Cooley PESTLE Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Cooley Bundle

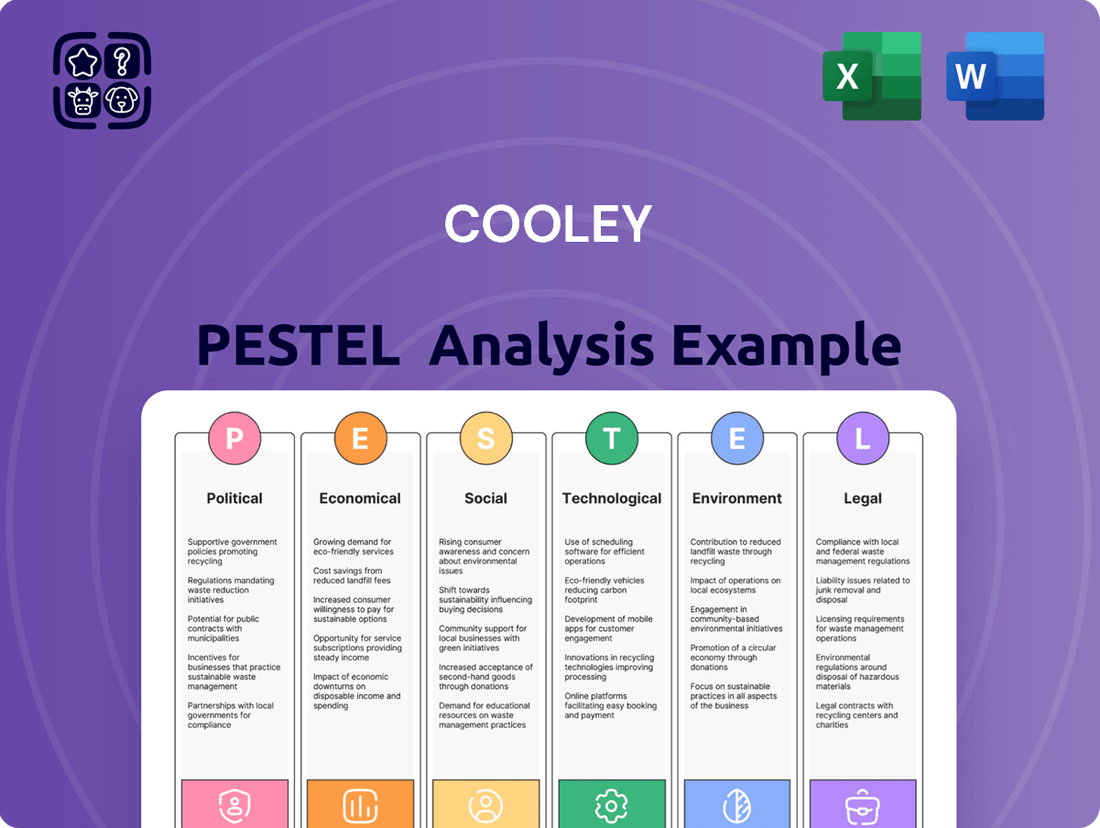

Unlock the secrets to Cooley's success by dissecting the political, economic, social, technological, environmental, and legal forces shaping its landscape. Our comprehensive PESTLE analysis provides actionable insights to inform your strategic decisions. Download the full report now and gain a critical understanding of the external factors impacting Cooley's future.

Political factors

Government policy shifts are a critical consideration for Cooley. For instance, changes in antitrust enforcement, particularly concerning major tech companies, directly affect Cooley's clients and the demand for their services. In 2024, regulatory bodies continued to scrutinize large technology firms, with several ongoing investigations and proposed legislation aimed at promoting competition.

Furthermore, alterations in R&D tax credits and venture capital funding policies can significantly influence the innovation landscape. The Inflation Reduction Act of 2022, for example, introduced new incentives for clean energy technologies, potentially boosting opportunities for Cooley's clients in that sector. Similarly, shifts in government support for life sciences research, such as increased NIH funding, create new avenues for legal advisory work.

The stability of international trade agreements, such as the USMCA or ongoing negotiations within the WTO, significantly impacts global M&A and cross-border investments. Geopolitical tensions, like those affecting semiconductor supply chains in 2024, directly influence the technology and life sciences sectors Cooley serves. For instance, trade disputes can lead to tariffs and restrictions, increasing costs and complexity for companies operating internationally.

Political decisions significantly influence the regulatory landscape for cutting-edge fields like artificial intelligence, gene editing, and digital health. Cooley must stay ahead of these evolving frameworks to guide clients through compliance hurdles and support their global market access.

For instance, in 2024, governments worldwide are actively debating and implementing new regulations around AI, with the EU's AI Act set to take full effect, impacting how companies develop and deploy AI technologies. This necessitates proactive legal counsel to ensure adherence and mitigate risks for Cooley's clients in this rapidly advancing sector.

