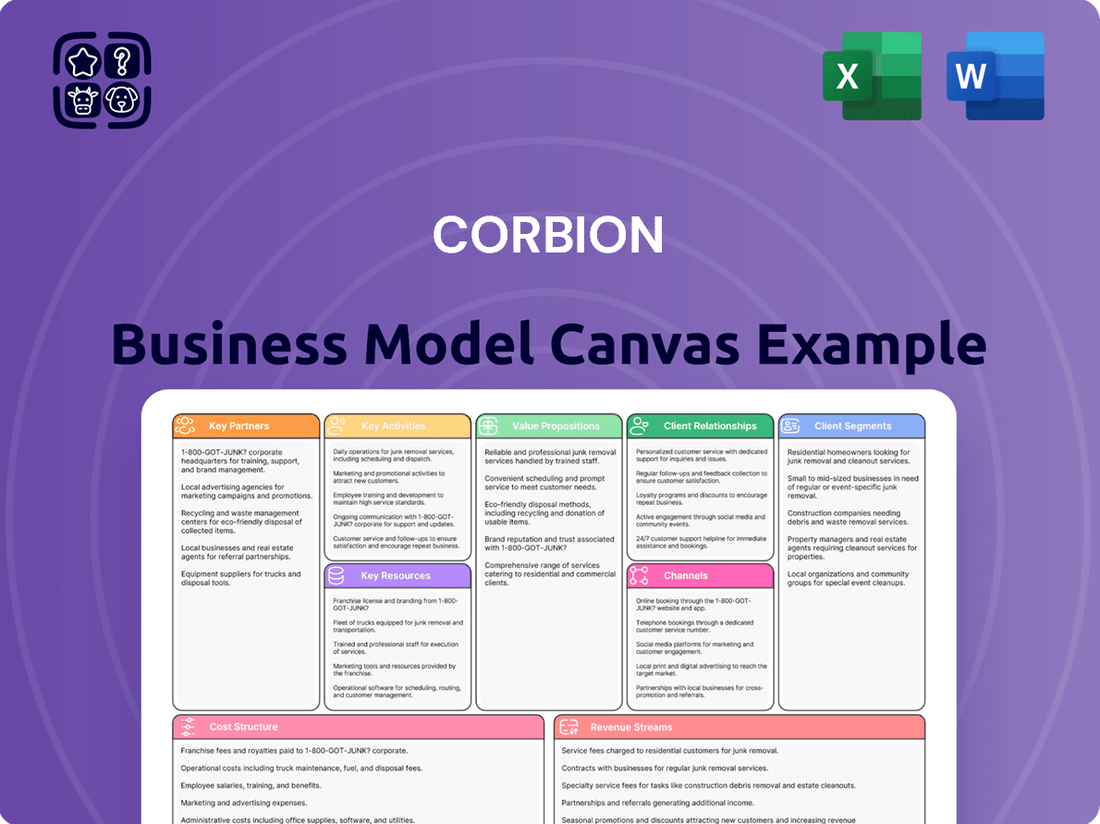

Corbion Business Model Canvas

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Corbion Bundle

Unlock the strategic DNA of Corbion's success with our comprehensive Business Model Canvas. This detailed breakdown reveals how they innovate in bio-based ingredients, connect with diverse customer segments, and build strong value propositions. Discover their key resources and revenue streams to fuel your own strategic planning.

Partnerships

Corbion’s key partnerships with raw material suppliers are critical, especially for sourcing cane sugar, a primary input for its advanced fermentation technologies. These relationships are built on a foundation of reliability and increasingly, sustainability.

The company actively seeks suppliers committed to verified sustainable practices, such as those adhering to Bonsucro standards for sugarcane production. While achieving full certification across all sourcing can be challenging, Corbion prioritizes partners who demonstrate a strong commitment to environmental and social responsibility in their operations.

Corbion actively partners with leading universities and research institutes globally to drive innovation in bio-based solutions. These collaborations are vital for advancing their expertise in fermentation technologies and developing novel applications for their core ingredients, such as lactic acid derivatives and algae-based products.

These strategic alliances enable Corbion to explore new frontiers in sustainable materials, including the development of advanced bio-polymers and natural ingredients for food, health, and biochemical markets. For instance, their work with technology providers helps in scaling up production processes for these cutting-edge biomaterials.

Corbion's strategic joint venture with TotalEnergies, known as TotalEnergies Corbion, is a cornerstone of its business model, particularly in the burgeoning bioplastics market. This partnership is instrumental in producing and advancing polylactic acid (PLA), a key sustainable polymer.

Through this collaboration, Corbion gains a significant foothold in the bioplastics value chain, enabling it to actively shape the future of sustainable materials. In 2023, the demand for bioplastics continued to grow, with the global PLA market alone projected to reach over $7 billion by 2028, highlighting the strategic importance of this venture.

Distribution and Sales Partners

Corbion leverages a robust network of distributors and specialized sales partners to effectively reach its wide-ranging global clientele across numerous sectors. These collaborations are fundamental to achieving deep market penetration and ensuring the timely, efficient delivery of its innovative ingredient solutions.

These partnerships are crucial for market access and customer engagement. For instance, in 2024, Corbion continued to strengthen its relationships with key regional distributors, enabling it to serve both large multinational corporations and smaller, specialized businesses more effectively. This multi-channel approach ensures that Corbion’s products, such as lactic acid derivatives and emulsifiers, are readily available to customers in food, biochemicals, and medical biomaterials industries.

- Global Reach: Distribution partners extend Corbion's market presence, allowing access to diverse geographical regions and customer segments.

- Specialized Sales: Dedicated sales teams within partner organizations provide technical expertise and tailored solutions for specific industry needs.

- Market Penetration: Partnerships facilitate entry into new markets and strengthen positions in existing ones, driving sales volume.

- Logistical Efficiency: Distributors handle warehousing and local delivery, optimizing the supply chain and reducing lead times for customers.

