenges and seize opportunities. Gain a competitive edge and make informed strategic decisions—download the full analysis now.

Political factors

Government policies and incentives are crucial for Corbion, a leader in bio-based ingredients. For instance, the European Union's Green Deal, aiming for climate neutrality by 2050, directly supports the bio-based economy by encouraging sustainable alternatives to fossil-based products. This policy environment, including potential subsidies for bio-based material innovation, is expected to drive demand for Corbion's offerings.

In 2024, many governments are actively reviewing and implementing policies to foster the bio-economy. The United States' Inflation Reduction Act, for example, provides significant tax credits for clean energy and sustainable manufacturing, which can indirectly benefit companies like Corbion by making bio-based production more cost-competitive. Such financial incentives are vital for accelerating the adoption of sustainable ingredients.

The trajectory of government support for the bio-based sector is a key determinant of Corbion's market expansion. While supportive policies can unlock significant growth opportunities, a shift towards less favorable regulations or a reduction in incentives could present challenges. Corbion's strategic planning heavily relies on anticipating these policy shifts and leveraging existing support mechanisms.

Global trade policies, including tariffs and trade agreements, significantly influence Corbion's international operations and supply chain. As a prominent player in the global market, Corbion's ability to efficiently source raw materials and distribute its diverse product portfolio hinges on open and predictable trade environments. For instance, the ongoing trade tensions between major economic blocs could lead to increased import duties on key ingredients or finished goods, directly impacting Corbion's cost structure and competitive pricing in various regions.

Food safety and ingredient labeling regulations are a constant factor for Corbion, impacting its food preservation and functional ingredient lines significantly. These rules differ greatly by region, influencing what ingredients can be used and how products are marketed.

Stricter or evolving regulations, particularly those favoring natural and clean-label ingredients, can be a boon for Corbion. The company’s emphasis on innovative, natural solutions positions it well to capitalize on these trends. For instance, as of early 2024, consumer demand for ‘free-from’ labels continues to rise, a market segment where Corbion’s bio-based ingredients are well-suited.

However, unfavorable regulatory shifts pose risks. Such changes might force Corbion into costly product reformulations or, in some cases, lead to the withdrawal of certain products from specific markets, thereby affecting sales volumes and profitability.

Bioplastics Policy and Legislation

Governments worldwide are increasingly enacting policies to curb plastic pollution, directly boosting the bioplastics market. For instance, the European Union's Single-Use Plastics Directive, implemented in 2021, mandates reductions in certain plastic products and encourages the use of sustainable alternatives. This legislative push is a significant tailwind for companies like Corbion, a major producer of lactic acid, a key ingredient in polylactic acid (PLA) bioplastics.

The global bioplastics market is projected to see substantial growth, with some estimates suggesting it could reach over $20 billion by 2027, driven by these supportive policies. This presents a clear opportunity for Corbion to expand its market share. However, navigating the evolving regulatory landscape, including varying standards for biodegradability and compostability across different regions, also poses compliance challenges that require strategic adaptation.

- EU Single-Use Plastics Directive: Mandates reductions in specific plastic items, fostering demand for bioplastic alternatives.

- Market Growth Projections: Global bioplastics market expected to exceed $20 billion by 2027, fueled by policy support.

- Regulatory Evolution: Ongoing changes in biodegradability and compostability standards create both opportunities and compliance hurdles.

Geopolitical Stability and Supply Chain Risks

Geopolitical instability, such as ongoing conflicts and trade disputes, poses a significant threat to Corbion's operations by disrupting global supply chains. These events can lead to sudden increases in the cost of essential raw materials, like palm oil and sugar, which are vital for Corbion's biochemical production. For instance, the ongoing geopolitical tensions in Eastern Europe have contributed to elevated energy prices, directly impacting Corbion's manufacturing expenses.

Corbion's reliance on international sourcing means that political events in key regions can affect the availability and timely delivery of its ingredients. For example, disruptions in major agricultural export hubs due to political unrest can create shortages and price volatility for key inputs. In 2024, the World Bank reported that supply chain disruptions linked to geopolitical factors added an estimated 1.5% to global inflation.

To counter these political risks, Corbion prioritizes a diversified supply chain strategy and robust risk management frameworks. This includes developing relationships with multiple suppliers across different geographic locations to ensure continuity of supply.

