Cooley Porter's Five Forces Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Cooley Bundle

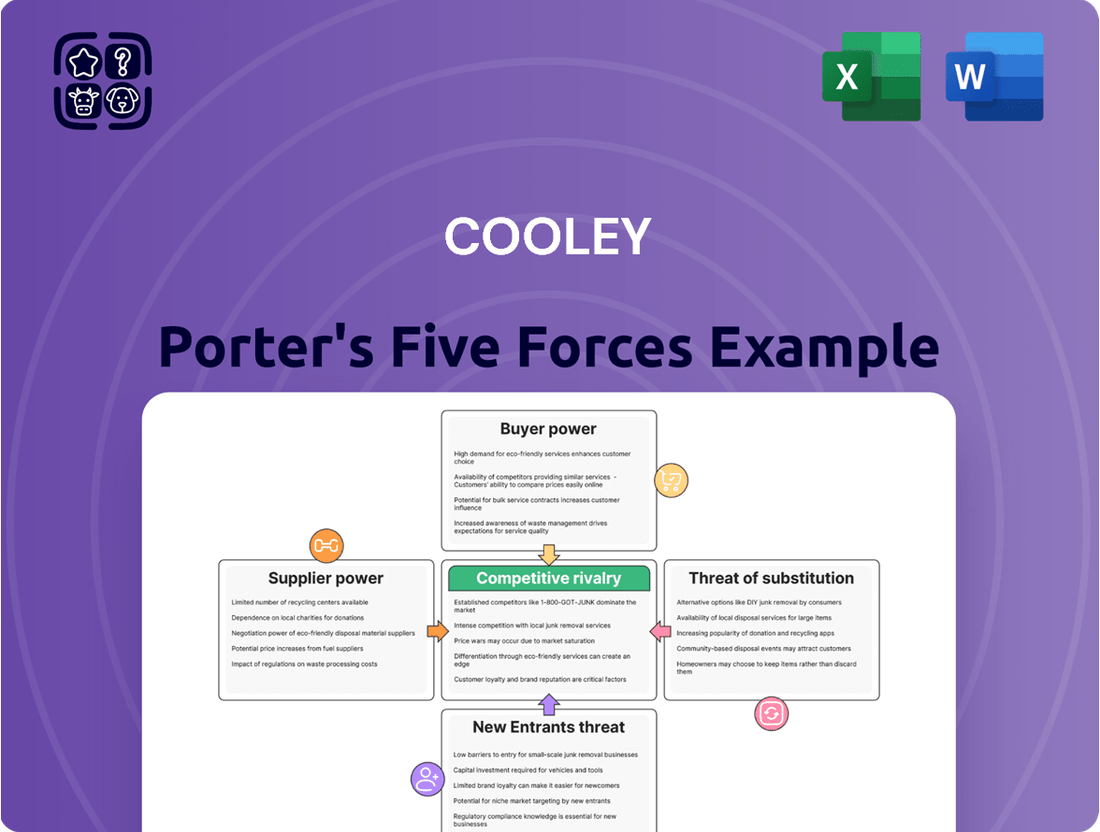

Cooley's Porter's Five Forces Analysis offers a critical lens to understand the competitive landscape of its industry. By examining the threat of new entrants, the bargaining power of buyers and suppliers, the threat of substitute products, and the intensity of rivalry, we gain a foundational understanding of market dynamics.

This brief snapshot only scratches the surface. Unlock the full Porter's Five Forces Analysis to explore Cooley’s competitive dynamics, market pressures, and strategic advantages in detail.

Suppliers Bargaining Power

The bargaining power of suppliers for a law firm like Cooley is significantly influenced by the talent pool and the specialization required. The key suppliers are the highly skilled legal professionals – attorneys, paralegals, and support staff. Cooley's focus on technology, life sciences, and high-growth sectors means the available talent with the necessary expertise is not vast, which inherently boosts the leverage of these specialized individuals.