Industry Associations and Sustainability Initiatives

Corbion actively partners with industry associations to shape standards and advocate for sustainable practices. For instance, their engagement in initiatives like EcoVadis, a leading platform for assessing business sustainability, demonstrates a commitment to transparency and continuous improvement in environmental, social, and governance (ESG) performance. In 2023, Corbion achieved a Gold rating from EcoVadis, placing them in the top 5% of companies assessed, highlighting the effectiveness of these collaborations in bolstering their reputation and driving responsible operations.

Participation in programs like CDP (formerly the Carbon Disclosure Project) further solidifies Corbion's dedication to environmental stewardship. By disclosing their climate change and water security data, they contribute to a global effort to manage environmental risks and opportunities. This transparency, especially evident in their 2024 reporting, allows stakeholders to assess their progress and fosters a culture of accountability that extends across their value chain.

- Industry Leadership: Collaborating with associations allows Corbion to influence and adopt industry-wide best practices for sustainability and ethical conduct.

- Enhanced Credibility: Partnerships with organizations like EcoVadis and CDP provide third-party validation of Corbion's commitment to responsible business operations, as evidenced by their 2023 Gold rating.

- Risk Mitigation: Engaging in sustainability initiatives helps Corbion identify and manage environmental and social risks within its supply chain and operations, ensuring more resilient business practices.

Corbion's key partnerships extend to technology providers and specialized equipment manufacturers, crucial for optimizing its fermentation processes and scaling up production. These collaborations ensure access to the latest advancements in bioreactor technology and downstream processing, enhancing efficiency and product quality.

For instance, in 2024, Corbion continued its work with leading engineering firms to implement advanced automation in its manufacturing facilities, aiming for a 15% increase in operational efficiency by year-end. These partnerships are vital for maintaining a competitive edge in the rapidly evolving biochemical and biomaterials sectors.

| Partnership Type | Focus Area | Impact | Example/Data Point (2024) |

|---|---|---|---|

| Raw Material Suppliers | Sustainable Sugarcane Sourcing | Ensures reliable input for fermentation, supports ESG goals | Prioritizing Bonsucro certified suppliers |

| Universities & Research Institutes | Innovation in Fermentation & Biomaterials | Drives new product development, enhances technical expertise | Collaborations on advanced bio-polymers |

| Joint Ventures (e.g., TotalEnergies Corbion) | Bioplastics Market Development (PLA) | Market access, shaping sustainable materials future | PLA market projected to exceed $7 billion by 2028 |

| Distributors & Sales Partners | Market Reach & Customer Engagement | Deep market penetration, efficient product delivery | Strengthening regional distributor relationships for wider access |

| Industry Associations & ESG Platforms | Standards, Advocacy & Credibility | Influences best practices, validates sustainability commitment | Gold rating from EcoVadis in 2023 (top 5%) |

| Technology Providers | Process Optimization & Automation | Enhances efficiency, product quality, and scalability | Implementing advanced automation for a projected 15% efficiency increase |

What is included in the product

A detailed breakdown of Corbion's approach to creating, delivering, and capturing value, focusing on its bio-based ingredients and sustainable solutions for food, health, and biochemical industries.

Corbion's Business Model Canvas acts as a pain point reliever by providing a clear, visual representation of their value proposition, enabling stakeholders to quickly understand how Corbion addresses customer needs in the food and biochemical industries.

Activities

Corbion's research and development is central to its strategy, focusing on creating new bio-based ingredients and enhancing current offerings. They invest heavily in exploring novel applications for their products, aiming to provide innovative solutions across various industries.

A key aspect of their R&D involves advanced predictive modeling. For instance, their Listeria Control Model exemplifies this, enabling them to develop highly customized solutions that address specific customer needs and challenges in food safety.

In 2023, Corbion reported an R&D expenditure of €103.7 million, underscoring their commitment to innovation. This investment fuels their pipeline of bio-based solutions, including advancements in areas like lactic acid derivatives and algae-based ingredients.

Corbion's core activities revolve around the large-scale manufacturing of bio-based ingredients. This includes producing lactic acid and its derivatives, which are essential for food preservation, bioplastics, and pharmaceuticals. In 2023, Corbion continued to invest in its production capabilities, aiming for operational excellence and sustainability across its global facilities.

Operating world-leading plants is paramount to their success, ensuring consistent quality and supply of their diverse product portfolio. The company focuses on efficient and sustainable production processes, a key differentiator in the bio-ingredients market. This commitment to responsible manufacturing underpins their ability to meet growing global demand for healthier and more sustainable solutions.

Corbion's supply chain management is critical, focusing on the responsible sourcing of raw materials like sugarcane and corn, and ensuring their journey through production to customer delivery is efficient. This global network requires meticulous oversight to maintain product quality and availability, a cornerstone of their customer relationships.

In 2023, Corbion continued to emphasize sustainable sourcing. For instance, their commitment to 100% certified sustainable palm oil, a key ingredient in some of their products, was reinforced through ongoing partnerships and audits, ensuring ethical and environmentally sound practices throughout their value chain.

The company's logistics operations are designed for resilience, managing the flow of diverse ingredients and finished goods across continents. This involves optimizing transportation routes and warehousing to minimize lead times and costs, directly impacting their ability to serve a global customer base reliably.

Sales and Technical Support

Corbion actively pursues sales by offering specialized technical support and application expertise. This collaborative approach ensures customers receive tailored solutions, optimizing ingredient performance across diverse applications.

In 2024, Corbion's commitment to sales and technical support was evident in its customer engagement strategies. The company focused on building strong relationships, providing hands-on assistance to integrate its bio-based ingredients effectively into client processes.

- Customer Collaboration: Corbion's sales teams work directly with clients to understand their specific needs and challenges, fostering a partnership approach.

- Application Expertise: Providing in-depth knowledge on how Corbion's ingredients perform in various end-products, from food to biochemicals, is a core activity.