Political Stability and Geopolitics

Cooley's clients, particularly those in technology and life sciences, are significantly impacted by political stability in their operating regions and target markets. For instance, the ongoing geopolitical tensions in Eastern Europe, which escalated in 2022 and continued through 2024, have disrupted supply chains for critical components and raw materials, affecting manufacturing timelines and costs for many tech firms. This instability necessitates careful legal and operational risk assessment for Cooley's clients looking to maintain or expand their global footprint.

Geopolitical events also influence capital flows and market access, directly affecting investment confidence. As of early 2025, the global economic outlook remains cautious, partly due to unresolved trade disputes and regional conflicts. Cooley must advise clients on navigating these complexities, including potential sanctions, trade barriers, and the need for diversified market strategies to mitigate risks associated with concentrated market reliance.

- Global Political Stability: While major economies like the US and EU generally exhibit stable political environments, emerging markets present varied levels of stability, impacting foreign direct investment.

- Geopolitical Risk Exposure: Cooley's clients in sectors reliant on global supply chains, such as semiconductor manufacturing or specialized medical devices, face heightened risks from ongoing geopolitical friction.

- Market Access Challenges: Trade policies and international relations directly influence Cooley's clients' ability to access key international markets, with potential tariffs and regulatory changes impacting profitability.

- Regulatory Uncertainty: Evolving political landscapes can lead to unpredictable regulatory shifts, requiring Cooley to provide proactive counsel on compliance and adaptation strategies.

Government Funding and Incentives

Government funding and incentives are pivotal for industries Cooley serves. For instance, the US Inflation Reduction Act of 2022 is channeling over $370 billion into clean energy and climate initiatives, creating significant opportunities for companies in sectors like renewable energy and electric vehicles. Cooley must monitor these programs to guide clients in accessing public funds and managing compliance.

These initiatives can significantly de-risk innovation and expansion for Cooley's clients. For example, the CHIPS and Science Act of 2022 allocates billions to boost domestic semiconductor manufacturing and research. Staying informed allows Cooley to advise clients on securing grants and tax credits, thereby enhancing their competitive edge.

- Federal Support for Innovation: The US government has committed substantial resources to R&D, with the National Science Foundation alone expecting a budget of $11.9 billion for fiscal year 2024, supporting advancements across various technological fields.

- State-Level Incentives: Many states offer their own grants and tax incentives for businesses investing in specific sectors, such as California's R&D tax credit or Texas's emerging technology funds.

- Navigating Compliance: Clients leveraging government funding must adhere to strict reporting and usage regulations, a complex area where Cooley's expertise is invaluable.

- Impact on Client Growth: Access to these funds can accelerate client product development cycles and market entry, directly impacting their growth trajectory and Cooley's advisory value.

Government policy and political stability are paramount for Cooley's clients. Regulatory scrutiny of large tech firms, ongoing in 2024, directly impacts their business models and legal needs. Shifts in R&D tax credits and venture capital policies, like those influenced by the Inflation Reduction Act of 2022, shape innovation landscapes and create new advisory opportunities.

Geopolitical tensions, evident in supply chain disruptions affecting semiconductor manufacturing through 2024, necessitate careful legal counsel for global operations. Trade policies and international relations dictate market access and investment confidence, with ongoing global economic caution in early 2025 stemming from unresolved trade disputes.

Government funding and incentives, such as the CHIPS and Science Act of 2022, significantly de-risk innovation for clients in critical sectors like semiconductors. Cooley's expertise is vital in helping clients navigate compliance for these substantial federal and state-level programs, directly accelerating their growth.

| Policy Area | 2024/2025 Impact | Cooley's Role |

|---|---|---|

| Antitrust Enforcement | Increased scrutiny of Big Tech, potential new regulations | Advising clients on compliance and competitive strategy |

| R&D Tax Credits/Funding | Continued incentives for clean energy (IRA 2022), tech innovation | Guiding clients on accessing funds and tax benefits |

| Geopolitical Tensions | Supply chain volatility, trade restrictions impacting tech/life sciences | Risk assessment for global operations and market access |

| Government R&D Investment | Significant federal budgets for NSF ($11.9B FY24), CHIPS Act billions | Assisting clients in securing grants and navigating compliance |

What is included in the product

The Cooley PESTLE Analysis systematically examines the Political, Economic, Social, Technological, Environmental, and Legal factors impacting the organization, providing a comprehensive understanding of the external landscape.

Provides a clear, actionable framework to identify and address external threats and opportunities, simplifying complex market dynamics for strategic decision-making.