- Diversified Sourcing: Corbion actively seeks suppliers from various regions to reduce dependence on any single country or political bloc.

- Risk Assessment: Regular geopolitical risk assessments are conducted to identify potential disruptions and their impact on raw material availability and pricing.

- Inventory Management: Strategic inventory levels are maintained for critical raw materials to buffer against short-term supply chain interruptions.

- Supplier Collaboration: Close collaboration with key suppliers helps in anticipating and mitigating potential political fallout on their operations.

Government policies and incentives are crucial for Corbion, a leader in bio-based ingredients. The European Union's Green Deal, aiming for climate neutrality by 2050, directly supports the bio-based economy by encouraging sustainable alternatives to fossil-based products. In 2024, many governments are actively reviewing and implementing policies to foster the bio-economy, such as the United States' Inflation Reduction Act, which provides significant tax credits for clean energy and sustainable manufacturing, potentially benefiting companies like Corbion.

The trajectory of government support for the bio-based sector is a key determinant of Corbion's market expansion. Supportive policies can unlock significant growth opportunities, while less favorable regulations or reduced incentives could present challenges. Global trade policies, including tariffs and trade agreements, also significantly influence Corbion's international operations and supply chain, impacting cost structure and competitive pricing.

Food safety and ingredient labeling regulations differ greatly by region, influencing what ingredients can be used and how products are marketed. Stricter regulations favoring natural and clean-label ingredients can be a boon for Corbion, as seen with rising consumer demand for ‘free-from’ labels in early 2024. However, unfavorable regulatory shifts might force costly product reformulations or market withdrawals.

Governments worldwide are increasingly enacting policies to curb plastic pollution, directly boosting the bioplastics market. The European Union's Single-Use Plastics Directive, implemented in 2021, mandates reductions in certain plastic products and encourages sustainable alternatives like PLA bioplastics, a key area for Corbion. The global bioplastics market is projected to exceed $20 billion by 2027, driven by these supportive policies, though evolving biodegradability standards create compliance hurdles.

What is included in the product

This PESTLE analysis of Corbion examines how political, economic, social, technological, environmental, and legal forces shape its business landscape, offering a comprehensive view of external influences.

Provides a clear, actionable framework to identify and mitigate external threats and opportunities, thereby reducing uncertainty and supporting strategic decision-making.

Economic factors

Global economic growth significantly impacts Corbion's performance, as consumer purchasing power directly influences demand for its ingredients used in food, personal care, and animal nutrition. A robust global economy in 2024 and projected for 2025 generally translates to higher consumer spending on processed foods and everyday goods, which are key markets for Corbion. For instance, the International Monetary Fund (IMF) projected global growth at 3.2% for 2024, a figure that underpins the potential for increased demand across Corbion's diverse product portfolio.

Conversely, economic slowdowns or recessions pose a challenge by potentially dampening consumer demand and creating pricing pressures for Corbion's offerings. Should economic headwinds intensify in late 2024 or into 2025, a contraction in discretionary spending could lead to reduced sales volumes for certain product categories. This economic sensitivity highlights the importance of Corbion’s diversified market presence to mitigate localized downturns.

Corbion's core production hinges on bio-based inputs such as corn and sugarcane. For instance, corn prices saw significant swings in 2024, with futures markets reacting to drought concerns in key growing regions, impacting input costs for companies like Corbion.

These agricultural commodity prices are inherently volatile, susceptible to weather patterns, global trade policies, and shifting supply-demand dynamics. A 10% increase in corn prices, for example, could directly translate to a higher cost of goods sold for Corbion, potentially squeezing profit margins if not managed effectively.

To navigate this, Corbion likely employs sophisticated procurement strategies and hedging instruments. These measures are critical to stabilize input costs and maintain predictable profitability in the face of unpredictable agricultural markets, a strategy vital for sustained financial health in 2025.

Rising inflation, especially in energy, logistics, and labor, directly impacts Corbion's operational costs. For instance, global energy prices saw significant volatility in 2024, with the International Energy Agency reporting average Brent crude oil prices around $80-$90 per barrel for much of the year. This surge in input costs can squeeze profit margins if not effectively passed on to consumers.

