Corbion Boston Consulting Group Matrix

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Corbion Bundle

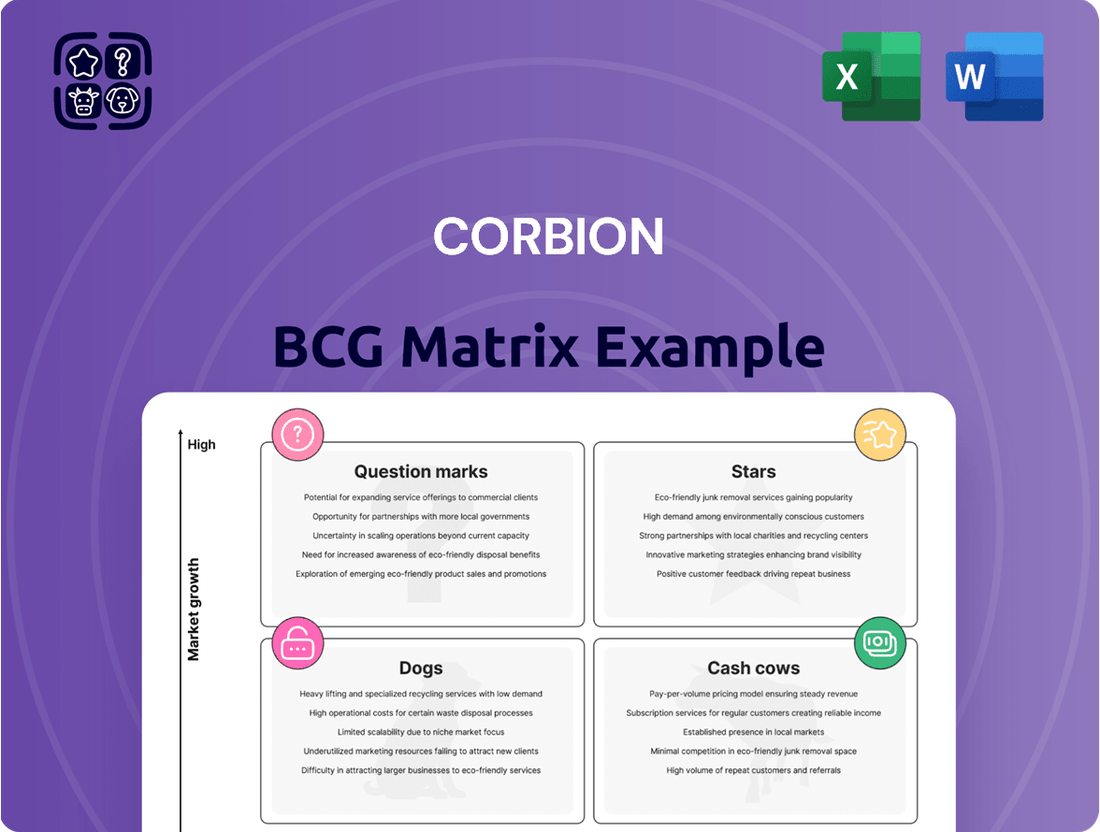

Understand Corbion's strategic product portfolio with this insightful BCG Matrix preview. See how their offerings stack up as Stars, Cash Cows, Dogs, or Question Marks in their respective markets.

Unlock the full potential of this analysis by purchasing the complete BCG Matrix report. Gain detailed quadrant placements, data-driven recommendations, and a clear roadmap to optimize Corbion's product investments and strategic decisions.

Stars

Corbion's significant stake in the TotalEnergies Corbion joint venture places it at the forefront of the burgeoning bioplastics sector. This venture benefits from a market poised for substantial growth, with projections indicating a compound annual growth rate (CAGR) between 14.8% and 16.8% from 2025 through 2032, fueled by a global push for sustainable materials.

The joint venture demonstrated impressive market traction, reporting strong organic sales growth during the first quarter and first half of 2025. This performance underscores the high demand and considerable growth potential for their innovative bio-based plastic solutions.