Economic factors

The global economic landscape in late 2024 and early 2025 presents a mixed picture, with moderating growth in developed economies and continued resilience in some emerging markets. However, persistent inflation and the impact of higher interest rates are increasing recession risks, particularly in Europe and potentially the US. This slowdown directly impacts Cooley's business, as deal volumes, including M&A and IPOs, tend to contract during economic downturns.

In 2024, global GDP growth is projected to be around 3.0%, a slight deceleration from previous years, according to IMF forecasts. This moderation means fewer companies are looking to go public or engage in large-scale mergers, directly affecting the demand for Cooley's corporate and capital markets legal services. Venture capital funding has also seen a significant pullback, with deal counts and values down considerably from their peaks in 2021 and 2022, impacting Cooley's work with startups and growth-stage companies.

Interest rate fluctuations significantly shape the economic landscape for firms like Cooley. For instance, the U.S. Federal Reserve's benchmark interest rate, the federal funds rate, hovered between 5.25% and 5.50% as of early 2024, a level that increases borrowing costs for businesses and potentially dampens investment appetite.

These shifts directly impact Cooley's corporate advisory services. When interest rates rise, the cost of capital for mergers, acquisitions, and corporate finance activities increases, which can lead to a slowdown in deal-making and a reduced demand for advisory services in these areas.

Conversely, periods of lower interest rates can stimulate M&A and investment, thereby boosting Cooley's workload in corporate advisory. For example, during periods of quantitative easing, lower borrowing costs often encourage companies to pursue growth through acquisitions, benefiting advisory firms.

The availability and deployment of venture capital and private equity are vital for Cooley's clients at the startup and growth stages. In the first half of 2024, global VC funding reached $175 billion, a notable increase from the previous year, indicating a more robust investment environment for emerging companies.

Investor sentiment, heavily influenced by market valuations and the potential for successful exits, directly impacts the demand for Cooley's expertise in fundraising and corporate governance. With IPO markets showing signs of recovery in late 2024, with several tech companies achieving strong public debuts, there's a renewed optimism that translates into increased activity for legal services supporting these transactions.

Inflationary Pressures

Rising inflation presents a significant challenge for Cooley by increasing its operational expenses, from office supplies to employee compensation. This inflationary pressure also affects Cooley's clients, particularly those in high-growth sectors, potentially leading to reduced legal budgets as they re-evaluate their spending in a tighter economic environment. For instance, the US Consumer Price Index (CPI) showed a notable increase, with annual inflation rates fluctuating throughout 2024 and into early 2025, impacting the cost of doing business across various industries.

Cooley must therefore focus on demonstrating exceptional value and efficiency in its legal services to retain clients. This might involve optimizing service delivery models or highlighting cost-saving strategies for clients facing their own inflationary challenges. The need for clear ROI on legal spend becomes paramount when economic uncertainty looms, pushing firms like Cooley to be more transparent about their billing and the tangible benefits they provide.

- Increased Operational Costs: Higher prices for goods and services directly impact Cooley's overhead.

- Client Budget Re-evaluation: Clients may scrutinize legal fees more closely, seeking greater cost-effectiveness.

- Focus on Value Proposition: Cooley needs to emphasize the tangible benefits and efficiency of its legal counsel.

- Impact on High-Growth Clients: Companies with less stable profitability are particularly vulnerable to economic downturns and may cut discretionary spending, including legal services.

Currency Exchange Rate Volatility

Currency exchange rate volatility directly impacts Cooley's global operations. For instance, if the US dollar strengthens significantly against the Euro, revenues earned in Euros by Cooley's European offices would translate to fewer dollars, potentially affecting overall profitability. This dynamic also influences client advisory services, as businesses navigating international trade face altered costs and revenues.

In 2024, major currency pairs like EUR/USD experienced notable swings. The Euro, for example, saw periods of depreciation against the dollar due to differing interest rate policies and economic outlooks between the US and the Eurozone. This volatility necessitates sophisticated advice for Cooley's clients involved in cross-border M&A or significant international contracts.

The impact extends to client investments and transaction costs. For a client acquiring a company in Japan, a weaker Yen in 2024 would make the acquisition cheaper in dollar terms, but conversely, a stronger Yen would increase the cost. Cooley's expertise in advising on financial risk management, including currency hedging instruments, becomes crucial in such scenarios.

- Impact on Revenue Translation: Fluctuations in exchange rates can alter the reported value of Cooley's international earnings when consolidated into its primary reporting currency.

- Client Transaction Costs: For clients engaged in international trade, currency volatility directly affects the cost of imports and the revenue from exports, influencing their legal needs.

- Investment Valuation: The value of international assets and investments held by clients, or potential acquisitions, is significantly influenced by prevailing exchange rates.

- Advisory Services Demand: Increased currency volatility often leads to a higher demand for Cooley's expertise in international finance, contract structuring, and risk mitigation strategies.