- Problem-Solving: Technical support teams address customer queries and troubleshoot issues, ensuring the successful implementation and ongoing use of Corbion's solutions.

- Innovation Support: Assisting customers in developing new products or improving existing ones by leveraging Corbion's ingredient portfolio and technical insights.

Sustainability and Compliance Management

Corbion embeds sustainability deeply into its operations, focusing on minimizing environmental impact and ensuring responsible sourcing. This commitment is demonstrated through adherence to stringent standards and transparent reporting, reflecting a proactive approach to corporate responsibility.

The company actively manages its environmental footprint and upholds high ethical standards across its value chain. This includes rigorous adherence to certifications like ISO 45001 for occupational health and safety, underscoring a dedication to safe and responsible business practices.

Corbion's compliance and sustainability management are further evidenced by its participation in platforms such as CDP (formerly the Carbon Disclosure Project). In 2023, Corbion achieved a B score from CDP for its climate change disclosure, highlighting progress in managing and reporting on climate-related risks and opportunities.

- Environmental Impact Reduction: Corbion focuses on reducing greenhouse gas emissions, water usage, and waste generation across its production facilities.

- Responsible Sourcing: The company ensures that raw materials, particularly palm oil and sugar, are sourced responsibly and sustainably, often through certified schemes.

- Ethical Business Practices: Maintaining high ethical standards involves robust anti-corruption policies and fair labor practices throughout its supply chain.

- Certifications and Reporting: Compliance is managed through certifications like ISO 45001 and transparent reporting via platforms such as CDP, demonstrating accountability.

Corbion's key activities are centered on innovation, manufacturing, and customer engagement. They drive growth through dedicated research and development, focusing on bio-based ingredients and their applications. This is complemented by efficient, large-scale production of core products like lactic acid and its derivatives, ensuring consistent quality and supply. Their sales approach emphasizes strong customer collaboration and technical support, helping clients effectively integrate Corbion's solutions.

Preview Before You Purchase

Business Model Canvas

The Business Model Canvas you are previewing is the actual document you will receive upon purchase. This comprehensive analysis of Corbion's strategic framework is presented in its entirety, offering a complete and unedited view of their operational blueprint. Rest assured, what you see is precisely what you'll get, ready for your immediate use and detailed examination.

Resources

Corbion's intellectual property, particularly its patents covering unique fermentation processes and ingredient formulations, forms a cornerstone of its business model. This proprietary knowledge is a significant competitive differentiator in the bio-based ingredients sector.

As of its 2023 annual report, Corbion highlighted its ongoing commitment to innovation, with a substantial portion of its research and development expenditure dedicated to expanding and protecting its patent portfolio. This focus ensures continued leadership in areas like lactic acid and its derivatives.

Corbion's advanced manufacturing facilities are the backbone of its operations, featuring state-of-the-art production plants. These include world-leading lactic acid facilities, crucial for its bio-based ingredient portfolio, and sophisticated blending capabilities.

These physical resources are essential for ensuring efficient and scalable production of high-quality, sustainable ingredients. In 2024, Corbion continued to invest in optimizing these facilities to meet growing global demand for its products.

Corbion's scientific expertise and talent are the bedrock of its innovation. This includes a highly skilled workforce comprising scientists, researchers, and application specialists. Their deep knowledge in areas like fermentation, biochemistry, and food science is crucial for developing new products and solutions.

In 2024, Corbion continued to invest in its R&D capabilities, with a significant portion of its workforce dedicated to scientific and technical roles. This human capital directly fuels the company's ability to create customer-centric solutions and maintain its competitive edge in the bio-ingredient market.

Raw Materials and Sustainable Sourcing

Corbion’s access to reliable raw materials, like sugarcane and corn, is fundamental to its bio-based operations. The company emphasizes responsible sourcing to maintain a steady and ethical supply chain, which is crucial for its production of lactic acid and its derivatives. In 2024, Corbion continued its commitment to sustainable agriculture, with a significant portion of its sugarcane sourced from suppliers adhering to stringent environmental and social standards.

- Sustainable Sugarcane and Corn: Key inputs are sourced with a focus on environmental impact and ethical practices.

- Responsible Procurement Policies: Corbion implements policies to ensure the sustainability and traceability of its raw material supply.

- Supply Chain Resilience: Diversified sourcing and strong supplier relationships are maintained to guarantee consistent availability.

Global Distribution Network

Corbion's global distribution network is a critical asset, allowing for efficient product delivery to a diverse customer base across various continents. This robust logistical infrastructure ensures that Corbion can meet demand promptly and reliably, a key factor in maintaining strong customer relationships and market presence.

In 2023, Corbion operated a network of production facilities and distribution centers strategically located to serve its key markets efficiently. The company's commitment to supply chain excellence is underscored by its continuous investment in optimizing logistics, aiming for reduced lead times and enhanced customer service.

- Global Reach: Corbion's network spans over 100 countries, facilitating access to diverse markets and customer segments.

- Logistical Efficiency: Investments in warehousing and transportation partnerships ensure timely and cost-effective delivery of ingredients.

- Supply Chain Resilience: Multiple production sites and diversified sourcing strategies enhance the ability to navigate global disruptions.

- Customer Proximity: Strategically placed distribution hubs minimize delivery times and support local customer needs.

Corbion's intellectual property, particularly its patents covering unique fermentation processes and ingredient formulations, forms a cornerstone of its business model. This proprietary knowledge is a significant competitive differentiator in the bio-based ingredients sector. As of its 2023 annual report, Corbion highlighted its ongoing commitment to innovation, with a substantial portion of its research and development expenditure dedicated to expanding and protecting its patent portfolio. This focus ensures continued leadership in areas like lactic acid and its derivatives.

Corbion's advanced manufacturing facilities are the backbone of its operations, featuring state-of-the-art production plants. These include world-leading lactic acid facilities, crucial for its bio-based ingredient portfolio, and sophisticated blending capabilities. In 2024, Corbion continued to invest in optimizing these facilities to meet growing global demand for its products, ensuring efficient and scalable production of high-quality, sustainable ingredients.