Corbion's algae-based omega-3 ingredients are a standout performer, positioned as a star in the company's portfolio. This segment is experiencing robust growth, driven by its appeal as a sustainable and ethical alternative to traditional fish oil sources. The demand is particularly strong in sectors like aquaculture, pet food, and human dietary supplements, reflecting a broader market shift towards eco-friendly solutions.

Significant investment has been channeled into this algae technology, with Corbion aiming to maximize its value creation potential. The company has successfully achieved commercial milestones and demonstrated profitability in this area. For instance, by 2024, Corbion has reported substantial revenue growth from its algae ingredients, underscoring its market penetration and customer acceptance.

Recent developments, such as obtaining regulatory approvals in key markets like China, further enhance the growth trajectory for Corbion's algae-based omega-3s. These approvals unlock significant new market opportunities, reinforcing the segment's status as a high-growth area with expanding market share. This strategic expansion is a testament to Corbion's commitment to innovation in sustainable nutrition.

Biomedical Polymers, a key player within Corbion's Health & Nutrition segment, is positioned for substantial expansion. The company has set an ambitious target to more than double its sales in this area, aiming to surpass €100 million by 2028. This strategic objective underscores the high growth potential anticipated for this specialized market.

In the first quarter of 2025, Biomedical Polymers experienced high single-digit growth, and this momentum continued with strong performance in the first half of the year. This growth is primarily fueled by increasing demand in critical applications such as orthopedic devices, advanced drug delivery systems, and the aesthetics sector.

These specialized applications represent high-value segments within the broader healthcare market, indicating robust demand for Corbion's innovative polymer solutions. The company's success in these areas reflects its growing market presence and its ability to meet the stringent requirements of these advanced medical fields.

Pharma Ingredients

Corbion's Pharma Ingredients segment, a key player within its Health & Nutrition division, demonstrates robust growth, exhibiting double-digit expansion. A significant driver of this success is its strong performance in the kidney dialysis market, particularly in China, highlighting its strategic positioning in a high-margin and expanding sector.

The company's commitment to producing high-quality active pharmaceutical ingredients and specialized polymers, all derived from lactic acid, underpins its Star classification. This focus on innovation and premium product offerings positions Pharma Ingredients for continued market leadership and substantial revenue generation.

- Double-digit expansion in the Pharma Ingredients segment.

- Leading presence in the growing kidney dialysis market, especially in China.

- Focus on high-quality active pharmaceutical ingredients and lactic acid-derived polymers.

Natural Food Preservation Solutions

Corbion is making significant investments in natural food preservation, a move that perfectly taps into the worldwide demand for clean-label and sustainable ingredients. This focus within their Functional Ingredients & Solutions segment is showing impressive growth, particularly with products like natural mold inhibitors and dairy stabilizers.

The company's deep knowledge in fermentation technology, combined with its commitment to extending shelf life and improving food safety without sacrificing quality, places these innovative solutions in a rapidly expanding market. For instance, the global market for natural food preservatives was valued at approximately USD 47.5 billion in 2023 and is projected to reach USD 78.2 billion by 2030, growing at a compound annual growth rate of 7.4%.

- Natural Preservatives Market Growth: The demand for clean-label products is driving significant expansion in natural food preservation.

- Corbion's Strategic Focus: Investments in fermentation-based solutions like mold inhibitors and stabilizers are key to their strategy.

- Market Value Projection: The global natural food preservatives market is expected to grow substantially, indicating strong future demand.

- Consumer Trends Alignment: Corbion's offerings align with consumer preferences for healthier, more sustainable food options.

Corbion's algae-based omega-3 ingredients are a clear star performer, experiencing robust growth driven by demand for sustainable alternatives in aquaculture, pet food, and supplements. Significant investment has fueled commercial success and profitability, with substantial revenue growth reported by 2024. Regulatory approvals in key markets like China further bolster this segment's expansion.

The Biomedical Polymers segment is also a star, with an ambitious target to more than double sales to over €100 million by 2028. High single-digit growth was seen in Q1 2025, continuing into the first half, driven by demand in orthopedics, drug delivery, and aesthetics.

Corbion's Pharma Ingredients segment is another star, showing double-digit expansion, particularly in the kidney dialysis market in China. Their focus on high-quality active pharmaceutical ingredients and lactic acid-derived polymers positions them for continued market leadership.