Economic headwinds persist into 2025, with global growth moderating and inflation remaining a concern, though potentially easing from 2024 peaks. Higher interest rates continue to influence deal volumes, impacting Cooley's core business in M&A and capital markets. Venture capital funding, while showing some recovery in 2024, remains sensitive to broader economic sentiment and investor risk appetite.

The U.S. Federal Reserve maintained its benchmark interest rate in the 5.25%-5.50% range through early 2024, a stance that increases borrowing costs for businesses and can dampen investment. This environment directly affects Cooley's clients by making financing for transactions more expensive, potentially slowing down M&A activity and IPOs.

Global inflation, while showing signs of cooling in some regions by late 2024, continued to pressure operational costs for firms like Cooley and influence client spending on legal services. For instance, the US CPI saw annual rates fluctuate, impacting business expenses and potentially leading clients to scrutinize legal budgets more closely.

| Economic Factor | 2024 Projection/Status | Impact on Cooley |

| Global GDP Growth | Projected ~3.0% (IMF) | Moderating growth may reduce deal volumes (M&A, IPOs). |

| Interest Rates (US Fed Funds) | 5.25%-5.50% (early 2024) | Higher borrowing costs can dampen investment and deal activity. |

| Venture Capital Funding | $175 billion (H1 2024) | Increased funding supports startups, but overall VC activity sensitive to market conditions. |

| Inflation (US CPI) | Fluctuating annual rates | Increases operational costs and may lead to client budget re-evaluation. |

Preview the Actual Deliverable

Cooley PESTLE Analysis

The preview shown here is the exact Cooley PESTLE Analysis document you’ll receive after purchase—fully formatted and ready to use.

This is a real screenshot of the product you’re buying—delivered exactly as shown, no surprises, providing a comprehensive look at the Political, Economic, Social, Technological, Legal, and Environmental factors affecting Cooley.

The content and structure of this Cooley PESTLE Analysis shown in the preview is the same document you’ll download after payment, offering actionable insights.

Sociological factors

The demand for specialized legal expertise, particularly in high-growth sectors like technology and life sciences, intensifies the competition for top legal talent. This fierce competition directly impacts Cooley's capacity to secure and keep skilled professionals, as firms vie for individuals with niche proficiencies.

Societal shifts emphasizing work-life balance and a positive firm culture are increasingly important. In 2024, surveys indicate that over 60% of legal professionals consider firm culture and flexibility as key factors when choosing an employer, influencing Cooley's recruitment strategies and employee retention efforts.

The global population is aging, with the UN projecting that by 2050, one in six people worldwide will be 65 or older. This demographic shift directly impacts the life sciences and technology sectors, creating demand for new healthcare solutions, assistive technologies, and financial services tailored to seniors. Cooley must recognize these evolving client needs to offer specialized legal expertise in areas like elder law, healthcare compliance, and the burgeoning fintech market catering to this demographic.

Public sentiment towards emerging technologies like artificial intelligence and biotechnology significantly shapes the regulatory landscape and consumer demand for Cooley's clients. For instance, a 2024 survey indicated that while 65% of consumers are optimistic about AI's potential benefits, over 50% expressed concerns about job displacement and data privacy, directly influencing how these technologies are adopted and regulated.

Cooley's advisory role extends beyond legal compliance to encompass crucial ethical considerations and public relations strategies. Navigating public perception, particularly around data privacy, is paramount; a 2025 report found that 70% of consumers are more likely to engage with companies that demonstrate transparent data handling practices, a key factor for clients in the tech and biotech sectors.

Diversity, Equity, and Inclusion (DEI)

The growing societal focus on Diversity, Equity, and Inclusion (DEI) significantly influences Cooley's internal culture and its external relationships. This emphasis shapes how the firm attracts talent and meets the evolving expectations of its client base, particularly high-growth companies and institutional investors who increasingly prioritize these values.

Cooley's commitment to DEI is vital for securing top-tier talent from a wider pool and for demonstrating alignment with the core principles of many forward-thinking businesses and investment firms. For instance, in 2024, law firms across the US reported that 39% of associates were individuals from minority ethnic groups, a figure that continues to rise, highlighting the demand for diverse legal teams.

- Talent Acquisition: A strong DEI program is essential for attracting and retaining a diverse workforce, crucial for innovation and understanding varied client needs.

- Client Expectations: Many clients, especially in technology and venture capital, actively seek law firms that reflect their own DEI commitments, impacting business development.

- Reputation and Brand: Demonstrating robust DEI practices enhances Cooley's reputation as a socially responsible and modern legal service provider.

- Market Competitiveness: Firms with established DEI initiatives often hold a competitive edge in attracting both talent and clients in the current market landscape.

Workplace Culture and Employee Well-being

Societal expectations regarding workplace culture are rapidly shifting, with a pronounced emphasis on employee well-being and work-life balance. This directly impacts how law firms like Cooley structure their operations and approach talent acquisition and retention. Firms that fail to adapt risk losing valuable talent to more progressive competitors.