Indeed, law firms across the board are engaged in a fierce 'talent war,' grappling with a noticeable skills shortage. Skilled lawyers are in high demand, and this demand directly translates into competitive salary expectations. For instance, in 2024, reports indicated that starting salaries for associates at top-tier law firms continued to climb, often exceeding $200,000 annually, reflecting the intense competition for qualified legal minds.

In 2024, the legal industry continued to see intense competition for skilled attorneys, making compensation and benefits a significant factor in supplier power. Law firms that failed to offer competitive salaries, comprehensive health insurance, and robust retirement plans often found themselves struggling to attract and retain top talent. For instance, a 2024 survey indicated that over 60% of associates considered compensation and benefits the primary driver in their job selection.

The demand for work-life balance also amplified the bargaining power of legal professionals. As firms increasingly recognized the importance of employee well-being to prevent burnout and maintain productivity, those offering flexible work arrangements, generous paid time off, and mental health resources gained an edge. This shift meant that legal talent could more readily negotiate terms, knowing that many firms were eager to meet these evolving expectations to secure their services.

Legal technology providers, offering everything from research databases to AI-powered tools, hold a growing influence. As law firms increasingly embrace these solutions in 2024 and 2025 to boost efficiency and client satisfaction, the vendors of advanced, specialized legal tech gain leverage.

Real Estate and Office Space

For a global firm like Cooley, with its extensive network of 19 offices spanning the US, Asia, and Europe, real estate landlords are significant suppliers. The cost and accessibility of premium office space in major innovation centers directly impact the firm's operational expenses. For instance, in 2024, average asking rents for prime office space in major US cities like New York and San Francisco remained robust, reflecting continued demand, though some markets saw slight softening due to increased vacancy rates.

The bargaining power of these real estate suppliers is influenced by several factors. While landlords of well-located, high-quality properties in desirable urban areas can command higher rents, the growing adoption of hybrid and remote work models by companies like Cooley may gradually diminish this power. This shift allows firms to potentially reduce their physical footprint or negotiate more favorable lease terms, especially as office vacancy rates fluctuated across different regions in 2024.

- Real Estate as a Supplier: Landlords of Cooley's 19 global offices are key suppliers.

- Cost Influence: The price and availability of prime office space in innovation hubs directly affect operational costs.

- Market Trends: In 2024, prime office rents in major US cities remained high, though some markets saw increased vacancy.

- Hybrid Work Impact: The trend towards hybrid and remote work models may reduce landlord bargaining power over time.

External Consulting and Expert Services

The bargaining power of suppliers in the external consulting and expert services sector is significant, especially for specialized areas. Think about niche consultants, expert witnesses, or e-discovery service providers. When a law firm or business needs highly specific knowledge for a complex case or critical advisory work, these suppliers can command higher fees because their expertise is hard to find elsewhere.

This leverage is amplified when demand for these specialized services surges. For instance, in 2024, the market for cybersecurity consulting saw robust growth, driven by an increasing number of sophisticated cyber threats. Firms with proven track records and deep expertise in areas like incident response or data breach forensics found themselves in a strong negotiating position.

- Niche Expertise: Suppliers with unique, in-demand skills have greater bargaining power.

- Demand Fluctuations: Increased demand for specialized services, like those in cybersecurity in 2024, strengthens supplier leverage.

- Substitutability: When a supplier's services are difficult to replace, their power increases.

- High-Stakes Projects: Complex litigation or critical business advisory work often necessitates specialized external help, enhancing supplier influence.

The bargaining power of suppliers is amplified when there are few alternatives and the cost of switching is high. In the legal industry, this is particularly true for specialized talent and advanced legal technologies. For example, the intense competition for experienced attorneys in 2024, with starting salaries often exceeding $200,000 annually at top firms, highlights the significant leverage skilled legal professionals possess.