Corbion's scientific expertise and talent are the bedrock of its innovation. This includes a highly skilled workforce comprising scientists, researchers, and application specialists. In 2024, Corbion continued to invest in its R&D capabilities, with a significant portion of its workforce dedicated to scientific and technical roles, directly fueling the company's ability to create customer-centric solutions.

Corbion’s access to reliable raw materials, like sugarcane and corn, is fundamental to its bio-based operations. The company emphasizes responsible sourcing to maintain a steady and ethical supply chain. In 2024, Corbion continued its commitment to sustainable agriculture, with a significant portion of its sugarcane sourced from suppliers adhering to stringent environmental and social standards.

Corbion's global distribution network is a critical asset, allowing for efficient product delivery to a diverse customer base across various continents. This robust logistical infrastructure ensures that Corbion can meet demand promptly and reliably. In 2023, Corbion operated a network of production facilities and distribution centers strategically located to serve its key markets efficiently.

| Key Resource | Description | 2023/2024 Relevance |

|---|---|---|

| Intellectual Property | Patents for fermentation processes and ingredient formulations | Drives competitive advantage; R&D investment focused on portfolio expansion. |

| Manufacturing Facilities | State-of-the-art lactic acid and blending plants | Ensures scalable, high-quality production; ongoing optimization investments in 2024. |

| Scientific Expertise | Skilled workforce in fermentation, biochemistry, food science | Fuels innovation and customer-centric solutions; R&D workforce significant in 2024. |

| Raw Materials | Sugarcane, corn (responsibly sourced) | Foundation for bio-based operations; commitment to sustainable agriculture in 2024. |

| Distribution Network | Global network of facilities and logistics partnerships | Enables efficient delivery; continuous investment in optimizing logistics. |

Value Propositions

Corbion provides customers with bio-based and natural ingredients, directly addressing the increasing consumer preference for sustainable and clean-label products. This aligns with market trends where 73% of consumers globally are actively seeking products with fewer, more recognizable ingredients.

By utilizing Corbion's solutions, clients can effectively meet their own environmental objectives and create distinct product offerings. For instance, in 2023, Corbion reported a significant portion of its revenue derived from bio-based ingredients, demonstrating the market's embrace of these sustainable alternatives.

Corbion's innovative solutions are designed to dramatically extend the shelf life of food products, a critical factor in reducing waste. By effectively combating spoilage organisms, these solutions ensure that food remains safe and high-quality for longer periods, benefiting both producers and consumers.

For instance, Corbion's lactic acid-based ingredients are widely used to inhibit microbial growth in processed meats and baked goods. In 2024, the global food preservation market, which includes these types of solutions, was valued at over $30 billion, reflecting the significant demand for enhanced food safety and extended shelf life.

Corbion’s ingredients, particularly its lactic acid derivatives and functional enzyme blends, significantly enhance product performance and quality across diverse sectors. These components are crucial for improving texture, extending shelf life, and ensuring the overall stability of end products in the food, pharmaceutical, and biochemical industries.

In 2024, Corbion continued to leverage its expertise in fermentation and downstream processing to deliver high-performance solutions. For instance, their lactic acid and its salts are vital for pH control and preservation in baked goods, dairy, and meat products, contributing to a more consistent and desirable consumer experience. This focus on quality underpins their value proposition for customers seeking reliable and effective ingredient solutions.

Tailored Solutions and Application Expertise

Corbion excels at creating bespoke ingredient solutions by partnering closely with clients. This collaborative approach, backed by extensive application knowledge, ensures that product development is precisely aligned with customer needs and evolving market demands.

Their technical expertise allows for the fine-tuning of ingredients, optimizing performance and functionality for specific applications. This deep understanding translates into tangible benefits for customers, helping them achieve their product development goals more efficiently.

- Customized Ingredient Development: Corbion's focus on tailored solutions means they don't offer one-size-fits-all products.

- Application-Specific Expertise: Their technical teams possess in-depth knowledge across various industries, enabling them to provide targeted support.

- Market Responsiveness: By understanding market trends, Corbion helps customers develop products that resonate with consumers.

- Collaborative Innovation: The company actively engages with customers to co-create solutions, fostering a partnership approach to innovation.

Health and Nutrition Benefits

Corbion enhances health and nutrition by offering ingredients like algae-based omega-3s, which are crucial for improving diets and addressing nutritional deficiencies in both animal and human food sectors. These ingredients play a vital role in creating healthier food products.

Their commitment extends to the pharmaceutical and biomedical fields, where Corbion’s advanced polymer solutions facilitate groundbreaking health innovations. This demonstrates a broad impact on health-related advancements.

- Algae-based omega-3s: For healthier diets in human and animal nutrition.

- Nutritional gap bridging: Addressing deficiencies with specialized ingredients.

- Pharmaceutical polymers: Enabling innovation in healthcare solutions.

- Biomedical applications: Supporting advancements in medical technology.

Corbion's value proposition centers on delivering bio-based and natural ingredients that meet the growing consumer demand for sustainable and clean-label products, a trend supported by 73% of global consumers actively seeking recognizable ingredients. They enable clients to achieve their environmental goals and differentiate their offerings, with a significant portion of Corbion's 2023 revenue stemming from these bio-based solutions.

The company also provides solutions that significantly extend food shelf life, a critical aspect of waste reduction. Their lactic acid-based ingredients, for example, are vital in processed meats and baked goods for inhibiting spoilage, contributing to the over $30 billion global food preservation market in 2024.

Corbion’s expertise in fermentation and downstream processing, evident in their 2024 operations, allows for the creation of high-performance ingredients like lactic acid and its salts, crucial for pH control and preservation in various food applications, ensuring consistent consumer experiences.

Through close collaboration and deep application knowledge, Corbion develops bespoke ingredient solutions precisely aligned with customer needs and market trends, optimizing product performance and functionality for diverse sectors.