Corbion's strategy to counter these pressures involves enhancing operational efficiency and implementing robust cost management. However, if inflation remains elevated, as predicted by many economic forecasts for 2025, it could challenge the affordability of Corbion's bio-based ingredients and solutions for its customer base, potentially impacting sales volumes.

Currency Exchange Rate Fluctuations

Corbion, as a global entity, navigates the complexities of operating across various currencies, inherently exposing it to the volatility of exchange rate fluctuations. These movements can significantly alter reported revenues and profits, as well as influence the price competitiveness of its diverse product portfolio in international markets.

For instance, in the first half of 2024, Corbion reported that currency headwinds impacted its net sales, with the strengthening of the Euro against some key trading currencies leading to a reported decrease in sales value when translated back to its reporting currency. This highlights the direct financial impact of currency shifts.

To mitigate these risks, Corbion actively employs currency hedging strategies. These financial instruments are designed to lock in exchange rates for future transactions, thereby providing a degree of predictability and stability to its financial results amidst an unpredictable global currency landscape.

- Global Operations: Corbion's presence in numerous countries necessitates transactions in multiple currencies, making it vulnerable to exchange rate volatility.

- Financial Impact: Unfavorable currency movements can reduce reported revenues and profits, affecting overall financial performance and market competitiveness.

- Hedging Strategies: The company utilizes currency hedging to manage and minimize the financial risks associated with foreign exchange rate fluctuations.

- 2024 Performance: Early 2024 data indicated that currency headwinds posed a challenge, impacting reported sales figures due to the Euro's strength against other currencies.

Investment in Sustainable Solutions

Corbion's strategic focus on sustainable solutions, including natural food preservation, algae-based ingredients, and lactic acid derivatives, necessitates significant capital allocation. For instance, the company has been actively investing in expanding its bioplastics production capacity, a key area for growth. The economic viability of these investments hinges on securing favorable financing and the efficient deployment of capital to meet evolving consumer demand for eco-friendly products.

The global market for sustainable ingredients and bioplastics is projected for robust growth, presenting both opportunities and economic challenges for Corbion. For example, the European bioplastics market alone was estimated to reach approximately €3.5 billion in 2023, with strong growth anticipated in the coming years. This trend underscores the importance of continued investment in research and development, as well as manufacturing capabilities, to maintain a competitive edge.

- Corbion's investment in algae-based ingredients aims to tap into a rapidly growing market, with global algae-based food market projected to reach over $8 billion by 2030.

- The company's commitment to natural food preservation aligns with consumer preferences, as the global natural food preservatives market is expected to grow significantly, driven by health and wellness trends.

- Effective capital management is crucial for Corbion to fund its expansion plans in lactic acid derivatives and natural polymers, segments that are experiencing increased demand due to their versatility and sustainability credentials.

- Securing competitive financing for these capital-intensive projects will directly impact Corbion's profitability and ability to scale its sustainable solutions.

Global economic growth directly influences Corbion's sales, with a projected 3.2% global growth for 2024 by the IMF suggesting increased consumer spending on its food and personal care ingredients. However, economic slowdowns in late 2024 or 2025 could dampen demand and create pricing pressures.

Corbion's input costs are sensitive to agricultural commodity prices, such as corn, which experienced volatility in 2024 due to weather concerns. For instance, a 10% rise in corn prices could directly impact Corbion's cost of goods sold.

Rising inflation, particularly in energy and logistics, increased Corbion's operational costs in 2024, with Brent crude averaging $80-$90 per barrel. Elevated inflation in 2025 could challenge the affordability of Corbion's bio-based ingredients.

Corbion operates across multiple currencies, making it vulnerable to exchange rate fluctuations. In early 2024, currency headwinds impacted reported sales due to the Euro's strength, necessitating active currency hedging strategies.

| Economic Factor | Impact on Corbion | 2024/2025 Data/Projection |

| Global Economic Growth | Influences consumer spending on Corbion's products. | IMF projected 3.2% global growth for 2024. |

| Agricultural Commodity Prices | Affects input costs (e.g., corn). | Corn prices volatile in 2024 due to weather. |

| Inflation (Energy, Logistics) | Increases operational costs. | Brent crude averaged $80-$90/barrel in 2024. |

| Currency Exchange Rates | Impacts reported revenues and profits. | Euro strength caused headwinds in early 2024. |

What You See Is What You Get

Corbion PESTLE Analysis

The preview shown here is the exact document you’ll receive after purchase—fully formatted and ready to use. This detailed Corbion PESTLE analysis covers all critical external factors impacting the company.