Furthermore, providers of niche legal technology, essential for efficiency and client service, also wield considerable power. As firms increasingly adopt AI-driven research tools and e-discovery platforms, the vendors of these specialized solutions benefit from high demand and limited substitutability, strengthening their negotiating position.

| Supplier Type | Key Factors Influencing Power | 2024 Market Trend Example |

| Legal Talent (Attorneys, Paralegals) | Skills specialization, demand vs. supply, compensation expectations | Starting associate salaries at top firms surpassed $200,000. |

| Legal Technology Providers | Technological advancement, integration complexity, vendor concentration | Growth in AI legal research tools and e-discovery platforms. |

| Real Estate (Office Space) | Location quality, market vacancy rates, adoption of hybrid work | Prime office rents remained robust in major cities, though vacancy rates fluctuated. |

| Specialized Consultants/Expert Witnesses | Niche expertise, demand for specific case needs, reputation | Increased demand for cybersecurity and data breach forensics expertise. |

What is included in the product

Cooley's Five Forces Analysis provides a comprehensive framework to understand the competitive intensity and profitability potential within its operating environment by examining threats from new entrants, the bargaining power of buyers and suppliers, the threat of substitutes, and the intensity of rivalry among existing competitors.

Quickly identify and address the most impactful competitive pressures with a visual breakdown of all five forces, streamlining strategic planning.

Customers Bargaining Power

Cooley's client base, heavily concentrated in technology, life sciences, and venture capital, comprises sophisticated entities accustomed to rigorous financial oversight. These clients, particularly in the current economic climate of 2024, are increasingly scrutinizing legal spend, driving demand for more predictable and value-driven fee structures.

The heightened cost-consciousness among these sophisticated clients is evident in the growing adoption of alternative fee arrangements (AFAs) over traditional billable hours. This trend reflects a desire for greater transparency and control over legal expenses, directly impacting the bargaining power of Cooley's customer base.

Many high-growth companies and financial institutions, particularly those in sectors like technology and finance, maintain substantial in-house legal departments. For instance, in 2024, a significant percentage of Fortune 500 companies reported having dedicated legal teams capable of managing a substantial portion of their legal needs, from contract review to intellectual property. This internal capacity allows clients to insource routine legal tasks, thereby increasing their bargaining power and potentially reducing their dependence on external law firms for all legal matters.

Cooley's primary clients, often well-funded startups and established tech and life sciences firms, have a significant advantage due to the abundance of specialized law firms available to them. This accessibility to numerous reputable legal service providers directly amplifies their bargaining power.

Clients can readily compare pricing, service levels, and expertise across multiple firms, creating an environment where they can demand better terms or readily switch if they perceive a lack of value. For instance, in 2024, the legal services market for technology startups saw increased competition, with many boutique firms emerging to challenge larger players, further empowering these clients.

Demand for Value and Efficiency

Clients are increasingly seeking more than just legal acumen; they demand demonstrable efficiency, cost predictability, and overall value from their legal partners. This shift is significantly amplified by the growing availability and adoption of technology within the legal sector.

The push for transparent billing, such as fixed-fee arrangements, and the integration of strategic insights into legal counsel empower clients. For instance, a 2024 survey indicated that 65% of corporate legal departments prioritize technology adoption for cost savings and efficiency gains, directly influencing their choice of law firms.

- Client Expectations: Focus on efficiency, predictability, and value.

- Technology Adoption: Firms leveraging technology gain a competitive edge.

- Billing Transparency: Fixed fees and clear cost structures are highly valued.

- Strategic Insights: Clients seek proactive advice beyond reactive legal services.

Market Conditions in Venture Capital and M&A

Cooley's deep involvement in venture capital and M&A means client bargaining power is closely tied to the health of these markets. When venture funding or deal-making slows, such as during certain phases of 2023 and early 2024, the demand for legal services can decrease. This often makes clients more sensitive to pricing.

For instance, a report indicated a significant drop in venture capital funding rounds in the first half of 2023 compared to the previous year, impacting the volume of deals requiring legal support. This environment can empower clients to negotiate more aggressively on legal fees.

- Venture Capital Downturn: Reduced VC investment directly impacts the number of startups seeking funding and M&A advisory, lessening client urgency and increasing their leverage.

- M&A Slowdown: A decrease in M&A transactions similarly reduces the demand for Cooley's services in this area, giving clients more room to negotiate fees.