Corbion's natural food preservation, including mold inhibitors and dairy stabilizers, is also a star. This segment taps into the global demand for clean-label ingredients, with the natural food preservatives market projected to reach USD 78.2 billion by 2030.

| Segment | BCG Status | Key Growth Drivers | 2024/2025 Performance Highlights | Future Outlook |

|---|---|---|---|---|

| Algae-based Omega-3 | Star | Sustainable alternative, demand in aquaculture, pet food, supplements | Substantial revenue growth, commercial milestones achieved | Continued expansion, regulatory approvals enhancing market access |

| Biomedical Polymers | Star | Orthopedics, drug delivery, aesthetics | High single-digit growth in Q1 2025, strong H1 performance | Target to exceed €100 million in sales by 2028 |

| Pharma Ingredients | Star | Kidney dialysis (especially China), high-quality APIs, lactic acid polymers | Double-digit expansion | Continued market leadership, strong revenue generation |

| Natural Food Preservation | Star | Clean-label demand, mold inhibitors, dairy stabilizers | Impressive growth in functional ingredients | Alignment with growing natural food preservatives market (projected USD 78.2B by 2030) |

What is included in the product

The Corbion BCG Matrix analyzes its business units by market share and growth rate to guide investment and resource allocation.

A clear visual map of Corbion's portfolio, simplifying strategic decisions.

Cash Cows

Corbion's core lactic acid production is a true cash cow, reflecting its dominant position as the global market leader. This foundational segment operates in a mature yet stable market, consistently delivering strong sales and substantial cash flow.

This reliable revenue stream is crucial, providing the financial muscle to invest in growth areas like bioplastics. For instance, in 2023, Corbion's overall revenue reached €1.15 billion, with lactic acid and its derivatives forming a significant portion of this, showcasing its enduring strength.

Corbion's established food ingredients, particularly those serving the bakery and meat industries, are classic cash cows. These are mature markets where Corbion has a solid foothold, meaning they don't see rapid expansion but generate steady, predictable revenue.

The consistent demand for these ingredients, coupled with high profit margins due to established customer loyalty and effective products, makes them a reliable income stream. For instance, in 2023, Corbion's Functional Ingredients & Solutions segment, which houses many of these mature offerings, continued to be a significant contributor to the company's overall financial health, demonstrating the enduring value of these established product lines.

Corbion's Functional Blends represent a significant cash cow within its portfolio. These are specialized ingredient combinations tailored for diverse food and even some non-food uses, showcasing Corbion's strong application knowledge.

These established offerings are likely positioned in mature markets where the company has secured a competitive edge. They are known for consistently generating robust cash flow, requiring minimal additional investment for promotion due to their strong market standing.

In 2023, Corbion reported a notable increase in its biobased ingredients segment, which includes functional blends, contributing to overall company growth. The demand for customized and functional food ingredients continues to rise globally, supporting the steady performance of these mature product lines.

Traditional Biochemicals

Corbion's traditional biochemicals, while perhaps not experiencing explosive growth, represent a stable foundation within their portfolio. These established products are likely situated in mature industrial markets, benefiting from the company's extensive global infrastructure and deep fermentation expertise. This operational efficiency translates into reliable revenue streams, contributing positively to the overall volume and mix growth observed in the Functional Ingredients & Solutions segment.

For instance, in 2024, Corbion's Functional Ingredients & Solutions segment has demonstrated resilience. While specific figures for traditional biochemicals within this segment are not always granularly broken out, the segment's overall performance indicates the steady contribution of these mature product lines. The company's ongoing investment in optimizing its production capabilities further solidifies the dependable cash flow generated by these biochemicals.

- Mature Market Presence: Traditional biochemicals operate in established industrial sectors, ensuring consistent demand.

- Operational Efficiency: Corbion's optimized global infrastructure and fermentation expertise drive cost-effective production.

- Stable Revenue Generation: These products provide reliable income, supporting overall business stability.

- Contribution to Growth: They play a key role in the positive volume/mix growth of the Functional Ingredients & Solutions segment.