To remain competitive, Cooley must actively respond to these evolving norms. This includes offering enhanced flexibility, robust mental health support, and fostering an inclusive environment. For instance, a 2024 survey indicated that 70% of legal professionals consider flexible work arrangements a critical factor when choosing an employer.

- Increased demand for flexible work arrangements: Hybrid and remote work options are becoming standard expectations.

- Focus on mental health and well-being: Law firms are increasingly investing in programs and resources to support employee mental health.

- Emphasis on diversity, equity, and inclusion (DEI): A strong DEI commitment is crucial for attracting and retaining a diverse workforce.

- Desire for meaningful work and professional development: Employees seek opportunities for growth and to feel their contributions are valued.

Societal trends highlight a growing demand for specialized legal services in emerging fields like AI ethics and biotech patent law, forcing firms like Cooley to adapt their talent acquisition. Public sentiment, with a 2024 survey showing 65% optimism but 50% concern regarding AI, directly influences regulatory frameworks and client adoption rates. Furthermore, the increasing emphasis on Diversity, Equity, and Inclusion (DEI) is reshaping firm culture, with 2024 data indicating 39% of associates in US law firms are from minority ethnic groups, a figure Cooley must leverage for talent and client engagement.

Work-life balance and mental well-being are now paramount, with 70% of legal professionals in a 2024 survey prioritizing flexible work. This societal shift necessitates that Cooley offers enhanced flexibility and support to remain competitive in talent acquisition and retention.

| Societal Factor | Impact on Cooley | Supporting Data (2024-2025) |

|---|---|---|

| Demand for Specialized Expertise | Intensifies competition for niche legal talent in tech and life sciences. | High demand for AI ethics and biotech patent lawyers. |

| Work-Life Balance & Well-being | Requires flexible work arrangements and mental health support for talent retention. | 70% of legal professionals consider flexibility critical for employer choice. |

| Diversity, Equity, and Inclusion (DEI) | Crucial for attracting diverse talent and meeting client expectations. | 39% of US law firm associates are from minority ethnic groups. |

| Public Sentiment on Technology | Shapes regulatory landscapes and consumer demand for tech clients. | 65% optimistic about AI benefits, 50% concerned about job displacement/privacy. |

Technological factors

The relentless pace of technological advancement, particularly in fields like artificial intelligence and quantum computing, presents both complex legal hurdles and significant new avenues for client service. Cooley's strategic imperative involves cultivating deep expertise in these emerging domains to guide clients through intellectual property protection, navigating evolving regulatory landscapes, and optimizing commercialization strategies.

The legal industry is undergoing a significant digital transformation, driven by the widespread adoption of LegalTech. This includes advanced AI-powered tools for legal research, sophisticated automation platforms, and robust data analytics. For a firm like Cooley, embracing these technologies is crucial for streamlining operations and cutting costs.

By integrating LegalTech, Cooley can boost efficiency, allowing lawyers to focus on higher-value tasks. This technological shift is not just about internal improvements; it's about delivering more innovative and cost-effective solutions to clients, thereby securing a competitive advantage in the evolving legal market.

As Cooley increasingly relies on digital platforms for client services and internal operations, cybersecurity and data protection have become critical concerns. The firm must invest in advanced security measures to safeguard sensitive client information and its own proprietary data from evolving cyber threats. In 2023, the global average cost of a data breach rose to $4.45 million, highlighting the significant financial and reputational risks involved.

Cooley's role extends to advising clients on navigating the complex landscape of data privacy regulations, such as GDPR and CCPA. The firm's expertise in breach response planning and legal counsel is essential for clients facing potential data incidents. The increasing volume of cyberattacks, with reports indicating a 40% rise in ransomware attacks against businesses in the past year, underscores the demand for such specialized legal services.

Pace of Innovation in Client Industries

The rapid evolution of technology, particularly in areas like artificial intelligence, biotechnology, and digital platforms, directly fuels the need for Cooley's specialized legal expertise. Industries like software development and pharmaceuticals are constantly innovating, creating new intellectual property and regulatory landscapes that require sophisticated legal navigation. For instance, the global AI market was valued at approximately $150.3 billion in 2023 and is projected to grow significantly, indicating a surge in related legal needs for Cooley's clients.

Cooley's success hinges on its capacity to not only understand but also anticipate these technological shifts to offer proactive and cutting-edge legal counsel. This includes advising on emerging patentability issues, complex data privacy regulations, and the intricacies of cross-border technology licensing agreements. The firm's engagement with venture capital funding in the tech sector, which saw substantial activity in 2024, underscores the dynamic environment it serves.

- Accelerated IP Demand: The pace of innovation in tech and life sciences necessitates constant updates in intellectual property strategies, from patent filings to trade secret protection.