- Price Sensitivity: In leaner market conditions, clients, especially those with tighter budgets, are more inclined to scrutinize and challenge legal billing rates.

- Market Recovery Impact: Conversely, a robust recovery in VC and M&A activity would likely shift bargaining power back towards Cooley as demand for their specialized services increases.

Clients of Cooley, particularly in technology and life sciences, possess considerable bargaining power due to the availability of numerous specialized law firms. This competitive landscape allows clients to easily compare fees and services, driving demand for greater value and cost predictability. In 2024, many sophisticated clients are actively seeking alternative fee arrangements and leveraging in-house legal capabilities, further amplifying their negotiation leverage.

| Factor | Impact on Client Bargaining Power | 2024 Data/Trend |

|---|---|---|

| Availability of Alternatives | High | Increased competition from boutique firms and specialized legal tech providers. |

| Client Sophistication | High | Clients are more informed about legal market pricing and service expectations. |

| Demand for Value | High | Clients prioritize efficiency, predictability, and demonstrable ROI on legal spend. 65% of corporate legal departments prioritize technology for cost savings (2024 survey). |

| Market Conditions (VC/M&A) | Moderate to High | Downturns in VC funding and M&A activity (e.g., H1 2023 saw significant drops) increase client price sensitivity. |

What You See Is What You Get

Cooley Porter's Five Forces Analysis

This preview showcases the complete Porter's Five Forces Analysis you will receive immediately after purchase, offering a thorough examination of competitive forces within an industry. You'll gain insights into the intensity of rivalry, the bargaining power of buyers and suppliers, the threat of new entrants, and the threat of substitute products. This document is professionally formatted and ready for your immediate use, providing a comprehensive tool for strategic decision-making.

Rivalry Among Competitors

The legal market, especially for dynamic sectors like technology and life sciences, is incredibly crowded. Numerous established and respected law firms actively compete for the same high-profile clients.

Cooley contends with significant rivalry from other major global and national players. Firms like Goodwin Procter, Latham & Watkins, and Wilson Sonsini Goodrich & Rosati are direct competitors, all possessing strong specializations in technology, life sciences, and venture capital, making client acquisition a fierce battle.

Cooley's strong focus on tech and life sciences, while a strength, also means direct competition. Other law firms are actively building and enhancing their own specialized practices in these lucrative sectors, creating a head-to-head contest for the same high-value deals and clients. This intense rivalry is fueled by firms competing directly on their depth of expertise and specific industry insights.

The legal industry is locked in a fierce talent war, a critical component of competitive rivalry. Law firms are aggressively vying for top legal minds, recognizing that skilled lawyers are essential for client relationships and overall firm performance.

Firms are enhancing compensation packages, including competitive salaries and benefits, alongside improved work-life balance initiatives to attract and keep their best people. The departure of experienced attorneys can significantly disrupt ongoing client matters and negatively impact a firm's profitability and reputation.

Pricing Pressure and Alternative Fee Arrangements

Clients are increasingly scrutinizing legal spend, pushing firms like Cooley to offer more cost-effective and transparent fee structures. This shift away from purely hourly billing intensifies competition, as firms must demonstrate value and efficiency to win business. Many clients now expect alternative fee arrangements (AFAs), such as fixed fees or success-based billing, to manage their legal budgets more predictably.

The pressure for pricing innovation means that Cooley faces heightened rivalry from firms willing to adopt flexible billing models. This trend is evident across the legal industry, with a significant portion of law firm revenue now coming from AFAs. For instance, a 2024 survey indicated that over 60% of corporate legal departments actively negotiate AFAs for a substantial portion of their matters.

- Client Demand: Growing emphasis on cost-effectiveness and budget predictability drives the adoption of AFAs.

- Competitive Imperative: Firms must offer flexible pricing to remain competitive and attract clients prioritizing value.

- Industry Trend: AFAs are becoming standard practice, with a majority of corporate legal departments utilizing them.

- Efficiency Focus: Pricing pressure encourages firms to streamline operations and improve service delivery efficiency.