The content and structure shown in the preview is the same document you’ll download after payment. You'll gain immediate access to a comprehensive breakdown of Political, Economic, Social, Technological, Legal, and Environmental influences on Corbion.

Sociological factors

Consumers are actively seeking out products with natural, healthy, and sustainably sourced ingredients. This shift in preference is evident across various sectors, from food and beverages to personal care and home goods. For instance, a 2024 Nielsen report indicated that 60% of consumers globally are willing to pay more for products with natural ingredients.

This growing demand perfectly aligns with Corbion's core competencies in bio-based ingredients, lactic acid, and natural preservation technologies. The market pull for these solutions is substantial, as companies across industries look to reformulate their products to meet consumer expectations for cleaner labels and healthier options.

The increasing global emphasis on health and wellness directly fuels the demand for functional ingredients, dietary supplements, and healthier food choices. Corbion is well-positioned to capitalize on this, with offerings like algae-based omega-3 and ingredients vital for pharmaceutical applications, presenting significant growth avenues within its Health & Nutrition segment.

Societal awareness of environmental issues like plastic pollution and climate change is significantly increasing. This growing concern directly influences consumer behavior, pushing demand towards eco-friendly products and sustainable practices. For instance, a 2024 survey indicated that over 70% of consumers are willing to pay more for products with sustainable packaging.

This societal shift creates a strong market advantage for companies like Corbion, whose bioplastics and sustainable ingredient solutions align with these evolving consumer preferences. The global bioplastics market is projected to reach $12.5 billion by 2025, demonstrating substantial growth driven by these environmental considerations.

Ethical Sourcing and Supply Chain Transparency

Consumers and stakeholders are increasingly vocal about ethical sourcing and supply chain transparency. This societal shift puts pressure on companies like Corbion to demonstrate responsible procurement and sustainable practices. For instance, a 2024 survey indicated that over 70% of consumers consider a company's ethical practices when making purchasing decisions.

Corbion's proactive approach to responsible sourcing, particularly for its bio-based ingredients, directly addresses these growing expectations. This commitment not only bolsters its brand reputation but also fosters deeper consumer trust, a critical differentiator in today's market. The company's 2024 sustainability report highlighted a 15% increase in certified sustainable raw material sourcing compared to the previous year.

- Consumer Demand: Growing consumer preference for ethically produced goods.

- Stakeholder Pressure: Investors and NGOs scrutinizing supply chain practices.

- Reputational Benefit: Enhanced brand image through transparent and ethical sourcing.

- Market Advantage: Differentiating from competitors by meeting higher ethical standards.

Shifting Dietary Preferences (e.g., Plant-Based)

The increasing global adoption of plant-based diets, driven by health, environmental, and ethical concerns, creates significant opportunities for Corbion. As consumers actively seek alternatives to traditional animal proteins, demand for ingredients that mimic the taste, texture, and nutritional profile of conventional foods escalates. Corbion's expertise in fermentation and bio-based ingredients positions it to capitalize on this trend by supplying functional solutions that improve the sensory experience and shelf-life of plant-based products.

By 2025, the plant-based food market is projected to reach substantial growth. For instance, the global plant-based meat market alone was valued at approximately $8.3 billion in 2022 and is expected to grow at a compound annual growth rate (CAGR) of around 17.9% from 2023 to 2030, reaching an estimated $33.3 billion by 2030. This expansion underscores the market's potential for ingredient suppliers like Corbion.

- Market Growth: The plant-based food sector is experiencing rapid expansion, with projections indicating continued strong growth through 2025 and beyond.

- Consumer Demand: Growing consumer preference for healthier, more sustainable food options is a primary driver for the shift towards plant-based diets.

- Corbion's Role: Corbion can leverage its bio-based ingredient portfolio to enhance the quality and appeal of plant-based food products, meeting evolving consumer needs.

- Innovation Opportunity: The trend presents a clear avenue for Corbion to innovate and develop new ingredient solutions tailored for the burgeoning alternative protein market.

Societal trends highlight a growing consumer demand for products that are natural, healthy, and sustainably sourced, a shift that directly benefits Corbion's bio-based ingredient offerings.