Dairy Stabilizers

Dairy stabilizers within Corbion's portfolio represent a classic cash cow. While the market for these ingredients, which improve texture and extend shelf life in products like yogurt and ice cream, is mature, demand remains robust and consistent. This stability translates into reliable revenue streams for Corbion, underscoring their cash-generating power.

Corbion's focus on functional ingredients for the food industry, including dairy stabilizers, has been a cornerstone of its business. For instance, in 2023, Corbion reported net sales of €1.12 billion for its Food segment, with ingredients like dairy stabilizers playing a significant role in this performance. The consistent need for enhanced product quality and shelf-life in the dairy sector ensures ongoing demand for these established solutions.

- Mature Market Stability: Dairy stabilizers operate in a well-established market with predictable demand.

- Consistent Revenue Generation: These products contribute reliably to Corbion's overall sales figures.

- Product Enhancement: They are essential for improving texture and shelf life in various dairy products.

- 2023 Food Segment Performance: Corbion's Food segment achieved net sales of €1.12 billion, with stabilizers being a key contributor.

Corbion's established lactic acid business is a prime example of a cash cow. This segment benefits from a mature market where Corbion holds a leading global position, ensuring consistent and substantial cash flow generation. The company's deep expertise in fermentation and its extensive production network allow for efficient, cost-effective manufacturing, further solidifying its profitability.

The reliable income from lactic acid and its derivatives is vital, providing the financial resources to fund innovation and expansion into newer, higher-growth areas like bioplastics. For instance, Corbion's commitment to sustainability is evident in its investments in biobased solutions, supported by the steady earnings from its core lactic acid operations. In 2023, Corbion's overall revenue was €1.15 billion, highlighting the significant contribution of its foundational businesses.

Corbion's portfolio of functional ingredients for the food industry, such as those used in bakery and meat applications, also functions as a cash cow. These products serve stable, mature markets where Corbion has a strong market presence and established customer relationships. This leads to predictable sales and healthy profit margins, requiring minimal incremental investment to maintain their market share.

The consistent demand for these high-quality ingredients, coupled with Corbion's operational efficiencies, ensures a steady stream of cash. The Functional Ingredients & Solutions segment, which includes many of these mature offerings, continued to be a significant contributor to Corbion's financial health in 2023, demonstrating the enduring value of these established product lines.

| Product/Segment | Market Position | Cash Flow Generation | Investment Needs | 2023 Performance Indicator |

| Lactic Acid & Derivatives | Global Market Leader | Strong & Consistent | Low (Maintenance) | Significant contributor to €1.15B total revenue |

| Food Ingredients (Bakery, Meat) | Established Foothold | Steady & Predictable | Low (Maintenance) | Key part of €1.12B Food segment net sales |

Delivered as Shown

Corbion BCG Matrix

The Corbion BCG Matrix preview you see is the identical, fully formatted document you will receive immediately after purchase. This means no watermarks, no placeholder text, and no surprises – just a comprehensive, analysis-ready report designed for strategic decision-making.

Dogs

Corbion’s Emulsifiers business was divested in April 2024, a move that clearly marked it as a non-core asset. This strategic decision was driven by a restructuring initiative designed to boost free cash flow and improve profit margins by shedding operations that no longer aligned with the company's core strategy.

The divestment suggests the Emulsifiers segment likely represented a low-growth, low-market share area within Corbion's portfolio. Such segments often require significant capital investment but yield diminishing strategic returns, making their exit a sensible step for capital allocation.

Corbion's strategic review, as part of its 'Advance 2025' plan, identified the frozen dough business for divestiture. This move indicates that the segment was likely experiencing limited growth and held a relatively small share of its market.

Businesses like frozen dough, when categorized as question marks or dogs in a BCG matrix, often require significant investment to maintain or grow their market share, yet offer uncertain returns. Corbion's decision to exit suggests this particular frozen dough operation was not meeting its strategic objectives for profitability or growth.

In 2024, the broader food ingredients market saw varied performance, with some segments experiencing robust demand while others, like potentially less differentiated frozen dough products, faced increased competition and margin pressures, reinforcing the rationale for focusing on core, high-growth areas.