- Regulatory Foresight: Emerging technologies often outpace existing regulations, requiring legal firms to provide guidance on compliance and future-proofing strategies.

- Client Industry Growth: Sectors like cloud computing and personalized medicine are experiencing exponential growth, creating a sustained demand for specialized legal services.

- Talent Acquisition: Keeping pace also means attracting and retaining legal talent with expertise in rapidly developing technological fields.

Impact of Remote Work Technologies

The rapid evolution of collaboration and communication technologies has been a game-changer, making remote and hybrid work not just feasible but often preferable. These advancements directly impact how businesses like Cooley operate.

Cooley can strategically harness these tools to boost its operational agility. This includes accessing a wider, global talent pool, unhindered by geographical limitations, and ensuring consistent, high-quality client service across diverse time zones and locations. For instance, by mid-2024, many professional services firms reported a significant increase in the adoption of AI-powered collaboration tools, aiming to streamline workflows and enhance team productivity.

- Enhanced Productivity: Tools like Slack and Microsoft Teams saw increased usage in 2024, with many firms reporting productivity gains of up to 15% in remote settings.

- Global Talent Access: Cooley can tap into specialized legal and technical expertise worldwide, potentially reducing recruitment costs and time-to-hire.

- Client Service Delivery: Virtual meeting platforms and cloud-based document sharing ensure seamless client interactions and efficient case management, regardless of physical location.

- Cost Efficiencies: Reduced reliance on physical office space can lead to significant savings on real estate and associated overheads, a trend observed across the legal sector in the 2024 fiscal year.

Technological advancements are fundamentally reshaping the legal landscape, demanding continuous adaptation from firms like Cooley. The rapid growth of AI, quantum computing, and LegalTech necessitates deep expertise to navigate new client needs and operational efficiencies.

The increasing reliance on digital platforms for client services and internal operations highlights the critical importance of robust cybersecurity measures. Global data breach costs continue to rise, emphasizing the need for proactive defense and compliance with evolving data privacy regulations.

Cooley's ability to advise clients on intellectual property, data privacy, and regulatory compliance in rapidly innovating sectors like AI and biotechnology is paramount. The firm's strategic engagement with the venture capital ecosystem, particularly in tech funding, reflects the dynamic market it serves.

The adoption of advanced collaboration and communication technologies enables greater operational agility and access to a global talent pool. These tools are crucial for enhancing productivity and delivering seamless client service across diverse geographical locations.

| Technology Area | Impact on Cooley | Key Data Point (2023-2025) | Cooley's Strategic Response |

| Artificial Intelligence (AI) | Enhanced legal research, document analysis, client advisory on AI IP | Global AI market valued at ~$150.3 billion in 2023; projected significant growth. | Developing AI expertise, advising on AI patentability and regulatory compliance. |

| LegalTech Adoption | Streamlined operations, cost reduction, improved efficiency | Increased adoption of AI-powered legal tools by ~30% of firms in 2024. | Integrating advanced LegalTech for research, automation, and data analytics. |

| Cybersecurity | Protecting sensitive client data, mitigating breach risks | Global average cost of data breach rose to $4.45 million in 2023. | Investing in advanced security measures, advising clients on data protection and breach response. |

| Collaboration Tools | Facilitating remote work, global talent access, enhanced productivity | Firms reported up to 15% productivity gains with AI collaboration tools in remote settings by mid-2024. | Leveraging virtual platforms and cloud-based systems for agile operations and client service. |

Legal factors

Changes in intellectual property laws are a constant factor for Cooley. For instance, the ongoing evolution of patent eligibility criteria, as seen in recent USPTO guidance and court decisions through early 2025, directly affects how Cooley advises clients on securing and defending patent rights. Similarly, updates to copyright protections, including those related to AI-generated works, necessitate continuous adaptation in client counseling.

The global landscape of data privacy is rapidly evolving, with a noticeable surge in new and more stringent regulations. This trend is particularly impactful for technology and life sciences sectors, which often handle vast amounts of sensitive personal information. For instance, as of early 2024, several US states have enacted or are in the process of implementing comprehensive data privacy laws, mirroring the complexity faced by companies navigating international standards like GDPR.

Antitrust and competition law enforcement is a significant legal factor impacting businesses, especially in the technology sector. Regulators are increasing their scrutiny of mergers, acquisitions, and strategic alliances. For instance, in 2023, the US Federal Trade Commission (FTC) challenged a record number of mergers, signaling a more aggressive stance on market concentration.

Cooley's expertise in this area is crucial for clients navigating these complex regulatory landscapes. The firm advises on ensuring deal approvals and mitigating risks of costly litigation. This focus helps businesses structure transactions to comply with evolving antitrust guidelines, a critical consideration for maintaining market access and avoiding substantial penalties.