The increasing global focus on health and wellness, coupled with a rise in plant-based diets, creates significant opportunities for Corbion to supply functional ingredients and alternatives to traditional proteins.

Heightened societal awareness regarding environmental issues like plastic pollution and climate change drives demand for eco-friendly solutions, positioning Corbion's bioplastics and sustainable ingredients favorably.

Consumers and stakeholders are increasingly prioritizing ethical sourcing and supply chain transparency, making Corbion's commitment to responsible procurement a key differentiator.

| Societal Trend | Consumer Behavior Impact | Corbion's Opportunity | Relevant Data Point (2024/2025) |

| Demand for Natural & Healthy Ingredients | Preference for cleaner labels and healthier options | Leverage expertise in bio-based ingredients and natural preservation | 60% of global consumers willing to pay more for natural ingredients (Nielsen, 2024) |

| Health & Wellness Focus | Increased demand for functional ingredients and healthier food choices | Capitalize on algae-based omega-3 and pharmaceutical ingredients | Projected growth in functional food ingredients market |

| Environmental Awareness (Plastic Pollution, Climate Change) | Preference for eco-friendly products and sustainable practices | Offer bioplastics and sustainable ingredient solutions | Global bioplastics market projected to reach $12.5 billion by 2025 |

| Ethical Sourcing & Transparency | Purchasing decisions influenced by company ethics | Demonstrate responsible procurement and build consumer trust | Over 70% of consumers consider ethical practices in purchasing (Survey, 2024) |

| Plant-Based Diets | Seeking alternatives to animal proteins | Supply ingredients for plant-based food products | Global plant-based meat market valued at ~$8.3 billion (2022), projected strong CAGR |

Technological factors

Corbion's reliance on fermentation means technological leaps are crucial. Innovations in microbial strains and bioreactor design, for instance, could boost lactic acid yields by an estimated 10-15% by 2025, directly impacting cost-effectiveness and the development of new bio-based materials.

Ongoing advancements in bioplastics, particularly Polylactic Acid (PLA), are creating significant market opportunities for Corbion. These innovations directly influence the demand for Corbion's core products, such as lactic acid, which is a key ingredient in PLA production.

Technological breakthroughs are enhancing the performance, affordability, and biodegradability of bioplastics. For instance, improvements in PLA processing and formulation are making it a more viable alternative to traditional plastics in packaging, textiles, and automotive sectors, directly benefiting Corbion's growth trajectory.

Corbion's growth hinges on its capacity to innovate, creating novel functional ingredients and finding new uses for them across industries such as food, personal care, and pharmaceuticals. This commitment to R&D and application know-how enables Corbion to deliver advanced solutions that address changing consumer demands and set its products apart. For instance, in 2023, Corbion reported a 9.5% increase in sales for its biobased ingredients, signaling strong market adoption of its innovative offerings.

Automation and Digitization in Manufacturing

Corbion's manufacturing operations are significantly impacted by technological advancements. The increasing adoption of automation and digitization, often referred to as Industry 4.0, promises to boost efficiency and quality. For instance, smart factory solutions can streamline production lines, potentially reducing waste and energy consumption, key areas for a company focused on bio-based ingredients. This trend is underscored by global manufacturing automation spending, which was projected to reach over $200 billion in 2024, indicating a strong industry-wide commitment to these technologies.

The integration of advanced robotics and AI in production can lead to enhanced precision and consistency in Corbion's product output. Furthermore, data analytics plays a crucial role in optimizing supply chain management, allowing for better inventory control and more responsive logistics. By leveraging these digital tools, Corbion can aim to reduce operational costs, including labor, while simultaneously improving the overall quality and reliability of its ingredients.

- Increased Efficiency: Automation can speed up production cycles, leading to higher output volumes.

- Reduced Costs: Lower labor requirements and optimized resource utilization contribute to cost savings.

- Improved Quality: Precision in automated processes minimizes errors and enhances product consistency.

- Supply Chain Optimization: Digitization enables better tracking, forecasting, and management of raw materials and finished goods.

Biomedical Polymer Innovation

Corbion's strategic investment in biomedical polymers directly taps into the rapid technological evolution within the medical device and pharmaceutical sectors. This focus leverages advancements in creating materials that are not only safe for biological interaction but also enhance device functionality.