The FDCA initiative at Corbion represented an early-stage, non-core venture that the company intended to divest. This move suggests that the project, despite initial investment, failed to gain significant market traction or demonstrate sufficient growth potential.

Positioned within the 'Dog' quadrant of the BCG matrix, FDCA likely consumed resources without generating substantial returns, acting as a cash trap with limited future prospects for Corbion.

Underperforming Niche Biochemical Applications

While Corbion's biochemicals division generally performs well, some specialized applications within this segment have seen persistent market weakness. For instance, certain niche biochemicals might be facing challenges due to limited adoption or intense rivalry.

These specific applications, if characterized by a low market share and facing strong competition or declining demand, would be categorized as Dogs in the BCG matrix. Corbion's strategic direction emphasizes scalable growth, which naturally leads to a disinvestment or divestiture from such underperforming areas.

- Niche Biochemicals: Specific applications with limited market traction.

- Low Market Share: These areas hold a small percentage of their respective markets.

- Intense Competition/Diminishing Demand: Facing significant rivalry or declining customer interest.

- Strategic Disengagement: Corbion prioritizes scalable growth, moving away from these weak segments.

Co-packing and Blending (Non-Core)

Corbion's 'Advance 2025' strategy identified co-packing and certain blending activities as non-core, signaling an intent to divest these operations. These segments likely represented lower-growth service areas that did not align with Corbion's core competencies in areas like bio-based ingredients, suggesting limited profitability or strategic advantage.

These non-core activities were categorized as Dogs within the BCG Matrix framework. This classification implies they possess low market share and operate in low-growth markets, offering minimal potential for future expansion or significant returns for Corbion.

- Non-Core Focus: Corbion's strategic review under 'Advance 2025' pinpointed co-packing and specific blending services for divestment.

- Strategic Misalignment: These operations were deemed not central to Corbion's core competencies, indicating they were likely low-growth and less profitable ventures.

- BCG Matrix Classification: The divestment strategy aligns with classifying these activities as Dogs due to their low market share and operating in slow-growth sectors.

Corbion's strategic divestments, such as the Emulsifiers business in April 2024, highlight a clear move away from low-growth, low-market share segments. These divested units, like the identified frozen dough business and certain niche biochemical applications, fit the 'Dog' profile in the BCG matrix. This classification indicates they consume resources without generating substantial returns, prompting Corbion to focus on more promising growth areas.

The 'Advance 2025' strategy explicitly targeted underperforming segments for divestiture. This includes activities like co-packing and specific blending services, which were deemed non-core and unlikely to offer significant future expansion or returns. Such divestments are crucial for optimizing capital allocation and improving overall profitability.

The divestment of the Emulsifiers business in April 2024, for example, directly addresses the 'Dog' category. This segment likely experienced limited growth and a modest market share, making its exit a logical step to enhance free cash flow and profit margins. Corbion's focus remains on scalable growth and core competencies.

Corbion's 2024 financial disclosures confirmed a strategic shift, with the divestment of the Emulsifiers business being a key event. This move aligns with identifying and exiting 'Dog' category assets, which are characterized by low market share and low market growth, thereby freeing up resources for more strategic investments.

Question Marks

Corbion's new egg replacers, Vantage™ 12E and Vantage™ 11E, are positioned as Stars in the BCG Matrix. These products target the bakery market, a sector experiencing significant growth due to volatile egg prices and supply chain issues. The demand for consistent and cost-effective egg alternatives is on the rise, with the global egg replacer market projected to reach approximately USD 2.4 billion by 2027, growing at a CAGR of around 5.5%.

Within Corbion's Biomedical Polymers, early-stage drug delivery applications are currently positioned as question marks. While the broader segment shows strong growth, these specific applications are in their nascent stages, meaning they are developing rapidly but have not yet captured substantial market share. Corbion's strategic focus on expanding business development in this area for 2025 highlights the significant growth potential they foresee.

These emerging drug delivery solutions require substantial investment to scale up production and achieve wider market penetration. As such, they represent a classic question mark in the BCG matrix – high growth potential but currently low market share, necessitating strategic investment to convert them into stars or cash cows in the future.