Regulatory Frameworks for Emerging Technologies

Governments worldwide are actively crafting new legal structures to address emerging technologies. For instance, the European Union's AI Act, expected to be fully implemented by 2025, sets a precedent for AI governance, classifying systems by risk level. Cooley's clients need to navigate these evolving rules to ensure their innovative products and services remain compliant.

Staying ahead of these legislative shifts is crucial. For example, the U.S. Securities and Exchange Commission (SEC) has been increasingly scrutinizing cryptocurrency and digital asset regulations, with significant enforcement actions in 2023 and ongoing policy discussions throughout 2024. Cooley's role involves providing clients with foresight into these developing legal landscapes.

This proactive approach helps clients avoid potential penalties and capitalize on opportunities. Consider the autonomous vehicle sector; by mid-2024, several U.S. states had introduced or updated legislation concerning self-driving car testing and deployment, highlighting the dynamic nature of this regulatory environment. Cooley's expertise ensures clients are prepared for these changes.

Key areas of regulatory focus include:

- Artificial Intelligence: Developing ethical guidelines and data privacy standards for AI deployment.

- Cryptocurrency: Establishing clear rules for digital asset exchanges, stablecoins, and decentralized finance (DeFi).

- Autonomous Systems: Defining safety standards and liability frameworks for self-driving vehicles and drones.

- Data Governance: Implementing robust data protection and cybersecurity measures in line with global standards.

Securities and Capital Markets Regulations

Changes in securities laws and capital markets regulations significantly influence Cooley's corporate and capital markets practices. For instance, the SEC's proposed rule changes in 2024 regarding private fund disclosures and marketing could reshape how Cooley advises clients on venture capital and private equity transactions. The firm must guide clients through evolving compliance requirements for IPOs and public company reporting, ensuring they maintain market access and regulatory adherence.

Navigating these complex legal landscapes is crucial for clients seeking to raise capital or operate as public entities. The ongoing debate and potential legislative changes around SPACs, for example, directly impact the firm's advisory services for alternative public offerings. Cooley's expertise is vital in helping businesses understand and comply with these dynamic rules, thereby facilitating their growth and market presence.

- Evolving Disclosure Requirements: New regulations, such as potential updates to Regulation S-K for ESG reporting, necessitate careful client counsel to ensure accurate and compliant public disclosures.

- Venture Financing Landscape: Shifts in regulations affecting accredited investor definitions or crowdfunding platforms can alter the capital-raising options available to Cooley's startup clients.

- Public Company Oversight: Increased scrutiny on corporate governance and executive compensation, as seen in recent enforcement actions, requires Cooley to provide robust compliance advice to its public company clientele.

Legal factors present a dynamic environment for Cooley, particularly concerning intellectual property and data privacy. For example, the U.S. Patent and Trademark Office's evolving guidance on patent eligibility through early 2025 directly impacts how Cooley advises clients on securing patents for new technologies, including those related to AI-generated content.

Antitrust enforcement is also a critical legal consideration, with regulators like the FTC demonstrating an increasingly aggressive stance. In 2023, the FTC challenged a record number of mergers, underscoring the need for Cooley to guide clients in structuring transactions to avoid costly litigation and maintain market access.

Governments are actively shaping new legal frameworks for emerging technologies, such as the EU's AI Act, slated for full implementation by 2025, which classifies AI systems by risk level. Similarly, the SEC's heightened scrutiny of cryptocurrency regulations, with significant enforcement actions in 2023 and ongoing policy discussions in 2024, requires Cooley's proactive counsel.

Securities laws and capital markets regulations also demand constant attention. Proposed SEC rule changes in 2024 concerning private fund disclosures could significantly alter how Cooley advises on venture capital and private equity transactions, necessitating updated guidance on IPOs and public company reporting.

Environmental factors

Investors are increasingly prioritizing Environmental, Social, and Governance (ESG) factors, with global ESG assets projected to reach $50 trillion by 2025. This trend significantly shapes corporate strategies and investment flows, as companies demonstrating strong ESG performance often gain better access to capital and enjoy enhanced market reputations.

Cooley actively guides clients through the complexities of ESG, offering expertise in compliance, transparent reporting, and developing robust ESG strategies. Navigating these environmental considerations is becoming crucial for maintaining competitive advantage and attracting investment in the evolving financial landscape.

Evolving climate change regulations, including stricter carbon emission targets and mandates for renewable energy adoption, are significantly shaping the operational landscape for businesses. For instance, the European Union's Carbon Border Adjustment Mechanism (CBAM), fully implemented in 2026, will impact industries exporting goods to the EU, requiring them to account for embedded carbon emissions. Cooley's expertise in navigating these complex regulatory frameworks, particularly for clients in energy-intensive sectors like manufacturing and technology, is crucial for ensuring compliance and mitigating litigation risks associated with environmental non-adherence.