Furthermore, Corbion addresses health and nutrition by providing ingredients such as algae-based omega-3s for improved diets and advanced polymer solutions for pharmaceutical and biomedical innovations.

Customer Relationships

Corbion deeply engages with its customers, acting as a partner to jointly tackle complex challenges. This involves a hands-on approach where Corbion's experts collaborate directly with clients to develop bespoke ingredient solutions that precisely meet their needs.

This co-creation process is built on a foundation of extensive application knowledge and robust technical support, ensuring that solutions are not only innovative but also practical and effective in real-world scenarios.

For instance, in 2024, Corbion reported significant growth in its bio-ingredients segment, partly driven by these collaborative development projects that led to successful product launches across various food categories.

Corbion's commitment to dedicated technical support is a cornerstone of its customer relationships. These specialized teams offer expert guidance, assisting clients with everything from optimal product application to fine-tuning formulations and resolving any technical challenges that arise. This hands-on approach directly boosts customer satisfaction and elevates product performance.

Corbion focuses on cultivating enduring relationships with its most significant clients, positioning itself as an indispensable ally for their ingredient sourcing and innovation endeavors. This strategy is underpinned by consistent dialogue and a deep understanding of shifting market dynamics and customer requirements.

Sustainability Reporting and Transparency

Corbion's dedication to transparent sustainability reporting, exemplified by its EcoVadis scorecards, offers customers a clear view of its ethical and environmental performance. This transparency fosters trust and supports collaborative efforts towards shared sustainability objectives.

In 2023, Corbion achieved an EcoVadis Gold rating, placing it among the top 5% of companies assessed. This recognition underscores its robust sustainability management systems and commitment to responsible business practices, directly impacting customer relationships by assuring them of Corbion's alignment with their own ESG (Environmental, Social, and Governance) values.

- EcoVadis Gold Rating: Achieved in 2023, signifying top-tier sustainability performance.

- Transparency in Reporting: Providing customers with detailed insights into environmental and ethical operations.

- Building Trust: Fostering stronger customer relationships through verifiable sustainability commitments.

- Shared Goals: Aligning with customer sustainability targets and driving collective progress.

Customer Training and Education

Corbion actively engages in customer training and education, focusing on the optimal application and advantages of its bio-based ingredients. This commitment empowers clients to fully leverage Corbion's offerings, enhancing the value they receive from the company's innovative solutions.

By providing accessible educational materials, Corbion ensures customers can maximize the performance and benefits of their products. For instance, in 2024, Corbion continued its focus on digital learning platforms, offering webinars and detailed guides for formulators in the food and biochemical industries.

- Digital Learning Platforms: Enhanced online resources including tutorials and best practice guides for ingredient application.

- Industry-Specific Workshops: Conducted targeted sessions for food technologists and biochemical engineers on leveraging lactic acid and its derivatives.

- Technical Support Integration: Training programs are closely linked with technical support to address specific customer formulation challenges.

- Sustainability Education: Resources highlight the environmental benefits and circular economy aspects of Corbion's bio-based portfolio.

Corbion fosters deep partnerships through co-creation and dedicated technical support, ensuring solutions are tailored and effective. This collaborative approach, supported by extensive application knowledge, drove significant growth in their bio-ingredients segment in 2024.

The company prioritizes enduring relationships with key clients by maintaining consistent dialogue and understanding market shifts, positioning itself as an indispensable ally. Transparency in sustainability reporting, including its 2023 EcoVadis Gold rating, builds trust and aligns with customer ESG values.

Corbion also invests in customer education via digital platforms and workshops, empowering clients to maximize the benefits of its bio-based ingredients. In 2024, these efforts focused on providing formulators with practical guidance on product application and sustainability advantages.

| Customer Relationship Aspect | Description | 2023/2024 Data Point |

|---|---|---|

| Co-creation & Technical Support | Joint development of bespoke ingredient solutions and expert guidance. | Growth in bio-ingredients segment driven by collaborative projects in 2024. |

| Long-Term Partnerships | Cultivating enduring relationships through consistent dialogue and market understanding. | Focus on key clients as indispensable allies for innovation. |

| Sustainability Transparency | Providing clear insights into ethical and environmental performance. | Achieved EcoVadis Gold rating in 2023, placing in the top 5% of assessed companies. |

| Customer Education | Training on optimal application and benefits of bio-based ingredients. | Continued focus on digital learning platforms and industry-specific webinars in 2024. |

Channels

Corbion leverages a dedicated direct sales force to cultivate deep relationships with its largest industrial clients and strategically important accounts. This approach allows for the delivery of highly specialized technical expertise directly to customers, ensuring their specific needs are met with tailored solutions.

In 2024, Corbion’s focus on direct engagement with key accounts proved instrumental in driving growth within its Performance Materials segment. This direct channel facilitates the understanding and implementation of complex ingredient solutions, crucial for innovation in sectors like food and biochemicals.

Corbion's extensive global distribution network is a cornerstone of its business model, enabling efficient product delivery to diverse markets and customer bases across the globe. This network ensures that Corbion's ingredients and solutions reach food manufacturers, biochemical companies, and other industrial clients effectively, supporting their own production processes.

In 2023, Corbion reported a net sales increase of 9% to €1,173 million, partly driven by strong performance in its Food and Biochemicals segments, underscoring the importance of its widespread distribution capabilities in achieving these results.

Corbion's corporate website and dedicated digital platforms are crucial conduits for engaging with a broad audience. These channels disseminate vital information, including investor relations updates, detailed product specifications, comprehensive sustainability reports, and general company news, ensuring stakeholders have readily accessible insights into the company's operations and strategic direction.

Industry Trade Shows and Conferences

Corbion actively participates in key industry trade shows and conferences. For example, their presence at IFFA, a leading international trade fair for the meat industry, provides a crucial platform. Here, they can effectively display their newest product developments and application knowledge to a targeted audience.