Emerging innovations, such as novel biocompatible polymers and sophisticated drug delivery systems, represent significant opportunities for Corbion. These specialized ingredients are poised to drive high-growth, high-margin revenue streams, reflecting the increasing demand for advanced biomaterials in healthcare.

- Biomedical Polymer Market Growth: The global biomedical polymers market was valued at approximately USD 11.5 billion in 2023 and is projected to reach over USD 20 billion by 2030, exhibiting a compound annual growth rate (CAGR) of around 8.5%.

- Drug Delivery Systems: Innovations in controlled-release drug delivery, utilizing advanced polymers, are expanding treatment efficacy and patient compliance, a key area for Corbion's ingredient development.

- Medical Device Advancements: The integration of new polymers in areas like 3D-printed implants and minimally invasive surgical tools is a major driver for specialized material suppliers like Corbion.

Corbion's technological landscape is shaped by advancements in fermentation, bioplastics, and manufacturing automation. Innovations in microbial strains and bioreactor design are projected to improve lactic acid yields, directly impacting cost-effectiveness and the development of new bio-based materials. The company's focus on Polylactic Acid (PLA) aligns with the growing market for bioplastics, with technological improvements making PLA a more viable alternative to traditional plastics across various sectors.

| Technological Area | Key Developments | Impact on Corbion | Relevant Data/Projections |

| Fermentation Technology | Microbial strain optimization, Bioreactor design | Increased yield, Reduced production costs | Potential 10-15% yield increase in lactic acid by 2025 |

| Bioplastics (PLA) | Improved processing, Enhanced biodegradability | Market expansion, Increased demand for lactic acid | Growing demand in packaging, textiles, automotive |

| Manufacturing Automation (Industry 4.0) | Robotics, AI, Data Analytics | Enhanced efficiency, Reduced waste, Improved quality | Global automation spending projected over $200 billion in 2024 |

| Biomedical Polymers | Novel biocompatible materials, Advanced drug delivery | High-growth revenue streams, New market opportunities | Biomedical polymers market projected to exceed $20 billion by 2030 |

Legal factors

Corbion navigates a dense landscape of international and national environmental laws governing emissions, waste disposal, and water quality. For instance, the European Union's Industrial Emissions Directive (IED) sets strict limits on pollutants from industrial activities, impacting Corbion's manufacturing sites. Failure to comply can result in significant fines and operational disruptions, as seen with penalties levied against companies for exceeding wastewater discharge limits in various jurisdictions.

Corbion's food ingredient operations are heavily regulated by stringent food safety and quality standards. Compliance with frameworks like Hazard Analysis and Critical Control Points (HACCP) and ISO certifications are not just best practices but legal mandates, ensuring product integrity and consumer safety.

Failure to meet these rigorous requirements, which are continuously evolving, can result in significant legal penalties and jeopardize market access. For instance, in 2024, the European Food Safety Authority (EFSA) continued to update its guidance on various food additives and contaminants, directly impacting ingredient specifications for companies like Corbion.

Maintaining high-quality control, validated through these certifications, is crucial for retaining customer trust and securing contracts. In 2025, the global food ingredient market is expected to continue its growth, with a strong emphasis on traceability and safety, making adherence to these legal standards a key competitive advantage for Corbion.

Corbion's competitive edge hinges on protecting its innovative bio-based ingredients and proprietary production processes through patents and intellectual property rights. These legal frameworks are crucial for safeguarding its significant R&D investments, which in 2024 continued to be a major focus, and preventing the unauthorized use of its advanced technologies by competitors.

Labor Laws and Employment Regulations

Corbion must meticulously adhere to a complex web of labor laws and employment regulations across its global operations. This includes stringent compliance with wage and hour laws, ensuring safe and healthy working conditions, and upholding fair employment practices. Failure to comply can lead to significant legal repercussions and reputational damage.

As of recent reports, the average wage in the food processing industry, a sector relevant to Corbion's operations, has seen fluctuations. For instance, in the United States, the average hourly wage for food processing workers was approximately $17.50 in early 2024, with variations by region and specific role. Similarly, occupational health and safety standards, such as those enforced by OSHA in the US, mandate specific safety protocols that companies like Corbion must implement to protect their workforce.

Key legal factors impacting Corbion's labor relations include:

- Compliance with minimum wage laws: Ensuring all employees receive at least the legally mandated minimum wage in each operating jurisdiction.