Corbion's omega-3 DHA Nutrition business, recognized as a 'Star' due to its strong global performance, is actively pursuing expansion into new geographical markets. Recent regulatory approvals in China, for instance, unlock significant new market avenues for these products.

While the product demonstrates established success worldwide, its market share within these newly accessible regions is still in its early stages. These ventures into new territories represent high-growth potential, though they necessitate initial investment to cultivate market presence and share.

This strategic push into uncharted territories, with their inherent growth prospects and upfront investment requirements, aligns with the characteristics of a 'Question Mark' within the BCG Matrix framework. For example, Corbion's expansion into the burgeoning Asian infant nutrition market in 2024, where DHA is increasingly recognized for its cognitive benefits, exemplifies this strategy.

Incubator Projects with Longer Time Horizons

Corbion's Incubator projects represent their investment in the future, focusing on nascent technologies and markets that require substantial upfront capital for research and development. These ventures, while not currently contributing significantly to revenue or profit, are strategically positioned for potential high growth. For instance, Corbion's ongoing exploration into advanced bio-based materials, a key area for their Incubator segment, requires significant R&D investment, with early-stage market penetration still minimal.

These early-stage initiatives are characterized by their long development cycles and inherent uncertainty, making them cash consumers rather than generators in their current phase. The goal is for these Incubator projects to eventually transition into 'Stars' within the BCG matrix, achieving market leadership and high growth. However, their current status is that of question marks, demanding careful financial management and strategic patience.

- Incubator Projects: Early-stage initiatives with long-term potential.

- Cash Consumption: Significant investment in R&D without immediate returns.

- Market Position: Low current market share and profitability, high future growth potential.

- Strategic Goal: To evolve into 'Stars' by achieving market leadership and high growth.

Specific Bio-based Alternatives in Nascent Industrial Applications

Corbion's commitment to bio-based ingredients positions it to explore emerging industrial applications where its expertise in fermentation and lactic acid derivatives can offer sustainable alternatives. These nascent markets, while holding significant growth potential, would see Corbion with a low initial market share, characteristic of a Question Mark in the BCG matrix.

For instance, Corbion might be investigating bio-based polymers for advanced packaging or bio-solvents for industrial cleaning, areas where established petrochemical alternatives dominate. Success in these ventures hinges on strategic investment to build market presence and technological capabilities.

- Bio-based polymers for industrial packaging: Targeting niche applications requiring specific performance characteristics, potentially displacing traditional plastics.

- Bio-solvents for specialized cleaning agents: Offering environmentally friendly alternatives in sectors like electronics manufacturing or precision engineering.

- Lactic acid derivatives in advanced materials: Exploring uses in biodegradable composites or specialized coatings, leveraging Corbion's core competencies.

- Investment in R&D and market development: Crucial for scaling production and establishing market acceptance in these early-stage industrial sectors.

Corbion's early-stage drug delivery applications and expansion into new geographic markets for its omega-3 DHA Nutrition business are currently classified as Question Marks in the BCG Matrix. These segments exhibit high growth potential but have a low market share, requiring significant investment to develop and capture market position. The company's Incubator projects and exploration into new bio-based industrial applications also fall into this category, demanding substantial R&D and market development efforts to achieve future success.

| BCG Category | Corbion Business Segment | Market Growth | Market Share | Strategic Implication |

|---|---|---|---|---|

| Question Mark | Biomedical Polymers (Early-stage drug delivery) | High | Low | Requires significant investment to grow market share. |

| Question Mark | Omega-3 DHA Nutrition (New Geographic Markets) | High | Low (in new markets) | Investment needed to build presence and capture share. |

| Question Mark | Incubator Projects (e.g., advanced bio-based materials) | High Potential | Low | Substantial R&D investment for long-term growth. |

| Question Mark | Emerging Bio-based Industrial Applications | High Potential | Low | Strategic investment to build market presence and capabilities. |

BCG Matrix Data Sources

Our Corbion BCG Matrix is informed by a blend of internal financial data, external market research reports, and industry-specific growth projections to ensure strategic accuracy.