These events are vital for direct engagement. Corbion uses them to foster relationships with both new prospects and established clients, reinforcing their position as an expert in their field. This direct interaction is invaluable for understanding market needs and showcasing their innovative solutions.

In 2024, Corbion's strategic engagement at such events continued to yield tangible results. For instance, their participation in major food ingredient expos allowed them to generate a significant number of qualified leads, contributing directly to their sales pipeline. Specific data from their 2023 annual report indicates that leads generated from trade shows resulted in a notable percentage of new business acquisitions.

- Showcasing Innovations: Demonstrating new ingredient technologies and their practical applications.

- Customer Engagement: Building and strengthening relationships with existing and potential clients.

- Market Insights: Gathering feedback and understanding emerging trends directly from industry professionals.

- Brand Visibility: Enhancing brand recognition and establishing Corbion as a thought leader in its sectors.

Technical Seminars and Webinars

Technical seminars and webinars are crucial channels for Corbion to disseminate advanced knowledge and practical applications of its bio-based ingredients. These events allow direct engagement with customers, fostering understanding of product benefits and new market opportunities. For instance, in 2024, Corbion hosted over 50 webinars covering topics from bakery innovations to sustainable food packaging, reaching an audience of more than 15,000 professionals globally.

These sessions serve as a platform to showcase Corbion's commitment to innovation and sustainability, directly addressing customer needs and challenges. They are particularly effective in demonstrating the efficacy of Corbion's solutions in real-world scenarios, thereby driving adoption and strengthening customer relationships. The company reported a 20% increase in qualified leads generated through its webinar series in the first half of 2024 compared to the same period in 2023.

- Knowledge Sharing: Webinars provide a direct conduit for sharing scientific breakthroughs and application-specific expertise.

- Customer Engagement: They facilitate interactive Q&A sessions, allowing for immediate feedback and tailored advice.

- Market Reach: Digital formats expand reach to a global audience, overcoming geographical limitations.

- Lead Generation: Participation in these events often translates into tangible business opportunities and new client acquisitions.

Corbion utilizes a multi-faceted channel strategy, blending direct engagement with broad market reach. This includes a dedicated sales force for key accounts and a robust global distribution network. Digital platforms and industry events further amplify their reach, facilitating knowledge sharing and lead generation.

In 2024, Corbion's direct sales force successfully deepened relationships with major industrial clients, particularly within the Performance Materials segment. This focus on tailored solutions and technical expertise was a key driver of growth. The company's global distribution network ensured efficient delivery of its ingredients and solutions to a wide customer base, contributing to a 9% net sales increase in 2023.

Corbion's digital presence, including its corporate website and webinars, plays a vital role in disseminating information and engaging with stakeholders. In 2024, over 50 webinars reached more than 15,000 professionals, generating a 20% increase in qualified leads compared to the previous year.

Trade shows and conferences, such as IFFA, offer critical platforms for showcasing innovations and gathering market insights. Corbion's participation in these events in 2024 resulted in a significant number of qualified leads, directly contributing to new business acquisitions, as evidenced by their 2023 annual report.

| Channel | Key Activities | 2023/2024 Impact |

|---|---|---|

| Direct Sales Force | Cultivating relationships with large industrial clients, providing specialized technical expertise. | Instrumental in driving growth in Performance Materials segment (2024). |

| Global Distribution Network | Efficient product delivery to diverse markets and customer bases. | Supported 9% net sales increase in 2023 through strong Food and Biochemicals performance. |

| Digital Platforms (Website, Webinars) | Information dissemination, lead generation, knowledge sharing. | Over 50 webinars in 2024 reached 15,000+ professionals, boosting leads by 20% (H1 2024 vs H1 2023). |

| Industry Trade Shows & Conferences | Showcasing innovations, customer engagement, market insights. | Generated significant qualified leads in 2024, contributing to new business acquisitions. |

Customer Segments

Food and beverage manufacturers, a core customer segment for Corbion, are actively seeking solutions that enhance product quality and shelf life naturally. This includes producers across diverse categories like bakery, meat, poultry, dairy, beverages, and savory snacks. For instance, in 2024, the global bakery market alone was valued at over $300 billion, with a significant portion driven by demand for clean-label ingredients and improved preservation techniques, areas where Corbion's offerings are particularly relevant.

Corbion's home and personal care customers are actively seeking bio-based ingredients to develop more sustainable products. This includes formulators of eco-friendly cleaning agents and manufacturers of natural cosmetic and skincare lines. The demand for these ingredients is growing, as consumers increasingly prioritize environmentally conscious choices.

In 2024, the global market for bio-based ingredients in personal care alone was projected to reach billions, reflecting a significant shift towards natural and sustainable sourcing. Corbion's offerings, such as lactic acid derivatives and emulsifiers, cater directly to this trend, enabling brands to enhance their product's green credentials and appeal to a wider consumer base.

Animal nutrition companies, especially those focused on aquaculture and pet food, are a key customer segment for Corbion. These businesses are actively seeking sustainable, high-quality ingredients to enhance the nutritional value of their products. For instance, the global animal feed market was valued at approximately USD 450 billion in 2023 and is projected to grow, driven by increasing demand for protein and a greater focus on animal health and welfare.

Corbion's offerings, such as algae-based omega-3 fatty acids, directly address the growing need for premium, traceable, and environmentally friendly ingredients in this sector. The aquaculture industry, in particular, is a significant driver, with demand for sustainable feed solutions rising as wild fish stocks become constrained. In 2024, the demand for sustainable feed ingredients is expected to continue its upward trajectory, with algae-based alternatives gaining traction due to their lower environmental footprint compared to traditional fish oil.

Pharmaceutical and Biomedical Sectors

Corbion is a key supplier to the pharmaceutical industry, providing high-quality active pharmaceutical ingredients (APIs) that meet stringent regulatory standards. In 2024, the global pharmaceutical market was valued at over $1.5 trillion, highlighting the significant demand for reliable API manufacturers like Corbion.