- Adherence to working hour regulations: Managing overtime, breaks, and maximum working hours to comply with local labor codes.

- Enforcement of occupational health and safety standards: Implementing robust safety measures to prevent workplace accidents and ensure employee well-being, with fines for non-compliance often running into thousands of dollars per violation.

- Protection against discrimination and unfair dismissal: Upholding legal frameworks that prevent discriminatory hiring practices and ensure fair termination procedures.

Product Liability and Consumer Protection Laws

Corbion must navigate a complex web of product liability and consumer protection laws across its global operations. These regulations mandate that its ingredients and solutions are safe for intended use, accurately represented on labels, and perform as advertised to prevent costly legal battles, product recalls, and damage to its brand image. For instance, in 2023, the European Union continued to strengthen its consumer protection framework, with ongoing discussions around enhanced digital product passports that could impact ingredient traceability and transparency for companies like Corbion.

Failure to adhere to these standards can result in significant financial penalties and operational disruptions. Corbion's commitment to rigorous quality control and transparent communication is therefore paramount. The company's 2024 sustainability report highlighted a continued focus on product stewardship, aiming to minimize adverse impacts throughout the value chain, a key element in managing these legal risks.

Key areas of compliance include:

- Food Safety Regulations: Ensuring all food ingredients meet stringent safety standards, such as those set by the FDA in the US and EFSA in Europe.

- Labeling Accuracy: Providing clear and truthful information regarding ingredients, allergens, nutritional content, and origin to consumers.

- Product Performance Claims: Substantiating all claims made about the efficacy and benefits of its bio-based ingredients and solutions.

- Recall Procedures: Maintaining robust systems for rapid product recalls in the event of safety concerns or non-compliance.

Corbion's operations are subject to evolving international trade laws and sanctions, which can impact sourcing and market access. For example, changes in tariffs or import/export restrictions, such as those affecting agricultural commodities in 2024, directly influence supply chain costs and availability.

Intellectual property laws are critical for protecting Corbion's innovations in bio-based ingredients. In 2024, the company continued to invest in R&D, seeking patents for new fermentation processes and applications, safeguarding its competitive advantage against rivals.

Corbion must also comply with a broad spectrum of corporate governance and compliance regulations, including anti-bribery and anti-corruption laws. Adherence to these standards is crucial for maintaining investor confidence and avoiding legal penalties, with global enforcement bodies actively pursuing violations.

Environmental factors

Corbion faces increasing global pressure to address climate change, driving a need to shrink its carbon footprint. This involves setting robust emission reduction targets across Scope 1, 2, and 3, and strategically investing in renewable energy sources and process efficiencies to meet these goals.

In 2023, Corbion committed to reducing its Scope 1 and 2 greenhouse gas emissions by 42% by 2030, using 2020 as a baseline. The company is also working with suppliers to address its Scope 3 emissions, which represent the majority of its footprint.

Water is absolutely vital for Corbion's operations, especially its fermentation processes which rely heavily on this resource. The increasing reality of water scarcity in various regions where Corbion operates presents a significant operational risk that needs careful management.

Corbion is actively addressing this by focusing on robust water stewardship. This includes implementing efficient water management practices and stringent pollution control measures across all its manufacturing facilities, which is crucial for ensuring the company's long-term sustainability and operational continuity.

Corbion's reliance on agricultural feedstocks like sugarcane brings environmental scrutiny. The sourcing of these materials can impact biodiversity and lead to deforestation, posing a significant risk to the company's long-term sustainability and reputation.

To address this, Corbion emphasizes sustainable sourcing practices. Certifications such as Bonsucro, a global standard for sugarcane production, are crucial. In 2023, Bonsucro certified over 10 million tonnes of sugarcane, indicating a growing commitment to responsible agriculture within the industry, which Corbion actively participates in.

Waste Management and Circular Economy Principles

Minimizing waste and adopting circular economy principles are critical environmental considerations. Corbion's commitment to developing biodegradable bioplastics, like its PLA (polylactic acid) portfolio, directly addresses this by offering alternatives that can reduce plastic pollution. This focus on circularity in product lifecycles helps align the company with overarching global sustainability objectives, aiming to lessen the environmental footprint of its operations and offerings.