Technological Adoption and Innovation

The legal industry's competitive landscape is increasingly shaped by technological adoption. Firms that integrate advanced tools like artificial intelligence (AI), automation, and data analytics are better positioned to streamline operations and deliver superior client services. This technological race is a significant factor in how law firms differentiate themselves and attract business.

By leveraging these innovations, firms can achieve greater efficiency, reduce costs, and offer more sophisticated legal solutions. For instance, AI-powered contract review tools can significantly cut down on manual labor, freeing up legal professionals for higher-value tasks. This enhanced productivity translates directly into a competitive advantage.

- AI in Legal Services: A 2024 survey indicated that over 60% of law firms are exploring or actively implementing AI solutions for tasks such as document review and legal research.

- Efficiency Gains: Firms utilizing automation for routine administrative and document management tasks report an average efficiency improvement of 15-25%.

- Data Analytics in Strategy: Leading firms are employing data analytics to better understand client needs, predict litigation outcomes, and optimize resource allocation, leading to more data-driven decision-making.

- Innovation as a Differentiator: Early adopters of legal tech often command higher billing rates or win more complex cases due to their enhanced capabilities.

The legal market is intensely competitive, with numerous firms vying for clients, particularly in high-growth sectors like technology and life sciences. Cooley faces direct challenges from established players like Goodwin Procter and Latham & Watkins, all offering similar specialized services.

This rivalry extends to talent acquisition, as firms aggressively recruit top legal professionals by enhancing compensation and work-life balance. Furthermore, increasing client demand for cost-effectiveness is pushing firms towards alternative fee arrangements (AFAs), intensifying competition on pricing and value demonstration.

Technological adoption, including AI and data analytics, is also a key differentiator, with firms integrating these tools to improve efficiency and client service, creating a competitive edge for early adopters.

| Competitor | Key Specializations | 2023 Revenue (USD Billions) |

|---|---|---|

| Goodwin Procter | Technology, Life Sciences, Private Equity | 2.7 |

| Latham & Watkins | Corporate Law, Litigation, Finance | 5.3 |

| Wilson Sonsini Goodrich & Rosati | Technology, Venture Capital, Mergers & Acquisitions | 1.2 |

SSubstitutes Threaten

A significant substitute for external legal services is the establishment of an in-house legal department. As companies mature, they often bolster their internal legal teams, enabling them to manage a greater volume of work and more intricate legal issues internally. This growth can diminish the need for outside counsel, especially for recurring or less specialized legal tasks.

By 2024, many mid-to-large sized corporations have invested heavily in their in-house legal departments. Data suggests that the average Fortune 500 company now employs a legal department of over 30 lawyers, with some exceeding 100 professionals. This internal capacity allows them to handle a substantial portion of their legal needs, from contract review to compliance, thereby reducing their reliance on external law firms for day-to-day operations.

Alternative Legal Service Providers (ALSPs) present a significant threat by offering specialized legal and quasi-legal services like document review and e-discovery. These providers leverage technology for greater efficiency and often at a lower cost, directly impacting traditional law firms.

The ALSP market is expanding rapidly; it was valued at an estimated USD 24.49 billion in 2024. This growth is fueled by client demand for more cost-effective legal solutions, indicating a shift in how legal services are procured and delivered.

The rise of sophisticated legal tech and AI tools presents a significant threat of substitutes for traditional legal services. These technologies can automate tasks like legal research, document drafting, and contract analysis, which were once exclusively handled by lawyers.

For instance, AI-powered legal research platforms, which saw substantial investment and adoption throughout 2024, can drastically reduce the time and cost clients incur for these fundamental legal processes. This allows clients to undertake some legal functions in-house or seek more cost-effective solutions, directly substituting the need for certain lawyer-led services.

Legal Process Outsourcing (LPO)

The threat of substitutes in Legal Process Outsourcing (LPO) is significant. LPO firms offer cost-effective alternatives for various legal tasks, such as legal research, document review, and contract management, by leveraging talent from lower-cost geographic regions.