The legal sector, including firms like Cooley, faces growing pressure to adopt sustainable business practices. This focus on environmental responsibility is becoming a key differentiator, influencing client choice and talent acquisition. For instance, a 2024 survey revealed that over 60% of corporate clients consider a law firm's sustainability commitment when selecting external counsel.

Cooley's proactive stance on its environmental footprint, such as reducing energy consumption in its offices and promoting remote work options, directly impacts its brand image. This commitment resonates with an increasing number of environmentally aware clients and potential employees, reinforcing the firm's dedication to corporate social responsibility and aligning with global sustainability goals.

Resource Scarcity and Supply Chain Resilience

Concerns about resource scarcity, particularly for critical minerals essential in technology and renewable energy, are reshaping global supply chains. For instance, the International Energy Agency (IEA) highlighted in its 2024 report that demand for minerals like lithium and cobalt could increase by over 40 times by 2040 for clean energy technologies. This drives a need for businesses to secure stable and ethical sourcing.

Cooley can assist clients by navigating the complex legal landscape of sustainable sourcing and environmental due diligence, especially during mergers and acquisitions. This involves scrutinizing supply chain practices to mitigate risks associated with resource availability and regulatory compliance, ensuring long-term operational stability.

- Critical Mineral Demand: IEA projects a significant surge in demand for minerals like lithium and cobalt for clean energy, potentially increasing by over 40 times by 2040.

- Supply Chain Vulnerabilities: Geopolitical tensions and climate change impacts expose vulnerabilities in global supply chains, necessitating strategies for resilience.

- Legal Due Diligence: Cooley advises on environmental due diligence in M&A to assess risks related to resource scarcity and sustainable sourcing practices.

- Sustainable Sourcing: Businesses are increasingly seeking legal counsel on establishing and maintaining ethically sourced supply chains to meet growing consumer and regulatory demands.

Environmental Litigation and Risk Management

Environmental litigation is a significant and escalating risk for businesses, encompassing issues from pollution incidents to the far-reaching impacts of climate change and non-compliance with environmental regulations. Cooley's role involves proactively guiding clients through these complex legal landscapes, focusing on robust environmental risk assessment and strategic regulatory defense.

The firm must be adept at navigating disputes and providing counsel on compliance, especially as regulatory scrutiny intensifies. For instance, in 2024, environmental litigation filings saw a notable increase, with a particular surge in cases related to carbon emissions and plastic pollution, underscoring the need for specialized legal expertise.

- Growing Litigation Trends: Expect continued legal challenges concerning greenhouse gas emissions, water contamination, and biodiversity loss, impacting various industries.

- Regulatory Scrutiny: Agencies like the EPA are increasing enforcement actions, leading to higher potential fines and legal costs for non-compliant businesses.

- Climate Change Liability: Businesses are increasingly facing lawsuits alleging their contribution to climate change and failure to adapt to its impacts.

- Risk Mitigation Strategies: Cooley's advice will focus on proactive compliance, thorough due diligence in mergers and acquisitions, and effective dispute resolution mechanisms.

The increasing focus on environmental sustainability presents both challenges and opportunities for businesses. Stricter regulations, like the EU's CBAM impacting exports, and the surge in demand for critical minerals for clean energy, as highlighted by the IEA, necessitate careful planning and legal guidance.

Cooley assists clients in navigating these environmental complexities, from ensuring compliance with evolving climate change laws to advising on sustainable sourcing and mitigating environmental litigation risks. A 2024 survey indicated that over 60% of corporate clients consider a law firm's sustainability commitment when selecting counsel, underscoring the importance of this factor.

Environmental litigation is on the rise, with cases concerning emissions and pollution increasing in 2024. Cooley's expertise in risk assessment and regulatory defense is vital for businesses facing these escalating legal challenges and heightened scrutiny from agencies like the EPA.

| Environmental Factor | 2024/2025 Outlook | Impact on Businesses | Cooley's Role |

|---|---|---|---|

| Climate Change Regulations | Stricter carbon targets, CBAM implementation (2026) | Increased compliance costs, supply chain adjustments | Guidance on regulatory compliance, litigation risk mitigation |

| Resource Scarcity | 40x+ demand for clean energy minerals by 2040 (IEA) | Supply chain vulnerability, need for ethical sourcing | Due diligence in M&A, advice on sustainable sourcing |

| Environmental Litigation | Rising filings in 2024 (emissions, pollution) | Potential fines, reputational damage | Risk assessment, regulatory defense, dispute resolution |

PESTLE Analysis Data Sources

Our PESTLE analysis is meticulously constructed using data from reputable sources, including government publications, international economic organizations, and leading market research firms. This ensures each insight into political, economic, social, technological, legal, and environmental factors is both current and authoritative.