Corbion's strategic investments in bio-based materials and solutions are key. For instance, the company has been actively expanding its capacity for producing lactic acid and its derivatives, which are foundational for many biodegradable plastics. By promoting the recyclability and compostability of its products, Corbion aims to create closed-loop systems, thereby contributing to a more sustainable resource management framework. This proactive stance is vital as regulatory pressures and consumer demand for eco-friendly solutions continue to escalate globally.

The company's efforts are supported by market trends and data. The global bioplastics market, for example, was valued at approximately USD 12.0 billion in 2023 and is projected to grow significantly, with estimates suggesting a compound annual growth rate (CAGR) of around 18-20% through 2030. This growth trajectory underscores the increasing market acceptance and demand for materials that offer environmental benefits. Corbion's participation in this expanding market positions it to capitalize on the shift towards a circular economy.

Key aspects of Corbion's approach include:

- Development of advanced biopolymers: Focusing on materials like PLA that offer biodegradability and compostability.

- Circular product design: Engineering products with end-of-life solutions in mind, such as chemical or mechanical recycling.

- Partnerships for circularity: Collaborating with value chain partners to establish effective collection, recycling, and composting infrastructure.

- Reducing operational waste: Implementing internal processes to minimize waste generation across manufacturing and supply chain activities.

Pollution Control and Environmental Compliance

Corbion faces ongoing challenges in managing and controlling pollution, including air, water, and soil contamination stemming from its manufacturing processes. Strict adherence to environmental permits and the proactive implementation of pollution prevention technologies are paramount for ensuring compliance and minimizing adverse ecological effects.

The company's commitment to environmental stewardship is reflected in its investments in cleaner production methods. For instance, in 2023, Corbion reported a reduction in its Scope 1 and 2 greenhouse gas emissions by 17.6% compared to its 2019 baseline, demonstrating progress in its environmental performance.

- Regulatory Compliance: Corbion must navigate a complex web of local and international environmental regulations, ensuring all operations meet or exceed mandated standards for emissions and waste management.

- Pollution Prevention Investment: The company invests in advanced technologies to reduce its environmental footprint, such as wastewater treatment systems and air filtration units, to mitigate pollution at its source.

- Sustainability Reporting: Transparency in reporting environmental performance, including pollution metrics and compliance records, is crucial for maintaining stakeholder trust and demonstrating corporate responsibility.

Corbion's environmental strategy centers on reducing its carbon footprint, with a 2030 target of a 42% cut in Scope 1 and 2 greenhouse gas emissions from a 2020 baseline. The company also actively manages water scarcity risks through efficient usage and stringent pollution control at its facilities.

Sustainable sourcing of agricultural feedstocks, like sugarcane, is critical, with certifications such as Bonsucro, which certified over 10 million tonnes of sugarcane in 2023, demonstrating industry-wide commitment to responsible agriculture.

Corbion is a key player in the growing bioplastics market, valued at approximately USD 12.0 billion in 2023 and projected to grow at an 18-20% CAGR through 2030, driven by demand for biodegradable and compostable materials like PLA.

The company's commitment to circularity is evident in its development of advanced biopolymers and partnerships aimed at establishing effective recycling and composting infrastructure, contributing to a more sustainable resource management framework.

| Environmental Factor | Corbion's Action/Focus | Relevant Data/Context |

|---|---|---|

| Climate Change & Emissions | Reducing Scope 1 & 2 GHG emissions | Target: 42% reduction by 2030 (vs. 2020 baseline). 17.6% reduction achieved by 2023 (vs. 2019 baseline). |

| Water Management | Efficient water use and pollution control | Crucial for fermentation processes; addressing water scarcity risks. |

| Sustainable Sourcing | Responsible agricultural feedstock procurement | Emphasis on certifications like Bonsucro (over 10 million tonnes certified in 2023). |

| Waste & Circularity | Bioplastics development (PLA), waste reduction | Bioplastics market valued at USD 12.0 billion in 2023; projected 18-20% CAGR through 2030. |

PESTLE Analysis Data Sources

Our PESTLE Analysis for Corbion is informed by a comprehensive blend of data, including reports from leading market research firms, official government publications on regulations and economic policies, and up-to-date environmental impact assessments. This ensures a robust understanding of the external forces shaping the biochemicals and food ingredients sectors.