These services can be a direct substitute for in-house legal departments or traditional law firms performing these functions. For instance, many companies now utilize LPO providers for routine discovery processes, bypassing the need for extensive internal resources or higher-cost external counsel for these specific activities.

The market for LPO services is projected to continue its growth trajectory. Reports indicate the global LPO market was valued at approximately $12.1 billion in 2023 and is expected to reach around $35.1 billion by 2030, demonstrating a compound annual growth rate of roughly 16.3% during this period.

- Cost Savings: LPO offers substantial cost reductions, with some estimates suggesting savings of up to 60% compared to onshore legal services.

- Scalability: LPO providers can quickly scale resources up or down to meet fluctuating client demands, a flexibility often difficult for in-house teams to achieve.

- Focus on Core Competencies: By outsourcing non-core legal tasks, law firms and businesses can concentrate on strategic legal work and client relationships.

Non-Legal Professional Services Firms

The threat of substitutes from non-legal professional services firms is a growing concern. Consulting firms, accounting firms, and other advisory groups are expanding their offerings into areas traditionally dominated by law firms, such as regulatory compliance, risk management, and corporate advisory services. This encroachment means businesses can sometimes find suitable, albeit non-legal, alternatives for certain strategic advice.

These alternative service providers can be particularly attractive for business-oriented counsel where the strictures of legal practice are not the primary driver. For instance, in 2024, many large accounting firms reported significant growth in their advisory divisions, with revenue generated from non-audit services, including consulting, reaching new heights. This indicates a clear market shift where clients are seeking integrated solutions that may not exclusively require traditional legal expertise.

- Consulting and accounting firms are increasingly offering services like regulatory compliance and risk management, directly competing with legal services.

- Businesses may opt for these non-legal professionals for corporate advisory needs, especially when the focus is on business strategy rather than litigation or strict legal interpretation.

- The advisory arms of major accounting firms saw substantial revenue increases in 2024, highlighting the growing acceptance of these firms as providers of services that overlap with legal counsel.

The threat of substitutes for traditional legal services is multifaceted, encompassing in-house legal departments, Alternative Legal Service Providers (ALSPs), Legal Process Outsourcing (LPO), and non-legal professional services firms.

In 2024, the legal landscape saw continued growth in these substitute areas, driven by a demand for cost-efficiency and specialized services.

ALSPs, for example, captured a significant market share, with the sector valued at approximately USD 24.49 billion in 2024, showcasing a clear shift in how legal tasks are being handled.

Similarly, the LPO market, projected to reach around $35.1 billion by 2030, demonstrates the increasing reliance on outsourcing for legal functions.

| Substitute Category | Key Characteristics | 2024 Market Insight |

|---|---|---|

| In-house Legal Departments | Increased internal capacity, cost control for routine tasks | Average Fortune 500 company employs 30+ lawyers |

| Alternative Legal Service Providers (ALSPs) | Technology-driven efficiency, specialized services (e.g., e-discovery) | Market valued at USD 24.49 billion |

| Legal Process Outsourcing (LPO) | Cost savings (up to 60%), scalability for specific tasks | Global market projected to reach $35.1 billion by 2030 |

| Non-Legal Professional Services | Advisory services (compliance, risk management) from consultants/accountants | Significant revenue growth in advisory divisions of major accounting firms |

Entrants Threaten

Establishing a global law firm with a broad service offering and a strong reputation in niche areas, like Cooley, demands substantial capital for operations, technology, and talent acquisition. For instance, top-tier law firms in 2024 often report annual revenues in the hundreds of millions, even billions, underscoring the immense financial resources required to compete at this level.

Building a robust network of experienced legal professionals across multiple jurisdictions and cultivating client trust takes years, if not decades. This intangible asset, brand recognition and established relationships, is incredibly difficult for newcomers to replicate quickly.

These combined factors – significant capital needs, the necessity of a deep talent pool, and the long-term development of brand equity and client loyalty – present formidable barriers for new, full-service global law firms seeking to enter the market.