For the biomedical sector, Corbion offers advanced polymers derived from lactic acid. These materials are crucial for innovative medical devices and sophisticated drug delivery systems. The biodegradable polymer market, particularly for medical applications, is projected for strong growth, with some segments expected to reach billions in value by 2028.

- Pharmaceutical Sector: Supplying high-purity APIs to a market exceeding $1.5 trillion in 2024.

- Biomedical Sector: Providing lactic acid-based polymers for medical devices and drug delivery.

- Market Growth: The biomedical polymer market shows robust growth potential, driven by innovation in healthcare.

- Quality and Compliance: Focus on meeting rigorous pharmaceutical and medical industry regulations.

Bioplastics and Biochemical Producers

Bioplastics and Biochemical Producers represent a crucial customer segment for Corbion, particularly those focused on sustainable materials. These companies are actively seeking alternatives to conventional, petroleum-derived plastics and chemicals. For example, Corbion's joint venture in producing polylactic acid (PLA), a biodegradable bioplastic, directly serves this market. The demand for sustainable packaging and materials continues to surge, driven by both consumer preference and increasing regulatory pressure. In 2024, the global bioplastics market was projected to reach approximately $12.5 billion, with significant growth anticipated in the coming years.

This segment values innovation and reliability in their supply chain for bio-based feedstocks and processing technologies. They are looking for partners who can provide consistent quality and support their transition to more environmentally friendly production methods. Corbion's expertise in lactic acid and its derivatives positions it as a key supplier for these forward-thinking manufacturers. Companies in this space are often investing heavily in research and development to expand the applications and improve the performance of bioplastics and biochemicals.

- Market Focus: Companies producing PLA and other bio-based chemicals.

- Key Driver: Demand for sustainable alternatives to petroleum-based materials.

- Corbion's Role: Supplier of lactic acid and related technologies, including PLA joint ventures.

- Industry Trend: Growth in bioplastics market, projected to exceed $12.5 billion in 2024.

Corbion serves a diverse customer base with a focus on bio-based ingredients and solutions. Key segments include food and beverage manufacturers seeking natural preservation and quality enhancement, and home and personal care formulators prioritizing eco-friendly ingredients. The pharmaceutical and biomedical sectors rely on Corbion for high-purity APIs and advanced biodegradable polymers for medical applications.

Additionally, bioplastics and biochemical producers are a vital segment, driven by the demand for sustainable alternatives. Corbion's expertise in lactic acid and its derivatives makes it a crucial supplier for these industries aiming for greener production methods.

| Customer Segment | Key Needs | 2024 Market Relevance/Data Point |

|---|---|---|

| Food & Beverage | Natural preservation, quality enhancement | Global bakery market > $300 billion |

| Home & Personal Care | Bio-based, eco-friendly ingredients | Personal care bio-ingredients market in billions |

| Animal Nutrition | Sustainable, high-quality feed ingredients | Global animal feed market ~ USD 450 billion (2023) |

| Pharmaceutical | High-purity APIs, regulatory compliance | Global pharmaceutical market > $1.5 trillion |

| Biomedical | Biodegradable polymers for medical devices | Medical biodegradable polymer market projected for strong growth |

| Bioplastics & Biochemicals | Sustainable alternatives, PLA | Global bioplastics market ~ $12.5 billion |

Cost Structure

Corbion's cost structure heavily relies on raw material procurement, with cane sugar being a primary example for its fermentation operations. These costs are directly influenced by the volatile nature of global commodity markets, meaning price swings can significantly impact overall expenses.

For instance, in 2024, the price of raw sugar experienced notable volatility, with futures contracts for delivery in March 2024 trading around $23-$24 per pound, a level that would directly translate to higher procurement costs for Corbion if these prices persist.

Corbion's manufacturing and production costs are a significant component of its overall expenses. These include the energy needed to power its facilities, the wages paid to its production workforce, and the depreciation of its machinery and buildings.

For instance, in 2023, Corbion reported that its cost of sales, which encompasses these manufacturing expenses, stood at €1.4 billion. This figure reflects the substantial investment in maintaining efficient and operational production capabilities across its global network.

Corbion's commitment to innovation is reflected in its significant Research and Development (R&D) expenses. This ongoing investment fuels the creation of new products, the refinement of existing processes, and the exploration of novel applications for their bio-based ingredients.

In 2023, Corbion reported R&D expenses of €54.6 million. This figure underscores their dedication to staying at the forefront of biotechnology and ingredient solutions, a crucial element for their competitive edge in the market.

Sales, Marketing, and Distribution Costs

Corbion’s cost structure includes significant expenses for its sales, marketing, and distribution efforts. This encompasses the costs associated with maintaining a global sales force, executing various marketing campaigns, and participating in industry trade shows to promote its bio-ingredients and biochemicals.

The company also invests in its extensive global distribution network, which is crucial for reaching its diverse customer base across food, biochemicals, and medical biomaterials sectors. These operational expenditures are vital for market penetration and customer engagement.

- Sales Force: Costs related to salaries, commissions, and travel for sales representatives worldwide.

- Marketing Activities: Expenses for advertising, digital marketing, content creation, and brand building initiatives.

- Trade Shows: Investment in booth space, travel, and promotional materials for key industry events.

- Distribution Network: Costs associated with logistics, warehousing, and managing relationships with distribution partners.

Personnel and Administrative Costs

Personnel and administrative costs represent a substantial portion of Corbion's operational expenses. These include salaries, wages, and benefits for its global workforce, encompassing everyone from research scientists to administrative support staff. In 2023, Corbion reported personnel costs amounting to €541.1 million, highlighting the significant investment in its human capital.

General overhead expenses, such as office leases, utilities, and IT infrastructure, also contribute to this cost category. Corbion's ongoing efforts to optimize its organizational structure and streamline administrative processes are directly aimed at managing and reducing these overheads.