While establishing a full-service law firm is a significant undertaking, the threat of specialized niche entrants remains a pertinent concern. These new players, often smaller and more agile, can emerge by focusing on specific, high-demand areas within Cooley's existing client base. For instance, startups leveraging artificial intelligence for legal research or contract analysis could offer highly targeted services at more competitive price points, directly challenging established firms in those particular segments.

The legal profession is inherently protected by significant regulatory hurdles and stringent licensing requirements. Aspiring law firms must navigate complex bar admission processes, adhere to rigorous ethical codes, and maintain specific professional qualifications. These barriers ensure a high standard of practice but also make it challenging for new players to enter the market.

Capital Requirements and Infrastructure

Establishing a law firm today requires substantial capital, particularly for the advanced IT infrastructure, robust cybersecurity, and sophisticated knowledge management systems essential for competitive operations. For instance, the average annual IT spend for a mid-sized law firm can easily run into hundreds of thousands of dollars, a figure that can be a significant barrier for new players.

The need for a global presence, often involving multiple international offices and the associated legal and operational setup costs, further escalates these capital demands. This can easily add millions to the initial investment, making it difficult for smaller, less-funded entities to enter the market effectively.

- Significant IT Investment: Modern law firms require substantial outlays for technology, including cloud computing, AI-powered legal research tools, and secure client portals.

- Cybersecurity Costs: Protecting sensitive client data necessitates ongoing investment in advanced cybersecurity measures, which can represent 5-10% of a firm's operating budget.

- Global Infrastructure: Establishing and maintaining international offices involves considerable expenses related to real estate, staffing, and compliance in different jurisdictions.

Client Relationships and Reputation Building

In the legal sector, particularly for firms like Cooley, client relationships are paramount. These bonds are forged through trust, demonstrated expertise, and a consistent history of successful outcomes. New firms entering the market find it exceptionally difficult to build the necessary credibility and reputation to secure and keep high-value clients, especially in intricate and high-stakes legal matters.

The barriers to entry are significantly amplified by the time and resources required to cultivate these deep-seated client relationships. For instance, a significant portion of a law firm's revenue often comes from repeat business and referrals, which are directly tied to a strong reputation. In 2023, major law firms reported that over 70% of their new business originated from existing client relationships or referrals, highlighting the challenge for newcomers.

- High client retention rates are a hallmark of established firms, making it difficult for new entrants to gain market share.

- The long sales cycle in legal services means new firms must invest heavily in business development with no guarantee of immediate returns.

- Brand recognition and perceived expertise are critical differentiators that take years to develop, acting as a substantial barrier.

The threat of new entrants in the legal services market, particularly for global firms like Cooley, is generally considered moderate due to substantial barriers. These include the immense capital required for global operations, advanced technology, and top-tier talent, as well as the time-intensive process of building client relationships and brand reputation.

Regulatory hurdles, such as licensing and ethical compliance, further solidify the market. While specialized niche entrants can pose challenges, the overall difficulty for new, full-service global law firms to establish themselves remains high, requiring significant investment and long-term strategic development.

For instance, in 2024, the average revenue for the top 100 law firms globally exceeded $1 billion, indicating the scale of financial resources needed to compete. The need for extensive IT infrastructure, cybersecurity, and global office networks adds millions to initial setup costs, making it difficult for smaller, less-funded entities to enter effectively.

| Barrier | Description | Impact on New Entrants |

|---|---|---|

| Capital Requirements | High costs for global operations, technology, and talent. | Significant financial hurdle. |

| Brand & Reputation | Long-term development of trust and client loyalty. | Difficult to replicate quickly. |

| Regulatory Hurdles | Licensing, ethical codes, and compliance. | Ensures high standards but restricts entry. |

| Client Relationships | Building trust and securing high-value clients. | Takes years, with 2023 data showing 70%+ new business from existing clients/referrals. |

Porter's Five Forces Analysis Data Sources

Our Porter's Five Forces analysis is built upon a robust foundation of data, incorporating information from company annual reports, industry-specific market research, and government economic indicators to provide a comprehensive view of competitive pressures.