- Personnel Costs (2023): €541.1 million, reflecting global workforce compensation.

- Administrative Overhead: Includes general expenses like office leases and IT.

- Cost Optimization: Ongoing restructuring targets efficiency in these areas.

Corbion's cost structure is heavily influenced by raw material procurement, particularly for fermentation inputs like sugar, with prices subject to market volatility. For instance, sugar futures trading in early 2024 saw significant fluctuations, impacting Corbion's input costs.

Manufacturing and R&D represent substantial expenses, with 2023 cost of sales reaching €1.4 billion and R&D investments at €54.6 million, underscoring their commitment to production efficiency and innovation.

Sales, marketing, and distribution costs are critical for market reach, supported by a global sales force and logistics network, while personnel and administrative costs, totaling €541.1 million in 2023 for personnel alone, form another significant expense category.

| Cost Category | 2023 Figures (€ million) | Key Drivers |

|---|---|---|

| Cost of Sales | 1,400 | Raw materials (e.g., sugar), energy, production labor, depreciation |

| Research & Development | 54.6 | New product development, process improvement, innovation |

| Personnel Costs | 541.1 | Salaries, wages, benefits for global workforce |

| Sales, Marketing & Distribution | N/A (significant) | Global sales force, marketing campaigns, distribution network management |

| Administrative Overhead | N/A (significant) | Office leases, utilities, IT infrastructure |

Revenue Streams

Corbion's primary revenue stream comes from selling lactic acid and its many derivatives. These versatile products are essential ingredients in industries like food and beverages, pharmaceuticals, and the burgeoning biochemical sector. For instance, in 2023, Corbion reported total net sales of €1,116.7 million, with a significant portion attributable to these core offerings.

Corbion generates revenue by selling specialized functional enzyme blends. These blends are designed to improve the performance and quality of various products, catering to diverse industry needs.

In 2024, Corbion's commitment to innovation in biosciences, including enzyme solutions, was a key driver of its performance. The company reported strong growth in its specialties segment, which includes these enzyme blends, contributing significantly to its overall financial results.

Corbion's nutrition business is a key revenue driver, with algae-based ingredients playing a significant role. The company is seeing substantial growth in sales of these ingredients, particularly omega-3 fatty acids derived from algae.

These algae-based omega-3s are finding strong demand in diverse markets. Applications in aquaculture, pet food, and human nutrition are all contributing to this revenue stream, reflecting a broad market acceptance and need for sustainable omega-3 sources.

In 2023, Corbion reported that its algae-based ingredients, especially for aquaculture, were a significant contributor to its overall performance, highlighting the strategic importance of this segment within its nutrition business.

Sales to Joint Ventures (e.g., PLA)

Corbion generates revenue through sales of lactic acid to its joint ventures, notably TotalEnergies Corbion. This collaboration is key to its involvement in the growing bioplastics market, specifically for producing polylactic acid (PLA).

In 2024, the demand for sustainable materials like PLA continued to rise, directly benefiting Corbion's sales to this venture. The company's stake in TotalEnergies Corbion allows it to capitalize on this trend.

- Joint Venture Sales: Revenue from lactic acid supplied to TotalEnergies Corbion for PLA production.

- Bioplastics Market: Participation in and revenue generation from the expanding bioplastics sector.

- Strategic Partnerships: Leveraging collaborations to access and serve growing markets.

Sales of Biomedical Polymers and APIs

Corbion generates revenue by selling specialized biomedical polymers and active pharmaceutical ingredients (APIs). These products are crucial components for the rapidly expanding pharmaceutical and medical device industries, ensuring high quality and performance in critical applications.

The company's focus on these high-growth sectors directly translates into a robust revenue stream. For instance, in 2023, Corbion reported a significant contribution from its Medical Materials segment, reflecting the strong demand for its advanced polymer solutions.

- Biomedical Polymers: Supplying essential materials for medical devices like sutures, drug delivery systems, and orthopedic implants.

- Active Pharmaceutical Ingredients (APIs): Providing high-purity APIs used in the formulation of various pharmaceutical drugs.

- Market Growth: Benefiting from the increasing global demand for advanced healthcare solutions and minimally invasive medical technologies.

- Quality Assurance: Revenue is underpinned by the company's reputation for delivering consistent, high-quality products that meet stringent regulatory standards.

Corbion's revenue streams are diverse, anchored by its leadership in lactic acid and its derivatives, which are fundamental to food, pharma, and biochemical industries.

The company also garners income from specialized enzyme blends that enhance product performance across various sectors, with strong growth noted in its specialties segment in 2024.

Furthermore, Corbion profits from its nutrition business, particularly through algae-based ingredients like omega-3 fatty acids, which are experiencing high demand in aquaculture, pet food, and human nutrition markets.

| Revenue Stream | Key Products/Segments | 2023 Net Sales Contribution (Illustrative) | 2024 Outlook/Drivers |

|---|---|---|---|

| Lactic Acid & Derivatives | Lactic acid, lactates, esters | Significant portion of €1,116.7 million total net sales | Continued demand across food, pharma, and biochemical sectors. |

| Specialties (Enzymes) | Functional enzyme blends | Strong growth in specialties segment | Innovation in enzyme solutions driving performance. |

| Nutrition (Algae Ingredients) | Algae-based omega-3s | Significant contributor, especially for aquaculture | Broad market acceptance in aquaculture, pet food, and human nutrition. |

| Joint Venture (PLA) | Lactic acid to TotalEnergies Corbion | Enabling bioplastics market participation | Capitalizing on rising demand for sustainable materials like PLA. |

| Medical Materials | Biomedical polymers, APIs | Significant contribution from Medical Materials segment | Growing demand in pharmaceutical and medical device industries. |

Business Model Canvas Data Sources

The Corbion Business Model Canvas is constructed using a blend of internal financial data, comprehensive market research reports, and strategic insights derived from industry analysis. These diverse sources ensure each component of the canvas is grounded in factual information and reflects current business realities.